|

|

市場調査レポート

商品コード

1676854

モーター用アモルファスストリップ市場:製品タイプ、厚さ、製造プロセス、エンドユーザー別-2025-2030年の世界予測Amorphous Strip for Motor Market by Material Type, Thickness, Production Process, End-users - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| モーター用アモルファスストリップ市場:製品タイプ、厚さ、製造プロセス、エンドユーザー別-2025-2030年の世界予測 |

|

出版日: 2025年03月09日

発行: 360iResearch

ページ情報: 英文 190 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

モーター用アモルファスストリップ市場は、2024年には17億3,000万米ドルとなり、2025年には18億2,000万米ドル、CAGR 5.82%で成長し、2030年には24億3,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年 2024 | 17億3,000万米ドル |

| 推定年 2025 | 18億2,000万米ドル |

| 予測年 2030 | 24億3,000万米ドル |

| CAGR(%) | 5.82% |

モーター用アモルファス・ストリップ市場は、技術革新と進化する産業需要の交差点に立っています。効率、耐久性、エネルギーの最適化が性能の基準を決定する時代において、この市場はモーター製造と応用分野の極めて重要な要素として浮上してきました。高度なアモルファス材料の導入は、洗練された製造プロセスと相まって、製品の能力を再定義し、市場力学にパラダイムシフトをもたらしつつあります。

この調査は、新たな動向とダイナミックな顧客の要求がアモルファスストリップの技術革新にどのような影響を与えたかを詳細に理解することを目的としています。材料科学のブレークスルーと進化する生産技術の相互作用を分析することで、市場成長を加速させている要因についての洞察を提供しています。さらに本レポートでは、業界各社がいかにして斬新な設計や手法を取り入れる方向に舵を切り、製品が現在の性能基準を満たすだけでなく、将来の機能強化への道も開くようにしているかについて掘り下げています。

このような詳細な分析は、マクロ経済とミクロ経済の両方の要因の検証によってさらに強化されています。これにより、利害関係者は、過去のデータ、現在の状況、市場動向の予測から導き出された洞察に基づき、十分な情報に基づいた意思決定を行うことができるようになります。効率と性能の向上への継続的な取り組みにより、アモルファス・ストリップは現代のモーター技術の礎石となっています。

モーター用アモルファスストリップ市場情勢を再定義する変革的変化

モーター用アモルファスストリップ市場力学は、伝統的な製造慣行が革新的な技術革新と融合するにつれて大きな変貌を遂げています。ここ数年、材料科学と精密工学の先端研究により、より高性能でコスト効率に優れたソリューションへの需要が高まり、市場の様相は大きく変化しています。利害関係者は、スマートな製造工程とリアルタイムの監視システムの統合が、生産を合理化するだけでなく、製品全体の寿命を延ばしていることを確認しています。

この変革の中心的な原動力は、エネルギー効率と持続可能性への注目の高まりです。メーカー各社は、性能に妥協することなく、廃棄物を削減し、資源利用を最適化する、よりクリーンな生産プロセスを徐々に採用しています。このシフトは、生産技術の進化によって証明されており、従来の方法は、コンピュータ支援プロセスや自動化の導入に道を譲っています。市場が成熟するにつれて、企業はこれらの改善されたデジタル・ソリューションを採用し、納期の短縮と製造コストの低減につなげています。

さらに、自動車、産業、消費者セグメントにおける高精度の要求は、品質に対する新たなベンチマークを設定しました。このパラダイムシフトは、製品設計全体の革新と、信頼性を保証する品質管理システムの強化によって特徴付けられます。要するに、市場における変革的なシフトは、現在の業界要件に対応するだけでなく、アモルファス・ストリップ製造における将来の技術的進歩の枠組みを確立する基礎を築きつつあります。

市場戦略を形成する主要セグメンテーション洞察

強固なセグメンテーションの枠組みを通じて市場を理解することは、消費者動向を読み解き、生産戦略を導く上で極めて重要です。分析によると、材料タイプに基づくセグメンテーションは、コバルトベースのアモルファス材料、鉄ベースのアモルファス材料、ニッケルベースのアモルファスストリップを含む包括的な視点を提供します。これらの材料はそれぞれ、最終製品の性能特性に影響を与えるユニークな特性を備えており、精密工学とカスタマイズされたソリューションに重点を置いています。

厚さに基づく分類では、100マイクロメートルを超える厚いアモルファス・ストリップ、50~100マイクロメートルの薄いアモルファス・ストリップ、50マイクロメートル以下の極薄アモルファス・ストリップの重要性が強調され、多様なカテゴリーが明らかになりました。この微妙な分類により、メーカーは性能要件や用途固有の基準に基づいて生産工程を調整することができます。さらに、生産プロセスのセグメンテーションを考慮すると、市場は鋳造技術と圧延技術の二分化を示し、それぞれ特定の生産およびコスト効率目標を満たすように最適化されています。

さらに、エンドユーザーに基づくセグメンテーションから得られる洞察は、航空宇宙・防衛、自動車(商用車と乗用車にさらに分類)、家電、エネルギー・電力セクター、産業機械など、多様な応用分野を強調しています。この詳細なセグメンテーションの枠組みは、市場力学の理解を深めるだけでなく、的を絞った技術革新と戦略的投資の道筋を浮き彫りにします。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 市場力学

- 促進要因

- エネルギー効率の高いモーター部品の需要が高まる自動車産業

- 電子機器や電気機器のモーター用アモルファスストリップの使用増加

- 抑制要因

- モーター用アモルファスストリップに関連する原材料の入手可能性と価格の変動

- 機会

- 高性能モーターの必要性による産業オートメーションの拡大

- 非晶質材料の特性向上のための継続的な研究開発と革新

- 課題

- アモルファスストリップに関連する厳格な品質および環境基準

- 促進要因

- 市場セグメンテーション分析

- 材料タイプ:高い透磁率と低い保磁力によりコバルトベースの非晶質材料の使用が急増

- エンドユーザー:自動車用モーター向けアモルファスストリップの用途拡大により、持続可能性の向上と排出量の削減を実現

- ポーターのファイブフォース分析

- PESTEL分析

- 政治的

- 経済

- 社会

- 技術的

- 法律上

- 環境

第6章 モーター用アモルファスストリップ市場:素材タイプ別

- コバルト系アモルファス材料

- 鉄系アモルファス材料

- ニッケル基アモルファスストリップ

第7章 モーター用アモルファスストリップ市場厚さ別

- 厚いアモルファスストリップ(>100マイクロメートル)

- 薄いアモルファスストリップ(50~100マイクロメートル)

- 超薄アモルファスストリップ(<50マイクロメートル)

第8章 モーター用アモルファスストリップ市場製造工程別

- 鋳造

- ローリング

第9章 モーター用アモルファスストリップ市場:エンドユーザー別

- 航空宇宙および防衛

- 自動車

- 商用車

- 乗用車

- 家電

- エネルギー・電力部門

- 産業機械

第10章 南北アメリカのモーター用アモルファスストリップ市場

- アルゼンチン

- ブラジル

- カナダ

- メキシコ

- 米国

第11章 アジア太平洋地域のモーター用アモルファスストリップ市場

- オーストラリア

- 中国

- インド

- インドネシア

- 日本

- マレーシア

- フィリピン

- シンガポール

- 韓国

- 台湾

- タイ

- ベトナム

第12章 欧州・中東・アフリカのモーター用アモルファスストリップ市場

- デンマーク

- エジプト

- フィンランド

- フランス

- ドイツ

- イスラエル

- イタリア

- オランダ

- ナイジェリア

- ノルウェー

- ポーランド

- カタール

- ロシア

- サウジアラビア

- 南アフリカ

- スペイン

- スウェーデン

- スイス

- トルコ

- アラブ首長国連邦

- 英国

第13章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合シナリオ分析

- 戦略分析と提言

企業一覧

- Advanced Technology & Materials Co., Ltd.

- Bidragon Group

- China Amorphous Technology Co., Ltd.

- Foshan Huaxin Microlite Innovation Materials Co., Ltd.

- Guangzhou Amorphous Electronic Technology Co.,ltd.

- Hitachi Metals, Ltd.

- Lammotor

- Lamnow Co., Ltd.

- Metglas, Inc.

- MK Magnetics, Inc.

- Nano-metal Advanced Materials

- Nippon Steel Corporation

- OHMALLOY Material Co.,Ltd.

- Qingdao Yunlu Advanced Materials Technology Co., Ltd.

- Shenke Amorphous Technology Co., Ltd.

- Shouke Electronic Co., Ltd.

- Sunbow Group

- The Liquidmetal Group

- VACUUMSCHMELZE GmbH & Co. KG

- Xiamen Innovacera Advanced Materials Co.,Ltd.

- Zheijiang Zhaojing Electrical Technology Co., Ltd.

- Zhejiang Jingjing New Material Technology Co., Ltd

LIST OF FIGURES

- FIGURE 1. AMORPHOUS STRIP FOR MOTOR MARKET MULTI-CURRENCY

- FIGURE 2. AMORPHOUS STRIP FOR MOTOR MARKET MULTI-LANGUAGE

- FIGURE 3. AMORPHOUS STRIP FOR MOTOR MARKET RESEARCH PROCESS

- FIGURE 4. AMORPHOUS STRIP FOR MOTOR MARKET SIZE, 2024 VS 2030

- FIGURE 5. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, 2018-2030 (USD MILLION)

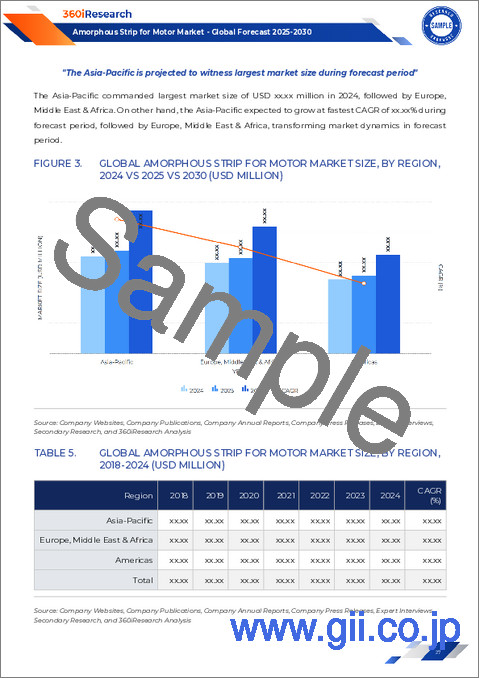

- FIGURE 6. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 8. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2024 VS 2030 (%)

- FIGURE 9. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 10. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2024 VS 2030 (%)

- FIGURE 11. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 12. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2024 VS 2030 (%)

- FIGURE 13. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 14. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2024 VS 2030 (%)

- FIGURE 15. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 16. AMERICAS AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 17. AMERICAS AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 18. UNITED STATES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY STATE, 2024 VS 2030 (%)

- FIGURE 19. UNITED STATES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 20. ASIA-PACIFIC AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 21. ASIA-PACIFIC AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 22. EUROPE, MIDDLE EAST & AFRICA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 23. EUROPE, MIDDLE EAST & AFRICA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 24. AMORPHOUS STRIP FOR MOTOR MARKET SHARE, BY KEY PLAYER, 2024

- FIGURE 25. AMORPHOUS STRIP FOR MOTOR MARKET, FPNV POSITIONING MATRIX, 2024

LIST OF TABLES

- TABLE 1. AMORPHOUS STRIP FOR MOTOR MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

- TABLE 3. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 6. AMORPHOUS STRIP FOR MOTOR MARKET DYNAMICS

- TABLE 7. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 8. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY COBALT-BASED AMORPHOUS MATERIALS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY IRON-BASED AMORPHOUS MATERIALS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY NICKEL-BASED AMORPHOUS STRIPS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 12. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICK AMORPHOUS STRIPS (> 100 MICROMETERS), BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THIN AMORPHOUS STRIPS (50-100 MICROMETERS), BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY ULTRA-THIN AMORPHOUS STRIPS (< 50 MICROMETERS), BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 16. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY CASTING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY ROLLING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 19. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AEROSPACE & DEFENSE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY COMMERCIAL VEHICLES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 22. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PASSENGER VEHICLES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 24. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY CONSUMER ELECTRONICS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 25. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY ENERGY & POWER SECTOR, BY REGION, 2018-2030 (USD MILLION)

- TABLE 26. GLOBAL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY INDUSTRIAL MACHINERY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 27. AMERICAS AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 28. AMERICAS AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 29. AMERICAS AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 30. AMERICAS AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 31. AMERICAS AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 32. AMERICAS AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 33. ARGENTINA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 34. ARGENTINA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 35. ARGENTINA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 36. ARGENTINA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 37. ARGENTINA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 38. BRAZIL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 39. BRAZIL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 40. BRAZIL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 41. BRAZIL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 42. BRAZIL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 43. CANADA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 44. CANADA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 45. CANADA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 46. CANADA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 47. CANADA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 48. MEXICO AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 49. MEXICO AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 50. MEXICO AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 51. MEXICO AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 52. MEXICO AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 53. UNITED STATES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 54. UNITED STATES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 55. UNITED STATES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 56. UNITED STATES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 57. UNITED STATES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 58. UNITED STATES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 59. ASIA-PACIFIC AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 60. ASIA-PACIFIC AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 61. ASIA-PACIFIC AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 62. ASIA-PACIFIC AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 63. ASIA-PACIFIC AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 64. ASIA-PACIFIC AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 65. AUSTRALIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 66. AUSTRALIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 67. AUSTRALIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 68. AUSTRALIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 69. AUSTRALIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 70. CHINA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 71. CHINA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 72. CHINA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 73. CHINA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 74. CHINA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 75. INDIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 76. INDIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 77. INDIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 78. INDIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 79. INDIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 80. INDONESIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 81. INDONESIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 82. INDONESIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 83. INDONESIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 84. INDONESIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 85. JAPAN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 86. JAPAN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 87. JAPAN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 88. JAPAN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 89. JAPAN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 90. MALAYSIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 91. MALAYSIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 92. MALAYSIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 93. MALAYSIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 94. MALAYSIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 95. PHILIPPINES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 96. PHILIPPINES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 97. PHILIPPINES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 98. PHILIPPINES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 99. PHILIPPINES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 100. SINGAPORE AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 101. SINGAPORE AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 102. SINGAPORE AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 103. SINGAPORE AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 104. SINGAPORE AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 105. SOUTH KOREA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 106. SOUTH KOREA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 107. SOUTH KOREA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 108. SOUTH KOREA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 109. SOUTH KOREA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 110. TAIWAN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 111. TAIWAN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 112. TAIWAN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 113. TAIWAN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 114. TAIWAN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 115. THAILAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 116. THAILAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 117. THAILAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 118. THAILAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 119. THAILAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 120. VIETNAM AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 121. VIETNAM AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 122. VIETNAM AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 123. VIETNAM AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 124. VIETNAM AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 125. EUROPE, MIDDLE EAST & AFRICA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 126. EUROPE, MIDDLE EAST & AFRICA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 127. EUROPE, MIDDLE EAST & AFRICA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 128. EUROPE, MIDDLE EAST & AFRICA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 129. EUROPE, MIDDLE EAST & AFRICA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 130. EUROPE, MIDDLE EAST & AFRICA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 131. DENMARK AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 132. DENMARK AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 133. DENMARK AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 134. DENMARK AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 135. DENMARK AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 136. EGYPT AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 137. EGYPT AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 138. EGYPT AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 139. EGYPT AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 140. EGYPT AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 141. FINLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 142. FINLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 143. FINLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 144. FINLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 145. FINLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 146. FRANCE AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 147. FRANCE AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 148. FRANCE AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 149. FRANCE AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 150. FRANCE AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 151. GERMANY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 152. GERMANY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 153. GERMANY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 154. GERMANY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 155. GERMANY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 156. ISRAEL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 157. ISRAEL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 158. ISRAEL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 159. ISRAEL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 160. ISRAEL AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 161. ITALY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 162. ITALY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 163. ITALY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 164. ITALY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 165. ITALY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 166. NETHERLANDS AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 167. NETHERLANDS AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 168. NETHERLANDS AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 169. NETHERLANDS AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 170. NETHERLANDS AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 171. NIGERIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 172. NIGERIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 173. NIGERIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 174. NIGERIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 175. NIGERIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 176. NORWAY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 177. NORWAY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 178. NORWAY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 179. NORWAY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 180. NORWAY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 181. POLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 182. POLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 183. POLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 184. POLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 185. POLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 186. QATAR AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 187. QATAR AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 188. QATAR AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 189. QATAR AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 190. QATAR AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 191. RUSSIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 192. RUSSIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 193. RUSSIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 194. RUSSIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 195. RUSSIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 196. SAUDI ARABIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 197. SAUDI ARABIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 198. SAUDI ARABIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 199. SAUDI ARABIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 200. SAUDI ARABIA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 201. SOUTH AFRICA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 202. SOUTH AFRICA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 203. SOUTH AFRICA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 204. SOUTH AFRICA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 205. SOUTH AFRICA AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 206. SPAIN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 207. SPAIN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 208. SPAIN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 209. SPAIN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 210. SPAIN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 211. SWEDEN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 212. SWEDEN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 213. SWEDEN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 214. SWEDEN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 215. SWEDEN AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 216. SWITZERLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 217. SWITZERLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 218. SWITZERLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 219. SWITZERLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 220. SWITZERLAND AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 221. TURKEY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 222. TURKEY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 223. TURKEY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 224. TURKEY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 225. TURKEY AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 226. UNITED ARAB EMIRATES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 227. UNITED ARAB EMIRATES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 228. UNITED ARAB EMIRATES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 229. UNITED ARAB EMIRATES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 230. UNITED ARAB EMIRATES AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 231. UNITED KINGDOM AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 232. UNITED KINGDOM AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY THICKNESS, 2018-2030 (USD MILLION)

- TABLE 233. UNITED KINGDOM AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY PRODUCTION PROCESS, 2018-2030 (USD MILLION)

- TABLE 234. UNITED KINGDOM AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY END-USERS, 2018-2030 (USD MILLION)

- TABLE 235. UNITED KINGDOM AMORPHOUS STRIP FOR MOTOR MARKET SIZE, BY AUTOMOTIVE, 2018-2030 (USD MILLION)

- TABLE 236. AMORPHOUS STRIP FOR MOTOR MARKET SHARE, BY KEY PLAYER, 2024

- TABLE 237. AMORPHOUS STRIP FOR MOTOR MARKET, FPNV POSITIONING MATRIX, 2024

The Amorphous Strip for Motor Market was valued at USD 1.73 billion in 2024 and is projected to grow to USD 1.82 billion in 2025, with a CAGR of 5.82%, reaching USD 2.43 billion by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 1.73 billion |

| Estimated Year [2025] | USD 1.82 billion |

| Forecast Year [2030] | USD 2.43 billion |

| CAGR (%) | 5.82% |

The amorphous strip for motor market stands at the crossroads of technological innovation and evolving industrial demands. In an era where efficiency, durability, and energy optimization dictate the standards for performance, this market has emerged as a pivotal element in motor manufacturing and application sectors. The introduction of advanced amorphous materials, coupled with refined production processes, is redefining product capabilities and offering a paradigm shift in market dynamics.

The research encapsulates a detailed understanding of how emerging trends and dynamic customer demands have influenced innovation in amorphous strips. By analyzing the interplay between material science breakthroughs and evolving production techniques, the study provides insights into the factors that are accelerating market growth. Moreover, the report delves into how industrial players are pivoting to incorporate novel designs and methodologies, ensuring that products not only meet current performance criteria but also pave the way for future enhancements.

Such in-depth analysis is further consolidated by an examination of both macro and microeconomic factors. Stakeholders are thereby empowered to make informed decisions based on insights drawn from historical data, present conditions, and forecasts of market trends. The continuous drive towards improved efficiency and performance establishes amorphous strips as a cornerstone in modern motor technology.

Transformative Shifts Redefining the Amorphous Strip for Motor Market Landscape

The dynamics of the amorphous strip for motor market have undergone significant transformation as traditional manufacturing practices merge with innovative technological breakthroughs. In recent years, the landscape has experienced a shift driven by advanced research in material science and precision engineering, fueling the demand for higher performance and cost-effective solutions. Stakeholders have observed that the integration of smart manufacturing processes and real-time monitoring systems has not only streamlined production but also increased the overall lifespan of products.

A central driver in this transformation is the increasing focus on energy efficiency and sustainability. Manufacturers are progressively adopting cleaner production processes that reduce waste and optimize resource use while not compromising on performance. This shift is evidenced by the evolution in production technology, where legacy methods have given way to the incorporation of computer-aided processes and automation. As the market matures, companies embrace these improved digital solutions, leading to quicker turnaround times and lower manufacturing costs.

Additionally, the demand for high precision in automotive, industrial, and consumer segments has set a new benchmark for quality. This paradigm shift is characterized by innovation across product design, and enhanced quality control systems that assure reliability. In essence, the transformative shifts in the market are laying down a foundation that not only addresses current industry requirements but also establishes a framework for future technological advancements in amorphous strip production.

Key Segmentation Insights Shaping Market Strategy

Understanding the market through a robust framework of segmentation is pivotal in deciphering consumer trends and guiding production strategies. The analysis indicates that the segmentation based on material type provides a comprehensive perspective that includes cobalt-based amorphous materials, iron-based amorphous materials, and nickel-based amorphous strips. Each of these materials brings a unique set of properties that influence the performance characteristics of the final product, further honing industry focus on precision engineering and customized solutions.

The thickness-based segmentation unveils diverse categories, highlighting the significance of thick amorphous strips that exceed 100 micrometers, thin amorphous strips ranging between 50 and 100 micrometers, and ultra-thin amorphous strips that are below 50 micrometers. This nuanced classification allows manufacturers to tailor their production processes based on performance requirements and application-specific criteria. Moreover, if one considers the production process segmentation, the market exhibits a dichotomy between casting and rolling techniques which are each optimized to meet specific production and cost efficiency goals.

Furthermore, insights drawn from the segmentation based on end-users emphasize the varied application areas including aerospace and defense, automotive-further dissected into commercial and passenger vehicles-as well as consumer electronics, the energy and power sector, and industrial machinery. This detailed segmentation framework not only enriches our understanding of market dynamics but also highlights avenues for targeted innovation and strategic investments.

Based on Material Type, market is studied across Cobalt-based Amorphous Materials, Iron-based Amorphous Materials, and Nickel-Based Amorphous Strips.

Based on Thickness, market is studied across Thick Amorphous Strips (> 100 micrometers), Thin Amorphous Strips (50-100 micrometers), and Ultra-Thin Amorphous Strips (< 50 micrometers).

Based on Production Process, market is studied across Casting and Rolling.

Based on End-users, market is studied across Aerospace & Defense, Automotive, Consumer Electronics, Energy & Power Sector, and Industrial Machinery. The Automotive is further studied across Commercial Vehicles and Passenger Vehicles.

Regional Variations Informing Market Expansion and Growth

Regional analysis in the amorphous strip for motor market reveals distinct dynamics that underscore local trends and growth opportunities. In the Americas, innovative production techniques have combined with a robust industrial base to foster rapid adoption of amorphous materials in cutting-edge motor technologies. Market maturity in this region is highlighted by substantial investments in research and a commitment to energy efficiency standards across various industrial applications.

In the Europe, Middle East & Africa cluster, regulatory frameworks and sustainability mandates have played a critical role in shaping market evolution. This region observes a strong inclination towards integrating advanced production processes with stringent quality controls, ensuring that emerging products meet both international benchmarks and local consumer confidence. The mix of mature industries with a strategic focus on renewable innovations is creating fertile ground for market growth.

Asia-Pacific remains a cornerstone of rapid industrialization and innovation, where dynamic manufacturing ecosystems are rapidly adopting sophisticated production methods. The blend of high-volume production capabilities, an emphasis on process efficiency, and rigorous quality standards are driving investments in state-of-the-art amorphous strip solutions. Collectively, the interplay of these regional insights underscores their individual contributions towards a globally interconnected market, accentuating the differences in adoption and market maturity that set the stage for competitive advantage.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Prominent Market Participants and Their Strategic Influence

A clear understanding of the competitive landscape is critical to appreciating market trends and future growth trajectories. Key companies have been recognized for their strategic advancements and technological innovations. Companies such as Advanced Technology & Materials Co., Ltd., Bidragon Group, China Amorphous Technology Co., Ltd., Foshan Huaxin Microlite Innovation Materials Co., Ltd., and Guangzhou Amorphous Electronic Technology Co., ltd., are at the forefront of material development and novel process optimization. Established industry leaders like Hitachi Metals, Ltd., Lammotor, and Lamnow Co., Ltd. have consistently introduced innovative solutions that bridge the gap between traditional production methodologies and modern industrial demands.

Other influential players, including Metglas, Inc., MK Magnetics, Inc., and Nano-metal Advanced Materials, have implemented advanced research and development strategies that lay the groundwork for future technological breakthroughs. Big names such as Nippon Steel Corporation, OHMALLOY Material Co., Ltd., Qingdao Yunlu Advanced Materials Technology Co., Ltd., and Shenke Amorphous Technology Co., Ltd. continue to invest in state-of-the-art production facilities. Companies like Shouke Electronic Co., Ltd., Sunbow Group, The Liquidmetal Group, VACUUMSCHMELZE GmbH & Co. KG, Xiamen Innovacera Advanced Materials Co., Ltd., Zheijiang Zhaojing Electrical Technology Co., Ltd., and Zhejiang Jingjing New Material Technology Co., Ltd. further underscore a competitive environment that emphasizes quality, innovation, and sustainability. This diverse group of market participants acts as a catalyst for progressive trends, facilitating profound shifts in production paradigms and value creation.

The report delves into recent significant developments in the Amorphous Strip for Motor Market, highlighting leading vendors and their innovative profiles. These include Advanced Technology & Materials Co., Ltd., Bidragon Group, China Amorphous Technology Co., Ltd., Foshan Huaxin Microlite Innovation Materials Co., Ltd., Guangzhou Amorphous Electronic Technology Co.,ltd., Hitachi Metals, Ltd., Lammotor, Lamnow Co., Ltd., Metglas, Inc., MK Magnetics, Inc., Nano-metal Advanced Materials, Nippon Steel Corporation, OHMALLOY Material Co.,Ltd., Qingdao Yunlu Advanced Materials Technology Co., Ltd., Shenke Amorphous Technology Co., Ltd., Shouke Electronic Co., Ltd., Sunbow Group, The Liquidmetal Group, VACUUMSCHMELZE GmbH & Co. KG, Xiamen Innovacera Advanced Materials Co.,Ltd., Zheijiang Zhaojing Electrical Technology Co., Ltd., and Zhejiang Jingjing New Material Technology Co., Ltd. Actionable Recommendations for Visionary Industry Leaders

Industry leaders are encouraged to leverage the evolving trends in material science and production innovations to secure a competitive advantage in the amorphous strip market. It is advisable to invest significantly in research and development initiatives that focus on hybrid material compositions while adopting advanced process methodologies to elevate efficiency and maintain quality standards. Strategic partnerships with academic institutions and technology innovators can provide a pipeline of fresh insights and foster an environment conducive for breakthrough research.

Adopting a multi-dimensional approach to production is also critical. Leaders should consider optimizing their production strategies by integrating both casting and rolling techniques where applicable, thereby allowing for flexibility and scalability in manufacturing processes. Moreover, it is essential to prioritize market segmentation insights by aligning product development with specific needs identified in material type, thickness, and end-user applications. Engaging in continuous market intelligence and regular benchmarking against global standards will enable firms to identify potential gaps and unlock new revenue streams.

Finally, a proactive strategy that includes diversifying investments across key geographic regions, particularly emerging markets in Asia-Pacific along with established markets in the Americas and Europe, Middle East & Africa, will provide a balanced portfolio approach to managing market risks and exploiting growth opportunities.

Conclusive Perspectives on Future Market Dynamics

In concluding the executive summary, the intricate dynamics of the amorphous strip for motor market clearly indicate a path of robust growth driven by technological innovation and evolving consumer demands. The analysis conducted through advanced segmentation, regional diversification, and a thorough evaluation of major market players has provided a granular view of where the industry is headed. The market is set to experience continuous improvements as evolving material science research, automation, and digital transformation reshape production methodologies.

Companies are poised to benefit from these developments by taking a strategic stance towards innovation and sustainability, ensuring that they remain responsive to market needs. Not only do these trends promise enhanced performance and efficiency, but they also unlock new avenues for product diversification and cost savings. Furthermore, a collaborative spirit among industry stakeholders is paving the way for cross-functional innovation, ultimately contributing to stronger, more resilient market dynamics.

Thus, the study serves as a definitive guide that amalgamates historical insights with futuristic projections, offering a detailed roadmap that enables decision-makers to navigate the complexities of the global market while minimizing risks and capitalizing on emerging opportunities.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Growing automotive industry with demand for energy efficient motor components

- 5.1.1.2. Rising use of amorphous strip for motors in electronics and electrical applications

- 5.1.2. Restraints

- 5.1.2.1. Fluctuations in availability and prices of raw materials associated with amorphous strip for motor

- 5.1.3. Opportunities

- 5.1.3.1. Expansion of industrial automation with the need for high-performance motors

- 5.1.3.2. Ongoing R&D and innovations in amorphous materials to enhance their properties

- 5.1.4. Challenges

- 5.1.4.1. Stringent quality and environmental standards asssociated with amorphous strips

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Material Type: Burgeoning usage of cobalt-based amorphous materials owing to their high permeability and low coercivity

- 5.2.2. End-users: Expanding applications of amorphous strips for motors in automotive to enhance sustainability and reduce emissions

- 5.3. Porter's Five Forces Analysis

- 5.3.1. Threat of New Entrants

- 5.3.2. Threat of Substitutes

- 5.3.3. Bargaining Power of Customers

- 5.3.4. Bargaining Power of Suppliers

- 5.3.5. Industry Rivalry

- 5.4. PESTLE Analysis

- 5.4.1. Political

- 5.4.2. Economic

- 5.4.3. Social

- 5.4.4. Technological

- 5.4.5. Legal

- 5.4.6. Environmental

6. Amorphous Strip for Motor Market, by Material Type

- 6.1. Introduction

- 6.2. Cobalt-based Amorphous Materials

- 6.3. Iron-based Amorphous Materials

- 6.4. Nickel-Based Amorphous Strips

7. Amorphous Strip for Motor Market, by Thickness

- 7.1. Introduction

- 7.2. Thick Amorphous Strips (> 100 micrometers)

- 7.3. Thin Amorphous Strips (50-100 micrometers)

- 7.4. Ultra-Thin Amorphous Strips (< 50 micrometers)

8. Amorphous Strip for Motor Market, by Production Process

- 8.1. Introduction

- 8.2. Casting

- 8.3. Rolling

9. Amorphous Strip for Motor Market, by End-users

- 9.1. Introduction

- 9.2. Aerospace & Defense

- 9.3. Automotive

- 9.3.1. Commercial Vehicles

- 9.3.2. Passenger Vehicles

- 9.4. Consumer Electronics

- 9.5. Energy & Power Sector

- 9.6. Industrial Machinery

10. Americas Amorphous Strip for Motor Market

- 10.1. Introduction

- 10.2. Argentina

- 10.3. Brazil

- 10.4. Canada

- 10.5. Mexico

- 10.6. United States

11. Asia-Pacific Amorphous Strip for Motor Market

- 11.1. Introduction

- 11.2. Australia

- 11.3. China

- 11.4. India

- 11.5. Indonesia

- 11.6. Japan

- 11.7. Malaysia

- 11.8. Philippines

- 11.9. Singapore

- 11.10. South Korea

- 11.11. Taiwan

- 11.12. Thailand

- 11.13. Vietnam

12. Europe, Middle East & Africa Amorphous Strip for Motor Market

- 12.1. Introduction

- 12.2. Denmark

- 12.3. Egypt

- 12.4. Finland

- 12.5. France

- 12.6. Germany

- 12.7. Israel

- 12.8. Italy

- 12.9. Netherlands

- 12.10. Nigeria

- 12.11. Norway

- 12.12. Poland

- 12.13. Qatar

- 12.14. Russia

- 12.15. Saudi Arabia

- 12.16. South Africa

- 12.17. Spain

- 12.18. Sweden

- 12.19. Switzerland

- 12.20. Turkey

- 12.21. United Arab Emirates

- 12.22. United Kingdom

13. Competitive Landscape

- 13.1. Market Share Analysis, 2024

- 13.2. FPNV Positioning Matrix, 2024

- 13.3. Competitive Scenario Analysis

- 13.3.1. Epson and Epson Atmix awarded at the 2024

- 13.3.2. NYCOA has launched a new amorphous nylon

- 13.3.3. Yunlu Advanced Materials launches production of 120,000-ton amorphous material

- 13.4. Strategy Analysis & Recommendation

Companies Mentioned

- 1. Advanced Technology & Materials Co., Ltd.

- 2. Bidragon Group

- 3. China Amorphous Technology Co., Ltd.

- 4. Foshan Huaxin Microlite Innovation Materials Co., Ltd.

- 5. Guangzhou Amorphous Electronic Technology Co.,ltd.

- 6. Hitachi Metals, Ltd.

- 7. Lammotor

- 8. Lamnow Co., Ltd.

- 9. Metglas, Inc.

- 10. MK Magnetics, Inc.

- 11. Nano-metal Advanced Materials

- 12. Nippon Steel Corporation

- 13. OHMALLOY Material Co.,Ltd.

- 14. Qingdao Yunlu Advanced Materials Technology Co., Ltd.

- 15. Shenke Amorphous Technology Co., Ltd.

- 16. Shouke Electronic Co., Ltd.

- 17. Sunbow Group

- 18. The Liquidmetal Group

- 19. VACUUMSCHMELZE GmbH & Co. KG

- 20. Xiamen Innovacera Advanced Materials Co.,Ltd.

- 21. Zheijiang Zhaojing Electrical Technology Co., Ltd.

- 22. Zhejiang Jingjing New Material Technology Co., Ltd