|

|

市場調査レポート

商品コード

1804453

電子機器不要ロボット市場:材料、技術、用途、エンドユーザー産業別 - 2025年~2030年の世界予測Electronics-Free Robots Market by Material, Technology, Application, End User Industry - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電子機器不要ロボット市場:材料、技術、用途、エンドユーザー産業別 - 2025年~2030年の世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 189 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

電子機器不要ロボット市場の2024年の市場規模は6億1,736万米ドルで、2025年には6億7,638万米ドルに成長し、CAGRは10.05%、2030年には10億9,676万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 6億1,736万米ドル |

| 推定年2025 | 6億7,638万米ドル |

| 予測年2030 | 10億9,676万米ドル |

| CAGR(%) | 10.05% |

産業オートメーション、コンシューマーエンゲージメント、次世代研究のブレークスルーに向けた、エレクトロニクスを使わないロボティクスの基礎と戦略的意義の解明

電子機器不要ロボット工学は、オートメーションと機械設計のパラダイムシフトを象徴するもので、複雑な運動と制御を実現するために、純粋に非電子部品を利用します。数十年にわたる空気圧式、油圧式、純粋な機械式システムの研究から生まれたこれらのイノベーションは、エラストマー、ハイドロゲル、シリコーンなどの素材に依存し、従来の回路を使用せずに作動、感知、コンプライアンスを実現します。このような関心の高まりは、過酷な環境下でも確実に作動し、フェイルセーフ性能を提供し、電子部品サプライヤーへの依存を低減できる機械に対する需要に後押しされています。

複数の業界と研究領域にわたり、エレクトロニクス不要のロボット情勢を形成する革命的進歩と新たな動向

エラストマー配合やハイドロゲル複合材の進歩を含む材料科学の飛躍的進歩は、電子機器不要のロボットシステムの能力を根本的に変えました。これらの材料は現在、調整可能な剛性と自己修復特性を示し、洗練された空気圧および油圧アーキテクチャと組み合わされることで、前例のないレベルの器用さと信頼性を可能にします。その結果、設計者はマイクロプロセッサの代わりに複雑な機械的論理回路を統合し、電子的故障モードなしに予測不可能な環境に適応できるロボットを作り出しています。

2025年に実施される米国の関税措置がエレクトロニクス・フリーのロボティクス・サプライチェーンに及ぼす戦略的・経営的影響の評価

2025年に導入された米国の関税措置は、輸入された機械的サブアセンブリや特殊材料に依存するサプライチェーンに大きな圧力をかけています。海外のサプライヤーから調達した精密油圧バルブや特注のエラストマーシーラントなどの部品は関税の引き上げに直面し、メーカーは調達戦略の見直しを迫られています。その結果、製造コストは上昇し、国内での代替品を探したり、既存のパートナーとの契約を再交渉したりするため、スケジュールは延びています。

電子機器不要ロボット市場の材料、技術、用途、エンドユーザー業界セグメンテーションを深堀りする

材料セグメンテーションを掘り下げると、エラストマーが柔軟な作動を必要とする用途で引き続き優位を占めており、繰り返し動作のための弾性と耐疲労性を提供していることがわかる。一方、ハイドロゲルは、外科手術支援における新しいプロトタイプに見られるように、コンプライアンスと生体適合性が要求される環境で関心を集めています。シリコーン材料は熱安定性と成形性が高く評価され、カスタムエンドエフェクターやソフトロボットグリッパーで複雑な形状を可能にしています。

南北アメリカ、中東・アフリカ、アジア太平洋地域における電子機器不要ロボット普及に影響を与える地域動態と成長促進要因

地域分析によると、南北アメリカはサプライチェーンの回復力を優先する政府の取り組みに支えられ、防衛と産業オートメーションの導入でリードしています。特に米国は、助成金プログラムを通じてシリコーンやエラストマー部品の国内生産を促進しています。カナダは、技術教育に空気圧トレーニングモジュールを統合し、機械ロボット工学の専門知識開発における役割を強化しています。ラテンアメリカでは、ロジスティクスと倉庫管理のパイロットプロジェクトが、成長するeコマース業務を最適化するために、低コストの機械式仕分けシステムをテストしています。

世界の電子機器不要ロボット分野でイノベーションと競合ポジションを加速する主要企業プロファイル

業界大手各社は、イノベーションを推進する注目すべきプレーヤー数社とともに、エレクトロニクスフリーのソリューションを含むポートフォリオを急速に拡大しています。定評あるエンジニアリング企業は、材料の専門家と協力して、ロボット関節用のエラストマー複合材を改良しています。同時に、空気圧バルブのニッチな開発企業は、そのコンポーネントを大規模なオートメーションシステムに統合するための戦略的パートナーシップを確保しています。

進化する電子機器不要ロボット・エコシステムにおけるリーダーシップ、イノベーション、市場回復力を推進するための実行可能な戦略的提言

業界のリーダーは、シリコーンやエラストマーなど重要な材料の現地調達サプライチェーンの開発を優先し、関税変動や輸入遅延の影響を軽減する必要があります。加えて、大学や研究センターとのパートナーシップを促進することで、特に医療やリハビリテーション用途において、新規ハイドロゲル配合の実用的な機器への転換を加速させることができます。パイロット生産施設に共同投資することで、企業は市場投入までの時間を短縮し、実環境下での信頼性を実証するケーススタディを生み出すことができます。

電子機器不要ロボット研究を支えるデータ収集、分析手法、検証アプローチを強調する厳密な調査手法

この分析は、機械工学、材料科学、産業オートメーションの第一人者との1次インタビューを組み合わせた混合調査法の枠組みに基づいています。国防調達担当官、医療機器開発者、遊園地経営者との綿密なディスカッションにより、配備の課題や性能要件に関する生の視点が得られました。二次情報源には、査読付きジャーナル、特許データベース、技術白書などが含まれ、材料特性とシステムアーキテクチャの三角測量が可能となりました。

電子機器不要ロボット技術の今後の成長を促進する機会、課題の考察

エレクトロニクスを使わないロボット技術の進化は、弾力性があり、持続可能で安全なオートメーション・ソリューションへの幅広いシフトを強調しています。先端材料と機械システムが融合し、電子部品に頼らずに堅牢な性能を発揮するようになるにつれて、さまざまな分野にチャンスが広がっています。同時に、政策開発や地域的な力学は、サプライチェーン戦略や展開モデルに影響を与え続けると思われます。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 自律型医療用マイクロロボットへの流体ロジック制御システムの統合

- 深海探査作業向けに設計された空気圧ロジックロボットの進歩

- 電子廃棄物の排出量を削減するため、電子機器を搭載しない持続可能なロボットへの関心が高まっている

- ロボットにおける刺激応答性ハイドロゲルを用いた形状変形アクチュエータの革新

- プログラム可能な化学ロボットのためのDNA鎖置換回路の調査

- 爆発性雰囲気における電子機器不要ロボットに対する規制上のインセンティブの強化

- 現場修理用のモジュラープラグアンドプレイ機械ロジックブロックの開発

- 高放射線産業環境における機械弁ベースロボットの導入

- 標的ドラッグデリバリーアプリケーションにおける化学反応駆動型ソフトロボットの採用

- 電子機器を必要としない自動化のための双安定機械計算モジュールの出現

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 電子機器不要ロボット市場:材料別

- エラストマー

- ハイドロゲル

- シリコーン

第9章 電子機器不要ロボット市場:技術別

- 油圧式

- 機械

- 空気圧

第10章 電子機器不要ロボット市場:用途別

- 消費者向けエンターテインメント

- 知育玩具

- テーマパークのアトラクション

- 防衛と安全保障

- 産業オートメーション

- 物流と倉庫

- 梱包システム

- 選別システム

- 医療機器

- リハビリテーション

- 外科手術の補助

第11章 電子機器不要ロボット市場:エンドユーザー産業別

- 自動車

- 教育

- ヘルスケア

- 製造業

- 石油・ガス

第12章 南北アメリカの電子機器不要ロボット市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第13章 欧州・中東・アフリカの電子機器不要ロボット市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第14章 アジア太平洋地域の電子機器不要ロボット市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第15章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Parker-Hannifin Corporation

- IMI plc

- Festo SE & Co. KG

- Moog Inc.

- Lifeward, Inc.

- Metal Work Pneumatic S.p.A.

- OnRobot A/S

- Sarcos Corporation

- SCHUNK SE & Co. KG

- Soft Robotics Inc.

第16章 リサーチAI

第17章 リサーチ統計

第18章 リサーチコンタクト

第19章 リサーチ記事

第20章 付録

LIST OF FIGURES

- FIGURE 1. ELECTRONICS-FREE ROBOTS MARKET RESEARCH PROCESS

- FIGURE 2. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 3. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 4. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 5. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2024 VS 2030 (%)

- FIGURE 6. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2024 VS 2030 (%)

- FIGURE 8. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 9. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2024 VS 2030 (%)

- FIGURE 10. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 11. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2024 VS 2030 (%)

- FIGURE 12. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 13. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 14. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 15. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY STATE, 2024 VS 2030 (%)

- FIGURE 16. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 17. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 18. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 19. ASIA-PACIFIC ELECTRONICS-FREE ROBOTS MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 20. ASIA-PACIFIC ELECTRONICS-FREE ROBOTS MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 21. ELECTRONICS-FREE ROBOTS MARKET SHARE, BY KEY PLAYER, 2024

- FIGURE 22. ELECTRONICS-FREE ROBOTS MARKET, FPNV POSITIONING MATRIX, 2024

- FIGURE 23. ELECTRONICS-FREE ROBOTS MARKET: RESEARCHAI

- FIGURE 24. ELECTRONICS-FREE ROBOTS MARKET: RESEARCHSTATISTICS

- FIGURE 25. ELECTRONICS-FREE ROBOTS MARKET: RESEARCHCONTACTS

- FIGURE 26. ELECTRONICS-FREE ROBOTS MARKET: RESEARCHARTICLES

LIST OF TABLES

- TABLE 1. ELECTRONICS-FREE ROBOTS MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

- TABLE 3. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, 2018-2024 (USD MILLION)

- TABLE 4. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, 2025-2030 (USD MILLION)

- TABLE 5. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 6. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 7. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 8. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 9. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 10. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 11. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY ELASTOMERS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 12. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY ELASTOMERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 13. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY HYDROGELS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 14. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY HYDROGELS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 15. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY SILICONE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 16. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY SILICONE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 17. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 18. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 19. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY HYDRAULIC, BY REGION, 2018-2024 (USD MILLION)

- TABLE 20. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY HYDRAULIC, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MECHANICAL, BY REGION, 2018-2024 (USD MILLION)

- TABLE 22. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MECHANICAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY PNEUMATIC, BY REGION, 2018-2024 (USD MILLION)

- TABLE 24. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY PNEUMATIC, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 26. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 27. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, BY REGION, 2018-2024 (USD MILLION)

- TABLE 28. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY EDUCATIONAL TOYS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 30. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY EDUCATIONAL TOYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY THEME PARK ATTRACTIONS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 32. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY THEME PARK ATTRACTIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 34. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 35. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY DEFENSE AND SECURITY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 36. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY DEFENSE AND SECURITY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY INDUSTRIAL AUTOMATION, BY REGION, 2018-2024 (USD MILLION)

- TABLE 38. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY INDUSTRIAL AUTOMATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, BY REGION, 2018-2024 (USD MILLION)

- TABLE 40. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY PACKING SYSTEMS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 42. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY PACKING SYSTEMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY SORTING SYSTEMS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 44. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY SORTING SYSTEMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 46. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 47. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 48. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY REHABILITATION, BY REGION, 2018-2024 (USD MILLION)

- TABLE 50. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY REHABILITATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY SURGICAL ASSISTANCE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 52. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY SURGICAL ASSISTANCE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 54. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 55. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 56. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 57. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY AUTOMOTIVE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 58. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY EDUCATION, BY REGION, 2018-2024 (USD MILLION)

- TABLE 60. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY EDUCATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY HEALTHCARE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 62. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MANUFACTURING, BY REGION, 2018-2024 (USD MILLION)

- TABLE 64. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY OIL & GAS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 66. GLOBAL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY OIL & GAS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 68. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 69. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 70. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 71. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 72. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 73. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 74. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 75. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 76. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 77. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 78. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 79. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 80. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 81. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 82. AMERICAS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 84. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 85. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 86. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 87. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 88. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 90. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 91. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 92. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 93. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 94. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 95. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 96. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 97. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY STATE, 2018-2024 (USD MILLION)

- TABLE 98. UNITED STATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY STATE, 2025-2030 (USD MILLION)

- TABLE 99. CANADA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 100. CANADA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 101. CANADA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 102. CANADA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 103. CANADA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 104. CANADA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105. CANADA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 106. CANADA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 107. CANADA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 108. CANADA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 109. CANADA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 110. CANADA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 111. CANADA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 112. CANADA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 113. MEXICO ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 114. MEXICO ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 115. MEXICO ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 116. MEXICO ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 117. MEXICO ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 118. MEXICO ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119. MEXICO ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 120. MEXICO ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 121. MEXICO ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 122. MEXICO ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 123. MEXICO ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 124. MEXICO ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 125. MEXICO ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 126. MEXICO ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127. BRAZIL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 128. BRAZIL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 129. BRAZIL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 130. BRAZIL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 131. BRAZIL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 132. BRAZIL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133. BRAZIL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 134. BRAZIL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 135. BRAZIL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 136. BRAZIL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 137. BRAZIL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 138. BRAZIL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 139. BRAZIL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 140. BRAZIL ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 141. ARGENTINA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 142. ARGENTINA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 143. ARGENTINA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 144. ARGENTINA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 145. ARGENTINA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 146. ARGENTINA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147. ARGENTINA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 148. ARGENTINA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 149. ARGENTINA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 150. ARGENTINA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 151. ARGENTINA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 152. ARGENTINA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 153. ARGENTINA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 154. ARGENTINA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 155. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 156. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 157. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 158. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 159. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 160. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 161. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 162. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 163. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 164. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 165. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 166. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 167. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 168. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 169. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 170. EUROPE, MIDDLE EAST & AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 171. UNITED KINGDOM ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 172. UNITED KINGDOM ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 173. UNITED KINGDOM ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 174. UNITED KINGDOM ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 175. UNITED KINGDOM ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 176. UNITED KINGDOM ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 177. UNITED KINGDOM ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 178. UNITED KINGDOM ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 179. UNITED KINGDOM ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 180. UNITED KINGDOM ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 181. UNITED KINGDOM ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 182. UNITED KINGDOM ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 183. UNITED KINGDOM ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 184. UNITED KINGDOM ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 185. GERMANY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 186. GERMANY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 187. GERMANY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 188. GERMANY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 189. GERMANY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 190. GERMANY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 191. GERMANY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 192. GERMANY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 193. GERMANY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 194. GERMANY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 195. GERMANY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 196. GERMANY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 197. GERMANY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 198. GERMANY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 199. FRANCE ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 200. FRANCE ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 201. FRANCE ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 202. FRANCE ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 203. FRANCE ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 204. FRANCE ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 205. FRANCE ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 206. FRANCE ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 207. FRANCE ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 208. FRANCE ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 209. FRANCE ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 210. FRANCE ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 211. FRANCE ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 212. FRANCE ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 213. RUSSIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 214. RUSSIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 215. RUSSIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 216. RUSSIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 217. RUSSIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 218. RUSSIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 219. RUSSIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 220. RUSSIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 221. RUSSIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 222. RUSSIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 223. RUSSIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 224. RUSSIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 225. RUSSIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 226. RUSSIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 227. ITALY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 228. ITALY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 229. ITALY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 230. ITALY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 231. ITALY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 232. ITALY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 233. ITALY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 234. ITALY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 235. ITALY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 236. ITALY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 237. ITALY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 238. ITALY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 239. ITALY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 240. ITALY ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 241. SPAIN ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 242. SPAIN ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 243. SPAIN ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 244. SPAIN ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 245. SPAIN ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 246. SPAIN ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 247. SPAIN ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 248. SPAIN ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 249. SPAIN ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 250. SPAIN ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 251. SPAIN ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 252. SPAIN ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 253. SPAIN ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 254. SPAIN ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 255. UNITED ARAB EMIRATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 256. UNITED ARAB EMIRATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 257. UNITED ARAB EMIRATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 258. UNITED ARAB EMIRATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 259. UNITED ARAB EMIRATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 260. UNITED ARAB EMIRATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 261. UNITED ARAB EMIRATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 262. UNITED ARAB EMIRATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 263. UNITED ARAB EMIRATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 264. UNITED ARAB EMIRATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 265. UNITED ARAB EMIRATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 266. UNITED ARAB EMIRATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 267. UNITED ARAB EMIRATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 268. UNITED ARAB EMIRATES ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 269. SAUDI ARABIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 270. SAUDI ARABIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 271. SAUDI ARABIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 272. SAUDI ARABIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 273. SAUDI ARABIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 274. SAUDI ARABIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 275. SAUDI ARABIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 276. SAUDI ARABIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 277. SAUDI ARABIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 278. SAUDI ARABIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 279. SAUDI ARABIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 280. SAUDI ARABIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 281. SAUDI ARABIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 282. SAUDI ARABIA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 283. SOUTH AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 284. SOUTH AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 285. SOUTH AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 286. SOUTH AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 287. SOUTH AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 288. SOUTH AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 289. SOUTH AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 290. SOUTH AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 291. SOUTH AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 292. SOUTH AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 293. SOUTH AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 294. SOUTH AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 295. SOUTH AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 296. SOUTH AFRICA ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 297. DENMARK ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 298. DENMARK ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 299. DENMARK ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 300. DENMARK ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 301. DENMARK ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 302. DENMARK ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 303. DENMARK ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 304. DENMARK ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 305. DENMARK ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2018-2024 (USD MILLION)

- TABLE 306. DENMARK ELECTRONICS-FREE ROBOTS MARKET SIZE, BY LOGISTICS AND WAREHOUSING, 2025-2030 (USD MILLION)

- TABLE 307. DENMARK ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2018-2024 (USD MILLION)

- TABLE 308. DENMARK ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MEDICAL DEVICES, 2025-2030 (USD MILLION)

- TABLE 309. DENMARK ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2018-2024 (USD MILLION)

- TABLE 310. DENMARK ELECTRONICS-FREE ROBOTS MARKET SIZE, BY END USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 311. NETHERLANDS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2018-2024 (USD MILLION)

- TABLE 312. NETHERLANDS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 313. NETHERLANDS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

- TABLE 314. NETHERLANDS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 315. NETHERLANDS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 316. NETHERLANDS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 317. NETHERLANDS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2018-2024 (USD MILLION)

- TABLE 318. NETHERLANDS ELECTRONICS-FREE ROBOTS MARKET SIZE, BY CONSUMER ENTERTAINMENT, 2025-2030 (USD MILLION)

TABL

The Electronics-Free Robots Market was valued at USD 617.36 million in 2024 and is projected to grow to USD 676.38 million in 2025, with a CAGR of 10.05%, reaching USD 1,096.76 million by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 617.36 million |

| Estimated Year [2025] | USD 676.38 million |

| Forecast Year [2030] | USD 1,096.76 million |

| CAGR (%) | 10.05% |

Unlocking the Fundamentals and Strategic Implications of Electronics-Free Robotics for Industrial Automation, Consumer Engagement, and Next-Generation Research Breakthroughs

Electronics-free robotics represents a paradigm shift in automation and mechanical design, harnessing purely non-electronic components to achieve complex motion and control. Emerging from decades of research into pneumatic, hydraulic and purely mechanical systems, these innovations rely on materials such as elastomers, hydrogels and silicone to deliver actuation, sensing and compliance without traditional circuitry. This resurgence of interest is driven by demands for machines that can operate reliably in extreme environments, offer fail-safe performance and reduce reliance on electronic suppliers.

Moreover, as industries seek to diversify supply chains and enhance resilience against chip shortages, the strategic relevance of electronics-free robots has never been clearer. In addition to industrial automation, applications span from consumer entertainment installations to defense and security platforms, each leveraging unique material and mechanical technologies. This report serves as a foundational guide, outlining transformative trends, regulatory impacts and competitive dynamics shaping the field.

Furthermore, the following sections explore how shifts in policy, segmentation insights and regional drivers converge to define future opportunities. By examining tariff implications, key corporate developments and actionable recommendations, this executive summary equips decision-makers with the clarity needed to navigate a rapidly evolving landscape.

Revolutionary Advances and Emerging Trends Shaping the Electronics-Free Robotics Landscape Across Multiple Industries and Research Domains

Breakthroughs in material science, including advances in elastomer formulations and hydrogel composites, have fundamentally altered the capabilities of electronics-free robotic systems. These materials now exhibit tunable stiffness and self-healing properties that, when combined with refined pneumatic and hydraulic architectures, enable unprecedented levels of dexterity and reliability. Consequently, designers are integrating complex mechanical logic circuits in place of microprocessors, creating robots that can adapt to unpredictable environments without electronic failure modes.

In parallel, miniaturization of fluidic valves and mechanical sensors has unlocked new applications in medical devices, where sterilization compatibility and electromagnetic immunity are critical. Additionally, hybrid approaches that blend silicone structures with embedded fluid networks have demonstrated robust performance in consumer entertainment installations such as theme park attractions and educational toys. This technological convergence signifies a transformative era in which electronics-free robotics transcends niche use cases to enter mainstream deployment.

As these shifts gain momentum, ecosystems of suppliers, integrators and end users are adapting. Partnerships across academia and industry are expediting prototyping cycles, while regulatory bodies are reconsidering certification pathways for devices lacking conventional electronic safeguards. Therefore, stakeholders must recognize how these transformative trends are redefining both technical possibilities and commercial viability across multiple sectors.

Assessing the Strategic and Operational Consequences of United States Tariffs Implemented in 2025 on Electronics-Free Robotics Supply Chains

The United States tariff measures introduced in 2025 have exerted significant pressure on supply chains reliant upon imported mechanical subassemblies and specialized materials. Components such as precision hydraulic valves and custom elastomeric sealants sourced from overseas suppliers now face elevated duties, prompting manufacturers to reassess sourcing strategies. Consequently, production costs have risen and timelines extended as firms seek domestic alternatives or renegotiate agreements with existing partners.

Moreover, these tariff revisions have spurred regionalization of supply chains, particularly among equipment makers serving defense and security applications. US-based producers of silicone-based actuators and hydrogel composites are ramping up capacity, driven by incentivized procurement programs. In addition, companies in the Americas are capitalizing on proximity advantages to reduce lead times and buffer against future policy shifts.

Meanwhile, downstream users in medical device and industrial automation segments have reported recalibrated investment plans in response to higher component prices. Although short-term project timelines have been adjusted, this environment is also driving innovation in local material synthesis and mechanical design optimization. Through these cumulative effects, the 2025 tariff regime is catalyzing both challenges and opportunities in the evolving electronics-free robotics landscape.

Deep Dive into Material, Technological, Application and End User Industry Segmentation Insights for Electronics-Free Robotics Market

Delving into material segmentation reveals that elastomers continue to dominate applications requiring flexible actuation, offering elasticity and fatigue resistance for repetitive motions. Meanwhile, hydrogels are gaining interest for environments demanding compliance and biocompatibility, as evidenced by new prototypes in surgical assistance. Silicone materials, prized for their thermal stability and moldability, are enabling complex geometries in custom end effectors and soft robotic grippers.

When technology segmentation is considered, hydraulic systems remain the preferred choice for high-force industrial operations, providing smooth control and high-load capacity. Mechanical architectures, leveraging gears, springs and cams, are resurfacing in designs where electronic failure is unacceptable, such as defense training simulators. Pneumatic technologies, characterized by rapid response and lightweight components, are being integrated into educational toys and theme park attractions, creating tactile experiences that are both safe and engaging.

Application segmentation highlights consumer entertainment installations where educational toys utilize purely mechanical logic to teach problem-solving, while theme park rides employ pneumatic actuators for immersive, fail-safe thrills. Defense and security platforms are embedding elastomeric and mechanical circuits to operate in electromagnetically contested environments. Industrial automation sees hydraulic press cells and sorting stations relying on fluidic controls instead of electronic interfaces. In logistics and warehousing, packing systems exploit pneumatic grippers for delicate items, while sorting systems utilize mechanical gates for high-speed throughput. Medical devices are embracing both rehabilitation exoskeletons driven by hydraulic pistons and surgical assistance tools fashioned from soft hydrogels for minimally invasive operations.

Looking at end user industries, the automotive sector employs robust silicone-actuated modules in testing rigs, while educational institutions incorporate mechanical robots in curricula to teach basic engineering concepts. Healthcare providers deploy hydrogel-based assistive devices in therapy, manufacturers design hydraulic assembly lines for heavy components, and the oil and gas industry integrates elastomeric safety valves in exploration equipment. Together, these segmentation insights underscore the diverse configurations and applications that define the electronics-free robotics ecosystem.

Regional Dynamics and Growth Drivers Influencing Electronics-Free Robotics Adoption in the Americas, Europe Middle East & Africa, and Asia-Pacific Territories

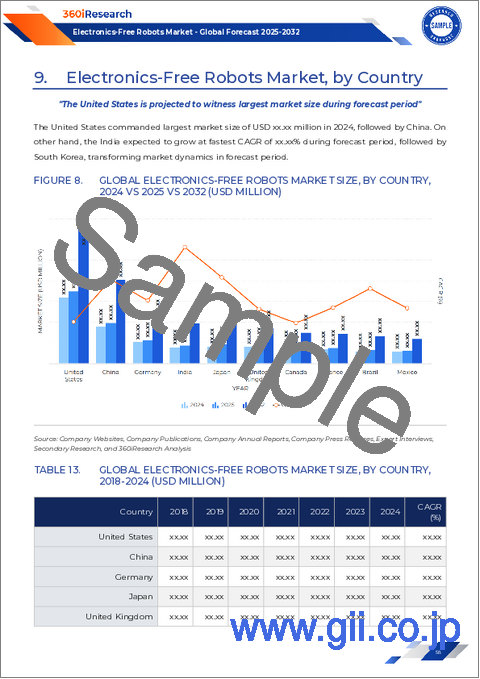

Regional analysis indicates that the Americas lead in defense and industrial automation adoption, underpinned by government initiatives that prioritize supply chain resilience. The United States, in particular, is fostering domestic production of silicone and elastomeric components through grant programs. Canada is integrating pneumatic training modules in technical education, reinforcing its role in the development of mechanical robotics expertise. In Latin America, pilot projects in logistics and warehousing are testing low-cost mechanical sortation systems to optimize growing e-commerce operations.

Meanwhile, Europe, the Middle East and Africa exhibit diverse application dynamics. Western European nations are emphasizing soft robotics for medical and rehabilitation applications, supported by stringent healthcare regulations that favor biocompatible materials. The Middle East is exploring mechanical unmanned systems for oil and gas operations, capitalizing on elastomeric sealing technologies that can withstand extreme temperatures and pressures. Across Africa, educational initiatives are introducing mechanical learning kits, fostering grassroots innovation in regions where electronic components are less accessible.

In the Asia-Pacific region, high-volume manufacturing hubs are expanding capacity for hydraulic actuators and custom silicone molds. Japan and South Korea are pioneering mechanical logic controllers in automotive testing facilities, while Southeast Asian countries are deploying pneumatic amusement park attractions to attract tourism. Australia is investing in rehabilitation devices that rely on hydrogel compliance, bridging advanced research with clinical practice. Collectively, these regional insights illuminate how geographic factors and policy environments shape the trajectory of electronics-free robotics adoption.

Profiling Key Industry Players Accelerating Innovation and Competitive Positioning in the Electronics-Free Robotics Sector Worldwide

Industry leaders are rapidly expanding their portfolios to include electronics-free solutions, with several notable players driving innovation. Established engineering firms are collaborating with material specialists to refine elastomeric composites for robotic joints. At the same time, niche developers of pneumatic valves are securing strategic partnerships to integrate their components into large-scale automation systems.

Concurrently, emerging companies focused on hydrogel synthesis for medical applications are attracting capital from venture investors seeking to address unmet needs in surgical assistance and rehabilitation. Key manufacturers of silicone molds have diversified into bespoke gripper technologies, leveraging decades of expertise in soft material processing. In addition, conglomerates with defense and aerospace backgrounds are integrating mechanical logic modules into unmanned platforms, reflecting a renewed emphasis on electronics-free resilience.

Across the board, collaboration between research institutes and commercial entities is accelerating prototyping cycles. Patent activity around purely mechanical control systems has surged, indicating a competitive race to secure intellectual property. Furthermore, several consortia are standardizing interface protocols for fluidic and mechanical interconnects, facilitating interoperability and reducing development friction. These corporate maneuvers underscore the strategic importance placed on electronics-free robotics as a frontier of technological differentiation.

Actionable Strategic Recommendations to Propel Leadership, Innovation, and Market Resilience in the Evolving Electronics-Free Robotics Ecosystem

Industry leaders should prioritize the development of localized supply chains for critical materials such as silicone and elastomers, thereby mitigating exposure to tariff fluctuations and import delays. In addition, fostering partnerships with universities and research centers will accelerate the translation of novel hydrogel formulations into practical devices, especially in medical and rehabilitation applications. By co-investing in pilot production facilities, organizations can reduce time-to-market and generate case studies that demonstrate reliability under real-world conditions.

Moreover, companies should adopt modular design principles for pneumatic and hydraulic subsystems, enabling rapid reconfiguration and scalable production. This approach will support both industrial automation deployments and consumer-facing applications, such as educational robotics kits and amusement park attractions. Furthermore, establishing a consortium to define standardized mechanical interface protocols will streamline integration efforts across diverse platforms.

Finally, executives must cultivate talent skilled in mechanical control theory and soft material engineering, ensuring that teams possess the expertise to innovate without reliance on electronics. By investing in targeted training programs and cross-disciplinary collaboration, organizations can build resilient capabilities that underpin sustainable leadership in the electronics-free robotics ecosystem.

Rigorous Research Methodology Highlighting Data Collection, Analysis Techniques and Validation Approaches Underpinning the Electronics-Free Robotics Study

This analysis is founded on a mixed-methods research framework combining primary interviews with leading experts in mechanical engineering, material science and industrial automation. In-depth discussions with defense procurement officers, medical device developers and amusement park operators provided firsthand perspectives on deployment challenges and performance requirements. Secondary sources included peer-reviewed journals, patent databases and technical white papers, enabling triangulation of material properties and system architectures.

Quantitative data was corroborated through anonymized supplier shipment records and tariff databases, ensuring an accurate assessment of supply chain dynamics following the 2025 policy changes. Qualitative insights underwent thematic analysis to identify recurring patterns in technology adoption and segmentation preferences. All findings were subjected to rigorous validation through expert panels and scenario workshops, confirming the robustness of conclusions and recommendations.

Throughout the research process, ethical standards were upheld, proprietary information was handled with confidentiality, and methodological transparency was maintained to support reproducibility. This comprehensive approach guarantees that the insights presented reflect the most current and reliable information available on electronics-free robotics.

Conclusive Reflections on the Opportunities, Challenges and Strategic Imperatives Driving Future Growth in Electronics-Free Robotics Technologies

The evolution of electronics-free robotics underscores a broader shift toward resilient, sustainable and safe automation solutions. Opportunities abound across multiple sectors as advanced materials and mechanical systems converge to deliver robust performance without reliance on electronic components. At the same time, policy developments and regional dynamics will continue to influence supply chain strategies and deployment models.

Key challenges include scaling custom material synthesis, establishing standardized interfaces and cultivating specialized talent. However, through targeted investments in localized manufacturing, collaborative research partnerships and modular design frameworks, industry participants can turn these challenges into strategic advantages. The cumulative insights provided herein illuminate clear pathways to capitalize on emerging trends and enhance organizational resilience.

Ultimately, leaders who embrace the principles of electronics-free design and integrate them within broader automation strategies will be well-positioned to capture value in an increasingly competitive environment. The strategic imperatives outlined lay the groundwork for informed decision-making and sustained innovation.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Market Sizing & Forecasting

5. Market Dynamics

- 5.1. Integration of fluidic logic control systems in autonomous medical microrobots

- 5.2. Advancements in pneumatic logic robots designed for deep-sea exploration tasks

- 5.3. Growing interest in sustainable robots without electronics to reduce e-waste footprint

- 5.4. Innovations in shape-morphing actuators using stimulus-responsive hydrogels in robots

- 5.5. Research on DNA strand displacement circuits for programmable chemical robotics

- 5.6. Increased regulatory incentives for electronics-free robots in explosive atmospheres

- 5.7. Development of modular plug-and-play mechanical logic blocks for field repairs

- 5.8. Deployment of mechanical valve-based robots in high-radiation industrial environments

- 5.9. Adoption of chemical reaction-powered soft robots for targeted drug delivery applications

- 5.10. Emergence of bistable mechanical computing modules for electronics-free automation

6. Market Insights

- 6.1. Porter's Five Forces Analysis

- 6.2. PESTLE Analysis

7. Cumulative Impact of United States Tariffs 2025

8. Electronics-Free Robots Market, by Material

- 8.1. Introduction

- 8.2. Elastomers

- 8.3. Hydrogels

- 8.4. Silicone

9. Electronics-Free Robots Market, by Technology

- 9.1. Introduction

- 9.2. Hydraulic

- 9.3. Mechanical

- 9.4. Pneumatic

10. Electronics-Free Robots Market, by Application

- 10.1. Introduction

- 10.2. Consumer Entertainment

- 10.2.1. Educational Toys

- 10.2.2. Theme Park Attractions

- 10.3. Defense And Security

- 10.4. Industrial Automation

- 10.5. Logistics And Warehousing

- 10.5.1. Packing Systems

- 10.5.2. Sorting Systems

- 10.6. Medical Devices

- 10.6.1. Rehabilitation

- 10.6.2. Surgical Assistance

11. Electronics-Free Robots Market, by End User Industry

- 11.1. Introduction

- 11.2. Automotive

- 11.3. Education

- 11.4. Healthcare

- 11.5. Manufacturing

- 11.6. Oil & Gas

12. Americas Electronics-Free Robots Market

- 12.1. Introduction

- 12.2. United States

- 12.3. Canada

- 12.4. Mexico

- 12.5. Brazil

- 12.6. Argentina

13. Europe, Middle East & Africa Electronics-Free Robots Market

- 13.1. Introduction

- 13.2. United Kingdom

- 13.3. Germany

- 13.4. France

- 13.5. Russia

- 13.6. Italy

- 13.7. Spain

- 13.8. United Arab Emirates

- 13.9. Saudi Arabia

- 13.10. South Africa

- 13.11. Denmark

- 13.12. Netherlands

- 13.13. Qatar

- 13.14. Finland

- 13.15. Sweden

- 13.16. Nigeria

- 13.17. Egypt

- 13.18. Turkey

- 13.19. Israel

- 13.20. Norway

- 13.21. Poland

- 13.22. Switzerland

14. Asia-Pacific Electronics-Free Robots Market

- 14.1. Introduction

- 14.2. China

- 14.3. India

- 14.4. Japan

- 14.5. Australia

- 14.6. South Korea

- 14.7. Indonesia

- 14.8. Thailand

- 14.9. Philippines

- 14.10. Malaysia

- 14.11. Singapore

- 14.12. Vietnam

- 14.13. Taiwan

15. Competitive Landscape

- 15.1. Market Share Analysis, 2024

- 15.2. FPNV Positioning Matrix, 2024

- 15.3. Competitive Analysis

- 15.3.1. Parker-Hannifin Corporation

- 15.3.2. IMI plc

- 15.3.3. Festo SE & Co. KG

- 15.3.4. Moog Inc.

- 15.3.5. Lifeward, Inc.

- 15.3.6. Metal Work Pneumatic S.p.A.

- 15.3.7. OnRobot A/S

- 15.3.8. Sarcos Corporation

- 15.3.9. SCHUNK SE & Co. KG

- 15.3.10. Soft Robotics Inc.