|

|

市場調査レポート

商品コード

1808668

自動車用調光ガラス市場:調光技術タイプ別、用途別、車種別、エンドユーザー別-2025-2030年の世界予測Automotive Dimming Glass Market by Type of Dimming Technology, Application, Vehicle Type, End User - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動車用調光ガラス市場:調光技術タイプ別、用途別、車種別、エンドユーザー別-2025-2030年の世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 195 Pages

納期: 即日から翌営業日

|

概要

自動車用調光ガラス市場は、2024年には57億7,000万米ドルとなり、2025年には61億3,000万米ドル、CAGR6.49%で成長し、2030年には84億2,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 57億7,000万米ドル |

| 推定年2025 | 61億3,000万米ドル |

| 予測年2030 | 84億2,000万米ドル |

| CAGR(%) | 6.49% |

アダプティブ・ディミングのコア原理と新たなモビリティ動向を重視したスマート自動車ガラスの夜明けを公開

自動車業界は、車内環境の設計方法において根本的な変革期を迎えており、適応型調光ガラスはこの進化の最前線に立っています。この先進的なグレージング・ソリューションは、光の透過をリアルタイムで制御することで、より安全で快適な車内環境を実現すると同時に、AR(拡張現実)ヘッドアップディスプレイなどの新たな機能をサポートします。世界のモビリティが、よりパーソナライゼーションとエネルギー効率にシフトする中、調光ガラス技術は、次世代自動車アーキテクチャの重要な実現要素として台頭してきています。

自律移動、エネルギー効率、ユーザーの期待の融合が自動車用ガラスシステムを変える

自動車用調光ガラスの情勢は、材料技術革新にとどまらず、様々な変革の力によって変化しています。自律走行の開発により、変化する光条件にシームレスに適応し、センサーやカメラの最適な視認性を確保しながら、乗員の快適性を維持する車内環境が求められています。同時に、厳しいエネルギー効率義務化により、日射熱の上昇を積極的に抑えるガラスシステムの統合が奨励され、航続距離の延長と冷却負荷の低減を実現する電動パワートレインをサポートしています。

2025年米国関税率改定が調光ガラス統合のサプライチェーンダイナミクスとコスト構造に与える影響の評価

2025年、一部のガラスと電子部品に対する米国の関税改定が導入され、自動車用調光ガラスのサプライチェーン全体のコスト構造に影響を与えることが予想されます。これらの措置は、主要な海外サプライヤーからの輸入原材料と特殊ポリマーコンパウンドを対象とするもので、生産経済性を維持する上で当面の課題となります。部品メーカーや一流システムインテグレーターは、マージンプロファイルを侵食しかねない関税の上昇を緩和するために、調達戦略を見直す必要があります。

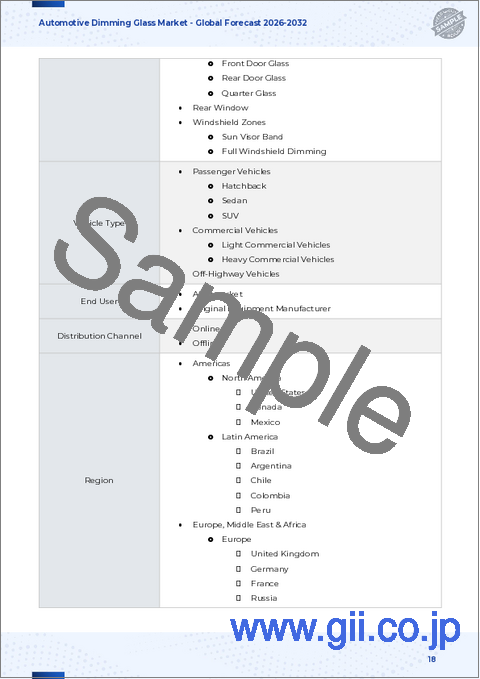

技術バリエーション、アプリケーション領域、車両クラス、ユーザーニッチにまたがる調光ガラスの多面的セグメンテーションの解読

市場セグメンテーションの微妙な理解により、調光ガラスの需要を形成する多様な技術フレームワークとアプリケーション環境が明らかになります。酸化還元反応によって透明度を調節するエレクトロクロミックデバイスは、高速スイッチングを提供するポリマー分散液晶フィルムと共存しています。浮遊粒子デバイスは、高コントラスト比でこの配列をさらに補完し、機能設計の可能性を広げます。

スマートガラス革新の触媒としてアジア太平洋と欧州・中東・アフリカが注目される地域的原動力と採用パターンのマッピング

自動車用調光ガラスの採用軌道を形成する上で、地域ダイナミックスは極めて重要な役割を果たしています。南北アメリカでは、堅調な自動車生産拠点とプレミアムキャビン機能に対する消費者の需要が、先進的なグレージングシステムの早期導入を後押ししています。燃費効率と乗員の安全性に重点を置いた規制の枠組みは、熱的快適性を向上させながら機械的遮光への依存を減らすソリューションの導入をメーカーに促しています。

自動車用調光ガラスの市場リーダーシップを決定づける企業戦略と共同研究開発への取り組み

自動車用調光ガラスの分野で業界をリードする企業は、統合的な戦略的取り組みを通じて他社との差別化を図っています。ある企業は最先端のコーティング化学に特化した先端研究センターを設立し、エレクトロクロミック性能と耐久性の反復的最適化を可能にしています。また、ヘッドアップディスプレイモジュールに調光機能をシームレスに組み込むために、半導体やディスプレイ技術企業との共同開発を進めている企業もあります。

持続可能な競争優位のための、適応的製造アライアンスの構築規制への関与とユーザー中心設計の道筋

今後広がるチャンスを生かすため、業界のリーダーは、複数の調光技術を1つの屋根の下でサポートするモジュール式製造能力への投資を優先すべきです。柔軟な生産プラットフォームを確立することで、エレクトロクロミック、ポリマー分散型液晶、浮遊粒子デバイスの各ライン間の迅速な切り替えが可能になり、進化する自動車プログラムの需要に生産能力を合わせることができます。同時に、半導体やディスプレイのインテグレーターと戦略的提携を結ぶことで、調光機能と車載情報システムの融合を加速させることができます。

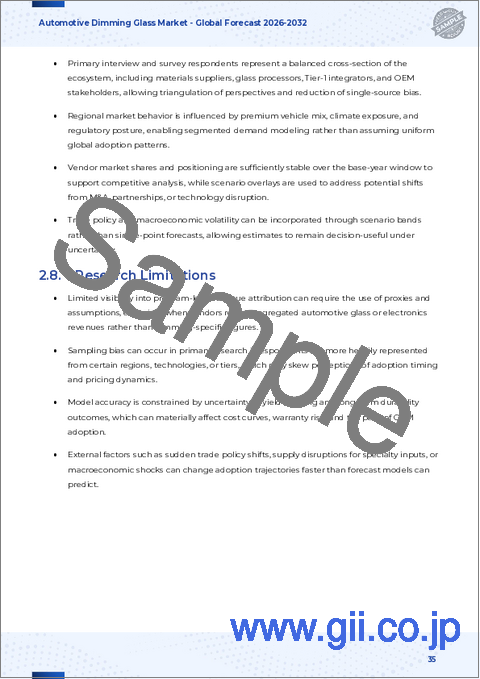

一次専門家インタビューと二次情報および定量的検証プロトコルを統合した調査手法とデータソース

本研究では、1次調査と2次調査の手法を統合した厳密な調査デザインを採用しています。最初に、自動車およびガラス製造セクターの上級幹部、エンジニアリングリーダー、設計スペシャリストに対して構造化インタビューを実施しました。これらの対話により、技術的な準備状況、サプライチェーンの力学、エンドユーザーの要求に関する直接的な見解が得られました。二次情報は、より広範なモビリティと持続可能性の動向の中で調査結果を整理するために、権威ある業界出版物、業界団体、規制文書から入手しました。

自動車用調光ガラスのエコシステムにおける技術的収斂と規制への適応と戦略的先見性の統合

進化する自動車用調光ガラスの情勢は、材料科学のブレークスルー、規制の要請、消費者の期待の移り変わりの収束を強調しています。エレクトロクロミック、高分子分散型液晶、浮遊粒子デバイス技術が成熟するにつれ、これらの技術は総体として車内の快適性、安全性、エネルギー効率の新たなパラダイムを可能にします。同時に、貿易政策の調整と地域的な採用パターンがサプライチェーン戦略を再構築し、利害関係者はより弾力的で機敏なオペレーションモデルの採用を余儀なくされています。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 促進要因の視認性を向上させるために、エレクトロクロミック調光ガラスとADAS(先進運転支援システム)を統合

- 車内の空調管理とエネルギー効率を最適化するために、パノラマサンルーフ用のスマート調光ガラスの採用が増加

- エネルギー消費量を削減し走行距離を延ばす電気自動車向け低消費電力発色コーティングの開発

- 持続可能性のために太陽エネルギーの採取と調整可能な色合いを組み合わせた多機能調光ガラスの進歩

- 乗客がスマートフォンアプリを介してガラスの不透明度を制御できるパーソナライズされたユーザーインターフェースの成長により、カスタマイズが強化されました。

- 高級自動車セグメントとブランドの差別化に対応する、美的色調調整調光ガラス技術の出現

- 自動車用調光ガラスにセンサーとIoT接続を統合し、リアルタイムの周囲光と温度の適応を実現

- 世界の自動車安全基準を満たすために、調光ガラスの紫外線および赤外線遮断性能の向上を求める規制の推進

- 自動車用途の調光ガラスラミネートの大規模生産におけるロールツーロール製造プロセスによるコスト最適化

- 自動車分野の循環型経済の取り組みを支援するため、調光ガラスにおけるリサイクル可能でバイオベースのポリマー中間膜に焦点を当てる

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 自動車用調光ガラス市場調光技術の種類別

- エレクトロクロミック

- ポリマー分散液晶(PDLC)

- 浮遊粒子装置(SPD)

第9章 自動車用調光ガラス市場:用途別

- ヘッドアップディスプレイ

- サンルーフとムーンルーフ

- バイザー

- ウィンドウズ

第10章 自動車用調光ガラス市場:車両タイプ別

- 商用車

- 大型車両

- 小型商用車

- 乗用車

- ハッチバック

- セダン

- SUV

第11章 自動車用調光ガラス市場:エンドユーザー別

- アフターマーケット

- オリジナル機器メーカー

第12章 南北アメリカの自動車用調光ガラス市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第13章 欧州・中東・アフリカの自動車用調光ガラス市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第14章 アジア太平洋地域の自動車用調光ガラス市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第15章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- AGC Inc.

- Gentex Corporation

- Ambilight Inc.

- Continental AG

- Corning Incorporated

- EB GLASS

- Fuyao Group

- Gauzy Ltd

- General Motors

- Glasstronn

- Intelligent Glass

- Nippon Sheet Glass Co., Ltd.

- Pleotint LLC

- Privete

- SageGlass

- Saint-Gobain S.A.

- Shanghai Honghu Industry

- Shenzhen Huake Chuangzhi Technology Co., Ltd.

- Shenzhen Yuguang New Materials

- Smart Glass Technologies, LLC

- SmartGlass International

- View, Inc.

- Xinyi Glass

- Yangzhou Jingcai Intelligent Glass Technology Co., Ltd.

- Magna International Inc.