|

|

市場調査レポート

商品コード

1792305

建築用内装塗料の市場レポート:樹脂タイプ別、技術別、流通チャネル別、消費者タイプ別、最終用途別、地域別、2025~2033年Interior Architectural Coatings Market Report by Resin Type, Technology, Distribution Channel, Type of Consumer, End Use Sector, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 建築用内装塗料の市場レポート:樹脂タイプ別、技術別、流通チャネル別、消費者タイプ別、最終用途別、地域別、2025~2033年 |

|

出版日: 2025年08月01日

発行: IMARC

ページ情報: 英文 137 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

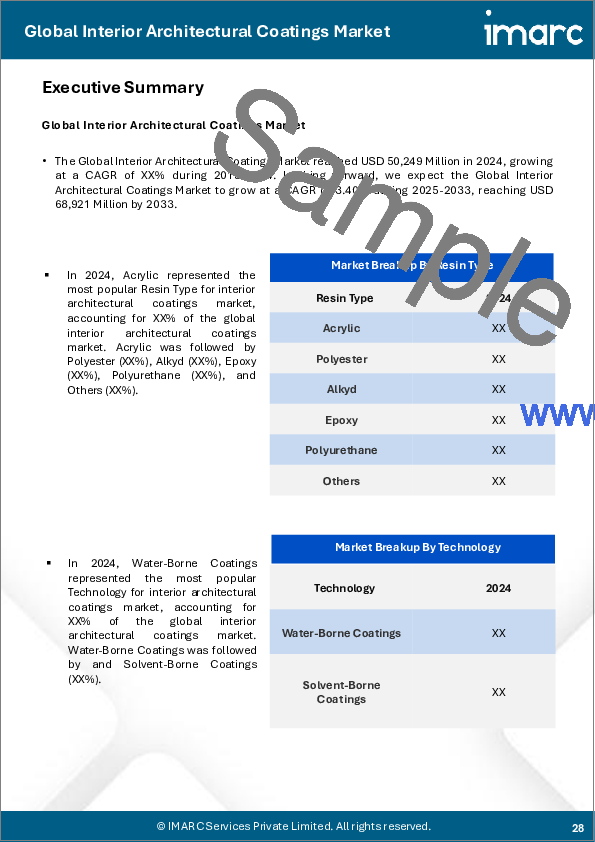

世界の建築用内装塗料の市場規模は2024年に502億米ドルに達しました。IMARC Groupは、2033年には689億米ドルに達し、2025~2033年にかけて3.40%の成長率(CAGR)を示すと予測しています。同市場は、主に建設活動の活発化、環境に優しい塗料への需要の高まり、様々な技術の進歩によって大きな成長を遂げています。また、住宅部門の急成長とプロフェッショナルの優位性も市場成長にプラスに寄与しています。

建築用内装塗料市場の分析:

- 主な市場促進要因:都市化と可処分所得の増加を背景とした、住宅・商業両部門における建設活動の急速な増加が挙げられます。環境に優しい低VOC塗料への注目の高まりは、厳しい環境規制と持続可能な製品に対する消費者の嗜好に合致しています。また、さまざまな技術の進歩により、耐久性が高く、塗りやすく、汎用性の高い塗料が開発され、市場の成長を後押ししています。

- 主な市場動向:主な市場動向としては、環境意識の高まりと規制の圧力により、環境に優しく低VOC製品に対する需要が急速に高まっていることが挙げられます。また、様々な技術の進歩により、革新的で耐久性に優れ、塗布が容易な塗料剤が開発されています。カスタマイズや美的嗜好も、幅広い仕上げや色の開発を後押ししています。さらに、セルフクリーニングや抗菌特性を備えたスマート塗料の成長も大きな牽引力となっています。こうした要因が総合的に、建築用内装塗料市場の成長に明るい見通しをもたらしています。

- 地理的動向:アジア太平洋地域は、急速な都市化、建設活動の増加、中間層の人口増加により、建築用内装塗料市場をリードしています。中国やインドなどの国々では、インフラ整備や住宅建設が盛んに行われており、高品質な塗料への需要が高まっています。さらに、可処分所得の増加、美観と住宅改修への関心の高まりも市場成長に寄与しています。同地域の良好な経済状況と持続可能で環境に優しい塗料への投資も、同市場における同地域のリーダーシップを強化しています。

- 競合情勢:建築用内装塗料の主要市場プレイヤーには、Akzo Nobel N.V.、Axalta Coatings Systems, LLC、Asian Paints Limited、BASF SE、Nippon Paint/ Nipsea Group、Kansai Paint Co. Ltd.、PPG Industries, Inc.Ltd.、PPG Industries, Inc.、RPM International Inc.、The Sherwin-Williams Company、The Valspar Corporationなどがあります。

- 課題と機会:市場は、厳しい環境規制、高い原料コスト、多様な消費者の需要を満たすための継続的な技術革新の必要性など、様々な課題に直面しています。しかし、これらの課題は、環境に優しく低VOCの塗料や、耐久性に優れた配合の開発など、大きな機会ももたらしています。セルフクリーニング性や抗菌性を備えたスマート塗料への動向の高まりは、さらなる成長の可能性をもたらしています。新興市場における建設活動の拡大と、カスタマイズされた美的ソリューションに対する需要の高まりが、建築用内装塗料市場の成長をさらに後押ししています。

建築用内装塗料市場の動向:

技術の進歩

技術の進歩は、優れた耐久性、防汚性、塗りやすさを提供する高度な配合の開発に焦点を当てています。革新的な技術には、滑らかな仕上がりを保証するセルフレベリング塗料や、さまざまな表面に適した接着特性を強化した塗料などがあります。これらの進歩により、メンテナンスコストが削減され、塗装面の寿命が延びます。さらに、ナノテクノロジーやスマート素材を塗料に取り入れることで、塗料の性能が向上し、環境要因や摩耗に対する耐性が高まります。例えば、BASFはIO-Hybrid Technologyを導入し、Acronal(R)EDGE 7073で建築用塗料に革命を起こしました。この革新的な塗料は、優れたカバー力を提供し、缶内の殺生物剤の必要性を排除し、抗菌保護を提供します。住宅、商業、工業プロジェクトにおいて、効率的な塗布とプロフェッショナルな仕上がりが期待できます。

普及が進むスマート塗料

スマート塗料は、メンテナンスの手間を軽減するセルフクリーニング特性や、より健康的な住環境を促進する抗菌機能などの特徴により、建築用内装塗料市場に革命をもたらしています。また、断熱性や反射仕上げなどの省エネ性能は、室内の温度調節を助け、エネルギー効率を高めます。このような革新的な塗料は、美観だけでなく機能的なメリットも提供するため、現代のインテリアデザインへの採用が拡大しています。例えば、2023年2月、PPGとCorningは共同で、Corningのガーディアント技術を統合し、継続的な抗菌保護を提供するCopper Armor塗料を発表しました。EPA(米国環境保護庁)の殺ウイルス剤として登録されたこの塗料は、銅の抗菌力と多様なカラーパレットを組み合わせ、さまざまな環境に適しています。2時間以内にウイルスや細菌を死滅させる能力を持つこの製品は、商業空間でも住宅空間でも、人通りの多い場所に最適です。

建設業界の成長

新興市場を中心とした住宅・商業施設の建設拡大が、内装用塗料の需要を大幅に押し上げています。急速な都市化と可処分所得の増加が、新たな住宅プロジェクトや商業開発を後押ししています。このような建設活動の急増により、耐久性、美観、保護の面で高品質の内装塗料が必要とされています。さらに、インフラ整備を促進する政府の取り組みも市場拡大に寄与しています。このように、建設業界の成長は、消費者の嗜好の変化やプロジェクトの要件に対応するために、内装塗料メーカーに大きな機会を生み出しています。Invest Indiaが発表したデータによると、インドの建設産業は2025年までに1兆4,000億米ドルに達し、2030年までにインドのGDPの70%を都市が生み出すと予測されています。2030年までに約6億人が都市部に住むと予想されており、2,500万戸の中級住宅と手頃な価格の住宅が追加される需要が生まれます。政府はNIPの下、インフラ整備に1兆4,000億米ドルを割り当てており、2023年度連邦予算でも追加割り当てが示されています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の建築用内装塗料市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場内訳:樹脂タイプ別

- 市場内訳:技術別

- 市場内訳:流通チャネル別

- 市場内訳:消費者タイプ別

- 市場内訳:最終用途別

- 市場内訳:地域別

- 市場予測

- SWOT分析

- バリューチェーン分析

- ポーターのファイブフォース分析

- 価格分析

第6章 市場内訳:樹脂タイプ別

- アクリル

- ポリエステル

- アルキド

- エポキシ

- ポリウレタン

- その他

第7章 市場内訳:技術別

- 水性塗料

- 溶剤系塗料

第8章 市場内訳:流通チャネル別

- 直営店

- 独立系販売代理店

- 大規模小売業者・卸売業者

第9章 市場内訳:消費者タイプ別

- プロフェッショナル

- DIY消費者

第10章 市場内訳:最終用途別

- 住宅

- 非住宅

第11章 市場内訳:地域別

- アジア太平洋地域

- 欧州

- 北米

- 中東・アフリカ

- ラテンアメリカ

第12章 建築用内装塗料の製造プロセス

- 製品概要

- 原材料の要件

- 製造プロセス

- 主要成功要因とリスク要因

第13章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Akzo Nobel N.V.

- Axalta Coatings Systems, LLC

- Asian Paints Limited

- BASF SE

- Nippon Paint/Nipsea Group

- Kansai Paint Co. Ltd.

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- The Valspar Corporation

List of Figures

- Figure 1: Global: Interior Architectural Coatings Market: Major Drivers and Challenges

- Figure 2: Global: Interior Architectural Coatings Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Interior Architectural Coatings Market: Breakup by Resin Type (in %), 2024

- Figure 4: Global: Interior Architectural Coatings Market: Breakup by Technology (in %), 2024

- Figure 5: Global: Interior Architectural Coatings Market: Breakup by Distribution Channel (in %), 2024

- Figure 6: Global: Interior Architectural Coatings Market: Breakup by Type of Consumer (in %), 2024

- Figure 7: Global: Interior Architectural Coatings Market: Breakup by End-Use Sector (in %), 2024

- Figure 8: Global: Interior Architectural Coatings Market: Breakup by Region (in %), 2024

- Figure 9: Global: Interior Architectural Coatings Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 10: Global: Interior Architectural Coatings Industry: SWOT Analysis

- Figure 11: Global: Interior Architectural Coatings Industry: Value Chain Analysis

- Figure 12: Global: Interior Architectural Coatings Industry: Porter's Five Forces Analysis

- Figure 13: Global: Interior Architectural Coatings (Acrylic) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 14: Global: Interior Architectural Coatings (Acrylic) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 15: Global: Interior Architectural Coatings (Polyester) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 16: Global: Interior Architectural Coatings (Polyester) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 17: Global: Interior Architectural Coatings (Alkyd) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 18: Global: Interior Architectural Coatings (Alkyd) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 19: Global: Interior Architectural Coatings (Epoxy) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 20: Global: Interior Architectural Coatings (Epoxy) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 21: Global: Interior Architectural Coatings (Polyurethane) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 22: Global: Interior Architectural Coatings (Polyurethane) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 23: Global: Interior Architectural Coatings (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 24: Global: Interior Architectural Coatings (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 25: Global: Interior Architectural Coatings (Water-Borne Coatings) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 26: Global: Interior Architectural Coatings (Water-Borne Coatings) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 27: Global: Interior Architectural Coatings (Solvent-Borne Coatings) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 28: Global: Interior Architectural Coatings (Solvent-Borne Coatings) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 29: Global: Interior Architectural Coatings Market: Sales through Company-Owned Stores (in Million USD), 2019 & 2024

- Figure 30: Global: Interior Architectural Coatings Market Forecast: Sales through Company-Owned Stores (in Million USD), 2025-2033

- Figure 31: Global: Interior Architectural Coatings Market: Sales through Independent Distributors (in Million USD), 2019 & 2024

- Figure 32: Global: Interior Architectural Coatings Market Forecast: Sales through Independent Distributors (in Million USD), 2025-2033

- Figure 33: Global: Interior Architectural Coatings Market: Sales through Large Retailers and Wholesalers (in Million USD), 2019 & 2024

- Figure 34: Global: Interior Architectural Coatings Market Forecast: Sales through Large Retailers and Wholesalers (in Million USD), 2025-2033

- Figure 35: Global: Interior Architectural Coatings (Professional Consumers) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 36: Global: Interior Architectural Coatings (Professional Consumers) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 37: Global: Interior Architectural Coatings (DIY Consumers) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 38: Global: Interior Architectural Coatings (DIY Consumers) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 39: Global: Interior Architectural Coatings (Residential Sector) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 40: Global: Interior Architectural Coatings (Residential Sector) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 41: Global: Interior Architectural Coatings (Non-Residential Sector) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 42: Global: Interior Architectural Coatings (Non-Residential Sector) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 43: Asia Pacific: Interior Architectural Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 44: Asia Pacific: Interior Architectural Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 45: Europe: Interior Architectural Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 46: Europe: Interior Architectural Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 47: North America: Interior Architectural Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 48: North America: Interior Architectural Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 49: Middle East and Africa: Interior Architectural Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 50: Middle East and Africa: Interior Architectural Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 51: Latin America: Interior Architectural Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 52: Latin America: Interior Architectural Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 53: Interior Architectural Coatings Manufacturing: Detailed Process Flow

List of Tables

- Table 1: Global: Interior Architectural Coatings Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Interior Architectural Coatings Market Forecast: Breakup by Resin Type (in Million USD), 2025-2033

- Table 3: Global: Interior Architectural Coatings Market Forecast: Breakup by Technology (in Million USD), 2025-2033

- Table 4: Global: Interior Architectural Coatings Market Forecast: Breakup by Distribution Channel (in Million USD), 2025-2033

- Table 5: Global: Interior Architectural Coatings Market Forecast: Breakup by Type of Consumer (in Million USD), 2025-2033

- Table 6: Global: Interior Architectural Coatings Market Forecast: Breakup by End-Use Sector (in Million USD), 2025-2033

- Table 7: Global: Interior Architectural Coatings Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 8: Interior Architectural Coatings Manufacturing: Raw Material Requirements

- Table 9: Global: Interior Architectural Coatings Market: Competitive Structure

- Table 10: Global: Interior Architectural Coatings Market: Key Players

The global interior architectural coatings market size reached USD 50.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 68.9 Billion by 2033, exhibiting a growth rate (CAGR) of 3.40% during 2025-2033. The market is experiencing a significant growth mainly driven by the rising construction activities, growing demand for eco-friendly coatings, and various technological advancements. Rapid growth in residential sector and professional consumer dominance is also contributing positively to the market growth.

Interior Architectural Coatings Market Analysis:

- Major Market Drivers: Key market drivers include the rapid increase in construction activities in both residential and commercial sector generally driven by urbanization and rising disposable incomes. The rising focus on eco-friendly and low-VOC coatings aligns with the strict environmental regulations and consumer preferences for sustainable products. Various technological advancements have also led to the development of more durable, easy to apply and versatile coatings, thereby propelling the market growth.

- Key Market Trends: Key market trends include the rapidly growing demand for eco-friendly and low-VOC products mainly due to the rising environmental awareness and regulatory pressures. Various technological advancements are also leading to innovative, durable and easy to apply coatings. Customization and aesthetic preferences are also driving the development of wide range of finishes and colors. Furthermore, the growth of smart coatings with self-cleaning and antimicrobial properties is also gaining significant traction. These factors are collectively creating a positive outlook for the interior architectural coatings market growth.

- Geographical Trends: The Asia-Pacific region leads the interior architectural coatings market due to rapid urbanization, increasing construction activities, and a growing middle-class population. Countries like China and India are experiencing significant infrastructure development and residential construction, driving demand for high-quality coatings. Additionally, rising disposable incomes and a growing focus on aesthetics and home improvement contribute to market growth. The region's favorable economic conditions and investments in sustainable and eco-friendly coatings also bolster its leadership in the market.

- Competitive Landscape: Some of the major market players in the interior architectural coatings industry include Akzo Nobel N.V., Axalta Coatings Systems, LLC, Asian Paints Limited, BASF SE, Nippon Paint/ Nipsea Group, Kansai Paint Co. Ltd., PPG Industries, Inc., RPM International Inc., The Sherwin-Williams Company, and The Valspar Corporation, among many others.

- Challenges and Opportunities: The market faces various challenges which includes the strict environmental regulations, high raw material costs and the pressing need for continuous innovation to meet diverse consumer demands. However, these challenges is presents significant opportunities as well which includes the development of ecofriendly, low- VOC coatings and advanced, durable formulations. The growing trends toward smart coatings with self-cleaning and antimicrobial properties offer additional growth prospects. Expansion in construction activities in emerging markets and the rising demand for customized aesthetic solutions further drive the interior architectural coatings market growth.

Interior Architectural Coatings Market Trends:

Technological Advancements

Technological advancements in the interior architectural coatings market analysis focus on developing advanced formulations that provide superior durability, stain resistance, and ease of application. Innovations include self-leveling paints, which ensure a smooth finish, and coatings with enhanced adhesive properties, making them suitable for a variety of surfaces. These advancements reduce maintenance costs and extend the lifespan of coated surfaces. Additionally, the incorporation of nanotechnology and smart materials in coatings enhances their performance, making them more resilient to environmental factors and wear. For instance, BASF introduced IO-Hybrid Technology, revolutionizing architectural coatings with Acronal(R) EDGE 7073. This innovative paint formulation offers superior coverage, eliminates the need for in-can biocides, and provides anti-microbial protection. Users can expect efficient application and professional results for residential, commercial, and industrial projects. Experience the future today by discovering the transformative benefits of Acronal(R) EDGE 7073.

Rising Prevalence of Smart Coatings

Smart coatings are revolutionizing the interior architectural coatings market with features like self-cleaning properties, which reduce maintenance efforts, and anti-microbial capabilities that promote healthier living environments. Energy-saving properties, such as thermal insulation and reflective finishes, help regulate indoor temperatures, enhancing energy efficiency. These innovative coatings offer functional benefits beyond aesthetics, driving their growing adoption in modern interior design. For instance, in February 2023, PPG and Corning collaborated to introduce Copper Armor paint, integrating Corning's Guardiant technology to offer continuous antimicrobial protection. The paint, EPA registered as virucidal, combines the antimicrobial power of copper with a diverse color palette and is suitable for various environments. With a capacity to kill viruses and bacteria within two hours, the product is ideal for high-traffic areas in both commercial and residential spaces.

Growth in the Construction Industry

The expansion in residential and commercial construction, especially in emerging markets, is significantly boosting the demand for interior coatings. Rapid urbanization and increasing disposable incomes are driving new housing projects and commercial developments. This surge in construction activities necessitates high-quality interior coatings for durability, aesthetics, and protection. Additionally, government initiatives promoting infrastructure development further fuel market growth. The rising construction industry thus creates substantial opportunities for interior coating manufacturers to cater to evolving consumer preferences and project requirements. According to the data published by the Invest India, the construction industry in India is expected to reach $1.4 trillion by 2025, with cities projected to generate 70% of India's GDP by 2030. Around 600 million people are anticipated to live in urban areas by 2030, creating a demand for 25 million additional mid-end and affordable housing units. The government has allocated $1.4 trillion for infrastructure under NIP, with additional allocations highlighted in the Union Budget 2023.

Interior Architectural Coatings Market Segmentation:

Breakup by Resin Type:

- Acrylic

- Polyester

- Alkyd

- Epoxy

- Polyurethane

- Others

Acrylic accounts for the majority of the market share

Acrylic coatings account for the majority of the interior architectural coatings market share due to their superior performance characteristics. These coatings offer excellent durability, quick drying times, and resistance to moisture and UV damage, making them ideal for various indoor applications. Acrylic coatings are also valued for their low odor and low VOC content, aligning with the growing consumer demand for environmentally friendly and safe products. Their versatility in finishes and ease of application further contribute to their dominant position in the market.

Breakup by Technology:

- Water-Borne Coatings

- Solvent-Borne Coatings

Water-Borne Coatings holds the largest share of the industry

Water-borne coatings hold the largest share of the Interior Architectural Coatings industry due to their environmental benefits and superior performance. These coatings emit low levels of volatile organic compounds (VOCs), making them safer for indoor air quality and compliant with stringent environmental regulations. Additionally, water-borne coatings offer excellent durability, easy application, and quick drying times. Their ability to maintain color stability and resistance to mold and mildew further enhances their appeal. As consumers and industries increasingly prioritize sustainability, the demand for water-borne coatings continues to grow, solidifying their leading market position.

Breakup by Distribution Channel:

- Company-Owned Stores

- Independent Distributors

- Large Retailers and Wholesalers

Company-owned stores represents the leading market segment

Company-owned stores represent the leading segment in the interior architectural coatings market forecast, driven by their ability to offer a consistent brand experience and high-quality customer service. These stores enable manufacturers to directly engage with customers, ensuring they receive expert advice and support tailored to their specific needs. Additionally, company-owned stores allow for better control over product presentation, inventory management, and promotional activities. By maintaining a direct sales channel, companies can effectively build brand loyalty, gather customer feedback, and respond quickly to market trends, further solidifying their market leadership.

Breakup by Type of Consumer:

- Professional Consumers

- DIY Consumers

Professional consumers exhibits a clear dominance in the market

Professional consumers exhibit clear dominance in the Interior Architectural Coatings market due to their significant purchasing power and influence on product trends. These consumers, including contractors, painters, and construction firms, prioritize high-quality, durable, and efficient coatings to ensure the longevity and aesthetic appeal of their projects. Their expertise and preference for premium, performance-oriented products drive demand for specialized coatings. Manufacturers often tailor their product lines and services to meet the specific needs of professional consumers, further reinforcing their dominant position in the market. This segment's consistent and large-scale purchasing behavior underpins its critical role in market dynamics.

Breakup by End Use Sector:

- Residential

- Non-Residential

Residential dominates the market

The residential sector dominates the interior architectural coatings market, driven by continuous housing development, renovation, and remodeling activities. Homeowners seek high-quality coatings that offer aesthetic appeal, durability, and environmental safety. The growing trend of DIY home improvement projects also contributes to the demand for user-friendly and versatile interior coatings. Additionally, rising disposable incomes and the increasing importance of home aesthetics and interior design fuel the preference for premium products. This robust demand from the residential sector makes it the leading segment in the interior architectural coatings market, driving innovation and sales growth.

Breakup by Region:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

Asia Pacific leads the market, accounting for the largest interior architectural coatings market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Middle East and Africa, and Latin America. According to the report, Asia-Pacific represents the largest regional market for interior architectural coatings.

Asia Pacific leads the Interior Architectural Coatings market, accounting for the largest market share due to rapid urbanization, industrialization, and economic growth in the region. Countries like China, India, and Southeast Asian nations are witnessing a surge in residential and commercial construction activities, driven by increasing population and rising disposable incomes. For instance, China's construction industry has seen significant transformation and technological advancement. The industry, with an output value exceeding 31 trillion yuan in 2022, has made strides in efficiency and energy reduction. Notable progress includes the development of a "zero-altitude" astronomical observation station and high-precision equipment for ultra-high-rise buildings. The industry's integration with advanced manufacturing and focus on green construction methods indicate a shift towards innovation-driven and sustainable development. Additionally, government initiatives promoting infrastructure development and affordable housing projects further boost demand. The expanding middle class and growing awareness of interior aesthetics and quality also contribute to the preference for premium coatings. These factors collectively position Asia Pacific as the dominant force in the global Interior Architectural Coatings market.

Key Questions Answered in This Report:

- How has the global interior architectural coatings market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global interior architectural coatings market?

- What is the impact of each driver, restraint, and opportunity on the global interior architectural coatings market?

- What are the key regional markets?

- Which countries represent the most attractive interior architectural coatings market?

- What is the breakup of the market based on the resin type?

- Which is the most attractive resin type in the interior architectural coatings market?

- What is the breakup of the market based on the technology?

- Which is the most attractive technology in the interior architectural coatings market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the interior architectural coatings market?

- What is the breakup of the market based on the type of consumer?

- Which is the most attractive type of consumer in the interior architectural coatings market?

- What is the breakup of the market based on the end-use sector?

- Which is the most attractive end-use sector in the interior architectural coatings market?

- What is the breakup of the market based on the region?

- Which is the most attractive region in the interior architectural coatings market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global interior architectural coatings market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Interior Architectural Coatings Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Breakup by Resin Type

- 5.5 Market Breakup by Technology

- 5.6 Market Breakup by Distribution Channel

- 5.7 Market Breakup by Type of Consumer

- 5.8 Market Breakup by End-Use Sector

- 5.9 Market Breakup by Region

- 5.10 Market Forecast

- 5.11 SWOT Analysis

- 5.11.1 Overview

- 5.11.2 Strengths

- 5.11.3 Weaknesses

- 5.11.4 Opportunities

- 5.11.5 Threats

- 5.12 Value Chain Analysis

- 5.13 Porters Five Forces Analysis

- 5.13.1 Overview

- 5.13.2 Bargaining Power of Buyers

- 5.13.3 Bargaining Power of Suppliers

- 5.13.4 Degree of Competition

- 5.13.5 Threat of New Entrants

- 5.13.6 Threat of Substitutes

- 5.14 Price Analysis

- 5.14.1 Key Price Indicators

- 5.14.2 Price Structure

- 5.14.3 Margin Analysis

6 Market Breakup by Resin Type

- 6.1 Acrylic

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Polyester

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Alkyd

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Epoxy

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Polyurethane

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

- 6.6 Others

- 6.6.1 Market Trends

- 6.6.2 Market Forecast

7 Market Breakup by Technology

- 7.1 Water-Borne Coatings

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Solvent-Borne Coatings

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

8 Market Breakup by Distribution Channel

- 8.1 Company-Owned Stores

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Independent Distributors

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Large Retailers and Wholesalers

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

9 Market Breakup by Type of Consumer

- 9.1 Professional Consumers

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 DIY Consumers

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

10 Market Breakup by End-Use Sector

- 10.1 Residential

- 10.1.1 Market Trends

- 10.1.2 Market Forecast

- 10.2 Non-Residential

- 10.2.1 Market Trends

- 10.2.2 Market Forecast

11 Market Breakup by Region

- 11.1 Asia Pacific

- 11.1.1 Market Trends

- 11.1.2 Market Forecast

- 11.2 Europe

- 11.2.1 Market Trends

- 11.2.2 Market Forecast

- 11.3 North America

- 11.3.1 Market Trends

- 11.3.2 Market Forecast

- 11.4 Middle East and Africa

- 11.4.1 Market Trends

- 11.4.2 Market Forecast

- 11.5 Latin America

- 11.5.1 Market Trends

- 11.5.2 Market Forecast

12 Interior Architectural Coatings Manufacturing Process

- 12.1 Product Overview

- 12.2 Raw Material Requirements

- 12.3 Manufacturing Process

- 12.4 Key Success and Risk Factors

13 Competitive Landscape

- 13.1 Market Structure

- 13.2 Key Players

- 13.3 Profiles of Key Players

- 13.3.1 Akzo Nobel N.V.

- 13.3.2 Axalta Coatings Systems, LLC

- 13.3.3 Asian Paints Limited

- 13.3.4 BASF SE

- 13.3.5 Nippon Paint/Nipsea Group

- 13.3.6 Kansai Paint Co. Ltd.

- 13.3.7 PPG Industries Inc.

- 13.3.8 RPM International Inc.

- 13.3.9 The Sherwin-Williams Company

- 13.3.10 The Valspar Corporation