|

|

市場調査レポート

商品コード

1804768

電池用導電性添加剤市場:製品タイプ、形態、用途、最終用途産業別-2025-2030年の世界予測Battery Conductive Additives Market by Product Type, Form, Application, End Use Industry - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電池用導電性添加剤市場:製品タイプ、形態、用途、最終用途産業別-2025-2030年の世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 198 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

電池用導電性添加剤市場は、2024年には14億2,000万米ドルとなり、2025年には15億3,000万米ドル、CAGR 8.31%で成長し、2030年には22億9,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 14億2,000万米ドル |

| 推定年2025 | 15億3,000万米ドル |

| 予測年2030 | 22億9,000万米ドル |

| CAGR(%) | 8.31% |

バッテリー導電性添加剤は、性能、安全性、寿命の向上において極めて重要な役割を果たし、現代のエネルギー貯蔵ソリューションの要となっています。電化に向けた世界的な動きが加速する中、市場力学を理解することは、チャンスを生かそうとする利害関係者にとって極めて重要です。厳しい環境規制、野心的な炭素削減目標、信頼性の高いエネルギー貯蔵に対する消費者の要求の融合により、導電性添加剤は材料革新の最前線に押し上げられました。これらの特殊な材料は、電極処方内の効率的な電子輸送を促進し、充放電速度、サイクル寿命、熱安定性などの主要な性能指標に直接影響を与えます。この進化する状況の中で、メーカーは原材料の調達から先進的なセル化学との統合に至るまで、複雑な課題を乗り越えています。一方、自動車、家電、工業分野のエンドユーザーは、エネルギー密度とコスト効率のさらなる向上を求めています。このイントロダクションでは、導電性グラファイト、カーボンブラック、グラフェン変種、炭素繊維がどのように次世代電池を形成しているかを探る。また、サプライチェーンの力学と規制の影響を分析するための基礎も確立しています。このセクションでは、技術の進歩と市場の洞察を統合することで、バッテリー導電性添加剤セクターを定義する変革的シフト、政策への影響、戦略的必須事項の包括的検討のための舞台を整えます。

革新、持続可能性の重要性、新素材のブレークスルーを通じて電池用導電性添加剤業界を形成している変革的シフトのマッピング

近年、電池用導電性添加剤セクターは、材料科学のブレークスルーと持続可能性への圧力の高まりによってパラダイムシフトを起こしています。従来のカーボンブラックから先進的なグラフェンや繊維複合材への移行は、業界がより高い導電性と機械的弾力性を追求していることを象徴しています。同時に、無溶剤分散技術やリサイクル前駆体の利用など、環境に優しい製造方法の統合は、循環型経済原則への幅広いコミットメントを強調するものです。自動車メーカー、家電メーカー、エネルギー貯蔵プロバイダーが、標準化された性能ベンチマークをめぐって協力し合うことで、こうした変革的なシフトは、業界を超えた協力関係によってさらに増幅されます。材料開発メーカーと電池メーカー間の新たなパートナーシップは、電極配合の最適化を目指した共同開発イニシアチブを加速させています。さらに、分散技術の進歩により、添加剤の均質な分布が可能になり、電気化学的安定性が最大化されています。並行して、計算モデリングと機械学習ツールが性能予測分析を容易にし、新規配合の市場投入までの時間を短縮しています。規制機関は、低排出ガス生産経路を奨励し、材料性能の最低閾値を設定することで、こうした動向を強化しています。その結果、今日の情勢は、俊敏なイノベーション・サイクル、戦略的提携、持続可能性指標への注目の高まりによって定義されています。本セクションでは、こうした変化を解き明かし、各ドライバーがどのようにリンクして競合環境を再構築し、長期的な価値創造に寄与しているかをマッピングします。

2025年米国関税の電池用導電性添加剤サプライチェーン、価格ダイナミクス、世界貿易フローへの累積影響評価

2025年の米国の関税賦課は、電池用導電性添加剤のエコシステムに複雑な経済的圧力をもたらしました。輸入カーボンブラック、導電性グラファイト、グラフェン材料に関税が適用されるため、サプライチェーン全体の利害関係者は調達コストの再調整に直面しています。この政策決定は世界的な貿易の流れに波及し、戦略的な出荷ルートの変更や代替調達の交渉の引き金となりました。これを受けて、関税負担を軽減するために生産拠点を最終用途市場の近くにシフトした添加剤メーカーもあれば、顧客との関係を維持するために価格設定モデルを革新したり、コスト増を吸収したりしたメーカーもあります。その累積的な影響は契約交渉にまで及び、バイヤーは価格を固定し、原材料の入手可能性を確保するために、より長期的な契約を求めるようになっています。さらに、研究開発チームは、関税のかかる輸入品への依存を減らすため、現地での原料合成・精製プロセスを模索しています。同時に、主要地域の政府は、先端添加剤の国内製造に対抗する情勢を導入し、グローバルな競合情勢をさらに複雑にしています。こうした政策の変動には、マージンの回復力を維持するための機敏なサプライチェーン管理とダイナミックなコスト・モデリングが必要です。本セクションでは、こうした関税措置が、関税撤廃後の環境において、戦略的意思決定、調達戦略、より広範な市場アーキテクチャにどのような影響を与えたかを評価します。

導電性添加剤の成長経路を明らかにするために、製品タイプ、形態、用途、最終用途産業別に主要なセグメンテーションインサイトを明らかにします

電池用導電性添加剤市場を詳細に調査することで、製品タイプ、形態、用途、最終用途産業ごとに異なる業績と需要輪郭が明らかになります。導電性グラファイト、カーボンブラック、カーボンファイバー、新興のグラフェンは、それぞれ独自の導電性、粒子形態、コストプロファイルを持ち、特定のセル構造に適しているかどうかを決定します。粉末ベースの添加剤は、拡張性の高い電極配合のために選択されることが多いが、一方、分散形式は、均一な分布を必要とする高エネルギー化学物質への正確な統合を可能にします。一方、リチウムイオン分野では、リン酸鉄、酸化マンガン、ニッケル・コバルト・アルミニウム、ニッケル・マンガン・コバルトなどの配合が、性能ベンチマークを満たすために高度なグラファイトやグラフェン複合材料の需要を牽引しています。さらに、自動車産業などの最終用途産業では、エネルギー密度と安全性のバランスが取れた材料が求められ、家電メーカーは小型化と熱管理を優先し、産業ユーザーは費用対効果の高い拡張性を重視し、据置型エネルギー貯蔵事業者は長期安定性を求めています。これらのセグメントを重ねることで、市場ニーズの異質性が強調され、的を絞った製品開発や付加価値サービスの機会が浮き彫りになります。こうした微妙な差異を認識することで、利害関係者は技術ロードマップを個別の市場セグメントと整合させ、差別化された成長軌道を活用することができます。

南北アメリカ、中東・アフリカ、アジア太平洋地域の中核的な洞察を明らかにすることで、多様な需要促進要因と戦略的機会を明らかにします

電池用導電性添加剤市場の地域力学は、成長速度、規制状況、製造能力において微妙なコントラストを示しています。南北アメリカでは、自動車の電動化が強く要求され、再生可能エネルギー貯蔵設備への投資が活発で、高性能導電性黒鉛とカーボンブラックの需要が高まっています。市場参入企業は、有利な政策枠組みや一流セルメーカーへの近接性を活用し、現地生産を拡大しています。逆に、欧州、中東・アフリカでは、循環型経済への取り組みが野心的な脱炭素化目標に収斂しているため、規制環境が多様に変化しています。この地域では、持続可能な生産方法を検証し、ライフサイクル性能を最適化するために、添加剤開発者とエンドユーザーとの協力が活発化しています。一方、アジア太平洋地域は、材料革新と大規模製造の両面で依然として強国であり、大手メーカーが単価の引き下げを推進する一方で、次世代グラフェンや繊維ベースのソリューションを推進しています。アジア太平洋の主要市場では政府との提携により、新規導電システムの研究開発資金が加速しており、同地域の競争力が強化されています。これらの地域全体では、地域に根ざしたサプライチェーンと専門的な技術サービスが重要な差別化要因として台頭しており、企業は需要、政策、生産能力における地域の特異性を反映した戦略を立てる必要に迫られています。

電池用導電性添加剤の主要企業と競合情勢を明らかにし、提携、イノベーション、投資戦略に役立てる

電池用導電性添加剤の競合情勢は、老舗の化学大手、特殊な材料に特化したイノベーター、機敏な新興企業が混在して形成されています。業界の既存企業は、統合された事業と広範な流通網を活用して、カーボンブラック、黒鉛、繊維複合材料を含む幅広いポートフォリオを供給しています。これらの企業は、パイロット・スケールの施設やアプリケーション・ラボに多額の投資を行い、主要なバッテリー・メーカーと配合を共同開発していることが多いです。同時に、ニッチな課題への課題者たちは、グラフェン合成における画期的な調査、独自の分散技術、学術機関との連携を通じて差別化を図っています。このため、合弁事業からライセンシング契約に至るまで、商業化のタイムラインを早めることを目的としたさまざまな協力モデルが育まれてきました。添加剤メーカーと細胞メーカーとの提携は、エンドツーエンドの材料認定へのシフトを意味し、より一般的になりつつあります。さらに、戦略的買収は、革新的能力を確保し、世界的な足跡を拡大するためのテコとして浮上しています。初期段階の開発企業による資金調達活動は、サイクル寿命と熱管理の向上を約束する差別化された導電性ソリューションに対する投資家の信頼を浮き彫りにしています。このような競争戦略は、長期的な価値創造を推進する上で、技術的リーダーシップとエコシステム・コラボレーションの重要性を強調しています。

市場の複雑さを克服し、先進導電性添加剤の採用を促進し、競争力を強化するために、業界リーダーに実行可能な提言を提供します

進化する電池用導電性添加剤市場で成功するためには、業界のリーダーは、イノベーション、回復力、顧客との連携を優先する多面的なアプローチを採用しなければならないです。まず、電池メーカーと戦略的パートナーシップを確立することで、製品検証を加速し、次世代電極処方の共同開発の機会を引き出すことができます。これと並行して、原料ソースを多様化し、現地生産能力を強化することで、政策の変動や物流の途絶を緩衝することができます。高度な特性評価ツールや予測モデリング・プラットフォームに投資することで、材料性能評価をさらに強化し、新規添加剤の認定までの時間を短縮することができます。さらに、前駆体の選択から使用済み製品の再利用に至るまで、バリューチェーン全体に持続可能性の指標を組み込むことで、規制の期待に応えるだけでなく、環境意識の高い顧客の共感を得ることができます。自動車、エレクトロニクス、エネルギー貯蔵の利害関係者と的を絞ったパイロット・プログラムに参加することで、用途に特化した性能上の利点を明らかにし、製品ロードマップに反映させることができます。最後に、リーダーは、より深いパートナーシップを育み、収益源を増やすために、現場での技術サポートや配合の最適化など、モジュール式のサービス提供を検討すべきです。これらの提言を実行することで、企業は競合との差別化を確保し、リスクを軽減し、明日の高性能電池材料のエコシステムの最前線に立つことができます。

電池用導電性添加剤市場調査における包括的な分析とデータの完全性を確保するために採用した厳密な調査手法の詳細

本レポートで紹介する洞察は、包括的な調査対象とデータの完全性を確保するために設計された、厳密で多層的な調査手法に由来しています。1次調査は、材料サプライヤー、セルメーカー、技術コンサルタント、自動車、家電、産業、エネルギー貯蔵分野のエンドユーザーなど、バリューチェーン全体の主要利害関係者との綿密な面談を特徴としており、本調査の骨格を成しています。これらの対話から、性能要件、コスト感覚、地域規制の影響に関する定性的な背景が得られました。同時に2次調査として、業界出版物、特許出願、技術白書、規制文書を体系的にレビューし、新たな材料動向や研究開発を検証しました。製品の流れを追跡し、集中リスクを特定し、関税の影響を評価するために、サプライチェーンのマッピングを実施しました。さらに、競合ベンチマーキング分析を実施し、主要企業の技術ポートフォリオ、戦略的パートナーシップ、投資パターンを評価しました。データの三角測量技術により、異なる情報源から得られた知見が首尾一貫した洞察をもたらすように調整されました。調査の枠組みには、ピアレビューと専門家による検証の段階も取り入れ、結論の信頼性を強化しました。この強固な調査手法が、報告書のセグメンテーションに関する洞察、関税への影響評価、戦略的提言の信頼性を支えています。

電池用導電性添加剤の市場進化、技術的進歩、戦略的課題に関する中核的知見を統合した結論的洞察

バッテリー導電性添加剤市場の軌跡は、技術革新、政策情勢の変化、消費者需要の進化が重なることで特徴付けられます。新しいグラフェン誘導体から高性能炭素繊維に至るまで、先進的な添加剤化学は、エネルギー密度、サイクル寿命、安全性のさらなる向上を可能にする態勢を整えています。同時に、貿易政策と地域的なインセンティブはサプライチェーンとコスト構造の再構築を続けており、利害関係者は機敏な製造・調達戦略の採用を迫られています。市場セグメンテーション分析では、この市場での成功は、多様な最終用途産業における鉛酸、リチウムイオン、ニッケル水素化学の明確なニーズに対応するテーラーメイドのソリューションにかかっていることが強調されています。地域的なダイナミクスはさらに、現地生産の足跡と、材料開発者とセル生産者間の協力体制の重要性を浮き彫りにしています。競争が激化する中、性能と持続可能性のバランスを取りながら、責任を持ってイノベーションを行う能力が、決定的な差別化要因となると思われます。最終的には、データ主導の洞察力、戦略的パートナーシップ、積極的なリスク管理を統合した組織が、電動化された交通機関、ポータブル電子機器、据置型エネルギー貯蔵アプリケーションの急速な拡大に資本参加する上で最も有利な立場になると思われます。この結論は、核となる発見を統合し、進化する導電性添加剤の展望における戦略的行動のための舞台を整えるものです。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- リチウムイオン急速充電効率を高めるナノ加工グラフェン導電性添加剤の需要増加

- 高容量電池の体積膨張を軽減するために導電性ポリマー添加剤をシリコンアノードに統合する

- 電池製造時の炭素フットプリントを削減する持続可能なバイオマス由来の炭素導電性添加剤の開発

- 次世代固体電池の導電性を向上させる先進的なハイブリッドカーボンナノチューブとグラフェンの複合材料

- 大型電池電極における均一な導電助剤分布のための超音波分散技術の採用

- 導電性添加剤の表面機能化を調整して電極-電解質界面の安定性とサイクル寿命を向上させる

- 無溶媒メカノケミカル合成法による高純度ナノグラファイト導電性添加剤のコスト効率の高いスケーリング

- 環境適合電池向け低排出導電性添加剤製造プロセスへの規制主導の移行

- 3Dプリントされた導電性添加剤フレームワークを利用して、電池カソードの細孔構造と電気経路を最適化します。

- 電気伝導性と電極の機械的完全性を予測するための導電性添加剤ネットワーク形成のデータ駆動型モデリング

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 電池用導電性添加剤市場:製品タイプ別

- カーボンブラック

- カーボンファイバー

- 導電性グラファイト

- グラフェン

第9章 電池用導電性添加剤市場:形態別

- 分散

- 粉

第10章 電池用導電性添加剤市場:用途別

- 鉛蓄電池

- リチウムイオン電池

- リン酸鉄リチウム

- マンガン酸リチウム

- リチウムニッケルコバルトアルミニウム

- リチウムニッケルマンガンコバルト

- ニッケル水素電池

第11章 電池用導電性添加剤市場:最終用途産業別

- 自動車

- 家電

- 産業

- 据置型エネルギー貯蔵

第12章 南北アメリカの電池用導電性添加剤市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第13章 欧州・中東・アフリカの電池用導電性添加剤市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第14章 アジア太平洋地域の電池用導電性添加剤市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第15章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Cabot Corporation

- Imerys SA

- Abvigen Inc.

- ADEKA CORPORATION

- Arkema S.A.

- artience Co., Ltd.

- BASF SE

- Birla Carbon India Private Limited

- Chasm Advanced Materials, Inc.

- Initial Energy Science & Technology Co.,Ltd

- LG Energy Solution Ltd.

- Ossila BV

- Resonac Holdings Corporation

- Targray Technology International Inc.

- XIAMEN TOB NEW ENERGY TECHNOLOGY CO., LTD.

第16章 リサーチAI

第17章 リサーチ統計

第18章 リサーチコンタクト

第19章 リサーチ記事

第20章 付録

LIST OF FIGURES

- FIGURE 1. BATTERY CONDUCTIVE ADDITIVES MARKET RESEARCH PROCESS

- FIGURE 2. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 3. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 4. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 5. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2024 VS 2030 (%)

- FIGURE 6. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2024 VS 2030 (%)

- FIGURE 8. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 9. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2024 VS 2030 (%)

- FIGURE 10. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 11. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2024 VS 2030 (%)

- FIGURE 12. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 13. AMERICAS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 14. AMERICAS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 15. UNITED STATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY STATE, 2024 VS 2030 (%)

- FIGURE 16. UNITED STATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 17. EUROPE, MIDDLE EAST & AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 18. EUROPE, MIDDLE EAST & AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 19. ASIA-PACIFIC BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 20. ASIA-PACIFIC BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 21. BATTERY CONDUCTIVE ADDITIVES MARKET SHARE, BY KEY PLAYER, 2024

- FIGURE 22. BATTERY CONDUCTIVE ADDITIVES MARKET, FPNV POSITIONING MATRIX, 2024

- FIGURE 23. BATTERY CONDUCTIVE ADDITIVES MARKET: RESEARCHAI

- FIGURE 24. BATTERY CONDUCTIVE ADDITIVES MARKET: RESEARCHSTATISTICS

- FIGURE 25. BATTERY CONDUCTIVE ADDITIVES MARKET: RESEARCHCONTACTS

- FIGURE 26. BATTERY CONDUCTIVE ADDITIVES MARKET: RESEARCHARTICLES

LIST OF TABLES

- TABLE 1. BATTERY CONDUCTIVE ADDITIVES MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

- TABLE 3. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, 2018-2024 (USD MILLION)

- TABLE 4. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, 2025-2030 (USD MILLION)

- TABLE 5. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 6. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 7. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 8. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 9. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 10. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 11. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY CARBON BLACK, BY REGION, 2018-2024 (USD MILLION)

- TABLE 12. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY CARBON BLACK, BY REGION, 2025-2030 (USD MILLION)

- TABLE 13. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY CARBON FIBER, BY REGION, 2018-2024 (USD MILLION)

- TABLE 14. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY CARBON FIBER, BY REGION, 2025-2030 (USD MILLION)

- TABLE 15. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY CONDUCTIVE GRAPHITE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 16. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY CONDUCTIVE GRAPHITE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 17. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY GRAPHENE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 18. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY GRAPHENE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 19. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 20. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 21. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY DISPERSION, BY REGION, 2018-2024 (USD MILLION)

- TABLE 22. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY DISPERSION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY POWDER, BY REGION, 2018-2024 (USD MILLION)

- TABLE 24. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY POWDER, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 26. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 27. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LEAD ACID BATTERIES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 28. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LEAD ACID BATTERIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 30. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM IRON PHOSPHATE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 32. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM IRON PHOSPHATE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM MANGANESE OXIDE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 34. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM MANGANESE OXIDE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM NICKEL COBALT ALUMINUM, BY REGION, 2018-2024 (USD MILLION)

- TABLE 36. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM NICKEL COBALT ALUMINUM, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM NICKEL MANGANESE COBALT, BY REGION, 2018-2024 (USD MILLION)

- TABLE 38. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM NICKEL MANGANESE COBALT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 40. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 41. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY NIMH BATTERIES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 42. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY NIMH BATTERIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 44. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 45. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY AUTOMOTIVE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 46. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY CONSUMER ELECTRONICS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 48. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY CONSUMER ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY INDUSTRIAL, BY REGION, 2018-2024 (USD MILLION)

- TABLE 50. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY INDUSTRIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY STATIONARY ENERGY STORAGE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 52. GLOBAL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY STATIONARY ENERGY STORAGE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53. AMERICAS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 54. AMERICAS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 55. AMERICAS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 56. AMERICAS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 57. AMERICAS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 58. AMERICAS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 59. AMERICAS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 60. AMERICAS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 61. AMERICAS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 62. AMERICAS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 63. AMERICAS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 64. AMERICAS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65. UNITED STATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 66. UNITED STATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 67. UNITED STATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 68. UNITED STATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 69. UNITED STATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 70. UNITED STATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 71. UNITED STATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 72. UNITED STATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 73. UNITED STATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 74. UNITED STATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 75. UNITED STATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY STATE, 2018-2024 (USD MILLION)

- TABLE 76. UNITED STATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY STATE, 2025-2030 (USD MILLION)

- TABLE 77. CANADA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 78. CANADA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 79. CANADA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 80. CANADA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 81. CANADA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 82. CANADA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 83. CANADA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 84. CANADA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 85. CANADA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 86. CANADA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 87. MEXICO BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 88. MEXICO BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 89. MEXICO BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 90. MEXICO BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 91. MEXICO BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 92. MEXICO BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93. MEXICO BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 94. MEXICO BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 95. MEXICO BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 96. MEXICO BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 97. BRAZIL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 98. BRAZIL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 99. BRAZIL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 100. BRAZIL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 101. BRAZIL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 102. BRAZIL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 103. BRAZIL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 104. BRAZIL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 105. BRAZIL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 106. BRAZIL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 107. ARGENTINA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 108. ARGENTINA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 109. ARGENTINA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 110. ARGENTINA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 111. ARGENTINA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 112. ARGENTINA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113. ARGENTINA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 114. ARGENTINA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 115. ARGENTINA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 116. ARGENTINA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 117. EUROPE, MIDDLE EAST & AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 118. EUROPE, MIDDLE EAST & AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 119. EUROPE, MIDDLE EAST & AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 120. EUROPE, MIDDLE EAST & AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 121. EUROPE, MIDDLE EAST & AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 122. EUROPE, MIDDLE EAST & AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 123. EUROPE, MIDDLE EAST & AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 124. EUROPE, MIDDLE EAST & AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 125. EUROPE, MIDDLE EAST & AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 126. EUROPE, MIDDLE EAST & AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127. EUROPE, MIDDLE EAST & AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 128. EUROPE, MIDDLE EAST & AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 129. UNITED KINGDOM BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 130. UNITED KINGDOM BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 131. UNITED KINGDOM BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 132. UNITED KINGDOM BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 133. UNITED KINGDOM BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 134. UNITED KINGDOM BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135. UNITED KINGDOM BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 136. UNITED KINGDOM BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 137. UNITED KINGDOM BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 138. UNITED KINGDOM BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139. GERMANY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 140. GERMANY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 141. GERMANY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 142. GERMANY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 143. GERMANY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 144. GERMANY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145. GERMANY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 146. GERMANY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 147. GERMANY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 148. GERMANY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149. FRANCE BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 150. FRANCE BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 151. FRANCE BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 152. FRANCE BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 153. FRANCE BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 154. FRANCE BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 155. FRANCE BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 156. FRANCE BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 157. FRANCE BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 158. FRANCE BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 159. RUSSIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 160. RUSSIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 161. RUSSIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 162. RUSSIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 163. RUSSIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 164. RUSSIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165. RUSSIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 166. RUSSIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 167. RUSSIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 168. RUSSIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 169. ITALY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 170. ITALY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 171. ITALY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 172. ITALY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 173. ITALY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 174. ITALY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 175. ITALY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 176. ITALY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 177. ITALY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 178. ITALY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 179. SPAIN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 180. SPAIN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 181. SPAIN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 182. SPAIN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 183. SPAIN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 184. SPAIN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 185. SPAIN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 186. SPAIN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 187. SPAIN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 188. SPAIN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 189. UNITED ARAB EMIRATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 190. UNITED ARAB EMIRATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 191. UNITED ARAB EMIRATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 192. UNITED ARAB EMIRATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 193. UNITED ARAB EMIRATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 194. UNITED ARAB EMIRATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 195. UNITED ARAB EMIRATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 196. UNITED ARAB EMIRATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 197. UNITED ARAB EMIRATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 198. UNITED ARAB EMIRATES BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 199. SAUDI ARABIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 200. SAUDI ARABIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 201. SAUDI ARABIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 202. SAUDI ARABIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 203. SAUDI ARABIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 204. SAUDI ARABIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 205. SAUDI ARABIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 206. SAUDI ARABIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 207. SAUDI ARABIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 208. SAUDI ARABIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 209. SOUTH AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 210. SOUTH AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 211. SOUTH AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 212. SOUTH AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 213. SOUTH AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 214. SOUTH AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 215. SOUTH AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 216. SOUTH AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 217. SOUTH AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 218. SOUTH AFRICA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 219. DENMARK BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 220. DENMARK BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 221. DENMARK BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 222. DENMARK BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 223. DENMARK BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 224. DENMARK BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 225. DENMARK BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 226. DENMARK BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 227. DENMARK BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 228. DENMARK BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 229. NETHERLANDS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 230. NETHERLANDS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 231. NETHERLANDS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 232. NETHERLANDS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 233. NETHERLANDS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 234. NETHERLANDS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 235. NETHERLANDS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 236. NETHERLANDS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 237. NETHERLANDS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 238. NETHERLANDS BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 239. QATAR BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 240. QATAR BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 241. QATAR BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 242. QATAR BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 243. QATAR BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 244. QATAR BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 245. QATAR BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 246. QATAR BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 247. QATAR BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 248. QATAR BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 249. FINLAND BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 250. FINLAND BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 251. FINLAND BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 252. FINLAND BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 253. FINLAND BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 254. FINLAND BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 255. FINLAND BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 256. FINLAND BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 257. FINLAND BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 258. FINLAND BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 259. SWEDEN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 260. SWEDEN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 261. SWEDEN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 262. SWEDEN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 263. SWEDEN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 264. SWEDEN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 265. SWEDEN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 266. SWEDEN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 267. SWEDEN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 268. SWEDEN BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 269. NIGERIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 270. NIGERIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 271. NIGERIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 272. NIGERIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 273. NIGERIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 274. NIGERIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 275. NIGERIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 276. NIGERIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 277. NIGERIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 278. NIGERIA BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 279. EGYPT BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 280. EGYPT BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 281. EGYPT BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 282. EGYPT BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 283. EGYPT BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 284. EGYPT BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 285. EGYPT BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 286. EGYPT BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 287. EGYPT BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 288. EGYPT BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 289. TURKEY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 290. TURKEY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 291. TURKEY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 292. TURKEY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 293. TURKEY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 294. TURKEY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 295. TURKEY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 296. TURKEY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 297. TURKEY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 298. TURKEY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 299. ISRAEL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 300. ISRAEL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 301. ISRAEL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 302. ISRAEL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD MILLION)

- TABLE 303. ISRAEL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 304. ISRAEL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 305. ISRAEL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2018-2024 (USD MILLION)

- TABLE 306. ISRAEL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY LITHIUM-ION BATTERIES, 2025-2030 (USD MILLION)

- TABLE 307. ISRAEL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 308. ISRAEL BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY END USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 309. NORWAY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 310. NORWAY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 311. NORWAY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2018-2024 (USD MILLION)

- TABLE 312. NORWAY BATTERY CONDUCTIVE ADDITIVES MARKET SIZE, BY FORM, 2025-2030 (USD

The Battery Conductive Additives Market was valued at USD 1.42 billion in 2024 and is projected to grow to USD 1.53 billion in 2025, with a CAGR of 8.31%, reaching USD 2.29 billion by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 1.42 billion |

| Estimated Year [2025] | USD 1.53 billion |

| Forecast Year [2030] | USD 2.29 billion |

| CAGR (%) | 8.31% |

Battery conductive additives have become a cornerstone of modern energy storage solutions, playing a pivotal role in enhancing performance, safety, and longevity. As the global drive toward electrification accelerates, understanding the underlying market dynamics is critical for stakeholders aiming to capitalize on opportunities. The convergence of stringent environmental regulations, ambitious carbon reduction targets, and consumer demand for reliable energy storage has propelled conductive additives to the forefront of material innovation. These specialized materials facilitate efficient electron transport within electrode formulations, directly influencing key performance metrics such as charge-discharge rates, cycle life, and thermal stability. In this evolving landscape, manufacturers are navigating complex challenges ranging from raw material sourcing to integration with advanced cell chemistries. Meanwhile, end users across automotive, consumer electronics, and industrial sectors are pushing for ever-greater energy density and cost-efficiency. This introduction frames an exploration of how conductive graphites, carbon blacks, graphene variants, and carbon fibers are shaping next-generation batteries. It also establishes the foundation for analyzing supply chain dynamics and regulatory influences. By synthesizing technological advances with market insights, this section sets the stage for a comprehensive examination of transformative shifts, policy impacts, and strategic imperatives that define the battery conductive additives sector.

Mapping the Transformative Shifts Reshaping Battery Conductive Additives Industry Through Innovations, Sustainability Imperatives, and Emerging Material Breakthroughs

In recent years, the battery conductive additives sector has undergone a paradigm shift driven by breakthroughs in material science and mounting sustainability pressures. The transition from traditional carbon blacks to advanced graphene and fiber composites exemplifies the industry's pursuit of higher conductivity and mechanical resilience. Simultaneously, the integration of ecofriendly manufacturing practices, including solventless dispersion techniques and recycled precursor utilization, underscores a broader commitment to circular economy principles. These transformative shifts are further amplified by cross-industry collaboration, as automakers, consumer electronics firms, and energy storage providers coalesce around standardized performance benchmarks. Emerging partnerships between material developers and cell producers are accelerating co-development initiatives aimed at optimizing electrode formulations. Additionally, advancements in dispersion technology are enabling homogenous additive distribution, which in turn maximizes electrochemical stability. In parallel, computational modeling and machine learning tools are facilitating predictive performance analysis, reducing time-to-market for novel formulations. Regulatory bodies are reinforcing these trends by incentivizing low-emission production pathways and setting minimum material performance thresholds. As a result, the landscape today is defined by agile innovation cycles, strategic alliances, and a heightened focus on sustainability metrics. This section unpacks these shifts, mapping how each driver interlinks to reshape the competitive environment and inform long-term value creation.

Assessing the Cumulative Impact of the 2025 United States Tariffs on Battery Conductive Additives Supply Chains, Pricing Dynamics, and Global Trade Flows

The imposition of United States tariffs in 2025 has introduced a complex layer of economic pressure on the battery conductive additives ecosystem. Stakeholders across the supply chain have faced recalibrations in procurement costs as duties are applied to imported carbon blacks, conductive graphites, and graphene materials. This policy decision has reverberated through global trade flows, triggering strategic rerouting of shipments and the negotiation of alternative sourcing arrangements. In response, some additive producers have shifted production footprints closer to end-use markets to mitigate tariff burdens, while others have innovated pricing models or absorbed incremental costs to maintain client relationships. The cumulative impact extends to contract negotiations, where buyers now seek longer-term agreements to lock in pricing and secure raw material availability. Additionally, R&D teams are exploring local material synthesis and refining processes that reduce reliance on tariffed imports. Simultaneously, governments in key regions have introduced counterbalancing incentives for domestic manufacturing of advanced additives, further complicating the global competitive landscape. These policy oscillations necessitate agile supply chain management and dynamic cost modeling to preserve margin resilience. This section assesses how these tariff measures have influenced strategic decision-making, procurement strategies, and the broader market architecture in a post-tariff environment.

Uncovering Key Segmentation Insights by Product Type, Form, Application, and End Use Industry to Illuminate Growth Pathways in Conductive Additives

A granular examination of the battery conductive additives market reveals distinct performance and demand contours across product type, form, application, and end use industry. Conductive graphites, carbon blacks, carbon fibers, and emerging graphene variants each bring unique conductivity, particle morphology, and cost profiles that determine their suitability for specific cell architectures. Powder-based additives are often selected for highly scalable electrode formulations, whereas dispersion formats enable precise integration in high-energy chemistries requiring uniform distribution. In the application sphere, legacy lead acid battery producers continue to rely on well-established conductive blacks, while lithium-ion segments-including iron phosphate, manganese oxide, nickel cobalt aluminum, and nickel manganese cobalt formulations-drive demand for advanced graphites and graphene composites to meet performance benchmarks. Furthermore, end use industries such as automotive demand materials that balance energy density with safety, consumer electronics suppliers prioritize miniaturization and thermal management, industrial users focus on cost-effective scalability, and stationary energy storage operators require long-cycle stability. Layering these segments underscores the heterogeneity of market needs and highlights opportunities for targeted product development and value-added services. Recognizing these subtleties empowers stakeholders to align their technology roadmaps with discrete market segments and capitalize on differentiated growth trajectories.

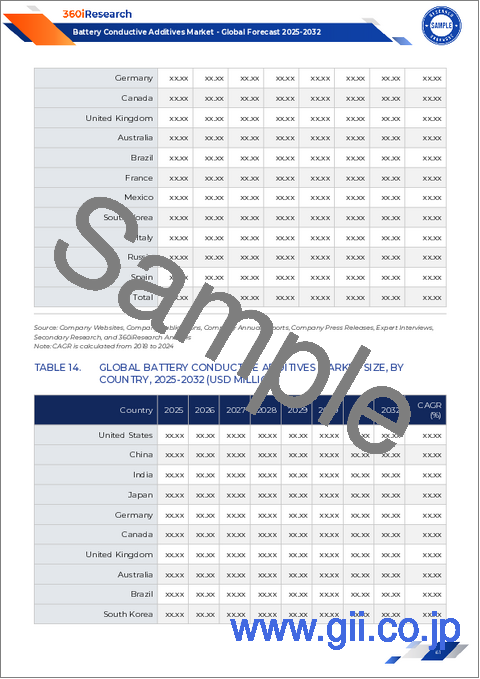

Elucidating Core Regional Insights Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Reveal Diversified Demand Drivers and Strategic Opportunities

Regional dynamics within the battery conductive additives market exhibit nuanced contrasts in growth velocity, regulatory context, and manufacturing capabilities. In the Americas, strong automotive electrification mandates and robust investment in renewable energy storage facilities bolster demand for high-performance conductive graphites and carbon blacks. Market participants are expanding local production to capitalize on favorable policy frameworks and proximity to tier-one cell manufacturers. Conversely, Europe, the Middle East & Africa present a diverse tapestry of regulatory environments where the push for circular economy practices converges with ambitious decarbonization goals. This region sees heightened collaboration between additive developers and end users to validate sustainable production methods and optimize life-cycle performance. Meanwhile, the Asia-Pacific corridor remains a powerhouse of both material innovation and large-scale manufacturing, with leading producers driving down unit costs while advancing next-generation graphene and fiber-based solutions. Government alliances in key Asia-Pacific markets are accelerating R&D funding for novel conductive systems, reinforcing the region's competitive edge. Across these geographies, localized supply chains and specialized technical services are emerging as critical differentiators, compelling companies to tailor strategies that reflect regional idiosyncrasies in demand, policy, and production capacity.

Highlighting Leading Companies and Competitive Dynamics in the Battery Conductive Additives Landscape to Inform Collaboration, Innovation, and Investment Strategies

Competitive dynamics in the battery conductive additives landscape are shaped by a mix of established chemical majors, specialized material innovators, and agile startups. Industry incumbents leverage integrated operations and extensive distribution networks to supply a broad portfolio encompassing carbon blacks, graphites, and fiber composites. These players often invest heavily in pilot-scale facilities and application laboratories to co-develop formulations with key battery manufacturers. At the same time, niche challengers differentiate through breakthrough research in graphene synthesis, proprietary dispersion technologies, and collaborations with academic institutions. This has fostered a spectrum of collaboration models, from joint ventures to licensing agreements, aimed at accelerating commercialization timelines. Partnerships between additive makers and cell producers are becoming more prevalent, signifying a shift toward end-to-end material qualification. Moreover, strategic acquisitions have emerged as a lever to secure innovative capabilities and expand global footprint. Fundraising activities among early-stage developers highlight investor confidence in differentiated conductive solutions that promise enhanced cycle life and thermal management. Collectively, these competitive maneuvers underscore the criticality of technology leadership and ecosystem collaboration in driving long-term value creation.

Delivering Actionable Recommendations for Industry Leaders to Navigate Market Complexity, Drive Adoption of Advanced Conductive Additives, and Enhance Competitiveness

To thrive in the evolving battery conductive additives market, industry leaders must adopt a multifaceted approach that prioritizes innovation, resilience, and customer alignment. First, establishing strategic partnerships with cell manufacturers can accelerate product validation and unlock co-development opportunities for next-generation electrode formulations. In parallel, diversifying raw material sources and strengthening local production capabilities will buffer against policy fluctuations and logistical disruptions. Investing in advanced characterization tools and predictive modeling platforms can further enhance material performance evaluation, reducing time-to-qualification for new additives. Additionally, embedding sustainability metrics throughout the value chain-from precursor selection to end-of-life reuse-will not only meet regulatory expectations but also resonate with environmentally conscious customers. Engaging in targeted pilot programs with automotive, electronics, and energy storage stakeholders can illuminate application-specific performance benefits and inform product roadmaps. Finally, leaders should explore modular service offerings, such as on-site technical support and formulation optimization, to foster deeper partnerships and drive incremental revenue streams. By executing these recommendations, companies can secure competitive differentiation, mitigate risks, and position themselves at the forefront of tomorrow's high-performance battery materials ecosystem.

Detailing the Rigorous Research Methodology Employed to Generate Comprehensive Analysis and Ensure Data Integrity in the Battery Conductive Additives Market Study

The insights presented in this report stem from a rigorous, multi-tiered research methodology designed to ensure comprehensive coverage and data integrity. Primary research formed the backbone of the study, featuring in-depth interviews with key stakeholders across the value chain, including material suppliers, cell manufacturers, technology consultants, and end users in automotive, consumer electronics, industrial, and energy storage sectors. These conversations provided qualitative context on performance requirements, cost sensitivities, and regional regulatory influences. Concurrently, secondary research involved the systematic review of industry publications, patent filings, technical whitepapers, and regulatory documents to validate emerging material trends and policy developments. Supply chain mapping exercises were conducted to trace product flows, identify concentration risks, and assess tariff implications. Additionally, competitive benchmarking analyses were performed to evaluate technology portfolios, strategic partnerships, and investment patterns among leading companies. Data triangulation techniques ensured that findings from disparate sources were reconciled to deliver coherent insights. The research framework also incorporated peer review and expert validation stages, reinforcing the credibility of conclusions. This robust methodology underpins the reliability of the report's segmentation insights, tariff impact assessments, and strategic recommendations.

Concluding Insights That Synthesize Core Findings on Market Evolution, Technological Advances, and Strategic Imperatives in Battery Conductive Additives

The trajectory of the battery conductive additives market is characterized by a confluence of technological innovation, shifting policy landscapes, and evolving consumer demand. Advanced additive chemistries, from novel graphene derivatives to high-performance carbon fibers, are poised to unlock incremental gains in energy density, cycle life, and safety. At the same time, trade policies and regional incentives continue to reshape supply chains and cost structures, compelling stakeholders to adopt agile manufacturing and sourcing strategies. Segmentation analysis underscores that success in this market hinges on tailored solutions that address the distinct needs of lead acid, lithium-ion, and nickel-metal hydride chemistries across diverse end use industries. Regional dynamics further highlight the importance of local production footprints and collaborative frameworks between material developers and cell producers. As competition intensifies, the ability to innovate responsibly-balancing performance with sustainability-will be a critical differentiator. Ultimately, those organizations that integrate data-driven insights, strategic partnerships, and proactive risk management will be best positioned to capitalize on the rapid expansion of electrified transportation, portable electronics, and stationary energy storage applications. This conclusion synthesizes the core findings and sets the stage for strategic action in the evolving conductive additives landscape.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Market Sizing & Forecasting

5. Market Dynamics

- 5.1. Rising demand for nanoengineered graphene conductive additives to boost lithium-ion fast charging efficiency

- 5.2. Integration of conductive polymeric additives with silicon anodes to mitigate volume expansion in high-capacity batteries

- 5.3. Development of sustainable biomass-derived carbon conductive additives to reduce battery production carbon footprint

- 5.4. Advanced hybrid carbon nanotube and graphene composites improving conductivity in next-generation solid-state batteries

- 5.5. Adoption of ultrasonic dispersion techniques for uniform conductive additive distribution in large-format battery electrodes

- 5.6. Tailoring surface functionalization of conductive additives to enhance electrode-electrolyte interfacial stability and cycle life

- 5.7. Cost-effective scaling of high-purity nano-graphite conductive additives through solvent-free mechanochemical synthesis methods

- 5.8. Regulatory-driven shift toward low-emission conductive additive manufacturing processes for environmentally compliant batteries

- 5.9. Utilization of 3D-printed conductive additive frameworks to optimize pore structure and electrical pathways in battery cathodes

- 5.10. Data-driven modeling of conductive additive network formation to predict electrical conductivity and electrode mechanical integrity

6. Market Insights

- 6.1. Porter's Five Forces Analysis

- 6.2. PESTLE Analysis

7. Cumulative Impact of United States Tariffs 2025

8. Battery Conductive Additives Market, by Product Type

- 8.1. Introduction

- 8.2. Carbon Black

- 8.3. Carbon Fiber

- 8.4. Conductive Graphite

- 8.5. Graphene

9. Battery Conductive Additives Market, by Form

- 9.1. Introduction

- 9.2. Dispersion

- 9.3. Powder

10. Battery Conductive Additives Market, by Application

- 10.1. Introduction

- 10.2. Lead Acid Batteries

- 10.3. Lithium-Ion Batteries

- 10.3.1. Lithium Iron Phosphate

- 10.3.2. Lithium Manganese Oxide

- 10.3.3. Lithium Nickel Cobalt Aluminum

- 10.3.4. Lithium Nickel Manganese Cobalt

- 10.4. NiMH Batteries

11. Battery Conductive Additives Market, by End Use Industry

- 11.1. Introduction

- 11.2. Automotive

- 11.3. Consumer Electronics

- 11.4. Industrial

- 11.5. Stationary Energy Storage

12. Americas Battery Conductive Additives Market

- 12.1. Introduction

- 12.2. United States

- 12.3. Canada

- 12.4. Mexico

- 12.5. Brazil

- 12.6. Argentina

13. Europe, Middle East & Africa Battery Conductive Additives Market

- 13.1. Introduction

- 13.2. United Kingdom

- 13.3. Germany

- 13.4. France

- 13.5. Russia

- 13.6. Italy

- 13.7. Spain

- 13.8. United Arab Emirates

- 13.9. Saudi Arabia

- 13.10. South Africa

- 13.11. Denmark

- 13.12. Netherlands

- 13.13. Qatar

- 13.14. Finland

- 13.15. Sweden

- 13.16. Nigeria

- 13.17. Egypt

- 13.18. Turkey

- 13.19. Israel

- 13.20. Norway

- 13.21. Poland

- 13.22. Switzerland

14. Asia-Pacific Battery Conductive Additives Market

- 14.1. Introduction

- 14.2. China

- 14.3. India

- 14.4. Japan

- 14.5. Australia

- 14.6. South Korea

- 14.7. Indonesia

- 14.8. Thailand

- 14.9. Philippines

- 14.10. Malaysia

- 14.11. Singapore

- 14.12. Vietnam

- 14.13. Taiwan

15. Competitive Landscape

- 15.1. Market Share Analysis, 2024

- 15.2. FPNV Positioning Matrix, 2024

- 15.3. Competitive Analysis

- 15.3.1. Cabot Corporation

- 15.3.2. Imerys SA

- 15.3.3. Abvigen Inc.

- 15.3.4. ADEKA CORPORATION

- 15.3.5. Arkema S.A.

- 15.3.6. artience Co., Ltd.

- 15.3.7. BASF SE

- 15.3.8. Birla Carbon India Private Limited

- 15.3.9. Chasm Advanced Materials, Inc.

- 15.3.10. Initial Energy Science & Technology Co.,Ltd

- 15.3.11. LG Energy Solution Ltd.

- 15.3.12. Ossila BV

- 15.3.13. Resonac Holdings Corporation

- 15.3.14. Targray Technology International Inc.

- 15.3.15. XIAMEN TOB NEW ENERGY TECHNOLOGY CO., LTD.