|

|

市場調査レポート

商品コード

1642497

アルミニウム押出成形の市場レポート:製品タイプ別、合金タイプ別、最終用途産業別、地域別、2025年~2033年Aluminum Extrusion Market Report by Product Type, Alloy Type, End-Use Industry, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| アルミニウム押出成形の市場レポート:製品タイプ別、合金タイプ別、最終用途産業別、地域別、2025年~2033年 |

|

出版日: 2025年01月18日

発行: IMARC

ページ情報: 英文 134 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

世界のアルミニウム押出成形の市場規模は、2024年に974億米ドルに達しました。IMARC Groupは、2025年から2033年にかけての成長率(CAGR)は7.4%で、2033年までには1,852億米ドルに達すると予測しています。持続可能な建築への注目が高まっていること、原材料が入手可能で製造コストが比較的低いこと、建築や自動車産業でアルミニウム押出成形が広く利用されていることなどが、市場を推進している主な要因です。

アルミニウム押出成形は、一定の断面形状を持つ物体を作成するために使用される製造プロセスです。このプロセスでは、溶融アルミニウムをダイス(押出材に特定の形状を与える形状の開口部)に通す必要があります。通常、アルミニウムビレットは高温に加熱され、油圧プレスやラムを使ってダイに押し込んだり引き抜いたりします。この工程は汎用性が高く、複雑で入り組んだ形状を高い精度と一貫性で製造することができます。アルミニウム押出成形は、フレーム、レール、トラック、さらには電子用途のヒートシンクなど、幅広い製品の製造に一般的に使用されています。アルミニウムは軽量で耐食性に優れ、熱伝導率が高いため、自動車、航空宇宙、建築などさまざまな産業で好まれている材料です。

持続可能なアーキテクチャへの注目の高まりが、世界市場を牽引しています。環境に配慮した資源効率の高いグリーン・ビルディングは、世界的にますます人気が高まっています。これらの建築物では、窓やドアなどの主要部品にアルミニウム押出成形が頻繁に使用されており、建築分野での需要が高まっています。さらに、アルミニウム固有の柔軟性により、最小限のエネルギー消費で簡単に成形や曲げ加工ができるため、さまざまな産業用途でその魅力が高まっています。特定の要件に合わせてカスタマイズできるアルミニウム押出成形の汎用性は、航空宇宙、エネルギー、エレクトロニクスなど、さまざまな業界にアピールしています。この適応性により、アルミニウム押出製品の新しい市場と用途が開かれます。特にアジア太平洋を含む地域では、原材料が入手可能で製造コストが比較的低いため、アルミニウム押出成形はさまざまな用途で経済的な選択肢となっています。この費用対効果の高さは、大規模プロジェクトや全体的な材料コストの削減を目指す産業にとって特に魅力的です。

アルミニウム押出成形市場傾向 / 促進要因:

自動車・輸送分野における需要の増加

環境問題への関心が自動車業界をより持続可能な実践へと向かわせる中、軽量でエネルギー効率の高い材料へのニーズが高まっています。アルミニウム部品を使用することで、メーカーは車両重量を大幅に減らすことができ、それによって燃費を向上させ、温室効果ガスの排出量を減らすことができます。運輸部門が最大のエネルギー消費者のひとつであることを考えると、この変革は大きな波及効果をもたらします。さらに、アルミニウムは耐腐食性に優れているため、風雨にさらされる自動車外装部品や、船舶・航空宇宙用途に最適です。電気自動車(EV)もこの需要に貢献しています。内燃エンジン車からEVへの移行が加速するにつれて、アルミニウム押出成形のような軽量材料のニーズは、特にバッテリーの筐体や構造部品で高まると予想されます。さらに、地下鉄、路面電車、高速鉄道などの公共交通インフラへの投資が世界的に進んでいることも、輸送分野におけるアルミニウム押出成形の需要を促進しています。

成長する建設業界

アルミニウムの美的魅力、耐食性、高強度対重量比により、アルミニウムは近代的な建築設計に求められる材料となっています。グリーン建築や持続可能な建築の実践により、耐久性だけでなく環境にも優しい材料へのニーズが高まっています。アルミニウムはリサイクル可能であり、建築に使用することでLEED(エネルギーと環境設計におけるリーダーシップ)の認証ポイントに貢献することがよくあります。建設業界は、都市化や人口増加の影響もあり、発展途上国で急速な成長を遂げています。このような建設活動の増加は、アルミニウム押出製品に対する需要の増加につながります。さらに、押出技術の進歩により、ますます複雑で美しいデザインが可能になり、建設用途におけるアルミニウムの魅力がさらに高まっています。

製造プロセスの技術的進歩

直接押出、間接押出、静水圧押出などの高度な方法は、より高い柔軟性を提供し、より複雑な形状やフォームを作成するための新たな道を開きます。さらに、インダストリー4.0構想は、リアルタイムの監視、予知保全、データ分析を含むスマートな製造手法を組み込んでいるため、最適な生産レベルと品質管理が保証されます。これらの進歩により、操業コストが削減され、生産能力が向上し、メーカーはより競争力のある価格と多様な製品ポートフォリオを提供できるようになりました。その結果、以前はコストや複雑さを理由にアルミニウム押出成形を見過ごしていた業界も、今では有効な選択肢として検討するようになり、市場の需要が拡大しています。

目次

第1章 序文

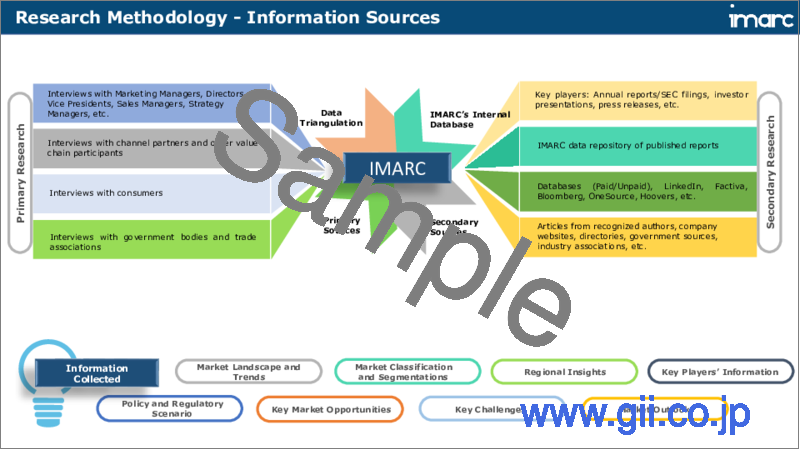

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 予測調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のアルミニウム押出成形市場

- 市場概要

- 市場実績

- 金額動向

- 数量動向

- COVID-19の影響

- 市場内訳:製品タイプ別

- 市場内訳:合金タイプ別

- 市場内訳:最終用途産業別

- 市場内訳:地域別

- 市場予測

第6章 市場内訳:製品タイプ別

- ミル仕上げ

- 市場動向

- 市場予測

- 陽極酸化処理

- 市場動向

- 市場予測

- 粉体塗装

- 市場動向

- 市場予測

第7章 市場内訳:合金タイプ別

- 1000シリーズアルミニウム合金

- 市場動向

- 市場予測

- 2000シリーズアルミニウム合金

- 市場動向

- 市場予測

- 3000シリーズアルミニウム合金

- 市場動向

- 市場予測

- 5000シリーズアルミニウム合金

- 市場動向

- 市場予測

- 6000シリーズアルミニウム合金

- 市場動向

- 市場予測

- 7000シリーズアルミニウム合金

- 市場動向

- 市場予測

第8章 市場内訳:最終用途産業別

- 建築・建設

- 市場動向

- 市場予測

- 交通機関

- 市場動向

- 市場予測

- 機械設備

- 市場動向

- 市場予測

- 耐久消費財

- 市場動向

- 市場予測

- 電気

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第9章 市場内訳:地域別

- アジア太平洋

- 市場動向

- 市場予測

- 欧州

- 市場動向

- 市場予測

- 北米

- 市場動向

- 市場予測

- 中東・アフリカ

- 市場動向

- 市場予測

- ラテンアメリカ

- 市場動向

- 市場予測

第10章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格分析

- 主要価格指標

- 価格構造

- マージン分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

List of Figures

- Figure 1: Global: Aluminum Extrusion Market: Major Drivers and Challenges

- Figure 2: Global: Aluminum Extrusion Market: Sales Volume (in Million Metric Tons), 2019-2024

- Figure 3: Global: Aluminum Extrusion Market: Sales Value (in Billion USD), 2019-2024

- Figure 4: Global: Aluminum Extrusion Market: Breakup by Product Type (in %), 2024

- Figure 5: Global: Aluminum Extrusion Market: Breakup by Alloy Type (in %), 2024

- Figure 6: Global: Aluminum Extrusion Market: Breakup by End-Use Industry (in %), 2024

- Figure 7: Global: Aluminum Extrusion Market: Breakup by Region (in %), 2024

- Figure 8: Global: Aluminum Extrusion Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 9: Global: Aluminum Extrusion Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 10: Global: Aluminum Extrusion Industry: SWOT Analysis

- Figure 11: Global: Aluminum Extrusion Industry: Value Chain Analysis

- Figure 12: Global: Aluminum Extrusion Industry: Porter's Five Forces Analysis

- Figure 13: Global: Aluminum Extrusion (Mill Finished) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 14: Global: Aluminum Extrusion (Mill Finished) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 15: Global: Aluminum Extrusion (Anodized) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 16: Global: Aluminum Extrusion (Anodized) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 17: Global: Aluminum Extrusion (Powder Coated) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 18: Global: Aluminum Extrusion (Powder Coated) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 19: Global: Aluminum Extrusion (1000 Series Aluminum Alloy) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 20: Global: Aluminum Extrusion (1000 Series Aluminum Alloy) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 21: Global: Aluminum Extrusion (2000 Series Aluminum Alloy) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 22: Global: Aluminum Extrusion (2000 Series Aluminum Alloy) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 23: Global: Aluminum Extrusion (3000 Series Aluminum Alloy) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 24: Global: Aluminum Extrusion (3000 Series Aluminum Alloy) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 25: Global: Aluminum Extrusion (5000 Series Aluminum Alloy) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 26: Global: Aluminum Extrusion (5000 Series Aluminum Alloy) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 27: Global: Aluminum Extrusion (6000 Series Aluminum Alloy) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 28: Global: Aluminum Extrusion (6000 Series Aluminum Alloy) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 29: Global: Aluminum Extrusion (7000 Series Aluminum Alloy) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 30: Global: Aluminum Extrusion (7000 Series Aluminum Alloy) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 31: Global: Aluminum Extrusion (Building and Construction) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 32: Global: Aluminum Extrusion (Building and Construction) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 33: Global: Aluminum Extrusion (Transportation) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 34: Global: Aluminum Extrusion (Transportation) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 35: Global: Aluminum Extrusion (Machinery and Equipment) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 36: Global: Aluminum Extrusion (Machinery and Equipment) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 37: Global: Aluminum Extrusion (Consumer Durables) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 38: Global: Aluminum Extrusion (Consumer Durables) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 39: Global: Aluminum Extrusion (Electrical) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 40: Global: Aluminum Extrusion (Electrical) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 41: Global: Aluminum Extrusion (Other End-Use Industries) Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 42: Global: Aluminum Extrusion (Other End-Use Industries) Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 43: North America: Aluminum Extrusion Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 44: North America: Aluminum Extrusion Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 45: Asia Pacific: Aluminum Extrusion Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 46: Asia Pacific: Aluminum Extrusion Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 47: Europe: Aluminum Extrusion Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 48: Europe: Aluminum Extrusion Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 49: Latin America: Aluminum Extrusion Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 50: Latin America: Aluminum Extrusion Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

- Figure 51: Middle East and Africa: Aluminum Extrusion Market: Sales Volume (in Million Metric Tons), 2019 & 2024

- Figure 52: Middle East and Africa: Aluminum Extrusion Market Forecast: Sales Volume (in Million Metric Tons), 2025-2033

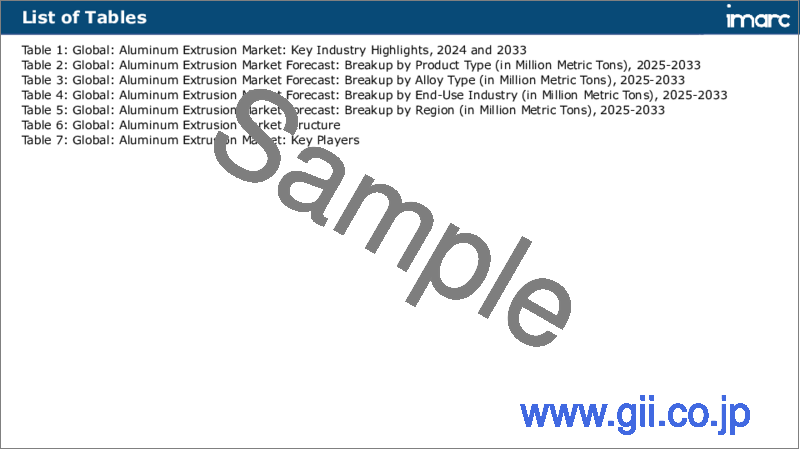

List of Tables

- Table 1: Global: Aluminum Extrusion Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Aluminum Extrusion Market Forecast: Breakup by Product Type (in Million Metric Tons), 2025-2033

- Table 3: Global: Aluminum Extrusion Market Forecast: Breakup by Alloy Type (in Million Metric Tons), 2025-2033

- Table 4: Global: Aluminum Extrusion Market Forecast: Breakup by End-Use Industry (in Million Metric Tons), 2025-2033

- Table 5: Global: Aluminum Extrusion Market Forecast: Breakup by Region (in Million Metric Tons), 2025-2033

- Table 6: Global: Aluminum Extrusion Market Structure

- Table 7: Global: Aluminum Extrusion Market: Key Players

The global aluminum extrusion market size reached USD 97.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 185.2 Billion by 2033, exhibiting a growth rate (CAGR) of 7.4% during 2025-2033. The escalating focus on sustainable architecture, the availability of raw materials and relatively lower manufacturing costs, and the widespread utilization of aluminum extrusion in construction and automotive industry yare some of the major factors propelling the market.

Aluminum extrusion is a manufacturing process used to create objects with a fixed, cross-sectional profile. The process involves forcing molten aluminum through a die, which is a shaped opening that gives the resulting extruded material its specific shape. Typically, aluminum billets are heated to a high temperature and then pushed or pulled through the die using a hydraulic press or ram. This process is highly versatile and can produce complex, intricate shapes with a high degree of accuracy and consistency. Aluminum extrusion is commonly used to make a wide range of products, such as frames, rails, tracks, and even heat sinks for electronic applications. As aluminum is lightweight, corrosion-resistant, and has good thermal conductivity, it is a preferred material for various industries, including automotive, aerospace, and construction.

The escalating focus on sustainable architecture is driving the global market. Environmentally responsible and resource-efficient green buildings are becoming increasingly popular worldwide. These structures frequently employ aluminum extrusions in key components, such as windows and doors, enhancing the material's demand in the building sector. Additionally, the inherent flexibility of aluminum, which allows for easy shaping and bending with minimal energy expenditure, heightens its appeal for a variety of industrial uses. The versatility of aluminum extrusions, which can be customized to meet specific requirements, appeals to various industries, including aerospace, energy, and electronics. This adaptability opens new markets and applications for aluminum extrusion products. The availability of raw materials and relatively lower manufacturing costs, especially in regions, including Asia-Pacific, make aluminum extrusions an economical choice for various applications. This cost-effectiveness is particularly appealing for large-scale projects and for industries aiming to reduce overall material costs.

Aluminum Extrusion Market Trends/Drivers:

Increasing Demand in Automotive and Transportation Sector

As environmental concerns push the automotive industry toward more sustainable practices, there is an increasing need for lightweight, energy-efficient materials. By using aluminum components, manufacturers can significantly reduce vehicle weight, thereby improving fuel efficiency and lowering greenhouse gas emissions. Given that the transportation sector is one of the largest consumers of energy, this transformation has a profound ripple effect. In addition, aluminum's high resistance to corrosion makes it ideal for external automobile parts exposed to the elements, as well as for use in marine and aerospace applications. Electric vehicles (EVs) also contribute to this demand. As the transition from internal combustion engine vehicles to EVs accelerates, the need for lightweight materials, such as extruded aluminum is expected to increase, especially for battery enclosures and structural components. Moreover, the ongoing investment in public transport infrastructures, including metros, trams, and high-speed trains globally fuels demand for aluminum extrusion in the transportation sector.

Growing Construction Industry

The aesthetic appeal, corrosion resistance, and high strength-to-weight ratio of aluminum make it a sought-after material for modern architectural designs. Green construction or sustainable building practices are augmenting the need for materials that are not only durable but also environmentally friendly. Aluminum is recyclable and using it in construction often contributes to LEED (Leadership in Energy and Environmental Design) certification points. The construction industry is experiencing rapid growth in developing countries, partly due to urbanization and growing populations. This uptick in construction activities leads to a higher demand for aluminum extrusion products. Moreover, advancements in extrusion technology allow for increasingly complex and aesthetically pleasing designs, further boosting aluminum's appeal in construction applications.

Technological Advancements in Manufacturing Processes

Advanced methods, including direct extrusion, indirect extrusion, and hydrostatic extrusion offer higher flexibility and open up new avenues for creating more complex shapes and forms. Moreover, Industry 4.0 initiatives incorporate smart manufacturing practices that include real-time monitoring, predictive maintenance, and data analytics, thus ensuring optimal production levels and quality control. These advancements have reduced operational costs and increased output capabilities, allowing manufacturers to offer more competitive pricing and diverse product portfolios. As a result, industries that might have previously overlooked aluminum extrusion due to cost or complexity are now more inclined to consider it as a viable option, thereby expanding the market demand.

Aluminum Extrusion Industry Segmentation:

Breakup by Product Type:

Mill Finished

Anodized

Powder Coated

Mill finished dominates the market

Mill finished extrusions are essentially aluminum profiles that have gone through the extrusion process and are in a form that is ready to be used or further processed. These profiles have not been anodized, painted, or otherwise coated and typically have a fairly smooth surface with some manufacturing lines visible. One of the main reasons for the dominance of mill-finished products is their versatility and adaptability. Since they have not undergone additional finishing treatments, they can be easily customized by the end-user for a variety of applications, be it in construction, automotive, or electrical engineering. This flexibility is particularly advantageous for industries that require specific, custom solutions. Skipping the additional treatment processes not only reduces production time but also minimizes costs, making mill-finished products more affordable. Moreover, the properties of mill-finished aluminum, such as corrosion resistance and high strength-to-weight ratio, are often sufficient for many applications, negating the need for further surface treatments.

Breakup by Alloy Type:

1000 Series Aluminum Alloy

2000 Series Aluminum Alloy

3000 Series Aluminum Alloy

5000 Series Aluminum Alloy

6000 Series Aluminum Alloy

7000 Series Aluminum Alloy

6000 series aluminum alloy dominates the market

6000 series aluminum alloys primarily composed of aluminum, magnesium, and silicon, are renowned for their versatility, combining multiple beneficial attributes, including high strength, excellent corrosion resistance, and superior machinability. The 6000 Series is particularly indispensable in sectors, such as automotive and construction, where there's an increasing demand for materials that are both lightweight and strong. In the automotive industry, the alloys are integral to the development of parts that are durable yet light enough to enhance fuel efficiency and reduce greenhouse gas emissions. The construction industry values the 6000 Series for its excellent formability, making it a go-to choice for structural components such as window and door frames, curtain walls, and roofing systems. Its corrosion-resistant qualities and the ease with which it can be anodized add to its durability and aesthetic versatility, making it suitable for both indoor and outdoor applications.

Breakup by End-Use Industry:

Building and Construction

Transportation

Machinery and Equipment

Consumer Durables

Electrical

Others

Building and construction dominate the market

The construction industry values aluminum extrusions for their versatility and aesthetic appeal. Advances in extrusion technology have enabled increasingly intricate and complex designs, thereby expanding the architectural possibilities. This is especially crucial in an era where sustainable, yet aesthetically pleasing, construction is becoming the norm. Aluminum's recyclability aligns well with green building initiatives, and its use can contribute to certifications, such as Leadership in Energy and Environmental Design. Additionally, rapid urbanization and economic development, particularly in emerging economies, have fueled an unprecedented boom in construction activities. This has generated a rising demand for durable and cost-effective materials, and aluminum extrusions perfectly fit that criterion. Moreover, as modern buildings become more complex with integrated systems for energy efficiency, the flexibility of aluminum extrusions to be easily customized makes them an even more attractive choice for builders and architects. They can be used in a multitude of applications, from HVAC systems to solar panel installations, making them integral to the modern construction landscape.

Breakup by Region:

Asia Pacific

Europe

North America

Middle East and Africa

Latin America

Asia Pacific exhibits a clear dominance, accounting for the largest aluminum extrusion market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Middle East and Africa, and Latin America. According to the report, Asia Pacific accounted for the largest market share.

The automotive industry in the Asia Pacific region is an upward trajectory, with countries like Japan and South Korea being notable automotive powerhouses, and China emerging as the world's largest auto market. The push for lightweight and fuel-efficient vehicles to meet increasingly stringent environmental regulations further propels the need for aluminum extrusion products. Also, the Asia Pacific region is a hub for manufacturing and technology, sectors that also make extensive use of aluminum extrusions. Whether it's in consumer electronics, machinery, or even aerospace, the diversity of applications adds to the region's consumption of extruded aluminum. Additionally, several governments in the region are actively investing in infrastructure development, further impelling demand for aluminum in sectors, including transportation and public utilities. Furthermore, rapid industrialization, expanding construction, a escalating automotive sector, and favorable economic conditions the Asia Pacific region not only dominates the current aluminum extrusion market but is also poised for significant growth in the foreseeable future.

Competitive Landscape:

Several companies are investing in R&D to develop new, innovative products. This includes more efficient extrusion processes, as well as new alloy compositions that offer improved properties, such as higher tensile strength or better corrosion resistance. Numerous companies are focusing on creating more energy-efficient manufacturing processes or using more recycled material in their products. They aim to reduce their carbon footprint and appeal to environmentally conscious consumers Additionally, various major companies have opted for vertical integration, where they control multiple stages of the supply chain, from raw material extraction to the final extruded product. Companies are continually exploring new applications for aluminum extrusions in various industries, including renewable energy, healthcare, and consumer electronics, thereby diversifying their portfolio, and reducing dependency on a single sector. Companies also invest in ensuring that their processes and products comply with industry-specific regulations and standards, including environmental regulations and safety standards, to avoid legal issues and to build trust among consumers.

The competitive landscape of the market has been studied in the report with the detailed profiles of the key players operating in the market.

Key Questions Answered in This Report

- 1. How big is the global aluminum extrusion market?

- 2. What is the expected growth rate of the global aluminum extrusion market during 2025-2033?

- 3. What are the key factors driving the global aluminum extrusion market?

- 4. What has been the impact of COVID-19 on the global aluminum extrusion market?

- 5. What is the breakup of the global aluminum extrusion market based on the product type?

- 6. What is the breakup of the global aluminum extrusion market based on the alloy type?

- 7. What is the breakup of the global aluminum extrusion market based on the end-use industry?

- 8. What are the key regions in the global aluminum extrusion market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Aluminum Extrusion Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.2.1 Value Trends

- 5.2.2 Volume Trends

- 5.3 Impact of COVID-19

- 5.4 Market Breakup by Product Type

- 5.5 Market Breakup by Alloy Type

- 5.6 Market Breakup by End-Use Industry

- 5.7 Market Breakup by Region

- 5.8 Market Forecast

6 Market Breakup by Product Type

- 6.1 Mill Finished

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Anodized

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Powder Coated

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

7 Market Breakup by Alloy Type

- 7.1 1000 Series Aluminum Alloy

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 2000 Series Aluminum Alloy

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 3000 Series Aluminum Alloy

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 5000 Series Aluminum Alloy

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 6000 Series Aluminum Alloy

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

- 7.6 7000 Series Aluminum Alloy

- 7.6.1 Market Trends

- 7.6.2 Market Forecast

8 Market Breakup by End-Use Industry

- 8.1 Building and Construction

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Transportation

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Machinery and Equipment

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Consumer Durables

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Electrical

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

- 8.6 Others

- 8.6.1 Market Trends

- 8.6.2 Market Forecast

9 Market Breakup by Region

- 9.1 Asia Pacific

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 Europe

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 North America

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Middle East and Africa

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

- 9.5 Latin America

- 9.5.1 Market Trends

- 9.5.2 Market Forecast

10 SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

- 13.1 Key Price Indicators

- 13.2 Price Structure

- 13.3 Margin Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players