|

|

市場調査レポート

商品コード

1642714

ジオポリマー市場レポート:用途別、最終用途産業別、地域別、2025年~2033年Geopolymer Market Report by Application (Cement and Concrete, Furnace and Reactor Insulators, Composites, Decorative Artifacts), End-Use Industry (Building Construction, Infrastructure, Industrial, Art and Decoration, and Others), and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| ジオポリマー市場レポート:用途別、最終用途産業別、地域別、2025年~2033年 |

|

出版日: 2025年01月18日

発行: IMARC

ページ情報: 英文 137 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

ジオポリマーの世界市場規模は2024年に89億米ドルに達しました。IMARC Groupは、2025年から2033年にかけての成長率(CAGR)は20.06%で、2033年には460億米ドルに達すると予測しています。二酸化炭素排出量を削減するための持続可能な建設慣行への注目の高まり、環境汚染に対する意識の高まり、有利な政府の取り組み、廃棄物管理ソリューションの需要増加が、市場を推進している主な要因の一部です。

ジオポリマーは鉱物ベースの材料であり、アルミノケイ酸塩材料とアルカリ溶液との反応からなる化学プロセスを通じて製造されます。純粋な無機ジオポリマーやハイブリッド・ジオポリマーとして広く利用されています。従来のセメントに比べて機械的特性が向上し、耐火性や耐薬品性が高く、二酸化炭素排出量も少ないです。ジオポリマーは環境にやさしく、持続可能な選択肢であるため、建設やインフラ・プロジェクトに使用され、その需要は世界中で高まっています。

現在、建設分野では環境にやさしく高い引張強度を持つ材料への需要が高まっており、市場にプラスの影響を与えています。さらに、世界中で橋、トンネル、道路の補修にジオポリマーの利用が増加しており、市場の成長を強化しています。これとは別に、ジオポリマーは生産時のエネルギー消費を削減するため、需要が伸びており、市場の見通しは良好です。さらに、耐火・耐熱コーティング剤や接着剤への利用が増加していることも、業界の投資家に有利な成長機会をもたらしています。このほか、地球温暖化防止の必要性が高まっていることも、市場の成長を後押ししています。これに加えて、コンクリート用バインダーとしてポルトランドセメントに代わる費用対効果の高い代替品への需要が高まっていることも、市場の成長に寄与しています。

ジオポリマー市場動向/促進要因:

持続可能な建設慣行への注目の高まり

世界中の個人や建設業者の間で持続可能な建設慣行への注目が高まっていることが、市場の成長に寄与しています。従来のセメント生産は、二酸化炭素(CO2)排出と資源枯渇の主な原因となっています。さらに、温室効果ガス(GHG)排出が環境に与える有害な影響に対する認識も高まっています。これとは別に、二酸化炭素排出量が少なく、限りある資源への依存度が低いジオポリマーは、持続可能性の目標によく合致しています。これに伴い、各国の行政機関は、カーボンフットプリントを削減し、環境に優しいソリューションを支援することで、持続可能な材料の採用を奨励しており、市場の見通しは良好です。

環境汚染に対する意識の高まり

個人の間で様々な深刻な病気を引き起こす環境汚染に対する意識の高まりが、市場の成長を後押ししています。これに伴い、ジオポリマーは温室効果ガス(GHG)の排出量が大幅に少ない、従来のセメントに代わる適切で環境に優しい代替品を提供しています。これらのポリマーは、資源消費を最小限に抑え、廃棄物管理を改善することで、汚染削減と持続可能な開発の目標に密接に合致します。これとは別に、多くの国の政府機関や規制機関は、炭素排出を抑制するための厳しい規則や政策を実施することで、環境に優しい材料の使用にインセンティブを与えています。さらに、これは建設会社がジオポリマーをベースとした製品を革新し、より持続可能な環境を提供することを奨励しています。

廃棄物管理ソリューションへの需要の高まり

環境問題に対処し、持続可能な廃棄物処理ソリューションを促進するため、廃棄物管理システムにおけるこれらのポリマーに対する需要の高まりが、市場の成長を強化しています。これらのポリマー系材料は、有害・有毒廃棄物を効果的にカプセル化し、溶出を最小限に抑え、土壌や地下水の汚染を防止します。このため、埋立地のライナーやキャップなど、耐久性があり安定した廃棄物封じ込め構造の構築に適しています。また、フライアッシュやスラグのような産業製品別を利用することで、埋立地からの転換を図ることもできます。さらに、様々な種類の廃棄物を管理し、地域社会や生態系にとってより安全でクリーンな環境を促進するための実用的で生態学的な解決策を提供することから、これらのポリマーの利用が増加しており、市場の成長を後押ししています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- プロパティ

- 主要業界動向

第5章 世界のジオポリマー市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場内訳:用途別

- 市場内訳:最終用途産業別

- 市場内訳:地域別

- 市場予測

第6章 市場内訳:用途別

- セメントとコンクリート

- 市場動向

- 市場予測

- 炉および原子炉絶縁体

- 市場動向

- 市場予測

- 複合材料

- 市場動向

- 市場予測

- 装飾品

- 市場動向

- 市場予測

第7章 市場内訳:最終用途産業別

- 建物建設

- 市場動向

- 市場予測

- インフラ

- 市場動向

- 市場予測

- 産業

- 市場動向

- 市場予測

- 芸術と装飾

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第8章 市場内訳:地域別

- アジア太平洋地域

- 市場動向

- 市場予測

- 欧州

- 市場動向

- 市場予測

- 北米

- 市場動向

- 市場予測

- 中東・アフリカ

- 市場動向

- 市場予測

- ラテンアメリカ

- 市場動向

- 市場予測

第9章 世界のジオポリマー産業:SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第10章 世界のジオポリマー産業:バリューチェーン分析

- 概要

- 研究開発

- 原材料調達

- 製造

- マーケティング

- 流通

- 最終用途

第11章 世界のジオポリマー産業:ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第12章 世界のジオポリマー産業:価格分析

- 価格指標

- 価格構造

- マージン分析

第13章 ジオポリマー製造プロセス

- 製品概要

- 原材料要件

- 製造工程

- 主要成功要因とリスク要因

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Imerys Group

- Milliken & Company Inc.

- PCI Augsburg GMBH

- Rocla

- Wagners

- Universal Enterprise

- Schlumberger Ltd

- Murray & Roberts Cementation Co. Ltd

- Banah UK Ltd

- Zeobond Pty Ltd

- Uretek

- BASF

- Corning Inc.

- Nu-Core

- Pyromeral Systems

- Airbus

List of Figures

- Figure 1: Global: Geopolymer Market: Major Drivers and Challenges

- Figure 2: Global: Geopolymer Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Geopolymer Market: Breakup by Application (in %), 2024

- Figure 4: Global: Geopolymer Market: Breakup by End-Use Industry (in %), 2024

- Figure 5: Global: Geopolymer Market: Breakup by Region (in %), 2024

- Figure 6: Global: Geopolymer Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 7: Global: Geopolymer Industry: SWOT Analysi

- Figure 8: Global: Geopolymer Industry: Value Chain Analysis

- Figure 9: Global: Geopolymer Industry: Porter's Five Forces Analysis

- Figure 10: Global: Geopolymer (Cement and Concrete) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: Geopolymer (Cement and Concrete) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: Geopolymer (Furnace and Reactor Insulators) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Geopolymer (Furnace and Reactor Insulators) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Geopolymer (Composites) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Geopolymer (Composites) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Geopolymer (Decorative Artifacts) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Geopolymer (Decorative Artifacts) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Geopolymer (Building Construction) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Geopolymer (Building Construction) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Geopolymer (Infrastructure) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Geopolymer (Infrastructure) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Geopolymer (Industrial) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Geopolymer (Industrial) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Geopolymer (Art and Decoration) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Geopolymer (Art and Decoration) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: Geopolymer (Others) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: Geopolymer (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Asia Pacific: Geopolymer Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Asia Pacific: Geopolymer Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: Europe: Geopolymer Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: Europe: Geopolymer Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: North America: Geopolymer Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: North America: Geopolymer Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: Middle East and Africa: Geopolymer Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: Middle East and Africa: Geopolymer Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: Latin America: Geopolymer Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: Latin America: Geopolymer Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: Geopolymer Manufacturing: Process Flow

List of Tables

- Table 1: Global: Geopolymer Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Geopolymer Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 3: Global: Geopolymer Market Forecast: Breakup by End-Use Industry (in Million USD), 2025-2033

- Table 4: Global: Geopolymer Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 5: Geopolymer: Raw Material Requirements

- Table 6: Global: Geopolymer Market Structure

- Table 7: Global: Geopolymer Market: Key Players

The global geopolymer market size reached USD 8.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 46 Billion by 2033, exhibiting a growth rate (CAGR) of 20.06% during 2025-2033. The growing focus on sustainable construction practices to reduce carbon footprint, rising awareness about environmental pollution, along with favorable government initiatives, and increasing demand for waste management solutions are some of the major factors propelling the market.

Geopolymer is a mineral-based material that is manufactured through a chemical process that comprises the reaction of aluminosilicate materials with an alkaline solution, commonly involving industrial by-products, such as fly ash or slag. It is widely available as pure inorganic and hybrid geopolymers. It exhibits enhanced mechanical properties, high resistance to fire and chemicals, and has a lower carbon footprint as compared to conventional cement. As it is an eco-friendly and sustainable choice for construction and infrastructure projects, the demand for geopolymers is rising across the globe.

At present, the increasing demand for environmentally friendly and high tensile strength materials in the construction sector is influencing the market positively. Moreover, the rising utilization of geopolymers for repairing bridges, tunnels, and roads across the globe is strengthening the growth of the market. Apart from this, the growing demand for geopolymers, as they reduce energy consumption during production, is offering a favorable market outlook. Additionally, the rising utilization of these polymers in fire and heat-resistant coatings and adhesives is offering lucrative growth opportunities to industry investors. Besides this, the increasing need to reduce global warming is impelling the growth of the market. In addition to this, the rising demand for cost-effective alternatives to Portland cement as a binder in concrete is contributing to the growth of the market.

Geopolymer Market Trends/Drivers:

Rising focus on sustainable construction practices

The increasing focus on sustainable construction practices among individuals and builders across the globe is contributing to the growth of the market. Traditional cement production is a major contributor to carbon dioxide (CO2) emissions and resource depletion. Furthermore, there is a rise in awareness about the harmful impact of greenhouse gas (GHG) emissions in the environment. Apart from this, geopolymers, with their lower carbon footprint and reduced reliance on finite resources, align well with the sustainability goals. In line with this, governing agencies of various countries are encouraging the adoption of sustainable materials by reducing carbon footprint and supporting eco-friendly solutions, which is offering a favorable market outlook.

Increasing awareness about environmental pollution

The rising awareness about environmental pollution that causes various severe diseases among individuals is bolstering the growth of the market. In line with this, geopolymers offer a suitable and eco-friendly alternative to conventional cement that produces significantly fewer greenhouse gas (GHG) emissions. These polymers assist in minimizing resource consumption and improving waste management that aligns closely with the goals of pollution reduction and sustainable development. Apart from this, governing agencies and regulatory bodies of numerous countries are incentivizing the use of environmentally friendly materials by implementing stringent rules and policies to curb carbon emissions. Furthermore, this encourages construction companies to innovate geopolymer-based products and provide a more sustainable environment.

Growing demand for waste management solutions

The rising demand for these polymers in waste management systems, as they address environmental concerns and promote sustainable waste disposal solutions, is strengthening the growth of the market. These polymer-based materials encapsulate hazardous and toxic waste effectively, minimize leaching, and prevent soil and groundwater contamination. This makes them suitable for the creation of durable and stable waste containment structures, such as landfill liners and caps. In line with this, they can utilize industrial by-products like fly ash and slag that divert these materials from landfills. Furthermore, the rising utilization of these polymers, as they offer a practical and ecological solution for managing various types of waste and promoting a safer and cleaner environment for communities and ecosystems, is bolstering the growth of the market.

Geopolymer Industry Segmentation:

Breakup by Application:

Cement and Concrete

Furnace and Reactor Insulators

Composites

Decorative Artifacts

Cement and concrete represent the largest market segment

Breakup by End-Use Industry:

Building Construction

Infrastructure

Industrial

Art and Decoration

Others

Infrastructure accounts for the majority of the market share

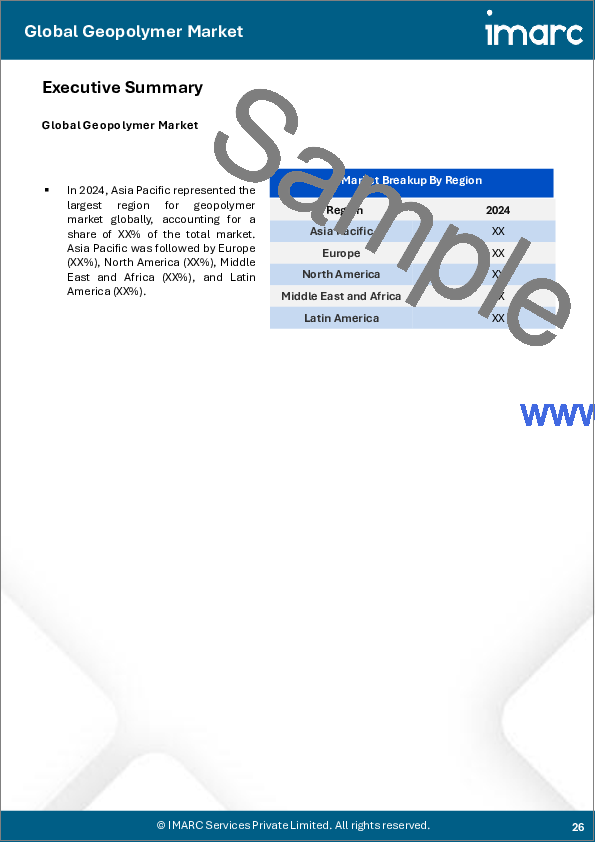

Breakup by Region:

Asia Pacific

Europe

North America

Middle East and Africa

Latin America

Asia Pacific exhibits a clear dominance, accounting for the largest geopolymer market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, the Middle East and Africa, and Latin America. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific held the biggest market share due to the growing number of power plants. In addition, the rising adoption of geopolymers to manufacture railroad sleepers is bolstering the growth of the market in the Asia Pacific region. Moreover, the increasing demand for these polymers in the concrete mix to reduce the amount of carbon dioxide (CO2) emissions in the region is supporting the growth of the market. Apart from this, the rising focus on eco-friendly practices is contributing to the growth of the market in the region.

Competitive Landscape:

Key players companies are investing in research and development (R&D) activities to develop new formulations, optimize production processes, and enhance the performance characteristics of geopolymer products. This includes exploring different raw materials, alkali activators, and curing techniques to tailor properties for specific applications. In line with this, they are diversifying their product offerings to cater to a broader range of industries and applications. This involves creating specialized blends for construction, infrastructure, aerospace, and other sectors and addressing their unique requirements. Apart from this, companies are forming collaborations with research institutions, universities, and other industry players to share knowledge, leverage expertise, and enhance technologies. Furthermore, manufacturers are ensuring their products adhere to international standards and regulations.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

Imerys Group

Milliken & Company Inc.

PCI Augsburg GMBH

Rocla

Wagners

Universal Enterprise

Schlumberger Ltd

Murray & Roberts Cementation Co. Ltd

Banah UK Ltd

Zeobond Pty Ltd

Uretek

BASF

Corning Inc.

Nu-Core

Pyromeral Systems

Airbus

Key Questions Answered in This Report

- 1. What was the size of the global geopolymer market in 2024?

- 2. What is the expected growth rate of the global geopolymer market during 2025-2033?

- 3. What are the key factors driving the global geopolymer market?

- 4. What has been the impact of COVID-19 on the global geopolymer market?

- 5. What is the breakup of the global geopolymer market based on application?

- 6. What is the breakup of the global geopolymer market based on the end-use industry?

- 7. What are the key regions in the global geopolymer market?

- 8. Who are the key players/companies in the global geopolymer market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Properties

- 4.3 Key Industry Trends

5 Global Geopolymer Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Breakup by Application

- 5.5 Market Breakup by End-Use Industry

- 5.6 Market Breakup by Region

- 5.7 Market Forecast

6 Market Breakup by Application

- 6.1 Cement and Concrete

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Furnace and Reactor Insulators

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Composites

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Decorative Artifacts

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

7 Market Breakup by End-Use Industry

- 7.1 Building Construction

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Infrastructure

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Industrial

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Art and Decoration

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Others

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

8 Market Breakup by Region

- 8.1 Asia Pacific

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Europe

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 North America

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Middle East and Africa

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Latin America

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

9 Global Geopolymer Industry: SWOT Analysis

- 9.1 Overview

- 9.2 Strengths

- 9.3 Weaknesses

- 9.4 Opportunities

- 9.5 Threats

10 Global Geopolymer Industry: Value Chain Analysis

- 10.1 Overview

- 10.2 Research and Development

- 10.3 Raw Material Procurement

- 10.4 Manufacturing

- 10.5 Marketing

- 10.6 Distribution

- 10.7 End-Use

11 Global Geopolymer Industry: Porters Five Forces Analysis

- 11.1 Overview

- 11.2 Bargaining Power of Buyers

- 11.3 Bargaining Power of Suppliers

- 11.4 Degree of Competition

- 11.5 Threat of New Entrants

- 11.6 Threat of Substitutes

12 Global Geopolymer Industry: Price Analysis

- 12.1 Price Indicators

- 12.2 Price Structure

- 12.3 Margin Analysis

13 Geopolymer Manufacturing Process

- 13.1 Product Overview

- 13.2 Raw Material Requirements

- 13.3 Manufacturing Process

- 13.4 Key Success and Risk Factors

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 Imerys Group

- 14.3.2 Milliken & Company Inc.

- 14.3.3 PCI Augsburg GMBH

- 14.3.4 Rocla

- 14.3.5 Wagners

- 14.3.6 Universal Enterprise

- 14.3.7 Schlumberger Ltd

- 14.3.8 Murray & Roberts Cementation Co. Ltd

- 14.3.9 Banah UK Ltd

- 14.3.10 Zeobond Pty Ltd

- 14.3.11 Uretek

- 14.3.12 BASF

- 14.3.13 Corning Inc.

- 14.3.14 Nu-Core

- 14.3.15 Pyromeral Systems

- 14.3.16 Airbus