|

市場調査レポート

商品コード

1415398

環境センサー市場:タイプ別、展開別、用途別、業界別-2024年~2030年の世界予測Environmental Sensor Market by Type (Air Quality, Humidity, Integrated), Deployment (Indoor, Outdoor, Portable), Application, Vertical - Global Forecast 2024-2030 |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

| 環境センサー市場:タイプ別、展開別、用途別、業界別-2024年~2030年の世界予測 |

|

出版日: 2024年01月15日

発行: 360iResearch

ページ情報: 英文 184 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

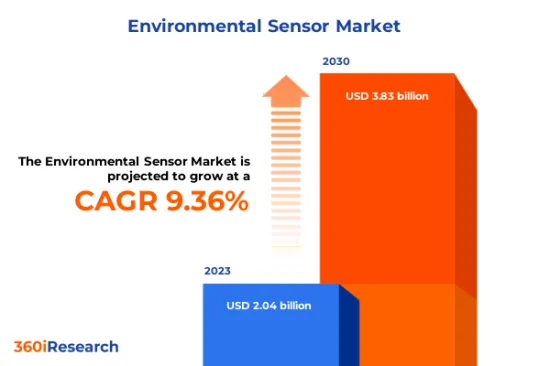

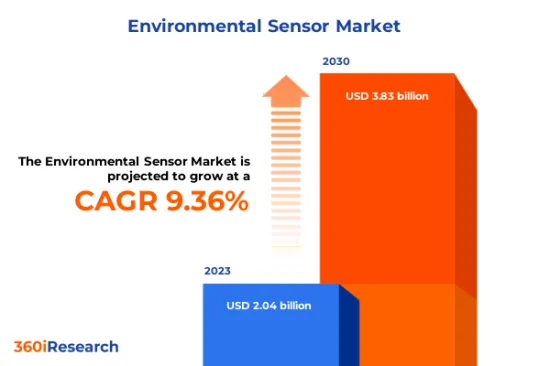

環境センサー市場規模は2023年に20億4,000万米ドルと推計され、2024年には22億3,000万米ドルに達し、CAGR 9.36%で2030年には38億3,000万米ドルに達すると予測されます。

環境センサーの世界市場

| 主な市場の統計 | |

|---|---|

| 基準年[2023] | 20億4,000万米ドル |

| 予測年[2024] | 22億3,000万米ドル |

| 予測年 [2030] | 38億3,000万米ドル |

| CAGR(%) | 9.36% |

環境センサーは、環境の特定の側面を検出・測定し、環境条件の詳細な記録を意図的に提供します。これらのセンサーは、農業、健康、安全、気候研究など様々な分野で不可欠な部品として重要です。環境センサーは、近年急速な技術革新と成長を遂げています。環境センサーの成長を見込んでいるのは、大気質モニタリングステーションの増加、消費者製品、HVAC、空気清浄機への環境センサー採用の増加です。さらに、健康と安全への懸念が環境モニタリングシステムの需要を高めており、環境センサーの利用が増加しています。対照的に、原材料の変動やセンサーアプリケーションの技術的な限界が市場の成長を阻害しています。しかし、市場のベンダーはセンサーの性能を向上させるための研究開発にますます取り組んでいます。さらに、ナノテクノロジーをベースとした環境モニタリング製品の開発などの技術的進歩により、様々な産業で広範な用途が見出されています。さらに、リアルタイムの環境大気質モニタリングにおけるリモートセンシング装置やGISのさまざまな役割は、この市場に大きな成長機会をもたらしています。

地域別洞察

南北アメリカでは、環境センサーに対する需要が顕著に増加しています。この動向は、これらの地域における急速な都市化、公害防止のニーズの高まり、気象モニタリングによって大きく後押しされています。また、環境保護意識も需要の急増に大きく寄与しています。これらの国はスマートシティプロジェクトに積極的に投資しており、効率的でリアルタイムな環境モニタリングシステムの必要性を後押ししています。さらに、EMEA(欧州・中東・アフリカ)地域は、多くの産業分野で環境センサーが広く取り入れられているため、大きな需要が見られます。欧州諸国は、厳しい環境規制と政策に後押しされ、最前線に位置しています。いくつかの国ではスマートデバイスやコネクテッドデバイスの普及が進んでおり、センサー需要を押し上げています。比較的遅れてはいますが、中東とアフリカは徐々に市場動向に同調しつつあり、主に大気質モニタリングと関連する健康への影響に焦点を当てています。さらに、アジア太平洋地域では、主に環境条件の悪化といくつかの国における自然災害のリスクにより、環境センサーの需要が急増しています。この地域では、技術進歩の先陣を切るいくつかの国が巨大市場として台頭しています。これらの国々は、技術の進歩を通じて持続可能性と環境保護に徐々に焦点を当てており、このようなセンサーの需要が急上昇しています。

FPNVポジショニング・マトリックス

FPNVポジショニングマトリックスは環境センサー市場の評価において極めて重要です。事業戦略と製品満足度に関連する主要指標を調査し、ベンダーの包括的な評価を提供します。この綿密な分析により、ユーザーは各自の要件に沿った十分な情報に基づいた意思決定を行うことができます。評価に基づき、ベンダーは成功の度合いが異なる4つの象限に分類されます:フォアフロント(F)、パスファインダー(P)、ニッチ(N)、バイタル(V)です。

市場シェア分析

市場シェア分析は、環境センサー市場におけるベンダーの現状について、洞察に満ちた詳細な調査を提供する包括的なツールです。全体的な収益、顧客基盤、その他の主要指標についてベンダーの貢献度を綿密に比較・分析することで、企業の業績や市場シェア争いの際に直面する課題について理解を深めることができます。さらに、この分析により、調査対象基準年に観察された累積、断片化の優位性、合併の特徴などの要因を含む、この分野の競合特性に関する貴重な考察が得られます。このような詳細レベルの拡大により、ベンダーはより多くの情報に基づいた意思決定を行い、市場で競争優位に立つための効果的な戦略を考案することができます。

本レポートは、以下の側面に関する貴重な洞察を提供しています:

1-市場の浸透度:主要企業が提供する市場に関する包括的な情報を提示しています。

2-市場の開拓度:有利な新興市場を深く掘り下げ、成熟市場セグメントにおける浸透度を分析しています。

3-市場の多様化:新製品の発売、未開拓の地域、最近の開発、投資に関する詳細な情報を提供します。

4-競合の評価と情報:市場シェア、戦略、製品、認証、規制状況、特許状況、主要企業の製造能力などを網羅的に評価します。

5-製品開発およびイノベーション:将来の技術、研究開発活動、画期的な製品開発に関する知的洞察を提供します。

本レポートは、以下のような主要な質問に対応しています:

1-環境センサー市場の市場規模および予測は?

2-環境センサー市場の予測期間中に投資を検討すべき製品、セグメント、用途、分野は何か?

3-環境センサー市場における技術動向と規制の枠組みは?

4-環境センサー市場における主要ベンダーの市場シェアは?

5-環境センサー市場への参入に適した形態や戦略的手段は?

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 市場力学

- 促進要因

- 健康と安全への懸念により環境監視システムの需要が急増

- 消費者製品、HVAC、空気清浄機への環境センサーの採用増加

- 大気質監視ステーションの増加

- 抑制要因

- 原材料不足による物価圧力の上昇

- 機会

- ナノテクノロジーを活用した環境モニタリング製品の開発

- リアルタイムの大気質モニタリングのためのリモートセンシングデバイスとGISの役割

- 課題

- センサーアプリケーションの技術的限界

- 促進要因

- 市場セグメンテーション分析

- タイプ:健康リスクを軽減するために空気質を監視するための空気質センサーに対する消費者の好み

- 展開:公衆衛生を保護し、天気予報を可能にするために、屋外用の環境センサーを広範囲に展開

- 用途:健康状態を改善し、健康上の問題を回避するためのスマートホームオートメーションにおける環境センサーの重要な役割

- 業界:安全な作業環境を評価および維持するための産業分野における環境センサーの範囲拡大

- 市場動向分析

- 高インフレの累積的影響

- ポーターのファイブフォース分析

- バリューチェーンとクリティカルパス分析

- 規制の枠組み

第6章 環境センサー市場:タイプ別

- 空気質

- 湿度

- 統合

- 土壌水分

- 温度

- 紫外線

- 水質

第7章 環境センサー市場:展開別

- 屋内

- 屋外

- ポータブル

第8章 環境センサー市場:用途別

- スマートシティ

- スマートホームオートメーション

- スマートオフィスオートメーション

第9章 環境センサー市場:業界別

- 商業用

- 産業用

- 住宅用

第10章 南北アメリカの環境センサー市場

- アルゼンチン

- ブラジル

- カナダ

- メキシコ

- 米国

第11章 アジア太平洋地域の環境センサー市場

- オーストラリア

- 中国

- インド

- インドネシア

- 日本

- マレーシア

- フィリピン

- シンガポール

- 韓国

- 台湾

- タイ

- ベトナム

第12章 欧州・中東・アフリカの環境センサー市場

- デンマーク

- エジプト

- フィンランド

- フランス

- ドイツ

- イスラエル

- イタリア

- オランダ

- ナイジェリア

- ノルウェー

- ポーランド

- カタール

- ロシア

- サウジアラビア

- 南アフリカ

- スペイン

- スウェーデン

- スイス

- トルコ

- アラブ首長国連邦

- 英国

第13章 競合情勢

- FPNVポジショニングマトリクス

- 市場シェア分析:主要企業別

- 競合シナリオ主要企業別の分析

- 合併・買収

- 契約、コラボレーション、パートナーシップ

- 新製品発売と機能強化

第14章 競争力のあるポートフォリオ

- 主要な企業プロファイル

- ABB Ltd.

- Aeroqual Limited

- Amphenol Corporation

- ams-OSRAM AG

- Comptus Inc.

- eLichens

- Honeywell International, Inc.

- Hunan Rika Electronic Tech Co., Ltd.

- IST AG

- KEMET Electronics Corporation

- Laird Connectivity

- METER Group, Inc.

- Murata Manufacturing Co., Ltd.

- Nissin Electric Co., Ltd.

- NuWave Sensor Technology Limited

- NXP Semiconductors N.V.

- Omron Corporation

- Renesas Electronics Corporation

- Ricoh Company, Ltd

- RioT Technology Corp.

- Robert Bosch GmbH

- Samsara Inc.

- Schneider Electric SE

- Sensirion AG

- Siemens AG

- STMicroelectronics International N.V.

- TE Connectivity Ltd.

- Texas Instruments Incorporated

- Vaisala Oyj

- Verkada Inc.

- Vertiv Group Corp.

- Zebra Technologies Corporatio

- 主要な製品ポートフォリオ

第15章 付録

- ディスカッションガイド

- ライセンスと価格について

LIST OF FIGURES

- FIGURE 1. ENVIRONMENTAL SENSOR MARKET RESEARCH PROCESS

- FIGURE 2. ENVIRONMENTAL SENSOR MARKET SIZE, 2023 VS 2030

- FIGURE 3. ENVIRONMENTAL SENSOR MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. ENVIRONMENTAL SENSOR MARKET SIZE, BY REGION, 2023 VS 2030 (%)

- FIGURE 5. ENVIRONMENTAL SENSOR MARKET SIZE, BY REGION, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 6. ENVIRONMENTAL SENSOR MARKET DYNAMICS

- FIGURE 7. ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2023 VS 2030 (%)

- FIGURE 8. ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 9. ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2023 VS 2030 (%)

- FIGURE 10. ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 11. ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2023 VS 2030 (%)

- FIGURE 12. ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 13. ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2023 VS 2030 (%)

- FIGURE 14. ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 15. AMERICAS ENVIRONMENTAL SENSOR MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 16. AMERICAS ENVIRONMENTAL SENSOR MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 17. UNITED STATES ENVIRONMENTAL SENSOR MARKET SIZE, BY STATE, 2023 VS 2030 (%)

- FIGURE 18. UNITED STATES ENVIRONMENTAL SENSOR MARKET SIZE, BY STATE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 19. ASIA-PACIFIC ENVIRONMENTAL SENSOR MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 20. ASIA-PACIFIC ENVIRONMENTAL SENSOR MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 21. EUROPE, MIDDLE EAST & AFRICA ENVIRONMENTAL SENSOR MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 22. EUROPE, MIDDLE EAST & AFRICA ENVIRONMENTAL SENSOR MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 23. ENVIRONMENTAL SENSOR MARKET, FPNV POSITIONING MATRIX, 2023

- FIGURE 24. ENVIRONMENTAL SENSOR MARKET SHARE, BY KEY PLAYER, 2023

LIST OF TABLES

- TABLE 1. ENVIRONMENTAL SENSOR MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2023

- TABLE 3. ENVIRONMENTAL SENSOR MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL ENVIRONMENTAL SENSOR MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 6. ENVIRONMENTAL SENSOR MARKET SIZE, BY AIR QUALITY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. ENVIRONMENTAL SENSOR MARKET SIZE, BY HUMIDITY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 8. ENVIRONMENTAL SENSOR MARKET SIZE, BY INTEGRATED, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. ENVIRONMENTAL SENSOR MARKET SIZE, BY SOIL MOISTURE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. ENVIRONMENTAL SENSOR MARKET SIZE, BY TEMPERATURE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. ENVIRONMENTAL SENSOR MARKET SIZE, BY ULTRAVIOLET, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. ENVIRONMENTAL SENSOR MARKET SIZE, BY WATER QUALITY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 14. ENVIRONMENTAL SENSOR MARKET SIZE, BY INDOOR, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. ENVIRONMENTAL SENSOR MARKET SIZE, BY OUTDOOR, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. ENVIRONMENTAL SENSOR MARKET SIZE, BY PORTABLE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 18. ENVIRONMENTAL SENSOR MARKET SIZE, BY SMART CITY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 19. ENVIRONMENTAL SENSOR MARKET SIZE, BY SMART HOME AUTOMATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. ENVIRONMENTAL SENSOR MARKET SIZE, BY SMART OFFICE AUTOMATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 22. ENVIRONMENTAL SENSOR MARKET SIZE, BY COMMERCIAL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. ENVIRONMENTAL SENSOR MARKET SIZE, BY INDUSTRIAL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 24. ENVIRONMENTAL SENSOR MARKET SIZE, BY RESIDENTIAL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 25. AMERICAS ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 26. AMERICAS ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 27. AMERICAS ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 28. AMERICAS ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 29. AMERICAS ENVIRONMENTAL SENSOR MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 30. ARGENTINA ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 31. ARGENTINA ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 32. ARGENTINA ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 33. ARGENTINA ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 34. BRAZIL ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 35. BRAZIL ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 36. BRAZIL ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 37. BRAZIL ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 38. CANADA ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 39. CANADA ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 40. CANADA ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 41. CANADA ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 42. MEXICO ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 43. MEXICO ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 44. MEXICO ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 45. MEXICO ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 46. UNITED STATES ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 47. UNITED STATES ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 48. UNITED STATES ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 49. UNITED STATES ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 50. UNITED STATES ENVIRONMENTAL SENSOR MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 51. ASIA-PACIFIC ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 52. ASIA-PACIFIC ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 53. ASIA-PACIFIC ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 54. ASIA-PACIFIC ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 55. ASIA-PACIFIC ENVIRONMENTAL SENSOR MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 56. AUSTRALIA ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 57. AUSTRALIA ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 58. AUSTRALIA ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 59. AUSTRALIA ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 60. CHINA ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 61. CHINA ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 62. CHINA ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 63. CHINA ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 64. INDIA ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 65. INDIA ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 66. INDIA ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 67. INDIA ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 68. INDONESIA ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 69. INDONESIA ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 70. INDONESIA ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 71. INDONESIA ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 72. JAPAN ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 73. JAPAN ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 74. JAPAN ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 75. JAPAN ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 76. MALAYSIA ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 77. MALAYSIA ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 78. MALAYSIA ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 79. MALAYSIA ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 80. PHILIPPINES ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 81. PHILIPPINES ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 82. PHILIPPINES ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 83. PHILIPPINES ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 84. SINGAPORE ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 85. SINGAPORE ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 86. SINGAPORE ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 87. SINGAPORE ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 88. SOUTH KOREA ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 89. SOUTH KOREA ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 90. SOUTH KOREA ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 91. SOUTH KOREA ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 92. TAIWAN ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 93. TAIWAN ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 94. TAIWAN ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 95. TAIWAN ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 96. THAILAND ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 97. THAILAND ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 98. THAILAND ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 99. THAILAND ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 100. VIETNAM ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 101. VIETNAM ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 102. VIETNAM ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 103. VIETNAM ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 104. EUROPE, MIDDLE EAST & AFRICA ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 105. EUROPE, MIDDLE EAST & AFRICA ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 106. EUROPE, MIDDLE EAST & AFRICA ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 107. EUROPE, MIDDLE EAST & AFRICA ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 108. EUROPE, MIDDLE EAST & AFRICA ENVIRONMENTAL SENSOR MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 109. DENMARK ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 110. DENMARK ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 111. DENMARK ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 112. DENMARK ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 113. EGYPT ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 114. EGYPT ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 115. EGYPT ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 116. EGYPT ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 117. FINLAND ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 118. FINLAND ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 119. FINLAND ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 120. FINLAND ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 121. FRANCE ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 122. FRANCE ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 123. FRANCE ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 124. FRANCE ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 125. GERMANY ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 126. GERMANY ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 127. GERMANY ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 128. GERMANY ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 129. ISRAEL ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 130. ISRAEL ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 131. ISRAEL ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 132. ISRAEL ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 133. ITALY ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 134. ITALY ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 135. ITALY ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 136. ITALY ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 137. NETHERLANDS ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 138. NETHERLANDS ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 139. NETHERLANDS ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 140. NETHERLANDS ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 141. NIGERIA ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 142. NIGERIA ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 143. NIGERIA ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 144. NIGERIA ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 145. NORWAY ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 146. NORWAY ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 147. NORWAY ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 148. NORWAY ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 149. POLAND ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 150. POLAND ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 151. POLAND ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 152. POLAND ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 153. QATAR ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 154. QATAR ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 155. QATAR ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 156. QATAR ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 157. RUSSIA ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 158. RUSSIA ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 159. RUSSIA ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 160. RUSSIA ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 161. SAUDI ARABIA ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 162. SAUDI ARABIA ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 163. SAUDI ARABIA ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 164. SAUDI ARABIA ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 165. SOUTH AFRICA ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 166. SOUTH AFRICA ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 167. SOUTH AFRICA ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 168. SOUTH AFRICA ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 169. SPAIN ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 170. SPAIN ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 171. SPAIN ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 172. SPAIN ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 173. SWEDEN ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 174. SWEDEN ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 175. SWEDEN ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 176. SWEDEN ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 177. SWITZERLAND ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 178. SWITZERLAND ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 179. SWITZERLAND ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 180. SWITZERLAND ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 181. TURKEY ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 182. TURKEY ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 183. TURKEY ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 184. TURKEY ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 185. UNITED ARAB EMIRATES ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 186. UNITED ARAB EMIRATES ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 187. UNITED ARAB EMIRATES ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 188. UNITED ARAB EMIRATES ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 189. UNITED KINGDOM ENVIRONMENTAL SENSOR MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 190. UNITED KINGDOM ENVIRONMENTAL SENSOR MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 191. UNITED KINGDOM ENVIRONMENTAL SENSOR MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 192. UNITED KINGDOM ENVIRONMENTAL SENSOR MARKET SIZE, BY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 193. ENVIRONMENTAL SENSOR MARKET, FPNV POSITIONING MATRIX, 2023

- TABLE 194. ENVIRONMENTAL SENSOR MARKET SHARE, BY KEY PLAYER, 2023

- TABLE 195. ENVIRONMENTAL SENSOR MARKET LICENSE & PRICING

[184 Pages Report] The Environmental Sensor Market size was estimated at USD 2.04 billion in 2023 and expected to reach USD 2.23 billion in 2024, at a CAGR 9.36% to reach USD 3.83 billion by 2030.

Global Environmental Sensor Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2023] | USD 2.04 billion |

| Estimated Year [2024] | USD 2.23 billion |

| Forecast Year [2030] | USD 3.83 billion |

| CAGR (%) | 9.36% |

An environmental sensor detects and measures a specific aspect of the environment, intentionally providing a detailed record of environmental conditions. These sensors are crucial for integral parts in fields diverse as agriculture, health and safety, and climate studies. The environmental sensor has undergone rapid innovation and growth in recent years. An increase in air quality monitoring stations and increasing adoption of environmental sensors for consumer products, HVAC, and air purifiers is anticipating the growth of environmental sensors. Furthermore, health and safety concerns are upsurging demand for environmental monitoring systems, which leads to the increasing utilization of environmental sensors. In contrast, fluctuating raw materials and technical limitations of sensor applications are penetrating the market growth. However, market vendors are increasingly working on research and development to improve sensor performance. Moreover, technological advancements such as the development of nanotechnology-based environmental monitoring products have found extensive applications across various industries. In addition, the various roles of remote sensing devices and GIS for real-time ambient air quality monitoring present substantial growth opportunities for this market.

Regional Insights

In the Americas, there's a remarkable increase in demand for environmental sensors. The trend is highly driven by rapid urbanization, an escalating need for pollution control, and weather monitoring in these regions. Environmental conservation awareness has also contributed significantly to the surge in demand. These nations aggressively invest in smart city projects, thus fuelling the need for efficient and real-time environmental monitoring systems. Furthermore, the EMEA region is witnessing a significant demand due to the wide-scale incorporation of environmental sensors in numerous industrial sectors. European nations are at the forefront, spurred by stringent environmental regulations and policies. Several countries are demonstrating a high propensity for smart and connected devices, pushing the demand for sensors. Although relatively slower, the Middle East and Africa are gradually tuning into market trends, focusing primarily on air-quality monitoring and related health implications. Moreover, in the Asia-Pacific region, the demand for environmental sensors is skyrocketing, primarily due to deterioration in environmental conditions and the risk of natural disasters in several countries. Several countries spearheading technological advancement have emerged as massive markets in the region. These countries are progressively focusing on sustainability and environmental protection through technological advancements and are witnessing a steep rise in the demand for such sensors.

FPNV Positioning Matrix

The FPNV Positioning Matrix is pivotal in evaluating the Environmental Sensor Market. It offers a comprehensive assessment of vendors, examining key metrics related to Business Strategy and Product Satisfaction. This in-depth analysis empowers users to make well-informed decisions aligned with their requirements. Based on the evaluation, the vendors are then categorized into four distinct quadrants representing varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V).

Market Share Analysis

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the Environmental Sensor Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the Environmental Sensor Market, highlighting leading vendors and their innovative profiles. These include ABB Ltd., Aeroqual Limited, Amphenol Corporation, ams-OSRAM AG, Comptus Inc., eLichens, Honeywell International, Inc., Hunan Rika Electronic Tech Co., Ltd., IST AG, KEMET Electronics Corporation, Laird Connectivity, METER Group, Inc., Murata Manufacturing Co., Ltd., Nissin Electric Co., Ltd., NuWave Sensor Technology Limited, NXP Semiconductors N.V., Omron Corporation, Renesas Electronics Corporation, Ricoh Company, Ltd, RioT Technology Corp., Robert Bosch GmbH, Samsara Inc., Schneider Electric SE, Sensirion AG, Siemens AG, STMicroelectronics International N.V., TE Connectivity Ltd., Texas Instruments Incorporated, Vaisala Oyj, Verkada Inc., Vertiv Group Corp., and Zebra Technologies Corporatio.

Market Segmentation & Coverage

This research report categorizes the Environmental Sensor Market to forecast the revenues and analyze trends in each of the following sub-markets:

- Type

- Air Quality

- Humidity

- Integrated

- Soil Moisture

- Temperature

- Ultraviolet

- Water Quality

- Deployment

- Indoor

- Outdoor

- Portable

- Application

- Smart City

- Smart Home Automation

- Smart Office Automation

- Vertical

- Commercial

- Industrial

- Residential

- Region

- Americas

- Argentina

- Brazil

- Canada

- Mexico

- United States

- California

- Florida

- Illinois

- New York

- Ohio

- Pennsylvania

- Texas

- Asia-Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Vietnam

- Europe, Middle East & Africa

- Denmark

- Egypt

- Finland

- France

- Germany

- Israel

- Italy

- Netherlands

- Nigeria

- Norway

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

- United Arab Emirates

- United Kingdom

- Americas

The report offers valuable insights on the following aspects:

1. Market Penetration: It presents comprehensive information on the market provided by key players.

2. Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

3. Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

4. Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

5. Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast of the Environmental Sensor Market?

2. Which products, segments, applications, and areas should one consider investing in over the forecast period in the Environmental Sensor Market?

3. What are the technology trends and regulatory frameworks in the Environmental Sensor Market?

4. What is the market share of the leading vendors in the Environmental Sensor Market?

5. Which modes and strategic moves are suitable for entering the Environmental Sensor Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Environmental Sensor Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Health and safety concerns upsurging demand for environmental monitoring systems

- 5.1.1.2. Increasing adoption of environmental sensors for consumer products, HVAC, and air purifiers

- 5.1.1.3. Increase in air quality monitoring stations

- 5.1.2. Restraints

- 5.1.2.1. Rising pricing pressure due to shortage of raw materials

- 5.1.3. Opportunities

- 5.1.3.1. Development of nanotechnology-based environmental monitoring products

- 5.1.3.2. Roles of remote sensing devices and GIS for real-time ambient air quality monitoring

- 5.1.4. Challenges

- 5.1.4.1. Technological limitations of sensor applications

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Type: Consumer preference for air quality sensor for monitoring air quality to mitigate health risks

- 5.2.2. Deployment: Extensive deployment of environmental sensors for the outdoors to protect public health and enable weather forecasting

- 5.2.3. Application: Significant role of environmental sensors for smart home automation to improve wellness, potentially avoiding health issues

- 5.2.4. Vertical: Wider scope of environmental sensors in industrial sector to evaluate and maintain a safe working environment

- 5.3. Market Trend Analysis

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Environmental Sensor Market, by Type

- 6.1. Introduction

- 6.2. Air Quality

- 6.3. Humidity

- 6.4. Integrated

- 6.5. Soil Moisture

- 6.6. Temperature

- 6.7. Ultraviolet

- 6.8. Water Quality

7. Environmental Sensor Market, by Deployment

- 7.1. Introduction

- 7.2. Indoor

- 7.3. Outdoor

- 7.4. Portable

8. Environmental Sensor Market, by Application

- 8.1. Introduction

- 8.2. Smart City

- 8.3. Smart Home Automation

- 8.4. Smart Office Automation

9. Environmental Sensor Market, by Vertical

- 9.1. Introduction

- 9.2. Commercial

- 9.3. Industrial

- 9.4. Residential

10. Americas Environmental Sensor Market

- 10.1. Introduction

- 10.2. Argentina

- 10.3. Brazil

- 10.4. Canada

- 10.5. Mexico

- 10.6. United States

11. Asia-Pacific Environmental Sensor Market

- 11.1. Introduction

- 11.2. Australia

- 11.3. China

- 11.4. India

- 11.5. Indonesia

- 11.6. Japan

- 11.7. Malaysia

- 11.8. Philippines

- 11.9. Singapore

- 11.10. South Korea

- 11.11. Taiwan

- 11.12. Thailand

- 11.13. Vietnam

12. Europe, Middle East & Africa Environmental Sensor Market

- 12.1. Introduction

- 12.2. Denmark

- 12.3. Egypt

- 12.4. Finland

- 12.5. France

- 12.6. Germany

- 12.7. Israel

- 12.8. Italy

- 12.9. Netherlands

- 12.10. Nigeria

- 12.11. Norway

- 12.12. Poland

- 12.13. Qatar

- 12.14. Russia

- 12.15. Saudi Arabia

- 12.16. South Africa

- 12.17. Spain

- 12.18. Sweden

- 12.19. Switzerland

- 12.20. Turkey

- 12.21. United Arab Emirates

- 12.22. United Kingdom

13. Competitive Landscape

- 13.1. FPNV Positioning Matrix

- 13.2. Market Share Analysis, By Key Player

- 13.3. Competitive Scenario Analysis, By Key Player

- 13.3.1. Merger & Acquisition

- 13.3.1.1. SIGAS and smartGAS Enter into a Strategic Merger

- 13.3.2. Agreement, Collaboration, & Partnership

- 13.3.2.1. Sensirion and AirTeq Collaborate for the Launch of the Indoor Air Quality Monitor AirCheq Pro

- 13.3.3. New Product Launch & Enhancement

- 13.3.3.1. Zebra Launches New Environmental Sensors

- 13.3.1. Merger & Acquisition

14. Competitive Portfolio

- 14.1. Key Company Profiles

- 14.1.1. ABB Ltd.

- 14.1.2. Aeroqual Limited

- 14.1.3. Amphenol Corporation

- 14.1.4. ams-OSRAM AG

- 14.1.5. Comptus Inc.

- 14.1.6. eLichens

- 14.1.7. Honeywell International, Inc.

- 14.1.8. Hunan Rika Electronic Tech Co., Ltd.

- 14.1.9. IST AG

- 14.1.10. KEMET Electronics Corporation

- 14.1.11. Laird Connectivity

- 14.1.12. METER Group, Inc.

- 14.1.13. Murata Manufacturing Co., Ltd.

- 14.1.14. Nissin Electric Co., Ltd.

- 14.1.15. NuWave Sensor Technology Limited

- 14.1.16. NXP Semiconductors N.V.

- 14.1.17. Omron Corporation

- 14.1.18. Renesas Electronics Corporation

- 14.1.19. Ricoh Company, Ltd

- 14.1.20. RioT Technology Corp.

- 14.1.21. Robert Bosch GmbH

- 14.1.22. Samsara Inc.

- 14.1.23. Schneider Electric SE

- 14.1.24. Sensirion AG

- 14.1.25. Siemens AG

- 14.1.26. STMicroelectronics International N.V.

- 14.1.27. TE Connectivity Ltd.

- 14.1.28. Texas Instruments Incorporated

- 14.1.29. Vaisala Oyj

- 14.1.30. Verkada Inc.

- 14.1.31. Vertiv Group Corp.

- 14.1.32. Zebra Technologies Corporatio

- 14.2. Key Product Portfolio

15. Appendix

- 15.1. Discussion Guide

- 15.2. License & Pricing