|

|

市場調査レポート

商品コード

1675423

業務用AC(業務用エアコン)市場:タイプ別、設置タイプ別、エンドユーザー別、地域別、2025-2033年Commercial Air Conditioner Market by Type (Chillers, Split Units, Packaged Unit, Variable Refrigerant Flow, and Others), Installation Type, End User, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 業務用AC(業務用エアコン)市場:タイプ別、設置タイプ別、エンドユーザー別、地域別、2025-2033年 |

|

出版日: 2025年03月01日

発行: IMARC

ページ情報: 英文 139 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

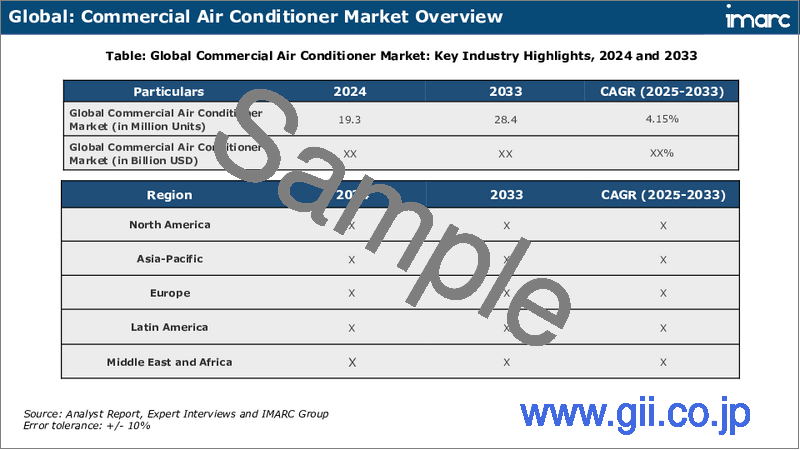

世界の業務用AC(業務用エアコン)市場規模は2024年に1,930万台に達しました。今後、IMARC Groupは、2033年には2,840万台に達し、2025~2033年の成長率(CAGR)は4.15%になると予測しています。ホスピタリティ施設における高度でエネルギー効率の高い冷房システムの設置の増加、世界の気温と湿度の上昇、ユーティリティ製品としてのACの受け入れの増加が、市場を牽引する主な要因のいくつかです。

業務用ACは、定義された、通常は密閉された空間の空気を冷やし、暖め、除湿するように設計された電化製品です。空気を処理するために冷凍サイクルに依存しており、部屋から暖かい空気を引き出し、より冷たい空気と置き換えることで機能します。一般的に、暖房と冷房システムを1つの屋上ユニットにまとめ、エネルギー消費を最適化します。あらゆる規模の商業スペースで、顧客や従業員の快適な温度と空気の質を維持するのに役立ちます。チラー、セントラル・エアコン・システム、パッケージ・ユニット、マルチ・スプリット・エアコン、ダクトレス・ミニ・スプリット・エアコンなど、さまざまな冷却能力、出力、設定のものが広く販売されています。これらのユニットはかなりのスペースを必要とするため、一般的に建物の屋上に設置され、住民や業務に支障をきたす騒音を防ぐのにも役立っています。その結果、業務用ACはショッピングモール、オフィス、学校、スポーツジム、ホテル、レストラン、店舗、映画館など、さまざまな商業施設に広く導入されています。

業務用AC市場の動向:

ホスピタリティと旅行・観光産業の急速な成長により、ホテル、レストラン、リゾートでは、宿泊客の満足度、快適性、定着率を向上させるための高度なシステムの設置が急増しています。これは、エネルギー効率の高い冷却システムへの需要の高まりと相まって、特に気温と湿度が急上昇している地域からの需要が、市場成長を促進する主な要因となっています。さらに、オゾン層の破壊と、大気汚染レベルの上昇や地球温暖化による気候条件の悪化が相まって、世界の平均気温が徐々に上昇しています。これに伴い、気候変動を理由に、空調システムが贅沢品ではなく実用品として受け入れられるようになり、商業空間の涼しく快適な温度を維持するための製品需要が増加しています。さらに、冷媒に関する政府の厳しい規制が導入されたことで、メーカー各社はエネルギー効率が高く、環境に優しい製品の開発を促しています。これとともに、省エネ機能やインバーター、空気清浄技術を組み込んだ業務用ACなど、主要プレーヤーによる革新的な製品バリエーションの発売が、市場の成長を触媒しています。急速な都市化と工業化、商業スペースの建設増加、ライフスタイルの改善、継続的な技術の進歩など、その他の要因も市場成長にプラスの推進力を与えると予測されます。

本レポートで扱う主な質問

- 世界の業務用AC市場はこれまでどのように推移してきたか?

- 世界の業務用AC市場の促進要因、抑制要因、機会は何か?

- 各促進要因、抑制要因、機会が世界の業務用AC市場に与える影響は?

- 主要な地域市場は?

- 最も魅力的な業務用AC市場はどの国か?

- タイプ別の市場内訳は?

- 業務用AC市場で最も魅力的なタイプは?

- 設置タイプ別の市場内訳は?

- 業務用AC市場で最も魅力的な設置タイプは?

- エンドユーザー別の市場内訳は?

- 業務用AC市場で最も魅力的なエンドユーザーは?

- 世界の業務用AC市場の競争構造は?

- 世界の業務用AC市場における主要プレイヤー/企業は?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の業務用AC市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:タイプ別

- チラー

- スプリットユニット

- パッケージユニット

- VRF

- その他

第7章 市場内訳:設置タイプ別

- 新規設置

- レトロフィット

第8章 市場内訳:エンドユーザー別

- ヘルスケア

- 教育機関

- 公共/政府

- 小売

- ホスピタリティ

- 製造

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 市場内訳:国別

第10章 促進要因・抑制要因・機会

- 概要

- 促進要因

- 抑制要因

- 機会

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Airedale International Air Conditioning Ltd.(Modine Manufacturing Company)

- Blue Star Limited

- Carrier Global Corporation

- Daikin Industries Ltd.

- Fujitsu General Limited

- Gree Electric Appliances Inc.

- Haier Group Corporation

- Hitachi Ltd.

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Panasonic Holdings Corporation

- Samsung Electronics Co. Ltd.

- Voltas Limited

List of Figures

- Figure 1: Global: Commercial Air Conditioner Market: Major Drivers and Challenges

- Figure 2: Global: Commercial Air Conditioner Market: Sales Volume (in Million Units), 2019-2024

- Figure 3: Global: Commercial Air Conditioner Market Forecast: Sales Volume (in Million Units), 2025-2033

- Figure 4: Global: Commercial Air Conditioner Market: Sales Value (in Billion USD), 2019-2024

- Figure 5: Global: Commercial Air Conditioner Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 6: Global: Commercial Air Conditioner Market: Breakup by Type (in %), 2024

- Figure 7: Global: Commercial Air Conditioner Market: Breakup by Installation Type (in %), 2024

- Figure 8: Global: Commercial Air Conditioner Market: Breakup by End User (in %), 2024

- Figure 9: Global: Commercial Air Conditioner Market: Breakup by Region (in %), 2024

- Figure 10: Global: Commercial Air Conditioner (Chillers) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: Commercial Air Conditioner (Chillers) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: Commercial Air Conditioner (Split Units) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Commercial Air Conditioner (Split Units) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Commercial Air Conditioner (Packaged Unit) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Commercial Air Conditioner (Packaged Unit) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Commercial Air Conditioner (Variable Refrigerant Flow (VRF)) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Commercial Air Conditioner (Variable Refrigerant Flow (VRF)) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Commercial Air Conditioner (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Commercial Air Conditioner (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Commercial Air Conditioner (New Installation) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Commercial Air Conditioner (New Installation) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Commercial Air Conditioner (Retrofit) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Commercial Air Conditioner (Retrofit) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Commercial Air Conditioner (Healthcare) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Commercial Air Conditioner (Healthcare) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: Commercial Air Conditioner (Educational/Institutional) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: Commercial Air Conditioner (Educational/Institutional) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Global: Commercial Air Conditioner (Public/Government) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Global: Commercial Air Conditioner (Public/Government) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: Global: Commercial Air Conditioner (Retail) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: Global: Commercial Air Conditioner (Retail) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: Global: Commercial Air Conditioner (Hospitality) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: Global: Commercial Air Conditioner (Hospitality) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: Global: Commercial Air Conditioner (Manufacturing) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: Global: Commercial Air Conditioner (Manufacturing) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: North America: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: North America: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: United States: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: United States: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: Canada: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: Canada: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: Asia-Pacific: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: Asia-Pacific: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: China: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: China: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: Japan: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: Japan: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: India: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: India: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: South Korea: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: South Korea: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: Australia: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: Australia: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: Indonesia: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: Indonesia: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 56: Others: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 57: Others: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 58: Europe: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 59: Europe: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 60: Germany: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 61: Germany: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 62: France: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 63: France: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 64: United Kingdom: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 65: United Kingdom: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 66: Italy: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 67: Italy: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 68: Spain: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 69: Spain: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 70: Russia: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 71: Russia: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 72: Others: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 73: Others: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 74: Latin America: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 75: Latin America: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 76: Brazil: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 77: Brazil: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 78: Mexico: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 79: Mexico: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 80: Others: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 81: Others: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 82: Middle East and Africa: Commercial Air Conditioner Market: Sales Value (in Million USD), 2019 & 2024

- Figure 83: Middle East and Africa: Commercial Air Conditioner Market: Breakup by Country (in %), 2024

- Figure 84: Middle East and Africa: Commercial Air Conditioner Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 85: Global: Commercial Air Conditioner Industry: Drivers, Restraints, and Opportunities

- Figure 86: Global: Commercial Air Conditioner Industry: Value Chain Analysis

- Figure 87: Global: Commercial Air Conditioner Industry: Porter's Five Forces Analysis

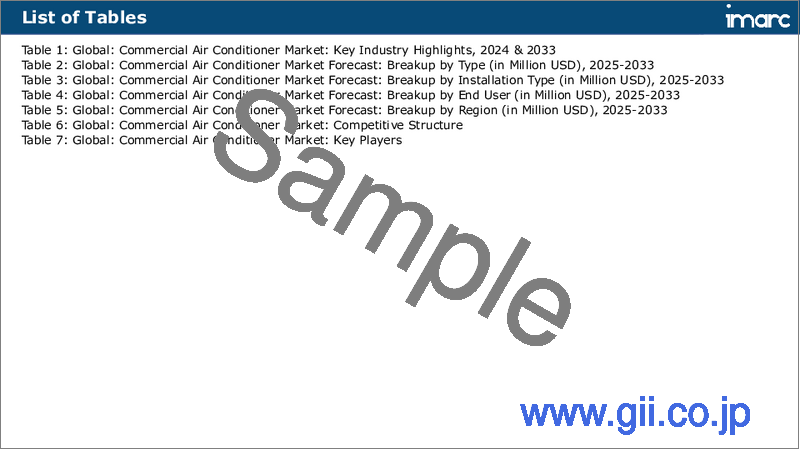

List of Tables

- Table 1: Global: Commercial Air Conditioner Market: Key Industry Highlights, 2024 & 2033

- Table 2: Global: Commercial Air Conditioner Market Forecast: Breakup by Type (in Million USD), 2025-2033

- Table 3: Global: Commercial Air Conditioner Market Forecast: Breakup by Installation Type (in Million USD), 2025-2033

- Table 4: Global: Commercial Air Conditioner Market Forecast: Breakup by End User (in Million USD), 2025-2033

- Table 5: Global: Commercial Air Conditioner Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Commercial Air Conditioner Market: Competitive Structure

- Table 7: Global: Commercial Air Conditioner Market: Key Players

The global commercial air conditioner (AC) market size reached 19.3 Million Units in 2024. Looking forward, IMARC Group expects the market to reach 28.4 Million Units by 2033, exhibiting a growth rate (CAGR) of 4.15% during 2025-2033. The rising installation of advanced and energy-efficient cooling systems in hospitality establishments, elevating temperatures and humidity levels worldwide, and increasing acceptance of ACs as utility products represent some of the key factors driving the market.

Commercial air conditioners are electrical appliances designed to chill, heat, and dehumidify air in defined, usually enclosed spaces. They rely on a refrigeration cycle to treat the air and work by drawing the warm air from the room and replacing it with cooler air. They generally combine the heating and cooling systems into a single rooftop unit for optimum energy consumption. They aid in maintaining a comfortable temperature and air quality for customers and employees in commercial spaces of all sizes. They are widely available in different cooling capacities, power, and settings, such as chillers, central air conditioning systems, packaged units, and multi-split and ductless mini-split air conditioners. Since these units require a significant amount of space, they are commonly installed on the rooftops of buildings, which also assists in preventing noise from disturbing the inhabitants or business operations. As a result, commercial air conditioners are extensively deployed in various commercial settings, including shopping malls, offices, schools, gyms, hotels, restaurants, shops, and movie theaters.

Commercial Air Conditioner (AC) Market Trends:

Due to the rapid growth of the hospitality and travel and tourism industries, there is a surge in the installation of advanced systems in hotels, restaurants, and resorts to improve guest satisfaction, comfort, and retention. This, coupled with the escalating demand for energy-efficient cooling systems, especially from regions with soaring temperature and humidity levels, represents the primary factor driving the market growth. Additionally, the combined effects of ozone layer depletion and constantly worsening climate conditions owing to elevating air pollution levels and global warming have led to a gradual increase in the average temperature worldwide. In line with this, the rising acceptance of air conditioning systems as utility products instead of luxury items on account of climate change has augmented the product demand to maintain cool and comfortable temperatures in commercial spaces. Furthermore, the introduction of stringent government regulations on refrigerants is prompting manufacturers to develop energy-efficient and eco-friendly products. Along with this, the launch of innovative product variants by key players, such as commercial air conditioners embedded with energy-saving features and inverter and air purification technologies, has catalyzed the market growth. Other factors, including rapid urbanization and industrialization, increasing construction of commercial spaces, improving lifestyles, and ongoing technological advancements, are also anticipated to provide a positive thrust to market growth.

Key Market Segmentation:

Type Insights:

- Commercial Air Conditioner (AC) Market

- Chillers

- Split Units

- Packaged Unit

- Variable Refrigerant Flow (VRF)

- Others

Installation Type Insights:

- New Installation

- Retrofit

End User Insights:

- Healthcare

- Educational/Institutional

- Public/Government

- Retail

- Hospitality

- Manufacturing

Regional Insights:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific was the largest market for commercial air conditioners (AC). Some of the factors driving the Asia-Pacific commercial air conditioner (AC) market included the expanding hospitality sector due to the rising number of tourists traveling to Asia-Pacific countries, growing commercialization, escalating demand for cooling equipment owing to high-temperature levels in the region, etc.

Competitive Landscape:

- The report has also provided a comprehensive analysis of the competitive landscape in the global commercial air conditioner (AC) market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include Airedale International Air Conditioning Ltd. (Modine Manufacturing Company), Blue Star Limited, Carrier Global Corporation, Daikin Industries Ltd., Fujitsu General Limited, Gree Electric Appliances Inc., Haier Group Corporation, Hitachi Ltd., LG Electronics Inc., Mitsubishi Electric Corporation, Panasonic Holdings Corporation, Samsung Electronics Co. Ltd., Voltas Limited, etc. Kindly note that this only represents a partial list of companies and the complete list has been provided in the report.

Key Questions Answered in This Report:

- How has the global commercial air conditioner (AC) market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global commercial air conditioner (AC) market?

- What is the impact of each driver, restraint, and opportunity on the global commercial air conditioner (AC) market?

- What are the key regional markets?

- Which countries represent the most attractive commercial air conditioner (AC) market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the commercial air conditioner (AC) market?

- What is the breakup of the market based on the installation type?

- Which is the most attractive installation type in the commercial air conditioner (AC) market?

- What is the breakup of the market based on end user?

- Which is the most attractive end user in the commercial air conditioner (AC) market?

- What is the competitive structure of the global commercial air conditioner (AC) market?

- Who are the key players/companies in the global commercial air conditioner (AC) market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Commercial Air Conditioner (AC) Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Type

- 6.1 Chillers

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Split Units

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Packaged Unit

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Variable Refrigerant Flow (VRF)

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Others

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

7 Market Breakup by Installation Type

- 7.1 New Installation

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Retrofit

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

8 Market Breakup by End User

- 8.1 Healthcare

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Educational/Institutional

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Public/Government

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Retail

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Hospitality

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

- 8.6 Manufacturing

- 8.6.1 Market Trends

- 8.6.2 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 United States

- 9.1.1.1 Market Trends

- 9.1.1.2 Market Forecast

- 9.1.2 Canada

- 9.1.2.1 Market Trends

- 9.1.2.2 Market Forecast

- 9.1.1 United States

- 9.2 Asia-Pacific

- 9.2.1 China

- 9.2.1.1 Market Trends

- 9.2.1.2 Market Forecast

- 9.2.2 Japan

- 9.2.2.1 Market Trends

- 9.2.2.2 Market Forecast

- 9.2.3 India

- 9.2.3.1 Market Trends

- 9.2.3.2 Market Forecast

- 9.2.4 South Korea

- 9.2.4.1 Market Trends

- 9.2.4.2 Market Forecast

- 9.2.5 Australia

- 9.2.5.1 Market Trends

- 9.2.5.2 Market Forecast

- 9.2.6 Indonesia

- 9.2.6.1 Market Trends

- 9.2.6.2 Market Forecast

- 9.2.7 Others

- 9.2.7.1 Market Trends

- 9.2.7.2 Market Forecast

- 9.2.1 China

- 9.3 Europe

- 9.3.1 Germany

- 9.3.1.1 Market Trends

- 9.3.1.2 Market Forecast

- 9.3.2 France

- 9.3.2.1 Market Trends

- 9.3.2.2 Market Forecast

- 9.3.3 United Kingdom

- 9.3.3.1 Market Trends

- 9.3.3.2 Market Forecast

- 9.3.4 Italy

- 9.3.4.1 Market Trends

- 9.3.4.2 Market Forecast

- 9.3.5 Spain

- 9.3.5.1 Market Trends

- 9.3.5.2 Market Forecast

- 9.3.6 Russia

- 9.3.6.1 Market Trends

- 9.3.6.2 Market Forecast

- 9.3.7 Others

- 9.3.7.1 Market Trends

- 9.3.7.2 Market Forecast

- 9.3.1 Germany

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.1.1 Market Trends

- 9.4.1.2 Market Forecast

- 9.4.2 Mexico

- 9.4.2.1 Market Trends

- 9.4.2.2 Market Forecast

- 9.4.3 Others

- 9.4.3.1 Market Trends

- 9.4.3.2 Market Forecast

- 9.4.1 Brazil

- 9.5 Middle East and Africa

- 9.5.1 Market Trends

- 9.5.2 Market Breakup by Country

- 9.5.3 Market Forecast

10 Drivers, Restraints, and Opportunities

- 10.1 Overview

- 10.2 Drivers

- 10.3 Restraints

- 10.4 Opportunities

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 Airedale International Air Conditioning Ltd. (Modine Manufacturing Company)

- 14.3.1.1 Company Overview

- 14.3.1.2 Product Portfolio

- 14.3.2 Blue Star Limited

- 14.3.2.1 Company Overview

- 14.3.2.2 Product Portfolio

- 14.3.2.3 Financials

- 14.3.3 Carrier Global Corporation

- 14.3.3.1 Company Overview

- 14.3.3.2 Product Portfolio

- 14.3.3.3 Financials

- 14.3.3.4 SWOT Analysis

- 14.3.4 Daikin Industries Ltd.

- 14.3.4.1 Company Overview

- 14.3.4.2 Product Portfolio

- 14.3.4.3 Financials

- 14.3.4.4 SWOT Analysis

- 14.3.5 Fujitsu General Limited

- 14.3.5.1 Company Overview

- 14.3.5.2 Product Portfolio

- 14.3.5.3 Financials

- 14.3.6 Gree Electric Appliances Inc.

- 14.3.6.1 Company Overview

- 14.3.6.2 Product Portfolio

- 14.3.6.3 Financials

- 14.3.7 Haier Group Corporation

- 14.3.7.1 Company Overview

- 14.3.7.2 Product Portfolio

- 14.3.8 Hitachi Ltd.

- 14.3.8.1 Company Overview

- 14.3.8.2 Product Portfolio

- 14.3.8.3 Financials

- 14.3.8.4 SWOT Analysis

- 14.3.9 LG Electronics Inc.

- 14.3.9.1 Company Overview

- 14.3.9.2 Product Portfolio

- 14.3.9.3 Financials

- 14.3.9.4 SWOT Analysis

- 14.3.10 Mitsubishi Electric Corporation

- 14.3.10.1 Company Overview

- 14.3.10.2 Product Portfolio

- 14.3.10.3 Financials

- 14.3.10.4 SWOT Analysis

- 14.3.11 Panasonic Holdings Corporation

- 14.3.11.1 Company Overview

- 14.3.11.2 Product Portfolio

- 14.3.11.3 Financials

- 14.3.11.4 SWOT Analysis

- 14.3.12 Samsung Electronics Co. Ltd.

- 14.3.12.1 Company Overview

- 14.3.12.2 Product Portfolio

- 14.3.12.3 Financials

- 14.3.12.4 SWOT Analysis

- 14.3.13 Voltas Limited

- 14.3.13.1 Company Overview

- 14.3.13.2 Product Portfolio

- 14.3.13.3 Financials

- 14.3.1 Airedale International Air Conditioning Ltd. (Modine Manufacturing Company)

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.