|

|

市場調査レポート

商品コード

1660975

フォトレジストとフォトレジスト補助材料の市場レポート:フォトレジストの種類別、フォトレジスト補助材料タイプ別、用途別、地域別、2025年~2033年Photoresist and Photoresist Ancillaries Market Report by Photoresist Type, Photoresist Ancillaries Type, Application, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| フォトレジストとフォトレジスト補助材料の市場レポート:フォトレジストの種類別、フォトレジスト補助材料タイプ別、用途別、地域別、2025年~2033年 |

|

出版日: 2025年02月10日

発行: IMARC

ページ情報: 英文 137 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

フォトレジストとフォトレジスト補助材料の市場の世界市場規模は2024年に41億米ドルに達しました。今後、IMARC Groupは、2033年には58億米ドルに達し、2025-2033年の成長率(CAGR)は3.78%になると予測しています。家庭用電子機器需要の増加、半導体製造における継続的な技術進歩、デバイスの小型化という新たな動向は、市場を牽引する重要な要因のひとつです。

家庭用電子機器の需要増加が市場成長を加速

フォトレジストとフォトレジスト補助材料の市場は継続的な成長を遂げています。先端電子機器の需要増加に伴い、半導体の需要も同時に増加しています。フォトレジストとフォトレジスト補助材料は、半導体製造プロセス、特にこれらのデバイスの動力源となるマイクロチップの製造において重要なコンポーネントです。その結果、スマートフォン、ノートパソコン、タブレット端末、その他の電子機器の需要増に対応して、フォトレジストとフォトレジスト補助材料の需要は今後も増加すると予想され、これが市場の成長を牽引しています。

本レポートでは、市場構造、主要企業による市場シェア、主要企業の市況分析、主要成功戦略、競合ダッシュボード、企業評価象限などの競合分析を網羅しています。また、主要企業の詳細プロファイルも掲載しています。市場構造は、少数の主要企業がシェアの大半を占める集中型です。フォトレジストとフォトレジスト補助材料業界では、製品の差別化が進んでいること、原材料サプライヤーの数が少ないこと、初期投資が高額であることから、新規参入企業の数は少ないです。

フォトレジストとフォトレジスト補助材料とは?

フォトレジストとは、フォトリソグラフィーの工程で光に当たると化学変化を起こす感光性材料のことで、基板(通常はシリコン・ウエハー)上にパターンを形成する技術です。レジストの化学的性質により、ポジ型とネガ型があります。フォトレジスト補助剤には、接着促進剤、エッジビード除去剤、プライマー、反射防止コーティング剤などがあり、フォトレジストの性能を向上させたり、フォトリソグラフィーを容易にするために、フォトレジストとともに使用されます。光を照射すると、フォトレジスト材料は化学変化を起こし、現像液に溶かしてパターン化された基板を現出させることができます。マイクロエレクトロニックデバイス、MEMS、その他の微細構造を作成するために、フォトレジストは基板上にパターンを形成するために使用され、エッジビーズ除去剤は、その後の処理工程に支障をきたす可能性のある、基板エッジの余分なフォトレジストを除去するために使用されます。

COVID-19の影響:

COVID-19の大流行は、フォトレジストとフォトレジスト補助材料業界に深刻な問題を引き起こし、多くの面で前例のない課題を課しました。製造に必要な主要原材料の輸入に関しては、世界の危機により、必要な原材料の入手に課題が生じた。サプライチェーンは封鎖措置により影響を受け、一時的な生産停止はプロジェクトの遅延や工程の中断を引き起こしました。ロジスティクスプロバイダーは、特に国境を越えた商品輸送の課題に直面し、メーカーも部品不足に直面しました。しかし、パンデミック後の世界市場は安定した成長を続けており、大手企業は製品需要に対応するため、政府の指示に従って生産設備を調整しています。

フォトレジストとフォトレジスト補助材料の市場の動向:

フォトレジストとフォトレジスト補助材料の市場の主な原動力は、フラットパネルディスプレイや家電製品での広範な使用です。この背景には、電気・電子機器の製造における継続的な技術進歩があります。さらに、電子デバイスの小型化傾向の高まりが、より小型で効率的な半導体やICの製造に必要なフォトレジストとフォトレジスト補助材料の需要増につながり、市場に弾みをつけています。高度な半導体やICを必要とするIoTデバイスの結果として、モノのインターネット(IoT)の利用が増加していることも、市場に有利な機会を生み出しています。さらに、医療機器や装置の製造における数々のイノベーションが市場を牽引しています。これとは別に、太陽電池の製造におけるフォトレジストとフォトレジスト補助材料の急速な利用につながる、ソーラーパネルなどの再生可能エネルギー技術に対する需要の増大も、市場を活性化しています。さらに、主要企業が地理的プレゼンスを高めるために実施したM&A(合併・買収)、提携、協力といった数々の戦略も、重要な成長促進要因として作用しています。その他の市場拡大要因としては、急速な都市化と工業化、可処分所得水準の新興国市場、自律走行車とコネクテッドカーの出現、広範な研究開発活動などが挙げられます。

本レポートで扱う主な質問

- 世界のフォトレジストとフォトレジスト補助材料の市場の市場規模は?

- 2025-2033年における世界のフォトレジストとフォトレジスト補助材料の市場の予想成長率は?

- 世界のフォトレジストとフォトレジスト補助材料の市場を牽引する主要因は何か?

- 世界のフォトレジストとフォトレジスト補助材料の市場に対するCOVID-19の影響は?

- 世界のフォトレジストとフォトレジスト補助材料の市場のフォトレジストタイプ別内訳は?

- 世界のフォトレジストとフォトレジスト補助材料の市場のフォトレジスト補助材料タイプによる内訳は?

- 世界のフォトレジストとフォトレジスト補助材料の市場の用途別内訳は?

- 世界のフォトレジストとフォトレジスト補助材料の市場における主要地域は?

- 世界のフォトレジストとフォトレジスト補助材料の市場における主要企業は?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

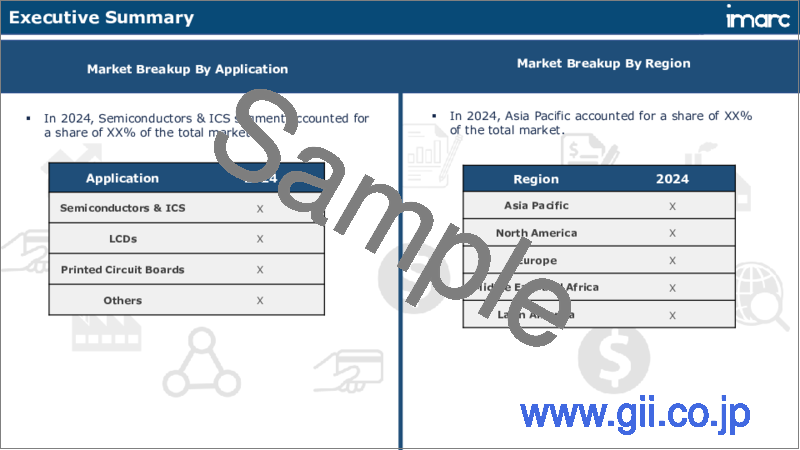

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のフォトレジストとフォトレジスト補助材料市場

- 市場概要

- 市場実績

- COVID-19の影響

- 価格分析

- 市場内訳:フォトレジストの種類別

- 市場内訳:フォトレジスト補助材料タイプ別

- 市場内訳:用途別

- 市場内訳:地域別

- 市場予測

- SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

- バリューチェーン分析

- 概要

- 研究開発

- 原材料調達

- 製造

- マーケティング

- 流通

- 最終用途

- ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第6章 フォトレジストとフォトレジスト補助材料の市場:フォレジストの種類別

- ArF液浸

- KrF

- ArFドライ

- GラインとIライン

第7章 フォトレジストとフォトレジスト補助材料の市場:フォトレジスト補助材料タイプ別

- 反射防止コーティング

- 除去剤

- 現像液

- その他

第8章 フォトレジストとフォトレジスト補助材料の市場:用途別

- 半導体およびICS

- LCDディスプレイ

- プリント基板

- その他

第9章 市場内訳:地域別

- アジア太平洋地域

- 北米

- 欧州

- 中東・アフリカ

- ラテンアメリカ

第10章 製造工程

- 製品概要

- 原材料要件

- 製造工程

- 主要成功要因とリスク要因

第11章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Tokyo Ohka Kogyo Co., Ltd.

- JSR Corporation

- DuPont de Nemours Inc.

- Shin-Etsu Chemical Co. Ltd.

- Fujifilm Electronics Materials Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Merck Az Electronics Materials

- Allresist GmbH

- Avantor Performance Materials, LLC

- Microchemicals GmbH

List of Figures

- Figure 1: Global: Photoresist and Photoresist Ancillaries Market: Major Drivers and Challenges

- Figure 2: Global: Photoresist and Photoresist Ancillaries Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Photoresist Market: Breakup by Type (in %), 2024

- Figure 4: Global: Photoresist Ancillaries Market: Breakup by Type (in %), 2024

- Figure 5: Global: Photoresist and Photoresist Ancillaries Market: Breakup by Application (in %), 2024

- Figure 6: Global: Photoresist and Photoresist Ancillaries Market: Breakup by Region (in %), 2024

- Figure 7: Global: Photoresist and Photoresist Ancillaries Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 8: Global: Photoresist and Photoresist Ancillaries Industry: SWOT Analysis

- Figure 9: Global: Photoresist and Photoresist Ancillaries Industry: Value Chain Analysis

- Figure 10: Global: Photoresist and Photoresist Ancillaries Industry: Porter's Five Forces Analysis

- Figure 11: Global: Photoresist (ArF Immersion) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 12: Global: Photoresist (ArF Immersion) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 13: Global: Photoresist (KrF) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 14: Global: Photoresist (KrF) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 15: Global: Photoresist (ArF Dry) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 16: Global: Photoresist (ArF Dry) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 17: Global: Photoresist (g- and i-line) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 18: Global: Photoresist (g- and i-line) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 19: Global: Photoresist Ancillaries (Anti-Reflective Coatings) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 20: Global: Photoresist Ancillaries (Anti-Reflective Coatings) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 21: Global: Photoresist Ancillaries (Remover) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 22: Global: Photoresist Ancillaries (Remover) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 23: Global: Photoresist Ancillaries (Developer) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 24: Global: Photoresist Ancillaries (Developer) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 25: Global: Photoresist Ancillaries (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 26: Global: Photoresist Ancillaries (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 27: Global: Photoresist and Photoresist Ancillaries (Applications in Semiconductors & ICS) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 28: Global: Photoresist and Photoresist Ancillaries (Applications in Semiconductors & ICS) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 29: Global: Photoresist and Photoresist Ancillaries (Applications in LCDs) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 30: Global: Photoresist and Photoresist Ancillaries (Applications in LCDs) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 31: Global: Photoresist and Photoresist Ancillaries (Applications in Printed Circuit Boards) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 32: Global: Photoresist and Photoresist Ancillaries (Applications in Printed Circuit Boards) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 33: Global: Photoresist and Photoresist Ancillaries (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 34: Global: Photoresist and Photoresist Ancillaries (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 35: Asia Pacific: Photoresist and Photoresist Ancillaries Market: Sales Value (in Million USD), 2019 & 2024

- Figure 36: Asia Pacific: Photoresist and Photoresist Ancillaries Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 37: North America: Photoresist and Photoresist Ancillaries Market: Sales Value (in Million USD), 2019 & 2024

- Figure 38: North America: Photoresist and Photoresist Ancillaries Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 39: Europe: Photoresist and Photoresist Ancillaries Market: Sales Value (in Million USD), 2019 & 2024

- Figure 40: Europe: Photoresist and Photoresist Ancillaries Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 41: Middle East and Africa: Photoresist and Photoresist Ancillaries Market: Sales Value (in Million USD), 2019 & 2024

- Figure 42: Middle East and Africa: Photoresist and Photoresist Ancillaries Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 43: Latin America: Photoresist and Photoresist Ancillaries Market: Sales Value (in Million USD), 2019 & 2024

- Figure 44: Latin America: Photoresist and Photoresist Ancillaries Market Forecast: Sales Value (in Million USD), 2025-2033

List of Tables

- Table 1: Global: Photoresist and Photoresist Ancillaries Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Photoresist Market Forecast: Breakup by Type (in Million USD), 2025-2033

- Table 3: Global: Photoresist Ancillaries Market Forecast: Breakup by Type (in Million USD), 2025-2033

- Table 4: Global: Photoresist and Photoresist Ancillaries Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 5: Global: Photoresist and Photoresist Ancillaries Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Photoresist and Photoresist Ancillaries Market: Competitive Structure

- Table 7: Global: Photoresist and Photoresist Ancillaries Market: Key Players

The global photoresist and photoresist ancillaries market size reached USD 4.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.78% during 2025-2033. The increasing demand for consumer electronics, continual technological advancements in semiconductor manufacturing and the emerging trend of device miniaturization represent some of the key factors driving the market.

The Increasing Demand for Consumer Electronic Devices is Accelerating the Market Growth

The photoresist and photoresist ancillaries market has been experiencing continuous growth. With the rise in demand for advanced electronic devices, there is a concurrent increase in demand for semiconductors. Photoresist and ancillaries is a critical component in the semiconductor manufacturing process, particularly in the production of microchips that power these devices. As a result, the demand for photoresist and ancillaries is expected to continue to rise in response to the increasing demand for smartphones, laptops, tablets, and other electronic devices, which is driving the growth of the market.

Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The market structure is concentrated with a small number of key players having majority of the share in the market. The volume of new entrants is low in the photoresist and photoresist ancillaries industry due to the high product differentiation, low number of raw material suppliers, and high initial investment.

What are Photoresist and Photoresist Ancillaries?

A photoresist is a light-sensitive material that undergoes a chemical change when exposed to light during the process of photolithography, which is a technique for creating patterns on a substrate, typically a silicon wafer. Depending on the chemistry of the resist, it can either be positive or negative. Photoresist ancillaries include adhesion promoters, edge bead removers, primers, and antireflective coatings, which are used in conjunction with photoresists to improve their performance or facilitate photolithography. Upon exposure to light, photoresist materials undergo a chemical change, and can be dissolved in a developer solution to reveal the patterned substrate. In order to create microelectronic devices, MEMS, or other microstructures, photoresists are used to create patterns on a substrate, while edge bead removers are used to remove excess photoresist from the substrate edges that can interfere with subsequent processing processes.

COVID-19 Impact:

The COVID-19 pandemic outbreak has caused a severe problem for the photoresist and photoresist ancillaries industry and imposed unprecedented challenges on numerous aspects. With regards to the imports of major raw materials required for manufacturing, the global crisis has resulted in challenges in obtaining necessary raw materials. Supply chains were impacted due to lockdown measures, with temporary production halts causing project delays and process disruptions. Logistics providers faced challenges in transporting goods, particularly across borders as well as manufacturers faced component shortages. However, the global market has been growing at a stable rate post-pandemic, and major companies have adjusted their production facilities in compliance with government directives to meet product demand.

Photoresist and Photoresist Ancillaries Market Trends:

The photoresist and photoresist ancillaries market is primarily driven by the widespread usage in flat-panel displays and consumer electronics. This can be attributed to the continual technological advancements in the manufacturing of electrical and electronics devices. Additionally, the growing trend of miniaturization of electronic devices leading to an increased demand for photoresists and ancillaries for the manufacturing of smaller and more efficient semiconductors and ICs is providing an impetus to the market. The rising usage of the Internet of Things (IoT) resulting in IoT devices requiring advanced semiconductors and ICs is also creating lucrative opportunities in the market. The market is further driven by the numerous innovations in the manufacturing of medical devices and equipment. Apart from this, the augmenting demand for renewable energy technologies, such as solar panels, leading to the rapid utilization of photoresist and photoresist ancillaries in the production of solar cells is also fueling the market. Furthermore, numerous strategies such as merger and acquisitions (M&As), partnerships and collaborations conducted by key players to enhance their geographical presence are also acting as a significant growth-inducing factor. Some of the other factors contributing to the market include rapid urbanization and industrialization, inflating disposable income levels, the advent of autonomous and connected vehicles, and extensive research and development (R&D) activities.

Key Market Segmentation:

Photoresist Type Insights:

- ArF Immersion

- KrF

- ArF Dry

- g- and i-line

Photoresist Ancillaries Type Insights:

- Anti-Reflective Coatings

- Remover

- Developer

- Others

Application Insights:

- Semiconductors & ICS

- LCDs

- Printed Circuit Boards

- Others

Regional Insights:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

- The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, North America, Europe, the Middle East and Africa and Latin America. According to the report, Asia Pacific was the largest market for photoresist and photoresist ancillaries. Some of the factors driving the Asia Pacific photoresist and photoresist ancillaries market included the presence of several key players, emerging trend of device miniaturization, advent of autonomous and connected vehicles due to the rapid expansion of automotive industry and a higher uptake of consumer electronic devices.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global photoresist and photoresist ancillaries market. Some of the companies covered in the report include:

- Tokyo Ohka Kogyo Co., Ltd.

- JSR Corporation

- DuPont de Nemours Inc.

- Shin-Etsu Chemical Co. Ltd.

- Fujifilm Electronics Materials Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Merck Az Electronics Materials

- Allresist GmbH

- Avantor Performance Materials, LLC

- Microchemicals GmbH

Key Questions Answered in This Report

- 1.How big is the global photoresist and photoresist ancillaries market?

- 2.What is the expected growth rate of the global photoresist and photoresist ancillaries market during 2025-2033?

- 3.What are the key factors driving the global photoresist and photoresist ancillaries market?

- 4.What has been the impact of COVID-19 on the global photoresist and photoresist ancillaries market?

- 5.What is the breakup of the global l photoresist and photoresist ancillaries market based on the photoresist type?

- 6.What is the breakup of the global photoresist and photoresist ancillaries market based on the photoresist ancillaries type?

- 7.What is the breakup of the global photoresist and photoresist ancillaries market based on the application?

- 8.What are the key regions in the global photoresist and photoresist ancillaries market?

- 9.Who are the key players/companies in the global photoresist and photoresist ancillaries market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Photoresist and Photoresist Ancillaries Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Price Analysis

- 5.5 Market Breakup by Photoresist Type

- 5.6 Market Breakup by Photoresist Ancillaries Type

- 5.7 Market Breakup by Application

- 5.8 Market Breakup by Region

- 5.9 Market Forecast

- 5.10 SWOT Analysis

- 5.10.1 Overview

- 5.10.2 Strengths

- 5.10.3 Weaknesses

- 5.10.4 Opportunities

- 5.10.5 Threats

- 5.11 Value Chain Analysis

- 5.11.1 Overview

- 5.11.2 Research and Development

- 5.11.3 Raw Material Procurement

- 5.11.4 Manufacturing

- 5.11.5 Marketing

- 5.11.6 Distribution

- 5.11.7 End-Use

- 5.12 Porters Five Forces Analysis

- 5.12.1 Overview

- 5.12.2 Bargaining Power of Buyers

- 5.12.3 Bargaining Power of Suppliers

- 5.12.4 Degree of Competition

- 5.12.5 Threat of New Entrants

- 5.12.6 Threat of Substitutes

6 Photoresist Market Breakup by Type

- 6.1 ArF Immersion

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 KrF

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 ArF Dry

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 g- and i-line

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

7 Photoresist Ancillaries Market Breakup by Type

- 7.1 Anti-Reflective Coatings

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Remover

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Developer

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Others

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

8 Photoresist and Photoresist Ancillaries Market: Breakup by Application

- 8.1 Semiconductors & ICS

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 LCDs

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Printed Circuit Boards

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Others

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

9 Market Breakup by Region

- 9.1 Asia Pacific

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 North America

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 Europe

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Middle East and Africa

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

- 9.5 Latin America

- 9.5.1 Market Trends

- 9.5.2 Market Forecast

10 Manufacturing Process

- 10.1 Product Overview

- 10.2 Raw Material Requirements

- 10.3 Manufacturing Process

- 10.4 Key Success and Risk Factors

11 Competitive Landscape

- 11.1 Market Structure

- 11.2 Key Players

- 11.3 Profiles of Key Players

- 11.3.1 Tokyo Ohka Kogyo Co., Ltd.

- 11.3.2 JSR Corporation

- 11.3.3 DuPont de Nemours Inc.

- 11.3.4 Shin-Etsu Chemical Co. Ltd.

- 11.3.5 Fujifilm Electronics Materials Co., Ltd.

- 11.3.6 Sumitomo Chemical Co., Ltd.

- 11.3.7 Merck Az Electronics Materials

- 11.3.8 Allresist GmbH

- 11.3.9 Avantor Performance Materials, LLC

- 11.3.10 Microchemicals GmbH