|

|

市場調査レポート

商品コード

1642693

ITトレーニング市場レポート:用途、エンドユーザー、地域別、2025年~2033年IT Training Market Report by Application, End User, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| ITトレーニング市場レポート:用途、エンドユーザー、地域別、2025年~2033年 |

|

出版日: 2025年01月18日

発行: IMARC

ページ情報: 英文 141 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

ITトレーニング市場の世界市場規模は2024年に800億米ドルに達しました。今後、IMARC Groupは、2033年には1,044億米ドルに達し、2025年から2033年にかけて2.97%の成長率(CAGR)を示すと予測しています。同市場は、急速な技術進歩、企業のスキル開拓への注力、事業拡大やデジタルトランスフォーメーションへの取り組みに伴う世界ITコンピテンシーへのニーズの高まりなどを背景に、着実な成長を遂げています。

ITトレーニング市場分析:

市場の成長と規模世界のITトレーニング市場は、主にテクノロジーの急速な進化と継続的なスキル開発の必要性によって、着実な成長軌道をたどっています。市場の拡大には、ITシステムの複雑化と様々な分野へのIT応用の拡大が寄与しています。

主な市場促進要因:主な促進要因としては、技術進歩のペースが速く、定期的なスキルアップが必要であること、企業が競争力を維持するために従業員のスキル開発に重点を置いていることなどが挙げられます。また、世界化と世界に通用するIT人材のニーズも市場成長に大きく寄与しています。

主な市場動向:顕著な動向は、パーソナライズされた学習体験のための研修プログラムにおけるAIとMLの統合です。また、サイバーセキュリティ、データ分析、クラウドコンピューティングのコースに対する需要も高まっており、ITにおける現在の注力分野を反映しています。

地理的動向:北米は高度なITインフラと大手ハイテク企業の存在により市場をリードしています。しかし、アジア太平洋地域は経済発展と技術導入により急成長しており、欧州は先端技術トレーニングとデータコンプライアンスに注力しています。

競合情勢:市場の特徴は、主要企業による戦略的提携、事業拡大、技術革新です。これらの企業は、基礎的な技術分野と高度な技術分野の両方に焦点を当て、幅広いITスキルを提供できるようサービスの多様化を図っています。

課題と機会:大きな課題のひとつは、急速に進化する技術状況に対応することであり、そのためには常にカリキュラムを更新する必要があります。しかし、このことは、研修プロバイダーにとって、IT業界のダイナミックなニーズを満たす最新の研修ソリューションを革新し、提供するチャンスでもあります。

ITトレーニング市場動向

急速な技術の進歩

世界のITトレーニング市場は、技術革新と進歩のペースに大きく影響されています。テクノロジーの進化に伴い、ITプロフェッショナルのスキルアップと再スキルが常に求められています。人工知能(AI)、機械学習(ML)、クラウドコンピューティング、サイバーセキュリティなどの新たなテクノロジーは、IT環境を絶えず変化させており、継続的なトレーニングや教育が必要とされています。このようなダイナミックな技術環境は、従業員の能力と競合を確実に維持するためにITトレーニングへの投資を組織に促しています。さらに、さまざまな業界における最先端技術の統合は、ITトレーニングの範囲を広げ、従来のIT分野にとどまらない広がりを見せています。ITトレーニング市場の見通しは、技術ソリューションが複雑化し、効果的な実装と保守のために専門的な知識が必要になっていることにも影響されています。

企業によるスキル開発の重視

世界中の組織が、特にIT分野において、従業員の継続的な学習と能力開発の重要性を認識しつつあります。このようにスキル開発が重視される背景には、急速に進化するデジタル情勢の中でスキルギャップを解消し、市場での競争力を維持する必要性があります。企業は、従業員のパフォーマンスを高め、生産性を向上させ、イノベーションを促進するために、IT研修プログラムに投資しています。従業員に最新のITスキルや知識を身につけさせることで、企業は新しい技術や手法への適応力を高め、ビジネスプロセスや成果の改善につなげることができます。さらに、企業の研修プログラムは、多様な学習スタイルやスケジュールに合わせて、オンラインコース、ワークショップ、認定資格など、さまざまな学習形式を取り入れるように進化しています。このようなスキル開発への注力は、技術の変化への対応であると同時に、競争の激しい市場において優秀な人材を引き付け、維持するための戦略的な動きでもあります。

世界化と地理的拡大

ITトレーニング市場の規模の拡大は、世界化とそれに伴うビジネスの地理的拡大によっても加速しています。企業が国境を越えて事業を拡大する中、世界に通用するIT人材へのニーズが高まっています。このような拡大には、技術的スキル、異文化コミュニケーション、さまざまな規制環境の理解といった面でのトレーニングが必要です。さらに、急成長する新興国のIT市場は、新たなビジネスチャンスと課題をもたらし、ローカライズされたITトレーニングソリューションの需要を促進しています。企業が世界な人材を活用し、国際市場に対応することを目指しているため、世界各地に拠点を持つIT研修プロバイダーや、オンラインでアクセス可能な研修オプションを提供するIT研修プロバイダーを求める傾向が強まっています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

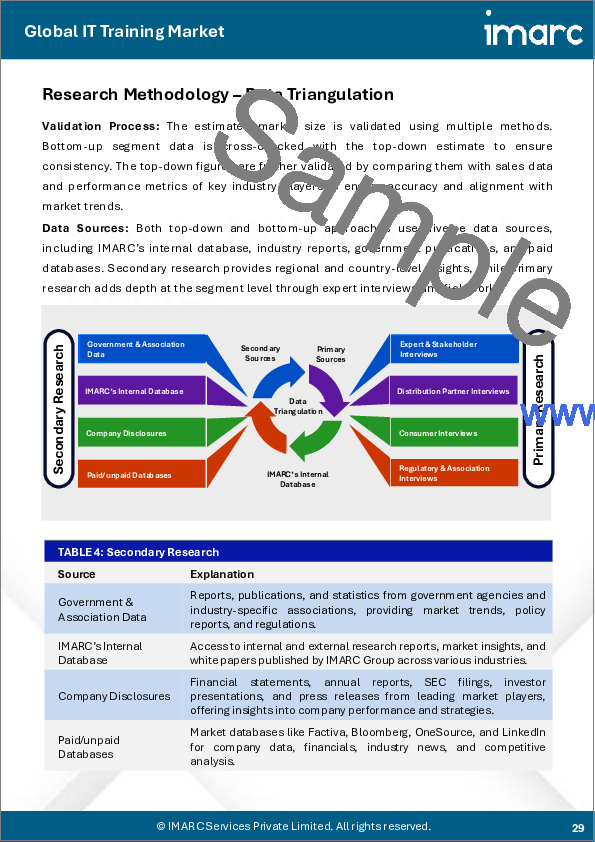

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のITトレーニング市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:用途別

- ITインフラストラクチャトレーニング

- 市場動向

- 市場予測

- エンタープライズアプリケーションとソフトウェアのトレーニング

- 市場動向

- 市場予測

- サイバーセキュリティトレーニング

- 市場動向

- 市場予測

- データベースとビッグデータのトレーニング

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第7章 市場内訳:エンドユーザー別

- 企業

- 市場動向

- 市場予測

- 学校と大学

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第8章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- 中東・アフリカ

- トルコ

- サウジアラビア

- イラン

- アラブ首長国連邦

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- コロンビア

- チリ

- ペルー

- その他

第9章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第10章 バリューチェーン分析

第11章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第12章 価格分析

第13章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Avnet, Inc.(Tech Data Corporation)

- Computer Generated Solutions

- Dell Technologies

- ExecuTrain

- ExitCertified(Tech Data Corporation)

- Fast Lane

- Firebrand Training Limited(BPP Education Group)

- Global Knowledge Training LL(Softskill)

- GP Strategies(Learning Technologies Group plc.)

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- ILX Group(APM Group)

- LearnQuest, Inc.

- New Horizons Computer Learning Center, Inc.

- Oracle Corporation

- QA Ltd.(CVC Capital Partners)

- SAP SE

- Corpex

List of Figures

- Figure 1: Global: IT Training Market: Major Drivers and Challenges

- Figure 2: Global: IT Training Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: IT Training Market: Breakup by Application (in %), 2024

- Figure 4: Global: IT Training Market: Breakup by End-User (in %), 2024

- Figure 5: Global: IT Training Market: Breakup by Region (in %), 2024

- Figure 6: Global: IT Training Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 7: Global: IT Training (IT Infrastructure Training) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 8: Global: IT Training (IT Infrastructure Training) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 9: Global: IT Training (Enterprise Application and Software Training) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 10: Global: IT Training (Enterprise Application and Software Training) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 11: Global: IT Training (Cyber Security Training) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 12: Global: IT Training (Cyber Security Training) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 13: Global: IT Training (Database and Big Data Training) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 14: Global: IT Training (Database and Big Data Training) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 15: Global: IT Training (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 16: Global: IT Training (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 17: Global: IT Training (Corporate) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 18: Global: IT Training (Corporate) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 19: Global: IT Training (Schools and Colleges) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 20: Global: IT Training (Schools and Colleges) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 21: Global: IT Training (Other End-Users) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 22: Global: IT Training (Other End-Users) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 23: North America: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 24: North America: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 25: United States: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 26: United States: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 27: Canada: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 28: Canada: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 29: Asia Pacific: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 30: Asia Pacific: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 31: China: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 32: China: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 33: Japan: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 34: Japan: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 35: India: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 36: India: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 37: South Korea: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 38: South Korea: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 39: Australia: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 40: Australia: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 41: Indonesia: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 42: Indonesia: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 43: Others: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 44: Others: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 45: Europe: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 46: Europe: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 47: Germany: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 48: Germany: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 49: France: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 50: France: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 51: United Kingdom: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 52: United Kingdom: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 53: Italy: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 54: Italy: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 55: Spain: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 56: Spain: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 57: Russia: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 58: Russia: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 59: Others: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 60: Others: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 61: Middle East and Africa: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 62: Middle East and Africa: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 63: Turkey: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 64: Turkey: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 65: Saudi Arabia: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 66: Saudi Arabia: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 67: Iran: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 68: Iran: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 69: United Arab Emirates: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 70: United Arab Emirates: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 71: Others: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 72: Others: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 73: Latin America: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 74: Latin America: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 75: Brazil: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 76: Brazil: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 77: Mexico: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 78: Mexico: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 79: Argentina: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 80: Argentina: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 81: Colombia: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 82: Colombia: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 83: Chile: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 84: Chile: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 85: Peru: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 86: Peru: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 87: Others: IT Training Market: Sales Value (in Million USD), 2019 & 2024

- Figure 88: Others: IT Training Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 89: Global: IT Training Industry: SWOT Analysis

- Figure 90: Global: IT Training Industry: Value Chain Analysis

- Figure 91: Global: IT Training Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: IT Training Market: Key Industry Highlights, 2024 & 2033

- Table 2: Global: IT Training Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 3: Global: IT Training Market Forecast: Breakup by End-User (in Million USD), 2025-2033

- Table 4: Global: IT Training Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 5: Global: IT Training Market Structure

- Table 6: Global: IT Training Market: Key Players

The global IT training market size reached USD 80.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 104.4 Billion by 2033, exhibiting a growth rate (CAGR) of 2.97% during 2025-2033. The market is experiencing steady growth, driven by rapid technological advancements, corporate focus on skill development, and the increasing need for global IT competencies amid business expansion and digital transformation initiatives.

IT Training Market Analysis:

Market Growth and Size: The global IT training market is experiencing a steady growth trajectory, primarily driven by the rapid evolution of technology and the need for continuous skill development. The market expansion is fueled by both the increasing complexity of IT systems and the broadening of IT applications across various sectors.

Major Market Drivers: Key drivers include the swift pace of technological advancements, necessitating regular upskilling, and the corporate emphasis on employee skill development to stay competitive. Globalization and the need for a globally competent IT workforce also significantly contribute to market growth.

Key Market Trends: A prominent trend is the integration of AI and ML in training programs for personalized learning experiences. There is also a rising demand for courses in cybersecurity, data analytics, and cloud computing, reflecting the current focus areas in IT.

Geographical Trends: North America leads the market due to its advanced IT infrastructure and the presence of major tech companies. However, the Asia Pacific region is rapidly growing, driven by economic development and tech adoption, while Europe focuses on advanced technology training and data compliance.

Competitive Landscape: The market is characterized by strategic collaborations, expansions, and technological innovations by key players. These players are diversifying their offerings to include a wide range of IT skills, focusing on both foundational and advanced technology areas.

Challenges and Opportunities: One major challenge is keeping pace with the rapidly evolving technological landscape, which requires constant curriculum updates. However, this also presents opportunities for training providers to innovate and offer the latest training solutions that meet the dynamic needs of the IT industry.

IT Training Market Trends:

Rapid technological advancements

The global IT training market is significantly influenced by the pace of technological innovations and advancements. As technology evolves, there is a constant need for upskilling and reskilling among IT professionals. Emerging technologies such as artificial intelligence (AI), machine learning (ML), cloud computing, and cybersecurity are continually reshaping the IT landscape, necessitating ongoing training and education. This dynamic technological environment compels organizations to invest in IT training to ensure their workforce remains competent and competitive. Furthermore, the integration of cutting-edge technologies in various industries has broadened the scope of IT training, extending beyond traditional IT sectors. The IT training market outlook is further influenced by the growing complexity of technological solutions, requiring specialized knowledge for effective implementation and maintenance.

Corporate emphasis on skill development

Organizations across the globe are increasingly recognizing the importance of continuous learning and development for their employees, especially in the IT domain. This emphasis on skill development is driven by the need to close the skills gap in a rapidly evolving digital landscape and to maintain a competitive edge in the market. Companies are investing in IT training programs to enhance employee performance, increase productivity, and foster innovation. By equipping their workforce with the latest IT skills and knowledge, organizations can better adapt to new technologies and methodologies, leading to improved business processes and outcomes. Moreover, corporate training programs are evolving to include a variety of learning formats, such as online courses, workshops, and certifications, tailored to meet diverse learning styles and schedules. This focus on skill development is a response to technological changes as well as a strategic move to attract and retain top talent in a competitive job market.

Globalization and geographical expansion

The expansion in the size of the IT training market is also being accelerated by globalization and the consequent geographical expansion of businesses. With companies extending their operations across borders, there is a heightened need for a globally competent IT workforce. This expansion necessitates training in technical skills, aspects like cross-cultural communication and understanding of various regulatory environments. Moreover, the burgeoning IT markets in emerging economies present additional business opportunities and challenges, driving the demand for localized IT training solutions. As businesses aim to harness global talent and cater to international markets, they increasingly seek IT training providers with a worldwide presence or those offering online, accessible training options.

IT Training Industry Segmentation:

Breakup by Application:

IT Infrastructure Training

Enterprise Application and Software Training

Cyber Security Training

Database and Big Data Training

Others

IT infrastructure training accounts for the majority of the market share

IT infrastructure training holds the largest share in the market as it encompasses training in network management, hardware, server administration, and storage systems, crucial for maintaining the operational backbone of modern businesses. Training programs in this domain are designed to equip professionals with the skills necessary to design, implement, and manage the IT infrastructure efficiently of an organization. With the increasing complexity of IT environments and the constant evolution of technologies, this segment is witnessing a steady demand for updated and comprehensive training modules, catering to both entry-level and experienced professionals.

The enterprise application and software training segment focuses on training related to enterprise applications and software, crucial for businesses to optimize their operations, customer relationship management, and resource planning. Courses in this category cover a wide range of software solutions, including enterprise resource planning (ERP), customer relationship management (CRM), and supply chain management (SCM) systems. As these applications play a pivotal role in streamlining business processes and enhancing efficiency, the demand for skilled professionals in this area remains high. Training in this segment is continuously evolving to incorporate the latest software updates and industry best practices.

Cyber security training is a rapidly growing segment, driven by the escalating number of cyber threats and regulatory compliance requirements. This training encompasses various aspects of information security, including network security, threat detection, risk management, and compliance. As organizations increasingly recognize the importance of protecting their data and IT infrastructure, the demand for skilled cyber security professionals is rising. Training programs in this area are focused on equipping individuals with the necessary skills to identify vulnerabilities, implement security protocols, and respond to cyber incidents effectively.

The database and big data training segment addresses the growing need for expertise in database management and big data analytics. It includes training in data modeling, database administration, and the use of big data tools and technologies. With the exponential growth of data and the importance of data-driven decision-making in business, skills in managing and analyzing large datasets are in high demand. Training in this domain is geared toward enabling professionals to efficiently handle data storage, retrieval, and analysis, utilizing the latest tools and methodologies in data science and database management.

The others segment encompasses various specialized IT training areas, such as software development, project management, cloud computing, and emerging technologies like blockchain and the Internet of Things (IoT). The diversity of this segment reflects the broad and evolving nature of the IT industry, catering to niche skills and innovative technologies that are gaining traction in the market. This segment is particularly dynamic, often adapting to the latest trends and technological advancements in the IT field.

Breakup by End User:

Corporate

Schools and Colleges

Others

Corporate holds the largest share in the industry

The corporate segment dominates the IT training market, reflecting the critical need for continuous skill development in the business sector. Corporations invest heavily in IT training to keep their workforce adept with the latest technological advancements and methodologies. This investment is driven by the desire to enhance productivity, innovate, and maintain a competitive edge in an increasingly digital world. Training programs in this segment are diverse, ranging from basic IT skills for non-technical staff to advanced technical training for IT professionals. The focus is on aligning the skills of the workforce with the strategic objectives of the company, which includes training in areas like cybersecurity, cloud computing, data analytics, and software development. Corporate training often utilizes a blend of online and in-person training methods to accommodate different learning preferences and work schedules.

The schools and colleges segment of the IT training market addresses the need of the educational sector to prepare students for the digital economy. This segment focuses on integrating IT skills into the curriculum, offering students foundational knowledge and skills in various aspects of information technology. The aim is to equip the future workforce with the necessary competencies to thrive in an increasingly tech-driven world. Training in this segment ranges from basic computer literacy to more specialized courses in programming, network administration, and data science. The emphasis is on creating a strong foundation in IT, which is essential for students who will later pursue advanced studies or careers in this field.

The others segment includes various non-traditional learners who seek IT training outside of corporate environments and educational institutions. This includes self-employed individuals, job seekers, career changers, and IT enthusiasts. Training in this segment is often more flexible and accessible, with a focus on online and self-paced learning options. This segment caters to a wide range of needs, from acquiring basic IT skills to gaining certifications in specific technologies or tools.

Breakup by Region:

North America

United States

Canada

Asia Pacific

China

Japan

India

South Korea

Australia

Indonesia

Others

Europe

Germany

France

United Kingdom

Italy

Spain

Russia

Others

Middle East and Africa

Turkey

Saudi Arabia

Iran

United Arab Emirates

Others

Latin America

Brazil

Mexico

Argentina

Colombia

Chile

Peru

Others

North America leads the market, accounting for the largest IT training market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia and others); the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates, and others); and Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others). According to the report, North America accounted for the largest market share.

North America, including the United States and Canada, represents the largest segment in the global IT training market. This dominance is attributed to the presence of major technology companies, a highly developed IT infrastructure, and substantial investments in research and development. The region is a leader in cutting-edge technologies like AI, ML, and cloud computing, driving the demand for advanced IT training solutions. Furthermore, the strong culture of continuous learning and development in North American corporations contributes to the growth of the North America IT training market.

The Asia Pacific IT training market is experiencing significant growth, driven by rapid economic development, increasing adoption of digital technologies, and a large, young, and tech-savvy population. Countries like India and China are leading this growth, with their expanding IT sectors and government initiatives promoting digital literacy and IT skills development. The region is seeing a rise in demand for IT training in areas such as software development, cybersecurity, and data analytics. Additionally, the growing startup ecosystem and the expansion of multinational corporations in this region are further bolstering the IT training market.

The Europe IT training market is characterized by its focus on advanced technology training and strong government support for digital education. The emphasis on data protection and privacy in the region, particularly with regulations like GDPR, has spurred the need for specialized IT training in cybersecurity and data compliance. Furthermore, the advanced industrial sector in the region demands ongoing IT skill development, particularly in areas such as Industry 4.0, automation, and IoT. The diverse language landscape of Europe also necessitates localized training solutions, catering to a multilingual workforce.

The Latin America IT training market is growing steadily, driven by digital transformation efforts across various sectors and increasing government initiatives to enhance digital skills among the population. Countries like Brazil, Mexico, and Argentina are seeing a rise in demand for IT training, particularly in response to the growing IT outsourcing market. The region is focusing on bridging the digital skills gap and fostering a tech-savvy workforce, with training programs increasingly focusing on areas such as software development, cloud computing, and cybersecurity.

The Middle East and Africa (MEA) IT training market is influenced by a growing emphasis on diversifying economies and reducing reliance on oil revenues. There is a concerted effort in countries like the UAE, Saudi Arabia, and South Africa to promote digital transformation and innovation. The IT training market in MEA is driven by initiatives to enhance IT infrastructure, increase internet penetration, and develop a skilled workforce capable of supporting emerging technologies. Demand for IT training in this region is focused on areas like software development, network administration, and cybersecurity, aligned with the digital growth objectives of the countries.

Leading Key Players in the IT Training Industry:

The leading companies in the IT training market are actively engaging in strategic collaborations, technological innovations, and expanding their service portfolios to meet diverse customer needs. These companies are focusing on developing cutting-edge, flexible learning platforms that incorporate AI and machine learning to personalize the training experience. They are also forming partnerships with educational institutions and technology firms to enrich their training content and ensure it aligns with current industry standards. In response to the global demand for specialized IT skills, these market leaders are offering a broad range of certifications and courses, covering emerging technologies like cybersecurity, cloud computing, and data analytics, while ensuring global accessibility through online platforms.

The IT training market report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

Avnet, Inc. (Tech Data Corporation)

Computer Generated Solutions

Dell Technologies

ExecuTrain

ExitCertified (Tech Data Corporation)

Fast Lane

Firebrand Training Limited (BPP Education Group)

Global Knowledge Training LL (Softskill)

GP Strategies (Learning Technologies Group plc.)

Hewlett Packard Enterprise Development LP

International Business Machines Corporation

ILX Group (APM Group)

LearnQuest, Inc.

New Horizons Computer Learning Center, Inc.

Oracle Corporation

QA Ltd. (CVC Capital Partners)

SAP SE

Corpex

Key Questions Answered in This Report

- 1. What was the size of the global IT training market in 2024?

- 2. What is the expected growth rate of the global IT training market during 2025-2033?

- 3. What are the key factors driving the global IT training market?

- 4. What has been the impact of COVID-19 on the global IT training market?

- 5. What is the breakup of the global IT training market based on the application?

- 6. What is the breakup of the global IT training market based on the end user?

- 7. What are the key regions in the global IT training market?

- 8. Who are the key players/companies in the global IT training market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global IT Training Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Application

- 6.1 IT Infrastructure Training

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Enterprise Application and Software Training

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Cyber Security Training

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Database and Big Data Training

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Others

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

7 Market Breakup by End-User

- 7.1 Corporate

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Schools and Colleges

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Others

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

8 Market Breakup by Region

- 8.1 North America

- 8.1.1 United States

- 8.1.1.1 Market Trends

- 8.1.1.2 Market Forecast

- 8.1.2 Canada

- 8.1.2.1 Market Trends

- 8.1.2.2 Market Forecast

- 8.1.1 United States

- 8.2 Asia Pacific

- 8.2.1 China

- 8.2.1.1 Market Trends

- 8.2.1.2 Market Forecast

- 8.2.2 Japan

- 8.2.2.1 Market Trends

- 8.2.2.2 Market Forecast

- 8.2.3 India

- 8.2.3.1 Market Trends

- 8.2.3.2 Market Forecast

- 8.2.4 South Korea

- 8.2.4.1 Market Trends

- 8.2.4.2 Market Forecast

- 8.2.5 Australia

- 8.2.5.1 Market Trends

- 8.2.5.2 Market Forecast

- 8.2.6 Indonesia

- 8.2.6.1 Market Trends

- 8.2.6.2 Market Forecast

- 8.2.7 Others

- 8.2.7.1 Market Trends

- 8.2.7.2 Market Forecast

- 8.2.1 China

- 8.3 Europe

- 8.3.1 Germany

- 8.3.1.1 Market Trends

- 8.3.1.2 Market Forecast

- 8.3.2 France

- 8.3.2.1 Market Trends

- 8.3.2.2 Market Forecast

- 8.3.3 United Kingdom

- 8.3.3.1 Market Trends

- 8.3.3.2 Market Forecast

- 8.3.4 Italy

- 8.3.4.1 Market Trends

- 8.3.4.2 Market Forecast

- 8.3.5 Spain

- 8.3.5.1 Market Trends

- 8.3.5.2 Market Forecast

- 8.3.6 Russia

- 8.3.6.1 Market Trends

- 8.3.6.2 Market Forecast

- 8.3.7 Others

- 8.3.7.1 Market Trends

- 8.3.7.2 Market Forecast

- 8.3.1 Germany

- 8.4 Middle East and Africa

- 8.4.1 Turkey

- 8.4.1.1 Market Trends

- 8.4.1.2 Market Forecast

- 8.4.2 Saudi Arabia

- 8.4.2.1 Market Trends

- 8.4.2.2 Market Forecast

- 8.4.3 Iran

- 8.4.3.1 Market Trends

- 8.4.3.2 Market Forecast

- 8.4.4 United Arab Emirates

- 8.4.4.1 Market Trends

- 8.4.4.2 Market Forecast

- 8.4.5 Others

- 8.4.5.1 Market Trends

- 8.4.5.2 Market Forecast

- 8.4.1 Turkey

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.1.1 Market Trends

- 8.5.1.2 Market Forecast

- 8.5.2 Mexico

- 8.5.2.1 Market Trends

- 8.5.2.2 Market Forecast

- 8.5.3 Argentina

- 8.5.3.1 Market Trends

- 8.5.3.2 Market Forecast

- 8.5.4 Colombia

- 8.5.4.1 Market Trends

- 8.5.4.2 Market Forecast

- 8.5.5 Chile

- 8.5.5.1 Market Trends

- 8.5.5.2 Market Forecast

- 8.5.6 Peru

- 8.5.6.1 Market Trends

- 8.5.6.2 Market Forecast

- 8.5.7 Others

- 8.5.7.1 Market Trends

- 8.5.7.2 Market Forecast

- 8.5.1 Brazil

9 SWOT Analysis

- 9.1 Overview

- 9.2 Strengths

- 9.3 Weaknesses

- 9.4 Opportunities

- 9.5 Threats

10 Value Chain Analysis

11 Porters Five Forces Analysis

- 11.1 Overview

- 11.2 Bargaining Power of Buyers

- 11.3 Bargaining Power of Suppliers

- 11.4 Degree of Competition

- 11.5 Threat of New Entrants

- 11.6 Threat of Substitutes

12 Price Analysis

13 Competitive Landscape

- 13.1 Market Structure

- 13.2 Key Players

- 13.3 Profiles of Key Players

- 13.3.1 Avnet, Inc. (Tech Data Corporation)

- 13.3.2 Computer Generated Solutions

- 13.3.3 Dell Technologies

- 13.3.4 ExecuTrain

- 13.3.5 ExitCertified (Tech Data Corporation)

- 13.3.6 Fast Lane

- 13.3.7 Firebrand Training Limited (BPP Education Group)

- 13.3.8 Global Knowledge Training LL (Softskill)

- 13.3.9 GP Strategies (Learning Technologies Group plc.)

- 13.3.10 Hewlett Packard Enterprise Development LP

- 13.3.11 International Business Machines Corporation

- 13.3.12 ILX Group (APM Group)

- 13.3.13 LearnQuest, Inc.

- 13.3.14 New Horizons Computer Learning Center, Inc.

- 13.3.15 Oracle Corporation

- 13.3.16 QA Ltd. (CVC Capital Partners)

- 13.3.17 SAP SE

- 13.3.18 Corpex