|

|

市場調査レポート

商品コード

1863534

生体適合性コーティング市場:材料タイプ別、用途別、エンドユーザー産業別、技術別- 世界予測2025-2032Biocompatible Coatings Market by Material Type, Application, End User Industry, Technology - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 生体適合性コーティング市場:材料タイプ別、用途別、エンドユーザー産業別、技術別- 世界予測2025-2032 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 197 Pages

納期: 即日から翌営業日

|

概要

生体適合性コーティング市場は、2032年までにCAGR12.87%で485億7,000万米ドル規模に成長すると予測されております。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 184億3,000万米ドル |

| 推定年2025 | 207億6,000万米ドル |

| 予測年2032 | 485億7,000万米ドル |

| CAGR(%) | 12.87% |

先進的な生体適合性コーティングが、医療分野全体において、医療機器の設計、性能、臨床統合をどのように変革しているかについて、明確かつ実践的な概要をご説明いたします

生体適合性コーティングは、ニッチな表面処理技術から、診断機器、治療機器、埋め込み型医療機器における基盤技術へと進化を遂げております。これらのコーティングは、人工材料と生体システムとの界面を仲介し、生体適合性、機器の耐久性、臨床結果を形作る役割を担っております。材料科学と精密医療が融合する中、コーティングの役割は、薬剤の能動的溶出、防汚防御、生理的刺激に反応する機械的適応インターフェースなどへと拡大しております。

本報告書では、コーティングが有害な組織反応の低減、デバイスの統合性向上、低侵襲的なデリバリー形式の実現を通じて、いかに臨床的価値へと変換されるかに重点を置いています。イントロダクションでは中核的な技術概念を明確化し、主流の製造・応用パラダイムを強調するとともに、進化する規制環境や償還環境を背景に、進行中のイノベーションの位置付けを説明します。読者の皆様には、コーティング技術の普及軌道を決定づける材料、応用領域、基盤技術、エンドユーザー動向について体系的な見解を得ていただけます。本報告書の目的は、意思決定者に対し、コーティング技術が製品設計の選択肢、サプライチェーン上の考慮事項、測定可能な臨床的・商業的利益をもたらす共同研究開発戦略にどのように影響するかを実践的に理解していただくことにあります。

材料、デバイスの小型化、規制要件、サプライチェーンのレジリエンスにおける収束するイノベーションが、生体適合性コーティング戦略をどのように再構築しているか

生体適合性コーティングの情勢は、科学技術の進歩と利害関係者の期待の変化が相まって、変革的な転換期を迎えています。ポリマー化学、ナノ構造化、表面機能化の革新により、抗血栓性、抗菌性、徐放性を単一層で統合する多機能コーティングが可能となりました。同時に、デバイスの小型化と埋め込み型・ウェアラブル治療機器の普及は、超薄型でありながら機能密度が高いコーティングを必要としており、開発者は成膜方法と基材適合性の再考を迫られています。

規制枠組みも適応を進めており、規制当局は設計段階での安全性確保とライフサイクルを通じたエビデンスを重視するようになりました。これにより、堅牢な生体適合性試験と市販後調査戦略の重要性が高まっています。サプライチェーンのレジリエンスも優先課題となり、生産者はトレーサビリティ、再現性、スケーラブルな製造を実証できる材料・プロセスパートナーを求めています。臨床医や調達チームは、長期的な性能と費用対効果の証拠をますます要求しており、開発者はトランスレーショナルエンドポイントと実世界データ収集を優先せざるを得ません。これらの変化が相まって、業界全体の研究開発ロードマップ、パートナーシップモデル、商業化のタイムラインを再定義しています。

米国における最近の関税調整が、コーティングバリューチェーン内の調達、製造のレジリエンス、地域別生産選択に及ぼす戦略的影響の評価

米国における最近の関税情勢は、生体適合性コーティングのエコシステム全体に波及する複雑性を生み出しています。関税調整は、堆積技術に使用される原材料と資本設備の両方に影響を及ぼし、調達計算を変え、ニアショアリングやサプライヤーの多様化を促進します。特殊な前駆体に依存する組織にとって、関税の増加は調達サイクルを延長し、製造ラインの総所有コストを上昇させる可能性があり、サプライヤー契約や在庫方針の再評価を促します。

これに対応し、多くの利害関係者は代替原料の採用、二次調達ルートの確保、重要化学品における安全在庫水準の引き上げなど、サプライチェーン構造の再構築を進めています。調達部門では、関税上昇条項の組み込みや長期的な価格可視性の確保を目的とした契約形態の見直しが行われています。重要な点として、関税圧力により戦略的連携のパターンも変化しています。企業は地域パートナーシップの構築や国内プロセス検証を推進し、国境を越えたリスクを軽減しようとしています。こうした調整は、パイロットラインの立地選定、優先的に工業化される技術、上流材料と下流製剤技術への投資資本配分などに、長期的に影響を及ぼす可能性があります。

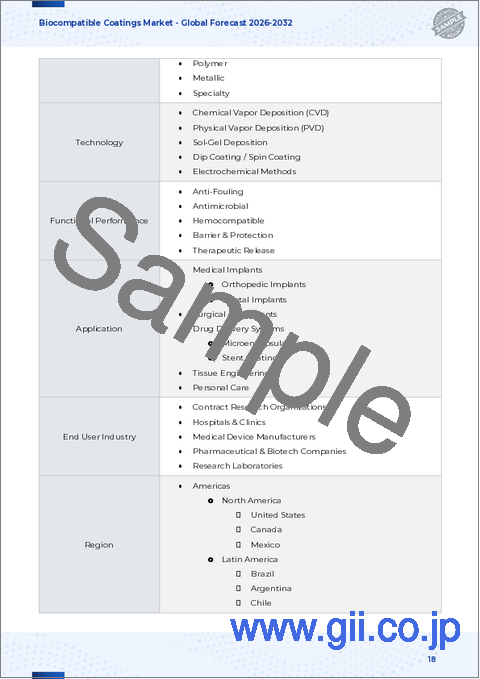

材料クラス、応用分野、エンドユーザーの優先事項、製造技術を戦略的製品ポジショニングに結びつける、きめ細かいセグメンテーション統合

セグメンテーションは、技術選択とアプリケーション要件・エンドユーザーニーズを結びつける実用的な視点を提供し、より細分化された製品戦略と商業戦略を可能にします。材料タイプで分析すると、セラミックコーティングは高い耐摩耗性と化学的安定性を備え、硬性インプラントに適しています。一方、複合コーティングはセラミックとポリマーの強みを組み合わせることでハイブリッド性能を実現します。金属コーティングは、特に診断機器や特定の外科用器具において、電気伝導性と構造補強が求められる場面で中心的な役割を果たします。ポリマーコーティングは、ハイドロゲル製剤、パリレンコンフォーマルコーティング、ポリエチレングリコール系化学物質、シリコーンエラストマーなど、その内部の多様性により、機械的コンプライアンス、親水性、薬物放出動態を精密に調整できる点で特別な注目を必要とします。

用途の細分化により性能目標と規制対応経路が明確化されます。診断機器には極めて低いバイオファウリングと表面均一性が求められ、薬物送達システムにはマイクロカプセル化、ナノキャリア、特殊ステントコーティングなどの選択肢を備えた徐放性界面が要求されます。また、植込み型デバイスは心血管ステント、歯科インプラント、眼科インプラント、整形外科インプラントに及び、それぞれ摩耗、腐食、組織統合性において異なる優先事項を有します。エンドユーザー産業の視点は、商業的関与と検証戦略を形作ります。受託研究機関は前臨床特性評価とスケールアップ支援を主導し、病院や診療所は観察研究や臨床試験を通じて臨床有用性を検証します。医療機器メーカーはコーティングを製品群に統合し、製薬会社は非経口投与や埋め込み型薬物送達との組み合わせを追求し、研究機関は新規コンセプトの探求を推進します。技術セグメンテーションは、化学気相成長法、エレクトロスピニング、物理気相成長法、プラズマ溶射、ゾルーゲル法などの製造方法を特定の用途要求にマッピングすることで、これらの選択をさらに運用化します。各プラットフォームにはサブドメインが存在します。CVD(化学気相成長)では低圧化学気相成長、金属有機プロセス、プラズマ強化型CVD、エレクトロスピニングではブレンド法、同軸法、溶融法、物理気相成長では電子ビーム法、スパッタリング法、熱法、プラズマ溶射では大気圧法と真空法、ゾルゲル法では浸漬法、スピン法、スプレー法などです。これらは実現可能な微細構造、スループット、スケーラビリティを決定します。材料、用途、エンドユーザー、技術の各視点を統合することで、利害関係者は技術的な実現可能性と臨床・商業的導入障壁を最適に整合させる開発経路を優先的に選択できます。

南北アメリカ、欧州、中東・アフリカ、アジア太平洋地域における多様な地域特性が、臨床検証の進め方、製造拠点の配置、市場参入戦略に与える影響

地域ごとの動向は、投資、製造スケールアップ、臨床検証活動の優先順位に影響を与える、差別化された機会セットと運用上の制約を生み出します。アメリカ大陸では、主要な臨床試験ネットワークへの近接性と強力な医療機器製造基盤が、迅速なトランスレーショナルパスウェイと、臨床検証のための病院・診療所との緊密な連携を支えています。欧州・中東・アフリカ地域は、市場間の規制調和と強力な学術・臨床クラスターがイノベーション連携を促進する一方、一部医療制度におけるコスト抑制圧力により、実世界データに基づく明確な価値提案が求められる、多様性に富んだ環境です。アジア太平洋地域は、急速なインフラ拡充、国内製造能力の成長、先端材料研究への注力の加速が特徴であり、迅速な導入サイクルを可能にする反面、地域ごとの規制差異やサプライヤー認定プロセスへの注意も必要です。

地域ごとの償還制度、調達行動、製造インセンティブが異なるため、企業は地域ごとに製品投入の順序、臨床エビデンス創出計画、サプライチェーンの展開を調整する必要があります。これは現地でのプロセスバリデーション、知的財産戦略、共同研究モデルの決定にも影響を及ぼします。実際には、最適な地域戦略とは、集中型研究開発と現地生産・臨床連携を融合させ、コスト効率と市場アクセス、規制順守のバランスを取るものです。

臨床導入と商業的価値を獲得する主体を決定づける、専門開発企業・OEM・受託パートナー間の主要な競争行動と提携モデル

競合は、専門的なコーティング開発企業、材料サプライヤー、独自表面ソリューションを統合する医療機器OEM、スケールアップ技術を提供する契約パートナーが混在する構造を示しています。主要企業は、深い配合ノウハウ、検証済み成膜プラットフォーム、広範な規制関連資料を組み合わせることで差別化を図り、パートナーや顧客の採用障壁を低減しています。コーティング技術革新者と医療機器メーカー間の戦略的提携は一般的であり、表面工学が中核的競争優位性となる統合ソリューションの共同開発を目的としています。

投資プログラムでは、複数の応用分野に適用可能なプラットフォーム技術を重視し、検証コストの償却と市場投入時期の加速を図っています。知的財産ポートフォリオは、表面化学、成膜プロセスの最適化、用途特化型処理プロトコルを頻繁に標的とします。同時に、受託研究開発・製造機関は、前臨床試験からGMP準拠コーティング実装までのエンドツーエンド開発経路を提供する能力を拡大しています。新規参入企業にとって、規模拡大への道筋は、ニッチ分野での専門性、明確な臨床的有効性の実証、製造基盤と規制対応経験を提供するパートナーシップの構築が不可欠です。最終的には、技術的差別化と、臨床導入までの時間短縮および運用リスク低減を実現する現実的な商業化経路を組み合わせた競争的ポジショニングが求められます。

材料革新、規制戦略、サプライチェーンのレジリエンスを連携させ、臨床導入と商業的牽引力を加速させるための実践的かつ優先順位付けされた提言

業界リーダーは、材料革新と規制計画、サプライチェーンの多様化、エビデンス創出を連携させる協調的戦略を追求すべきです。第一に、共通の製造基盤を維持しつつ異なる用途への迅速な再構成を可能とするモジュラー型コーティングプラットフォームへの投資により、バリデーション負担を軽減します。第二に、早期の規制当局との対話を優先し、構造化された当局との連携および積極的な生体適合性・性能試験により、下流工程での予期せぬ問題を減らし臨床受容を加速します。第三に、貿易政策や関税変動の影響を軽減するため、認定された二次サプライヤー、地域別製造オプション、追跡可能な原材料調達先を含む強靭な調達戦略を構築してください。

さらに、臨床パートナーとの共同検証経路を構築し、病院の調達基準に直結する実臨床データや市販後性能データを生成します。スループットと精度を両立する拡張可能な堆積技術に投資し、開発コスト分担と導入加速のためライセンシングや共同開発モデルを検討します。最後に、医療システムが臨床性能と並行して環境負荷を重視する傾向が強まる中、材料選定や廃棄物管理に持続可能性の観点を取り入れましょう。技術的、規制的、商業的、環境的側面を同時に考慮することで、製品ライフサイクル全体の摩擦を低減し、より予測可能な価値創出が可能となります。

透明性の高い多角の調査手法により、一次インタビュー、技術文献の統合分析、規制文書のレビュー、シナリオ検証を統合し、実践的な知見を裏付けます

本分析を支える調査手法は、多角的な証拠収集、専門家インタビュー、厳格な検証を組み合わせ、確固たる実践的知見を確保します。1次調査では、技術的課題・導入障壁・運用制約に関する直接的な見解を把握するため、研究開発責任者、製造部門幹部、調達専門家、臨床研究者への構造化インタビューを実施。2次調査では査読済み文献、規制ガイダンス文書、技術基準、業界ホワイトペーパーを統合し、一次知見の文脈化と技術性能主張の検証を行いました。

可能な限り、技術的知見については、実験室プロトコルのレビュー、特許状況の評価、公開されている規制当局への提出書類を通じて三角検証を行い、堆積方法、材料特性、デバイスコーティングとの相互作用に関する主張を検証しました。シナリオ分析を用いてサプライチェーンの緊急事態や関税の影響を調査し、証拠入力の定性的重み付けにより、結論が孤立した事例ではなく収束したシグナルを反映するよう確保しました。品質管理には、再現性と利害関係者の推奨事項への信頼性を支えるため、クロスインタビューによる検証、情報源の透明性、方法論的選択の明確な監査証跡が含まれました。

材料・技術選択を規制対応、サプライチェーンの回復力、臨床的に検証された成果の必要性へと結びつける簡潔な戦略的結論

サマリーしますと、生体適合性コーティングは材料科学と臨床応用の戦略的接点に位置し、ポリマー・堆積技術・ハイブリッド材料の進歩が新たなデバイス機能性と臨床ワークフローを実現しています。当分野の近未来の軌跡は、利害関係者が技術革新を規制の先見性・サプライチェーン適応性・臨床的に意義あるエビデンス創出と如何に統合するかで形作られます。関税動向と地域的ダイナミクスは複雑性を加える一方、地域的な能力構築と産業界・臨床界の緊密な連携を促すインセンティブも生み出しています。

意思決定者にとっての課題は明確です:アプリケーション横断的なモジュール性を可能にするプラットフォームアプローチを優先し、規制当局や臨床パートナーを早期に巻き込み、調達におけるレジリエンスと持続可能性への投資を行うことです。これらの取り組みは、臨床導入までの時間を短縮し、商業化のリスクを軽減し、表面技術がデバイスの差別化と臨床成果をますます左右する競合情勢において、防御可能なポジションを構築することにつながります。本稿の結論は、先進的な生体適合性コーティングの臨床的・商業的潜在価値を捉えるための戦略的計画立案、パートナーシップ決定、資源配分への示唆を目的としております。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 医療機器におけるタンパク質吸着低減のための両性イオン性ポリマーコーティングの活用拡大

- 薬物送達と細胞接着調節を組み合わせた多機能性ハイドロゲルコーティングの開発

- カスタム外科用インプラント向け3Dプリント対応生体適合性コーティングの拡大

- 心血管ステント性能向上のためのナノエンジニアリングダイヤモンドライクカーボンコーティングの進展

- 生理的刺激により成長因子を放出するスマート応答性コーティングの統合

- 長期間にわたる整形外科インプラントの統合を実現する、ムール貝の付着タンパク質に着想を得たコーティング技術の台頭

- 時間制御型薬物放出用途に向けた光分解性表面コーティングの出現

- 抗菌機能を有する新規複合デバイスコーティングの規制承認経路の増加

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 生体適合性コーティング市場:素材タイプ別

- セラミックコーティング

- 複合コーティング

- 金属コーティング

- ポリマーコーティング

- ハイドロゲル

- パリレン

- ポリエチレングリコール

- シリコーン

第9章 生体適合性コーティング市場:用途別

- 診断機器

- 薬物送達システム

- マイクロカプセル化

- ナノキャリア

- ステントコーティング

- 埋込型医療機器

- 心血管ステント

- 歯科インプラント

- 眼科用インプラント

- 整形外科用インプラント

- 外科用器具

- 組織工学用スキャフォールド

第10章 生体適合性コーティング市場エンドユーザー産業別

- CRO(受託研究機関)

- 病院および診療所

- 医療機器メーカー

- 製薬会社

- 研究機関

第11章 生体適合性コーティング市場:技術別

- 化学気相成長法

- 低圧化学気相成長法

- 金属有機化学気相成長法

- プラズマ強化化学気相成長法

- エレクトロスピニング

- ブレンドエレクトロスピニング

- 同軸エレクトロスピニング

- 溶融エレクトロスピン法

- 物理的気相成長法

- 電子線蒸発

- スパッタリング

- 熱蒸発

- プラズマ溶射

- 大気圧プラズマ溶射

- 真空プラズマ溶射

- ゾルゲル法

- ディップコーティング

- スピンコーティング

- スプレーコーティング

第12章 生体適合性コーティング市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第13章 生体適合性コーティング市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第14章 生体適合性コーティング市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第15章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Surmodics, Inc.

- DuPont de Nemours, Inc.

- DSM Biomedical B.V.

- Evonik Industries AG

- Akzo Nobel N.V.

- Henkel AG & Co. KGaA

- 3M Company

- Merck KGaA

- Specialty Coating Systems, Inc.

- Covalon Technologies Ltd.