|

|

市場調査レポート

商品コード

1677324

協調戦闘機市場:プラットフォーム、システム、サイズ、用途、エンドユーザー別 - 2025年~2030年の世界予測Collaborative Combat Aircraft Market by Platform, Sytem, Size, Application, End-User - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 協調戦闘機市場:プラットフォーム、システム、サイズ、用途、エンドユーザー別 - 2025年~2030年の世界予測 |

|

出版日: 2025年03月09日

発行: 360iResearch

ページ情報: 英文 192 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

協調戦闘機市場は、2024年には8億6,930万米ドルとなり、2025年には9億5,806万米ドル、CAGR 10.66%で成長し、2030年には15億9,642万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年 2024 | 8億6,930万米ドル |

| 推定年 2025 | 9億5,806万米ドル |

| 予測年 2030 | 15億9,642万米ドル |

| CAGR(%) | 10.66% |

急速に進化する防衛領域において、協調戦闘機は現代の空中戦を再構築する変革の力として台頭してきました。この入門編では、技術革新と戦略的統合が、共同作戦でシームレスに連携する航空機システムの開発をどのように推進しているかに焦点を当てながら、現在の環境を掘り下げて解説します。最先端のセンサー、航法補助装置、通信ネットワークによって強化された有人システムと無人システムの機能横断的な相乗効果は、作戦性能と戦略的柔軟性の新たな基準を打ち立てつつあります。

歴史的に、戦闘機は特殊な任務のために設計された孤立したユニットとして運用されてきました。今日、最新の航空プラットフォームの統合的な性質は、集団的な能力を発揮するための前例のない機会を解き放ちました。様々なシステムのユニークな長所を組み合わせることにより、世界中の防衛機関は、より高い精度と信頼性で、制空権や地上攻撃から監視や電子戦に至るまで、様々なタスクを実行できる新世代の航空機を実戦配備しています。この協調戦闘機に関する包括的な考察は、これらの統合システムがいかにして航空作戦の未来を定義しつつあるかについての基本的な理解を提供するものです。

このサマリーを読み進めるにつれ、市場力学を明確にする重要なセグメンテーションや地域分析とともに、状況を再定義する変革的なシフトに関する洞察が得られると思われます。ここでは、テクノロジーと戦略の融合に重点を置いており、このテーマはこうした高度な航空プラットフォームの開発と展開を支えています。

協調戦闘機市場の変革

戦闘機の運用力学は、急速な技術的進歩と進化する戦略ドクトリンによって大きな変化を経験しています。現代の空中戦は、もはや速度や火力だけで定義されるものではなく、統合性、柔軟性、情報収集が戦闘効果の最前線にあります。

デジタル通信とセンサー技術の進歩は、従来の航空機を、より大規模で相互接続されたネットワーク内のノードに変えました。このような相互接続性によって、プラットフォームは重要な情報をリアルタイムで共有できるようになり、それによって状況認識が強化され、協調的な戦術行動が可能になりました。サイロ化されたシステムから相互運用可能で協調的なネットワークへの進化はゲームチェンジャーであり、意思決定能力を高めると同時に、緊迫した戦闘シナリオにおける対応のスピードと効率を向上させる。

さらに、最近の軍事行動から学んだ教訓は、レガシー・システムの再評価に拍車をかけ、搭載コンピューティング、ステルス能力、任務の柔軟性のアップグレードを後押ししています。高度な精密誘導弾と自律制御システムの統合は、事前に計画された任務を完遂するだけでなく、予測不可能な状況にも適応できる航空機の出現を加速させています。このような変革により、動的な作戦環境においても、協調的な戦闘機が多用途性と回復力を維持できるようになっています。

有人機と無人機の融合が進むことで、人間の判断が機械主導の分析によってサポートされる戦略的エコシステムが形成されます。意思決定者がこれらの能力を活用することで、戦術的な優位性を維持しながら新たな脅威に対抗する態勢が整う。この情勢に見られる変革的なシフトは、戦闘態勢と作戦上の優位性を維持する上での適応性と先見性の重要性を強調しています。

主要セグメントに関する洞察

協調型戦闘機の市場洞察は、より広範な防衛エコシステム内の複雑さと機会を捉えるために包括的にセグメント化されています。市場セグメンテーションでは、プラットフォームに基づいて市場を調査し、現代の軍事作戦で重要な役割を果たす有人システムと無人システムの力学を分析します。安全な情報交換を促進する通信環境、精密な操縦に不可欠なナビゲーション・モジュール、重要な状況認識を提供するセンサー・アレイ、作戦火力を決定する武器システムなど、さまざまなシステムに分析を広げています。

さらに、市場セグメンテーションでは、航空機をサイズ別に分類し、小型無人航空機(UAV)に代表される軽量システムと、より幅広い高度な戦闘能力を包含する中型から大型の航空機に分類しています。用途別の区分では、制空権、電子戦、地上攻撃、情報・監視・偵察などの作戦領域に焦点を当てることで、市場分析をさらに精緻化します。各用途分野では、特定の戦術的要件を満たすために技術革新がどのように調整されているかについての文脈的洞察が得られます。

最後に、エンドユーザー別のセグメンテーションは、防衛部門、政府機関、民間請負業者がそれぞれ独自の運用要件と戦略的優先事項を持っていることを考慮すると、極めて重要です。このように市場セグメンテーションを注意深く分析することで、利害関係者はニッチな機会を特定し、現代の防衛活動の進化する要求に沿った戦略を調整することができます。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 市場力学

- 促進要因

- 世界中で高まる地政学的緊張と軍事力の近代化

- 現代の航空戦闘システムにおけるネットワーク中心の戦闘能力の必要性の高まり

- 業務効率とコスト効率に対する需要の高まり

- 抑制要因

- 高い研究開発費が急速なイノベーションと生産規模の拡大を制限している

- 機会

- 非伝統的戦争におけるCCAの適用の拡大

- 協働型無人航空機と有人航空機の統合

- 課題

- 相互接続されたプラットフォームを保護するためのサイバーセキュリティの脆弱性と課題

- 促進要因

- 市場セグメンテーション分析

- プラットフォーム:先進的な航空電子機器の統合が確立されたため、有人航空機の採用が増加している

- 用途:地上攻撃システムにおける協調戦闘機の応用拡大

- ポーターのファイブフォース分析

- PESTEL分析

- 政治

- 経済

- 社会

- 技術

- 法律

- 環境

第6章 協調戦闘機市場:プラットフォーム別

- 有人

- 無人

第7章 協調戦闘機市場:システム別

- 通信システム

- ナビゲーションシステム

- センサーシステム

- 武器システム

第8章 協調戦闘機市場:サイズ別

- 軽量(小型無人機)

- 中型から大型の航空機

第9章 協調戦闘機市場:用途別

- 航空優勢

- 電子戦

- 地上攻撃

- 諜報、監視、偵察

第10章 協調戦闘機の市場:エンドユーザー別

- 防衛

- 政府機関

- 民間請負業者

第11章 南北アメリカの協調戦闘機の市場

- アルゼンチン

- ブラジル

- カナダ

- メキシコ

- 米国

第12章 アジア太平洋地域の協調戦闘機の市場

- オーストラリア

- 中国

- インド

- インドネシア

- 日本

- マレーシア

- フィリピン

- シンガポール

- 韓国

- 台湾

- タイ

- ベトナム

第13章 欧州・中東・アフリカの協調戦闘機の市場

- デンマーク

- エジプト

- フィンランド

- フランス

- ドイツ

- イスラエル

- イタリア

- オランダ

- ナイジェリア

- ノルウェー

- ポーランド

- カタール

- ロシア

- サウジアラビア

- 南アフリカ

- スペイン

- スウェーデン

- スイス

- トルコ

- アラブ首長国連邦

- 英国

第14章 競合情勢

- 市場シェア分析, 2024

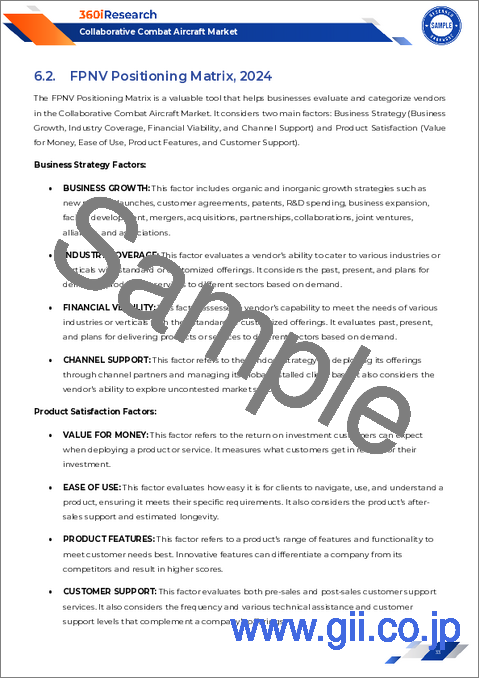

- FPNVポジショニングマトリックス, 2024

- 競合シナリオ分析

- 戦略分析と提言

企業一覧

- AeroVironment, Inc.

- Airbus Defence and Space GmbH

- Anduril Industries, Inc.

- BAE Systems plc

- Boeing Company

- Dassault Aviation SA

- Elbit Systems Ltd.

- Embraer S.A.

- General Atomics Aeronautical Systems

- Hindustan Aeronautics Limited

- Israel Aerospace Industries

- Korea Aerospace Industries, Ltd.

- Kratos Defense & Security Solutions, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- RUAG Holding

- Saab AB

- Textron Systems

- Thales Group

LIST OF FIGURES

- FIGURE 1. COLLABORATIVE COMBAT AIRCRAFT MARKET MULTI-CURRENCY

- FIGURE 2. COLLABORATIVE COMBAT AIRCRAFT MARKET MULTI-LANGUAGE

- FIGURE 3. COLLABORATIVE COMBAT AIRCRAFT MARKET RESEARCH PROCESS

- FIGURE 4. COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, 2024 VS 2030

- FIGURE 5. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 6. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 8. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2024 VS 2030 (%)

- FIGURE 9. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 10. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2024 VS 2030 (%)

- FIGURE 11. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 12. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2024 VS 2030 (%)

- FIGURE 13. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 14. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2024 VS 2030 (%)

- FIGURE 15. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 16. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2024 VS 2030 (%)

- FIGURE 17. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 18. AMERICAS COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 19. AMERICAS COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 20. UNITED STATES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY STATE, 2024 VS 2030 (%)

- FIGURE 21. UNITED STATES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 22. ASIA-PACIFIC COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 23. ASIA-PACIFIC COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 24. EUROPE, MIDDLE EAST & AFRICA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 25. EUROPE, MIDDLE EAST & AFRICA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 26. COLLABORATIVE COMBAT AIRCRAFT MARKET SHARE, BY KEY PLAYER, 2024

- FIGURE 27. COLLABORATIVE COMBAT AIRCRAFT MARKET, FPNV POSITIONING MATRIX, 2024

LIST OF TABLES

- TABLE 1. COLLABORATIVE COMBAT AIRCRAFT MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

- TABLE 3. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 6. COLLABORATIVE COMBAT AIRCRAFT MARKET DYNAMICS

- TABLE 7. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 8. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY MANNED, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY UNMANNED, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 11. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY COMMUNICATION SYSTEM, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY NAVIGATION SYSTEM, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SENSOR SYSTEM, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY WEAPON SYSTEM, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 16. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY LIGHTWEIGHT (SMALL UAVS), BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY MEDIUM TO LARGE AIRCRAFT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 19. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY AIR SUPERIORITY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY ELECTRONIC WARFARE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY GROUND ATTACK, BY REGION, 2018-2030 (USD MILLION)

- TABLE 22. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY INTELLIGENCE, SURVEILLANCE & RECONNAISSANCE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 24. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY DEFENSE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 25. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY GOVERNMENT AGENCIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 26. GLOBAL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PRIVATE CONTRACTORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 27. AMERICAS COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 28. AMERICAS COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 29. AMERICAS COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 30. AMERICAS COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 31. AMERICAS COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 32. AMERICAS COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 33. ARGENTINA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 34. ARGENTINA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 35. ARGENTINA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 36. ARGENTINA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 37. ARGENTINA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 38. BRAZIL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 39. BRAZIL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 40. BRAZIL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 41. BRAZIL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 42. BRAZIL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 43. CANADA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 44. CANADA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 45. CANADA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 46. CANADA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 47. CANADA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 48. MEXICO COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 49. MEXICO COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 50. MEXICO COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 51. MEXICO COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 52. MEXICO COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 53. UNITED STATES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 54. UNITED STATES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 55. UNITED STATES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 56. UNITED STATES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 57. UNITED STATES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 58. UNITED STATES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 59. ASIA-PACIFIC COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 60. ASIA-PACIFIC COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 61. ASIA-PACIFIC COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 62. ASIA-PACIFIC COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 63. ASIA-PACIFIC COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 64. ASIA-PACIFIC COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 65. AUSTRALIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 66. AUSTRALIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 67. AUSTRALIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 68. AUSTRALIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 69. AUSTRALIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 70. CHINA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 71. CHINA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 72. CHINA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 73. CHINA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 74. CHINA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 75. INDIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 76. INDIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 77. INDIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 78. INDIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 79. INDIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 80. INDONESIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 81. INDONESIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 82. INDONESIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 83. INDONESIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 84. INDONESIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 85. JAPAN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 86. JAPAN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 87. JAPAN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 88. JAPAN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 89. JAPAN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 90. MALAYSIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 91. MALAYSIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 92. MALAYSIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 93. MALAYSIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 94. MALAYSIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 95. PHILIPPINES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 96. PHILIPPINES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 97. PHILIPPINES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 98. PHILIPPINES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 99. PHILIPPINES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 100. SINGAPORE COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 101. SINGAPORE COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 102. SINGAPORE COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 103. SINGAPORE COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 104. SINGAPORE COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 105. SOUTH KOREA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 106. SOUTH KOREA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 107. SOUTH KOREA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 108. SOUTH KOREA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 109. SOUTH KOREA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 110. TAIWAN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 111. TAIWAN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 112. TAIWAN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 113. TAIWAN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 114. TAIWAN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 115. THAILAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 116. THAILAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 117. THAILAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 118. THAILAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 119. THAILAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 120. VIETNAM COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 121. VIETNAM COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 122. VIETNAM COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 123. VIETNAM COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 124. VIETNAM COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 125. EUROPE, MIDDLE EAST & AFRICA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 126. EUROPE, MIDDLE EAST & AFRICA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 127. EUROPE, MIDDLE EAST & AFRICA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 128. EUROPE, MIDDLE EAST & AFRICA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 129. EUROPE, MIDDLE EAST & AFRICA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 130. EUROPE, MIDDLE EAST & AFRICA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 131. DENMARK COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 132. DENMARK COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 133. DENMARK COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 134. DENMARK COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 135. DENMARK COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 136. EGYPT COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 137. EGYPT COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 138. EGYPT COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 139. EGYPT COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 140. EGYPT COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 141. FINLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 142. FINLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 143. FINLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 144. FINLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 145. FINLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 146. FRANCE COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 147. FRANCE COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 148. FRANCE COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 149. FRANCE COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 150. FRANCE COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 151. GERMANY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 152. GERMANY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 153. GERMANY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 154. GERMANY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 155. GERMANY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 156. ISRAEL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 157. ISRAEL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 158. ISRAEL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 159. ISRAEL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 160. ISRAEL COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 161. ITALY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 162. ITALY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 163. ITALY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 164. ITALY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 165. ITALY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 166. NETHERLANDS COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 167. NETHERLANDS COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 168. NETHERLANDS COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 169. NETHERLANDS COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 170. NETHERLANDS COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 171. NIGERIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 172. NIGERIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 173. NIGERIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 174. NIGERIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 175. NIGERIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 176. NORWAY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 177. NORWAY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 178. NORWAY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 179. NORWAY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 180. NORWAY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 181. POLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 182. POLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 183. POLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 184. POLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 185. POLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 186. QATAR COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 187. QATAR COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 188. QATAR COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 189. QATAR COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 190. QATAR COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 191. RUSSIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 192. RUSSIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 193. RUSSIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 194. RUSSIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 195. RUSSIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 196. SAUDI ARABIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 197. SAUDI ARABIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 198. SAUDI ARABIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 199. SAUDI ARABIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 200. SAUDI ARABIA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 201. SOUTH AFRICA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 202. SOUTH AFRICA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 203. SOUTH AFRICA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 204. SOUTH AFRICA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 205. SOUTH AFRICA COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 206. SPAIN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 207. SPAIN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 208. SPAIN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 209. SPAIN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 210. SPAIN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 211. SWEDEN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 212. SWEDEN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 213. SWEDEN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 214. SWEDEN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 215. SWEDEN COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 216. SWITZERLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 217. SWITZERLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 218. SWITZERLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 219. SWITZERLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 220. SWITZERLAND COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 221. TURKEY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 222. TURKEY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 223. TURKEY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 224. TURKEY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 225. TURKEY COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 226. UNITED ARAB EMIRATES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 227. UNITED ARAB EMIRATES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 228. UNITED ARAB EMIRATES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 229. UNITED ARAB EMIRATES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 230. UNITED ARAB EMIRATES COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 231. UNITED KINGDOM COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY PLATFORM, 2018-2030 (USD MILLION)

- TABLE 232. UNITED KINGDOM COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SYTEM, 2018-2030 (USD MILLION)

- TABLE 233. UNITED KINGDOM COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY SIZE, 2018-2030 (USD MILLION)

- TABLE 234. UNITED KINGDOM COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 235. UNITED KINGDOM COLLABORATIVE COMBAT AIRCRAFT MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 236. COLLABORATIVE COMBAT AIRCRAFT MARKET SHARE, BY KEY PLAYER, 2024

- TABLE 237. COLLABORATIVE COMBAT AIRCRAFT MARKET, FPNV POSITIONING MATRIX, 2024

The Collaborative Combat Aircraft Market was valued at USD 869.30 million in 2024 and is projected to grow to USD 958.06 million in 2025, with a CAGR of 10.66%, reaching USD 1,596.42 million by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 869.30 million |

| Estimated Year [2025] | USD 958.06 million |

| Forecast Year [2030] | USD 1,596.42 million |

| CAGR (%) | 10.66% |

In the rapidly evolving defense domain, collaborative combat aircraft have emerged as a transformative force reshaping modern aerial warfare. This introductory segment provides an in-depth exploration of the current environment, highlighting how technological innovation and strategic integration are driving the development of aircraft systems that seamlessly work together in joint operations. The cross-functional synergy between manned and unmanned systems, enhanced by cutting-edge sensors, navigational aids, and communications networks, is setting new standards for operational performance and strategic flexibility.

Historically, combat aircraft operated as isolated units designed for specialized missions. Today, the integrated nature of modern aerial platforms has unlocked unprecedented opportunities for collective capabilities. By combining the unique strengths of various systems, defense agencies worldwide are fielding a new generation of aircraft that can perform tasks ranging from air superiority and ground attack to surveillance and electronic warfare with increased precision and reliability. This comprehensive examination of the collaborative combat aircraft landscape provides a baseline understanding of how these integrated systems are defining the future of air operations.

As you progress through this summary, you will gain insights into the transformative shifts redefining the landscape, along with critical segmentation and regional analyses that offer clarity on market dynamics. The emphasis here is on the convergence of technology and strategy, a theme that underpins the development and deployment of these sophisticated aerial platforms.

Transformative Shifts in the Collaborative Combat Aircraft Landscape

The operational dynamics of combat aircraft have experienced significant shifts driven by rapid technological advancements and evolving strategic doctrines. Modern aerial warfare is no longer defined solely by speed or firepower; integration, flexibility, and intelligence gathering are now at the forefront of combat effectiveness.

Advancements in digital communication and sensor technology have turned traditional aircraft into nodes within a larger, interconnected network. Such interconnectivity enables platforms to share critical information in real-time, thereby enhancing situational awareness and enabling coordinated tactical maneuvers. The evolution from siloed systems towards inter-operable, collaborative networks is a game changer, providing enhanced decision-making capabilities while increasing the speed and efficiency of response in high-stakes combat scenarios.

Furthermore, lessons learned from recent military engagements have spurred a reassessment of legacy systems, pushing for upgrades in onboard computing, stealth capabilities, and mission flexibility. The integration of advanced precision-guided munitions and autonomous control systems is accelerating the emergence of aircraft that can not only complete pre-planned missions but also adapt to unpredictable situations. This transformation is ensuring that collaborative combat aircraft remain versatile and resilient even in dynamic operational environments.

The ongoing convergence of manned and unmanned vehicles contributes to a strategic ecosystem where human judgment is supported by machine-driven analytics. As decision-makers leverage these capabilities, they are better positioned to counter emerging threats while maintaining a tactical edge. The transformative shifts seen in this landscape underscore the importance of adaptability and foresight in maintaining combat readiness and operational superiority.

Key Segmentation Insights

The market insights for collaborative combat aircraft are comprehensively segmented to capture the complexities and opportunities within the broader defense ecosystem. The segmentation approach studies the market based on platform, analyzing the dynamics of both manned and unmanned systems which play crucial roles in modern military operations. It extends the analysis to different systems including communication environments that facilitate secure information exchange, navigation modules essential for precision maneuvers, sensor arrays that provide critical situational awareness, and weapon systems that determine operational firepower.

Additionally, market segmentation by size categorizes aircraft into lightweight systems, typically represented by small unmanned aerial vehicles (UAVs), and medium to large aircraft that encompass a broader range of advanced combat capabilities. The segmentation by application further refines the market analysis by focusing on operational domains such as air superiority, electronic warfare, ground attack, as well as intelligence, surveillance, and reconnaissance. Each application area provides contextual insights into how innovations are tailored to meet specific tactical requirements.

Finally, segmentation by end-user is pivotal, considering that defense sectors, government agencies, and private contractors each have unique operational requirements and strategic priorities. This careful dissection of market segmentation allows stakeholders to identify niche opportunities and tailor strategies that align with the evolving demands of modern defense operations.

Based on Platform, market is studied across Manned and Unmanned.

Based on Sytem, market is studied across Communication System, Navigation System, Sensor System, and Weapon System.

Based on Size, market is studied across Lightweight (Small UAVs) and Medium To Large Aircraft.

Based on Application, market is studied across Air Superiority, Electronic Warfare, Ground Attack, and Intelligence, Surveillance & Reconnaissance.

Based on End-User, market is studied across Defense, Government Agencies, and Private Contractors.

Key Regional Insights

A regional analysis of the collaborative combat aircraft market reveals varying dynamics across different global territories. In the Americas, there is significant investment in modernizing legacy systems while embracing next-generation integrated platforms. Economic and political factors in this region continue to drive both defense spending and the pursuit of cutting-edge military technologies.

In regions encompassing Europe, the Middle East, and Africa, the shift towards more unified and network-centric combat solutions is markedly evident. These regions are characterized by diverse strategic interests and an increasing need for interoperability among a wide range of defense systems. Amid evolving security challenges, stakeholders in these territories are focusing on enhancing collaborative capabilities and leveraging technological partnerships.

The Asia-Pacific region stands out due to its rapidly expanding defense budgets and a proactive push toward modernization. Here, nations are investing heavily in dual-use technologies that can provide both commercial and military advantages, thereby catalyzing advancements in collaborative aircraft platforms. The strategic outlook in Asia-Pacific is significantly influenced by the imperative to maintain regional stability, which in turn fuels innovation in integrated combat systems.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Key Companies Insights

Within the competitive landscape of collaborative combat aircraft, numerous industry players are driving innovation and strategic partnerships. Leading enterprises such as AeroVironment, Inc., Airbus Defence and Space GmbH, and Anduril Industries, Inc. are at the forefront of integrating state-of-the-art technologies into combat platforms. BAE Systems plc and the Boeing Company have long-standing reputations for delivering robust systems that combine legacy expertise with future-oriented innovations. Dassault Aviation SA and Elbit Systems Ltd. continue to push boundaries with advanced research and development investments, while Embraer S.A. and General Atomics Aeronautical Systems are rethinking combat aircraft design to meet the dynamic demands of modern warfare.

Other players such as Hindustan Aeronautics Limited and Israel Aerospace Industries have invested heavily in developing specialized capabilities that align with regional security imperatives. Korea Aerospace Industries, Ltd. alongside Kratos Defense & Security Solutions, Inc., are modernizing their fleets with next-generation systems that offer enhanced maneuverability and stealth features. The contributions of Leonardo S.p.A., Lockheed Martin Corporation, and Northrop Grumman Corporation are particularly noteworthy, as their integrated systems have set benchmarks for multi-domain operations. With strategic inputs from Raytheon Technologies Corporation, RUAG Holding, Saab AB, Textron Systems, and Thales Group, the sector continues to see pioneering approaches that are redefining both system integration and combat readiness across the globe.

The report delves into recent significant developments in the Collaborative Combat Aircraft Market, highlighting leading vendors and their innovative profiles. These include AeroVironment, Inc., Airbus Defence and Space GmbH, Anduril Industries, Inc., BAE Systems plc, Boeing Company, Dassault Aviation SA, Elbit Systems Ltd., Embraer S.A., General Atomics Aeronautical Systems, Hindustan Aeronautics Limited, Israel Aerospace Industries, Korea Aerospace Industries, Ltd., Kratos Defense & Security Solutions, Inc., Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, RUAG Holding, Saab AB, Textron Systems, and Thales Group. Actionable Recommendations for Industry Leaders

Industry leaders are encouraged to adopt a forward-thinking approach that harmonizes both technological innovation and strategic adaptability. To remain competitive, decision-makers must invest in research and development initiatives aimed at enhancing integration between manned and unmanned systems. The convergence of advanced sensor technologies, robust communication networks, and autonomous capabilities presents an opportunity to consolidate disparate platforms into cohesive combat units. Leaders should also prioritize scalability and modularity in system design to ensure that platforms can be swiftly upgraded to meet future operational needs.

It is imperative to foster cross-industry collaborations and strategic alliances that can accelerate the pace of innovation. By partnering with technology firms, defense contractors, and academic institutions, organizations can share knowledge and develop interoperable solutions that are resilient to emerging threats. In addition, continuous monitoring of geopolitical trends and regional security developments is vital to anticipate market shifts and realign strategic priorities accordingly. Overcoming legacy system challenges through modernization programs should be considered a priority, ensuring that existing fleets are not left behind in the wake of newer technologies.

Finally, strategic investments in talent development and training are essential. The evolving complexity of collaborative combat aircraft demands a workforce that is adept in both technological domains and strategic execution. By nurturing expertise and encouraging a culture that embraces innovation, industry leaders can build a robust foundation for sustained competitive advantage in the rapidly transforming defense landscape.

Conclusion

The evolution of collaborative combat aircraft is fundamentally reshaping modern warfare by combining advanced engineering with strategic integration. Through the synthesis of manned and unmanned capabilities, the defense industry is driving significant improvements in operational efficiency, real-time intelligence, and tactical responsiveness. This executive summary has outlined the multifaceted landscape of collaborative combat aircraft, emphasizing the transformative shifts in technology and strategic applications that underpin this sector.

An integrated approach that meticulously analyzes segmentations-ranging from platform types and system functionalities to application areas and end-user demands-illustrates the nuanced complexities of the current market. In parallel, regional and company-specific insights provide a broader view of how different stakeholders are responding to global defense challenges. The comprehensive review outlined here serves not only as an analytical report but also as a strategic playbook for organizations intent on leveraging these advancements for enhanced mission effectiveness.

The ongoing drive towards integration and technological sophistication is both an opportunity and a challenge. With rapid technological advancements, stakeholders who adopt a proactive, integrative approach to system development and market analytics will position themselves ahead of the curve. Ultimately, the continuous evolution of collaborative combat aircraft underscores the necessity of innovative strategies that reconcile technological potential with practical military application.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Growing geopolitical tensions and military modernization worldwide

- 5.1.1.2. Rising need for network-centric warfare capabilities in modern air combat systems

- 5.1.1.3. Increased demand for operational efficiency and cost-effectiveness

- 5.1.2. Restraints

- 5.1.2.1. High R&D expenditures limiting rapid innovation and production scaling

- 5.1.3. Opportunities

- 5.1.3.1. Expansion of CCA applications in non-traditional warfare

- 5.1.3.2. Integration of collaborative UAVs with manned aircraft

- 5.1.4. Challenges

- 5.1.4.1. Cybersecurity vulnerabilities and challenges in safeguarding interconnected platforms

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Platform: Increasing adoption of manned aircraft due to their established integration of advanced avionics

- 5.2.2. Application: Expanding application of collaborative combat aircraft in ground attack systems

- 5.3. Porter's Five Forces Analysis

- 5.3.1. Threat of New Entrants

- 5.3.2. Threat of Substitutes

- 5.3.3. Bargaining Power of Customers

- 5.3.4. Bargaining Power of Suppliers

- 5.3.5. Industry Rivalry

- 5.4. PESTLE Analysis

- 5.4.1. Political

- 5.4.2. Economic

- 5.4.3. Social

- 5.4.4. Technological

- 5.4.5. Legal

- 5.4.6. Environmental

6. Collaborative Combat Aircraft Market, by Platform

- 6.1. Introduction

- 6.2. Manned

- 6.3. Unmanned

7. Collaborative Combat Aircraft Market, by Sytem

- 7.1. Introduction

- 7.2. Communication System

- 7.3. Navigation System

- 7.4. Sensor System

- 7.5. Weapon System

8. Collaborative Combat Aircraft Market, by Size

- 8.1. Introduction

- 8.2. Lightweight (Small UAVs)

- 8.3. Medium To Large Aircraft

9. Collaborative Combat Aircraft Market, by Application

- 9.1. Introduction

- 9.2. Air Superiority

- 9.3. Electronic Warfare

- 9.4. Ground Attack

- 9.5. Intelligence, Surveillance & Reconnaissance

10. Collaborative Combat Aircraft Market, by End-User

- 10.1. Introduction

- 10.2. Defense

- 10.3. Government Agencies

- 10.4. Private Contractors

11. Americas Collaborative Combat Aircraft Market

- 11.1. Introduction

- 11.2. Argentina

- 11.3. Brazil

- 11.4. Canada

- 11.5. Mexico

- 11.6. United States

12. Asia-Pacific Collaborative Combat Aircraft Market

- 12.1. Introduction

- 12.2. Australia

- 12.3. China

- 12.4. India

- 12.5. Indonesia

- 12.6. Japan

- 12.7. Malaysia

- 12.8. Philippines

- 12.9. Singapore

- 12.10. South Korea

- 12.11. Taiwan

- 12.12. Thailand

- 12.13. Vietnam

13. Europe, Middle East & Africa Collaborative Combat Aircraft Market

- 13.1. Introduction

- 13.2. Denmark

- 13.3. Egypt

- 13.4. Finland

- 13.5. France

- 13.6. Germany

- 13.7. Israel

- 13.8. Italy

- 13.9. Netherlands

- 13.10. Nigeria

- 13.11. Norway

- 13.12. Poland

- 13.13. Qatar

- 13.14. Russia

- 13.15. Saudi Arabia

- 13.16. South Africa

- 13.17. Spain

- 13.18. Sweden

- 13.19. Switzerland

- 13.20. Turkey

- 13.21. United Arab Emirates

- 13.22. United Kingdom

14. Competitive Landscape

- 14.1. Market Share Analysis, 2024

- 14.2. FPNV Positioning Matrix, 2024

- 14.3. Competitive Scenario Analysis

- 14.3.1. NewSpace Research and Technologies launches the Indian Naval collaborative drone concept

- 14.3.2. Saudi Arabia and Turkey sign a USD 100 million defense agreement for advancing unmanned aerial and combat drone technology

- 14.3.3. BAE Systems, Leonardo and JAIEC pave the way for next-generation combat aircraft industrial innovation

- 14.4. Strategy Analysis & Recommendation

Companies Mentioned

- 1. AeroVironment, Inc.

- 2. Airbus Defence and Space GmbH

- 3. Anduril Industries, Inc.

- 4. BAE Systems plc

- 5. Boeing Company

- 6. Dassault Aviation SA

- 7. Elbit Systems Ltd.

- 8. Embraer S.A.

- 9. General Atomics Aeronautical Systems

- 10. Hindustan Aeronautics Limited

- 11. Israel Aerospace Industries

- 12. Korea Aerospace Industries, Ltd.

- 13. Kratos Defense & Security Solutions, Inc.

- 14. Leonardo S.p.A.

- 15. Lockheed Martin Corporation

- 16. Northrop Grumman Corporation

- 17. Raytheon Technologies Corporation

- 18. RUAG Holding

- 19. Saab AB

- 20. Textron Systems

- 21. Thales Group