|

|

市場調査レポート

商品コード

1831906

ライドシェア市場レポート:サービスタイプ別、予約モード別、会員タイプ別、通勤タイプ別、地域別、2025~2033年Ride Sharing Market Report by Service Type, Booking Mode, Membership Type, Commute Type, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| ライドシェア市場レポート:サービスタイプ別、予約モード別、会員タイプ別、通勤タイプ別、地域別、2025~2033年 |

|

出版日: 2025年10月01日

発行: IMARC

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

世界のライドシェア市場規模は2024年に1,313億米ドルに達しました。今後、IMARC Groupでは、2033年には5,072億米ドルに達し、2025~2033年にかけて14.62%の成長率(CAGR)を示すと予測しています。同市場は、スマートフォンの普及率の上昇や技術の進歩に加え、技術の進歩、経済効率、サステイナブル共有輸送モデルへのシフトによって推進されます。

ライドシェアとは、移動コスト、混雑、環境への影響を軽減するため、個人が乗り物を共有して移動する交通モデルのことです。このコンセプトは、一般の人々がデジタルプラットフォームを通じて自家用車をパートタイムタクシーに変えることを可能にすることで、従来型タクシーサービスとは対照的です。これらのプラットフォームは、典型的にはスマートフォンのアプリケーションであり、同じ方向に向かう乗客とドライバーをマッチングします。ライドシェアは、その利便性、費用対効果、スマートフォンとモバイルインターネットアクセスの台頭により、大きな支持を得ています。市場の参入企業は、経済的な相乗りオプションからより豪華な一人乗りまで、さまざまなサービスを提供しています。このモデルは拡大性があるため、世界市場に急速に拡大し、都市住民や通勤者、自家用車や公共輸送を利用できない人々にアピールしています。ライドシェアの成長には、安全性、ドライバーの雇用形態、従来型タクシーサービスへの影響に関する規制上の課題や懸念が伴っています。このような問題にもかかわらず、ライドシェアは、従来型輸送手段に代わる軟質な選択肢を提供し、進化する都市交通に不可欠な存在であり続けています。

ライドシェアの市場動向

技術の進歩、特にスマートフォン技術とモバイルインターネット接続は、世界のライドシェア市場を牽引する重要な要因の一つです。スマートフォンの普及は、アプリベースライドシェアプラットフォームの成長を促進し、ドライバーと乗客のリアルタイムマッチングを可能にしています。GPS技術により効率的なルートプランニングが可能になり、デジタル決済システムによりシームレスな金融取引が可能になりました。さらに、データ分析の開発により、これらのプラットフォームは価格設定とロジスティクスを最適化し、ユーザー体験を向上させています。経済的には、ライドシェアは利用者にコスト削減を記載しています。一般的に、従来型タクシー運賃を下回り、特に駐車場代や維持費が高い都市部では、自家用車を所有する必要性が減るからです。この経済効率は、都市化が進み、都市住民に対する経済的圧力が高まる中で、特に魅力的です。

社会的・環境的要因も、ライドシェア市場の成長に大きく寄与しています。環境問題に対する意識が高まっており、ライドシェアはよりサステイナブル輸送手段の選択肢とみなされています。車両稼働率を最大化することで、二酸化炭素排出量と交通渋滞を削減し、より広範な環境目標に合致します。さらに、社会的な考え方の変化、特に若年層の間では、所有することよりも利用することが好まれ、共有サービスがより受け入れられるようになっています。この変化は、資産やサービスを個人間で共有する「シェアリングエコノミー」への大きな動向の一部であり、多くの場合技術によって促進されています。ライドシェアはまた、既存の公共交通網の隙間にも対応し、ラスト・マイル接続のための柔軟なソリューションを記載しています。しかし、この産業は、規制のハードル、運転手と乗客双方の安全と権利に対する懸念、従来型タクシーサービスへの影響などの課題に直面しています。これらの問題は、自律走行車技術による破壊の可能性とともに、ライドシェア市場の将来的な軌道に対する継続的な検討事項となっています。

本レポートで扱う主要質問

- ライドシェア市場の規模は?

- ライドシェア市場の将来展望は?

- ライドシェア市場を牽引する主要因は何か?

- ライドシェア市場が最も大きい地域は?

- 世界のライドシェア市場における主要企業は?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

第5章 世界のライドシェア市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:サービスタイプ別

- Eヘイリング

- カーシェアリング

- ステーションベースモビリティ

- レンタカー

第7章 市場内訳:予約モード別

- アプリベース

- ウェブベース

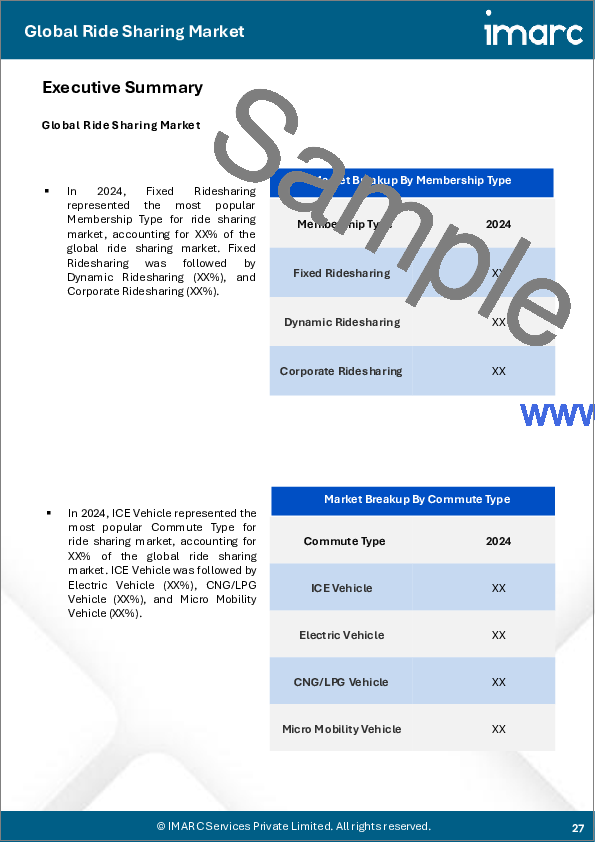

第8章 市場内訳:会員タイプ別

- 固定ライドシェアリング

- ダイナミックライドシェアリング

- 企業向けライドシェアリング

第9章 市場内訳:通勤タイプ別

- 内燃車両

- 電気自動車

- CNG/LPG車

- マイクロモビリティビークル

第10章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

第11章 促進要因、抑制要因、機会

第12章 バリューチェーン分析

第13章 ポーターのファイブフォース分析

第14章 価格分析

第15章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- ANI Technologies Pvt. Ltd.(OLA)

- BlaBlaCar

- Bolt Technology OU

- Cabify

- Curb Mobility LLC

- Gett

- Grab Holdings Inc

- HyreCar Inc

- Lyft, Inc.

- Tomtom International B.V.

- Uber Technologies Inc.