|

|

市場調査レポート

商品コード

1809978

カーボンファーミング市場:実践タイプ、クレジットタイプ、農場規模、エンドユーザー別-2025-2030年世界予測Carbon Farming Market by Practice Type, Credit Type, Farm Size, End-User - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| カーボンファーミング市場:実践タイプ、クレジットタイプ、農場規模、エンドユーザー別-2025-2030年世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 191 Pages

納期: 即日から翌営業日

|

概要

カーボンファーミング市場は、2024年には13億7,000万米ドルとなり、2025年には14億5,000万米ドル、CAGR6.26%で成長し、2030年には19億7,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 13億7,000万米ドル |

| 推定年2025 | 14億5,000万米ドル |

| 予測年2030 | 19億7,000万米ドル |

| CAGR(%) | 6.26% |

持続可能な農業、気候レジリエンス、環境影響のための変革的イニシアティブとしてのカーボンファーミングの基礎的枠組みを明らかにします

農業と気候変動対策の接点がかつてないほど重要になっており、カーボンファーミングはニッチな概念から、バリューチェーン全体の利害関係者にとって戦略的必須事項へと押し上げられています。このイントロダクションは、炭素貯留の実践が土壌の健全性をどのように変え、資源利用を最適化し、クレジットメカニズムを通じて新たな収入源を生み出すかを理解するための基礎的枠組みを確立するものです。農業セクターが環境規制の強化や企業の持続可能性目標に適応するにつれ、炭素農業戦略の役割は、複数の実践タイプやエンドユーザーを包含するまでに拡大しています。

急速に進化する農業の持続可能性の情勢の中で、カーボンファーミングの実践と政策促進要因を形成するパラダイムシフトを検証します

炭素農業の進化は、農業のパラダイムを再定義する一連の変革的シフトに支えられています。政策の枠組みは透明性の高い炭素会計を推進し、民間セクターは環境、社会、ガバナンス戦略の一環として炭素クレジットを採用するようになっています。その結果、生産者と土地管理者は、土壌炭素の増加を検証し、複雑な報告要件を乗り越えるために、高度な測定技術とデータ分析を統合し始めています。

2025年の米国関税調整が世界の炭素農業バリューチェーンと貿易力学に及ぼす包括的な影響の評価

2025年に施行される米国関税の累積的影響は、炭素農業エコシステムの参加者に課題と戦略的機会の両方をもたらしました。輸入機器や特定の土壌改良材のコストを引き上げることで、これらの貿易措置は国内生産者に国内供給源を求め、それに応じて投資戦略を適応させるよう促しています。その結果、国内製造と地域供給の弾力性が重視されるようになり、機器メーカー、炭素プロジェクト開発業者、農業協同組合の間で新たなパートナーシップが生まれました。

実践タイプ、クレジットメカニズム、農場規模、エンドユーザー・プロファイルに基づく、オーダーメイドの炭素農法の機会を引き出すための主要なセグメンテーション洞察の解明

セグメンテーション分析により、炭素農法の導入と影響における、異なるカテゴリー間の微妙なパターンが明らかになりました。慣行タイプ別では、アグロフォレストリー(Agroforestry)が、換金作物と窒素固定樹木の列を統合した路地作物システムや、家畜の放牧と戦略的に植樹された樹冠を組み合わせたシルボパスチャーモデルを含む、多面的なアプローチとして浮上しています。バイオ炭の利用は、農業製品別の価値を高める残渣由来のバイオ炭や、持続的に収穫されたバイオマスから生産される木材由来のバイオ炭など、この分野をさらに多様化しています。

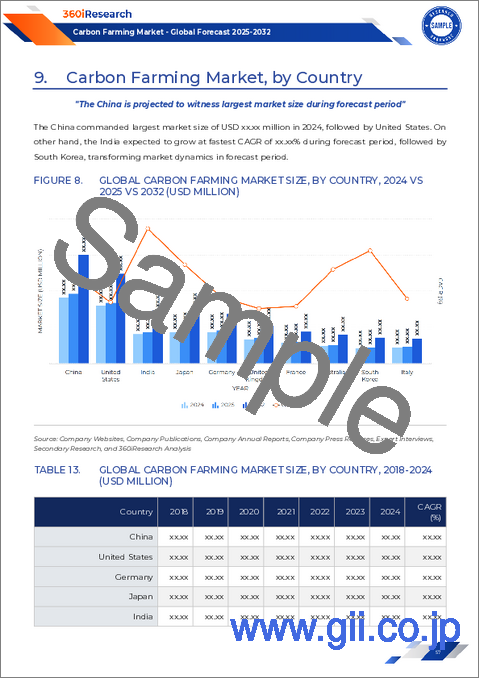

南北アメリカ、欧州、中東・アフリカ、アジア太平洋の地理的動向が炭素農法の導入軌道にどのような影響を及ぼすかを示す、重要な地域的洞察の発見

地域力学は、炭素農法イニシアチブの採用経路と影響力を形成する上で極めて重要な役割を果たします。アメリカ大陸では、先進的な連邦・州政策、強力な民間セクターの関与、大規模試験や成功モデルの迅速な拡大が可能な整備された農業インフラが、市場の勢いを牽引しています。ここでは、商品市場と新たなカーボン・ファイナンス・メカニズムとの相互作用が、ランド・スチュワードシップへの統合的なアプローチを促進しています。

世界の技術進歩と持続可能性への共同イニシアティブを推進する、主要な炭素農業プレイヤーの戦略的役割とイノベーションのプロファイルを浮き彫りにします

炭素農業の分野における主要な組織は、最先端の研究、戦略的パートナーシップ、および運営上の拡張性を統合していることで際立っています。先進的なアグリテック企業は、土壌炭素の変化をリアルタイムで定量化する堅牢なデータプラットフォームを展開し、生産者が従来の慣行から有効な隔離プロトコルへとシームレスに移行できるようにしています。一方、専門的なプロジェクト開発者は、地域の協同組合や技術プロバイダーと提携し、地域の農学的条件や社会経済的目標を反映したイニシアチブを共同設計しています。

炭素農業の統合を加速し、利害関係者の関与を強化し、経済的成果を最適化するための、業界リーダーへの実行可能な提言を提示します

炭素農法の有望性を測定可能な進展に結びつけるためには、業界のリーダーは、運営、財政、規制のハードルを克服するために設計された一連の戦略的行動を受け入れる必要があります。第一に、先進的なリモートセンシングと土壌分析をプロジェクトのワークフローに組み込むことで、炭素測定の精度を高め、検証サイクルを加速することができます。その結果、これらの能力は、割高なクレジット評価を引き出し、利害関係者の信頼を高めることになります。

炭素農業戦略開発のための信頼できる証拠と洞察を提供する、定性的・定量的アプローチを組み合わせた強固な調査手法の詳細

本分析を支える調査手法は、洞察の妥当性を検証し、炭素農業の状況を包括的にカバーすることを目的とした、定性的手法と定量的手法の厳格な融合に基づいています。一次データ収集では、農家、プロジェクト開発者、政策専門家、エンドユーザー代表との綿密なインタビューを行い、運用の実態、投資の促進要因、新たな障壁についてニュアンスの異なる理解を可能にしました。

持続可能な農業における炭素農業の役割に関する包括的な考察で締めくくる気候レジリエンスと成長のための政策的意義と将来の軌道

結論として、炭素農法は、農業の脱炭素化、生態系の回復力の育成、多様な利害関係者への新たな経済機会の創出に向けた、ダイナミックで多次元的な道筋を示すものです。規制の進化、技術革新、利害関係者の協力の相互作用により、世界の地域と市場セグメントで導入が加速する舞台が整いました。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 多様な農地における炭素隔離率を最適化するための精密農業技術の統合

- 利害関係者の透明性を高めるブロックチェーンベースの炭素クレジット検証プラットフォームの出現

- 持続可能な畜産製品に対する消費者の需要によって推進される再生型放牧慣行の拡大

- AIを活用した土壌健全性モニタリングツールを導入し、リアルタイムの炭素回収効率を測定

- 森林農業のスタートアップ企業と伝統的な農家が協力して、樹木ベースの農業を拡大する

- 土壌炭素貯蔵を奨励する政府支援の生態系サービス支払い制度の実施

- 土壌有機炭素の変化を正確に測定できる衛星画像解析の開発

- バイオ炭と強化岩石風化プロジェクトからの炭素除去クレジットの企業調達の増加

- 農業デジタルアドバイザリープラットフォームによるカバークロップと無耕起農法の統合

- 炭素貯蔵のためにマングローブや海草藻場を復元する沿岸ブルーカーボンプロジェクトへの投資増加

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 カーボンファーミング市場練習の種類別

- アグロフォレストリー

- 路地耕作

- 森林牧草地

- バイオチャールの応用

- 残留物由来バイオチャール

- 木質由来バイオチャール

- カバークロッピング

- マメ科植物のカバークロップ

- 非マメ科カバークロップ

- 土壌炭素固定

第9章 カーボンファーミング市場クレジットの種類別

- コンプライアンスカーボンクレジット

- 自主的な炭素クレジット

第10章 カーボンファーミング市場農場規模別

- 大規模農場

- 中規模農場

- 小規模農場

第11章 カーボンファーミング市場:エンドユーザー別

- 法人

- 農家と牧場主

- 政府機関

- 非営利団体

第12章 南北アメリカのカーボンファーミング市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第13章 欧州・中東・アフリカのカーボンファーミング市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第14章 アジア太平洋地域のカーボンファーミング市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第15章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Agreena ApS

- Boomitra Inc.

- Bayer AG

- Grassroots Carbon Public Benefit LLC

- GreenCollar Group

- AgriProve

- Indigo Ag, Inc.

- re.green

- TruCarbon by TruTerra

- Agoro Carbon Alliance by Yara International ASA.

- Carbon Sequestration Inc.

- Continuum Ag.

- Regen Network Development, PBC

- SCS Global Services

- Soil Capital Ltd

- Terramera Inc.

- Vayda, Inc.

- Verra

- Anthesis Group Ltd.