|

|

市場調査レポート

商品コード

1702304

セラミドの市場規模、シェア、動向、予測:タイプ、プロセス、用途、地域別、2025年~2033年Ceramide Market Size, Share, Trends, and Forecast by Type, Process, Application, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| セラミドの市場規模、シェア、動向、予測:タイプ、プロセス、用途、地域別、2025年~2033年 |

|

出版日: 2025年04月01日

発行: IMARC

ページ情報: 英文 142 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

セラミドの世界市場規模は、2024年には4億1,230万米ドルとなりました。今後、IMARC Groupは、市場は2033年までに6億2,880万米ドルに達し、2025年から2033年にかけて4.56%のCAGRを示すと予測しています。現在、アジア太平洋地域が市場を独占しており、2024年には37.3%という大きな市場シェアを占めています。現在、アジア太平洋地域が最大のシェアを占めているのは、皮膚の健康に対する意識の高まり、強固な製造能力、政府の支援策、良好な人口動態によるものです。

セラミドは細胞膜に天然に存在する脂質で、スフィンゴシンアルコールと脂肪酸で構成されています。セラミドは、細胞の分化やアポトーシスに影響する様々な細胞プロセスを仲介するのに役立っています。その結果、肝脂肪症、肥満に伴う合併症、炎症の調節、障害脂肪酸の酸化に利用されています。さらに、慢性的な乾燥、環境要因、加齢、皮膚損傷によって引き起こされる様々な皮膚や髪の問題を治療するために、様々な化粧品やパーソナル製品の保湿剤として使用されています。

セラミドの市場動向:

湿疹や乾癬に悩む人の皮膚では、セラミドが著しく減少しています。したがって、飲酒や喫煙をする人の増加による湿疹や乾癬の有病率の上昇は、皮膚科学製品におけるセラミドの使用を促進する重要な要因の一つです。これに伴い、天然に存在するセラミドは加齢とともに減少するため、高齢人口の増加が、保水力を高め、肌の自然なバリアを回復させ、目に見える老化の兆候を抑えるセラミドベースの製品に対する需要を促進しています。さらに、動物性製品別を使用せずに合成生産されるため、ビーガン化粧品の新たな動向がセラミドの採用にプラスの影響を与えています。これに加えて、糖尿病は世界の主要死因の一つであるため、製薬業界ではセラミドの利用が増加しています。さらに、セラミドは、インスリン抵抗性、B細胞アポトーシスの誘導、インスリン遺伝子発現の減少において重要な役割を果たしており、糖尿病とその合併症を管理するための潜在的な治療標的の特定に役立っています。これとは別に、個人間の健康意識の高まりにより、セラミドはより健康的な生活を促進するサプリメントに広く使用されています。

本レポートで扱う主な質問

- セラミドの市場の市場規模は?

- セラミドの市場の将来展望は?

- セラミドの市場を牽引する主な要因は何か?

- セラミドの市場のシェアが最も高い地域は?

- 世界のセラミドの市場の主要企業は?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

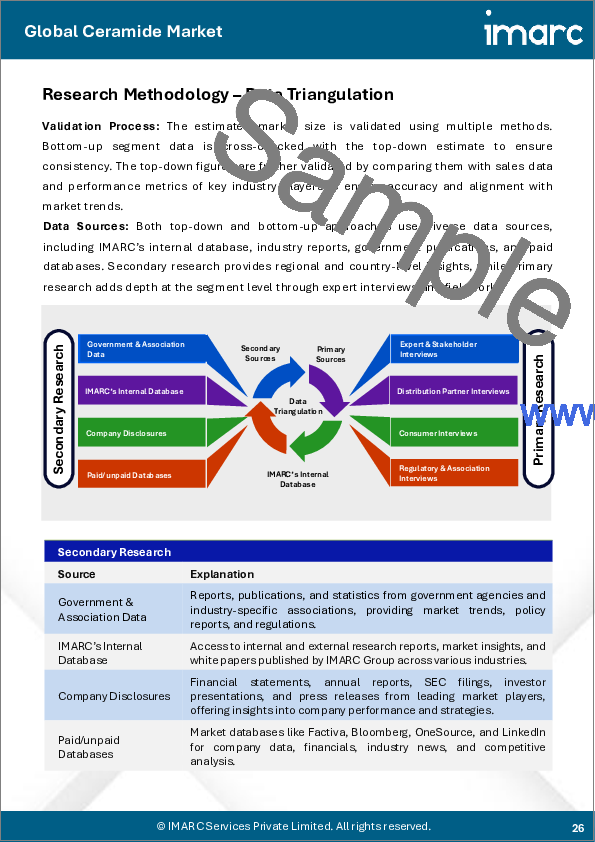

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のセラミド市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:タイプ別

- 天然

- 合成

第7章 市場内訳:プロセス別

- 発酵セラミド

- 植物エキスセラミド

第8章 市場内訳:用途別

- 化粧品

- 食品

- その他

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 市場内訳:国別

第10章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Air Liquide S.A.

- Anderson Global Group LLC

- Arkema S.A.

- Ashland Inc.

- Cayman Chemical Company

- Croda International Plc

- Evonik Industries AG

- Incospharm Corporation

- Jarchem Industries Inc.

- Kao Corporation

- Toyobo Co. Ltd.

- Vantage Specialty Chemicals

List of Figures

- Figure 1: Global: Ceramide Market: Major Drivers and Challenges

- Figure 2: Global: Ceramide Market: Sales Value (in Million USD), 2019-2024

- Figure 3: Global: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 4: Global: Ceramide Market: Breakup by Type (in %), 2024

- Figure 5: Global: Ceramide Market: Breakup by Process (in %), 2024

- Figure 6: Global: Ceramide Market: Breakup by Application (in %), 2024

- Figure 7: Global: Ceramide Market: Breakup by Region (in %), 2024

- Figure 8: Global: Ceramide (Natural) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 9: Global: Ceramide (Natural) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 10: Global: Ceramide (Synthetic) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: Ceramide (Synthetic) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: Ceramide (Fermentation Ceramides) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Ceramide (Fermentation Ceramides) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Ceramide (Plant Extract Ceramides) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Ceramide (Plant Extract Ceramides) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Ceramide (Cosmetics) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Ceramide (Cosmetics) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Ceramide (Food) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Ceramide (Food) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Ceramide (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Ceramide (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: North America: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: North America: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: United States: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: United States: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Canada: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Canada: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Asia-Pacific: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Asia-Pacific: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: China: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: China: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: Japan: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: Japan: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: India: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: India: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: South Korea: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: South Korea: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: Australia: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: Australia: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: Indonesia: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: Indonesia: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: Others: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: Others: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: Europe: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: Europe: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: Germany: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: Germany: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: France: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: France: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: United Kingdom: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: United Kingdom: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: Italy: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: Italy: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: Spain: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: Spain: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 56: Russia: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 57: Russia: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 58: Others: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 59: Others: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 60: Latin America: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 61: Latin America: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 62: Brazil: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 63: Brazil: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 64: Mexico: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 65: Mexico: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 66: Others: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 67: Others: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 68: Middle East and Africa: Ceramide Market: Sales Value (in Million USD), 2019 & 2024

- Figure 69: Middle East and Africa: Ceramide Market: Breakup by Country (in %), 2024

- Figure 70: Middle East and Africa: Ceramide Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 71: Global: Ceramide Industry: SWOT Analysis

- Figure 72: Global: Ceramide Industry: Value Chain Analysis

- Figure 73: Global: Ceramide Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Ceramide Market: Key Industry Highlights, 2024 & 2033

- Table 2: Global: Ceramide Market Forecast: Breakup by Type (in Million USD), 2025-2033

- Table 3: Global: Ceramide Market Forecast: Breakup by Process (in Million USD), 2025-2033

- Table 4: Global: Ceramide Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 5: Global: Ceramide Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Ceramide Market: Competitive Structure

- Table 7: Global: Ceramide Market: Key Players

The global ceramide market size was valued at USD 412.3 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 628.8 Million by 2033, exhibiting a CAGR of 4.56% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of 37.3% in 2024. At present, Asia Pacific holds the largest ceramide market share owing to increasing awareness for skin health, robust manufacturing capabilities, supportive government initiatives, and favorable demographics.

Ceramides are lipids found naturally in cell membranes and composed of sphingosine alcohol with fatty acids. They aid in mediating various cellular processes affecting cell differentiation and apoptosis. As a result, they are utilized in liver steatosis, obesity-associated comorbidities, regulating inflammation, and oxidizing impaired fatty acid. Moreover, they are used as a moisturizing agent in various cosmetic and personal products to help treat different skin and hair problems caused by chronic dryness, environmental factors, aging, and skin damage.

Ceramide Market Trends:

Individuals who suffer from eczema and psoriasis have a significant reduction of ceramides in their skin. Thus, the rising prevalence of eczema and psoriasis on account of the increasing number of people that drink and smoke represents one of the key factors catalyzing the usage of ceramides in dermatological products. In line with this, as naturally occurring ceramides decline with age, the growing geriatric population is driving the demand for ceramide-based products to improve water retention, restore the skin's natural barrier, and reduce the visible signs of aging. Additionally, the emerging trend of vegan cosmetics is positively influencing the adoption of ceramides as they are synthetically produced without the use of animal byproducts. Besides this, as diabetes mellitus is one of the leading causes of death worldwide, there is a rise in the utilization of ceramides in the pharmaceutical industry. Furthermore, ceramides play a significant role in insulin resistance, induction of B-cell apoptosis, and the reduction of insulin gene expression, which assists in identifying potential therapeutic targets for managing diabetes mellitus and its complications. Apart from this, due to rising health consciousness among individuals, ceramides are widely being used in supplements that promote a healthier life.

Key Market Segmentation:

Breakup by Type:

- Natural

- Synthetic

Breakup by Process:

- Fermentation Ceramides

- Plant Extract Ceramides

Breakup by Application:

- Cosmetics

- Food

- Others

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players being Air Liquide S.A., Anderson Global Group LLC, Arkema S.A., Ashland Inc., Cayman Chemical Company, Croda International Plc, Evonik Industries AG, Incospharm Corporation, Jarchem Industries Inc., Kao Corporation, Toyobo Co. Ltd. and Vantage Specialty Chemicals.

Key Questions Answered in This Report

- 1.How big is the ceramide market?

- 2.What is the future outlook of the ceramide market?

- 3.What are the key factors driving the ceramide market?

- 4.Which region accounts for the largest ceramide market share?

- 5.Which are the leading companies in the global ceramide market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Ceramide Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Type

- 6.1 Natural

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Synthetic

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

7 Market Breakup by Process

- 7.1 Fermentation Ceramides

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Plant Extract Ceramides

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

8 Market Breakup by Application

- 8.1 Cosmetics

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Food

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Others

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 United States

- 9.1.1.1 Market Trends

- 9.1.1.2 Market Forecast

- 9.1.2 Canada

- 9.1.2.1 Market Trends

- 9.1.2.2 Market Forecast

- 9.1.1 United States

- 9.2 Asia-Pacific

- 9.2.1 China

- 9.2.1.1 Market Trends

- 9.2.1.2 Market Forecast

- 9.2.2 Japan

- 9.2.2.1 Market Trends

- 9.2.2.2 Market Forecast

- 9.2.3 India

- 9.2.3.1 Market Trends

- 9.2.3.2 Market Forecast

- 9.2.4 South Korea

- 9.2.4.1 Market Trends

- 9.2.4.2 Market Forecast

- 9.2.5 Australia

- 9.2.5.1 Market Trends

- 9.2.5.2 Market Forecast

- 9.2.6 Indonesia

- 9.2.6.1 Market Trends

- 9.2.6.2 Market Forecast

- 9.2.7 Others

- 9.2.7.1 Market Trends

- 9.2.7.2 Market Forecast

- 9.2.1 China

- 9.3 Europe

- 9.3.1 Germany

- 9.3.1.1 Market Trends

- 9.3.1.2 Market Forecast

- 9.3.2 France

- 9.3.2.1 Market Trends

- 9.3.2.2 Market Forecast

- 9.3.3 United Kingdom

- 9.3.3.1 Market Trends

- 9.3.3.2 Market Forecast

- 9.3.4 Italy

- 9.3.4.1 Market Trends

- 9.3.4.2 Market Forecast

- 9.3.5 Spain

- 9.3.5.1 Market Trends

- 9.3.5.2 Market Forecast

- 9.3.6 Russia

- 9.3.6.1 Market Trends

- 9.3.6.2 Market Forecast

- 9.3.7 Others

- 9.3.7.1 Market Trends

- 9.3.7.2 Market Forecast

- 9.3.1 Germany

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.1.1 Market Trends

- 9.4.1.2 Market Forecast

- 9.4.2 Mexico

- 9.4.2.1 Market Trends

- 9.4.2.2 Market Forecast

- 9.4.3 Others

- 9.4.3.1 Market Trends

- 9.4.3.2 Market Forecast

- 9.4.1 Brazil

- 9.5 Middle East and Africa

- 9.5.1 Market Trends

- 9.5.2 Market Breakup by Country

- 9.5.3 Market Forecast

10 SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 Air Liquide S.A.

- 14.3.1.1 Company Overview

- 14.3.1.2 Product Portfolio

- 14.3.1.3 Financials

- 14.3.1.4 SWOT Analysis

- 14.3.2 Anderson Global Group LLC

- 14.3.2.1 Company Overview

- 14.3.2.2 Product Portfolio

- 14.3.3 Arkema S.A.

- 14.3.3.1 Company Overview

- 14.3.3.2 Product Portfolio

- 14.3.3.3 Financials

- 14.3.3.4 SWOT Analysis

- 14.3.4 Ashland Inc.

- 14.3.4.1 Company Overview

- 14.3.4.2 Product Portfolio

- 14.3.4.3 Financials

- 14.3.4.4 SWOT Analysis

- 14.3.5 Cayman Chemical Company

- 14.3.5.1 Company Overview

- 14.3.5.2 Product Portfolio

- 14.3.6 Croda International Plc

- 14.3.6.1 Company Overview

- 14.3.6.2 Product Portfolio

- 14.3.6.3 Financials

- 14.3.6.4 SWOT Analysis

- 14.3.7 Evonik Industries AG

- 14.3.7.1 Company Overview

- 14.3.7.2 Product Portfolio

- 14.3.7.3 Financials

- 14.3.7.4 SWOT Analysis

- 14.3.8 Incospharm Corporation

- 14.3.8.1 Company Overview

- 14.3.8.2 Product Portfolio

- 14.3.9 Jarchem Industries Inc.

- 14.3.9.1 Company Overview

- 14.3.9.2 Product Portfolio

- 14.3.10 Kao Corporation

- 14.3.10.1 Company Overview

- 14.3.10.2 Product Portfolio

- 14.3.10.3 Financials

- 14.3.10.4 SWOT Analysis

- 14.3.11 Toyobo Co. Ltd.

- 14.3.11.1 Company Overview

- 14.3.11.2 Product Portfolio

- 14.3.11.3 Financials

- 14.3.11.4 SWOT Analysis

- 14.3.12 Vantage Specialty Chemicals

- 14.3.12.1 Company Overview

- 14.3.12.2 Product Portfolio

- 14.3.1 Air Liquide S.A.