|

|

市場調査レポート

商品コード

1075861

結晶セルロースの世界市場:2022年~2027年Microcrystalline Cellulose Market - Forecast(2022 - 2027) |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 結晶セルロースの世界市場:2022年~2027年 |

|

出版日: 2022年04月01日

発行: IndustryARC

ページ情報: 英文 111 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

結晶セルロースの市場規模は予測期間中6.8%のCAGRで推移し、2027年には14億米ドルの規模に成長すると予測されています。同市場の成長は、加工食品への需要の増加、医薬品や化粧品・パーソナルケア製品の生産量の増加などによってもたらされています。また、人口の急激な増加、肥満疾患の増加、健康食品に対する消費者の期待の変化も製品消費を促進するでしょう。

原料別で見ると、脂肪代替物、テクスチャライザー、伸長剤、増量剤としての使用により、木材ベースの部門が2019年に最大のシェアを示しています。また、エンドユース産業別では、医薬品の部門が2019年に最大のシェアを示し、予測期間中は7%のCAGRで成長すると予測されています。

当レポートでは、世界の結晶セルロースの市場を調査し、市場の定義と概要、市場成長への各種影響因子の分析、市場規模の推移・予測、各種区分・地域/主要国別の内訳、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 結晶セルロース市場:市場概要

第2章 結晶セルロース市場:エグゼクティブサマリー

第3章 結晶セルロース市場:情勢

- 比較分析

- 主要企業の市場シェア分析

- 主要企業の製品ベンチマーキング

- 主要5社の財務分析

- 主要企業の特許分析

- 価格分析

第4章 結晶セルロース市場:市場影響因子

- 市場促進要因

- 市場抑制要因

- 市場機会

- ポーターのファイブフォースモデル

第5章 結晶セルロース市場:戦略的分析

- バリューチェーン分析

- 市場機会の分析

- 市場ライフサイクル

- サプライヤー・流通販売業者の分析

第6章 結晶セルロース市場:原料別

- 木材

- 非木材

第7章 結晶セルロース市場:エンドユーザー産業別

- 食品・飲料

- 製薬

- 崩壊剤

- 粘着防止剤

- 吸着剤

- カプセル希釈剤

- その他

- 化粧品&パーソナルケア

- 塗料・コーティング

- その他

第8章 結晶セルロース市場:地域別

- 北米

- 南米

- 欧州

- アジア太平洋

- 中東・アフリカ

第9章 結晶セルロース市場:エントロピー

- 新製品の発売

- M&A・協力・JV・提携

第10章 結晶セルロース市場:企業分析

- 市場シェア・企業収益・製品・M&A・展開

Microcrystalline Cellulose Market size is forecast to reach $1.4 billion by 2027, after growing at a CAGR of 6.8% during 2022-2027. The growth of the microcrystalline cellulose market is mainly driven by the rising demand for packaged food and the growing production of pharmaceutical and cosmetic and personal care products. It is used as a substitute for unhealthy fat and adds texture to baked food products. The product contains a significant amount of fibers that helps to enhance digestion, it also acts as an outstanding nutrient source to a variety of nutrients. Rapidly growing population, increasing obesity diseases and shifting consumer expectations of healthy food would drive product consumption.

Report Coverage

The report: "Microcrystalline Cellulose Market- Forecast (2022-2027)", by IndustryARC, covers an in-depth analysis of the following segments of the Microcrystalline Cellulose Industry.

By Source Type: Wood Based and Non-Wood Based.

By End Use Industry: Food & Beverage, Pharmaceutical, Cosmetics & Personal Care, Paint and Coatings and others.

By Geography: North America, South America, Europe, APAC, and RoW.

Key Takeaways

Improving disposable income in the Asia Pacific region influences consumers to buy multiple varieties of personal care products, thus driving the growth of the demand for microcrystalline cellulose. For instance, the personal care sector in India was valued at around $6.5 billion in 2016 and is expected to cross more than USD 20 billion by the end of 2026.

Increasing the use of microcrystalline cellulose in the food and pharmaceutical industries would primarily increase the penetration of the microcrystalline cellulose market over the forecast period. In addition, skin care, hair care, and oral care products use microcrystalline cellulose as an essential ingredient to boost their consistency and performance.

Due to the COVID-19 pandemic most of the countries has gone under lockdown, due to which operations of various industries such as personal care & cosmetics has been negatively affected, which is hampering the Microcrystalline Cellulose market growth.

Microcrystalline Cellulose Market Segment Analysis - Type of Material

Wood-based microcrystalline cellulose held the largest share in the microcrystalline cellulose market in 2019, owing to its use as a fat replacement, texturizer, extensor and bulking agent. In the drug formulation for vitamin tablets and supplements, the wood based microcrystalline cellulose is largely applicable. Growing investments in R&D across the pharmaceutical industry would help its drug formulation implementation. Non-wood based microcrystalline cellulose is growing at a significant CAGR with its adaptation for industrial purposes. The decrease in wood supply, combined with increasing demand for pulp from emerging economies in Asia Pacific, Africa and Latin America, would drive the penetration of the segment. Reed stalks, sisal fiber, coconut shells, rice and wheat straws, soy bean husk, jute, sugarcane bagasse, groundnut husk and a variety of other sources are non-wood sources. In addition, due to high abundance and ease of accessibility, agricultural residues are an excellent substitute for wood products.

Microcrystalline Cellulose Market Segment Analysis - End Use Industry

The pharmaceutical held the largest share in the microcrystalline cellulose market in 2019 and is growing at a CAGR of 7% during the forecast period. In fast release tablets & liquid dosage forms, sustained-release multiarticulate and matrix tablet dosage forms, topical formulations, and chewable & effervescent tablets, microcrystalline cellulose is progressively being used due to its compressibility properties, microcrystalline cellulose is commonly used in the pharmaceutical industry as an excipient and is especially used in solid dose forms, such as tablets. Significant factors expected to fuel the growth of microcrystalline cellulose market are the rising demand for pharmaceutical excipients for the manufacture of medicines coupled with the rapidly growing pharmaceutical industry.

Microcrystalline Cellulose Market Segment Analysis - Geography

Europe held the largest share in the microcrystalline cellulose market in 2019 up to 30%, owning to the growing investments in the production of medicines and the continuing efforts of pharmaceutical firms to deliver products of superior quality. Moreover, economic recovery and an improvement in the employment rate are the growth drivers for the region's processed food industry, which in turn encourages the growth of microcrystalline cellulose market. In addition, the demand in Asia-Pacific is expected to grow relatively faster in terms of revenue in the coming years. Rapidly increasing pharmaceutical manufacturing companies in the country, together with favorable government investment in the manufacture of medicinal drugs, are also expected to generate demand for pharmaceutical excipients, which in turn is expected to help the growth of the Asia Pacific microcrystal cellulose market over the forecast period.

Microcrystalline Cellulose Market Drivers

Growing pharmaceutical and food industry

As a stabilizer, binder, film-forming agent, suspension agent, and disintegrant in tablet formulations, ointments, and other topical therapeutic bases, microcrystalline cellulose is used in the pharmaceutical industry. It is one of the pharmaceutical industry's most relevant and frequently used excipients. It is a primary thinner and is used in pharmaceutical formulations as a binding agent. In drug preparations, such as pills, capsules, sachets, and so on, it is commonly used. The global microcrystalline cellulose market is driven by the increasing development of pharmaceutical products. Emerging countries such as China, Brazil and India are fast-growing markets that are expected to further increase demand for microcrystalline cellulose. As the rapidly rising population mainly propels the food industry. For instance, the population of Indonesia grew to 267 million in 2018, according to the World Bank, compared to 264 million in 2017. Microcrystalline cellulose is used in the preparation of various food products and is preferred to enhance their consistency as a hot and cold stabilizer in ice cream, canned meat, frozen food and seasoning. Cellulose, which is widely accepted as a dietary fiber, is the main component of the formula. It finds important applications in functional & nutraceutical foods to enhance the functioning of lipid metabolizing gastrointestinal tract and expression enzymes. Therefore, owning to these factors the demand for microcrystalline cellulose is increasing.

Microcrystalline Cellulose Market Challenges

Availability of substitutes

Microcrystalline cellulose, as such, has no replacements available. But there are a variety of goods that are better than MCC and have very particular applications. Carboxymethyl cellulose (CMC), kappa-carrageenan, and croscarmellose sodium are only some of the products available (CCS). To stabilize emulsions in food products such as ice creams and baking products, CMC is used in food & beverages. CMC is also used as a disintegrant, stabilizer, binder, and suspension agent in pharmaceutical applications. Plant-based Guar gum can also be used in ice creams and other dairy products in the food & beverage industry. The current high market prices of guar gum, however may to some degree suppress its demand. In the long run, if the price of guar gum decreases, the growth of the microcrystalline cellulose market would have a negative effect. Therefore, the availability of a possible replacement for microcrystalline cellulose may have a significant effect on the market growth.

Market Landscape

Technology launches, acquisitions and R&D activities are key strategies adopted by players in the Microcrystalline Cellulose Market. In 2019, the market of Microcrystalline Cellulose Market has been consolidated by the top five players accounting for xx% of the share. Major players in the Microcrystalline Cellulose market includes DowDuPont, Asahi Kasei Chemicals Corporation, Rayonier Advanced Materials, Roquette, DFE Pharma GmbH & Co.KG, JRS Pharma GmbH & Co.KG, Avantor Performance Materials Inc., among others.

Acquisitions/Product Launches:

In August 2015, DFE Pharma launched low-moisture lactose grade Pharmacel 112 to formulate active pharmaceutical ingredients.

In November 2017, DowDuPont (US) acquired FMC Corporation's health & nutrition business segment (US). The acquisition allowed the company to expand its capabilities in the field of pharmaceutical excipients. In terms of gaining new ingredients for MCC, the acquisition also benefited the company.

In September 2017, Roquette acquired Itacel (Brazil). The acquisition enabled the company to improve its role in the MCC market and to become a major supplier to the pharmaceutical industry.

Table of Contents

1. Microcrystalline Celluloses Market- Market Overview

- 1.1 Definitions and Scope

2. Microcrystalline Celluloses Market- Executive Summary

- 2.1 Market Revenue, Market Size and Key Trends by Company

- 2.2 Key trends by Source Type

- 2.3 Key Trends by End Use Industry

- 2.4 Key Trends by Geography

3. Microcrystalline Celluloses Market- Landscape

- 3.1 Comparative analysis

- 3.1.1 Market Share Analysis- Top Companies

- 3.1.2 Product Benchmarking- Top Companies

- 3.1.3 Top 5 Financials Analysis

- 3.1.4 Patent Analysis- Top Companies

- 3.1.5 Pricing Analysis

4. Microcrystalline Celluloses Market- Market Forces

- 4.1 Market Drivers

- 4.2 Market Constraints

- 4.3 Market Opportunities

- 4.4 Porters five force model

- 4.4.1 Bargaining power of suppliers

- 4.4.2 Bargaining powers of customers

- 4.4.3 Threat of new entrants

- 4.4.4 Rivalry among existing players

- 4.4.5 Threat of substitutes

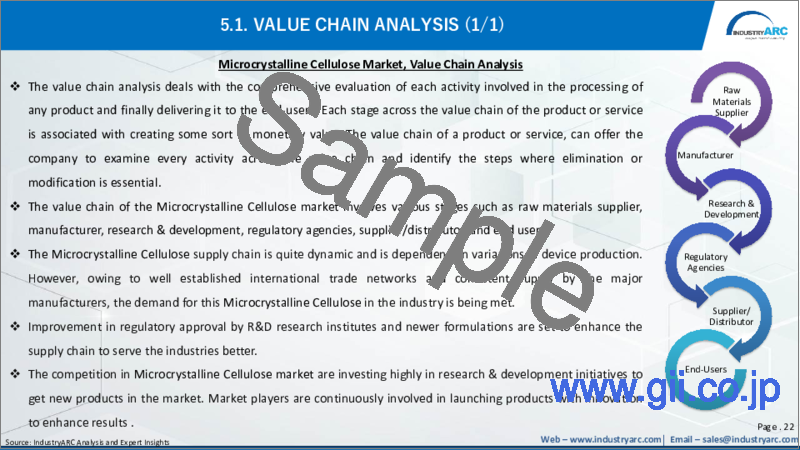

5. Microcrystalline Celluloses Market -Strategic analysis

- 5.1 Value chain analysis

- 5.2 Opportunities analysis

- 5.3 Market life cycle

- 5.4 Suppliers and distributors Analysis

6. Microcrystalline Celluloses Market- By Source Type (Market Size -$Million / $Billion)

- 6.1 Wood Based

- 6.2 Non-Wood Based

7. Microcrystalline Celluloses Market- By End Use Industry (Market Size -$Million / $Billion)

- 7.1 Food & Beverage

- 7.2 Pharmaceutical

- 7.2.1 Disintegrating Agents

- 7.2.2 Anti-Sticking Agents

- 7.2.3 Adsorbents

- 7.2.4 Capsule Diluents

- 7.2.5 Others

- 7.3 Cosmetics & Personal Care

- 7.4 Paints & coatings

- 7.5 Others

8. Microcrystalline Celluloses Market - By Geography (Market Size -$Million / $Billion)

- 8.1 North America

- 8.1.1 U.S.

- 8.1.2 Canada

- 8.1.3 Mexico

- 8.2 South America

- 8.2.1 Brazil

- 8.2.2 Argentina

- 8.2.3 Colombia

- 8.2.4 Rest of South America

- 8.3 Europe

- 8.3.1 U.K

- 8.3.2 Germany

- 8.3.3 Italy

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Taiwan

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 ROW

- 8.5.1 Middle East

- 8.5.2 Africa

9. Microcrystalline Celluloses Market- Entropy

- 9.1 New Product Launches

- 9.2 M&A's, Collaborations, JVs and Partnerships

10. Microcrystalline Celluloses Market Company Analysis

- 10.1 Market Share, Company Revenue, Products, M&A, Developments

- 10.2 Company 1

- 10.3 Company 2

- 10.4 Company 3

- 10.5 Company 4

- 10.6 Company 5

- 10.7 Company 6

- 10.8 Company 7

- 10.9 Company 8

- 10.10 Company 9

- 10.11 Company 10 and more

"*Financials would be provided on a best efforts basis for private companies"