|

|

市場調査レポート

商品コード

1661064

シリコーン市場レポート:製品タイプ、用途、地域別、2025年~2033年Silicones Market Report by Product Type (Elastomers, Fluids, Gels, Resins), Application (Industrial Processes, Construction Materials, Home and Personal Care, Transportation, Energy, Healthcare, Electronics, and Others), and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| シリコーン市場レポート:製品タイプ、用途、地域別、2025年~2033年 |

|

出版日: 2025年02月10日

発行: IMARC

ページ情報: 英文 138 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

シリコーンの世界市場規模は2024年に152億米ドルに達しました。今後、IMARC Groupは、市場は2033年までに231億米ドルに達し、2025年から2033年にかけて4.8%の成長率(CAGR)を示すと予測しています。建設業界の著しい成長、化粧品・パーソナルケア業界における製品利用の増加、広範な研究開発(R&D)活動は、シリコーン市場を強化する主な要因の一つです。

シリコーンは、ケイ素と酸素の繰り返し単位に有機基が結合した合成ポリマーで、ユニークな特性を示します。エラストマー、ゲル、流体、グリース、樹脂、シーラント、接着剤、エマルションなどが含まれます。シリコーンは、自動車、電子部品、建築、医療用インプラント、創傷被覆材、化粧品、パーソナルケア製品、航空機、ソーラーパネルなどに広く使用されています。シリコーンは、卓越した熱安定性、耐薬品性、電気絶縁性、粘性、弾性、表面相互作用などの物理的特性を示します。また、不活性、無毒性、生体適合性があり、過酷で高負荷な条件下でも長寿命を実現します。

ガスケット、Oリング、シール、エンジン部品、照明システム、エアバッグ、排ガスシステムなどの自動車部品の製造において、絶縁を提供し、摩擦を減らし、過熱を最小限に抑え、構造的完全性を維持し、液体や汚染物質の侵入を防ぐために、製品の利用が増加していることが、市場成長の原動力となっています。さらに、優れた生体適合性と耐久性により、カテーテル、ペースメーカーリード、創傷ケア製品、インプラントを製造するヘルスケア・医療分野での製品需要の増加が、市場成長に寄与しています。これとは別に、電子機器をほこり、湿気、振動から保護するための接着剤、シーラント、コンフォーマルコーティングとして、エレクトロニクス産業での製品採用の増加が市場成長にプラスの影響を与えています。さらに、航空宇宙産業における航空機エンジン、窓、構造部品のシーリングおよび接着材料としての製品利用の増加が、市場成長に好影響を与えています。その他の要因としては、急速な工業化活動、発電産業における製品利用の増加、個人用保護具(PPE)の需要拡大などが挙げられ、市場成長の原動力になると予想されます。

シリコーン市場動向/促進要因:

建設業界の著しい成長

シリコーンは、その汎用性と建築性能を高め、耐久性を提供し、美観を向上させるユニークな特性により、建設業界で数多くの用途を見出しています。これに伴い、シリコーンは接着剤やシーリング剤として、窓、ドア、ファサードの防水やシーリング用途に使用されています。さらに、構造用グレージング用途では、機械的固定を使用せずにガラスパネルと建物の構造フレームを接着するために使用されます。このほか、シリコーンは、温度変化、地震活動、構造的な沈下による動きに対応するための伸縮継手にも幅広く使用されています。さらに、紫外線(UV)抵抗性を付与し、雨漏りを防止するコーティングやメンブレンとして、屋根システムで広く利用されています。さらに、シリコーンは乾式壁システムの目地を密閉し、遮音性を高め、内装表面の耐久性と美観を向上させる。

化粧品とパーソナルケア産業における製品利用の高まり

シリコーンは、ファンデーション、下地、コンシーラー、チークなど、様々な化粧品に幅広く使用されており、滑らかな仕上がりを作り、小じわを目立たなくし、顔料と肌との密着性を高めています。さらに、有効成分の塗布と吸収を高め、エモリエント剤として作用し、皮膚の保護バリアを形成して保湿を助け、皮膚の滑らかさを向上させ、ソフトでベルベットのような感触を提供する、スキンケアやヘアケア製品の製造における製品の利用が増加しています。これとは別に、シリコーンは制汗剤、デオドラント剤、フレグランスに幅広く応用され、フレグランス分子の徐放を促進し、香りの持続性と拡散性を高めています。このほか、シリコーンはボディローション、クリーム、バスオイル、シャワージェルにも使用され、製品の質感を向上させ、保湿性を高めています。

広範な研究開発(R&D)活動

シリコーンの分野では、新製品や新用途の開発につながる注目すべき技術革新がいくつも見られます。これに伴い、損傷や切断時に自己修復する自己修復性シリコーンの開発は、耐久性と耐用年数を向上させ、市場成長にプラスの影響を与えています。さらに、高度に複雑でカスタマイズされたシリコーンベースのオブジェクトやプロトタイプを作成するための3次元(3D)印刷の利用が、市場の成長を促進しています。さらに、光や熱などの特定の刺激を受けると形状が変化する形状記憶シリコーンのイントロダクションが市場成長を強化しています。このほか、植物由来の原料など持続可能な資源に由来し、環境への悪影響を低減するバイオベースシリコーンが最近の動向として市場開拓され、市場の成長を後押ししています。

目次

第1章 序文

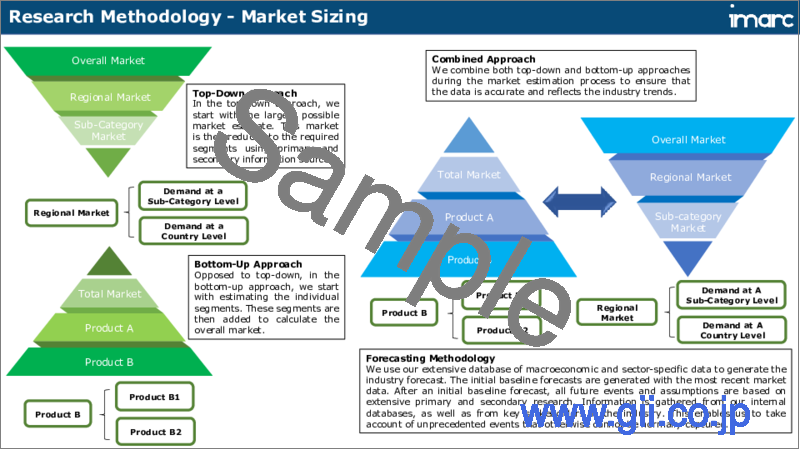

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- プロパティ

- 主要業界動向

第5章 世界のシリコーン市場

- 市場概要

- 市場実績

- 数量動向

- 金額動向

- COVID-19の影響

- 市場内訳:製品タイプ別

- 市場内訳:用途別

- 市場内訳:地域別

- 市場予測

- SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

- バリューチェーン分析

- 概要

- 研究開発

- 原材料調達

- 製造

- マーケティング

- 流通

- 最終用途

- ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

- 価格分析

- 価格動向

- 価格指標

- マージン分析

第6章 市場内訳:製品タイプ別

- エラストマー

- 市場動向

- 市場予測

- 流体

- 市場動向

- 市場予測

- ジェル

- 市場動向

- 市場予測

- 樹脂

- 市場動向

- 市場予測

第7章 市場内訳:用途別

- 工業プロセス

- 市場動向

- 市場予測

- 建設資材

- 市場動向

- 市場予測

- ホーム&パーソナルケア

- 市場動向

- 市場予測

- 交通機関

- 市場動向

- 市場予測

- エネルギー

- 市場動向

- 市場予測

- ヘルスケア

- 市場動向

- 市場予測

- エレクトロニクス

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第8章 市場内訳:地域別

- 北米

- 市場動向

- 市場予測

- 欧州

- 市場動向

- 市場予測

- アジア太平洋地域

- 市場動向

- 市場予測

- ラテンアメリカ

- 市場動向

- 市場予測

- 中東・アフリカ

- 市場動向

- 市場予測

第9章 原料分析

- 主要原料の需要と供給

- 世界のシリコン金属市場

- 市場実績

- 価格動向

- 市場予測

- 市場内訳:地域別

- 市場内訳:最終用途別

- 主要サプライヤー

- 世界のシリコン金属市場

第10章 シリコーン製造プロセス

- 製品概要

- 原材料要件

- 製造工程

- 主要成功要因とリスク要因

第11章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Dow Chemical Company

- Wacker Chemie AG

- Shin-Etsu Chemical Co., Ltd.

- Momentive Performance Materials Inc.

- Elkem ASA

List of Figures

- Figure 1: Global: Silicones Market: Major Drivers and Challenges

- Figure 2: Global: Silicones Market: Sales Volume (in Million Tons), 2019-2024

- Figure 3: Global: Silicones Market: Sales Value (in Billion USD), 2019-2024

- Figure 4: Global: Silicones Market: Breakup by Product Type (in %), 2024

- Figure 5: Global: Silicones Market: Breakup by Application (in %), 2024

- Figure 6: Global: Silicones Market: Breakup by Region (in %), 2024

- Figure 7: Global: Silicones Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 8: Global: Silicones Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 9: Global: Silicones Industry: SWOT Analysis

- Figure 10: Global: Silicones Industry: Value Chain Analysis

- Figure 11: Global: Silicones Industry: Porter's Five Forces Analysis

- Figure 12: Global: Silicones Market: Average Prices D5 Price Trends (in USD/MT)

- Figure 13: Global: Silicones Market: Average Prices Emulsion Price Trends (in USD/MT)

- Figure 14: Silicones Price Structure Analysis

- Figure 15: Silicones Price Structure Analysis (in %)

- Figure 16: Global: Elastomers Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 17: Global: Elastomers Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 18: Global: Fluids Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 19: Global: Fluids Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 20: Global: Gels Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 21: Global: Gels Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 22: Global: Resins Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 23: Global: Resins Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 24: Global: Silicones Market (Applications in Industrial Processes): Sales Volume (in Million Tons), 2019 & 2024

- Figure 25: Global: Silicones Market Forecast (Applications in Industrial Processes): Sales Volume (in Million Tons), 2025-2033

- Figure 26: Global: Silicones Market (Applications in Construction Materials): Sales Volume (in Million Tons), 2019 & 2024

- Figure 27: Global: Silicones Market Forecast (Applications in Construction Materials): Sales Volume (in Million Tons), 2025-2033

- Figure 28: Global: Silicones Market (Applications in Home and Personal Care): Sales Volume (in Million Tons), 2019 & 2024

- Figure 29: Global: Silicones Market Forecast (Applications in Home and Personal Care): Sales Volume (in Million Tons), 2025-2033

- Figure 30: Global: Silicones Market (Applications in Transportation): Sales Volume (in Million Tons), 2019 & 2024

- Figure 31: Global: Silicones Market Forecast (Applications in Transportation): Sales Volume (in Million Tons), 2025-2033

- Figure 32: Global: Silicones Market (Applications in Energy): Sales Volume (in Million Tons), 2019 & 2024

- Figure 33: Global: Silicones Market Forecast (Applications in Energy): Sales Volume (in Million Tons), 2025-2033

- Figure 34: Global: Silicones Market (Applications in Healthcare): Sales Volume (in Million Tons), 2019 & 2024

- Figure 35: Global: Silicones Market Forecast (Applications in Healthcare): Sales Volume (in Million Tons), 2025-2033

- Figure 36: Global: Silicones Market (Applications in Electronics): Sales Volume (in Million Tons), 2019 & 2024

- Figure 37: Global: Silicones Market Forecast (Applications in Electronics): Sales Volume (in Million Tons), 2025-2033

- Figure 38: Global: Silicones Market (Other Applications): Sales Volume (in Million Tons), 2019 & 2024

- Figure 39: Global: Silicones Market Forecast (Other Applications): Sales Volume (in Million Tons), 2025-2033

- Figure 40: North America: Silicones Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 41: North America: Silicones Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 42: Europe: Silicones Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 43: Europe: Silicones Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 44: Asia Pacific: Silicones Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 45: Asia Pacific: Silicones Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 46: Latin America: Silicones Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 47: Latin America: Silicones Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 48: Middle East and Africa: Silicones Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 49: Middle East and Africa: Silicones Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 50: Global: Silicon Metal Market: Consumption Volume (in Million Tons), 2019-2024

- Figure 51: Global: Silicon Metal Market: Average Prices (in USD/Ton), 2019-2024

- Figure 52: Global: Silicon Metal Market Forecast: Consumption Volume (in Million Tons), 2025-2033

- Figure 53: Global: Silicon Metal Market: Breakup by Region (in %)

- Figure 54: Global: Silicon Metal Market: Breakup by End-Use (in %)

- Figure 55: Silicones Manufacturing: Process Flow

List of Tables

- Table 1: Silicones: General Properties

- Table 2: Global: Silicones Market: Key Industry Highlights, 2024 and 2033

- Table 3: Global: Silicones Market Forecast: Breakup by Product Type (in Million Tons), 2025-2033

- Table 4: Global: Silicones Market Forecast: Breakup by Application (in Million Tons), 2025-2033

- Table 5: Global: Silicones Market Forecast: Breakup by Region (in Million Tons), 2025-2033

- Table 6: Silicones: Raw Material Requirements

- Table 7: Global: Silicones Market Structure

- Table 8: Global: Silicones Market: Key Players

The global silicones market size reached USD 15.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 23.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.8% during 2025-2033. The significant growth in the construction industry, the rising product utilization in the cosmetic and personal care industry, and extensive research and development (R&D) activities are among major factors bolstering the silicones market.

Silicones refers to synthetic polymers composed of repeating silicon-oxygen units with attached organic groups that exhibit unique properties. It includes elastomers, gels, fluids, greases, resins, sealants, adhesives, and emulsions. They are widely used in automobiles, electronic assemblies, construction activities, medical implants, wound dressings, cosmetics, personal care products, aircraft, and solar panels. Silicones exhibit exceptional thermal stability, chemical resistance, electrical insulation, and physical properties, such as viscosity, elasticity, and surface interactions. They are also inert, non-toxic, biocompatible, and offer long service life in demanding and heavy load conditions.

The rising product utilization in the manufacturing of automotive parts, such as gaskets, o-rings, seals, engine components, lighting systems, airbags, and emission systems, to provide insulation, reduce friction, minimize overheating, maintain structural integrity, and prevent the ingress of fluids and contaminants is proving an impetus to the market growth. Furthermore, the increasing product demand in the healthcare and medical sector to produce catheters, pacemakers lead, wound-care products, and implants, due to their excellent biocompatibility and durability, is contributing to the market growth. Apart from this, the growing product adoption in the electronics industry as adhesives, sealants, and conformal coatings to protect electronic devices from dust, moisture, and vibrations is positively influencing the market growth. Moreover, the increasing product utilization in the aerospace industry as a sealing and bonding material in aircraft engines, windows, and structural components is favoring the market growth. Other factors, including rapid industrialization activities, increasing product utilization in the power generation industry, and growing demand for personal protective equipment (PPE), are anticipated to drive the market growth.

Silicones Market Trends/Drivers:

The significant growth in the construction industry

Silicones find numerous applications in the construction industry due to their versatility and unique properties that enhance building performance, provide durability, and increase aesthetic appeal. In line with this, silicones are used as adhesives and sealants for waterproofing and sealing applications in windows, doors, and facades. Furthermore, they are used in structural glazing applications to bond glass panels with the building's structural frames without using mechanical fixing. Apart from this, silicones find extensive applications in expansion joints to accommodate movements caused by temperature variations, seismic activities, and structural settling. Moreover, the widespread product utilization in roofing systems as coatings and membranes to provide ultraviolet (UV) resistance and prevent leaks. Additionally, silicones aid in sealing joints in drywall systems, providing acoustic insulation, and enhancing the durability and aesthetics of interior surfaces, which is favoring the market growth.

The rising product utilization in the cosmetics and personal care industry

Silicones are widely used in various makeup products, such as foundations, primers, concealers, and blushes to create a smooth finish, reduce fine lines, and improve the adherence of pigments to the skin. Furthermore, in the increasing product utilization in manufacturing skin and hair care products that enhance the application and absorption of active ingredients and act as an emollient, forming a protective barrier on the skin that aids in retaining moisture, improving skin smoothness, and providing a soft and velvety feel. Apart from this, silicones find extensive applications in antiperspirants, deodorants, and fragrances to facilitate the slow release of fragrance molecules and enhance the longevity and diffusion of scents. Besides this, silicones are also used in body lotions, creams, bath oils, and shower gels to improve product texture and enhance their moisturizing properties.

Extensive research and development (R&D) activities

The field of silicones has witnessed several notable innovations leading to the development of new products and applications. In line with this, the development of self-healing silicones that can repair themselves when damaged or cut, thus improving durability and service life, is positively influencing the market growth. Furthermore, the utilization of three-dimensional (3D) printing to create highly complex and customized silicone-based objects and prototypes is facilitating the market growth. Moreover, the introduction of shape-memory silicones that can change shapes when subjected to certain stimuli, such as light and heat, is strengthening the market growth. Besides this, the recent development of biobased silicones that are derived from sustainable sources, such as plant-based feedstocks, thus reducing adverse environmental impacts, is providing a thrust to the market growth.

Silicones Industry Segmentation:

Breakup by Product Type:

- Elastomers

- Fluids

- Gels

- Resins

Elastomers dominate the silicones market

Elastomers hold a majority share in the silicones market owing to their exceptional flexibility and elasticity, which allows them to stretch and return to their original shape without permanent deformation. They exhibit excellent resistance to heat, oil, solvents, acids, and bases, which makes them ideal candidates for applications in automotive engines, industrial machinery, aerospace, chemical processing, and electrical systems. Furthermore, elastomers have low permeability to gases and liquids, making them effective sealing agents under high pressure and vacuum conditions. Apart from this, they are easy to process and can be molded into different forms and shapes based on industry-specific requirements, which is contributing to the market growth.

Breakup by Application:

- Industrial Processes

- Construction Materials

- Home and Personal Care

- Transportation

- Energy

- Healthcare

- Electronics

- Others

Industrial processes represent the leading application segment

Silicones are widely used in various industrial processes, such as sealing, lubrication, insulation, coating, and bonding, as they exhibit a high degree of versatility and can be formulated into various forms, such as fluids, elastomers, resins, and gels. Furthermore, they offer high resistance to chemicals and temperatures while maintaining their performance and stability. Moreover, their high dielectric strength and excellent electrical insulation properties make them ideal for electronics applications, such as cables, connectors, and insulators. Apart from this, silicones form strong bonds between different substrates, such as metals, plastics, glass, and ceramics. As a result, silicones are widely used in electronic assembly lines, construction activities, and automotive manufacturing.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Asia Pacific exhibits a clear dominance in the market, accounting for the largest silicones market share

The report has also provided a comprehensive analysis of all the major regional markets, which includes North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. According to the report, Asia Pacific represented the largest market for silicones.

The Asia Pacific region is dominating the silicones market due to increasing product demand from various industries, such as consumer goods, automotive, electronics, aerospace, healthcare, and packaging. In addition to this, the implementation of supportive policies by regional governments to promote industrialization activities to boost economic growth is providing an impetus to the market growth. Moreover, Asia Pacific is becoming a manufacturing hub for various industries owing to the presence of a skilled labor force, favorable regulations, and competitive pricing, which, in turn, is facilitating the demand for silicones in various manufacturing activities. Apart from this, the growing product utilization in the construction industry due to the rapid urbanization activities and increasing demand for multiple infrastructures, such as roads, railway stations, airports, and bridges, is positively influencing the market growth.

Competitive Landscape:

Several top companies are significantly investing in research and development (R&D) activities and focusing on the development of new silicone-based products with improved properties and functionality to meet growing consumer demands, which is supporting the market growth. Along with this, the increasing emphasis by several manufacturers on product diversification to expand the customer base, enter emerging markets, and reduce dependency on specific sectors is acting as another growth-inducing factor. Moreover, several key players are engaged in strategic partnerships and acquisitions to expand their portfolios, increase market penetration, and get access to new technologies and distribution channels. Apart from this, the rising focus on promotional and marketing initiatives to improve brand visibility and increase awareness about products and services is creating a positive outlook for the market growth. Additionally, several top companies are incorporating sustainable practices to meet regulatory requirements and attract environmentally conscious customers.

The report has provided a comprehensive analysis of the competitive landscape in the global silicones market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Dow Chemical Company

- Wacker Chemie AG

- Shin-Etsu Chemical Co., Ltd.

- Momentive Performance Materials Inc.

- Elkem ASA

Key Questions Answered in This Report

- 1.What was the size of the global silicones market in 2024?

- 2.What is the expected growth rate of the global silicones market during 2025-2033?

- 3.What are the key factors driving the global silicones market?

- 4.What has been the impact of COVID-19 on the global silicones market?

- 5.What is the breakup of the global silicones market based on the product type?

- 6.What is the breakup of the global silicones market based on the application?

- 7.What are the key regions in the global silicones market?

- 8.Who are the key companies/players in the global silicones market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Properties

- 4.3 Key Industry Trends

5 Global Silicones Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.2.1 Volume Trends

- 5.2.2 Value Trends

- 5.3 Impact of COVID-19

- 5.4 Market Breakup by Product Type

- 5.5 Market Breakup by Application

- 5.6 Market Breakup by Region

- 5.7 Market Forecast

- 5.8 SWOT Analysis

- 5.8.1 Overview

- 5.8.2 Strengths

- 5.8.3 Weaknesses

- 5.8.4 Opportunities

- 5.8.5 Threats

- 5.9 Value Chain Analysis

- 5.9.1 Overview

- 5.9.2 Research and Development

- 5.9.3 Raw Material Procurement

- 5.9.4 Manufacturing

- 5.9.5 Marketing

- 5.9.6 Distribution

- 5.9.7 End-Use

- 5.10 Porters Five Forces Analysis

- 5.10.1 Overview

- 5.10.2 Bargaining Power of Buyers

- 5.10.3 Bargaining Power of Suppliers

- 5.10.4 Degree of Competition

- 5.10.5 Threat of New Entrants

- 5.10.6 Threat of Substitutes

- 5.11 Price Analysis

- 5.11.1 Price Trends

- 5.11.2 Price Indicators

- 5.11.3 Margins Analysis

6 Market Breakup by Product Type

- 6.1 Elastomers

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Fluids

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Gels

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Resins

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

7 Market Breakup by Application

- 7.1 Industrial Processes

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Construction Materials

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Home and Personal Care

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Transportation

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Energy

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

- 7.6 Healthcare

- 7.6.1 Market Trends

- 7.6.2 Market Forecast

- 7.7 Electronics

- 7.7.1 Market Trends

- 7.7.2 Market Forecast

- 7.8 Others

- 7.8.1 Market Trends

- 7.8.2 Market Forecast

8 Market Breakup by Region

- 8.1 North America

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Europe

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Asia Pacific

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Latin America

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Middle East and Africa

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

9 Feedstock Analysis

- 9.1 Supply and Demand of Key Feedstock

- 9.1.1 Global Silicon Metal Market

- 9.1.1.1 Market Performance

- 9.1.1.2 Price Trends

- 9.1.1.3 Market Forecast

- 9.1.1.4 Market Breakup by Region

- 9.1.1.5 Market Breakup by End Use

- 9.1.1.6 Key Suppliers

- 9.1.1 Global Silicon Metal Market

10 Silicones Manufacturing Process

- 10.1 Product Overview

- 10.2 Raw Material Requirements

- 10.3 Manufacturing Process

- 10.4 Key Success and Risk Factors

11 Competitive Landscape

- 11.1 Market Structure

- 11.2 Key Players

- 11.3 Profiles of Key Players

- 11.3.1 Dow Chemical Company

- 11.3.1.1 Company Overview

- 11.3.1.2 Description

- 11.3.1.3 Product Portfolio

- 11.3.1.4 Financials

- 11.3.2 Wacker Chemie AG

- 11.3.2.1 Company Overview

- 11.3.2.2 Description

- 11.3.2.3 Product Portfolio

- 11.3.2.4 Financials

- 11.3.2.5 SWOT Analysis

- 11.3.3 Shin-Etsu Chemical Co., Ltd.

- 11.3.3.1 Company Overview

- 11.3.3.2 Description

- 11.3.3.3 Product Portfolio

- 11.3.3.4 Financials

- 11.3.3.5 SWOT Analysis

- 11.3.4 Momentive Performance Materials Inc.

- 11.3.4.1 Company Overview

- 11.3.4.2 Description

- 11.3.4.3 Product Portfolio

- 11.3.4.4 Financials

- 11.3.4.5 SWOT Analysis

- 11.3.5 Elkem ASA

- 11.3.5.1 Company Overview

- 11.3.5.2 Description

- 11.3.5.3 Product Portfolio

- 11.3.5.4 Financials

- 11.3.1 Dow Chemical Company