|

|

市場調査レポート

商品コード

1677054

軍用コネクター&相互接続市場:製品タイプ、素材、結合方式、実装タイプ、用途、エンドユーザー、流通チャネル別-2025-2030年世界予測Military Connectors & Interconnects Market by Product Type, Material, Coupling Method, Mounting Type, Application, End User, Distribution Channel - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 軍用コネクター&相互接続市場:製品タイプ、素材、結合方式、実装タイプ、用途、エンドユーザー、流通チャネル別-2025-2030年世界予測 |

|

出版日: 2025年03月09日

発行: 360iResearch

ページ情報: 英文 186 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

軍用コネクター&相互接続市場は、2024年には33億7,000万米ドルとなり、2025年には35億3,000万米ドル、CAGR 5.06%で成長し、2030年には45億4,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年 2024 | 33億7,000万米ドル |

| 推定年 2025 | 35億3,000万米ドル |

| 予測年 2030 | 45億4,000万米ドル |

| CAGR(%) | 5.06% |

軍用コネクターと相互接続市場は、技術革新と堅牢な性能が現代の防衛システムの進化を促進する重要な岐路に立っています。急速な技術進歩と安全保障上の懸念の高まりによって定義される時代において、業界の利害関係者は、製品の改良、運用効率の向上、厳格な安全基準の遵守を余儀なくされています。当レポートでは、市場動向を詳細に調査し、競合情勢を形成しつつある根本的な要因を明らかにします。

詳細な市場セグメンテーションと地域分析に基づき、バックプレーンコネクターから長方形コネクターに至る製品タイプのニュアンスを掘り下げ、複合材料、金属、ポリマーなどのさまざまな材料の役割を明らかにし、バヨネット、センターロック、ネジ構成などの複雑な結合技術を探求しています。この分析は、ケーブル、パネル、PCBマウントシステムなどの実装オプションの評価によってサポートされ、通信システム、地上軍用車両、海軍機能、監視およびナビゲーションシステム、高度な兵器システムなどの重要なアプリケーションにまで及んでいます。

ここで紹介する競合考察は、方法論的なアプローチを採用し、複数のソースからのデータを統合することで、戦略的計画と競合差別化のための実用的な情報を意思決定者に提供することを目的としています。業界情勢は急速に変化しており、業界のリーダーにとって、新たな機会を活用し、防衛技術の最前線であり続けるためのイノベーションを推進することが不可欠です。

軍用コネクター市場を形成する変革的変化

最近の技術の進歩と防衛上の優先事項のシフトにより、軍用コネクターおよび相互接続市場が再定義されています。現代の軍事作戦では、弾力性があるだけでなく、複雑な作戦シナリオに適応できるデバイスが求められています。デジタル通信ネットワークの進化と無人システムへの依存の高まりにより、高速データと完全なシグナルインテグリティに対応したコネクタの開発が加速しています。

業界の主な参加企業は、現在および将来の戦場での課題に対処する最先端技術の統合を目指して、研究開発に多額の投資を行っています。コスト最適化戦略と妥協のない品質要求が融合する中、サプライヤーは斬新な設計アーキテクチャーと並んで材料科学の革新を取り入れています。複合材、金属、ポリマー製コネクターの開発は、重量を最小限に抑えながら性能を最大化し、厳しい条件を満たすために登場しました。

この変革は、防衛調達のパラダイムの変化、モジュール式システム設計への軸足、相互運用性の向上をサポートするシステムに対するニーズの急増といった世界の動向によってさらに推進されています。メーカー各社は、過酷な環境下でも製品の信頼性を確保できるよう、バヨネット式、センターロック式、ねじ込み式など、製造工程を適応させ、新しいカップリング方式を活用しています。先端材料、洗練された設計、最先端のエンジニアリングの融合により、業界は性能、効率、耐久性において新たなベンチマークを打ち立てるべく、大きな変化を目の当たりにしています。

軍用コネクターと相互接続に関する主要セグメント分析

詳細なセグメンテーション分析により、戦略立案に役立つ重要な市場情報が明らかになります。市場は、製品タイプ、材料構成、結合方式、実装タイプ、用途別、エンドユーザーカテゴリー、流通チャネルなど、さまざまな側面から分析されます。

製品タイプを評価する場合、市場はバックプレーン、基板対基板、ケーブルアセンブリ、円形構成、D-Subフォーマット、光ファイバーインターフェース、高速データ相互接続、マイクロ/ミニチュアバリエーション、汎用性の高い角形コネクターなど、多数のコネクター設計を包含します。これらのバリエーションは、明確な運用要件と性能基準に対応することで、さまざまな軍事用途に対応できるように意図的に設計されています。

材料ベースの区分は、複合材、金属、ポリマーコネクターの本質的な特性と適合性の重要な評価を導入しています。各素材は、耐久性、熱安定性、重量の優位性という独自の融合をもたらし、戦闘地域や高ストレス環境における全体的な性能に影響を与えます。

さらに、カップリング方式の区分では、バヨネット、センターロック、およびネジ式システムによって提供される機能効率を検証しています。各アプローチは、さまざまな戦術的条件下で安全な接続を損なうことなく、迅速な接続を保証するために開発されています。ケーブル、パネル、PCBベースのいずれであっても、取り付けタイプは、取り付けの容易さと、多様なプラットフォーム構成内での構造的統合の必要性との間の密接なバランスを反映しています。

アプリケーションのセグメンテーションは、通信システム、地上軍用車両、海軍アプリケーション、統合監視およびナビゲーションシステム、高度な兵器システムなどの重要な軍事使用事例をカバーしています。この微妙な分析は、期待される性能とシステムの互換性についての包括的な理解に貢献します。最後に、防衛請負業者、政府・軍事機関、相手先商標製品メーカーにまたがるエンドユーザー分析は、オフラインとオンラインの流通チャネルの進化するダイナミクスと相まって、市場を定義する多次元的な課題と機会をカプセル化しています。この多層的なセグメンテーションの枠組みは、業界の利害関係者が特定のニッチを効率的にターゲットとし、現代の軍事作戦の厳しい基準を満たすために製品ポートフォリオを最適化するための戦略的レンズを提供します。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 市場力学

- 促進要因

- 防衛用途における安全で信頼性の高いコネクタの需要の高まり

- 防衛分野での無人車両やロボットの導入拡大によりコネクタ需要が増加

- 電子戦能力への注目が高まり、堅牢なコネクタシステムの需要が高まっている

- 抑制要因

- 既存の軍事システムとの統合の複雑さ

- 機会

- スマートな軍事コネクタの実装とリアルタイムデータのためのIoTの統合

- 軍用コネクタの機動性と効率性を高める軽量素材の登場

- 課題

- 過酷な環境条件ではコネクタの動作寿命が限られる

- 促進要因

- 市場セグメンテーション分析

- 製品タイプ:レーダーシステムにおける大量のデータレートを処理するためのバックプレーンコネクタの需要が高まっています

- 用途:海軍部門における軍用コネクタおよび相互接続の採用により、海水への暴露による腐食を防ぎ、高い電磁両立性を維持します。

- ポーターのファイブフォース分析

- PESTEL分析

- 政治的

- 経済

- 社会

- 技術的

- 法律上

- 環境

第6章 軍用コネクター&相互接続市場:製品タイプ別

- バックプレーンコネクタ

- 基板対基板コネクタ

- ケーブルアセンブリ

- 円形コネクタ

- D-Subコネクタ

- 光ファイバーコネクタ

- 高速データ相互接続

- マイクロ/ミニチュアコネクタ

- 長方形コネクタ

第7章 軍用コネクター&相互接続市場:素材別

- 複合コネクタ

- 金属コネクタ

- ポリマーコネクタ

第8章 軍用コネクター&相互接続市場カップリング方式

- 銃剣

- センターロック

- スレッド

第9章 軍用コネクター&相互接続市場取り付けタイプ別

- ケーブルマウント

- パネルマウント

- PCBマウント

第10章 軍用コネクター&相互接続市場:用途別

- 通信システム

- 地上軍用車両

- 海軍への応用

- 監視・ナビゲーションシステム

- 兵器システム

第11章 軍用コネクター&相互接続市場:エンドユーザー別

- 防衛関連企業

- 政府機関および軍事機関

- オリジナル機器製造会社(OEM)

第12章 軍用コネクター&相互接続市場:流通チャネル別

- オフライン

- オンライン

第13章 南北アメリカの軍用コネクター&相互接続市場

- アルゼンチン

- ブラジル

- カナダ

- メキシコ

- 米国

第14章 アジア太平洋地域の軍用コネクター&相互接続市場

- オーストラリア

- 中国

- インド

- インドネシア

- 日本

- マレーシア

- フィリピン

- シンガポール

- 韓国

- 台湾

- タイ

- ベトナム

第15章 欧州・中東・アフリカの軍用コネクター&相互接続市場

- デンマーク

- エジプト

- フィンランド

- フランス

- ドイツ

- イスラエル

- イタリア

- オランダ

- ナイジェリア

- ノルウェー

- ポーランド

- カタール

- ロシア

- サウジアラビア

- 南アフリカ

- スペイン

- スウェーデン

- スイス

- トルコ

- アラブ首長国連邦

- 英国

第16章 競合情勢

- 市場シェア分析, 2024

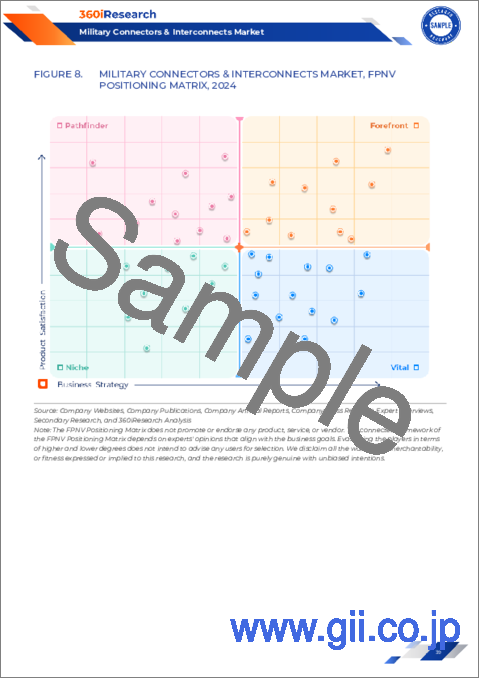

- FPNVポジショニングマトリックス, 2024

- 競合シナリオ分析

- 戦略分析と提言

企業一覧

- Amphenol Corporation

- Bel Fuse Inc.

- Carlisle Companies Inc.

- Conesys, Inc.

- Corning Incorporated

- Eaton Corporation plc

- Esterline Technologies Corporation by TransDigm Group Incorporated

- Fischer Connectors SA

- Glenair GmbH

- HARTING Technology Group

- Hirose Electric Co., Ltd.

- IEH Corporation

- ITT Inc.

- JAE Electronics, Inc.

- LEMO S.A.

- Milnec Interconnect Systems

- Molex, LLC by Koch Industries, Inc.

- ODU GmbH & Co. KG

- Phoenix Contact GmbH & Co. KG

- Radiall S.A.

- Rosenberger Hochfrequenztechnik GmbH & Co. KG

- Smiths Group plc

- TE Connectivity Ltd.

- Weidmuller Interface GmbH & Co. KG

- Winchester Interconnect by Aptiv PLC

LIST OF FIGURES

- FIGURE 1. MILITARY CONNECTORS & INTERCONNECTS MARKET MULTI-CURRENCY

- FIGURE 2. MILITARY CONNECTORS & INTERCONNECTS MARKET MULTI-LANGUAGE

- FIGURE 3. MILITARY CONNECTORS & INTERCONNECTS MARKET RESEARCH PROCESS

- FIGURE 4. MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, 2024 VS 2030

- FIGURE 5. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 6. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 8. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2024 VS 2030 (%)

- FIGURE 9. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 10. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2024 VS 2030 (%)

- FIGURE 11. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 12. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2024 VS 2030 (%)

- FIGURE 13. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 14. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2024 VS 2030 (%)

- FIGURE 15. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 16. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2024 VS 2030 (%)

- FIGURE 17. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 18. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2024 VS 2030 (%)

- FIGURE 19. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 20. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2024 VS 2030 (%)

- FIGURE 21. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 22. AMERICAS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 23. AMERICAS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 24. UNITED STATES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY STATE, 2024 VS 2030 (%)

- FIGURE 25. UNITED STATES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 26. ASIA-PACIFIC MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 27. ASIA-PACIFIC MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 28. EUROPE, MIDDLE EAST & AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 29. EUROPE, MIDDLE EAST & AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 30. MILITARY CONNECTORS & INTERCONNECTS MARKET SHARE, BY KEY PLAYER, 2024

- FIGURE 31. MILITARY CONNECTORS & INTERCONNECTS MARKET, FPNV POSITIONING MATRIX, 2024

LIST OF TABLES

- TABLE 1. MILITARY CONNECTORS & INTERCONNECTS MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

- TABLE 3. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 6. MILITARY CONNECTORS & INTERCONNECTS MARKET DYNAMICS

- TABLE 7. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 8. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY BACKPLANE CONNECTORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY BOARD-TO-BOARD CONNECTORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY CABLE ASSEMBLIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY CIRCULAR CONNECTORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY D-SUB CONNECTORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY FIBER OPTIC CONNECTORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY HIGH-SPEED DATA INTERCONNECTS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MICRO/MINIATURE CONNECTORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY RECTANGULAR CONNECTORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 18. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COMPOSITE CONNECTORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 19. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY METAL CONNECTORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY POLYMER CONNECTORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 22. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY BAYONET, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY CENTER-LOCK, BY REGION, 2018-2030 (USD MILLION)

- TABLE 24. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY THREADED, BY REGION, 2018-2030 (USD MILLION)

- TABLE 25. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 26. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY CABLE MOUNT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 27. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PANEL MOUNT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 28. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PCB MOUNT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 29. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 30. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COMMUNICATION SYSTEMS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 31. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY GROUND MILITARY VEHICLES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 32. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY NAVAL APPLICATIONS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 33. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY SURVEILLANCE & NAVIGATION SYSTEM, BY REGION, 2018-2030 (USD MILLION)

- TABLE 34. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY WEAPON SYSTEMS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 35. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 36. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DEFENSE CONTRACTORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 37. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY GOVERNMENT & MILITARY AGENCIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 38. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY ORIGINAL EQUIPMENT MANUFACTURER(OEM), BY REGION, 2018-2030 (USD MILLION)

- TABLE 39. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 40. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY OFFLINE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 41. GLOBAL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY ONLINE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 42. AMERICAS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 43. AMERICAS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 44. AMERICAS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 45. AMERICAS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 46. AMERICAS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 47. AMERICAS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 48. AMERICAS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 49. AMERICAS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 50. ARGENTINA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 51. ARGENTINA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 52. ARGENTINA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 53. ARGENTINA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 54. ARGENTINA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 55. ARGENTINA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 56. ARGENTINA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 57. BRAZIL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 58. BRAZIL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 59. BRAZIL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 60. BRAZIL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 61. BRAZIL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 62. BRAZIL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 63. BRAZIL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 64. CANADA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 65. CANADA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 66. CANADA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 67. CANADA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 68. CANADA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 69. CANADA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 70. CANADA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 71. MEXICO MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 72. MEXICO MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 73. MEXICO MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 74. MEXICO MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 75. MEXICO MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 76. MEXICO MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 77. MEXICO MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 78. UNITED STATES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 79. UNITED STATES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 80. UNITED STATES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 81. UNITED STATES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 82. UNITED STATES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 83. UNITED STATES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 84. UNITED STATES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 85. UNITED STATES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 86. ASIA-PACIFIC MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 87. ASIA-PACIFIC MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 88. ASIA-PACIFIC MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 89. ASIA-PACIFIC MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 90. ASIA-PACIFIC MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 91. ASIA-PACIFIC MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 92. ASIA-PACIFIC MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 93. ASIA-PACIFIC MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 94. AUSTRALIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 95. AUSTRALIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 96. AUSTRALIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 97. AUSTRALIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 98. AUSTRALIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 99. AUSTRALIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 100. AUSTRALIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 101. CHINA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 102. CHINA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 103. CHINA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 104. CHINA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 105. CHINA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 106. CHINA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 107. CHINA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 108. INDIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 109. INDIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 110. INDIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 111. INDIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 112. INDIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 113. INDIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 114. INDIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 115. INDONESIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 116. INDONESIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 117. INDONESIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 118. INDONESIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 119. INDONESIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 120. INDONESIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 121. INDONESIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 122. JAPAN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 123. JAPAN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 124. JAPAN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 125. JAPAN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 126. JAPAN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 127. JAPAN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 128. JAPAN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 129. MALAYSIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 130. MALAYSIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 131. MALAYSIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 132. MALAYSIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 133. MALAYSIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 134. MALAYSIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 135. MALAYSIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 136. PHILIPPINES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 137. PHILIPPINES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 138. PHILIPPINES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 139. PHILIPPINES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 140. PHILIPPINES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 141. PHILIPPINES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 142. PHILIPPINES MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 143. SINGAPORE MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 144. SINGAPORE MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 145. SINGAPORE MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 146. SINGAPORE MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 147. SINGAPORE MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 148. SINGAPORE MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 149. SINGAPORE MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 150. SOUTH KOREA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 151. SOUTH KOREA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 152. SOUTH KOREA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 153. SOUTH KOREA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 154. SOUTH KOREA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 155. SOUTH KOREA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 156. SOUTH KOREA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 157. TAIWAN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 158. TAIWAN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 159. TAIWAN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 160. TAIWAN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 161. TAIWAN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 162. TAIWAN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 163. TAIWAN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 164. THAILAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 165. THAILAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 166. THAILAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 167. THAILAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 168. THAILAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 169. THAILAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 170. THAILAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 171. VIETNAM MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 172. VIETNAM MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 173. VIETNAM MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 174. VIETNAM MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 175. VIETNAM MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 176. VIETNAM MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 177. VIETNAM MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 178. EUROPE, MIDDLE EAST & AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 179. EUROPE, MIDDLE EAST & AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 180. EUROPE, MIDDLE EAST & AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 181. EUROPE, MIDDLE EAST & AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 182. EUROPE, MIDDLE EAST & AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 183. EUROPE, MIDDLE EAST & AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 184. EUROPE, MIDDLE EAST & AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 185. EUROPE, MIDDLE EAST & AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 186. DENMARK MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 187. DENMARK MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 188. DENMARK MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 189. DENMARK MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 190. DENMARK MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 191. DENMARK MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 192. DENMARK MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 193. EGYPT MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 194. EGYPT MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 195. EGYPT MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 196. EGYPT MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 197. EGYPT MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 198. EGYPT MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 199. EGYPT MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 200. FINLAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 201. FINLAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 202. FINLAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 203. FINLAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 204. FINLAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 205. FINLAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 206. FINLAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 207. FRANCE MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 208. FRANCE MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 209. FRANCE MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 210. FRANCE MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 211. FRANCE MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 212. FRANCE MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 213. FRANCE MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 214. GERMANY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 215. GERMANY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 216. GERMANY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 217. GERMANY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 218. GERMANY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 219. GERMANY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 220. GERMANY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 221. ISRAEL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 222. ISRAEL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 223. ISRAEL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 224. ISRAEL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 225. ISRAEL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 226. ISRAEL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 227. ISRAEL MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 228. ITALY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 229. ITALY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 230. ITALY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 231. ITALY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 232. ITALY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 233. ITALY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 234. ITALY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 235. NETHERLANDS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 236. NETHERLANDS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 237. NETHERLANDS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 238. NETHERLANDS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 239. NETHERLANDS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 240. NETHERLANDS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 241. NETHERLANDS MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 242. NIGERIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 243. NIGERIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 244. NIGERIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 245. NIGERIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 246. NIGERIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 247. NIGERIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 248. NIGERIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 249. NORWAY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 250. NORWAY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 251. NORWAY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 252. NORWAY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 253. NORWAY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 254. NORWAY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 255. NORWAY MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 256. POLAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 257. POLAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 258. POLAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 259. POLAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 260. POLAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 261. POLAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 262. POLAND MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 263. QATAR MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 264. QATAR MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 265. QATAR MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 266. QATAR MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 267. QATAR MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 268. QATAR MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 269. QATAR MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 270. RUSSIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 271. RUSSIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 272. RUSSIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 273. RUSSIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 274. RUSSIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 275. RUSSIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 276. RUSSIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 277. SAUDI ARABIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 278. SAUDI ARABIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 279. SAUDI ARABIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 280. SAUDI ARABIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 281. SAUDI ARABIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 282. SAUDI ARABIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 283. SAUDI ARABIA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 284. SOUTH AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 285. SOUTH AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 286. SOUTH AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 287. SOUTH AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 288. SOUTH AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 289. SOUTH AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 290. SOUTH AFRICA MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 291. SPAIN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY PRODUCT TYPE, 2018-2030 (USD MILLION)

- TABLE 292. SPAIN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 293. SPAIN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY COUPLING METHOD, 2018-2030 (USD MILLION)

- TABLE 294. SPAIN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY MOUNTING TYPE, 2018-2030 (USD MILLION)

- TABLE 295. SPAIN MILITARY CONNECTORS & INTERCONNECTS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 296. S

The Military Connectors & Interconnects Market was valued at USD 3.37 billion in 2024 and is projected to grow to USD 3.53 billion in 2025, with a CAGR of 5.06%, reaching USD 4.54 billion by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 3.37 billion |

| Estimated Year [2025] | USD 3.53 billion |

| Forecast Year [2030] | USD 4.54 billion |

| CAGR (%) | 5.06% |

The military connectors and interconnects market is at a critical juncture, where innovation and robust performance are driving the evolution of modern defense systems. In an era defined by rapid technological advancements and heightened security concerns, industry stakeholders are compelled to refine product offerings, enhance operational efficiencies, and meet stringent safety norms. This report provides an in-depth look at the prevailing market trends, uncovering the underlying forces that are reshaping the competitive landscape.

Structured around detailed market segmentation and regional analysis, the discussion delves into the nuances of product types ranging from backplane connectors to rectangular connectors, highlights the role of different materials such as composites, metals, and polymers, and explores the intricate coupling techniques that include bayonet, center-lock, and threaded configurations. The analysis is supported by the evaluation of mounting options like cable, panel, and PCB mount systems, and extends to critical applications such as communication systems, ground military vehicles, naval functionalities, surveillance and navigation systems, and advanced weapon systems.

By adopting a methodical approach and synthesizing data from multiple sources, the insights presented here aim to empower decision-makers with actionable intelligence for strategic planning and competitive differentiation. The landscape is rapidly transforming, and it is imperative for industry leaders to harness emerging opportunities and drive innovation to remain at the forefront of defense technology.

Transformative Shifts Reshaping the Military Connectors Market

Recent advancements in technology and shifts in defense priorities have redefined the military connectors and interconnects market. Modern military operations demand devices that are not only resilient but also adaptable to complex operational scenarios. The evolution of digital communication networks and the increasing reliance on unmanned systems have accelerated the development of connectors tailored for high-speed data and immaculate signal integrity.

Key industry participants are investing significantly in research and development, aiming to integrate state-of-the-art technologies that address both current and future battlefield challenges. As cost-optimization strategies merge with the demand for uncompromising quality, suppliers are embracing materials science innovations alongside novel design architectures. Developments in composite, metal, and polymer connectors have emerged to meet rigorous conditions while minimizing weight and maximizing performance.

This transformation is further propelled by global trends such as the shifting paradigms in defense procurement, a pivot towards modular system designs, and the burgeoning need for systems that support enhanced interoperability. Manufacturers are adapting production processes and leveraging new coupling methods, whether bayonet, center-lock, or threaded, to ensure that their products deliver reliability in harsh environments. Through this fusion of advanced materials, sophisticated design, and cutting-edge engineering, the industry is witnessing a profound shift that is poised to set new benchmarks in performance, efficiency, and durability.

Key Segmentation Insights into Military Connectors and Interconnects

A detailed segmentation analysis reveals critical layers of market intelligence that are instrumental for strategic planning. The market is dissected through various dimensions which include product type, material composition, coupling method, mounting type, application specificity, end-user categories, and distribution channels.

When evaluating product types, the market encompasses a multitude of connector designs such as backplane, board-to-board, cable assemblies, circular configurations, D-Sub formats, fiber optic interfaces, high-speed data interconnects, micro/miniature variants, and the versatile rectangular connectors. These variations are deliberately engineered to cater to a range of military applications by addressing distinct operational requirements and performance criteria.

Material-based segmentation introduces a critical assessment of the intrinsic properties and suitability of composite, metal, and polymer connectors. Each material brings its unique blend of durability, thermal stability, and weight advantages to the table, influencing the overall performance in combat zones and high-stress environments.

Furthermore, the coupling method segmentation examines the functional efficiencies offered by bayonet, center-lock, and threaded systems. Each approach is developed to assure rapid connectivity without compromising secure engagement under variable tactical conditions. The mounting type, whether cable, panel, or PCB-based, reflects an intimate balance between ease of installation and the need for structural integration within diverse platform configurations.

Application segmentation covers critical military use-cases such as communication systems, ground military vehicles, naval applications, integrated surveillance and navigation systems, and advanced weapon systems. This nuanced analysis contributes to a comprehensive understanding of performance expectations and system compatibility. Finally, the end-user analysis-spanning defense contractors, government and military agencies, and original equipment manufacturers-coupled with the evolving dynamics of offline and online distribution channels, encapsulates the multidimensional challenges and opportunities that define the market. This multilayered segmentation framework offers a strategic lens through which industry stakeholders can efficiently target specific niches and optimize their product portfolios to meet the exacting standards of modern military operations.

Based on Product Type, market is studied across Backplane Connectors, Board-to-Board Connectors, Cable Assemblies, Circular Connectors, D-Sub Connectors, Fiber Optic Connectors, High-Speed Data Interconnects, Micro/Miniature Connectors, and Rectangular Connectors.

Based on Material, market is studied across Composite Connectors, Metal Connectors, and Polymer Connectors.

Based on Coupling Method, market is studied across Bayonet, Center-Lock, and Threaded.

Based on Mounting Type, market is studied across Cable Mount, Panel Mount, and PCB Mount.

Based on Application, market is studied across Communication Systems, Ground Military Vehicles, Naval Applications, Surveillance & Navigation System, and Weapon Systems.

Based on End User, market is studied across Defense Contractors, Government & Military Agencies, and Original Equipment Manufacturer(OEM).

Based on Distribution Channel, market is studied across Offline and Online.

Regional Dynamics Influencing Military Connectors & Interconnects

Regional insights form a backbone of the analysis as the market exhibits distinct trends across various geographical territories. The dynamics in the Americas have seen a consistent emphasis on technological upgrades in defense systems, driven by sustained government expenditure and a robust network of defense contractors. Innovation in high-speed data interconnects and ruggedized mechanical connectors is particularly noticeable in this region.

Across Europe, the Middle East, and Africa, geopolitical considerations and collaborative defense initiatives have fostered a competitive environment where stringent regulatory standards and high-quality benchmarks are non-negotiable. The demand in these regions is fueled by an increasing need for secure and interoperable communication systems that can support integrated defense frameworks, thereby driving the adoption of circular, board-to-board, and micro connector configurations among other formats.

In the Asia-Pacific region, rapid modernization in defense capabilities has been prominent. Here, the market is buoyed by significant investments in research and development, leading to breakthroughs in connector technology that seamlessly integrate with advanced combat and surveillance systems. This region's distinctive focus on cost-effective yet durable solutions aligns with the expansion of both local manufacturing and international collaborations, making it a hotbed for innovative product applications and next-generation system integrations.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Insights on Key Industry Players in the Military Connectors Sector

Within the competitive landscape, several key companies have emerged as leaders by consistently delivering cutting-edge solutions and pioneering technologies. The market is characterized by the strong presence of companies such as Amphenol Corporation, Bel Fuse Inc., Carlisle Companies Inc., and Conesys, Inc. Their offerings are often characterized by high reliability and robust performance, which are essential attributes in military applications.

Major industry players including Corning Incorporated, Eaton Corporation plc, Esterline Technologies Corporation by TransDigm Group Incorporated, and Fischer Connectors SA are pushing the boundaries by integrating advanced materials and design innovations that set new industry standards. Innovative product strategies are accompanied by strategic alliances with industry-leading academic and research institutions, ensuring that these companies remain ahead in the rapidly evolving technological landscape.

Other prominent companies like Glenair GmbH, HARTING Technology Group, Hirose Electric Co., Ltd., IEH Corporation, and ITT Inc. have significantly contributed to the diversification of product portfolios and enhanced supply chain resilience. The specialized focus of industry giants such as JAE Electronics, Inc., LEMO S.A., Milnec Interconnect Systems, Molex, LLC by Koch Industries, Inc., and ODU GmbH & Co. KG is a testament to their commitment to innovation and quality.

Moreover, the strategic endeavors undertaken by Phoenix Contact GmbH & Co. KG, Radiall S.A., Rosenberger Hochfrequenztechnik GmbH & Co. KG, Smiths Group plc, TE Connectivity Ltd., Weidmuller Interface GmbH & Co. KG, and Winchester Interconnect by Aptiv PLC reinforce a shared commitment to engineering excellence. The intricate balance of in-house research, strategic partnerships, and customized solutions has strengthened market positioning and is instrumental in addressing evolving defense needs worldwide.

The report delves into recent significant developments in the Military Connectors & Interconnects Market, highlighting leading vendors and their innovative profiles. These include Amphenol Corporation, Bel Fuse Inc., Carlisle Companies Inc., Conesys, Inc., Corning Incorporated, Eaton Corporation plc, Esterline Technologies Corporation by TransDigm Group Incorporated, Fischer Connectors SA, Glenair GmbH, HARTING Technology Group, Hirose Electric Co., Ltd., IEH Corporation, ITT Inc., JAE Electronics, Inc., LEMO S.A., Milnec Interconnect Systems, Molex, LLC by Koch Industries, Inc., ODU GmbH & Co. KG, Phoenix Contact GmbH & Co. KG, Radiall S.A., Rosenberger Hochfrequenztechnik GmbH & Co. KG, Smiths Group plc, TE Connectivity Ltd., Weidmuller Interface GmbH & Co. KG, and Winchester Interconnect by Aptiv PLC. Actionable Recommendations for Industry Leaders in Military Connectors

Industry leaders need to invest in enhancing their research and development efforts to stay ahead of rapid technological changes and emergent military requirements. An integrated strategy that combines product innovation, strategic partnerships, and sustainable manufacturing practices is essential for long-term competitive advantage.

Organizations should focus on developing connectors with enhanced performance parameters by capitalizing on advanced materials and innovative design concepts. Engagements with multidisciplinary research teams will facilitate breakthroughs in connector technologies that address the dual need for high-speed connectivity and durability in extreme operational environments.

In addition, companies must consider diversifying product portfolios to cover a wider spectrum of applications that include communication systems, ground military vehicles, naval applications, and specialized surveillance and navigation systems. By investing in flexible coupling methods such as bayonet, center-lock, and threaded designs, and by adopting versatile mounting options spanning cable, panel, and PCB configurations, firms will be better positioned to meet the loquacious demands of modern defense requirements.

It is also recommended that leaders strengthen their market presence by forming strategic alliances and nurturing long-term relationships with defense contractors, government agencies, and OEMs. Embracing both offline and online distribution channels will enable a more agile response to market volatility and regional disparities. Clear channels of communication with supply chain partners will allow for rapid adjustments in production and improved responsiveness to emerging market trends. This multi-pronged approach not only safeguards against potential disruptions but also cultivates a robust infrastructure that is primed for growth and innovation.

Conclusion: Charting the Future of Military Connectors & Interconnects

The military connectors and interconnects market stands on the brink of transformation, powered by relentless innovation, strategic market segmentation, and dynamic regional developments. As the demand for secure, high-performance interconnects grows, the industry is increasingly relying on advancements in product design, engineering excellence, and adaptive manufacturing processes.

Through a comprehensive understanding of product types, material properties, coupling methods, mounting styles, and application domains, stakeholders can better anticipate market trends and align their strategies to meet evolving operational requirements. The integration of detailed segmentation insights with regional trends highlights the importance of tailoring solutions to specific geographical and tactical needs.

Key industry players are not only meeting current challenges but are also setting the stage for the future by investing in innovation and forging strategic partnerships. The collective commitment towards enhancing performance standards and operational efficiency is driving the industry forward into a new era of connectivity and integration. Ultimately, sustained investment in research and development, coupled with a commitment to quality and strategic expansion, will solidify the foundation for future growth in this critical market.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Rising demand for secure and reliable connectors in defense applications

- 5.1.1.2. Growing adoption of unmanned vehicles and robotics in defense sectors boosting connector demand

- 5.1.1.3. Increased focus on electronic warfare capabilities generating demand for robust connector systems

- 5.1.2. Restraints

- 5.1.2.1. Complexity in integration with existing military systems

- 5.1.3. Opportunities

- 5.1.3.1. Integration of IoT for smart military connector implementation and real-time data

- 5.1.3.2. Rising lightweight materials for increased mobility and efficiency in military connectors

- 5.1.4. Challenges

- 5.1.4.1. Limited operational lifespan of connectors in extreme environmental conditions

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Product Type: Growing preference for backplane connectors to handle substantial data rates in radar systems

- 5.2.2. Application: Adoption of military connectors and interconnects in naval sector to prevent corrosion from saltwater exposure and maintain high electromagnetic compatibility

- 5.3. Porter's Five Forces Analysis

- 5.3.1. Threat of New Entrants

- 5.3.2. Threat of Substitutes

- 5.3.3. Bargaining Power of Customers

- 5.3.4. Bargaining Power of Suppliers

- 5.3.5. Industry Rivalry

- 5.4. PESTLE Analysis

- 5.4.1. Political

- 5.4.2. Economic

- 5.4.3. Social

- 5.4.4. Technological

- 5.4.5. Legal

- 5.4.6. Environmental

6. Military Connectors & Interconnects Market, by Product Type

- 6.1. Introduction

- 6.2. Backplane Connectors

- 6.3. Board-to-Board Connectors

- 6.4. Cable Assemblies

- 6.5. Circular Connectors

- 6.6. D-Sub Connectors

- 6.7. Fiber Optic Connectors

- 6.8. High-Speed Data Interconnects

- 6.9. Micro/Miniature Connectors

- 6.10. Rectangular Connectors

7. Military Connectors & Interconnects Market, by Material

- 7.1. Introduction

- 7.2. Composite Connectors

- 7.3. Metal Connectors

- 7.4. Polymer Connectors

8. Military Connectors & Interconnects Market, by Coupling Method

- 8.1. Introduction

- 8.2. Bayonet

- 8.3. Center-Lock

- 8.4. Threaded

9. Military Connectors & Interconnects Market, by Mounting Type

- 9.1. Introduction

- 9.2. Cable Mount

- 9.3. Panel Mount

- 9.4. PCB Mount

10. Military Connectors & Interconnects Market, by Application

- 10.1. Introduction

- 10.2. Communication Systems

- 10.3. Ground Military Vehicles

- 10.4. Naval Applications

- 10.5. Surveillance & Navigation System

- 10.6. Weapon Systems

11. Military Connectors & Interconnects Market, by End User

- 11.1. Introduction

- 11.2. Defense Contractors

- 11.3. Government & Military Agencies

- 11.4. Original Equipment Manufacturer(OEM)

12. Military Connectors & Interconnects Market, by Distribution Channel

- 12.1. Introduction

- 12.2. Offline

- 12.3. Online

13. Americas Military Connectors & Interconnects Market

- 13.1. Introduction

- 13.2. Argentina

- 13.3. Brazil

- 13.4. Canada

- 13.5. Mexico

- 13.6. United States

14. Asia-Pacific Military Connectors & Interconnects Market

- 14.1. Introduction

- 14.2. Australia

- 14.3. China

- 14.4. India

- 14.5. Indonesia

- 14.6. Japan

- 14.7. Malaysia

- 14.8. Philippines

- 14.9. Singapore

- 14.10. South Korea

- 14.11. Taiwan

- 14.12. Thailand

- 14.13. Vietnam

15. Europe, Middle East & Africa Military Connectors & Interconnects Market

- 15.1. Introduction

- 15.2. Denmark

- 15.3. Egypt

- 15.4. Finland

- 15.5. France

- 15.6. Germany

- 15.7. Israel

- 15.8. Italy

- 15.9. Netherlands

- 15.10. Nigeria

- 15.11. Norway

- 15.12. Poland

- 15.13. Qatar

- 15.14. Russia

- 15.15. Saudi Arabia

- 15.16. South Africa

- 15.17. Spain

- 15.18. Sweden

- 15.19. Switzerland

- 15.20. Turkey

- 15.21. United Arab Emirates

- 15.22. United Kingdom

16. Competitive Landscape

- 16.1. Market Share Analysis, 2024

- 16.2. FPNV Positioning Matrix, 2024

- 16.3. Competitive Scenario Analysis

- 16.3.1. Molex acuire AirBorn to enhances military and aerospace interconnect solutions

- 16.3.2. FDH Electronics expands military market reach with Amphenol distribution agreement

- 16.3.3. Smiths Interconnect launch advanced technology for enhanced connectivity in mission-critical military applications

- 16.4. Strategy Analysis & Recommendation

Companies Mentioned

- 1. Amphenol Corporation

- 2. Bel Fuse Inc.

- 3. Carlisle Companies Inc.

- 4. Conesys, Inc.

- 5. Corning Incorporated

- 6. Eaton Corporation plc

- 7. Esterline Technologies Corporation by TransDigm Group Incorporated

- 8. Fischer Connectors SA

- 9. Glenair GmbH

- 10. HARTING Technology Group

- 11. Hirose Electric Co., Ltd.

- 12. IEH Corporation

- 13. ITT Inc.

- 14. JAE Electronics, Inc.

- 15. LEMO S.A.

- 16. Milnec Interconnect Systems

- 17. Molex, LLC by Koch Industries, Inc.

- 18. ODU GmbH & Co. KG

- 19. Phoenix Contact GmbH & Co. KG

- 20. Radiall S.A.

- 21. Rosenberger Hochfrequenztechnik GmbH & Co. KG

- 22. Smiths Group plc

- 23. TE Connectivity Ltd.

- 24. Weidmuller Interface GmbH & Co. KG

- 25. Winchester Interconnect by Aptiv PLC