|

|

市場調査レポート

商品コード

1820103

マルチベンダーATMソフトウェア市場レポート:コンポーネント、機能、エンドユーザー、地域別、2025年~2033年Multivendor ATM Software Market Report by Component, Function, End User, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| マルチベンダーATMソフトウェア市場レポート:コンポーネント、機能、エンドユーザー、地域別、2025年~2033年 |

|

出版日: 2025年09月01日

発行: IMARC

ページ情報: 英文 145 Pages

納期: 2~3営業日

|

概要

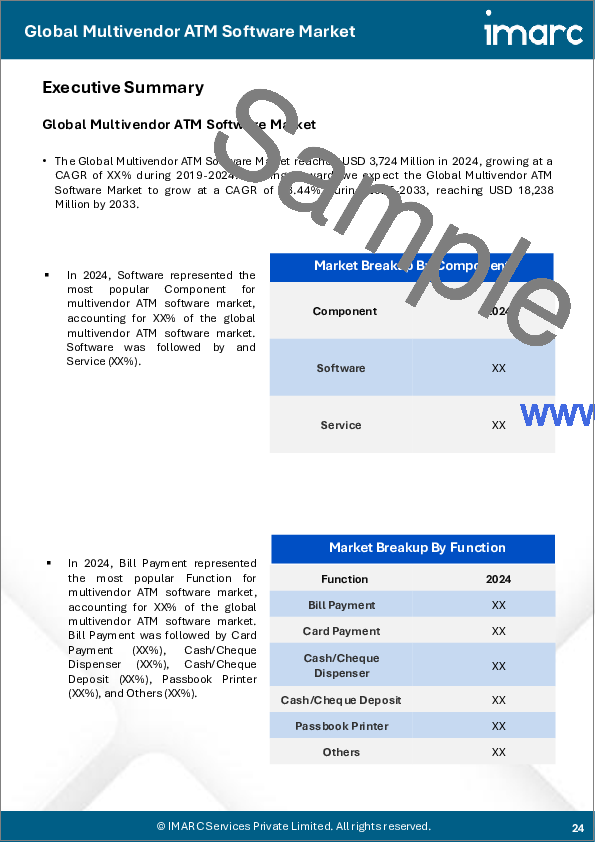

世界のマルチベンダーATMソフトウェア市場規模は2024年に37億米ドルに達しました。今後、IMARC Groupは、同市場が2033年までに182億米ドルに達し、2025年から2033年にかけて18.44%の成長率(CAGR)を示すと予測しています。

マルチベンダーATMソフトウェアは、銀行がATMネットワークを管理することで、コスト削減、機能性向上、競争力強化を可能にします。現金の払い出しやリサイクル、トランザクションのプリファレンス、ターゲットマーケティングなど、高度なバンキング機能の実行を支援します。ATMのハードウェアとソフトウェアの変更に伴う実装、テスト、認証、メンテナンスの大幅なコスト削減を実現します。これに加えて、市場促進要因や規制に対応した変更を柔軟に実施できます。また、単一のソフトウェアプラットフォームを使用することで、メンテナンスとアップデートを合理化し、一貫したユーザーインターフェースを提供します。その結果、世界中の金融機関がマルチベンダーATMソフトウェアを採用し、ATMのユーザーインターフェイスを近代化し、現在進行中の標準や要求に従って、より良い顧客体験に対応しています。

マルチベンダーATMソフトウェアの市場動向:

バンキングサービスの利用拡大に伴い、金融機関はATMチャネル管理を一元化し、ネットワークセキュリティを強化できる単一のコマンドコントロールに注力しています。これが、マルチベンダーATMソフトウェアの世界的な普及を促進する大きな要因の一つとなっています。マルチベンダーATMソフトウェアは、メンテナンスが容易で、低コストで迅速に機能を拡張することができます。さらに、消費者の要求の高まり、セキュリティへの懸念、業界の規制により、ベンダーは柔軟なソリューションやオプションを提供し、先進的な機能やサービスで市場投入までのスピードをサポートしています。これは、銀行が新機能を簡単かつ迅速に追加・展開し、競争力を高め、顧客の要件を満たすのに役立ち、ひいては市場にプラスの影響を与えています。これとは別に、マルチベンダー環境は、顧客関係管理、窓口端末、銀行システムのセキュリティ向上とバックエンド統合の簡素化という利点を提供し、市場企業に有利な成長機会をもたらしています。

本レポートで扱う主な質問

- 世界のマルチベンダーATMソフトウェア市場はこれまでどのように推移し、今後どのように推移するのか?

- 世界のマルチベンダーATMソフトウェア市場に与えたCOVID-19の影響は?

- 主要地域市場とは?

- コンポーネント別の市場内訳は?

- 機能別の市場内訳は?

- エンドユーザー別の市場内訳は?

- 業界のバリューチェーンにおける様々な段階とは?

- 業界の主要な促進要因と課題は何か?

- 世界のマルチベンダーATMソフトウェア市場の構造と主要企業は?

- 業界における競合の程度は?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

第5章 世界のマルチベンダーATMソフトウェア市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:コンポーネント別

- ソフトウェア

- サービス

第7章 市場内訳:機能別

- 請求書の支払い

- カード決済

- 現金/小切手の出金

- 現金/小切手の入金

- 通帳プリンター

- その他

第8章 市場内訳:エンドユーザー別

- 銀行と金融機関

- 独立系ATM導入者

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

第10章 SWOT分析

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Auriga SpA

- Clydestone Limited

- CashLink Global Systems Private Limited

- Diebold Nixdorf Incorporated

- GRG Banking(Guangzhou Radio Group)

- KAL ATM Software GmbH

- Hyosung Corporation

- NCR Corporation

- Printec Group

- Renovite Technologies Inc

- Vortex Engineering Pvt. Ltd.

- Worldline