|

|

市場調査レポート

商品コード

1800857

分散アンテナシステム市場レポート:提供、システムタイプ、範囲、技術、最終用途、地域別、2025年~2033年Distributed Antenna System Market Report by Offering, System Type, Coverage, Technology, End Use, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 分散アンテナシステム市場レポート:提供、システムタイプ、範囲、技術、最終用途、地域別、2025年~2033年 |

|

出版日: 2025年08月01日

発行: IMARC

ページ情報: 英文 119 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

分散アンテナシステムの世界市場規模は2024年に159億米ドルに達しました。今後、IMARC Groupは、2033年には348億米ドルに達し、2025~2033年の成長率(CAGR)は10.26%になると予測しています。データ利用の増加とマルチオペレータリソースの展開が、市場全体の成長を後押ししています。

分散アンテナシステム市場動向:

接続性向上への需要

スタジアム、空港、ショッピングモール、複合ビジネス施設などの増加により、接続性の向上に対する需要が高まっており、これが市場を後押ししています。さらに、十分なカバレッジと容量を提供することから、従来のシングルアンテナシステムからDASへと好みがシフトしていることも、大きな成長促進要因となっています。例えば、2024年2月、アッシュビル・リージョナル空港の当局は、新たに生まれつつある空港とその周辺で次世代5G接続を提供するため、米国で最も優れた中立的ホスト・プロバイダとしてボルディン・ネットワークスを選択しました。さらに、このシステムは、複数のアンテナに負荷を分散させることで、データ速度の低下、通話の切断、全体的な接続性の低下など、さまざまな課題を軽減し、より信頼性の高い高品質のカバレッジを提供することで、ユーザー体験を向上させることができます。これは、分散アンテナシステム市場の最近のビジネスチャンスの1つとなっています。例えば、2023年8月、情報通信技術ソリューションの世界の大手プロバイダーの1つであるZTE Corporationは、China Mobileの浙江支店およびChina Mobile Research Instituteと共同で、杭州で開催された第19回アジア競技大会のサイクリング競技場で、無線ネットワークのカバレッジ品質を高めるための5G-A Reconfigurable Intelligent Surface(RIS)の適用検証に成功しました。これとは別に、スマートフォンやその他の無線デバイスの普及が、予測期間中の市場の活性化につながると予想されます。例えば、2023年4月、Zinwave(Wilson Electronics, LLC)は改良型5Gセルラーネットワークスキャナーの開発を発表しました。このスキャナーを使えば、ユーザーはどのタワーでもピンポイントで信号品質、キャリア、強度、バンド、周波数などを知ることができます。

拡大するスマートインフラ

自動化の新たな動向やスマートホームの人気の高まりにより、IoTデバイスの利用が増加しており、新たな無線接続の必要性が高まっています。DASは、データの安全かつシームレスな伝送を保証することによって、これらのIoTデバイスをサポートするために必要なネットワークバックボーンを提供することができ、これが分散アンテナシステム市場の需要を増大させています。例えば、2023年10月、各国のLoRaWANネットワークの最大手ネットワーク事業者の1つであるEverynetは、AWS IoT Coreを介して長距離広域ネットワーク(LoRaWAN)への接続アクセスを提供しました。これとは別に、デジタル統合の高まりも市場を強化しています。例えば、2023年11月、非地上ネットワーク(NTN)サービスプロバイダーの1つであるSkylo Technologiesと衛星通信会社のViasatは、世界D2D(Direct-to-Device)ネットワークの導入を発表しました。さらに、スマートホームの普及により、シームレスな通信へのニーズが高まっており、これが市場の強化につながっています。例えば、リライアンス・ジオはJioFiberネットワークを通じてスマートホーム・ソリューションを提供しており、多数のスマートホーム・デバイスと手動でペアリングすることができます。これに伴い、2024年2月、バルセロナで開催されたMWC 2024において、ファーウェイ光ビジネス製品ラインのプレジデントであるボブ・チェンは、全光学スマートホーム向けのファーウェイiFTTR OptiXstar F50シリーズを正式に発表しました。これは、より多くのスマートホームアプリケーションをサポートすることで、事業者がユーザーにより多様なスマートホームサービスを提供できるようにするものです。さらに、スマートシティ構想の立ち上げは、日常業務において公衆Wi-Fiとセルラーネットワークに広く依存しており、これが分散アンテナシステム市場の見通しをさらに明るいものにしています。例えば、NECの子会社であるNECコーポレーション・インディアは、2023年8月にティルパティでスマートシティプロジェクトを開始しました。このプロジェクトでNECインディアは、統合サービスなどのICTソリューションを統合コマンド・コントロール・センターとともに導入し、リアルタイム・データ分析と都市全体の双方向通信を促進しました。

公共安全への関心の高まり

政府機関は、緊急サービスのための強固な通信システムの確立に注力しており、これが市場全体に貢献しています。これに加えて、規制当局による厳格な規制の実施により、大規模な改修プロジェクトや新しい建物へのDAS設置が義務付けられており、潜在的な不感地帯を含む施設内の全エリアで救急隊員が通信を維持できるようになっていることが、市場を刺激しています。例えば、2023年11月、アバリ・ワイヤレスはトロント交通委員会(TTC)向けに分散型アンテナ・システム(DAS)を供給する入札を受け、TTCの地下鉄地下システム区間で無線通信を提供することになりました。さらに、DASと既存の公共安全通信システムとの統合が進んでいることも、分散アンテナシステム市場の収益を押し上げています。例えば、2023年9月、インド国道庁(NHAI)はERSモバイルアプリを立ち上げ、路上ユニットへの派遣情報を最適化することで、迅速な支援を求める緊急通報への迅速な対応を実現しています。このほか、接続性と安全性を強化するためにDASを設置する利点に対する不動産所有者や管理者の意識の高まりが、今後数年間の市場を牽引すると予想されます。例えば、MCAを含む企業は、現場接続、双方向無線、無線信号強化システムを必要とする不動産開発業者や建設業者に、専門的に調整された通信ソリューションを提供しています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

第5章 世界の分散アンテナシステム市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:提供別

- コンポーネント

- サービス

第7章 市場内訳:システムタイプ別

- アクティブ

- パッシブ

- デジタル

- ハイブリッド

第8章 市場内訳:範囲別

- 屋内

- 屋外

第9章 市場内訳:技術別

- キャリアWi-Fi

- スモールセル

- 自己組織化ネットワーク

- その他

第10章 市場内訳:最終用途別

- 製造

- ヘルスケア

- 政府

- 輸送機関

- ホスピタリティ

- 公共の会場

- 教育

- 通信

- その他

第11章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

第12章 SWOT分析

第13章 バリューチェーン分析

第14章 ポーターのファイブフォース分析

第15章 価格指標

第16章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- American Tower Corporation

- Boingo Wireless Inc.

- Cobham Wireless

- Comba Telecom Systems Holdings

- CommScope Inc.

- Corning Incorporated

- Dali Wireless Inc.

- TE Connectivity

- Westell Technologies Inc.

- Zinwave(Wilson Electronics, LLC)

List of Figures

- Figure 1: Global: Distributed Antenna System Market: Major Drivers and Challenges

- Figure 2: Global: Distributed Antenna System Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Distributed Antenna System Market: Breakup by Offering (in %), 2024

- Figure 4: Global: Distributed Antenna System Market: Breakup by System Type (in %), 2024

- Figure 5: Global: Distributed Antenna System Market: Breakup by Coverage (in %), 2024

- Figure 6: Global: Distributed Antenna System Market: Breakup by Technology (in %), 2024

- Figure 7: Global: Distributed Antenna System Market: Breakup by End-Use (in %), 2024

- Figure 8: Global: Distributed Antenna System Market: Breakup by Region (in %), 2024

- Figure 9: Global: Distributed Antenna System Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 10: Global: Distributed Antenna System (Components) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: Distributed Antenna System (Components) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: Distributed Antenna System (Services) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Distributed Antenna System (Services) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Distributed Antenna System (Active) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Distributed Antenna System (Active) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Distributed Antenna System (Passive) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Distributed Antenna System (Passive) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Distributed Antenna System (Digital) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Distributed Antenna System (Digital) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Distributed Antenna System (Hybrid) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Distributed Antenna System (Hybrid) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Distributed Antenna System (Indoor) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Distributed Antenna System (Indoor) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Distributed Antenna System (Outdoor) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Distributed Antenna System (Outdoor) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: Distributed Antenna System (Carrier Wi-Fi) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: Distributed Antenna System (Carrier Wi-Fi) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Global: Distributed Antenna System (Small Cells) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Global: Distributed Antenna System (Small Cells) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: Global: Distributed Antenna System (Self-Organizing Network) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: Global: Distributed Antenna System (Self-Organizing Network) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: Global: Distributed Antenna System (Other Technologies) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: Global: Distributed Antenna System (Other Technologies) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: Global: Distributed Antenna System (Manufacturing) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: Global: Distributed Antenna System (Manufacturing) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: Global: Distributed Antenna System (Healthcare) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: Global: Distributed Antenna System (Healthcare) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: Global: Distributed Antenna System (Government) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: Global: Distributed Antenna System (Government) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: Global: Distributed Antenna System (Transportation) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: Global: Distributed Antenna System (Transportation) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: Global: Distributed Antenna System (Hospitality) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: Global: Distributed Antenna System (Hospitality) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: Global: Distributed Antenna System (Public Venues) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: Global: Distributed Antenna System (Public Venues) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: Global: Distributed Antenna System (Education) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: Global: Distributed Antenna System (Education) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: Global: Distributed Antenna System (Telecommunication) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: Global: Distributed Antenna System (Telecommunication) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: Global: Distributed Antenna System (Other End-Uses) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: Global: Distributed Antenna System (Other End-Uses) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: North America: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: North America: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: United States: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: United States: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 56: Canada: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 57: Canada: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 58: Asia Pacific: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 59: Asia Pacific: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 60: China: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 61: China: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 62: Japan: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 63: Japan: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 64: India: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 65: India: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 66: South Korea: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 67: South Korea: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 68: Australia: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 69: Australia: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 70: Indonesia: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 71: Indonesia: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 72: Others: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 73: Others: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 74: Europe: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 75: Europe: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 76: Germany: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 77: Germany: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 78: France: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 79: France: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 80: United Kingdom: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 81: United Kingdom: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 82: Italy: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 83: Italy: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 84: Spain: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 85: Spain: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 86: Russia: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 87: Russia: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 88: Others: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 89: Others: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 90: Latin America: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 91: Latin America: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 92: Brazil: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 93: Brazil: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 94: Mexico: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 95: Mexico: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 96: Others: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 97: Others: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 98: Middle East and Africa: Distributed Antenna System Market: Sales Value (in Million USD), 2019 & 2024

- Figure 99: Middle East and Africa: Distributed Antenna System Market: Breakup by Country (in %), 2024

- Figure 100: Middle East and Africa: Distributed Antenna System Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 101: Global: Distributed Antenna System Industry: SWOT Analysis

- Figure 102: Global: Distributed Antenna System Industry: Value Chain Analysis

- Figure 103: Global: Distributed Antenna System Industry: Porter's Five Forces Analysis

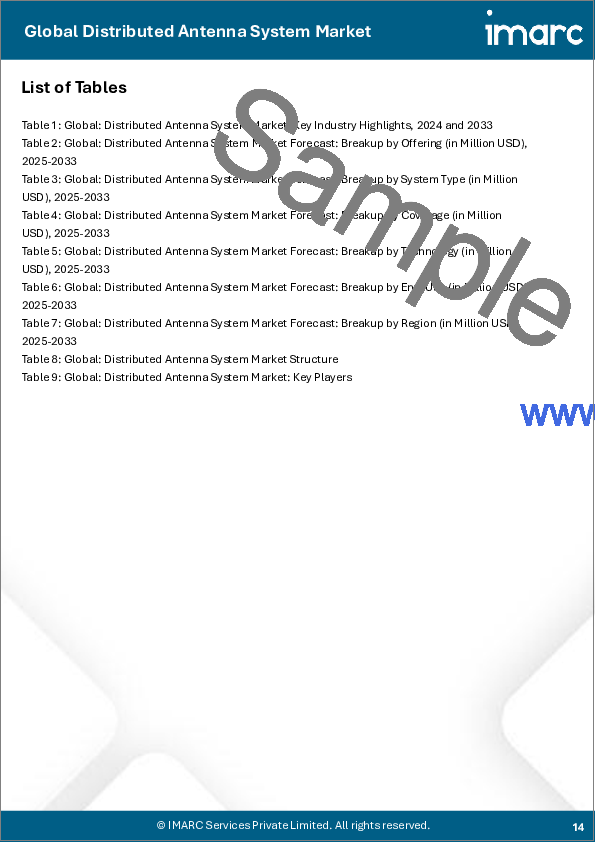

List of Tables

- Table 1: Global: Distributed Antenna System Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Distributed Antenna System Market Forecast: Breakup by Offering (in Million USD), 2025-2033

- Table 3: Global: Distributed Antenna System Market Forecast: Breakup by System Type (in Million USD), 2025-2033

- Table 4: Global: Distributed Antenna System Market Forecast: Breakup by Coverage (in Million USD), 2025-2033

- Table 5: Global: Distributed Antenna System Market Forecast: Breakup by Technology (in Million USD), 2025-2033

- Table 6: Global: Distributed Antenna System Market Forecast: Breakup by End-Use (in Million USD), 2025-2033

- Table 7: Global: Distributed Antenna System Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 8: Global: Distributed Antenna System Market Structure

- Table 9: Global: Distributed Antenna System Market: Key Players

The global distributed antenna system market size reached USD 15.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 34.8 Billion by 2033, exhibiting a growth rate (CAGR) of 10.26% during 2025-2033. The rising usage of data, along with the increasing deployment of multi-operator resources, is bolstering the overall market growth.

Distributed Antenna System Market Trends:

Demand for Improved Connectivity

The increasing number of stadiums, airports, shopping malls, business complexes, etc., is escalating the demand for enhanced connectivity, which is propelling the market. Moreover, the shifting preferences among these locations from traditional single-antenna systems towards DAS, as it offers adequate coverage and capacity, is acting as a significant growth-inducing factor. For example, in February 2024, authorities at the Asheville Regional Airport selected Boldyn Networks as the foremost neutral host provider in the U.S. to provide next-generation 5G connectivity in and around the new budding airports. Additionally, this system can alleviate various challenges, such as slow data speeds, dropped calls, overall poor connectivity, etc., by distributing the load across multiple antennas, thereby improving the user experience by offering more reliable and high-quality coverage. This, in turn, represents one of the distributed antenna system market recent opportunities. For instance, in August 2023, ZTE Corporation, one of the leading global providers of information and communication technology solutions, in collaboration with China Mobile's Zhejiang Branch and China Mobile Research Institute, completed the successful application verification of 5G-A Reconfigurable Intelligent Surface (RIS) at the cycling stadium for the 19th Asian Games in Hangzhou to enhance wireless network coverage quality. Apart from this, the widespread adoption of smartphones and other wireless devices is expected to fuel the market over the forecasted period. For example, in April 2023, Zinwave (Wilson Electronics, LLC) announced the development of an improved 5G cellular network scanner. It allows users to pinpoint any tower to learn signal quality, carrier, strength, band, frequency, etc.

Expanding Smart Infrastructures

The increasing usage of IoT devices, on account of the emerging trend of automation and the rising popularity of smart homes, is inflating the need for novel wireless connectivity. A DAS can provide the required network backbone to support these IoT devices by ensuring that data is transmitted securely and seamlessly, which is augmenting the distributed antenna system market demand. For instance, in October 2023, Everynet, one of the largest network operators across countries for national LoRaWAN networks, provided connectivity access to its long-range wide area network (LoRaWAN) via AWS IoT Core. Apart from this, the elevating digital integration is also bolstering the market. For example, in November 2023, Skylo Technologies, one of the non-terrestrial network (NTN) service providers, and Viasat, the satellite communications company, announced the introduction of a global direct-to-device (D2D) network. Furthermore, the widespread popularity of smart homes is escalating the need for seamless communications, which, in turn, is strengthening the market. For instance, Reliance Jio offers smart home solutions through the JioFiber network that can be paired with a host of smart home devices manually. In line with this, in February 2024, Bob Chen, President of Huawei Optical Business Product Line, officially launched the Huawei iFTTR OptiXstar F50 series for all-optical smart homes, during the MWC 2024 in Barcelona. It supports more smart home applications, thereby helping operators to provide more diversified smart home services to users. Moreover, the launch of smart city initiatives extensively relies on public Wi-Fi and cellular networks for daily operations, which is further creating a positive distributed antenna system market outlook. For example, in August 2023, NEC Corporation India, a subsidiary of NEC Corporation, launched the smart city project in Tirupati. Under this project, NEC India implemented ICT solutions, such as integrated services, along with a unified command and control center, to facilitate real-time data analysis and two-way communications throughout the city.

Increasing Public Safety Concerns

Government bodies are focusing on establishing robust communication systems for emergency services, which is contributing to the overall market. In addition to this, the implementation of stringent regulations by regulatory authorities that mandate the installation of DAS in significant renovation projects or new buildings to ensure that first responders can maintain communication in all areas of a facility, including potential dead zones, is impelling the market. For instance, in November 2023, Avari Wireless was given the tender to supply distributed antenna systems (DAS) for the Toronto Transit Commission (TTC) to offer radio communications coverage over a TTC underground subway system segment. Moreover, the rising integration of DAS with existing public safety communication systems is also elevating the distributed antenna system market revenue. For example, in September 2023, the National Highways Authority of India (NHAI) launched the ERS Mobile App to optimize dispatch information to on-road units, thereby ensuring swift responses to emergency calls for prompt assistance. Besides this, the growing awareness among property owners and managers towards the advantages of installing a DAS for enhanced connectivity and safety is expected to drive the market in the coming years. For instance, companies, including MCA, provide expertly tailored communications solutions to property developers and builders in need of job-site connectivity, two-way radios, and wireless signal enhancement systems.

Global Distributed Antenna System Market Segmentation:

Breakup by Offering:

- Components

- Services

Services account for the majority of the market share

The growth in this segmentation is propelled by the increasing number of activities, such as site surveys. Distributed antenna systems find extensive applications in sports arenas, commercial buildings, healthcare facilities, etc., which is acting as another significant growth-inducing factor. For instance, in March 2024, Samsung Electronics and O2 Telefonica announced the launch of their first Open RAN and virtualized RAN (vRAN) commercial site in Germany. It is the first time that Samsung's 5G vRAN solution is being utilized in a commercial network across the country. Moreover, the widespread adoption of 5G networks and the expanding Internet of Things (IoT) technologies are positively influencing the distributed antenna system market growth. For example, in December 2023, AT&T launched open and interoperable radio access networks (RAN) in the United States through collaboration with Ericsson.

Breakup by System Type

- Active

- Passive

- Digital

- Hybrid

Hybrid holds the largest share in the industry

Hybrid distributed antenna systems are gaining traction, as they allow for efficient signal distribution while maintaining signal quality over long distances. For example, Superior Essex Inc. produces indoor plenum fiber and copper hybrid cables for distributed antenna systems (DAS). The dual-cable design enables the transmission of communications while also providing power to DAS remote units. Apart from this, they are advantageous in scenarios where there are variations in signal frequencies, building structures, coverage needs, etc. For instance, in May 2024, TerraMaster introduced the D8 Hybrid, which offers an industry-unique 2+6 RAID hybrid storage configuration.

Breakup by Coverage:

- Indoor

- Outdoor

Indoor accounts for the largest distributed antenna system market share

The emergence of advanced technologies, such as 5G, is stimulating the adoption of indoor distributed antenna systems. Additionally, these systems are essential to ensure that consumers and businesses can experience the low latency and high-speed connectivity offered by the next-generation technology. Consequently, they are extensively utilized across the globe. For instance, in Mach 2019, Telewave developed an indoor DAS system for CBRS and IoT deployment. Moreover, in November 2023, Kajeet launched a neutral host private wireless platform aimed at offering indoor coverage using the General Authorized Access (GAA) unlicensed portion of the Citizens Broadband Radio Service (CBRS) spectrum band.

Breakup by Technology:

- Carrier Wi-Fi

- Small Cells

- Self-Organizing Network

- Others

Self-organizing network exhibits a clear dominance in the market

The increasing 4G LTE and 5G deployments that require continuous optimization, monitoring, and adjustments to deliver optimal performance are driving the segment's growth. Apart from this, the self-organizing network can identify areas of congestion or signal degradation, reconfigure the DAS system to address issues, analyze network performance data in real-time, etc., which is acting as another significant growth-inducing factor. Additionally, as per the distributed antenna system market statistics, the escalating demand for improved network reliability will continue to bolster the growth in the segmentation over the forecasted period. For example, in July 2023, Airtel Rwanda officially launched its 4G LTE Network, which is available to individuals, homes, and businesses across India. It became the first mobile network operator (MNO) in Rwanda to obtain its own 4G license, enabling the company to provide high-speed internet connectivity.

Breakup by End-Use:

- Manufacturing

- Healthcare

- Government

- Transportation

- Hospitality

- Public Venues

- Education

- Telecommunication

- Others

Public venues dominate the market

The rising usage of distributed antenna systems in public venues, as they assist in alleviating issues, such as slow data speed and dropped calls, is positively influencing the market. For example, in January 2024, Boingo Wireless, one of the total connectivity providers of Wi-Fi, cellular distributed antenna systems (DAS), and private networks, announced the successful deployment of the first-ever Wi-Fi 7 network at the Las Vegas Convention Center. Apart from this, the inflating installation of in-building public safety communication systems in such venues is projected to elevate the distributed antenna system market's recent price in the coming years. For instance, in September 2023, AT&T confirmed the successful completion of its public safety broadband network, FirstNet.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

The rising investments in advanced telecommunications infrastructures are stimulating the market in North America. For example, in August 2023, Adtran invested up to US$ 5 Million at its state-of-the-art manufacturing facility to increase the production capacity of advanced telecommunications equipment in the U.S. In line with this, in August 2023, Nokia partnered with Fabrinet, one of the global manufacturers of optical products, to produce multi-rate optical modules at the company's facility in California. Furthermore, the inflating use of wireless communication for both mission-critical operations and daily activities is also catalyzing the regional market. For instance, in March 2024, Cubic DTECH Mission Solutions, one of the recognized industry leaders in providing scalable, trusted, and intuitive edge compute and networking platforms, showcased its innovative Radio Over IP gateway systems during the International Wireless Communications Expo (IWCE) held at the Orange County Convention Center in Orlando, Florida. Besides this, the introduction of 5G networks with requirements for extensive small cell deployments and complex frequency bands is anticipated to stimulate the market in North America over the forecasted period. For example, in January 2024, Nokia developed the Nokia Federal Solutions (NFS), a dedicated unit that provides 5G private wireless, optical networking, and IP routing to the government bodies across the U.S.

Competitive Landscape:

Distributed antenna system market companies invest significantly in research and development to advance the technology. Moreover, they are continually innovating and expanding their product portfolios to cater to diverse customer needs. This includes developing new DAS hardware, software, and integrated solutions that offer better coverage, capacity, and scalability. Furthermore, DAS providers often tailor their solutions to specific industries or environments. They work closely with clients to design and implement customized DAS systems that address unique challenges, such as in-building coverage for healthcare facilities or large-scale stadiums. Also, leading players offer deployment and installation services to set up DAS systems in various settings, from commercial buildings and public venues to transportation hubs and residential complexes. They ensure the proper installation and integration of DAS components.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- American Tower Corporation

- Boingo Wireless Inc.

- Cobham Wireless

- Comba Telecom Systems Holdings

- CommScope Inc.

- Corning Incorporated

- Dali Wireless Inc.

- TE Connectivity

- Westell Technologies Inc.

- Zinwave (Wilson Electronics, LLC)

Key Questions Answered in This Report

- 1.How big is the distributed antenna system market?

- 2.What is the future outlook of distributed antenna system market?

- 3.What are the key factors driving the distributed antenna system market?

- 4.Which region accounts for the largest distributed antenna system market share?

- 5.Which are the leading companies in the global distributed antenna system market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Distributed Antenna System Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Offering

- 6.1 Components

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Services

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

7 Market Breakup by System Type

- 7.1 Active

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Passive

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Digital

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Hybrid

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

8 Market Breakup by Coverage

- 8.1 Indoor

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Outdoor

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

9 Market Breakup by Technology

- 9.1 Carrier Wi-Fi

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 Small Cells

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 Self-Organizing Network

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Others

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

10 Market Breakup by End-Use

- 10.1 Manufacturing

- 10.1.1 Market Trends

- 10.1.2 Market Forecast

- 10.2 Healthcare

- 10.2.1 Market Trends

- 10.2.2 Market Forecast

- 10.3 Government

- 10.3.1 Market Trends

- 10.3.2 Market Forecast

- 10.4 Transportation

- 10.4.1 Market Trends

- 10.4.2 Market Forecast

- 10.5 Hospitality

- 10.5.1 Market Trends

- 10.5.2 Market Forecast

- 10.6 Public Venues

- 10.6.1 Market Trends

- 10.6.2 Market Forecast

- 10.7 Education

- 10.7.1 Market Trends

- 10.7.2 Market Forecast

- 10.8 Telecommunication

- 10.8.1 Market Trends

- 10.8.2 Market Forecast

- 10.9 Others

- 10.9.1 Market Trends

- 10.9.2 Market Forecast

11 Market Breakup by Region

- 11.1 North America

- 11.1.1 United States

- 11.1.1.1 Market Trends

- 11.1.1.2 Market Forecast

- 11.1.2 Canada

- 11.1.2.1 Market Trends

- 11.1.2.2 Market Forecast

- 11.1.1 United States

- 11.2 Asia Pacific

- 11.2.1 China

- 11.2.1.1 Market Trends

- 11.2.1.2 Market Forecast

- 11.2.2 Japan

- 11.2.2.1 Market Trends

- 11.2.2.2 Market Forecast

- 11.2.3 India

- 11.2.3.1 Market Trends

- 11.2.3.2 Market Forecast

- 11.2.4 South Korea

- 11.2.4.1 Market Trends

- 11.2.4.2 Market Forecast

- 11.2.5 Australia

- 11.2.5.1 Market Trends

- 11.2.5.2 Market Forecast

- 11.2.6 Indonesia

- 11.2.6.1 Market Trends

- 11.2.6.2 Market Forecast

- 11.2.7 Others

- 11.2.7.1 Market Trends

- 11.2.7.2 Market Forecast

- 11.2.1 China

- 11.3 Europe

- 11.3.1 Germany

- 11.3.1.1 Market Trends

- 11.3.1.2 Market Forecast

- 11.3.2 France

- 11.3.2.1 Market Trends

- 11.3.2.2 Market Forecast

- 11.3.3 United Kingdom

- 11.3.3.1 Market Trends

- 11.3.3.2 Market Forecast

- 11.3.4 Italy

- 11.3.4.1 Market Trends

- 11.3.4.2 Market Forecast

- 11.3.5 Spain

- 11.3.5.1 Market Trends

- 11.3.5.2 Market Forecast

- 11.3.6 Russia

- 11.3.6.1 Market Trends

- 11.3.6.2 Market Forecast

- 11.3.7 Others

- 11.3.7.1 Market Trends

- 11.3.7.2 Market Forecast

- 11.3.1 Germany

- 11.4 Latin America

- 11.4.1 Brazil

- 11.4.1.1 Market Trends

- 11.4.1.2 Market Forecast

- 11.4.2 Mexico

- 11.4.2.1 Market Trends

- 11.4.2.2 Market Forecast

- 11.4.3 Others

- 11.4.3.1 Market Trends

- 11.4.3.2 Market Forecast

- 11.4.1 Brazil

- 11.5 Middle East and Africa

- 11.5.1 Market Trends

- 11.5.2 Market Breakup by Country

- 11.5.3 Market Forecast

12 SWOT Analysis

- 12.1 Overview

- 12.2 Strengths

- 12.3 Weaknesses

- 12.4 Opportunities

- 12.5 Threats

13 Value Chain Analysis

14 Porters Five Forces Analysis

- 14.1 Overview

- 14.2 Bargaining Power of Buyers

- 14.3 Bargaining Power of Suppliers

- 14.4 Degree of Competition

- 14.5 Threat of New Entrants

- 14.6 Threat of Substitutes

15 Price Indicators

16 Competitive Landscape

- 16.1 Market Structure

- 16.2 Key Players

- 16.3 Profiles of Key Players

- 16.3.1 American Tower Corporation

- 16.3.1.1 Company Overview

- 16.3.1.2 Product Portfolio

- 16.3.1.3 Financials

- 16.3.1.4 SWOT Analysis

- 16.3.2 Boingo Wireless Inc.

- 16.3.2.1 Company Overview

- 16.3.2.2 Product Portfolio

- 16.3.2.3 Financials

- 16.3.3 Cobham Wireless

- 16.3.3.1 Company Overview

- 16.3.3.2 Product Portfolio

- 16.3.4 Comba Telecom Systems Holdings

- 16.3.4.1 Company Overview

- 16.3.4.2 Product Portfolio

- 16.3.4.3 Financials

- 16.3.4.4 SWOT Analysis

- 16.3.5 CommScope Inc.

- 16.3.5.1 Company Overview

- 16.3.5.2 Product Portfolio

- 16.3.5.3 Financials

- 16.3.5.4 SWOT Analysis

- 16.3.6 Corning Incorporated

- 16.3.6.1 Company Overview

- 16.3.6.2 Product Portfolio

- 16.3.6.3 Financials

- 16.3.6.4 SWOT Analysis

- 16.3.7 Dali Wireless Inc.

- 16.3.7.1 Company Overview

- 16.3.7.2 Product Portfolio

- 16.3.8 TE Connectivity

- 16.3.8.1 Company Overview

- 16.3.8.2 Product Portfolio

- 16.3.8.3 Financials

- 16.3.8.4 SWOT Analysis

- 16.3.9 Westell Technologies Inc.

- 16.3.9.1 Company Overview

- 16.3.9.2 Product Portfolio

- 16.3.9.3 Financials

- 16.3.10 Zinwave (Wilson Electronics, LLC)

- 16.3.10.1 Company Overview

- 16.3.10.2 Product Portfolio

- 16.3.10.3 Financials

- 16.3.1 American Tower Corporation