|

|

市場調査レポート

商品コード

1871066

近代的カード発行プラットフォーム市場:2025~2030年Modern Card Issuing Platforms Market: 2025-2030 |

||||||

|

|||||||

| 近代的カード発行プラットフォーム市場:2025~2030年 |

|

出版日: 2025年11月17日

発行: Juniper Research Ltd

ページ情報: 英文

納期: 即日から翌営業日

|

概要

"近代的カード発行プラットフォーム市場、2030年までに42億ドルを突破 ― Juniper Research がフィンテックイノベーションを牽引する世界的リーダーを発表"

| 主要統計 | |

|---|---|

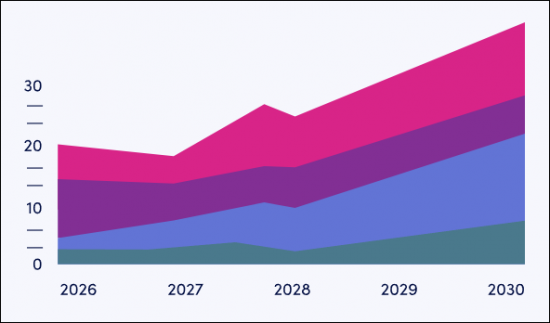

| 2025年の総取引額: | 18億米ドル |

| 2030年の総取引額: | 42億米ドル |

| 2025年から2030年までの市場成長率: | 129% |

| 予測期間: | 2025~2030年 |

概要

本調査シリーズは、進化する近代的カード発行プラットフォーム市場に関する詳細かつ洞察に富んだ分析を提供し、銀行、金融機関、フィンテック企業、技術ベンダーなどのステークホルダーが、将来の成長、主要な動向、競合環境を理解することを可能にします。

近代的カード発行プラットフォームとは、API駆動のアプローチを用いるカード管理システムであり、企業が自社サービスにカード発行や管理機能をシームレスに統合することを可能にします。これによりカード発行者には、デジタルウォレットやモバイルウォレットへの仮想カードのトークン化、モバイルバンキングアプリからのプッシュプロビジョニング、物理カードの即時かつパーソナライズされた発行といったメリットがもたらされます。さらに、現代的なカードプログラムは、銀行がレガシーシステムを全面的に刷新することなく金融サービスを近代化するための統合ソリューションを提供します。

本調査スイートには、個別に購入可能な複数のオプションが含まれ、これには近代的カード発行プラットフォームの普及状況と将来の成長をマッピングしたデータへのアクセス、市場における最新動向と機会を明らかにする洞察に富んだ調査、近代的カード発行分野における市場リーダー22社を詳細に分析した文書などがあります。

すべてのレポート内容は英語で提供されます。

主な特徴

- 市場力学:近代的カード発行プラットフォーム市場における主要な動向と市場拡大の課題に関する洞察を提供します。これらは、変化する決済環境、データを活用した顧客エンゲージメントとロイヤルティの向上方法、不正管理の進展、そして数多くの近代的カード発行使用事例の分析に対応しています。さらに、8つの主要地域市場の現状とセグメント成長を示す「国別準備度指数」を掲載し、将来展望も提供します。

- 主な知見と戦略的提言:近代的カード発行プラットフォーム市場における主要な開発機会と知見の詳細な分析し、ステークホルダーのための戦略的提言を提供します。

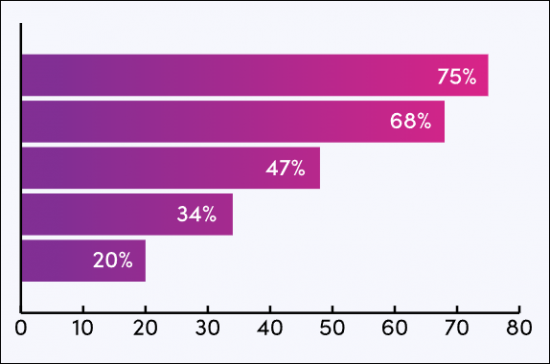

- Juniper Research競合リーダーボード:主要ベンダー22社の能力を評価します。

- 業界予測のベンチマーク:データセットには、近代的カード発行プラットフォームの収益予測が含まれており、クレジットカード、デビットカード、プリペイドカード、法人向けカード/個人向けカードに分類されています。また、発行される全決済カードに占める近代的カード発行プラットフォームの普及率も含まれています。

サンプルビュー

市場データ・予測レポート

サンプルビュー

市場動向・戦略レポート

市場データ・予測レポート

本調査スイートには、48の表と18,500のデータポイントからなる予測データの完全なセットへのアクセスが含まれます。

本調査スイートの指標には以下が含まれます。

- 決済カード総発行枚数

- 近代的カード発行プラットフォームによる新規発行決済カード数

- 近代的カード発行市場の総収益

これらの指標は以下の主要分野に分類されます。

|

|

競合リーダーボードレポート

本レポートでは、近代的カード発行プラットフォーム分野における主要ベンダー22社について詳細な評価と市場ポジショニングを提供します。

|

|

|

目次

市場動向・戦略

第1章 重要ポイントと戦略的提言

- 重要ポイント

- 戦略的提言

第2章 市場情勢

- イントロダクションと定義

- カード発行の歴史

- 近代的カード発行プロセス

- 近代的カード発行プラットフォームの技術的能力の分析

- きめ細かなカードコントロールとカスタマイズ

- データインテリジェンスと組み込み洞察

- 組み込み決済インフラ

- 近代的カード発行プラットフォームはカード所有者に何を提供できるか?

- パーソナライゼーション

- カスタマイズされた特典とロイヤルティプログラム

- 支払いの柔軟性

- カード発行会社はカード発行に関連するどのようなサービスを提供できるか?

- 発行者処理

- 高度データ分析

- チャージバックと紛争処理

- 支出管理

- 生体認証カード

- AI/MLによるリアルタイム不正検出

- ウェアラブル

- BINスポンサーシップ

第3章 主要動向と促進要因

- 主要動向と促進要因

- ハイパーパーソナライゼーション

- Visa Flexible Credential と Mastercard One Credential

- 非銀行業界を変革するCard-as-a-Service

- AIを活用した不正防止と支出管理

- MastercardとVisaのClick to Pay

- 持続可能性と環境に優しいソリューション

第4章 セグメント分析

- クレジットカード&チャージカード

- デビットカード

- バーチャルカード

- 暗号通貨カード

- プリペイドカード

- 公共部門におけるプリペイドカード

- ユースケース:給与支払い

- 信用組合:米国

第5章 国別準備指数

- 国別準備指数の概要

- 焦点市場

- 成長市場

- 飽和市場

- 発展途上市場

競合リーダーボード

第1章 Juniper Researchの競合リーダーボード

第2章 企業プロファイル

- ベンダープロファイル

- ACI Worldwide

- Adyen

- CR2

- Enfuce

- Entrust

- FIS

- Fiserv

- Galileo

- G+D

- Hips

- i2c

- IDEMIA

- Marqeta

- Modulr

- Nexi

- NymCard

- Paymentology

- Paynetics

- Pismo

- Stripe Issuing

- Thales

- Zeta

- 評価手法

- 関連調査

データ・予測

第1章 市場概要

第2章 市場サマリー

- 発行済み決済カード総数

- 近代的カード発行プラットフォームによる年間発行決済カード総数

- 近代的カード発行プラットフォームによる年間発行カード総数 (カードタイプ別)

- 近代的カード発行プラットフォームによる年間発行カード総数 (カード用途別)

- 近代的カード発行プラットフォームの総収益 (地域別)

- 近代的カード発行プラットフォームの総収益 (カードタイプ別)

- 近代的カード発行プラットフォームの総収益 (カード用途別)

第3章 セグメント分割

- クレジットカード発行

- 発行済みカード総数

- 近代的カード発行プラットフォームによる発行数

- 近代的カード発行プラットフォームによる総収益

- プリペイドカード

- 発行済みカード総数

- 近代的カード発行プラットフォームによる発行数

- 近代的カード発行プラットフォームによる総収益

- デビットカードとその他

- 発行済みカード総数

- 近代的カード発行プラットフォームによる発行数

- 近代的カード発行プラットフォームによる総収益

- 法人向けカード

- 近代的カード発行プラットフォームによる発行数

- 近代的カード発行プラットフォームによる総収益

- 個人向けカード

- 近代的カード発行プラットフォームによる発行数

- 近代的カード発行プラットフォームによる総収益