|

市場調査レポート

商品コード

1415033

産業用ユーティリティ通信市場:コンポーネント、技術タイプ、最終用途別-2024-2030年の世界予測Industrial Utility Communication Market by Component (Hardware, Software), Technology Type (Wired, Wireless), End-use - Global Forecast 2024-2030 |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

| 産業用ユーティリティ通信市場:コンポーネント、技術タイプ、最終用途別-2024-2030年の世界予測 |

|

出版日: 2024年01月16日

発行: 360iResearch

ページ情報: 英文 183 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

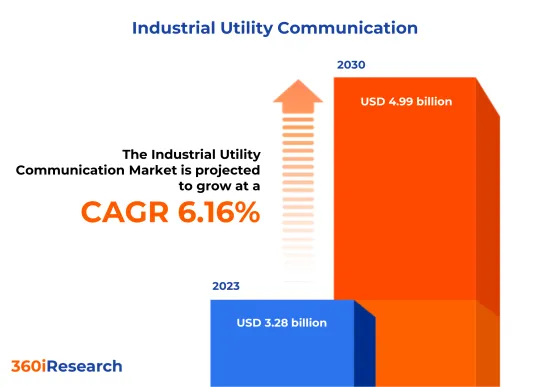

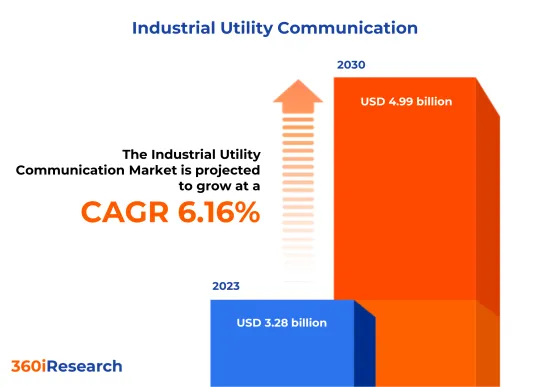

産業用ユーティリティ通信市場規模は2023年に32億8,000万米ドルと推計され、2024年には34億7,000万米ドルに達し、CAGR 6.16%で2030年には49億9,000万米ドルに達すると予測されます。

産業用ユーティリティ通信の世界市場

| 主な市場の統計 | |

|---|---|

| 基準年[2023] | 32億8,000万米ドル |

| 予測年[2024] | 34億7,000万米ドル |

| 予測年 [2030] | 49億9,000万米ドル |

| CAGR(%) | 6.16% |

産業用ユーティリティ通信とは、産業環境、特に電気、水、天然ガス、廃水などのユーティリティサービスを管理するために、情報を伝達するために使用されるシステムと方法を指します。この包括的な用語には、ユーティリティ・インフラ内のさまざまなデバイスや制御システム間の効率的で信頼性の高い通信を可能にするハードウェア、ソフトウェア、プロトコル、プロセスが含まれます。このような通信の主な目的は、ユーティリティ・グリッドの異なるセグメント間でのリアルタイムのデータ交換と調整を通じて、ユーティリティ・ネットワークの効果的な運用、監視、保守を保証することです。通信フレームワークには通常、無線周波数(RF)、光ファイバー、イーサネット、携帯電話接続などの有線・無線技術が含まれます。エンドユーザーには、発電所、下水処理施設、天然ガス・プロバイダー、その他の大規模な産業用ユーティリティ事業者が含まれ、効率的な運用のために堅牢で信頼性の高い通信を必要とします。産業用ユーティリティ通信市場の成長は、自動化やワイヤレス通信のニーズの高まり、スマートグリッド技術の採用を促進する政府の規制やイニシアチブ、クラウドベースの公益事業通信ソリューションに対する需要の高まり、接続性とデータ伝送速度を向上させる5Gなどのワイヤレス通信技術の進歩といった要因に影響されています。しかし、産業用ユーティリティ通信の利用拡大は、産業用ユーティリティ通信を実装するための高額な初期投資、セキュリティやサイバーセキュリティの脅威に関連する懸念、標準化に影響を及ぼす各地域の複雑な規制環境などが障害となっています。一方、スマートシティプロジェクトへの政府投資の増加、再生可能エネルギー源のグリッドへの統合、重要な通信インフラをサイバー脅威から保護するためのセキュリティソリューションの強化、予知保全とエネルギー最適化のためのリアルタイム分析を提供する統合プラットフォームの開発は、今後数年間の産業用ユーティリティ通信市場に潜在的な機会をもたらします。

地域別インサイト

北米の産業用ユーティリティ通信市場は成熟しており、高度な通信技術を特徴としています。スマートグリッドプロジェクト、サイバーセキュリティ、信頼性を重視する同地域の電力会社は、無線通信や光ファイバー通信システムの採用を進めています。カナダの消費者ニーズは、分散型エネルギー資源の統合と、より強靭なグリッドの開発を重視しています。カナダの電力会社は、通信機能を強化した高度計測インフラ(AMI)やグリッド・オートメーションへの投資を進めています。南米市場は、主にエネルギー・インフラの拡大と従来のユーティリティ・ネットワークのアップグレードの影響を受けて成長しています。ブラジルやアルゼンチンなどの国々は、堅牢な通信チャネルを必要とするスマートグリッド技術に投資しています。欧州連合(EU)による低炭素経済の推進は、再生可能エネルギーの統合とスマート・グリッド・ソリューションをサポートする通信技術の革新を促進しました。グリッドの管理と運用効率を高めるために、モノのインターネット(IoT)やマシンツーマシン(M2M)技術の採用が大きく推進されています。中東・アフリカでは、インフラ整備と公益事業の近代化の必要性から市場が成長しています。サウジアラビアのNEOMのようなスマートシティへの投資の増加や、アフリカのエネルギーに関するニューディール(NDEA)のようなイニシアティブが、分散型送電網を管理するユーティリティ通信システムの採用を後押ししています。APAC地域は、特に中国、日本、インドなどの国々で、大規模な都市化、工業化、スマートシティプロジェクトの急増により、市場開拓が急速に進んでいます。中国市場はスマートグリッド技術の研究開発の最前線にあり、政府のイニシアティブと投資に大きく支えられています。農村部の電化推進は、インド政府のスマートシティ構想と相まって、効率的なユーティリティ通信システムの需要を押し上げています。また、インドではスマートメータリング・プロジェクトが急増しており、市場の成長をさらに促進しています。

FPNVポジショニング・マトリックス

FPNVポジショニングマトリックスは産業用ユーティリティ通信市場の評価において極めて重要です。事業戦略と製品満足度に関連する主要指標を調査し、ベンダーの包括的な評価を提供します。この綿密な分析により、ユーザーは各自の要件に沿った十分な情報に基づいた意思決定を行うことができます。評価に基づき、ベンダーは成功の度合いが異なる4つの象限に分類されます:フォアフロント(F)、パスファインダー(P)、ニッチ(N)、バイタル(V)です。

市場シェア分析

市場シェア分析は、産業用ユーティリティ通信市場におけるベンダーの現状について、洞察に満ちた詳細な調査を提供する包括的なツールです。全体的な収益、顧客基盤、その他の主要指標についてベンダーの貢献度を綿密に比較・分析することで、企業の業績や市場シェア争いの際に直面する課題について理解を深めることができます。さらに、この分析により、調査対象基準年に観察された累積、断片化の優位性、合併の特徴などの要因を含む、この分野の競合特性に関する貴重な考察が得られます。このような詳細レベルの拡大により、ベンダーはより多くの情報に基づいた意思決定を行い、市場で競争優位に立つための効果的な戦略を考案することができます。

本レポートは、以下の側面に関する貴重な洞察を提供しています:

1-市場の浸透度:主要企業が提供する市場に関する包括的な情報を提示しています。

2-市場の開拓度:有利な新興市場を深く掘り下げ、成熟市場セグメントにおける浸透度を分析しています。

3-市場の多様化:新製品の発売、未開拓の地域、最近の開発、投資に関する詳細な情報を提供します。

4-競合の評価と情報:市場シェア、戦略、製品、認証、規制状況、特許状況、主要企業の製造能力などを網羅的に評価します。

5-製品開発およびイノベーション:将来の技術、研究開発活動、画期的な製品開発に関する知的洞察を提供します。

本レポートは、以下のような主要な質問に対応しています:

1-産業用ユーティリティ通信市場の市場規模および予測は?

2-産業用ユーティリティ通信市場の予測期間中に投資を検討すべき製品、セグメント、用途、分野は何か?

3-産業用ユーティリティ通信市場における技術動向と規制の枠組みは?

4-産業用ユーティリティ通信市場における主要ベンダーの市場シェアは?

5-産業用ユーティリティ通信市場への参入に適した形態や戦略的手段は?

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 市場力学

- 促進要因

- 自動化と無線通信のニーズの高まり

- スマートグリッド技術の導入を促進する政府の規制と取り組み

- クラウドベースのユーティリティ通信ソリューションに対する需要の高まり

- 抑制要因

- 産業用ユーティリティ通信の実装に多額の初期投資が必要

- 機会

- スマートシティプロジェクトへの政府投資の増加

- 再生可能エネルギー源と送電網の統合

- 課題

- セキュリティとサイバーセキュリティの脅威に関連する懸念

- 促進要因

- 市場セグメンテーション分析

- コンポーネント:産業用ユーティリティ通信ソリューションでのソフトウェアの使用量の増加

- テクノロジーの種類:柔軟性が高いため、公共事業におけるワイヤレス通信の優先度が高まっています

- 最終用途:電力会社間での産業用ユーティリティ通信の利用拡大

- 市場動向分析

- 高インフレの累積的影響

- ポーターのファイブフォース分析

- バリューチェーンとクリティカルパス分析

- 規制の枠組み

第6章 産業用ユーティリティ通信市場:コンポーネント別

- ハードウェア

- ソフトウェア

第7章 産業用ユーティリティ通信市場テクノロジータイプ別

- 有線

- 無線

第8章 産業用ユーティリティ通信市場:最終用途別

- 電力会社

- 石油ガス

第9章 南北アメリカの産業用ユーティリティ通信市場

- アルゼンチン

- ブラジル

- カナダ

- メキシコ

- 米国

第10章 アジア太平洋地域の産業用ユーティリティ通信市場

- オーストラリア

- 中国

- インド

- インドネシア

- 日本

- マレーシア

- フィリピン

- シンガポール

- 韓国

- 台湾

- タイ

- ベトナム

第11章 欧州・中東・アフリカの産業用ユーティリティ通信市場

- デンマーク

- エジプト

- フィンランド

- フランス

- ドイツ

- イスラエル

- イタリア

- オランダ

- ナイジェリア

- ノルウェー

- ポーランド

- カタール

- ロシア

- サウジアラビア

- 南アフリカ

- スペイン

- スウェーデン

- スイス

- トルコ

- アラブ首長国連邦

- 英国

第12章 競合情勢

- FPNVポジショニングマトリクス

- 市場シェア分析:主要企業別

- 競合シナリオ主要企業別の分析

- 合併・買収

- 新製品発売と機能強化

第13章 競争力のあるポートフォリオ

- 主要な企業プロファイル

- 4RF Limited

- Black & Veatch Corporation

- Cambium Networks, Ltd.

- Cisco Systems, Inc.

- Digi International Inc.

- Eaton Corporation PLC

- Fujitsu Limited

- General Electric Company

- Hitachi Energy Ltd.

- Honeywell International Inc.

- Itron, Inc.

- Landis+Gyr AG

- Milsoft Utility Solutions

- MiMOMax Wireless by Ubiik Inc.

- Motorola Solutions, Inc. by Zebra Technologies Corporation

- Nokia Corporation

- RAD Data Communications Ltd.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Sierra Wireless by Semtech Corporation

- Telefonaktiebolaget LM Ericsson

- Trilliant Holdings Inc.

- Valiant Communications

- ZTE Corporation

- 主要な製品ポートフォリオ

第14章 付録

- ディスカッションガイド

- ライセンスと価格について

LIST OF FIGURES

- FIGURE 1. INDUSTRIAL UTILITY COMMUNICATION MARKET RESEARCH PROCESS

- FIGURE 2. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, 2023 VS 2030

- FIGURE 3. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY REGION, 2023 VS 2030 (%)

- FIGURE 5. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY REGION, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 6. INDUSTRIAL UTILITY COMMUNICATION MARKET DYNAMICS

- FIGURE 7. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2023 VS 2030 (%)

- FIGURE 8. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 9. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2023 VS 2030 (%)

- FIGURE 10. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 11. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2023 VS 2030 (%)

- FIGURE 12. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 13. AMERICAS INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 14. AMERICAS INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 15. UNITED STATES INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY STATE, 2023 VS 2030 (%)

- FIGURE 16. UNITED STATES INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY STATE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 17. ASIA-PACIFIC INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 18. ASIA-PACIFIC INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 19. EUROPE, MIDDLE EAST & AFRICA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 20. EUROPE, MIDDLE EAST & AFRICA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 21. INDUSTRIAL UTILITY COMMUNICATION MARKET, FPNV POSITIONING MATRIX, 2023

- FIGURE 22. INDUSTRIAL UTILITY COMMUNICATION MARKET SHARE, BY KEY PLAYER, 2023

LIST OF TABLES

- TABLE 1. INDUSTRIAL UTILITY COMMUNICATION MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2023

- TABLE 3. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 6. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY HARDWARE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY SOFTWARE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 8. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 9. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY WIRED, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY WIRELESS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 12. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY ELECTRIC POWER UTILITIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY OIL & GAS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. AMERICAS INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 15. AMERICAS INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 16. AMERICAS INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 17. AMERICAS INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 18. ARGENTINA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 19. ARGENTINA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 20. ARGENTINA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 21. BRAZIL INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 22. BRAZIL INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 23. BRAZIL INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 24. CANADA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 25. CANADA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 26. CANADA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 27. MEXICO INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 28. MEXICO INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 29. MEXICO INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 30. UNITED STATES INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 31. UNITED STATES INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 32. UNITED STATES INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 33. UNITED STATES INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 34. ASIA-PACIFIC INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 35. ASIA-PACIFIC INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 36. ASIA-PACIFIC INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 37. ASIA-PACIFIC INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 38. AUSTRALIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 39. AUSTRALIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 40. AUSTRALIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 41. CHINA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 42. CHINA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 43. CHINA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 44. INDIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 45. INDIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 46. INDIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 47. INDONESIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 48. INDONESIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 49. INDONESIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 50. JAPAN INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 51. JAPAN INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 52. JAPAN INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 53. MALAYSIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 54. MALAYSIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 55. MALAYSIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 56. PHILIPPINES INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 57. PHILIPPINES INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 58. PHILIPPINES INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 59. SINGAPORE INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 60. SINGAPORE INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 61. SINGAPORE INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 62. SOUTH KOREA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 63. SOUTH KOREA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 64. SOUTH KOREA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 65. TAIWAN INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 66. TAIWAN INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 67. TAIWAN INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 68. THAILAND INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 69. THAILAND INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 70. THAILAND INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 71. VIETNAM INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 72. VIETNAM INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 73. VIETNAM INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 74. EUROPE, MIDDLE EAST & AFRICA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 75. EUROPE, MIDDLE EAST & AFRICA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 76. EUROPE, MIDDLE EAST & AFRICA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 77. EUROPE, MIDDLE EAST & AFRICA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 78. DENMARK INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 79. DENMARK INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 80. DENMARK INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 81. EGYPT INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 82. EGYPT INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 83. EGYPT INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 84. FINLAND INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 85. FINLAND INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 86. FINLAND INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 87. FRANCE INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 88. FRANCE INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 89. FRANCE INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 90. GERMANY INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 91. GERMANY INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 92. GERMANY INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 93. ISRAEL INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 94. ISRAEL INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 95. ISRAEL INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 96. ITALY INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 97. ITALY INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 98. ITALY INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 99. NETHERLANDS INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 100. NETHERLANDS INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 101. NETHERLANDS INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 102. NIGERIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 103. NIGERIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 104. NIGERIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 105. NORWAY INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 106. NORWAY INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 107. NORWAY INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 108. POLAND INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 109. POLAND INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 110. POLAND INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 111. QATAR INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 112. QATAR INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 113. QATAR INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 114. RUSSIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 115. RUSSIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 116. RUSSIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 117. SAUDI ARABIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 118. SAUDI ARABIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 119. SAUDI ARABIA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 120. SOUTH AFRICA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 121. SOUTH AFRICA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 122. SOUTH AFRICA INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 123. SPAIN INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 124. SPAIN INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 125. SPAIN INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 126. SWEDEN INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 127. SWEDEN INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 128. SWEDEN INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 129. SWITZERLAND INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 130. SWITZERLAND INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 131. SWITZERLAND INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 132. TURKEY INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 133. TURKEY INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 134. TURKEY INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 135. UNITED ARAB EMIRATES INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 136. UNITED ARAB EMIRATES INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 137. UNITED ARAB EMIRATES INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 138. UNITED KINGDOM INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 139. UNITED KINGDOM INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 140. UNITED KINGDOM INDUSTRIAL UTILITY COMMUNICATION MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 141. INDUSTRIAL UTILITY COMMUNICATION MARKET, FPNV POSITIONING MATRIX, 2023

- TABLE 142. INDUSTRIAL UTILITY COMMUNICATION MARKET SHARE, BY KEY PLAYER, 2023

- TABLE 143. INDUSTRIAL UTILITY COMMUNICATION MARKET LICENSE & PRICING

[183 Pages Report] The Industrial Utility Communication Market size was estimated at USD 3.28 billion in 2023 and expected to reach USD 3.47 billion in 2024, at a CAGR 6.16% to reach USD 4.99 billion by 2030.

Global Industrial Utility Communication Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2023] | USD 3.28 billion |

| Estimated Year [2024] | USD 3.47 billion |

| Forecast Year [2030] | USD 4.99 billion |

| CAGR (%) | 6.16% |

Industrial utility communication refers to the systems and methods used to convey information within industrial environments, specifically for managing utility services such as electricity, water, natural gas, and wastewater. This encompassing term includes the hardware, software, protocols, and processes that enable efficient and reliable communication between various devices and control systems within the utility infrastructure. The key purpose of such communications is to ensure the effective operation, monitoring, and maintenance of utility networks through real-time data exchange and coordination across different segments of the utility grid. The communication framework typically involves wired and wireless technologies, including radio frequency (RF), fiber optics, Ethernet, and cellular connections. End-users include power generation plants, wastewater treatment facilities, natural gas providers, and other large-scale industrial utility operators that require robust and reliable communication for efficient operations. The industrial utility communication market's growth is influenced by factors such as the increasing need for automation and wireless communication, government regulations and initiatives promoting the adoption of smart grid technologies, rising demand for cloud-based utility communication solutions, and advancements in wireless communication technology, such as 5G, enhancing connectivity and data transmission rates. However, the expanding utilization of industrial utility communication is hindered by high initial investment for implementing industrial utility communication, concerns associated with security and cybersecurity threats, and complex regulatory environments across different regions affecting standardization. On the other hand, increasing government investment in smart city projects, integration of renewable energy sources with grid, enhanced security solutions tailored to protect critical communication infrastructure from cyber threats, and development of integrated platforms offering real-time analytics for predictive maintenance and energy optimization presents potential opportunities for the industrial utility communication market in the coming years.

Regional Insights

North America's industrial utility communications market is mature and characterized by advanced communication technologies. With a strong emphasis on smart grid projects, cybersecurity, and reliability, utility companies in the region are progressively adopting wireless and fiber-optic communication systems. Consumer needs in Canada emphasize the integration of distributed energy resources and the development of a more resilient grid. Canadian utilities are investing in advanced metering infrastructure (AMI) and grid automation that offer enhanced communication capabilities. South America's market is growing, influenced mainly by the expansion of energy infrastructure and the upgrading of traditional utility networks. Countries such as Brazil and Argentina are investing in smart grid technologies, which demand robust communication channels. The European Union's push for a low-carbon economy has fostered innovation in communication technologies that support renewable integration and smart grid solutions. There is a significant push toward adopting the Internet of Things (IoT) and machine-to-machine (M2M) technologies to enhance grid management and operational efficiency. In the Middle East and Africa, the market is experiencing growth due to the need for infrastructure development and utility modernization. Growing investments in smart cities such as NEOM in Saudi Arabia and initiatives such as the New Deal on Energy for Africa (NDEA) encourage the adoption of utility communication systems to manage decentralized grids. The APAC region is witnessing rapid development in the industrial utility communication market due to massive urbanization, industrialization, and the proliferation of smart city projects, especially in countries such as China, Japan, and India. The Chinese market is at the forefront of research and development in smart grid technology, heavily backed by government initiatives and investments. The drive for electrification in rural areas, coupled with the Indian government's smart cities initiative, has propelled the demand for effective utility communication systems. India is also witnessing a surge in smart metering projects, further stimulating market growth.

FPNV Positioning Matrix

The FPNV Positioning Matrix is pivotal in evaluating the Industrial Utility Communication Market. It offers a comprehensive assessment of vendors, examining key metrics related to Business Strategy and Product Satisfaction. This in-depth analysis empowers users to make well-informed decisions aligned with their requirements. Based on the evaluation, the vendors are then categorized into four distinct quadrants representing varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V).

Market Share Analysis

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the Industrial Utility Communication Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the Industrial Utility Communication Market, highlighting leading vendors and their innovative profiles. These include 4RF Limited, Black & Veatch Corporation, Cambium Networks, Ltd., Cisco Systems, Inc., Digi International Inc., Eaton Corporation PLC, Fujitsu Limited, General Electric Company, Hitachi Energy Ltd., Honeywell International Inc., Itron, Inc., Landis+Gyr AG, Milsoft Utility Solutions, MiMOMax Wireless by Ubiik Inc., Motorola Solutions, Inc. by Zebra Technologies Corporation, Nokia Corporation, RAD Data Communications Ltd., Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Sierra Wireless by Semtech Corporation, Telefonaktiebolaget LM Ericsson, Trilliant Holdings Inc., Valiant Communications, and ZTE Corporation.

Market Segmentation & Coverage

This research report categorizes the Industrial Utility Communication Market to forecast the revenues and analyze trends in each of the following sub-markets:

- Component

- Hardware

- Software

- Technology Type

- Wired

- Wireless

- End-use

- Electric Power Utilities

- Oil & Gas

- Region

- Americas

- Argentina

- Brazil

- Canada

- Mexico

- United States

- California

- Florida

- Illinois

- New York

- Ohio

- Pennsylvania

- Texas

- Asia-Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Vietnam

- Europe, Middle East & Africa

- Denmark

- Egypt

- Finland

- France

- Germany

- Israel

- Italy

- Netherlands

- Nigeria

- Norway

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

- United Arab Emirates

- United Kingdom

- Americas

The report offers valuable insights on the following aspects:

1. Market Penetration: It presents comprehensive information on the market provided by key players.

2. Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

3. Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

4. Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

5. Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast of the Industrial Utility Communication Market?

2. Which products, segments, applications, and areas should one consider investing in over the forecast period in the Industrial Utility Communication Market?

3. What are the technology trends and regulatory frameworks in the Industrial Utility Communication Market?

4. What is the market share of the leading vendors in the Industrial Utility Communication Market?

5. Which modes and strategic moves are suitable for entering the Industrial Utility Communication Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Industrial Utility Communication Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Increasing need for automation and wireless communication

- 5.1.1.2. Government regulations and initiatives promoting the adoption of smart grid technologies

- 5.1.1.3. Rising demand for cloud-based utility communication solutions

- 5.1.2. Restraints

- 5.1.2.1. High initial investment for implementing industrial utility communication

- 5.1.3. Opportunities

- 5.1.3.1. Increasing government investment in smart city projects

- 5.1.3.2. Integration of renewable energy sources with grid

- 5.1.4. Challenges

- 5.1.4.1. Concerns associated with security and cybersecurity threats

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Component: Increasing usage of software in industrial utility communication solutions

- 5.2.2. Technology Type: Growing preference for wireless communication in utilities for its flexibility

- 5.2.3. End-use: Expanding utilization of industrial utility communication among electric power utilities

- 5.3. Market Trend Analysis

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Industrial Utility Communication Market, by Component

- 6.1. Introduction

- 6.2. Hardware

- 6.3. Software

7. Industrial Utility Communication Market, by Technology Type

- 7.1. Introduction

- 7.2. Wired

- 7.3. Wireless

8. Industrial Utility Communication Market, by End-use

- 8.1. Introduction

- 8.2. Electric Power Utilities

- 8.3. Oil & Gas

9. Americas Industrial Utility Communication Market

- 9.1. Introduction

- 9.2. Argentina

- 9.3. Brazil

- 9.4. Canada

- 9.5. Mexico

- 9.6. United States

10. Asia-Pacific Industrial Utility Communication Market

- 10.1. Introduction

- 10.2. Australia

- 10.3. China

- 10.4. India

- 10.5. Indonesia

- 10.6. Japan

- 10.7. Malaysia

- 10.8. Philippines

- 10.9. Singapore

- 10.10. South Korea

- 10.11. Taiwan

- 10.12. Thailand

- 10.13. Vietnam

11. Europe, Middle East & Africa Industrial Utility Communication Market

- 11.1. Introduction

- 11.2. Denmark

- 11.3. Egypt

- 11.4. Finland

- 11.5. France

- 11.6. Germany

- 11.7. Israel

- 11.8. Italy

- 11.9. Netherlands

- 11.10. Nigeria

- 11.11. Norway

- 11.12. Poland

- 11.13. Qatar

- 11.14. Russia

- 11.15. Saudi Arabia

- 11.16. South Africa

- 11.17. Spain

- 11.18. Sweden

- 11.19. Switzerland

- 11.20. Turkey

- 11.21. United Arab Emirates

- 11.22. United Kingdom

12. Competitive Landscape

- 12.1. FPNV Positioning Matrix

- 12.2. Market Share Analysis, By Key Player

- 12.3. Competitive Scenario Analysis, By Key Player

- 12.3.1. Merger & Acquisition

- 12.3.1.1. Ubiik acquires Mimomax, creating a best-of-breed wireless solutions provider for utilities and critical infrastructure

- 12.3.2. New Product Launch & Enhancement

- 12.3.2.1. Nokia announces 4G and 5G Core Network software solutions

- 12.3.1. Merger & Acquisition

13. Competitive Portfolio

- 13.1. Key Company Profiles

- 13.1.1. 4RF Limited

- 13.1.2. Black & Veatch Corporation

- 13.1.3. Cambium Networks, Ltd.

- 13.1.4. Cisco Systems, Inc.

- 13.1.5. Digi International Inc.

- 13.1.6. Eaton Corporation PLC

- 13.1.7. Fujitsu Limited

- 13.1.8. General Electric Company

- 13.1.9. Hitachi Energy Ltd.

- 13.1.10. Honeywell International Inc.

- 13.1.11. Itron, Inc.

- 13.1.12. Landis+Gyr AG

- 13.1.13. Milsoft Utility Solutions

- 13.1.14. MiMOMax Wireless by Ubiik Inc.

- 13.1.15. Motorola Solutions, Inc. by Zebra Technologies Corporation

- 13.1.16. Nokia Corporation

- 13.1.17. RAD Data Communications Ltd.

- 13.1.18. Rockwell Automation Inc.

- 13.1.19. Schneider Electric SE

- 13.1.20. Siemens AG

- 13.1.21. Sierra Wireless by Semtech Corporation

- 13.1.22. Telefonaktiebolaget LM Ericsson

- 13.1.23. Trilliant Holdings Inc.

- 13.1.24. Valiant Communications

- 13.1.25. ZTE Corporation

- 13.2. Key Product Portfolio

14. Appendix

- 14.1. Discussion Guide

- 14.2. License & Pricing