|

|

市場調査レポート

商品コード

1820353

難燃剤の市場規模、シェア、動向、予測:タイプ、用途、最終用途産業、地域別、2025年~2033年Flame Retardants Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 難燃剤の市場規模、シェア、動向、予測:タイプ、用途、最終用途産業、地域別、2025年~2033年 |

|

出版日: 2025年09月01日

発行: IMARC

ページ情報: 英文 141 Pages

納期: 2~3営業日

|

概要

難燃剤の世界市場規模は2024年に103億8,000万米ドルとなりました。今後、IMARC Groupは、同市場が2033年までに169億6,000万米ドルに達し、2025年から2033年にかけて5.56%のCAGRを示すと予測しています。現在、アジア太平洋地域が市場を独占しており、2024年には57.6%を超える大きな市場シェアを占めています。航空宇宙産業における難燃剤の使用の増加、様々な産業における火災安全規制や基準の重視の高まり、再生可能な資源に由来するバイオベースの難燃剤の導入などが、市場成長を促進する主な要因の一部です。

同市場は、主に建設、エレクトロニクス、自動車分野など、さまざまな産業における安全規制の高まりによって緩やかな成長を遂げています。例えば、エボニックは2024年6月、電気自動車のバッテリー筐体の安全性を向上させるTEGO Therm製品群を発表しました。これらの耐熱・耐火コーティングは、UL 94 V-0規格に準拠した熱暴走防止に役立ちます。厳しい火災安全基準とともに、住宅や商業ビルにおける耐火材料への需要の高まりも、市場成長に明るい見通しをもたらしています。難燃性部品を必要とする電子自動車や電子機器の使用が増加していることも、市場の需要をさらに押し上げています。新興国におけるインフラプロジェクトの拡大が市場機会をさらに押し上げています。

米国の難燃剤市場は、建設、自動車、電子機器などの業界全体にわたる厳しい火災安全規制と基準によって牽引されています。例えば、2024年7月、Cambium社とCheckerspot社は、防衛や商業分野をターゲットとした高温や火災に強いPFASフリーの発泡製品を作るための提携を発表しました。この提携は、持続可能な国内サプライチェーンを維持しながら、航空宇宙や自動車などの産業全体の性能を向上させるために高度なバイオマテリアルを活用するものです。都市化とインフラ開発により、住宅や商業ビルにおける耐火材への需要が高まっていることが、市場の成長を支えています。非ハロゲン系で環境に優しい難燃剤の技術革新は、持続可能性の目標と規制遵守に合致しており、市場の成長に寄与しています。

難燃剤市場の動向:

火災安全規制の重視の高まり

市場に好影響を与えている主な要因の1つは、複数の産業で火災安全基準や規制への注目が高まっていることです。さらに、ダッシュボード、シート、ワイヤーハーネスなど、事故時に炎を止める内装部品の製造に難燃剤が使用される自動車産業が増加していることも、市場に明るい見通しをもたらしています。NFPAによると、2018年から2022年にかけて、自動車または乗用車が関係する車両火災が年平均119,681件報告されました。これらの事故は、全車両火災の56%、高速道路車両火災の61%を占めています。一般的に、これらの火災は380人の民間人死亡者(65%)、783人の民間人負傷者(59%)、7億6,500万米ドルの物的損害(35%)につながりました。さらに、デバイスを保護し電気火災を防止するための難燃剤へのエレクトロニクス分野の依存度が高まっていることが、市場の成長を促進しています。火災のリスクを下げ、人々や財産を守るために、世界中の規制機関や管理団体も厳しい安全規制を実施しています。

複数の産業からの需要の高まり

安全性を向上させ、法的要件を満たすために、エレクトロニクス、自動車、建築など、さまざまな業界で難燃剤に対する需要が増加していることは、市場に大きな影響を与えています。さらに、住宅、商業施設、工業施設における火災の危険性を軽減するために、屋根材、被覆材、断熱材に難燃剤を使用する必要性が高まっています。世界銀行によると、現在、世界人口の56%、44億人が都市に住んでいます。2050年までにこの数字は倍増し、70%近くの人々が都市部に住むようになると予想されています。これとは別に、大手自動車メーカーはドライバーと乗客の安全性を高めるため、自動車の内装や電気系統に難燃性素材を採用する傾向を強めています。さらに、スマートフォン、ノートパソコン、その他のモバイル機器などの家電製品への難燃剤の採用が増加していることも、市場の成長を後押ししています。

技術の進歩

難燃剤技術の継続的な進歩も市場成長の主な要因です。さらに、環境にやさしく毒性が低い難燃剤の開発に注目が集まっていることも、有利な市場見通しをもたらしています。これとは別に、再生可能な資源に由来するバイオベースの難燃剤の導入は、幅広い消費者層を引き付けています。IEAによると、再生可能エネルギー供給の約40%は発電によるものです。さらに、複数のメーカーや研究者が、より適応性が高く、効率的で環境に優しい最先端の難燃剤ソリューションを生み出しています。さらに、化学物質の使用量を削減し、環境衛生を改善するために、ナノスケールの難燃剤化合物の使用が増加しているため、市場は拡大しています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

第5章 世界の難燃剤市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:タイプ別

- アルミナ三水和物

- 臭素化難燃剤

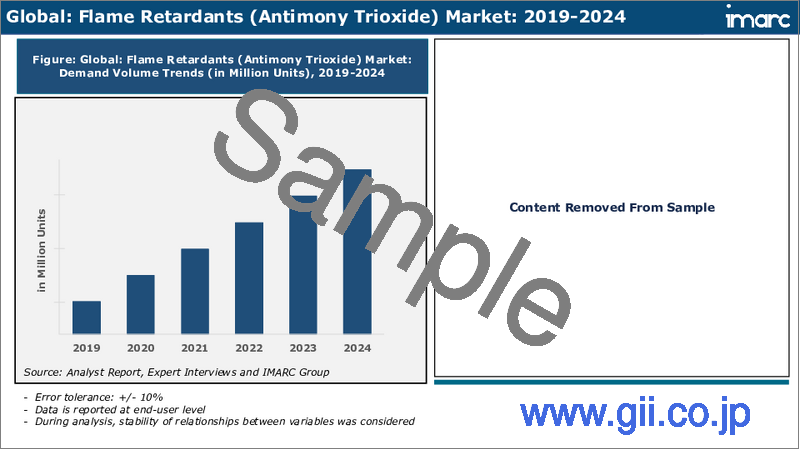

- 三酸化アンチモン

- リン難燃剤

- その他

第7章 市場内訳:用途別

- 不飽和ポリエステル樹脂

- エポキシ樹脂

- PVC

- ゴム

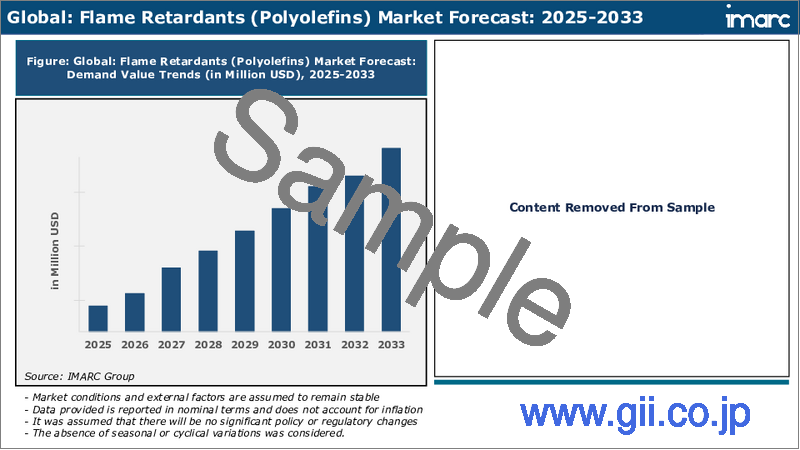

- ポリオレフィン

- その他

第8章 市場内訳:最終用途産業別

- 建設

- 電線・ケーブル

- 自動車・輸送

- 電気・電子工学

- その他

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

第10章 SWOT分析

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Almatis GmbH

- BASF SE

- Borealis GmbH(OMV Aktiengesellschaft)

- Budenheim Iberica S.L.U

- Campine NV

- Clariant AG

- Dover Chemical Corporation(ICC Industries Inc.)

- Dow Inc.

- ICL Group Ltd

- Lanxess AG

- Otsuka Chemical Co. Ltd.

- RTP Company(Miller Waste Mills Inc.)