|

|

市場調査レポート

商品コード

1870224

生分解性キレート剤市場:製品タイプ別、形態別、流通経路別、用途別、産業別- 世界予測2025-2032年Biodegradable Chelating Agents Market by Product Type, Form, Distribution Channel, Application, Industry - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 生分解性キレート剤市場:製品タイプ別、形態別、流通経路別、用途別、産業別- 世界予測2025-2032年 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 190 Pages

納期: 即日から翌営業日

|

概要

生分解性キレート剤市場は、2032年までにCAGR5.12%で56億9,000万米ドル規模に成長すると予測されております。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 38億1,000万米ドル |

| 推定年2025 | 40億米ドル |

| 予測年2032 | 56億9,000万米ドル |

| CAGR(%) | 5.12% |

生分解性キレート剤に関する権威ある見解:持続可能なキレート剤が製品開発、調達、コンプライアンス計画において不可欠となった理由を解説

生分解性キレート剤の登場は、工業用および民生用アプリケーションにおける金属封鎖へのアプローチにおいて、調合者、環境管理者、規制当局にとって決定的な転換点となります。これらの化合物は、従来のキレート剤と比較して環境プロファイルを改善しつつ、金属イオンを効果的に結合するよう設計されており、ライフサイクルおよび水生毒性の観点から評価されるケースが増加しています。利害関係者が循環性と残留性の低減を優先する中、議論は代替品の特定から、性能の同等性と持続可能性の認証を統合する方向へと移行しています。

規制強化、持続可能性を重視した調達、技術革新が相まって、生分解性キレート剤の競合環境と普及動向を再構築している

生分解性キレート剤の市場環境は、規制圧力、顧客の期待、持続可能な化学技術における革新によって変革的な変化を遂げつつあります。政策立案者による排水基準と生分解性基準の強化は、製剤開発者を「効果と環境残留性の低減」を両立させる代替品へと導いています。同時に、消費者向けブランドは透明性要求を強化しており、調達チームはキレート剤選定時に環境負荷、サプライチェーンのトレーサビリティ、評判リスクを考慮せざるを得ません。こうした要因の相乗効果により、より環境に優しい化学技術への投資と、コンプライアンス及び性能を実証する分析能力への投資が促進されています。

2025年に米国が実施した関税調整が、キレート剤のサプライチェーン、調達選択、調達レジリエンスに及ぼす累積的影響の評価

米国は2025年に一連の関税措置を導入し、生分解性キレート剤を含む特殊化学品原料のコスト構造、調達戦略、地域別サプライチェーンの流れに累積的な影響を及ぼしました。輸入課徴金および関税分類の調整により、特定の中間体および完成キレート剤の着陸コストが増加し、バイヤーは調達優先順位を見直し、異なる貿易リスクを抱える代替サプライヤーの探索を促されました。これに対応し、調達チームは関税、物流、関税コンプライアンスに関連する管理上の間接費を考慮に入れ、総所有コスト(TCO)を再評価しました。

製品化学、物理形態、流通チャネル、用途需要、業界状況が差別化された採用をどのように推進しているかを示す詳細なセグメンテーション視点

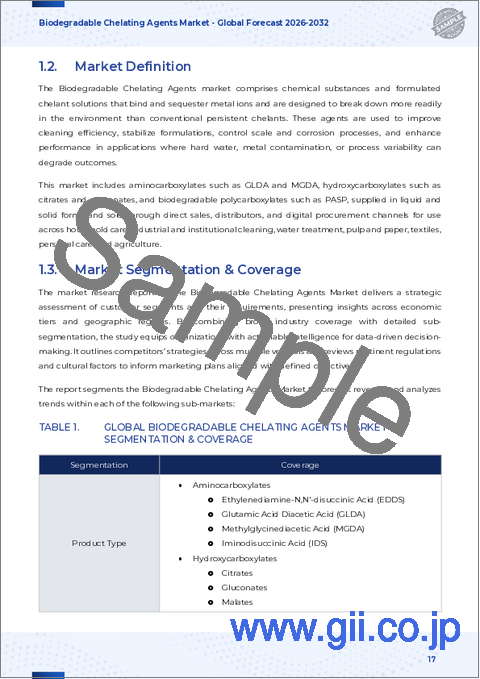

セグメンテーションの知見により、生分解性キレート剤における製品・形態・流通・用途・業界のベクトルが、採用パターンと技術要件をどのように形成しているかが明らかになります。製品タイプ別では、エチレンジアミン二コリン酸、グルタミン酸N,N-ジアセチル酸、イミノジコリン酸を調査対象とし、それぞれがキレート強度、生分解性プロファイル、配合適合性の異なるバランスを示し、下流用途での選定に影響を与えます。形態別では、液体と固体の市場を分析します。液体形態は連続プロセスでの投与が容易である一方、固体形態はバッチ製造において物流上の利点と濃度調整の柔軟性を提供します。流通チャネル別では、オフライン販売とオンライン販売を調査します。オフライン関係は技術サポートや大量調達において依然として重要ですが、オンラインチャネルは小規模な配合メーカーへのアクセスを加速させ、サンプル提供の迅速化を可能にしております。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 精密農業における微量栄養素供給システム向け生分解性キレート剤としてのエチレンジアミン-N,N'ージコハク酸の採用拡大

- 産業用洗浄剤における厳格な排出規制対応のため、ホスホン酸系キレート剤からイミノジコハク酸系への移行

- 重金属毒性ストレス低減のため、都市下水処理における生分解性キレート剤の導入拡大

- 化粧品分野における持続可能な金属イオン封じ込めを目的とした、発酵法による植物由来アミノ酸キレート剤の開発

- 抗菌特性を有する多機能性生分解性キレートポリマーのパーソナルケア製剤への統合

- EUグリーンディール規制の影響による化学製造分野におけるEDTAおよびNTAの環境配慮型キレート剤への代替加速

- 鉱業排水管理における生分解性キレート剤の活用拡大:厳格化する環境排出基準への対応

- バイオテクノロジー系スタートアップ企業と化学メーカーとの提携による生分解性キレート化合物の酵素生産拡大

- 水耕栽培システムにおける微量栄養素供給改善のための制御放出型生分解性キレート剤技術の進展

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 生分解性キレート剤市場:製品タイプ別

- エチレンジアミン二コハク酸

- グルタミン酸N,N-ジアセチル酸

- イミノジコハク酸

第9章 生分解性キレート剤市場:形態別

- 液体

- 固体

第10章 生分解性キレート剤市場:流通チャネル別

- オフライン販売

- オンライン販売

第11章 生分解性キレート剤市場:用途別

- 化粧品・パーソナルケア

- 洗剤・洗浄剤

- 農薬・肥料

- 繊維加工

- 水処理

第12章 生分解性キレート剤市場:業界別

- 農業

- 化学

- 石油・ガス

- パルプ・製紙

- 繊維産業

第13章 生分解性キレート剤市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州、中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第14章 生分解性キレート剤市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第15章 生分解性キレート剤市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第16章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- ADOB Sp. z o.o., ul.

- Aquapharm Chemical Pvt. Ltd. by PCBL Chemical Limited

- Archer Daniels Midland Company

- Ascend Performance Materials Operations LL

- Ava Chemicals Private Limited

- BASF SE

- Biesterfeld AG

- CD Bioparticles Inc.

- Dow Chemical Company

- Hebei Think-Do Chemicals Co.,ltd

- Humintech GmbH

- IngreCore BV.

- Innospec Inc.

- Jungbunzlauer Suisse AG

- LANXESS GmbH

- Lotioncrafter LLC

- Lubrizol Corporation

- Merck KGaA

- Mitsubishi Chemical Corporation

- NIPPON SHOKUBAI CO., LTD

- Nouryon Chemicals Holding B.V.

- PMP Fermentation Products, Inc.

- SpecialChem SA