|

市場調査レポート

商品コード

1411315

リチウム金属市場:供給源、純度、用途、最終用途別-2023-2030年の世界予測Lithium Metal Market by Source (Lithium Ores, Salt Lake Brine), Purity (99% and Above, Below 99%), Application, End-use - Global Forecast 2023-2030 |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

| リチウム金属市場:供給源、純度、用途、最終用途別-2023-2030年の世界予測 |

|

出版日: 2023年12月26日

発行: 360iResearch

ページ情報: 英文 185 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

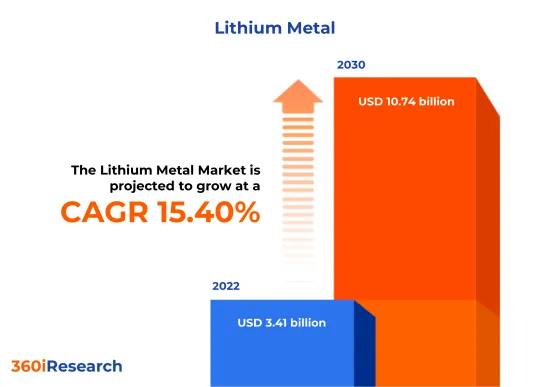

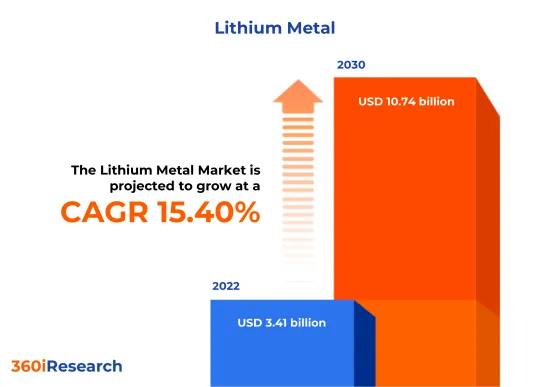

リチウム金属市場規模は2022年に34億1,000万米ドルと推計され、2023年には38億5,000万米ドルに達し、CAGR 15.40%で2030年には107億4,000万米ドルに達すると予測されます。

リチウム金属の世界市場

| 主な市場の統計 | |

|---|---|

| 基準年[2022] | 34億1,000万米ドル |

| 予測年[2023] | 38億5,000万米ドル |

| 予測年 [2030] | 107億4,000万米ドル |

| CAGR(%) | 15.4% |

リチウム(Li)金属は銀白色の柔らかいアルカリ金属で、標準的な条件下では最も軽い金属であり、最も軽い固体元素です。リチウムは反射率が高いため光沢を示し、反応性が高く可燃性です。水と反応すると水素ガスを発生し、水酸化リチウムを生成するため、取り扱いには注意が必要です。リチウム金属市場は、金属形態のリチウムの供給、需要、生産、用途に関連します。リチウムは、その高い電気化学ポテンシャルとエネルギー密度により、様々な産業で使用される重要な材料であり、主に電子機器、電気自動車(EV)、エネルギー貯蔵システム用の電池の製造に使用されます。世界の電気自動車需要の増加、使用量の増加、ポータブル家電によるリチウムイオン電池の需要増加が市場成長の原動力となっています。再生可能エネルギー発電プロジェクトにおけるリチウムイオンベースのエネルギー貯蔵システム(ESS)の利用拡大が市場成長を後押し。地政学的要因によるサプライチェーンの複雑さ、世界の商品価格の変動、採掘方法や製品の安全性に関する環境問題が市場成長を制約しています。さらに、リチウムの新しい抽出技術の開拓と固体電池の商業化は、市場拡大の機会を生み出すと期待されています。

地域別洞察

南北南北アメリカは、特にチリ、アルゼンチン、ボリビアといった国々にリチウムが大量に埋蔵されているのが特徴で、これらの国はリチウム塩水鉱床が密集していることで知られるリチウム・トライアングルの一部です。米国はかなりのスポジュメン埋蔵量を有しており、サプライ・チェーンを確保するため、リチウムのリサイクル技術を積極的に模索しています。特に北米では、技術の進歩と支援的な政策がリチウム市場の成長を促進すると予想されます。中国とオーストラリアを筆頭とするアジア太平洋(APAC)地域は、様々な埋蔵量の存在と生産能力の強化により、大きな貢献をしています。オーストラリアは最大のリチウム生産国で、主に硬岩鉱業(リチウム含有鉱物のスポジュメン)に由来します。さらに、中国は精製と化学生産に秀でており、世界のリチウム処理施設の大部分を保有しています。EMEA(欧州・中東・アフリカ)は多様な業界情勢を呈しており、急成長する電気自動車(EV)業界を支えるため、リチウムサプライチェーンの地域化に向けた欧州の取り組みが顕著です。欧州電池同盟やリチウム抽出プロジェクトへの投資を含むイニシアティブは、輸入への依存を減らすことを目的としています。アフリカ、特にコンゴ民主共和国とジンバブエには未開発のリチウム資源が豊富にあるが、インフラの不足が大きな懸念材料となっています。

FPNVポジショニング・マトリックス

FPNVポジショニングマトリックスはリチウム金属市場を評価する上で極めて重要です。事業戦略と製品満足度に関連する主要指標を調査し、ベンダーの包括的な評価を提供します。この綿密な分析により、ユーザーは各自の要件に沿った十分な情報に基づいた意思決定を行うことができます。評価に基づき、ベンダーは成功の度合いが異なる4つの象限に分類されます:フォアフロント(F)、パスファインダー(P)、ニッチ(N)、バイタル(V)です。

市場シェア分析

市場シェア分析は、リチウム金属市場におけるベンダーの現状について、洞察に満ちた詳細な調査を提供する包括的なツールです。全体的な収益、顧客基盤、その他の主要指標についてベンダーの貢献度を綿密に比較・分析することで、企業の業績や市場シェア争いの際に直面する課題について理解を深めることができます。さらに、この分析により、調査対象基準年に観察された累積、断片化の優位性、合併の特徴などの要因を含む、この分野の競合特性に関する貴重な考察が得られます。このような詳細レベルの拡大により、ベンダーはより多くの情報に基づいた意思決定を行い、市場で競争優位に立つための効果的な戦略を考案することができます。

本レポートは、以下の側面に関する貴重な洞察を提供しています:

1-市場の浸透度:主要企業が提供する市場に関する包括的な情報を提示しています。

2-市場の開拓度:有利な新興市場を深く掘り下げ、成熟市場セグメントにおける浸透度を分析しています。

3-市場の多様化:新製品の発売、未開拓の地域、最近の開発、投資に関する詳細な情報を提供します。

4-競合の評価と情報:市場シェア、戦略、製品、認証、規制状況、特許状況、主要企業の製造能力などを網羅的に評価します。

5-製品開発およびイノベーション:将来の技術、研究開発活動、画期的な製品開発に関する知的洞察を提供します。

本レポートは、以下のような主要な質問に対応しています:

1-リチウム金属市場の市場規模および予測は?

2-リチウム金属市場の予測期間中に投資を検討すべき製品、セグメント、用途、分野は何か?

3-リチウム金属市場における技術動向と規制の枠組みは?

4-リチウム金属市場における主要ベンダーの市場シェアは?

5-リチウム金属市場への参入に適した形態や戦略的手段は?

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 市場力学

- 促進要因

- 世界中で電気自動車の需要が増加

- ポータブル家庭用電化製品によるリチウムイオン電池の使用と需要の増加

- 再生可能エネルギー発電プロジェクトにおけるリチウムイオンベースのエネルギー貯蔵システム(ESS)の利用の増加

- 抑制要因

- リチウム金属の抽出に高コストがかかる

- 機会

- リチウムの新しい抽出技術の開発が進む

- 製薬会社による双極性疾患管理のためのリチウム使用の可能性が高まる

- 課題

- 採掘方法や製品の安全性に関する環境問題

- 促進要因

- 市場セグメンテーション分析

- 出典:電池用の鉱石からのリチウムへの関心の高まり

- 最終用途:電気自動車用途でのリチウム電池の使用の増加

- 用途:医療および産業分野におけるリチウム中間体の用途の拡大

- 純度:幅広い産業用途のため、99%未満の純度レベルのリチウム金属に対する大きな需要

- 市場動向分析

- リチウムイオン電池の使用の増加と南北アメリカにおけるリチウム金属の生産に対する政府の多額の投資

- アジア太平洋地域におけるリチウム電池の製造施設の拡大によるリチウム生産量の増加

- EMEA地域の大規模な自動車セクターをサポートするため、リチウムイオン電池の進歩に向けた研究開発活動を拡大

- 高インフレの累積的影響

- ポーターのファイブフォース分析

- バリューチェーンとクリティカルパス分析

- 規制の枠組み

第6章 リチウム金属市場:ソース別

- リチウム鉱石

- ソルトレークブライン

第7章 リチウム金属市場ピュリティにより

- 99%以上

- 99%未満

第8章 リチウム金属市場:用途別

- 合金

- 中間体

- リチウムイオン負極

第9章 リチウム金属市場:最終用途別

- 電池

- 金属・セラミックス加工

- 医薬品および医薬品

第10章 南北アメリカのリチウム金属市場

- アルゼンチン

- ブラジル

- カナダ

- メキシコ

- 米国

第11章 アジア太平洋地域のリチウム金属市場

- オーストラリア

- 中国

- インド

- インドネシア

- 日本

- マレーシア

- フィリピン

- シンガポール

- 韓国

- 台湾

- タイ

- ベトナム

第12章 欧州・中東・アフリカのリチウム金属市場

- デンマーク

- エジプト

- フィンランド

- フランス

- ドイツ

- イスラエル

- イタリア

- オランダ

- ナイジェリア

- ノルウェー

- ポーランド

- カタール

- ロシア

- サウジアラビア

- 南アフリカ

- スペイン

- スウェーデン

- スイス

- トルコ

- アラブ首長国連邦

- 英国

第13章 競合情勢

- FPNVポジショニングマトリクス

- 市場シェア分析:主要企業別

- 競合シナリオ主要企業別の分析

- 合併・買収

- 契約、コラボレーション、パートナーシップ

- 新製品発売と機能強化

- 投資、資金調達

- 受賞・表彰・拡大

第14章 競争力のあるポートフォリオ

- 主要な企業プロファイル

- Albemarle Corporation

- Allkem Limited

- American Lithium Corp.

- Armada Metals Limited

- Avalon Advanced Materials Inc.

- Bacanora Lithium PLC

- Belmont Metals Inc.

- China Energy Lithium Co., Ltd.

- China Lithium Products Technology Co., Ltd.

- CNNC Jianzhong Nuclear Fuel Co., Ltd.

- Critical Elements Lithium Corporation

- Critical Metals Corp.

- Desert Metals Limited

- European Metals Holdings Limited

- Ganfeng Lithium Group Co., Ltd.

- Imerys S.A.

- Lithium Power International Limited

- Livent Corporation

- LOHUM Cleantech Private Limited

- Metal Hawk Limited

- Mineral Resources Limited

- Morella Corporation Limited

- Nemaska Lithium

- Neometals Ltd.

- Noah Chemicals, Inc.

- Piedmont Lithium Inc.

- Pilbara Minerals Limited

- Rio Tinto PLC

- Sayona Mining Limited

- Shenzhen Chengxin Lithium Group Co., Ltd.

- Sigma Lithium Corporation

- Sociedad Quimica y Minera de Chile S.A.

- TechMet Limited

- Tianqi Lithium Holdings Pty Ltd.

- 主要な製品ポートフォリオ

第15章 付録

- ディスカッションガイド

- ライセンスと価格について

LIST OF FIGURES

- FIGURE 1. LITHIUM METAL MARKET RESEARCH PROCESS

- FIGURE 2. LITHIUM METAL MARKET SIZE, 2022 VS 2030

- FIGURE 3. LITHIUM METAL MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. LITHIUM METAL MARKET SIZE, BY REGION, 2022 VS 2030 (%)

- FIGURE 5. LITHIUM METAL MARKET SIZE, BY REGION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 6. LITHIUM METAL MARKET DYNAMICS

- FIGURE 7. LITHIUM METAL MARKET SIZE, BY SOURCE, 2022 VS 2030 (%)

- FIGURE 8. LITHIUM METAL MARKET SIZE, BY SOURCE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 9. LITHIUM METAL MARKET SIZE, BY PURITY, 2022 VS 2030 (%)

- FIGURE 10. LITHIUM METAL MARKET SIZE, BY PURITY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 11. LITHIUM METAL MARKET SIZE, BY APPLICATION, 2022 VS 2030 (%)

- FIGURE 12. LITHIUM METAL MARKET SIZE, BY APPLICATION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 13. LITHIUM METAL MARKET SIZE, BY END-USE, 2022 VS 2030 (%)

- FIGURE 14. LITHIUM METAL MARKET SIZE, BY END-USE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 15. AMERICAS LITHIUM METAL MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 16. AMERICAS LITHIUM METAL MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 17. UNITED STATES LITHIUM METAL MARKET SIZE, BY STATE, 2022 VS 2030 (%)

- FIGURE 18. UNITED STATES LITHIUM METAL MARKET SIZE, BY STATE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 19. ASIA-PACIFIC LITHIUM METAL MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 20. ASIA-PACIFIC LITHIUM METAL MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 21. EUROPE, MIDDLE EAST & AFRICA LITHIUM METAL MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 22. EUROPE, MIDDLE EAST & AFRICA LITHIUM METAL MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 23. LITHIUM METAL MARKET, FPNV POSITIONING MATRIX, 2022

- FIGURE 24. LITHIUM METAL MARKET SHARE, BY KEY PLAYER, 2022

LIST OF TABLES

- TABLE 1. LITHIUM METAL MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2022

- TABLE 3. LITHIUM METAL MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL LITHIUM METAL MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 6. LITHIUM METAL MARKET SIZE, BY LITHIUM ORES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. LITHIUM METAL MARKET SIZE, BY SALT LAKE BRINE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 8. LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 9. LITHIUM METAL MARKET SIZE, BY 99% AND ABOVE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. LITHIUM METAL MARKET SIZE, BY BELOW 99%, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 12. LITHIUM METAL MARKET SIZE, BY ALLOY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. LITHIUM METAL MARKET SIZE, BY INTERMEDIATES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. LITHIUM METAL MARKET SIZE, BY LITHIUM-ION ANODE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 16. LITHIUM METAL MARKET SIZE, BY BATTERIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. LITHIUM METAL MARKET SIZE, BY METALS & CERAMICS PROCESSING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. LITHIUM METAL MARKET SIZE, BY PHARMACEUTICALS & DRUGS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 19. AMERICAS LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 20. AMERICAS LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 21. AMERICAS LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 22. AMERICAS LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 23. AMERICAS LITHIUM METAL MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 24. ARGENTINA LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 25. ARGENTINA LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 26. ARGENTINA LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 27. ARGENTINA LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 28. BRAZIL LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 29. BRAZIL LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 30. BRAZIL LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 31. BRAZIL LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 32. CANADA LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 33. CANADA LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 34. CANADA LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 35. CANADA LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 36. MEXICO LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 37. MEXICO LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 38. MEXICO LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 39. MEXICO LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 40. UNITED STATES LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 41. UNITED STATES LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 42. UNITED STATES LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 43. UNITED STATES LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 44. UNITED STATES LITHIUM METAL MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 45. ASIA-PACIFIC LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 46. ASIA-PACIFIC LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 47. ASIA-PACIFIC LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 48. ASIA-PACIFIC LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 49. ASIA-PACIFIC LITHIUM METAL MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 50. AUSTRALIA LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 51. AUSTRALIA LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 52. AUSTRALIA LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 53. AUSTRALIA LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 54. CHINA LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 55. CHINA LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 56. CHINA LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 57. CHINA LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 58. INDIA LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 59. INDIA LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 60. INDIA LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 61. INDIA LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 62. INDONESIA LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 63. INDONESIA LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 64. INDONESIA LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 65. INDONESIA LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 66. JAPAN LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 67. JAPAN LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 68. JAPAN LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 69. JAPAN LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 70. MALAYSIA LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 71. MALAYSIA LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 72. MALAYSIA LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 73. MALAYSIA LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 74. PHILIPPINES LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 75. PHILIPPINES LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 76. PHILIPPINES LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 77. PHILIPPINES LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 78. SINGAPORE LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 79. SINGAPORE LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 80. SINGAPORE LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 81. SINGAPORE LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 82. SOUTH KOREA LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 83. SOUTH KOREA LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 84. SOUTH KOREA LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 85. SOUTH KOREA LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 86. TAIWAN LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 87. TAIWAN LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 88. TAIWAN LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 89. TAIWAN LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 90. THAILAND LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 91. THAILAND LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 92. THAILAND LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 93. THAILAND LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 94. VIETNAM LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 95. VIETNAM LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 96. VIETNAM LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 97. VIETNAM LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 98. EUROPE, MIDDLE EAST & AFRICA LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 99. EUROPE, MIDDLE EAST & AFRICA LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 100. EUROPE, MIDDLE EAST & AFRICA LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 101. EUROPE, MIDDLE EAST & AFRICA LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 102. EUROPE, MIDDLE EAST & AFRICA LITHIUM METAL MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 103. DENMARK LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 104. DENMARK LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 105. DENMARK LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 106. DENMARK LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 107. EGYPT LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 108. EGYPT LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 109. EGYPT LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 110. EGYPT LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 111. FINLAND LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 112. FINLAND LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 113. FINLAND LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 114. FINLAND LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 115. FRANCE LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 116. FRANCE LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 117. FRANCE LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 118. FRANCE LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 119. GERMANY LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 120. GERMANY LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 121. GERMANY LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 122. GERMANY LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 123. ISRAEL LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 124. ISRAEL LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 125. ISRAEL LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 126. ISRAEL LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 127. ITALY LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 128. ITALY LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 129. ITALY LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 130. ITALY LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 131. NETHERLANDS LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 132. NETHERLANDS LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 133. NETHERLANDS LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 134. NETHERLANDS LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 135. NIGERIA LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 136. NIGERIA LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 137. NIGERIA LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 138. NIGERIA LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 139. NORWAY LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 140. NORWAY LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 141. NORWAY LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 142. NORWAY LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 143. POLAND LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 144. POLAND LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 145. POLAND LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 146. POLAND LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 147. QATAR LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 148. QATAR LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 149. QATAR LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 150. QATAR LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 151. RUSSIA LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 152. RUSSIA LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 153. RUSSIA LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 154. RUSSIA LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 155. SAUDI ARABIA LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 156. SAUDI ARABIA LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 157. SAUDI ARABIA LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 158. SAUDI ARABIA LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 159. SOUTH AFRICA LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 160. SOUTH AFRICA LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 161. SOUTH AFRICA LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 162. SOUTH AFRICA LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 163. SPAIN LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 164. SPAIN LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 165. SPAIN LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 166. SPAIN LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 167. SWEDEN LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 168. SWEDEN LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 169. SWEDEN LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 170. SWEDEN LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 171. SWITZERLAND LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 172. SWITZERLAND LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 173. SWITZERLAND LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 174. SWITZERLAND LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 175. TURKEY LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 176. TURKEY LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 177. TURKEY LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 178. TURKEY LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 179. UNITED ARAB EMIRATES LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 180. UNITED ARAB EMIRATES LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 181. UNITED ARAB EMIRATES LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 182. UNITED ARAB EMIRATES LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 183. UNITED KINGDOM LITHIUM METAL MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 184. UNITED KINGDOM LITHIUM METAL MARKET SIZE, BY PURITY, 2018-2030 (USD MILLION)

- TABLE 185. UNITED KINGDOM LITHIUM METAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 186. UNITED KINGDOM LITHIUM METAL MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 187. LITHIUM METAL MARKET, FPNV POSITIONING MATRIX, 2022

- TABLE 188. LITHIUM METAL MARKET SHARE, BY KEY PLAYER, 2022

- TABLE 189. LITHIUM METAL MARKET LICENSE & PRICING

[185 Pages Report] The Lithium Metal Market size was estimated at USD 3.41 billion in 2022 and expected to reach USD 3.85 billion in 2023, at a CAGR 15.40% to reach USD 10.74 billion by 2030.

Global Lithium Metal Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2022] | USD 3.41 billion |

| Estimated Year [2023] | USD 3.85 billion |

| Forecast Year [2030] | USD 10.74 billion |

| CAGR (%) | 15.4% |

Lithium (Li) metal is a soft, silvery-white alkali metal, and it is the lightest metal and the lightest solid element under standard conditions. Lithium exhibits a luster due to its high reflectivity and is highly reactive and flammable. It must be handled cautiously due to its reactivity with water, as it releases hydrogen gas and forms lithium hydroxide. The lithium metal market pertains to the supply, demand, production, and applications of lithium in its metallic form. Lithium is a critical material used in various industries due to its high electrochemical potential and energy density, primarily in manufacturing batteries for electronic devices, electric vehicles (EVs), and energy storage systems. Increasing demand for electric vehicles worldwide, growing usage, and rising demand for lithium-ion batteries by portable consumer electronics are driving market growth. Growing utilization of lithium-ion-based energy storage systems (ESS) for renewable energy generation projects fuels market growth. Supply chain complexities due to geopolitical factors, fluctuating global commodity prices, and environmental concerns related to mining methods and product safety concerns are restricting market growth. Moreover, the development of new extraction techniques for lithium and the commercialization of solid-state batteries are expected to create opportunities for market expansion.

Regional Insights

The Americas is characterized by significant lithium reserves, notably in countries such as Chile, Argentina, and Bolivia, which are a part of the lithium triangle known for the high concentration of lithium brine deposits. The United States holds substantial spodumene reserves and actively explores lithium recycling technologies to secure its supply chain. Technological advancements and supportive policies, particularly in North America, are expected to drive the growth of the lithium market. The Asia-Pacific (APAC) region, spearheaded by China and Australia, is a major contributor, with the presence of various reserves and enhanced production capabilities. Australia is the largest lithium producer, primarily originating from hard rock mining (spodumene, a lithium bearing mineral). In addition, China excels in refining and chemical production, holding a significant portion of the global lithium processing facilities. EMEA presents a diversified landscape, with significant efforts from Europe to localize the lithium supply chain to support its rapidly growing electric vehicle (EV) industry. Initiatives, including the European Battery Alliance and investment in lithium extraction projects, aim to reduce dependency on imports. Africa, particularly the Democratic Republic of Congo and Zimbabwe, holds extensive untapped lithium resources; however, the lack of infrastructure is a major concern.

FPNV Positioning Matrix

The FPNV Positioning Matrix is pivotal in evaluating the Lithium Metal Market. It offers a comprehensive assessment of vendors, examining key metrics related to Business Strategy and Product Satisfaction. This in-depth analysis empowers users to make well-informed decisions aligned with their requirements. Based on the evaluation, the vendors are then categorized into four distinct quadrants representing varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V).

Market Share Analysis

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the Lithium Metal Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the Lithium Metal Market, highlighting leading vendors and their innovative profiles. These include Albemarle Corporation, Allkem Limited, American Lithium Corp., Armada Metals Limited, Avalon Advanced Materials Inc., Bacanora Lithium PLC, Belmont Metals Inc., China Energy Lithium Co., Ltd., China Lithium Products Technology Co., Ltd., CNNC Jianzhong Nuclear Fuel Co., Ltd., Critical Elements Lithium Corporation, Critical Metals Corp., Desert Metals Limited, European Metals Holdings Limited, Ganfeng Lithium Group Co., Ltd., Imerys S.A., Lithium Power International Limited, Livent Corporation, LOHUM Cleantech Private Limited, Metal Hawk Limited, Mineral Resources Limited, Morella Corporation Limited, Nemaska Lithium, Neometals Ltd., Noah Chemicals, Inc., Piedmont Lithium Inc., Pilbara Minerals Limited, Rio Tinto PLC, Sayona Mining Limited, Shenzhen Chengxin Lithium Group Co., Ltd., Sigma Lithium Corporation, Sociedad Quimica y Minera de Chile S.A., TechMet Limited, and Tianqi Lithium Holdings Pty Ltd..

Market Segmentation & Coverage

This research report categorizes the Lithium Metal Market to forecast the revenues and analyze trends in each of the following sub-markets:

- Source

- Lithium Ores

- Salt Lake Brine

- Purity

- 99% and Above

- Below 99%

- Application

- Alloy

- Intermediates

- Lithium-ion Anode

- End-use

- Batteries

- Metals & Ceramics Processing

- Pharmaceuticals & Drugs

- Region

- Americas

- Argentina

- Brazil

- Canada

- Mexico

- United States

- California

- Florida

- Illinois

- Nevada

- New York

- North Carolina

- Ohio

- Pennsylvania

- Texas

- Asia-Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Vietnam

- Europe, Middle East & Africa

- Denmark

- Egypt

- Finland

- France

- Germany

- Israel

- Italy

- Netherlands

- Nigeria

- Norway

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

- United Arab Emirates

- United Kingdom

- Americas

The report offers valuable insights on the following aspects:

1. Market Penetration: It presents comprehensive information on the market provided by key players.

2. Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

3. Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

4. Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

5. Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast of the Lithium Metal Market?

2. Which products, segments, applications, and areas should one consider investing in over the forecast period in the Lithium Metal Market?

3. What are the technology trends and regulatory frameworks in the Lithium Metal Market?

4. What is the market share of the leading vendors in the Lithium Metal Market?

5. Which modes and strategic moves are suitable for entering the Lithium Metal Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Lithium Metal Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Increasing demand for electric vehicles worldwide

- 5.1.1.2. Growing usage and demand for lithium-ion batteries by portable consumer electronics

- 5.1.1.3. Rising utilization of lithium-ion-based energy storage systems (ESS) for renewable energy generation projects

- 5.1.2. Restraints

- 5.1.2.1. High cost of extraction of lithium metal

- 5.1.3. Opportunities

- 5.1.3.1. Growing development of new extraction techniques for lithium

- 5.1.3.2. Growing potential usage of lithium by pharmaceutical companies to manage bipolar diseases

- 5.1.4. Challenges

- 5.1.4.1. Environmental concerns related to mining methods and product safety issues

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Source: Increasing preference for lithium from mineral ores for batteries

- 5.2.2. End-use: Rising use of lithium-powered batteries for electric vehicles application

- 5.2.3. Application: Growing applications of lithium intermediates in the medical and industrial sectors

- 5.2.4. Purity: Significant demand for lithium metal with a purity level below 99% owing to broader range of industrial applications

- 5.3. Market Trend Analysis

- 5.3.1. Growing use of lithium-ion batteries and significant government investment for lithium metal production in the Americas

- 5.3.2. Rising production of lithium with the growing expansion of manufacturing facilities of lithium batteries in the Asia-Pacific region

- 5.3.3. Growing R&D activities for advancements in lithium-ion batteries to support large automotive sector in the EMEA region

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Lithium Metal Market, by Source

- 6.1. Introduction

- 6.2. Lithium Ores

- 6.3. Salt Lake Brine

7. Lithium Metal Market, by Purity

- 7.1. Introduction

- 7.2. 99% and Above

- 7.3. Below 99%

8. Lithium Metal Market, by Application

- 8.1. Introduction

- 8.2. Alloy

- 8.3. Intermediates

- 8.4. Lithium-ion Anode

9. Lithium Metal Market, by End-use

- 9.1. Introduction

- 9.2. Batteries

- 9.3. Metals & Ceramics Processing

- 9.4. Pharmaceuticals & Drugs

10. Americas Lithium Metal Market

- 10.1. Introduction

- 10.2. Argentina

- 10.3. Brazil

- 10.4. Canada

- 10.5. Mexico

- 10.6. United States

11. Asia-Pacific Lithium Metal Market

- 11.1. Introduction

- 11.2. Australia

- 11.3. China

- 11.4. India

- 11.5. Indonesia

- 11.6. Japan

- 11.7. Malaysia

- 11.8. Philippines

- 11.9. Singapore

- 11.10. South Korea

- 11.11. Taiwan

- 11.12. Thailand

- 11.13. Vietnam

12. Europe, Middle East & Africa Lithium Metal Market

- 12.1. Introduction

- 12.2. Denmark

- 12.3. Egypt

- 12.4. Finland

- 12.5. France

- 12.6. Germany

- 12.7. Israel

- 12.8. Italy

- 12.9. Netherlands

- 12.10. Nigeria

- 12.11. Norway

- 12.12. Poland

- 12.13. Qatar

- 12.14. Russia

- 12.15. Saudi Arabia

- 12.16. South Africa

- 12.17. Spain

- 12.18. Sweden

- 12.19. Switzerland

- 12.20. Turkey

- 12.21. United Arab Emirates

- 12.22. United Kingdom

13. Competitive Landscape

- 13.1. FPNV Positioning Matrix

- 13.2. Market Share Analysis, By Key Player

- 13.3. Competitive Scenario Analysis, By Key Player

- 13.3.1. Merger & Acquisition

- 13.3.1.1. Armada Metals to Acquire Lithium Exploration Projects in Brazil

- 13.3.1.2. Codelco Makes First Lithium Acquisition With Australian Deal

- 13.3.1.3. MetalsTech to Acquire Sauvolles Lithium Project in Canada

- 13.3.2. Agreement, Collaboration, & Partnership

- 13.3.2.1. LIB Partners with VoltUp to Deliver 50,000 Lithium-ion Batteries

- 13.3.2.2. Li-Metal Corp. and Mustang Vacuum Systems Inc. Sign Definitive Agreements for Strategic Partnership in Lithium Metal Anode Business

- 13.3.2.3. Lithium Africa and Ganfeng Lithium Establish Strategic Exploration Partnership

- 13.3.2.4. Partnership between BASF and Nanotech Energy will Enable Production of Lithium-ion Batteries in North America with Locally Recycled Content and Low CO2 Footprint

- 13.3.2.5. American Battery Technology Company and TechMet-Mercuria Initiate Strategic Partnership for Marketing and Sales of Recycled Battery Metal Products

- 13.3.2.6. Aussie billionaire Gina Rinehart Enters Lithium Exploration in Partnership with NMDC

- 13.3.3. New Product Launch & Enhancement

- 13.3.3.1. Li-Metal Yields First Batch of Lithium Metal Ingots Using Reprocessing Technology

- 13.3.3.2. LOHUM Announces Pure Lithium Metal Recovered Through Recycling

- 13.3.4. Investment & Funding

- 13.3.4.1. GM Leads USD 50 Million Funding Round in EnergyX to Unlock U.S.-Based Lithium Supply for Rapidly Scaling EV Production

- 13.3.5. Award, Recognition, & Expansion

- 13.3.5.1. ExxonMobil Drilling First Lithium Well in Arkansas, Aims to be a Leading Supplier for Electric Vehicles by 2030

- 13.3.1. Merger & Acquisition

14. Competitive Portfolio

- 14.1. Key Company Profiles

- 14.1.1. Albemarle Corporation

- 14.1.2. Allkem Limited

- 14.1.3. American Lithium Corp.

- 14.1.4. Armada Metals Limited

- 14.1.5. Avalon Advanced Materials Inc.

- 14.1.6. Bacanora Lithium PLC

- 14.1.7. Belmont Metals Inc.

- 14.1.8. China Energy Lithium Co., Ltd.

- 14.1.9. China Lithium Products Technology Co., Ltd.

- 14.1.10. CNNC Jianzhong Nuclear Fuel Co., Ltd.

- 14.1.11. Critical Elements Lithium Corporation

- 14.1.12. Critical Metals Corp.

- 14.1.13. Desert Metals Limited

- 14.1.14. European Metals Holdings Limited

- 14.1.15. Ganfeng Lithium Group Co., Ltd.

- 14.1.16. Imerys S.A.

- 14.1.17. Lithium Power International Limited

- 14.1.18. Livent Corporation

- 14.1.19. LOHUM Cleantech Private Limited

- 14.1.20. Metal Hawk Limited

- 14.1.21. Mineral Resources Limited

- 14.1.22. Morella Corporation Limited

- 14.1.23. Nemaska Lithium

- 14.1.24. Neometals Ltd.

- 14.1.25. Noah Chemicals, Inc.

- 14.1.26. Piedmont Lithium Inc.

- 14.1.27. Pilbara Minerals Limited

- 14.1.28. Rio Tinto PLC

- 14.1.29. Sayona Mining Limited

- 14.1.30. Shenzhen Chengxin Lithium Group Co., Ltd.

- 14.1.31. Sigma Lithium Corporation

- 14.1.32. Sociedad Quimica y Minera de Chile S.A.

- 14.1.33. TechMet Limited

- 14.1.34. Tianqi Lithium Holdings Pty Ltd.

- 14.2. Key Product Portfolio

15. Appendix

- 15.1. Discussion Guide

- 15.2. License & Pricing