|

|

市場調査レポート

商品コード

1718439

紫外線硬化型接着剤市場:樹脂タイプ、配合、用途、エンドユーザー別-2025-2030年の世界予測UV-Curable Adhesive Market by Resin Type, Formulation, Application, End-User - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 紫外線硬化型接着剤市場:樹脂タイプ、配合、用途、エンドユーザー別-2025-2030年の世界予測 |

|

出版日: 2025年04月01日

発行: 360iResearch

ページ情報: 英文 198 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

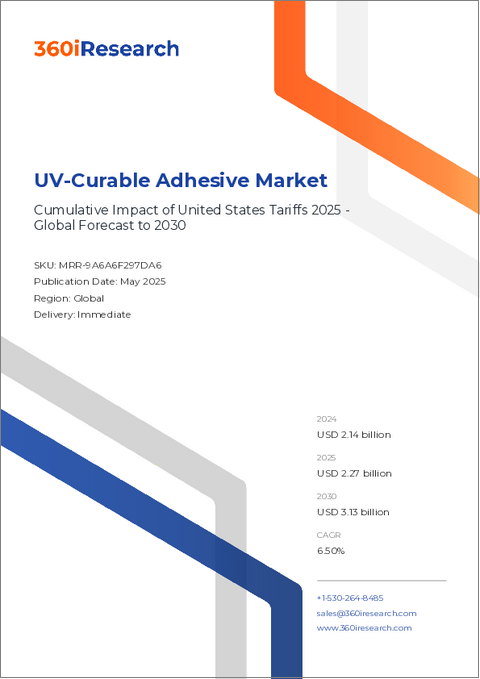

紫外線硬化型接着剤市場は、2023年に20億2,000万米ドルと評価され、2024年には21億4,000万米ドル、CAGR 6.41%で成長し、2030年には31億3,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年 2023 | 20億2,000万米ドル |

| 推定年 2024 | 21億4,000万米ドル |

| 予測年 2030 | 31億3,000万米ドル |

| CAGR(%) | 6.41% |

近年、UV硬化型接着剤の進化は、産業慣行と用途を再構築する極めて重要な技術的ブレークスルーとして浮上してきました。これらの先進的な接着剤は、生産速度の向上、製品の耐久性の強化、さまざまな分野での性能向上に活用されています。迅速な硬化時間、エネルギー効率、最小限の環境排出により、これらの接着剤は従来の溶剤ベースの配合に代わる魅力的な選択肢となっています。UV硬化型システムへの移行は、持続可能な製造工程と揮発性有機化合物の排出削減の継続的な推進にも支えられています。メーカーが革新的な接着ソリューションを求める中、高品質で環境に優しい接着剤を重視する業界の高まりは、あらゆる規模のビジネスに新たな機会をもたらしています。さらに、生産工程におけるデジタルモニタリングと自動化の統合は、UV硬化型接着剤の効果を増幅させています。この入門的な調査は、市場の現在のダイナミクス、技術的進歩、戦略的価値提案の詳細な考察のための舞台を設定し、利害関係者が十分な情報に基づいた意思決定を行うための情報を提供します。

紫外線硬化型接着剤市場の変革

UV硬化型接着剤の業界情勢は、長年の業界標準を塗り替える変革期を迎えています。化学配合の進歩は、自動化技術の統合と相まって、非常に効率的であるだけでなく、多様な産業用途の特定のニーズを満たすように調整されたソリューションの開発につながりました。新たな動向として、環境への配慮とコスト効率の両方をサポートする、より環境に優しく持続可能な接着剤ソリューションの採用が見られます。この市場はまた、スピード、精度、信頼性の向上に対する顧客の要求による技術革新からも恩恵を受けています。このようなダイナミックな変化は、製品の開発方法と、エンドユーザーが高性能環境において接着剤を使用する方法の両方に顕著に表れています。さらに、規制の圧力と環境問題の高まりにより、エネルギー消費と有害物質の排出を最小限に抑える代替品への移行が加速しています。この分野における先駆的な研究開発により、メーカーは作業効率を確保しながら、これまでにないレベルの品質管理と用途の多様性を実現できるようになっています。この変革は、テクノロジーと持続可能性が融合して魅力的な価値提案を生み出し、さらなる技術革新を促す環境を醸成するという、より広範な産業動向を反映しています。

市場力学を牽引する重要なセグメンテーション洞察

市場セグメンテーションの重要な洞察は、UV硬化型接着剤の成長を促進する市場力学の包括的な理解を提供します。樹脂の種類に基づく分析により、市場はアクリル樹脂、エポキシ樹脂、ポリエステル樹脂、ポリウレタン樹脂、シリコーン樹脂、ビニルエーテル樹脂など多様な樹脂配合で調査されていることが明らかになりました。このような詳細な区別により、利害関係者は各樹脂のタイプが特定の性能要件や業界標準をどのように満たしているかをよりよく把握することができます。さらに、配合分析では液体タイプと固体タイプを区別し、液体セグメントは高粘度液体と低粘度液体に、固体カテゴリーはフィルム&テープとペレットに分けられます。これらの微妙なグループ分けを理解することで、さまざまな運用環境に対応するために存在する製品の多様性を明確に把握することができます。接着、コーティング、シーリングをカバーする用途ベースのセグメンテーションは、接着剤が最終用途のシナリオに効果的に統合される方法についての洞察の別のレイヤーを追加します。ここでは、接着はさらにガラス、金属、プラスチック接着に細分化され、コーティングは装飾用途と工業用途に、シーリングはジョイント、表面、空隙充填に細分化されます。最後に、航空宇宙&防衛、自動車&輸送、建築&建設、エレクトロニクス&半導体、医療機器などのエンドユーザー産業に基づくセグメンテーションは、これらの接着剤の広範な範囲と適応性を強調しています。この多面的な枠組みは、地域別および用途別の需要によってもたらされる市場機会を特定するのに役立ちます。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 市場力学

- 促進要因

- 世界中で建設活動とインフラプロジェクトが増加

- 家電製品や小型医療機器の需要増加

- 急速に拡大する自動車産業における軽量車両組立用のUV硬化型接着剤の需要急増

- 抑制要因

- UV硬化型接着剤に関連する設備や装置に高い初期費用がかかる

- 機会

- 環境に優しいUV硬化型接着剤の導入

- 多様な用途に対応する特性を強化する紫外線硬化型接着剤のイノベーション

- 課題

- 硬化能力と基材適合性の限界に関する懸念

- 促進要因

- 市場セグメンテーション分析

- 樹脂タイプ:UV硬化型接着剤のエポキシ樹脂は、さまざまな業界で強度と耐久性を高めます。

- 処方:液体処方の多様性により、紫外線硬化型接着剤アプリケーションで広く普及しています。

- アプリケーション:接合アプリケーションの高い需要は、高度な製造ソリューションに対する継続的なニーズによって推進されています。

- エンドユーザー:エレクトロニクスの継続的な進歩により、UV硬化型接着剤の重要性と用途が拡大しています。

- ポーターのファイブフォース分析

- PESTEL分析

- 政治的

- 経済

- 社会

- 技術的

- 法律上

- 環境

第6章 紫外線硬化型接着剤市場:樹脂タイプ別

- アクリル樹脂

- エポキシ樹脂

- ポリエステル樹脂

- ポリウレタン樹脂

- 脂肪族ポリウレタン樹脂

- 芳香族ポリウレタン樹脂

- シリコーン樹脂

- ビニルエーテル樹脂

第7章 紫外線硬化型接着剤市場処方別

- 液体

- 高粘度液体

- 低粘度液体

- 固体

- フィルムとテープ

- ペレット

第8章 紫外線硬化型接着剤市場:用途別

- ボンディング

- ガラス接着

- 金属接合

- プラスチック接合

- コーティング

- 装飾コーティング

- 工業用コーティング

- シーリング

- ジョイントシーリング

- 表面シーリング

- ボイドフィリング

第9章 紫外線硬化型接着剤市場:エンドユーザー別

- 航空宇宙および防衛

- 航空機内装

- ヘリコプターのブレード

- 衛星コンポーネント

- 自動車・輸送

- 電気自動車用バッテリー

- 車両組立および部品

- 建築・建設

- 建築備品

- 床材用途

- ガラスの設置

- エレクトロニクスおよび半導体

- 回路基板

- ディスプレイパネル

- マイクロエレクトロニクス

- センサー

- 医療機器

- 診断機器

- ドラッグデリバリーデバイス

- 手術器具

- ウェアラブル医療機器

第10章 南北アメリカの紫外線硬化型接着剤市場

- アルゼンチン

- ブラジル

- カナダ

- メキシコ

- 米国

第11章 アジア太平洋地域の紫外線硬化型接着剤市場

- オーストラリア

- 中国

- インド

- インドネシア

- 日本

- マレーシア

- フィリピン

- シンガポール

- 韓国

- 台湾

- タイ

- ベトナム

第12章 欧州・中東・アフリカの紫外線硬化型接着剤市場

- デンマーク

- エジプト

- フィンランド

- フランス

- ドイツ

- イスラエル

- イタリア

- オランダ

- ナイジェリア

- ノルウェー

- ポーランド

- カタール

- ロシア

- サウジアラビア

- 南アフリカ

- スペイン

- スウェーデン

- スイス

- トルコ

- アラブ首長国連邦

- 英国

第13章 競合情勢

- 市場シェア分析, 2023

- FPNVポジショニングマトリックス, 2023

- 競合シナリオ分析

- 戦略分析と提言

企業一覧

- 3M Company

- Adhesives Research, Inc.

- Arkema Group

- Avery Dennison Corporation

- Cartell-UK Ltd

- Chase Corporation

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- Dexerials Corporation

- Dow Chemical Company

- Dymax Corporation

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hernon Manufacturing, Inc.

- Illinois Tool Works Inc.

- Master Bond Inc.

- Meridian Adhesives Group

- Metlok Private Limited

- Nitto Denko Corporation

- Norland Products Inc.

- Novachem Corporation Ltd.

- Panacol-Elosol GmbH

- Parker Hannifin Corporation

- Parson Adhesives, Inc.

- Permabond LLC

- SEKISUI CHEMICAL CO.,LTD.

- Thorlabs, Inc.

LIST OF FIGURES

- FIGURE 1. UV-CURABLE ADHESIVE MARKET MULTI-CURRENCY

- FIGURE 2. UV-CURABLE ADHESIVE MARKET MULTI-LANGUAGE

- FIGURE 3. UV-CURABLE ADHESIVE MARKET RESEARCH PROCESS

- FIGURE 4. UV-CURABLE ADHESIVE MARKET SIZE, 2023 VS 2030

- FIGURE 5. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 6. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY REGION, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 8. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2023 VS 2030 (%)

- FIGURE 9. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 10. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2023 VS 2030 (%)

- FIGURE 11. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 12. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2023 VS 2030 (%)

- FIGURE 13. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 14. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2023 VS 2030 (%)

- FIGURE 15. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 16. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 17. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 18. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY STATE, 2023 VS 2030 (%)

- FIGURE 19. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY STATE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 20. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 21. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 22. EUROPE, MIDDLE EAST & AFRICA UV-CURABLE ADHESIVE MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 23. EUROPE, MIDDLE EAST & AFRICA UV-CURABLE ADHESIVE MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 24. UV-CURABLE ADHESIVE MARKET SHARE, BY KEY PLAYER, 2023

- FIGURE 25. UV-CURABLE ADHESIVE MARKET, FPNV POSITIONING MATRIX, 2023

LIST OF TABLES

- TABLE 1. UV-CURABLE ADHESIVE MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2023

- TABLE 3. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 6. UV-CURABLE ADHESIVE MARKET DYNAMICS

- TABLE 7. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 8. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY ACRYLIC RESINS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY EPOXY RESINS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY POLYESTER RESINS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY ALIPHATIC POLYURETHANE RESIN, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY AROMATIC POLYURETHANE RESIN, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 15. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY SILICONE RESINS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY VINYL ETHER RESINS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 18. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, BY REGION, 2018-2030 (USD MILLION)

- TABLE 19. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY HIGH VISCOSITY LIQUID, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY LOW VISCOSITY LIQUID, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 22. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY FILMS & TAPE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 24. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY PELLETS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 25. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 26. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 27. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 28. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY GLASS BONDING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 29. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY METAL BONDING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 30. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY PLASTIC BONDING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 31. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 32. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 33. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY DECORATIVE COATINGS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 34. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY INDUSTRIAL COATINGS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 35. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 36. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 37. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY JOINT SEALING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 38. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY SURFACE SEALING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 39. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY VOID FILLING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 40. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 41. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 42. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 43. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY AIRCRAFT INTERIORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 44. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY HELICOPTER BLADES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 45. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY SATELLITE COMPONENTS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 46. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 47. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 48. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRIC VEHICLE BATTERIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 49. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY VEHICLE ASSEMBLIES & COMPONENTS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 50. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 51. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 52. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY ARCHITECTURAL FIXTURES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 53. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY FLOORING APPLICATIONS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 54. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY GLASS INSTALLATIONS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 55. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 56. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 57. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY CIRCUIT BOARDS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 58. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY DISPLAY PANELS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 59. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY MICROELECTRONICS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 60. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY SENSORS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 61. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 62. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 63. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY DIAGNOSTIC EQUIPMENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 64. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY DRUG DELIVERY DEVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 65. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY SURGICAL INSTRUMENTS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 66. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY WEARABLE MEDICAL DEVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 67. GLOBAL UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 68. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 69. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 70. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 71. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 72. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 73. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 74. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 75. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 76. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 77. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 78. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 79. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 80. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 81. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 82. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 83. AMERICAS UV-CURABLE ADHESIVE MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 84. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 85. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 86. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 87. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 88. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 89. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 90. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 91. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 92. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 93. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 94. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 95. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 96. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 97. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 98. ARGENTINA UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 99. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 100. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 101. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 102. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 103. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 104. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 105. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 106. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 107. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 108. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 109. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 110. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 111. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 112. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 113. BRAZIL UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 114. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 115. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 116. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 117. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 118. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 119. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 120. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 121. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 122. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 123. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 124. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 125. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 126. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 127. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 128. CANADA UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 129. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 130. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 131. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 132. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 133. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 134. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 135. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 136. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 137. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 138. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 139. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 140. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 141. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 142. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 143. MEXICO UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 144. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 145. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 146. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 147. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 148. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 149. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 150. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 151. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 152. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 153. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 154. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 155. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 156. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 157. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 158. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 159. UNITED STATES UV-CURABLE ADHESIVE MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 160. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 161. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 162. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 163. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 164. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 165. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 166. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 167. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 168. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 169. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 170. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 171. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 172. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 173. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 174. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 175. ASIA-PACIFIC UV-CURABLE ADHESIVE MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 176. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 177. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 178. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 179. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 180. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 181. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 182. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 183. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 184. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 185. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 186. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 187. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 188. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 189. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 190. AUSTRALIA UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 191. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 192. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 193. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 194. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 195. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 196. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 197. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 198. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 199. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 200. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 201. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 202. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 203. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 204. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 205. CHINA UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 206. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 207. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 208. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 209. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 210. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 211. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 212. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 213. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 214. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 215. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 216. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 217. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 218. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 219. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 220. INDIA UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 221. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 222. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 223. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 224. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 225. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 226. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 227. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 228. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 229. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 230. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 231. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 232. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 233. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 234. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 235. INDONESIA UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 236. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 237. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 238. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 239. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 240. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 241. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 242. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 243. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 244. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 245. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 246. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 247. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 248. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 249. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 250. JAPAN UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 251. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 252. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 253. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 254. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 255. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 256. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 257. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 258. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 259. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 260. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 261. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 262. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 263. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 264. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 265. MALAYSIA UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 266. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 267. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 268. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 269. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 270. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 271. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 272. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 273. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 274. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 275. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 276. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 277. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 278. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 279. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 280. PHILIPPINES UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 281. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 282. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 283. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 284. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 285. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 286. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 287. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 288. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 289. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 290. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 291. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 292. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 293. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 294. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 295. SINGAPORE UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 296. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 297. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 298. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 299. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 300. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 301. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 302. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 303. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 304. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 305. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 306. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 307. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 308. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 309. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 310. SOUTH KOREA UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 311. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 312. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 313. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 314. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 315. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 316. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 317. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 318. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 319. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 320. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 321. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 322. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 323. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 324. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 325. TAIWAN UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD MILLION)

- TABLE 326. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY RESIN TYPE, 2018-2030 (USD MILLION)

- TABLE 327. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY POLYURETHANE RESINS, 2018-2030 (USD MILLION)

- TABLE 328. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY FORMULATION, 2018-2030 (USD MILLION)

- TABLE 329. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY LIQUID, 2018-2030 (USD MILLION)

- TABLE 330. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY SOLID, 2018-2030 (USD MILLION)

- TABLE 331. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 332. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY BONDING, 2018-2030 (USD MILLION)

- TABLE 333. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY COATING, 2018-2030 (USD MILLION)

- TABLE 334. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY SEALING, 2018-2030 (USD MILLION)

- TABLE 335. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 336. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY AEROSPACE & DEFENSE, 2018-2030 (USD MILLION)

- TABLE 337. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, 2018-2030 (USD MILLION)

- TABLE 338. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY BUILDING & CONSTRUCTION, 2018-2030 (USD MILLION)

- TABLE 339. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY ELECTRONICS & SEMICONDUCTORS, 2018-2030 (USD MILLION)

- TABLE 340. THAILAND UV-CURABLE ADHESIVE MARKET SIZE, BY MEDICAL DEVICES, 2018-2030 (USD

The UV-Curable Adhesive Market was valued at USD 2.02 billion in 2023 and is projected to grow to USD 2.14 billion in 2024, with a CAGR of 6.41%, reaching USD 3.13 billion by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2023] | USD 2.02 billion |

| Estimated Year [2024] | USD 2.14 billion |

| Forecast Year [2030] | USD 3.13 billion |

| CAGR (%) | 6.41% |

In recent years, the evolution of UV-curable adhesives has emerged as a pivotal technological breakthrough that is reshaping industrial practices and applications. These advanced adhesives have been harnessed to increase production speed, enhance product durability, and deliver improved performance across a range of sectors. With rapid curing times, energy efficiency, and minimal environmental emissions, these adhesives stand as attractive alternatives to traditional solvent-based formulations. The shift to UV-curable systems is also underpinned by the continuous drive for sustainable manufacturing processes and reduction in volatile organic compound emissions. As manufacturers seek innovative bonding solutions, the industry's growing emphasis on high-quality and eco-friendly adhesives is opening new opportunities for businesses of all sizes. Furthermore, the integration of digital monitoring and automation in production processes has amplified the effectiveness of UV-curable adhesives. This introductory exploration sets the stage for an in-depth look at the market's current dynamics, technological advancements, and strategic value propositions that inform stakeholders in making well-informed decisions.

Transformative Shifts in the Landscape

The landscape of UV-curable adhesives is undergoing transformative shifts that are rewriting longstanding industry standards. Advancements in chemical formulations, coupled with the integration of automation technologies, have led to the development of solutions that are not only highly efficient but are also tailored to meet the specific needs of diverse industrial applications. Emerging trends have seen the adoption of greener and more sustainable adhesive solutions that support both environmental stewardship and cost efficiency. The market is also benefiting from innovation driven by customer demands for increased speed, precision, and reliability. These dynamic changes are evident in both the way products are developed and how end-users apply adhesives in high-performance settings. Moreover, regulatory pressures and rising environmental concerns have accelerated the move towards alternatives that minimize energy consumption and hazardous emissions. Pioneering research and development in this sector are enabling manufacturers to achieve unprecedented levels of quality control and application versatility while safeguarding operational efficiency. This transformation reflects a broader industrial trend where technology and sustainability converge to create compelling value propositions, fostering an environment ripe for further innovation.

Key Segmentation Insights Driving Market Dynamics

Critical segmentation insights offer a comprehensive understanding of the market dynamics driving the growth of UV-curable adhesives. Analysis based on resin type reveals that the market is studied across diverse resin formulations including acrylic, epoxy, polyester, polyurethane, silicone, and vinyl ether resins, where the polyurethane segment is further divided into aliphatic and aromatic variants. Such detailed differentiation enables stakeholders to better grasp how each resin type meets specific performance requirements and industry standards. Furthermore, the formulation analysis distinguishes between liquid and solid types, with the liquid segment further split into high viscosity and low viscosity liquids, while the solid category comprises films & tape and pellets. Understanding these nuanced groupings provides a clear picture of the product diversity that exists to cater to different operational environments. Application-based segmentation, which covers bonding, coating, and sealing, adds another layer of insight into how the adhesives are effectively integrated into end-use scenarios. Here, bonding is further subdivided into glass, metal, and plastic bonding, coating into decorative and industrial applications, and sealing into joint, surface, and void filling. Finally, segmentation based on end-user industries-including aerospace & defense, automotive & transportation, building & construction, electronics & semiconductors, and medical devices-underscores the extensive range and adaptability of these adhesives. This multi-faceted framework aids in pinpointing market opportunities driven by region-specific and application-specific demand.

Based on Resin Type, market is studied across Acrylic Resins, Epoxy Resins, Polyester Resins, Polyurethane Resins, Silicone Resins, and Vinyl Ether Resins. The Polyurethane Resins is further studied across Aliphatic Polyurethane Resin and Aromatic Polyurethane Resin.

Based on Formulation, market is studied across Liquid and Solid. The Liquid is further studied across High Viscosity Liquid and Low Viscosity Liquid. The Solid is further studied across Films & Tape and Pellets.

Based on Application, market is studied across Bonding, Coating, and Sealing. The Bonding is further studied across Glass Bonding, Metal Bonding, and Plastic Bonding. The Coating is further studied across Decorative Coatings and Industrial Coatings. The Sealing is further studied across Joint Sealing, Surface Sealing, and Void Filling.

Based on End-User, market is studied across Aerospace & Defense, Automotive & Transportation, Building & Construction, Electronics & Semiconductors, and Medical Devices. The Aerospace & Defense is further studied across Aircraft Interiors, Helicopter Blades, and Satellite Components. The Automotive & Transportation is further studied across Electric Vehicle Batteries and Vehicle Assemblies & Components. The Building & Construction is further studied across Architectural Fixtures, Flooring Applications, and Glass Installations. The Electronics & Semiconductors is further studied across Circuit Boards, Display Panels, Microelectronics, and Sensors. The Medical Devices is further studied across Diagnostic Equipment, Drug Delivery Devices, Surgical Instruments, and Wearable Medical Devices.

Key Regional Insights Illuminating Global Opportunities

A detailed review of regional trends highlights the varied influence of geographic nuances on the adoption and integration of UV-curable adhesives. In the Americas, the market benefits from a mature industrial base that prioritizes high performance and reliability, fueling demand for innovative adhesive solutions. Meanwhile, the Europe, Middle East & Africa regions exhibit an increasing trend towards sustainable and environmentally responsible manufacturing practices that support the transition to cleaner technologies. In Asia-Pacific, rapid industrialization, combined with significant investments in technological advancements, has created a robust environment for the adoption of these adhesives in both high-precision manufacturing and large-scale production lines. The interplay of economic growth, regulatory developments, and technological innovation across these regions not only diversifies market opportunities but also ensures a steady stream of advancements that reinforce the sector's competitive edge. Collectively, these regional dynamics play a critical role in shaping market strategies and enticing both local and global stakeholders to invest in cutting-edge adhesive technologies.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Key Company Insights Shaping Market Trends

An examination of key companies reveals a competitive landscape marked by innovation, strategic investments, and relentless pursuit of superior performance. Market leaders such as 3M Company, Adhesives Research, Inc., Arkema Group, and Avery Dennison Corporation have established robust research and development frameworks aimed at optimizing adhesive performance and expanding application options across various industries. Complementing these efforts, companies like Cartell-UK Ltd, Chase Corporation, and DELO Industrie Klebstoffe GmbH & Co. KGaA have carved out significant market positions through differentiated product portfolios and strategic regional expansions. Dexerials Corporation, Dow Chemical Company, and Dymax Corporation further emphasize the industry's focus on quality and technological advancement. The competitive environment is enriched by the contributions of H.B. Fuller Company, Henkel AG & Co. KGaA, Hernon Manufacturing, Inc., and Illinois Tool Works Inc., whose innovations continue to drive market trends. Master Bond Inc., Meridian Adhesives Group, Metlok Private Limited, and Nitto Denko Corporation have also played pivotal roles in enhancing adhesive performance. Last but not least, companies such as Norland Products Inc., Novachem Corporation Ltd., Panacol-Elosol GmbH, Parker Hannifin Corporation, Parson Adhesives, Inc., Permabond LLC, SEKISUI CHEMICAL CO.,LTD., and Thorlabs, Inc. stand as testament to the market's diversity, collectively pushing the industry toward more sustainable and high-performing solutions.

The report delves into recent significant developments in the UV-Curable Adhesive Market, highlighting leading vendors and their innovative profiles. These include 3M Company, Adhesives Research, Inc., Arkema Group, Avery Dennison Corporation, Cartell-UK Ltd, Chase Corporation, DELO Industrie Klebstoffe GmbH & Co. KGaA, Dexerials Corporation, Dow Chemical Company, Dymax Corporation, H.B. Fuller Company, Henkel AG & Co. KGaA, Hernon Manufacturing, Inc., Illinois Tool Works Inc., Master Bond Inc., Meridian Adhesives Group, Metlok Private Limited, Nitto Denko Corporation, Norland Products Inc., Novachem Corporation Ltd., Panacol-Elosol GmbH, Parker Hannifin Corporation, Parson Adhesives, Inc., Permabond LLC, SEKISUI CHEMICAL CO.,LTD., and Thorlabs, Inc.. Actionable Recommendations for Industry Leaders

For industry leaders looking to maintain a competitive advantage and capitalize on evolving market trends, a set of actionable recommendations emerges from current research and analysis. First, investing in advanced formulation technologies and R&D is essential for developing next-generation adhesives that are both robust and environmentally responsible. Companies should strategically form partnerships with technology providers to integrate digital process controls, enabling real-time quality assurance and performance monitoring. Second, adapting product offerings to meet specific end-user demands across diverse sectors-from aerospace to electronics-will be a key driver of market penetration. Embracing customer-centric innovation, companies can refine their product portfolios to enhance performance in applications ranging from glass, metal, and plastic bonding, to decorative and industrial coatings. Additionally, focusing on emerging markets and strengthening regional presence can unlock new revenue streams, particularly in rapidly industrializing economies. Lastly, a clear emphasis on sustainability, including the reduction of energy consumption and harmful emissions during the curing process, should permeate corporate strategies. This holistic approach not only meets regulatory requirements but also appeals to environmentally conscious consumers, ensuring a competitive edge in the long run.

Conclusion: Future Outlook and Strategic Imperatives

In synthesizing the extensive market insights, it is evident that UV-curable adhesives are set to redefine industry practices with a combination of technological innovation and strategic foresight. The multifaceted nature of the market, driven by detailed segmentation and regional as well as company-specific insights, underscores the transformative capabilities of these adhesives in addressing modern manufacturing challenges. As trends converge around sustainability, performance optimization, and digital integration, companies are positioned to leverage these advancements to secure market share and drive operational efficiency. The future of adhesive technology will likely be characterized by further consolidation of research efforts, enhanced customization capabilities, and an unwavering commitment to cleaner and faster curing processes. In this environment of relentless innovation and dynamic market conditions, stakeholders must remain agile, continuously adapting to both macroeconomic shifts and sector-specific transformations. Ultimately, a strategic focus on quality, sustainability, and differentiated performance will be key to unlocking long-term value and achieving remarkable success in this competitive market.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Rising construction activities and infrastructural projects across globe

- 5.1.1.2. Increasing demand for consumer electronics and miniaturized medical devices

- 5.1.1.3. Surge in demand for UV-curable adhesives in rapidly expanding automotive industry for lightweight vehicle assembly

- 5.1.2. Restraints

- 5.1.2.1. High initial costs required for the setup and equipment associated with UV-curing adhesives

- 5.1.3. Opportunities

- 5.1.3.1. Introduction of eco-friendly UV curable-adhesives

- 5.1.3.2. Innovation in UV-curable adhesive to enhance properties catering to diverse applications

- 5.1.4. Challenges

- 5.1.4.1. Concerns over limitation of curing ability and substrate compatibility

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Resin Type: Epoxy resins in UV-curable adhesives enhance strength and durability across various industries

- 5.2.2. Formulation: Versatility of liquid formulations drives their prevalence in UV-curable adhesive applications

- 5.2.3. Application: High demand in bonding applications is driven by the continuous need for advanced manufacturing solutions

- 5.2.4. End-User: Ongoing advancements in electronics enhances the relevance and application of UV-curable adhesives

- 5.3. Porter's Five Forces Analysis

- 5.3.1. Threat of New Entrants

- 5.3.2. Threat of Substitutes

- 5.3.3. Bargaining Power of Customers

- 5.3.4. Bargaining Power of Suppliers

- 5.3.5. Industry Rivalry

- 5.4. PESTLE Analysis

- 5.4.1. Political

- 5.4.2. Economic

- 5.4.3. Social

- 5.4.4. Technological

- 5.4.5. Legal

- 5.4.6. Environmental

6. UV-Curable Adhesive Market, by Resin Type

- 6.1. Introduction

- 6.2. Acrylic Resins

- 6.3. Epoxy Resins

- 6.4. Polyester Resins

- 6.5. Polyurethane Resins

- 6.5.1. Aliphatic Polyurethane Resin

- 6.5.2. Aromatic Polyurethane Resin

- 6.6. Silicone Resins

- 6.7. Vinyl Ether Resins

7. UV-Curable Adhesive Market, by Formulation

- 7.1. Introduction

- 7.2. Liquid

- 7.2.1. High Viscosity Liquid

- 7.2.2. Low Viscosity Liquid

- 7.3. Solid

- 7.3.1. Films & Tape

- 7.3.2. Pellets

8. UV-Curable Adhesive Market, by Application

- 8.1. Introduction

- 8.2. Bonding

- 8.2.1. Glass Bonding

- 8.2.2. Metal Bonding

- 8.2.3. Plastic Bonding

- 8.3. Coating

- 8.3.1. Decorative Coatings

- 8.3.2. Industrial Coatings

- 8.4. Sealing

- 8.4.1. Joint Sealing

- 8.4.2. Surface Sealing

- 8.4.3. Void Filling

9. UV-Curable Adhesive Market, by End-User

- 9.1. Introduction

- 9.2. Aerospace & Defense

- 9.2.1. Aircraft Interiors

- 9.2.2. Helicopter Blades

- 9.2.3. Satellite Components

- 9.3. Automotive & Transportation

- 9.3.1. Electric Vehicle Batteries

- 9.3.2. Vehicle Assemblies & Components

- 9.4. Building & Construction

- 9.4.1. Architectural Fixtures

- 9.4.2. Flooring Applications

- 9.4.3. Glass Installations

- 9.5. Electronics & Semiconductors

- 9.5.1. Circuit Boards

- 9.5.2. Display Panels

- 9.5.3. Microelectronics

- 9.5.4. Sensors

- 9.6. Medical Devices

- 9.6.1. Diagnostic Equipment

- 9.6.2. Drug Delivery Devices

- 9.6.3. Surgical Instruments

- 9.6.4. Wearable Medical Devices

10. Americas UV-Curable Adhesive Market

- 10.1. Introduction

- 10.2. Argentina

- 10.3. Brazil

- 10.4. Canada

- 10.5. Mexico

- 10.6. United States

11. Asia-Pacific UV-Curable Adhesive Market

- 11.1. Introduction

- 11.2. Australia

- 11.3. China

- 11.4. India

- 11.5. Indonesia

- 11.6. Japan

- 11.7. Malaysia

- 11.8. Philippines

- 11.9. Singapore

- 11.10. South Korea

- 11.11. Taiwan

- 11.12. Thailand

- 11.13. Vietnam

12. Europe, Middle East & Africa UV-Curable Adhesive Market

- 12.1. Introduction

- 12.2. Denmark

- 12.3. Egypt

- 12.4. Finland

- 12.5. France

- 12.6. Germany

- 12.7. Israel

- 12.8. Italy

- 12.9. Netherlands

- 12.10. Nigeria

- 12.11. Norway

- 12.12. Poland

- 12.13. Qatar

- 12.14. Russia

- 12.15. Saudi Arabia

- 12.16. South Africa

- 12.17. Spain

- 12.18. Sweden

- 12.19. Switzerland

- 12.20. Turkey

- 12.21. United Arab Emirates

- 12.22. United Kingdom

13. Competitive Landscape

- 13.1. Market Share Analysis, 2023

- 13.2. FPNV Positioning Matrix, 2023

- 13.3. Competitive Scenario Analysis

- 13.3.1. DELO DUALBOND EG4797 sets new standards in semiconductor precision with innovative UV-curable adhesive

- 13.3.2. Nekoosa launches NextBond UV-cured adhesive

- 13.3.3. H.B. Fuller's strategic acquisition of ND Industries increase UV-curable adhesive offerings

- 13.3.4. Permabond unveils UV643 adhesive for ultra-fast UV curing

- 13.3.5. Panacol's innovative UV-curable adhesives transforming e-mobility and automotive electronics

- 13.3.6. Panacol introduces UV-curable black epoxy resin adhesives

- 13.3.7. Panacol and Honle UV Technology's innovative UV-curable adhesives

- 13.3.8. Permabond 130UV sets a new standard in dual-curing adhesive

- 13.3.9. Henkel launches innovative medical-grade UV-curable adhesives enhancing safety and efficiency in wearable devices

- 13.3.10. Strategic integration of UV-cured adhesive coating equipment by ETI

- 13.4. Strategy Analysis & Recommendation

- 13.4.1. Henkel AG & Co. KGaA

- 13.4.2. H.B. Fuller Company

- 13.4.3. Dymax Corporation

- 13.4.4. Arkema Group

Companies Mentioned

- 1. 3M Company

- 2. Adhesives Research, Inc.

- 3. Arkema Group

- 4. Avery Dennison Corporation

- 5. Cartell-UK Ltd

- 6. Chase Corporation

- 7. DELO Industrie Klebstoffe GmbH & Co. KGaA

- 8. Dexerials Corporation

- 9. Dow Chemical Company

- 10. Dymax Corporation

- 11. H.B. Fuller Company

- 12. Henkel AG & Co. KGaA

- 13. Hernon Manufacturing, Inc.

- 14. Illinois Tool Works Inc.

- 15. Master Bond Inc.

- 16. Meridian Adhesives Group

- 17. Metlok Private Limited

- 18. Nitto Denko Corporation

- 19. Norland Products Inc.

- 20. Novachem Corporation Ltd.

- 21. Panacol-Elosol GmbH

- 22. Parker Hannifin Corporation

- 23. Parson Adhesives, Inc.

- 24. Permabond LLC

- 25. SEKISUI CHEMICAL CO.,LTD.

- 26. Thorlabs, Inc.