|

|

市場調査レポート

商品コード

1832016

局所鎮痛剤の市場規模、シェア、動向、予測:治療クラス、製剤、タイプ、流通チャネル、地域別、2025~2033年Topical Pain Relief Market Size, Share, Trends and Forecast by Therapeutic Class, Formulation, Type, Distribution Channel, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 局所鎮痛剤の市場規模、シェア、動向、予測:治療クラス、製剤、タイプ、流通チャネル、地域別、2025~2033年 |

|

出版日: 2025年10月01日

発行: IMARC

ページ情報: 英文 143 Pages

納期: 2~3営業日

|

概要

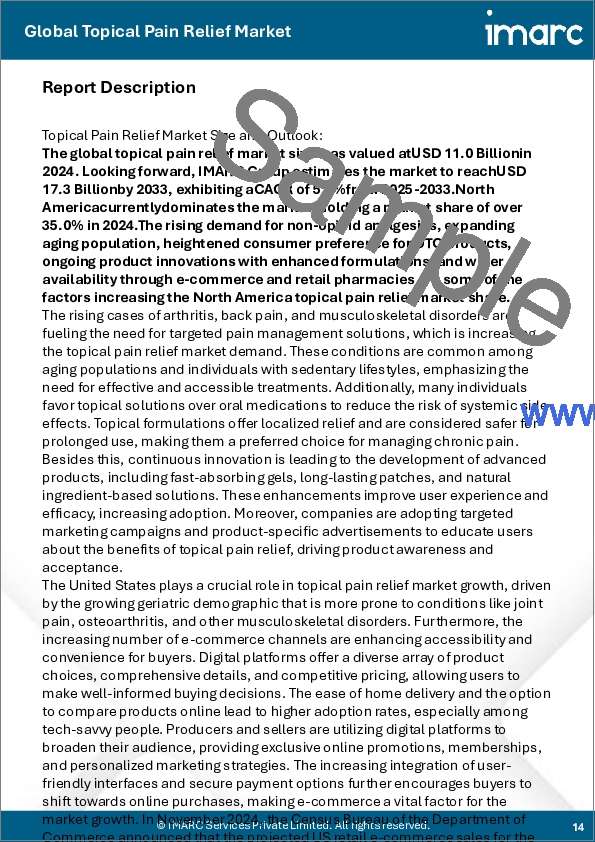

局所鎮痛剤の世界市場規模は2024年に110億米ドルとなりました。今後、IMARC Groupは、2033年には173億米ドルに達し、2025~2033年にかけて5.1%のCAGRを示すと予測しています。現在、北米が市場を独占しており、2024年の市場シェアは35.0%を超えています。非オピオイド鎮痛薬に対する需要の高まり、高齢化人口の拡大、OTC製品に対する消費者の嗜好の高まり、配合を改良した製品の継続的なイノベーション、eコマースや小売薬局を通じた幅広い入手可能性などが、北米の局所鎮痛剤市場シェアを高める要因となっています。

関節炎、腰痛、筋骨格系障害の増加により、標的を絞った疼痛管理ソリューションの必要性が高まっており、局所鎮痛剤市場の需要を高めています。これらの疾患は、高齢化した人々や座りっぱなしのライフスタイルの人々によく見られ、効果的で利用しやすい治療の必要性が強調されています。さらに、全身的な副作用のリスクを軽減するために、経口薬よりも外用薬を好む人も多いです。局所製剤は局所的な緩和をもたらし、長期間の使用にも安全であると考えられているため、慢性疼痛の管理には好ましい選択肢となっています。このほか、絶え間ない技術革新により、吸収の速いゲル、長時間持続するパッチ、天然成分ベースソリューションなど、先進的な製品の開発が進んでいます。このような機能強化により、使用感や効能が向上し、採用が増加しています。さらに、企業は対象を絞ったマーケティングキャンペーンや製品に特化した広告を採用し、局所鎮痛剤の利点をユーザーに啓蒙することで、製品の認知度と受容度を高めています。

米国は局所鎮痛剤市場の成長において重要な役割を担っており、これは関節痛、変形性関節症、その他の筋骨格系障害などの症状を起こしやすい高齢者層の増加によるものです。さらに、eコマースチャネルの増加により、購入者のアクセシビリティと利便性が向上しています。デジタルプラットフォームは、多様な製品の選択肢、包括的な詳細情報、競合価格設定を提供し、ユーザーが十分な情報を得た上で購入を決定できるようにしています。宅配が簡単で、オンラインで商品を比較できるオプションは、特に技術に精通した人々の間で、より高い普及率につながっています。生産者や販売者はデジタルプラットフォームを活用し、限定オンラインプロモーションや会員制サービス、パーソナライズされたマーケティング戦略を提供することで、利用者を広げています。ユーザーフレンドリーなインターフェースと安全な決済オプションの統合が進むことで、購入者のオンライン購入への移行がさらに促進され、eコマースは市場成長にとって不可欠な要素となっています。2024年11月、米国商務省国勢調査局は、2024年第3四半期の米国小売eコマース売上高予測が3,001億米ドルに達し、2024年第2四半期と比較して2.6%増加したと発表しました。

局所鎮痛剤市場動向

関節炎と筋骨格系障害の有病率の増加

クリーム、ゲル、パッチを含む局所鎮痛剤の選択肢は、経口薬に比べて全身的な副作用のリスクが低く、標的を絞った疼痛緩和を提供するため、多くの人に好まれます。世界保健機関(WHO)によると、世界で約17億1,000万人が筋骨格系障害に苦しんでおり、局所疼痛管理ソリューションの需要が高まっています。局所鎮痛剤市場洞察によると、これらの治療は複数の健康状態や薬剤を抱える高齢者にとって特に有益であり、薬剤相互作用のリスクを軽減します。経口鎮痛剤の効果的な代替品として局所療法が支持されるようになったことで、市場は大きく拡大しています。変形性関節症や関節リウマチのような症状を経験する人々は、しばしば局所的な不快感から迅速に解放され、運動能力や全体的な生活の質を向上させています。より優れた吸収技術や徐放性製剤などの改良により、ユーザーの関与はさらに高まっています。さらに、天然と有機製品の進歩は、より安全でサステイナブル治療オプションに対するニーズの高まりに対応しています。

ドラッグデリバリー技術の絶え間ない進歩

局所鎮痛剤アイテムの有効性を向上させるのに重要なドラッグデリバリー技術の継続的進歩は、局所鎮痛剤市場の重要な動向です。130万人以上に雇用を提供する米国の製薬産業は、マイクロカプセル化、ナノ製剤、経皮パッチなどの革新的な送達メカニズムの進歩をリードしてきました。これらの技術は、皮膚吸収の改善、放出制御、有効医薬品成分(API)の正確なターゲティングを容易にし、疼痛管理の強化につながります。これらの非侵襲的な技術は、全身への曝露を減らし副作用を軽減することで、従来型経口薬に比べてより安全な選択肢を求めるユーザーニーズの高まりに合致しています。さらに、ドラッグデリバリーシステムの改善により、現在の薬剤を作り直すことが可能になり、有効性と患者のアドヒアランスを高めることで、古いAPIを活性化することができます。企業はまた、カプセル化された原薬を持つマイクロニードルのような、様々な技術を統合したハイブリッドシステムを研究しており、イノベーションの可能性をさらに広げています。

研究開発(R&D)への投資拡大

局所鎮痛剤市場調査報告書によると、製薬企業による研究開発(R&D)投資の活発化が、有効性の向上、作用時間の延長、副作用の低減を実現する先進的製剤の開発を促進しています。こうした取り組みには、有機・天然代替品へのニーズの高まりに対応し、鎮痛効果を持つ新規有効成分や天然物質の研究も含まれています。2024年に563億米ドルと推定される世界の鎮痛剤市場は、鎮痛ソリューションの進歩に大きな可能性があることを裏付けています。製薬会社は研究開発を活用して、素早く吸収されるゲルや持続性のあるパッチなど、集中的な緩和を提供する革新的なドラッグデリバリーシステムを開発しています。さらに、さまざまな強さと活性成分を持つ製品レンジの拡大を目指した取り組みが、軽度から強い痛みの緩和まで、幅広いユーザーの要求に対応しています。このような進歩は、製品の性能を高め、激しい市場競争の中で企業が際立つための一助となります。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

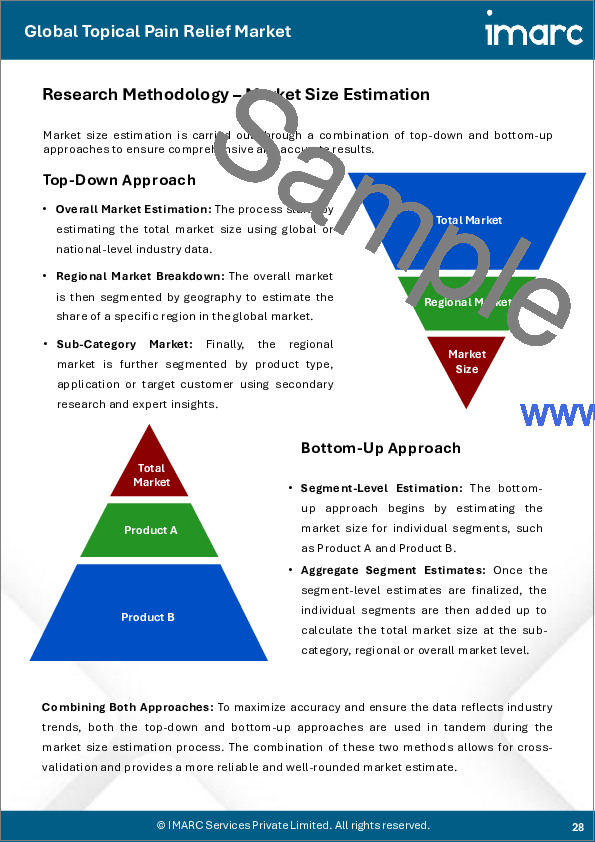

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

第5章 世界の局所鎮痛剤市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:治療クラス別

- 非オピオイド

- オピオイド

第7章 市場内訳:製剤別

- クリーム

- ゲル

- スプレー

- パッチ

- その他

第8章 市場内訳:タイプ別

- 配合鎮痛剤

- 市販鎮痛剤

第9章 市場内訳:流通チャネル別

- 薬局とドラッグストア

- 小売店

- オンラインストア

第10章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

第11章 SWOT分析

第12章 バリューチェーン分析

第13章 ポーターのファイブフォース分析

第14章 価格分析

第15章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Advacare Pharma

- Exzell Pharma Inc.

- Glaxosmithkline Plc

- Johnson & Johnson

- Novartis AG

- Pfizer Inc.

- Reckitt Benckiser Group Plc

- Sanofi S.A.

- Sun Pharmaceutical Industries Limited

- Topical Biomedics Inc.