|

|

市場調査レポート

商品コード

1806131

農業機械・機器市場:タイプ別、自動化レベル別、動力源別、駆動タイプ別、用途別、所有タイプ別、エンドユーザー別、流通チャネル別-2025-2030年世界予測Agricultural Machinery & Equipment Market by Type, Automation Level, Power Source, Drive Type, Application, Ownership Type, End User, Distribution Channel - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 農業機械・機器市場:タイプ別、自動化レベル別、動力源別、駆動タイプ別、用途別、所有タイプ別、エンドユーザー別、流通チャネル別-2025-2030年世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 194 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

農業機械・機器市場は、2024年には1,652億9,000万米ドルとなり、2025年にはCAGR 5.69%で1,744億5,000万米ドルに成長し、2030年には2,304億2,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 1,652億9,000万米ドル |

| 推定年2025 | 1,744億5,000万米ドル |

| 予測年2030 | 2,304億2,000万米ドル |

| CAGR(%) | 5.69% |

世界の農業機械の動向を包括的に調査するための舞台設定急速に進化するセクターにおける革新と戦略的課題

農業機械セクターは、食糧安全保障、持続可能性、効率性に対する世界的な需要が収束する中、極めて重要な岐路に立っています。過去10年間で、機械化は基本的なモーター駆動の機器から、作物生産のあらゆる段階を最適化する複雑なセンサー駆動システムへと進化しました。この進化は、制約のある耕地での収量を増やし、高齢化する農村人口における労働力依存を減らし、精密なアプリケーションによって環境への影響を最小限に抑えるという、高まる圧力によって推進されてきました。

創造的破壊の状況規制状況の変化と持続可能性の中で農業機械の状況を形成する主要な変革の特定

農業機械の情勢は、ロボット工学、接続性、データ解析の飛躍的進歩に牽引され、大きな変革期を迎えています。かつてはニッチな製品であった精密農業ツールは、今や衛星測位、機械学習モデル、リアルタイムセンサーを統合し、肥料や水をピンポイントで供給します。この転換は、収量の可能性を高めるだけでなく、化学物質の流出を抑制し、希少な水資源を節約することで、環境目標にも合致します。

米国の最近の関税が農業機械輸入に与える影響と、サプライ・チェーンと競合の位置づけをめぐるダイナミクスの変化

鉄鋼、アルミニウム、および一部の輸入機械部品に対する最近の関税引き上げは、農業機械市場に新たな複雑性をもたらしました。こうした措置の結果、メーカーは投入コストの上昇に直面し、グローバルな調達戦略の再評価を促しています。一部のOEMメーカーは、従来の供給拠点から、より低コストの地域や、優遇措置の恩恵を受ける国内製造施設へと多角化を加速させています。

装置タイプ別、自動化レベル別、動力源別、駆動タイプ別、用途別、所有者別、流通チャネル別の詳細なセグメンテーション別洞察の解明

セグメンテーションは、異なる製品カテゴリーが多様なユーザーニーズや運用状況とどのように共鳴しているかを明らかにします。機器の種類は、コンバインや飼料収穫機などの収穫機械、ベーラーや芝刈り機、コンディショナーなどの牧草・飼料機械、ドリップシステムとスプリンクラーシステムに分かれた灌漑ソリューション、ハローからシードドリルまでの整地・播種器具、50馬力から150馬力のトラクターから150馬力以上のハイパワーユニットまで幅広いラインナップに及ぶ。各カテゴリーは、独自のコスト構造、使用パターン、技術革新の軌跡を反映しています。

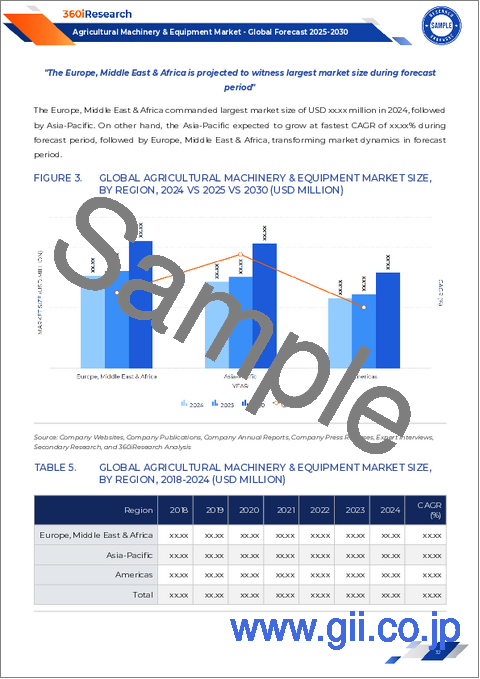

南北アメリカ、欧州、中東・アフリカ、アジア太平洋の農業機械部門における地域差と成長促進要因のハイライト

農業機械市場の地域力学は、多様な成長促進要因と競合情勢のタペストリーを明らかにしています。南北アメリカでは、高収量の汎用作物に重点が置かれ、十分な農地があることから、大型トラクターと精密誘導システムへの需要が高まっています。米国とブラジルの生産拠点は強固な研究開発エコシステムを裏付けており、一方、新興の南米市場では手作業に代わって低コストの機械化が採用されています。

農業機械の競合情勢を形成する業界大手プレイヤーの戦略革新パートナーシップとポジショニングの検証

業界の主要プレーヤーは、戦略的パートナーシップ、買収、的を絞った研究開発投資を通じて、ポートフォリオを磨き続けています。世界の既存企業は、テレマティクス、アナリティクス、遠隔監視を統合したデジタル・プラットフォームを倍増させ、サービス提供の差別化と継続的な収益源の確保を図っています。機器メーカーと農業技術の新興企業との開発は、AI主導の作物モニタリングと自律航行ソリューションの共同開発を加速させています。

競合のプレッシャーから業界リーダーを導くための実行可能な戦略的提言技術革新を活用し、新たな成長フロンティアを切り開く

業界のリーダーは、デジタル機能を中核製品ラインに統合することを優先し、リアルタイムのデータ収集がプレミアムなアドオンではなく、標準的な慣行となるようにしなければならないです。競争圧力と規制の不確実性を乗り切るために、メーカーは二重調達の取り決めを確立し、俊敏な流通モデルでロジスティクス・パートナーと協力することにより、サプライチェーンを多様化すべきです。

定量的データ分析、一次調査、二次情報を活用した厳密な調査手法の実証別堅牢性の確保

本調査は、定量的データ分析、100名を超える業界利害関係者との1次インタビュー、業界誌、規制当局への届出、企業の出版物などによる徹底的な2次調査を組み合わせた厳密な調査手法を採用しています。データの整合性を検証するため、複数の情報源からデータの三角比較を行い、異常値については専門家によるフォローアップを通じて調査しました。

洞察と戦略的インパータスを統合し、農業機械の利害関係者にとっての重要な考慮事項とともに将来の展望を強調

技術の破壊、貿易政策のシフト、地域的なニュアンスに関する洞察をまとめることで、この分野における敏捷性のための戦略的必須事項が浮き彫りになります。セグメンテーションに関する洞察を包括的に理解した利害関係者は、特定の農場規模、作物の種類、環境上の制約に対応するソリューションを調整することができます。同時に、関税に起因するサプライチェーンの調整を認識することで、より弾力的な調達戦略が可能になります。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 多様な地形における土壌の健康を最適化するためのモジュール式多機能耕作機の開発

- AI駆動型自律走行トラクターとLIDARおよびマシンビジョンの統合により、畑作物の栽培が可能に

- 交換可能なバッテリーパックを備えた小型ユーティリティトラクターの電動化により、排出ガスゼロの運用が可能

- リアルタイム遠隔診断と予測保守のための5G対応テレマティクスプラットフォームの導入

- 衛星画像とフィールドセンサーを使用した可変レート液体肥料散布機の急速な普及

- 初期資本要件を低減するためのサブスクリプションベースの農機具レンタルモデルの拡大

- 高馬力農業機械群に電力を供給する水素燃料電池のプロトタイプの登場

- 標的の雑草を防除し、化学薬品の使用を削減するためのドローンによるスポット散布システムの導入

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 農業機械・機器市場:タイプ別

- 収穫機械

- コンバイン

- 飼料収穫機

- 干草・飼料機械

- ベーラー

- 芝刈り機とコンディショナー

- 灌漑機械

- 点滴灌漑

- スプリンクラー灌漑

- 土地の準備、播種、植栽機器

- ハローズ

- 鋤

- ロータリー式耕運機と耕耘機

- 種子・肥料播種機

- トラクター

- 101~150馬力

- 50~75馬力

- 76~100馬力

- 150馬力以上

第9章 農業機械・機器市場:オートメーションレベル別

- 自動

- マニュアル

- 半自動

第10章 農業機械・機器市場電源別

- ディーゼル駆動

- 電動式

- ガソリン駆動

第11章 農業機械・機器市場:ドライブタイプ別

- 四輪駆動ハーベスター

- 二輪駆動ハーベスター

第12章 農業機械・機器市場:用途別

- 施肥と害虫駆除

- 土地開発

- 収穫後の作業

- 脱穀と収穫

第13章 農業機械・機器市場所有権の種類別

- リース機器

- 新しい装備

- 中古機器

第14章 農業機械・機器市場:エンドユーザー別

- 商業農場

- 小規模農場

第15章 農業機械・機器市場:流通チャネル別

- アフターマーケット

- オリジナル機器メーカー

第16章 南北アメリカの農業機械・機器市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第17章 欧州・中東・アフリカの農業機械・機器市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第18章 アジア太平洋地域の農業機械・機器市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第19章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- AGCO Corporation

- Alamo Group Inc.

- Amazonen-Werke H. Dreyer GmbH & Company KG

- ARGO SpA

- JC Bamford Excavators Ltd.

- Bucher Industries AG

- Changzhou Dongfeng Agricultural Machinery Group Co.,Ltd.

- China National Machinery Industry Corporation Ltd.

- Yanmar Holdings Co., Ltd.

- CNH Industrial N.V.

- Escorts Limited

- Greaves Cotton Ltd.

- Iseki & Co., Ltd.

- Deere & Company

- Kubota Corporation

- Mahindra & Mahindra Limited

- SDF Group

- Shivagrico Implements Ltd.

- Sonalika Group

- TAFE Motors and Tractors Limited

- Valmont Industries, Inc.

- VST Tillers Tractors Limited

- Zetor Tractors A.S.

第20章 リサーチAI

第21章 リサーチ統計

第22章 リサーチコンタクト

第23章 リサーチ記事

第24章 付録

LIST OF FIGURES

- FIGURE 1. AGRICULTURAL MACHINERY & EQUIPMENT MARKET RESEARCH PROCESS

- FIGURE 2. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 3. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 4. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 5. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2024 VS 2030 (%)

- FIGURE 6. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2024 VS 2030 (%)

- FIGURE 8. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 9. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2024 VS 2030 (%)

- FIGURE 10. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 11. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2024 VS 2030 (%)

- FIGURE 12. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 13. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2024 VS 2030 (%)

- FIGURE 14. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 15. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2024 VS 2030 (%)

- FIGURE 16. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 17. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2024 VS 2030 (%)

- FIGURE 18. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 19. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2024 VS 2030 (%)

- FIGURE 20. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 21. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 22. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 23. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY STATE, 2024 VS 2030 (%)

- FIGURE 24. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 25. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 26. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 27. ASIA-PACIFIC AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 28. ASIA-PACIFIC AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 29. AGRICULTURAL MACHINERY & EQUIPMENT MARKET SHARE, BY KEY PLAYER, 2024

- FIGURE 30. AGRICULTURAL MACHINERY & EQUIPMENT MARKET, FPNV POSITIONING MATRIX, 2024

- FIGURE 31. AGRICULTURAL MACHINERY & EQUIPMENT MARKET: RESEARCHAI

- FIGURE 32. AGRICULTURAL MACHINERY & EQUIPMENT MARKET: RESEARCHSTATISTICS

- FIGURE 33. AGRICULTURAL MACHINERY & EQUIPMENT MARKET: RESEARCHCONTACTS

- FIGURE 34. AGRICULTURAL MACHINERY & EQUIPMENT MARKET: RESEARCHARTICLES

LIST OF TABLES

- TABLE 1. AGRICULTURAL MACHINERY & EQUIPMENT MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

- TABLE 3. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, 2018-2024 (USD MILLION)

- TABLE 4. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, 2025-2030 (USD MILLION)

- TABLE 5. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 6. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 7. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 8. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 9. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2018-2024 (USD MILLION)

- TABLE 10. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 11. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 12. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 13. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COMBINE HARVESTERS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 14. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COMBINE HARVESTERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 15. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY FORAGE HARVESTERS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 16. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY FORAGE HARVESTERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 17. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2018-2024 (USD MILLION)

- TABLE 18. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2025-2030 (USD MILLION)

- TABLE 19. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 20. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY BALERS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 22. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY BALERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY MOWERS & CONDITIONERS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 24. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY MOWERS & CONDITIONERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2018-2024 (USD MILLION)

- TABLE 26. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2025-2030 (USD MILLION)

- TABLE 27. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 28. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIP IRRIGATION, BY REGION, 2018-2024 (USD MILLION)

- TABLE 30. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIP IRRIGATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY SPRINKLER IRRIGATION, BY REGION, 2018-2024 (USD MILLION)

- TABLE 32. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY SPRINKLER IRRIGATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2018-2024 (USD MILLION)

- TABLE 34. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2025-2030 (USD MILLION)

- TABLE 35. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, BY REGION, 2018-2024 (USD MILLION)

- TABLE 36. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARROWS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 38. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARROWS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY PLOWS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 40. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY PLOWS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY ROTAVATORS & CULTIVATORS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 42. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY ROTAVATORS & CULTIVATORS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY SEED & FERTILIZER DRILLS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 44. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY SEED & FERTILIZER DRILLS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2018-2024 (USD MILLION)

- TABLE 46. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 47. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 48. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY 101 TO 150 HP, BY REGION, 2018-2024 (USD MILLION)

- TABLE 50. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY 101 TO 150 HP, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY 50 TO 75 HP, BY REGION, 2018-2024 (USD MILLION)

- TABLE 52. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY 50 TO 75 HP, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY 76 TO 100 HP, BY REGION, 2018-2024 (USD MILLION)

- TABLE 54. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY 76 TO 100 HP, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY ABOVE 150 HP, BY REGION, 2018-2024 (USD MILLION)

- TABLE 56. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY ABOVE 150 HP, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2018-2024 (USD MILLION)

- TABLE 58. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2025-2030 (USD MILLION)

- TABLE 59. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2018-2024 (USD MILLION)

- TABLE 60. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2025-2030 (USD MILLION)

- TABLE 61. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATIC, BY REGION, 2018-2024 (USD MILLION)

- TABLE 62. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATIC, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY MANUAL, BY REGION, 2018-2024 (USD MILLION)

- TABLE 64. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY MANUAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY SEMI-AUTOMATIC, BY REGION, 2018-2024 (USD MILLION)

- TABLE 66. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY SEMI-AUTOMATIC, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2018-2024 (USD MILLION)

- TABLE 68. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2025-2030 (USD MILLION)

- TABLE 69. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DIESEL OPERATED, BY REGION, 2018-2024 (USD MILLION)

- TABLE 70. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DIESEL OPERATED, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY ELECTRIC OPERATED, BY REGION, 2018-2024 (USD MILLION)

- TABLE 72. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY ELECTRIC OPERATED, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY GASOLINE OPERATED, BY REGION, 2018-2024 (USD MILLION)

- TABLE 74. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY GASOLINE OPERATED, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2018-2024 (USD MILLION)

- TABLE 76. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 77. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY FOUR-WHEEL DRIVE HARVESTER, BY REGION, 2018-2024 (USD MILLION)

- TABLE 78. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY FOUR-WHEEL DRIVE HARVESTER, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TWO-WHEEL DRIVE HARVESTER, BY REGION, 2018-2024 (USD MILLION)

- TABLE 80. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TWO-WHEEL DRIVE HARVESTER, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 82. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 83. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY FERTILIZING & PEST CONTROL, BY REGION, 2018-2024 (USD MILLION)

- TABLE 84. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY FERTILIZING & PEST CONTROL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND DEVELOPMENT, BY REGION, 2018-2024 (USD MILLION)

- TABLE 86. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND DEVELOPMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POST-HARVEST OPERATIONS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 88. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POST-HARVEST OPERATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY THRESHING & HARVESTING, BY REGION, 2018-2024 (USD MILLION)

- TABLE 90. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY THRESHING & HARVESTING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2018-2024 (USD MILLION)

- TABLE 92. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 93. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LEASED EQUIPMENT, BY REGION, 2018-2024 (USD MILLION)

- TABLE 94. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LEASED EQUIPMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY NEW EQUIPMENT, BY REGION, 2018-2024 (USD MILLION)

- TABLE 96. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY NEW EQUIPMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY USED EQUIPMENT, BY REGION, 2018-2024 (USD MILLION)

- TABLE 98. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY USED EQUIPMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 100. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 101. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COMMERCIAL FARMS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 102. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COMMERCIAL FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY SMALLHOLDER FARMS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 104. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY SMALLHOLDER FARMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 106. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 107. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AFTERMARKET, BY REGION, 2018-2024 (USD MILLION)

- TABLE 108. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AFTERMARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY ORIGINAL EQUIPMENT MANUFACTURERS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 110. GLOBAL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY ORIGINAL EQUIPMENT MANUFACTURERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2018-2024 (USD MILLION)

- TABLE 112. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 113. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2018-2024 (USD MILLION)

- TABLE 114. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2025-2030 (USD MILLION)

- TABLE 115. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2018-2024 (USD MILLION)

- TABLE 116. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2025-2030 (USD MILLION)

- TABLE 117. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2018-2024 (USD MILLION)

- TABLE 118. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2025-2030 (USD MILLION)

- TABLE 119. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2018-2024 (USD MILLION)

- TABLE 120. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 121. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2018-2024 (USD MILLION)

- TABLE 122. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2025-2030 (USD MILLION)

- TABLE 123. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2018-2024 (USD MILLION)

- TABLE 124. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2025-2030 (USD MILLION)

- TABLE 125. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2018-2024 (USD MILLION)

- TABLE 126. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2025-2030 (USD MILLION)

- TABLE 127. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2018-2024 (USD MILLION)

- TABLE 128. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 129. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 130. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2018-2024 (USD MILLION)

- TABLE 132. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 133. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 134. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 135. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 136. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 137. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 138. AMERICAS AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2018-2024 (USD MILLION)

- TABLE 140. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 141. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2018-2024 (USD MILLION)

- TABLE 142. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2025-2030 (USD MILLION)

- TABLE 143. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2018-2024 (USD MILLION)

- TABLE 144. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2025-2030 (USD MILLION)

- TABLE 145. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2018-2024 (USD MILLION)

- TABLE 146. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2025-2030 (USD MILLION)

- TABLE 147. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2018-2024 (USD MILLION)

- TABLE 148. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 149. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2018-2024 (USD MILLION)

- TABLE 150. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2025-2030 (USD MILLION)

- TABLE 151. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2018-2024 (USD MILLION)

- TABLE 152. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2025-2030 (USD MILLION)

- TABLE 153. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2018-2024 (USD MILLION)

- TABLE 154. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2025-2030 (USD MILLION)

- TABLE 155. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2018-2024 (USD MILLION)

- TABLE 156. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 157. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 158. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 159. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2018-2024 (USD MILLION)

- TABLE 160. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 161. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 162. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 163. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 164. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 165. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY STATE, 2018-2024 (USD MILLION)

- TABLE 166. UNITED STATES AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY STATE, 2025-2030 (USD MILLION)

- TABLE 167. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2018-2024 (USD MILLION)

- TABLE 168. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 169. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2018-2024 (USD MILLION)

- TABLE 170. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2025-2030 (USD MILLION)

- TABLE 171. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2018-2024 (USD MILLION)

- TABLE 172. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2025-2030 (USD MILLION)

- TABLE 173. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2018-2024 (USD MILLION)

- TABLE 174. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2025-2030 (USD MILLION)

- TABLE 175. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2018-2024 (USD MILLION)

- TABLE 176. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 177. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2018-2024 (USD MILLION)

- TABLE 178. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2025-2030 (USD MILLION)

- TABLE 179. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2018-2024 (USD MILLION)

- TABLE 180. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2025-2030 (USD MILLION)

- TABLE 181. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2018-2024 (USD MILLION)

- TABLE 182. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2025-2030 (USD MILLION)

- TABLE 183. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2018-2024 (USD MILLION)

- TABLE 184. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 185. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 186. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 187. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2018-2024 (USD MILLION)

- TABLE 188. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 189. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 190. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 191. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 192. CANADA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 193. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2018-2024 (USD MILLION)

- TABLE 194. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 195. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2018-2024 (USD MILLION)

- TABLE 196. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2025-2030 (USD MILLION)

- TABLE 197. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2018-2024 (USD MILLION)

- TABLE 198. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2025-2030 (USD MILLION)

- TABLE 199. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2018-2024 (USD MILLION)

- TABLE 200. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2025-2030 (USD MILLION)

- TABLE 201. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2018-2024 (USD MILLION)

- TABLE 202. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 203. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2018-2024 (USD MILLION)

- TABLE 204. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2025-2030 (USD MILLION)

- TABLE 205. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2018-2024 (USD MILLION)

- TABLE 206. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2025-2030 (USD MILLION)

- TABLE 207. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2018-2024 (USD MILLION)

- TABLE 208. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2025-2030 (USD MILLION)

- TABLE 209. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2018-2024 (USD MILLION)

- TABLE 210. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 211. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 212. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 213. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2018-2024 (USD MILLION)

- TABLE 214. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 215. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 216. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 217. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 218. MEXICO AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 219. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2018-2024 (USD MILLION)

- TABLE 220. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 221. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2018-2024 (USD MILLION)

- TABLE 222. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2025-2030 (USD MILLION)

- TABLE 223. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2018-2024 (USD MILLION)

- TABLE 224. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2025-2030 (USD MILLION)

- TABLE 225. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2018-2024 (USD MILLION)

- TABLE 226. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2025-2030 (USD MILLION)

- TABLE 227. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2018-2024 (USD MILLION)

- TABLE 228. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 229. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2018-2024 (USD MILLION)

- TABLE 230. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2025-2030 (USD MILLION)

- TABLE 231. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2018-2024 (USD MILLION)

- TABLE 232. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2025-2030 (USD MILLION)

- TABLE 233. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2018-2024 (USD MILLION)

- TABLE 234. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2025-2030 (USD MILLION)

- TABLE 235. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2018-2024 (USD MILLION)

- TABLE 236. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 237. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 238. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 239. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2018-2024 (USD MILLION)

- TABLE 240. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 241. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 242. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 243. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 244. BRAZIL AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 245. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2018-2024 (USD MILLION)

- TABLE 246. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 247. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2018-2024 (USD MILLION)

- TABLE 248. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2025-2030 (USD MILLION)

- TABLE 249. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2018-2024 (USD MILLION)

- TABLE 250. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2025-2030 (USD MILLION)

- TABLE 251. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2018-2024 (USD MILLION)

- TABLE 252. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2025-2030 (USD MILLION)

- TABLE 253. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2018-2024 (USD MILLION)

- TABLE 254. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 255. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2018-2024 (USD MILLION)

- TABLE 256. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2025-2030 (USD MILLION)

- TABLE 257. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2018-2024 (USD MILLION)

- TABLE 258. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY AUTOMATION LEVEL, 2025-2030 (USD MILLION)

- TABLE 259. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2018-2024 (USD MILLION)

- TABLE 260. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY POWER SOURCE, 2025-2030 (USD MILLION)

- TABLE 261. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2018-2024 (USD MILLION)

- TABLE 262. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DRIVE TYPE, 2025-2030 (USD MILLION)

- TABLE 263. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 264. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 265. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2018-2024 (USD MILLION)

- TABLE 266. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY OWNERSHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 267. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 268. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 269. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 270. ARGENTINA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 271. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2018-2024 (USD MILLION)

- TABLE 272. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 273. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2018-2024 (USD MILLION)

- TABLE 274. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HARVESTING MACHINERY, 2025-2030 (USD MILLION)

- TABLE 275. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2018-2024 (USD MILLION)

- TABLE 276. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY HAYING & FORAGE MACHINERY, 2025-2030 (USD MILLION)

- TABLE 277. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2018-2024 (USD MILLION)

- TABLE 278. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY IRRIGATION MACHINERY, 2025-2030 (USD MILLION)

- TABLE 279. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2018-2024 (USD MILLION)

- TABLE 280. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY LAND PREPARATION, SEEDING & PLANTATION EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 281. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2018-2024 (USD MILLION)

- TABLE 282. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMENT MARKET SIZE, BY TRACTORS, 2025-2030 (USD MILLION)

- TABLE 283. EUROPE, MIDDLE EAST & AFRICA AGRICULTURAL MACHINERY & EQUIPMEN

The Agricultural Machinery & Equipment Market was valued at USD 165.29 billion in 2024 and is projected to grow to USD 174.45 billion in 2025, with a CAGR of 5.69%, reaching USD 230.42 billion by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 165.29 billion |

| Estimated Year [2025] | USD 174.45 billion |

| Forecast Year [2030] | USD 230.42 billion |

| CAGR (%) | 5.69% |

Setting the Stage for a Comprehensive Exploration of Global Agricultural Machinery Trends Innovations and Strategic Imperatives in a Rapidly Evolving Sector

The agricultural machinery sector stands at a pivotal crossroads as global demands for food security, sustainability, and efficiency converge. Over the past decade, mechanization has advanced from basic motorized equipment to complex, sensor-driven systems that optimize every stage of crop production. This evolution has been propelled by mounting pressure to increase yields on constrained arable land, reduce labor dependencies in aging rural populations, and minimize environmental impacts through precision applications.

As environmental regulations tighten and climate patterns grow more unpredictable, equipment manufacturers and farm operators alike are prioritizing technologies that deliver both ecological stewardship and heightened productivity. In parallel, digital connectivity and data analytics have become indispensable for insights into soil health, crop performance, and equipment maintenance. These innovations promise not only cost savings but also the agility to adapt to shifting market conditions.

Against this backdrop, stakeholders must navigate complex trade dynamics, evolving regulatory frameworks, and intensifying competition from new entrants offering modular and electric-powered solutions. Therefore, a comprehensive understanding of current market drivers, technological breakthroughs, and emerging partnership models is essential for crafting resilient strategies. This introduction positions the reader to explore the subsequent sections, which detail transformative shifts, tariff impacts, segmentation nuances, regional differentiators, key players' tactics, and actionable recommendations designed to inform strategic planning in agricultural machinery.

Identifying the Key Transformations Reshaping the Agricultural Machinery Landscape Amid Technological Disruption Regulatory Changes and Sustainability

The landscape of agricultural machinery is undergoing a profound transformation driven by breakthroughs in robotics, connectivity, and data analytics. Precision agriculture tools, once a niche offering, now integrate satellite positioning, machine-learning models, and real-time sensors to deliver fertilizer and water with pinpoint accuracy. This shift not only boosts yield potential but also aligns with environmental objectives by curbing chemical runoff and conserving scarce water resources.

Simultaneously, manufacturers are reimagining equipment design to support electrification and modularity. Electric tractors and battery-powered harvesters are transitioning from proof-of-concept stages to early commercial deployments in Europe and North America. Modular attachments and software-defined functions are enabling equipment fleets to be rapidly reconfigured for multiple tasks, thereby reducing capital expenditures and increasing utilization rates.

Furthermore, the proliferation of autonomous systems is challenging traditional labor models in regions facing workforce shortages. Pilot programs in several advanced economies demonstrate that self-guided tractors and robotic harvesters can operate around the clock under variable conditions, though full commercial adoption remains contingent on regulatory approvals and robust safety standards. In parallel, stakeholder collaboration on interoperability standards seeks to break down data silos, allowing third-party developers to create add-on services that unlock new revenue streams in predictive maintenance and agronomic advisory services.

These transformative shifts underscore the sector's transition from hardware-centric to data-driven solutions, reshaping competitive dynamics and forging pathways for both incumbents and new entrants to redefine value creation.

Impact of Recent US Tariffs on Agricultural Machinery Imports and the Shifting Dynamics across Supply Chains and Competitive Positioning

Recent tariff escalations on steel, aluminum, and certain imported machinery components have introduced new complexities into the agricultural equipment market. As a result of these measures, manufacturers have faced elevated input costs, prompting a reassessment of global sourcing strategies. Some original equipment producers have accelerated diversification away from traditional supply hubs toward lower-cost regions or domestic fabrication facilities benefiting from incentive programs.

The downstream effect has been a reassessment of pricing strategies, with some suppliers absorbing part of the increased costs to maintain market share, while others have initiated selective cost-pass-through mechanisms. Dealers and distributors have responded by intensifying promotional financing offers to buffer end users against price volatility and preserve replacement cycles.

Beyond immediate price impacts, the tariffs have catalyzed broader shifts in trade flows. Equipment flows that once traversed Pacific routes are increasingly rerouted through nearshore manufacturing platforms or consolidated via alternative transport corridors. In conjunction with regulatory incentives for reshoring critical industries, this dynamic is fostering renewed investment in regional assembly plants, thereby shortening lead times and enhancing supply chain resilience.

Moreover, the tariffs have underscored the importance of collaborative procurement strategies. Agricultural cooperatives and large commercial operations are banding together to negotiate volume discounts on key equipment and parts, seeking to offset the inflationary pressures. Consequently, the market is witnessing a gradual rebalancing favoring manufacturers capable of offering end-to-end value propositions encompassing financing, service contracts, and digital performance guarantees.

Uncovering the Insights from In-Depth Segmentation by Equipment Type Automation Level Power Source Drive Type Application Ownership and Distribution Channels

Segmentation unveils how distinct product categories resonate with diverse user needs and operational contexts. Equipment types span harvesting machinery such as combine harvesters and forage harvesters, haying and forage machinery including balers as well as mowers and conditioners, irrigation solutions split between drip and sprinkler systems, land preparation and seeding implements from harrows to seed drills, and a broad tractor lineup ranging from 50 to 150 horsepower all the way to high-power units above 150 horsepower. Each category reflects unique cost structures, usage patterns, and innovation trajectories.

Automation level further differentiates offerings as fully automatic platforms leverage advanced sensors and AI algorithms to execute field tasks with minimal human oversight, semi-automatic options combine automated guidance with operator inputs, and time-tested manual equipment remains prevalent where cost sensitivity or labor availability dictate simpler solutions.

Power source delineates diesel-dominated fleets from the growing portfolio of electric-operated and gasoline-driven models, a segmentation that directly influences total cost of ownership calculations, emissions profiles, and maintenance requirements. Drive type bifurcates self-propelled four-wheel harvesters from more compact two-wheel versions, serving distinct field terrains and crop types.

Application segments capture machines designed for fertilizing and pest control through to post-harvest operations, reflecting how specialized functionalities address agronomic challenges. Ownership models range from leased or rented units to newly purchased and second-hand equipment, providing flexibility for operators managing cash flow constraints. Finally, distribution channels span direct sales from original equipment manufacturers to aftermarket networks ensuring parts availability and service support, each playing a critical role in customer satisfaction and retention.

Highlighting Regional Variations and Growth Drivers across the Americas Europe Middle East Africa and Asia Pacific Agricultural Machinery Sectors

Regional dynamics in the agricultural machinery market reveal a tapestry of divergent growth drivers and competitive landscapes. In the Americas, emphasis on high-yield commodity crops combined with ample farmland has fueled demand for large-scale tractors and precision guidance systems. Production hubs in the United States and Brazil underscore robust R&D ecosystems, while emerging South American markets are adopting lower-cost mechanization to replace manual labor.

Meanwhile, Europe, the Middle East, and Africa exhibit a dual narrative. Western Europe leads in electrification pilots and regulatory alignment around emissions targets, whereas Eastern European markets are upgrading aging fleets with mid-range tractors and versatile implements. In the Middle East, water scarcity and sustainability mandates have driven rapid adoption of drip irrigation and automated greenhouse equipment. Across Africa, mechanization rates remain low but are accelerating via public-private partnerships and co-operative leasing models that lower barriers to entry.

In the Asia-Pacific region, a mosaic of smallholder farms in Southeast Asia contrasts with industrial-scale operations in Australia and New Zealand. Nations such as India and China are ramping up domestic production of low-cost tractors and developing OEM partnerships with established global players. The region's focus on digital extension services, microfinancing solutions, and customized compact machinery underscores its priority to maximize land use efficiency amid burgeoning population pressures.

Examining Leading Industry Players Strategies Innovations Partnerships and Positioning Shaping the Competitive Landscape of Agricultural Machinery

Major industry players continue to refine their portfolios through strategic partnerships, acquisitions, and targeted R&D investments. Global incumbents are doubling down on digital platforms that integrate telematics, analytics, and remote monitoring to differentiate service offerings and secure recurring revenue streams. Collaboration between equipment manufacturers and ag-tech startups has accelerated the co-development of AI-driven crop monitoring and autonomous navigation solutions.

Leading agri-equipment brands are also forging alliances with financial institutions to bundle equipment financing and insurance, thereby smoothing the acquisition process for farmers. Some have established dedicated venture capital funds to incubate emerging technology ventures that align with their long-term strategic roadmaps. Meanwhile, regional specialists are leveraging deep local market knowledge to customize machine configurations, after-sales service networks, and training programs that address specific crop cycles and soil conditions.

Competitive positioning increasingly hinges on the ability to offer end-to-end solutions, from equipment sales and leasing through predictive maintenance and data-driven advisory services. This shift compels companies to invest in talent with expertise in software development, data science, and sustainable design, blurring the lines between traditional machinery manufacturers and technology providers.

Actionable Strategic Recommendations to Guide Industry Leaders Through Competitive Pressures Harness Technological Innovations and Unlock New Growth Frontiers

Industry leaders must prioritize the integration of digital capabilities into core product lines, ensuring that real-time data collection becomes standard practice rather than a premium add-on. To navigate competitive pressures and regulatory uncertainties, manufacturers should diversify supply chains by establishing dual-sourcing arrangements and collaborating with logistics partners on agile distribution models.

Allocating R&D budgets toward electrification and autonomous solutions will differentiate offerings in markets where sustainability targets and labor shortages intensify demand for advanced machinery. Additionally, embracing modular design principles can reduce time to market and lower production costs, enabling rapid customization for regional preferences.

Fostering strategic alliances with technology firms, academic institutions, and local cooperatives can accelerate innovation cycles and expand go-to-market footprints. Companies should also refine service models by deploying predictive maintenance platforms that leverage machine learning to anticipate failures and optimize downtime.

Furthermore, revisiting ownership models to include leasing, equipment-as-a-service, and subscription plans will broaden customer access and create steady revenue streams. Lastly, prioritizing workforce reskilling initiatives will ensure that field technicians and operators can effectively harness emerging technologies, cementing customer loyalty and reinforcing brand equity.

Demonstrating the Rigorous Research Methodology Leveraging Quantitative Data Analysis Primary Interviews Secondary Sources to Ensure Robustness

This research adheres to a rigorous methodology combining quantitative data analysis, primary interviews with over one hundred industry stakeholders, and exhaustive secondary research across trade journals, regulatory filings, and company publications. Data points were triangulated through multiple sources to validate consistency, while outliers were investigated through follow-up expert consultations.

Primary engagements included structured interviews with equipment manufacturers, technology providers, distributors, and end users in key regions. These discussions informed a nuanced understanding of operational challenges, technology adoption rates, and investment priorities. Secondary insights were drawn from authoritative government reports, industry associations, and patent databases to track regulatory changes, sustainability mandates, and innovation pipelines.

The resulting qualitative and quantitative datasets were synthesized through advanced analytics tools, enabling segmentation of market dynamics by equipment type, automation level, power source, and regional characteristics. An iterative review process with senior domain experts ensured the final outputs reflect both current realities and emerging trends, delivering robust, actionable intelligence.

Synthesizing Insights and Strategic Imperatives to Emphasize Future Outlook with Key Considerations for Stakeholders in Agricultural Machinery

Bringing together insights on technology disruptions, trade policy shifts, and regional nuances highlights the strategic imperative for agility in this sector. Stakeholders equipped with a comprehensive understanding of segmentation insights can tailor solutions that address specific farm sizes, crop types, and environmental constraints. Simultaneously, an awareness of tariff-induced supply chain adjustments enables more resilient procurement strategies.

Regional comparisons underscore that no single approach suffices; success hinges on aligning product portfolios with local adoption drivers-whether that means compact electric tractors for smallholder operations in Asia or autonomous harvesters for large-scale farms in North America. Equally, competitive advantage will derive from integrated value propositions that bundle equipment, financing, and digital agronomy services.

Looking ahead, the companies best positioned to win will be those that combine hardware excellence with software prowess, maintain flexible manufacturing footprints, and foster ecosystems of partners across technology, finance, and distribution. As sustainability and productivity goals converge, the agricultural machinery market will reward those who can translate complex data streams into tangible yield improvements and cost efficiencies.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Market Sizing & Forecasting

5. Market Dynamics

- 5.1. Development of modular multi-functional tillage implements to optimize soil health across diverse terrains

- 5.2. Integration of AI-driven autonomous tractors with lidar and machine vision for row crops

- 5.3. Electrification of compact utility tractors with swappable battery packs for zero-emission operations

- 5.4. Deployment of 5G-enabled telematics platforms for real-time remote diagnostics and predictive maintenance

- 5.5. Rapid uptake of variable-rate liquid fertilizer applicators using satellite imagery and field sensors

- 5.6. Expansion of subscription-based farm equipment rental models to lower upfront capital requirements

- 5.7. Emergence of hydrogen fuel cell prototypes powering high-horsepower agricultural machinery fleets

- 5.8. Adoption of drone-based spot spraying systems for targeted weed control and reduced chemical usage

6. Market Insights

- 6.1. Porter's Five Forces Analysis

- 6.2. PESTLE Analysis

7. Cumulative Impact of United States Tariffs 2025

8. Agricultural Machinery & Equipment Market, by Type

- 8.1. Introduction

- 8.2. Harvesting Machinery

- 8.2.1. Combine Harvesters

- 8.2.2. Forage Harvesters

- 8.3. Haying & Forage Machinery

- 8.3.1. Balers

- 8.3.2. Mowers & Conditioners

- 8.4. Irrigation Machinery

- 8.4.1. Drip Irrigation

- 8.4.2. Sprinkler Irrigation

- 8.5. Land Preparation, Seeding & Plantation Equipment

- 8.5.1. Harrows

- 8.5.2. Plows

- 8.5.3. Rotavators & Cultivators

- 8.5.4. Seed & Fertilizer Drills

- 8.6. Tractors

- 8.6.1. 101 to 150 HP

- 8.6.2. 50 to 75 HP

- 8.6.3. 76 to 100 HP

- 8.6.4. Above 150 HP

9. Agricultural Machinery & Equipment Market, by Automation Level

- 9.1. Introduction

- 9.2. Automatic

- 9.3. Manual

- 9.4. Semi-Automatic

10. Agricultural Machinery & Equipment Market, by Power Source

- 10.1. Introduction

- 10.2. Diesel Operated

- 10.3. Electric Operated

- 10.4. Gasoline Operated

11. Agricultural Machinery & Equipment Market, by Drive Type

- 11.1. Introduction

- 11.2. Four-Wheel Drive Harvester

- 11.3. Two-Wheel Drive Harvester

12. Agricultural Machinery & Equipment Market, by Application

- 12.1. Introduction

- 12.2. Fertilizing & Pest Control

- 12.3. Land Development

- 12.4. Post-Harvest Operations

- 12.5. Threshing & Harvesting

13. Agricultural Machinery & Equipment Market, by Ownership Type

- 13.1. Introduction

- 13.2. Leased Equipment

- 13.3. New Equipment

- 13.4. Used Equipment

14. Agricultural Machinery & Equipment Market, by End User

- 14.1. Introduction

- 14.2. Commercial Farms

- 14.3. Smallholder Farms

15. Agricultural Machinery & Equipment Market, by Distribution Channel

- 15.1. Introduction

- 15.2. Aftermarket

- 15.3. Original Equipment Manufacturers

16. Americas Agricultural Machinery & Equipment Market

- 16.1. Introduction

- 16.2. United States

- 16.3. Canada

- 16.4. Mexico

- 16.5. Brazil

- 16.6. Argentina

17. Europe, Middle East & Africa Agricultural Machinery & Equipment Market

- 17.1. Introduction

- 17.2. United Kingdom

- 17.3. Germany

- 17.4. France

- 17.5. Russia

- 17.6. Italy

- 17.7. Spain

- 17.8. United Arab Emirates

- 17.9. Saudi Arabia

- 17.10. South Africa

- 17.11. Denmark

- 17.12. Netherlands

- 17.13. Qatar

- 17.14. Finland

- 17.15. Sweden

- 17.16. Nigeria

- 17.17. Egypt

- 17.18. Turkey

- 17.19. Israel

- 17.20. Norway

- 17.21. Poland

- 17.22. Switzerland

18. Asia-Pacific Agricultural Machinery & Equipment Market

- 18.1. Introduction

- 18.2. China

- 18.3. India

- 18.4. Japan

- 18.5. Australia

- 18.6. South Korea

- 18.7. Indonesia

- 18.8. Thailand

- 18.9. Philippines

- 18.10. Malaysia

- 18.11. Singapore

- 18.12. Vietnam

- 18.13. Taiwan

19. Competitive Landscape

- 19.1. Market Share Analysis, 2024

- 19.2. FPNV Positioning Matrix, 2024

- 19.3. Competitive Analysis

- 19.3.1. AGCO Corporation

- 19.3.2. Alamo Group Inc.

- 19.3.3. Amazonen-Werke H. Dreyer GmbH & Company KG

- 19.3.4. ARGO SpA

- 19.3.5. JC Bamford Excavators Ltd.

- 19.3.6. Bucher Industries AG

- 19.3.7. Changzhou Dongfeng Agricultural Machinery Group Co.,Ltd.

- 19.3.8. China National Machinery Industry Corporation Ltd.

- 19.3.9. Yanmar Holdings Co., Ltd.

- 19.3.10. CNH Industrial N.V.

- 19.3.11. Escorts Limited

- 19.3.12. Greaves Cotton Ltd.

- 19.3.13. Iseki & Co., Ltd.

- 19.3.14. Deere & Company

- 19.3.15. Kubota Corporation

- 19.3.16. Mahindra & Mahindra Limited

- 19.3.17. SDF Group

- 19.3.18. Shivagrico Implements Ltd.

- 19.3.19. Sonalika Group

- 19.3.20. TAFE Motors and Tractors Limited

- 19.3.21. Valmont Industries, Inc.

- 19.3.22. VST Tillers Tractors Limited

- 19.3.23. Zetor Tractors A.S.