|

|

市場調査レポート

商品コード

1661174

炭酸バリウム市場レポート:用途別、地域別、2025年~2033年Barium Carbonate Market Report by End-Use (Glass, Brick and Clay, Barium Ferrites, Photographic Paper Coatings, and Others), and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 炭酸バリウム市場レポート:用途別、地域別、2025年~2033年 |

|

出版日: 2025年02月10日

発行: IMARC

ページ情報: 英文 143 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

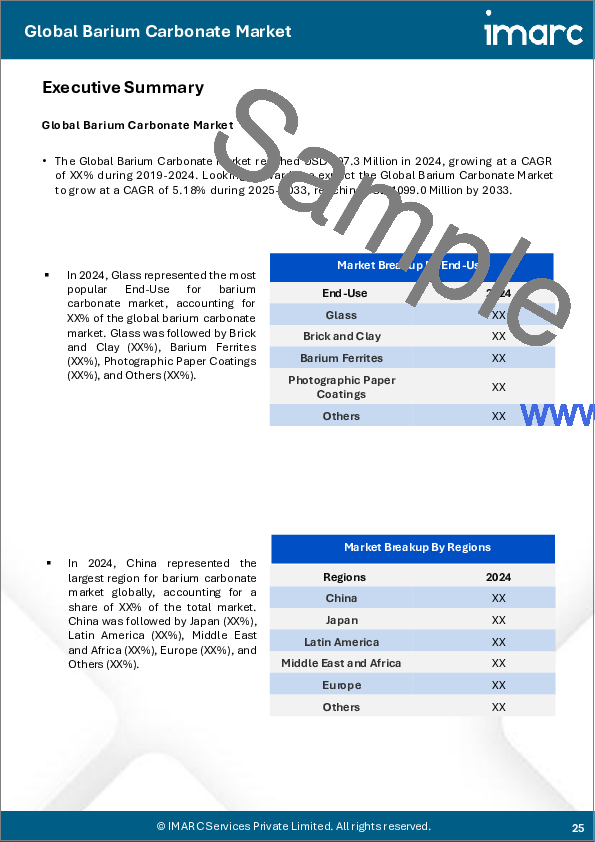

- 目次

炭酸バリウム市場の世界市場規模は2024年に6億9,730万米ドルに達しました。今後、IMARC Groupは、2033年には10億9,900万米ドルに達し、2025年から2033年にかけて5.18%の成長率(CAGR)を示すと予測しています。化学産業からの需要の高まり、様々な分野での継続的な研究開発活動、安定し確立されたサプライチェーンの存在が市場成長を促進する主な要因の一つです。

化学式BaCO3で表される炭酸バリウムは、天然に産出する白色の固体化合物で、ウィザライトという鉱物によく含まれています。炭酸バリウムは様々な用途に使用されています。セラミック業界では、炭酸バリウムは釉薬の輝度と滑らかさを高めるために利用されています。また、テレビ管に使用されるような特殊なガラスを製造する際の重要な成分でもあります。さらに、硫酸塩を除去して特定の化学溶液を精製するためにも使用されます。もうひとつの重要な用途は、レンガの製造における役割で、天然の可溶性塩の有害な影響を打ち消し、塩の跡がつくのを防ぎます。炭酸バリウムの摂取は有害であるため、取り扱いには注意が必要です。炭酸バリウムの使用と廃棄は、個人と環境の両方の健康を確保するための環境および安全規制によって管理されています。

化学業界からの需要の高まりは、主に世界市場を牽引しています。これとともに、数多くの医薬品の製剤化や新素材の開発における継続的な進歩が、市場に弾みをつけています。より複雑なプロセスや製品が出現するにつれて、高純度の化学溶液の必要性が高まっています。これに加えて、様々な分野での継続的な研究開発活動が市場にプラスの影響を与えています。革新的な使用法や効率改善は、成長を促す要因として作用しています。産業が多様化し、製品の提供を拡大すると、彼らは炭酸バリウムの新しい用途を見つけることができます。例えば、セラミックやガラスにはすでに使用されているが、これらの分野の中で、人気が高まるにつれて炭酸バリウムに大きく依存するようになる特殊な製品があるかもしれないです。さらに、安定した確立されたサプライチェーンが存在するため、市場の見通しは明るいです。

炭酸バリウム市場動向/促進要因:

エレクトロニクス・テレビ産業の拡大

エレクトロニクスとテレビ産業は急速なペースで拡大しており、これが需要を大きく牽引しています。テレビなどのディスプレイ機器に使われるブラウン管(CRT)の生産には欠かせない部品です。これらのブラウン管が効率的に機能するためには特殊なガラスが必要であり、このガラスに要求される特性を実現する上で極めて重要な役割を果たしています。新興国の工業化が進むにつれて、エレクトロニクス製品に対する需要が高まっており、特にこれらの製品の市場普及率がまだ低い地域ではその傾向が顕著です。加えて、新しい技術の出現により、需要の一部がCRTからLCD、LED、OLEDなどの技術にシフトしている可能性があります。さらに、エレクトロニクス産業の拡大と多様化が、特に新興経済国でのテレビ購入世帯数の増加と相まって、需要を促進しています。

セラミック・ガラス産業の成長

炭酸バリウムは、セラミック産業、特にグレージングにおいて不可欠な成分です。さらに、セラミック釉薬の輝度と滑らかさを向上させる。世界の都市化とインフラ整備の増加に伴い、タイルや衛生陶器を含むセラミック製品の需要が急増しています。また、ガラス産業は、様々な特殊なガラスを製造するために炭酸バリウムに大きく依存しています。さらに、多くの開発途上国における建設ラッシュがガラス製品の需要増につながっています。建築用途から家庭用装飾品まで、ガラス製品の多用途性は否定できないです。これらの産業が成長するにつれ、炭酸バリウムの需要への波及効果はより顕著になり、重要な市場促進要因となっています。

レンガ製造における需要

レンガ製造業界は、炭酸バリウムが重要性を保持している別のセクターです。この業界では、製品は、天然の可溶性塩の有害な影響に対抗するために使用されます。これらの塩はさらに、レンガにエフロレッセンスや塩の跡を形成し、美的魅力や構造的完全性を損なうことにつながります。急速な都市化とインフラ開発により、レンガを含む建設資材の需要は加速しています。それに伴い、高品質のレンガは建築の必需品であり、エフロレッセンスのないレンガへのニーズは高いです。建設産業が成長するにつれて、特に成長する都市の中心部では、レンガ製造における炭酸バリウムの需要もまた、対応する成長を見ています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 物理的および化学的性質

- 主要業界動向

第5章 世界の炭酸バリウム市場

- 市場概要

- 市場実績

- 数量動向

- 金額動向

- COVID-19の影響

- 価格動向

- 市場内訳:地域別

- 市場内訳:用途別

- 市場予測

- SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

- バリューチェーン分析

- 原材料調達

- 製造

- マーケティング

- 流通

- 輸出

- 最終用途

- ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

- 貿易データ

- 輸入

- 輸出

- 市場促進要因と成功要因

第6章 主要地域の実績

- 中国

- 日本

- ラテンアメリカ

- 中東・アフリカ

- 欧州

- その他

第7章 マーケット:用途別

- ガラス

- 市場動向

- 市場予測

- レンガと粘土

- 市場動向

- 市場予測

- バリウムフェライト

- 市場動向

- 市場予測

- 写真用紙コーティング

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第8章 競合情勢

- 市場構造

- 主要企業

第9章 炭酸バリウム製造プロセス

- 製品概要

- 関与する化学反応

- 製造工程

- 詳細なプロセスフロー

- 原材料要件

- マスバランスと原料転換率

第10章 炭酸バリウム原料市場分析

- バライト

- 市場実績

- 数量動向

- 金額動向

- 価格動向

- 市場内訳:地域別

- 市場内訳:用途別

- 主要サプライヤー

- 市場実績

- 石油コークス

- 市場実績

- 数量動向

- 金額動向

- 価格動向

- 市場内訳:地域別

- 市場内訳:用途別

- 主要サプライヤー

- 市場実績

- 炭酸ナトリウム

- 市場実績

- 数量動向

- 金額動向

- 価格動向

- 市場内訳:地域別

- 市場内訳:用途別

- 主要サプライヤー

- 市場実績

第11章 主要企業のプロファイル

- Solvay S.A.

- Chemical Products Corporation

- Hubei Jingshan Chutian Barium Salt Corporation Ltd.

- Guizhou Hongxing Development Co. Ltd.

- Sakai Chemical Industry Co. Ltd.

- Hebei Xinji Chemical Group Co. Ltd.

- Shaanxi Ankang Jianghua Group Co. Ltd.

- Zaozhuang City Yongli Chemical Co., Ltd.

List of Figures

- Figure 1: Global: Barium Carbonate Market: Major Drivers and Challenges

- Figure 2: Global: Barium Carbonate Market: Production Volume Trends (in '000 Tons), 2019-2024

- Figure 3: Global: Barium Carbonate Market: Production Value Trends (in Million USD), 2019-2024

- Figure 4: Global: Barium Carbonate Market: Average Price Trends (in USD/Ton), 2019-2024

- Figure 5: Global: Barium Carbonate Market: Breakup by Region (in %), 2024

- Figure 6: Global: Barium Carbonate Market: Breakup by End-Use (in %), 2024

- Figure 7: Global: Barium Carbonate Market Forecast: Production Volume Trends (in '000 Tons), 2025-2033

- Figure 8: Global: Barium Carbonate Market Forecast: Production Value Trends (in Million USD), 2025-2033

- Figure 9: Global: Barium Carbonate Industry: SWOT Analysis

- Figure 10: Global: Barium Carbonate Industry: Value Chain Analysis

- Figure 11: Global: Barium Carbonate Industry: Porter's Five Forces Analysis

- Figure 12: Global: Barium Carbonate Market: Import Value Breakup by Country (in %)

- Figure 13: Japan: Barium Carbonate Market: Import Value Trend (in '000 USD)

- Figure 14: Global: Barium Carbonate Market: Export Value Breakup by Country (in %)

- Figure 15: China: Barium Carbonate Market: Export Value Trend (in '000 USD)

- Figure 16: China: Barium Carbonate Market (in Tons), 2019 & 2024

- Figure 17: China: Barium Carbonate Market Forecast (in Tons), 2025-2033

- Figure 18: Japan: Barium Carbonate Market (in Tons), 2019 & 2024

- Figure 19: Japan: Barium Carbonate Market Forecast (in Tons), 2025-2033

- Figure 20: Latin America: Barium Carbonate Market (in Tons), 2019 & 2024

- Figure 21: Latin America: Barium Carbonate Market Forecast (in Tons), 2025-2033

- Figure 22: Middle East and Africa: Barium Carbonate Market (in Tons), 2019 & 2024

- Figure 23: Middle East and Africa: Barium Carbonate Market Forecast (in Tons), 2025-2033

- Figure 24: Europe: Barium Carbonate Market (in Tons), 2019 & 2024

- Figure 25: Europe: Barium Carbonate Market Forecast (in Tons), 2025-2033

- Figure 26: Others: Barium Carbonate Market (in Tons), 2019 & 2024

- Figure 27: Others: Barium Carbonate Market Forecast (in Tons), 2025-2033

- Figure 28: Global: Barium Carbonate Market: Glass (in Tons), 2019 & 2024

- Figure 29: Global: Barium Carbonate Market Forecast: Glass (in Tons), 2025-2033

- Figure 30: Global: Barium Carbonate Market: Brick and Clay (in Tons), 2019 & 2024

- Figure 31: Global: Barium Carbonate Market Forecast: Brick and Clay (in Tons), 2025-2033

- Figure 32: Global: Barium Carbonate Market: Barium Ferrites (in Tons), 2019 & 2024

- Figure 33: Global: Barium Carbonate Market Forecast: Barium Ferrites (in Tons), 2025-2033

- Figure 34: Global: Barium Carbonate Market: Photographic Paper Coatings (in Tons), 2019 & 2024

- Figure 35: Global: Barium Carbonate Market Forecast: Photographic Paper Coatings (in Tons), 2025-2033

- Figure 36: Global: Barium Carbonate Market: Other Applications (in Tons), 2019 & 2024

- Figure 37: Global: Barium Carbonate Market Forecast: Other Applications (in Tons), 2025-2033

- Figure 38: Barium Carbonate Manufacturing: Detailed Process Flow

- Figure 39: Barium Carbonate Manufacturing: Conversion Rate of Feedstocks

- Figure 40: Global: Barite Market: Production Volume Trends (in Million Tons), 2019-2024

- Figure 41: Global: Barite Market: Production Value Trends (in Million USD), 2019-2024

- Figure 42: Global: Barite Market Forecast: Production Volume Trends (in Million Tons), 2025-2033

- Figure 43: Global: Barite Market Forecast: Production Value Trends (in Million USD), 2025-2033

- Figure 44: Global: Barite Market: Average Price Trends (in USD/Ton), 2019-2033

- Figure 45: Global: Barite Market: Breakup by Region (in %)

- Figure 46: Global: Barite Market: Breakup by End-Use (in %)

- Figure 47: Global: Barite Market: Breakup by Key Players (in %)

- Figure 48: Global: Petcoke Market: Production Volume Trends (in Million Dry Metric Tons), 2019-2024

- Figure 49: Global: Petcoke Market: Production Value Trends (in Million USD), 2019-2024

- Figure 50: Global: Petcoke Market Forecast: Production Volume Trends (in Million Dry Metric Tons), 2025-2033

- Figure 51: Global: Petcoke Market Forecast: Production Value Trends (in Million USD), 2025-2033

- Figure 52: Global: Petcoke Market: Average Price Trends (in USD/Ton), 2019-2033

- Figure 53: Global: Petcoke Market: Breakup by Region (in %)

- Figure 54: Global: Petcoke Market: Breakup by End-Use (in %)

- Figure 55: Global: Petcoke Market: Production Capacity Breakup by Key Players (in %)

- Figure 56: Global: Sodium Carbonate Market: Production Volume Trends (in Million Tons), 2019-2024

- Figure 57: Global: Sodium Carbonate Market: Production Value Trends (in Million USD), 2019-2024

- Figure 58: Global: Sodium Carbonate Market Forecast: Production Volume Trends (in Million Tons), 2025-2033

- Figure 59: Global: Sodium Carbonate Market Forecast: Production Value Trends (in Million USD), 2025-2033

- Figure 60: Global: Sodium Carbonate Market: Average Price Trends (in USD/Ton), 2019-2033

- Figure 61: Global: Sodium Carbonate Market: Breakup by Region (in %)

- Figure 62: Global: Sodium Carbonate Market: Breakup by End-Use (in %)

- Figure 63: Global: Sodium Carbonate Market: Production Capacity Breakup by Key Players (in %)

List of Tables

- Table 1: Barium Carbonate: Physical Properties

- Table 2: Barium Carbonate: Chemical Properties

- Table 3: Global: Barium Carbonate Market: Key Industry Highlights, 2024 and 2033

- Table 4: Global: Barium Carbonate Market Forecast: Breakup by Region (in Tons), 2025-2033

- Table 5: Global: Barium Carbonate Market Forecast: Breakup by End-Use (in Tons), 2025-2033

- Table 6: Global: Barium Carbonate Market: Competitive Structure

- Table 7: Global: Barium Carbonate Market: Imports by Major Countries

- Table 8: Global: Barium Carbonate Market: Exports by Major Countries

- Table 9: Global: Barium Carbonate: List of Major Players

- Table 10: Barium Carbonate Manufacturing: Raw Material Requirements

- Table 11: Barium Carbonate Manufacturing: Chemical Reactions Involved

The global barium carbonate market size reached USD 697.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,099.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.18% during 2025-2033. The rising demand from the chemical industry, the continuous research and development activities in various sectors, and the presence of a stable and well-established supply chain are among the key factors driving the market growth.

Barium carbonate, often represented by the chemical formula BaCO3, is a white solid compound that is naturally occurring and commonly found in the mineral witherite. It is used in a variety of applications. In the ceramic industry, barium carbonate is utilized to enhance the brightness and smoothness of glazes. It's also a key ingredient in producing special types of glass, including those used for television tubes. Furthermore, it is employed to purify specific chemical solutions by removing sulfates. Another significant application is its role in the manufacturing of bricks, where it counteracts the detrimental effects of natural soluble salts, preventing the formation of salt marks. Handling barium carbonate requires caution since ingestion can be harmful. Its use and disposal are governed by environmental and safety regulations to ensure the well-being of both individuals and the environment.

The escalating demand from the chemical industry is majorly driving the global market. Along with this, continual advancements in the formulation of numerous pharmaceutical products and the development of new materials is providing an impetus to the market. As more complex processes and products emerge, the need for highly purified chemical solutions is escalating. In addition to this, continuous research and development activities in various sectors are positively influencing the market. Any innovative use or efficiency improvements are acting as a growth-inducing factor. As industries diversify and expand their product offerings, they may find new uses for barium carbonate. For instance, while it's already used in ceramics and glass, there might be specialized products within these sectors that come to rely more heavily on barium carbonate as they grow in popularity. Moreover, the presence of a stable and well-established supply chain creates a positive market outlook.

Barium Carbonate Market Trends/Drivers:

Expansion of the electronics and television industry

The electronics and television industry is expanding at a rapid pace, and this has significantly driven the demand. It is a crucial component in the production of cathode-ray tubes (CRTs) for televisions and other display devices. These tubes require special types of glass to function efficiently, and it plays a pivotal role in achieving the required properties for this glass. As developing countries continue to industrialize, there is a rise in the demand for electronics, especially in regions where the market penetration for these products is still low. In addition, the emergence of newer technologies might have shifted some of the demand away from CRTs in favor of technologies including LCD, LED, and OLED. Moreover, the expansion and diversification of the electronics industry, coupled with the rise in the number of households purchasing televisions, especially in emerging economies, are fueling the demand.

Growing ceramic and glass industries

Barium carbonate is an essential component in the ceramic industry, especially in glazing. Additionally, it enhances the brightness and smoothness of ceramic glazes. With urbanization and increased infrastructure development worldwide, the demand for ceramic products, including tiles and sanitary ware, has skyrocketed. In addition, the glass industry heavily relies on barium carbonate for producing various specialized types of glass. Furthermore, the construction growth in many developing nations is leading to a rise in the demand for glass products. From architectural applications to household decor, the versatility of glass products is undeniable. As these industries grow, the ripple effect on the demand for barium carbonate becomes more pronounced, marking it as a significant market driver.

Requirement in brick manufacturing

The brick manufacturing industry is another sector where barium carbonate holds importance. In this industry, the product is used to combat the harmful effects of natural soluble salts. These salts further lead to the formation of efflorescence or salt marks on bricks, compromising their aesthetic appeal and structural integrity. With rapid urbanization and infrastructural developments, the demand for construction materials, including bricks, has accelerated. In confluence with this, quality bricks are a staple in construction, and the need for bricks free from efflorescence is high. As the construction industry grows, especially in growing urban centers, the demand for barium carbonate in brick manufacturing also sees a corresponding growth.

Barium Carbonate Industry Segmentation:

Breakup by End Use:

- Glass

- Brick and Clay

- Barium Ferrites

- Photographic Paper Coatings

- Others

Brick and clay hold the largest market share

Market drivers for the brick and clay end use segment in the industry include the sustained growth in the construction and infrastructure sectors. As urbanization continues, there is a growing demand for high-quality bricks, tiles, and sanitary ware. Additionally, the product plays a critical role in this domain by countering the adverse effects of natural soluble salts, preventing the formation of unsightly efflorescence on bricks, and ensuring their structural integrity and aesthetic appeal. Along with this, stringent quality standards and regulations in the construction industry further underscore the need for barium carbonate in brick manufacturing. Moreover, the growing emphasis on sustainable building materials is leading to increased research and development efforts, potentially uncovering novel applications for construction materials. As a result, the brick and clay segment in the industry is poised for continued growth, fueled by the ever-expanding construction sector and its enduring need for high-performance building materials.

Breakup by Region:

- China

- Japan

- Latin America

- Middle East and Africa

- Europe

- Others

China leads the market, accounting for the largest barium carbonate market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include China, Japan, Latin America, Middle East and Africa, Europe, and others. According to the report, China accounted for the largest market share.

The barium carbonate industry in China is experiencing robust growth, primarily driven by the region's growing electronics manufacturing sector, one of the largest in the world, which relies heavily on barium carbonate for the production of cathode-ray tubes (CRTs), a fundamental component in older television and display technologies. As the country continues to advance technologically and urbanize, the demand for electronic devices remains high, influencing the need for barium carbonate. In addition, China's construction industry is expanding rapidly, driven by urbanization and infrastructure development. In addition, the government's commitment to quality and sustainability in construction projects further cements the demand.

Apart from this, China's chemical industry, another significant consumer of barium carbonate, is also experiencing growth as it diversifies and modernizes. The compound's use in purifying chemical solutions makes it indispensable in various industrial processes. Furthermore, the Chinese government's push for environmental regulations and cleaner production processes is resulting in a focus on the use of barium carbonate for sulfate removal in certain industries, thereby contributing to the market growth.

Competitive Landscape:

The key players are focusing on efficient and cost-effective production processes to ensure a stable supply of high-quality barium carbonate to their customers. They are investing in modernization and capacity expansion to meet growing demand. Along with this, the accelerating investments in research and development to explore new applications for barium carbonate and improve existing ones are positively influencing the market. In addition, companies must adhere to environmental and safety regulations, especially in the handling and disposal of barium compounds. Compliance is crucial to maintaining their social and environmental responsibilities, which is acting as another growth-inducing factor. Apart from this, manufacturers are implementing sustainable practices, such as recycling or reducing emissions, to minimize their environmental footprint and align with global sustainability goals. Furthermore, key players are diversifying their product portfolio by offering related chemicals or services to cater to a broader range of industries.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Solvay S.A.

- Chemical Products Corporation

- Hubei Jingshan Chutian Barium Salt Corporation Ltd.

- Guizhou Hongxing Development Co. Ltd.

- Sakai Chemical Industry Co. Ltd.

- Hebei Xinji Chemical Group Co. Ltd.

- Shaanxi Ankang Jianghua Group Co. Ltd.

- Zaozhuang City Yongli Chemical Co., Ltd.

Key Questions Answered in This Report

- 1.What was the size of the global barium carbonate market in 2024?

- 2.What is the expected growth rate of the global barium carbonate market during 2025-2033?

- 3.What are the key factors driving the global barium carbonate market?

- 4.What has been the impact of COVID-19 on the global barium carbonate market?

- 5.What is the breakup of the global barium carbonate market based on the end-use?

- 6.What are the key regions in the global barium carbonate market?

- 7.Who are the key players/companies in the global barium carbonate market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Physical and Chemical Properties

- 4.3 Key Industry Trends

5 Global Barium Carbonate Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.2.1 Volume Trends

- 5.2.2 Value Trends

- 5.3 Impact of COVID-19

- 5.4 Price Trends

- 5.5 Market Breakup by Region

- 5.6 Market Breakup by End-Use

- 5.7 Market Forecast

- 5.8 SWOT Analysis

- 5.8.1 Overview

- 5.8.2 Strengths

- 5.8.3 Weaknesses

- 5.8.4 Opportunities

- 5.8.5 Threats

- 5.9 Value Chain Analysis

- 5.9.1 Raw Material Procurement

- 5.9.2 Manufacturing

- 5.9.3 Marketing

- 5.9.4 Distribution

- 5.9.5 Exports

- 5.9.6 End-Use

- 5.10 Porter's Five Forces Analysis

- 5.10.1 Overview

- 5.10.2 Bargaining Power of Buyers

- 5.10.3 Bargaining Power of Suppliers

- 5.10.4 Degree of Competition

- 5.10.5 Threat of New Entrants

- 5.10.6 Threat of Substitutes

- 5.11 Trade Data

- 5.11.1 Imports

- 5.11.2 Exports

- 5.12 Key Market Drivers and Success Factors

6 Performance of Key Regions

- 6.1 China

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Japan

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Latin America

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Middle East and Africa

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Europe

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

- 6.6 Others

- 6.6.1 Market Trends

- 6.6.2 Market Forecast

7 Market by End-Use

- 7.1 Glass

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Brick and Clay

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Barium Ferrites

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Photographic Paper Coatings

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Others

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

8 Competitive Landscape

- 8.1 Market Structure

- 8.2 Key Players

9 Barium Carbonate Manufacturing Process

- 9.1 Product Overview

- 9.2 Chemical Reactions Involved

- 9.3 Manufacturing Process

- 9.4 Detailed Process Flow

- 9.5 Raw Material Requirements

- 9.6 Mass Balance and Feedstock Conversion Rates

10 Barium Carbonate Feedstock Market Analysis

- 10.1 Barite

- 10.1.1 Market Performance

- 10.1.1.1 Volume Trends

- 10.1.1.2 Value Trends

- 10.1.2 Price Trends

- 10.1.3 Market Breakup by Region

- 10.1.4 Market Breakup by End-Use

- 10.1.5 Key Suppliers

- 10.1.1 Market Performance

- 10.2 Pet Coke

- 10.2.1 Market Performance

- 10.2.1.1 Volume Trends

- 10.2.1.2 Value Trends

- 10.2.2 Price Trends

- 10.2.3 Market Breakup by Region

- 10.2.4 Market Breakup by End-Use

- 10.2.5 Key Suppliers

- 10.2.1 Market Performance

- 10.3 Sodium Carbonate

- 10.3.1 Market Performance

- 10.3.1.1 Volume Trends

- 10.3.1.2 Value Trends

- 10.3.2 Price Trends

- 10.3.3 Market Breakup by Region

- 10.3.4 Market Breakup by End-Use

- 10.3.5 Key Suppliers

- 10.3.1 Market Performance

11 Key Player Profiles

- 11.1 Solvay S.A.

- 11.2 Chemical Products Corporation

- 11.3 Hubei Jingshan Chutian Barium Salt Corporation Ltd.

- 11.4 Guizhou Hongxing Development Co. Ltd.

- 11.5 Sakai Chemical Industry Co. Ltd.

- 11.6 Hebei Xinji Chemical Group Co. Ltd.

- 11.7 Shaanxi Ankang Jianghua Group Co. Ltd.

- 11.8 Zaozhuang City Yongli Chemical Co., Ltd.