|

|

市場調査レポート

商品コード

1660995

太陽光発電インバーター市場レポート:技術、電圧、用途、地域別、2025年~2033年Solar PV Inverter Market Report by Technology, Voltage, Application, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 太陽光発電インバーター市場レポート:技術、電圧、用途、地域別、2025年~2033年 |

|

出版日: 2025年02月10日

発行: IMARC

ページ情報: 英文 145 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

太陽光発電インバーターの世界市場規模は2024年に87億米ドルに達しました。今後、IMARC Groupは、2033年には126億米ドルに達し、2025~2033年の成長率(CAGR)は4.18%になると予測しています。政府の取り組みや政策の実施、太陽光発電インバーターのコスト低下、世界のエネルギー需要の増加、急速な技術進歩などが市場を推進している主な要因です。

太陽光発電(PV)インバーターは、太陽電池パネルによって生成された直流電流を交流電流(AC)に変換する、太陽エネルギーシステムの重要なコンポーネントです。パワー・トランジスタ、トランス、複雑なソフトウェア制御などの主要部品で構成されています。太陽光発電インバーターは、住宅、商業ビル、農業、交通、都市計画、宇宙技術、遠隔電力システム、送電網サポート、環境保全活動など、さまざまな分野で応用されています。太陽光エネルギーの実用的な利用を可能にし、エネルギーの自立を促進し、再生可能なエネルギー源を提供し、固定価格買取制度を通じて潜在的な収入をもたらし、二酸化炭素排出量を削減します。

効率と信頼性を継続的に向上させ、熱管理を改善し、太陽光発電インバーターの容量を増大させる最近の技術進歩が、市場の成長を後押ししています。これに加え、グリッドサポート機能や高度なモニタリング機能を提供し、最適なシステム運用と保守を保証するスマートインバータのイントロダクションも成長を促す要因となっています。さらに、大衆の環境意識の高まりが、太陽光発電などの再生可能エネルギーへのシフトを促し、市場成長に寄与しています。これとは別に、太陽光が利用できないときに使用するために余剰の太陽光発電を貯蔵できるエネルギー貯蔵システムの登場と成長が、市場成長にプラスの影響を与えています。その他の要因としては、輸送部門の急速な電化、広範な研究開発(R&D)活動、農村部の電化需要の増加などが挙げられ、市場成長の原動力になると予想されます。

太陽光発電インバーター市場動向/促進要因:

政府のイニシアティブと政策の実施

政府の取り組みや政策は、市場の成長を促進する上で重要です。世界中の政府は、気候変動による差し迫った脅威と、太陽光発電のようなクリーンで再生可能なエネルギー源への移行の必要性を認識しています。この移行にインセンティブを与えるため、固定価格買取制度、税額控除、直接補助金などの支援制度を導入し、住宅所有者や企業がソーラーパネルを設置する際の経済的負担を軽減しています。これとともに、多くの国々が支援法に裏打ちされた積極的な再生可能エネルギー目標を制定しており、太陽光発電インバーターの需要をさらに押し上げています。こうした政策は、太陽光発電設備の初期費用を引き下げるだけでなく、長期的な経済性も高める。政府のこうした断固とした行動は、再生可能エネルギーへの強いコミットメントを示すものであり、それによって消費者や投資家に信頼を与え、市場の成長を促進しています。

製品コストの急速な低下

太陽光発電インバーターのコスト低下も、市場成長の大きな要因です。技術の進歩に伴い、製造プロセスの効率が向上し、原材料や部品のコスト削減に寄与しています。また、製造の自動化が進んだことで、人件費が削減され、人的ミスが最小限に抑えられ、製品の信頼性が高まった。さらに、需要の増加による生産規模の拡大が規模の経済をもたらし、太陽光発電インバーターの単位当たりのコストを引き下げています。さらに、電気料金の相殺を望む住宅所有者から持続可能性の目標達成を目指す企業まで、幅広い消費者にとって太陽光エネルギーがますます手頃な価格になってきています。コストの低下が太陽光発電システムの普及を後押しし、ひいては太陽光発電インバーターの需要も拡大しています。

世界中で高まるエネルギー需要

急速な工業化と都市化により、世界中でエネルギー需要が急増しています。従来のエネルギー源には限りがあり、環境に悪影響を及ぼすため、持続可能な代替手段を見つけることが不可欠となっています。太陽光発電インバーターによって促進される太陽光発電は、実行可能なソリューションを提供します。太陽エネルギーは、豊富で再生可能な資源である太陽の力を利用して発電します。輸送、暖房、冷房などの分野における電化への世界のシフトに伴い、電力需要は飛躍的に増大します。PVインバーターを使用した太陽光発電システムは、持続可能な方法でこの需要増に対応することができます。住宅の屋上から商業施設やユーティリティ・スケールの太陽光発電所まで、太陽エネルギーの用途は全面的に拡大しています。このように、世界のエネルギー需要の高まりは、太陽光発電インバーター市場の成長を推進する重要な原動力となっています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の太陽光発電インバーター市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場内訳:技術別

- 市場内訳:電圧別

- 市場内訳:用途別

- 市場内訳:地域別

- 市場予測

第6章 市場内訳:技術別

- セントラルインバーター

- 市場動向

- 市場予測

- ストリングインバーター

- 市場動向

- 市場予測

- マイクロインバーター

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第7章 市場内訳:電圧別

- 1,000V未満

- 市場動向

- 市場予測

- 1,000-1,499V

- 市場動向

- 市場予測

- 1,500V超

- 市場動向

- 市場予測

第8章 市場内訳:用途別

- ユーティリティスケール

- 市場動向

- 市場予測

- 住宅規模

- 市場動向

- 市場予測

- 小規模商業規模

- 市場動向

- 市場予測

- 大規模商業規模

- 市場動向

- 市場予測

- 産業規模

- 市場動向

- 市場予測

第9章 市場内訳:地域別

- アジア太平洋地域

- 市場動向

- 市場予測

- 欧州

- 市場動向

- 市場予測

- 北米

- 市場動向

- 市場予測

- 中東・アフリカ

- 市場動向

- 市場予測

- ラテンアメリカ

- 市場動向

- 市場予測

第10章 世界の太陽光発電インバーター産業:SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 世界の太陽光発電インバーター産業:バリューチェーン分析

- 概要

- 研究開発

- 原材料調達

- 製造

- マーケティング

- 流通

- 最終用途

第12章 世界の太陽光発電インバーター産業:ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 世界の太陽光発電インバーター産業:価格分析

- 価格指標

- 価格構造

- マージン分析

第14章 太陽光発電インバーターの製造プロセス

- 製品概要

- 原材料要件

- 製造工程

- 主要成功要因とリスク要因

第15章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- ABB Ltd

- Schneider Electric SE

- Siemens AG

- Mitsubishi Electric Corporation

- Omron Corporation

- General Electric Company

- SMA Solar Technology AG

- Delta Energy Systems Inc.

- Enphase Energy Inc.

- SolarEdge Technologies Inc.

- Huawei Technologies Co. Ltd

- Kstar New Energy Co. Ltd

- Sineng Electric Co. Ltd

- Sungrow Power Supply Co Ltd

- Tabuchi Electric Co. Ltd

- TBEA Sunoasis Co. Ltd

- Toshiba Corporation

List of Figures

- Figure 1: Global: Solar PV Inverter Market: Major Drivers and Challenges

- Figure 2: Global: Solar PV Inverter Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Solar PV Inverter Market: Breakup by Technology (in %), 2024

- Figure 4: Global: Solar PV Inverter Market: Breakup by Voltage (in %), 2024

- Figure 5: Global: Solar PV Inverter Market: Breakup by Application (in %), 2024

- Figure 6: Global: Solar PV Inverter Market: Breakup by Region (in %), 2024

- Figure 7: Global: Solar PV Inverter Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 8: Global: Solar PV Inverter Industry: SWOT Analysis

- Figure 9: Global: Solar PV Inverter Industry: Value Chain Analysis

- Figure 10: Global: Solar PV Inverter Industry: Porter's Five Forces Analysis

- Figure 11: Global: Solar PV Inverter (Central Inverters) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 12: Global: Solar PV Inverter (Central Inverters) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 13: Global: Solar PV Inverter (String Inverters) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 14: Global: Solar PV Inverter (String Inverters) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 15: Global: Solar PV Inverter (Microinverters) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 16: Global: Solar PV Inverter (Microinverters) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 17: Global: Solar PV Inverter (Others) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 18: Global: Solar PV Inverter (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 19: Global: Solar PV Inverter (< 1,000 V) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 20: Global: Solar PV Inverter (< 1,000 V) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 21: Global: Solar PV Inverter (1,000 - 1,499 V) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 22: Global: Solar PV Inverter (1,000 - 1,499 V) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 23: Global: Solar PV Inverter (> 1,500 V) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 24: Global: Solar PV Inverter (> 1,500 V) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 25: Global: Solar PV Inverter (Utility Scale) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 26: Global: Solar PV Inverter (Utility Scale) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 27: Global: Solar PV Inverter (Residential Scale) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 28: Global: Solar PV Inverter (Residential Scale) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 29: Global: Solar PV Inverter (Small Commercial Scale) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 30: Global: Solar PV Inverter (Small Commercial Scale) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 31: Global: Solar PV Inverter (Large Commercial Scale) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 32: Global: Solar PV Inverter (Large Commercial Scale) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 33: Global: Solar PV Inverter (Industrial Scale) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 34: Global: Solar PV Inverter (Industrial Scale) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 35: Asia Pacific: Solar PV Inverter Market: Sales Value (in Million USD), 2019 & 2024

- Figure 36: Asia Pacific: Solar PV Inverter Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 37: Europe: Solar PV Inverter Market: Sales Value (in Million USD), 2019 & 2024

- Figure 38: Europe: Solar PV Inverter Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 39: North America: Solar PV Inverter Market: Sales Value (in Million USD), 2019 & 2024

- Figure 40: North America: Solar PV Inverter Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 41: Middle East and Africa: Solar PV Inverter Market: Sales Value (in Million USD), 2019 & 2024

- Figure 42: Middle East and Africa: Solar PV Inverter Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 43: Latin America: Solar PV Inverter Market: Sales Value (in Million USD), 2019 & 2024

- Figure 44: Latin America: Solar PV Inverter Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 45: Solar PV Inverter Manufacturing: Process Flow

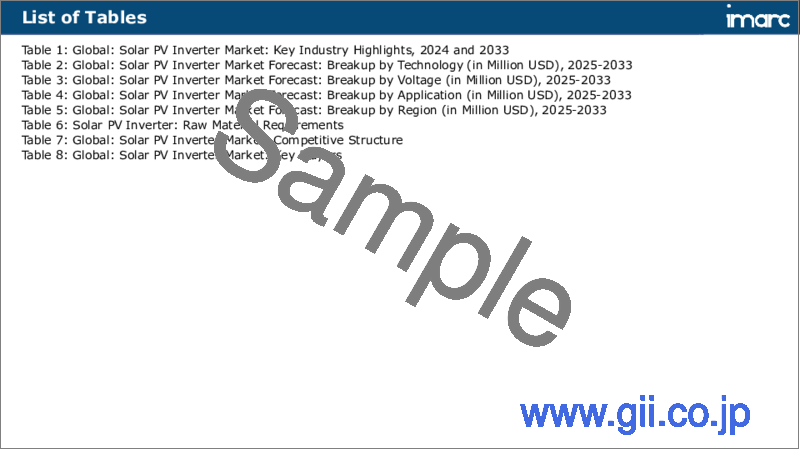

List of Tables

- Table 1: Global: Solar PV Inverter Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Solar PV Inverter Market Forecast: Breakup by Technology (in Million USD), 2025-2033

- Table 3: Global: Solar PV Inverter Market Forecast: Breakup by Voltage (in Million USD), 2025-2033

- Table 4: Global: Solar PV Inverter Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 5: Global: Solar PV Inverter Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Solar PV Inverter: Raw Material Requirements

- Table 7: Global: Solar PV Inverter Market: Competitive Structure

- Table 8: Global: Solar PV Inverter Market: Key Players

The global solar PV inverter market size reached USD 8.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.6 Billion by 2033, exhibiting a growth rate (CAGR) of 4.18% during 2025-2033. The implementation of government initiatives and policies, declining costs of solar PV inverters, increasing energy demand across the globe, and rapid technological advancements are some of the major factors propelling the market.

A solar photovoltaic (PV) inverter is a vital component of solar energy systems, transforming direct current produced by solar panels into alternating current (AC). It comprises key components, such as power transistors, transformers, and complex software controls. Solar PV inverter finds applications across diverse fields, including residential housing, commercial buildings, agricultural operations, transportation, urban planning, space technology, remote power systems, grid support, and environmental conservation initiatives. It enables the practical utilization of solar energy, promotes energy independence, provides a renewable energy source, offers potential income through feed-in tariffs, and reduces carbon footprints.

The recent technological advancements, which continuously refine efficiency and reliability, improve thermal management, and increase the capacity of solar PV inverters, are propelling the market growth. Along with this, the introduction of smart inverters, which provide grid support features and advanced monitoring capabilities, ensuring optimal system operation and maintenance, is acting as another growth-inducing factor. Furthermore, escalating environmental awareness among the masses is propelling the shift towards renewable energy sources, such as solar power, which is contributing to the market growth. Apart from this, the advent and growth of energy storage systems, which can store excess solar power for use when sunlight is not available, is positively influencing the market growth. Other factors, including rapid electrification of the transportation sector, extensive research and development (R&D) activities, and increasing demand for electrification of rural areas, are anticipated to drive the market growth.

Solar PV Inverter Market Trends/Drivers:

The implementation of government initiatives and policies

Government initiatives and policies are instrumental in fostering the market growth. Governments across the globe have recognized the imminent threat owing to climate change and the need to transition towards clean, renewable energy sources, such as solar power. To incentivize this transition, they have introduced an array of support mechanisms, such as feed-in tariffs, tax credits, and direct subsidies, which reduces the financial burden on homeowners and businesses for installing solar panels. Along with this, numerous countries have also enacted aggressive renewable energy targets backed by supportive legislation, which is further driving the demand for solar PV inverters. These policies not only lower the upfront costs of solar installations but also enhance their economic viability over the long term. Such decisive actions from governments signal a robust commitment to renewable energy, thereby instilling confidence among consumers and investors and driving the market growth.

The rapid decline in product costs

The declining cost of solar PV inverters is another significant driver of market growth. As technology advances, the efficiencies of manufacturing processes improve, contributing to a reduction in the cost of raw materials and components. The rise of automation in manufacturing has also reduced labor costs and minimized human error, enhancing product reliability. Furthermore, the expanding scale of production due to increasing demand leads to economies of scale, which reduces the per-unit cost of solar PV inverters. Moreover, solar energy is now becoming increasingly affordable for a wide array of consumers, from homeowners wanting to offset their electricity bills to businesses aiming to achieve sustainability goals. Lower costs are driving the widespread adoption of solar power systems and, by extension, the demand for solar PV inverters.

The increasing energy demand across the globe

The energy demand across the globe is surging due to rapid industrialization and urbanization activities. Traditional energy sources are limited and environmentally damaging, making it essential to find sustainable alternatives. Solar power, facilitated by solar PV inverters, provides a viable solution. Solar energy harnesses the sun's power, an abundant and renewable resource, to generate electricity. With the global shift towards electrification in sectors such as transport, heating, and cooling, the demand for electricity is set to grow exponentially. Solar power systems using PV inverters can meet this increased demand in a sustainable manner. From residential rooftops to commercial installations and utility-scale solar farms, the application of solar energy is expanding across the board. Thus, rising global energy demand is a key driver propelling the growth of the solar PV inverter market.

Solar PV Inverter Industry Segmentation:

Breakup by Technology:

- Central Inverters

- String Inverters

- Microinverters

- Others

String inverters dominate the market

String inverters are currently dominating the market as they have been the standard in the solar industry for many years, and their long-standing presence in the market has led to wide acceptance and trust in their technology. Furthermore, they offer a significant cost advantage over other types of inverters, such as microinverters and power optimizers. String inverters also have lower upfront costs, making them an attractive option for cost-conscious consumers. Apart from this, string inverters are incredibly efficient for larger, unshaded installations. They perform exceptionally well in conditions where solar panels receive uniform sunlight, making them a preferred choice for large residential, commercial, or utility-scale installations. Additionally, the recent development of multi-string inverters, which provide more flexibility and efficiency, is contributing to the market growth.

Breakup by Voltage:

- < 1,000 V

- 1,000 - 1,499 V

- 1,500 V

> 1500 V dominates the market

The >1500V segment is dominating the market as it allows more solar modules to be connected in series in a string, reducing the number of strings needed. This reduction leads to fewer combiner boxes, fewer cables, and fewer connections, thereby resulting in significant balance of system (BOS) cost savings. Furthermore, it results in a lower current for the same power output, which reduces resistive losses in the system, leading to an overall increase in system efficiency. Additionally, the recent technological advancements in components, such as inverters, transformers, and switchgears, have made it safer and more reliable to operate at these higher voltages, such as > 15000. Moreover, the implementation of favorable regulations and grid codes in many regions supports the adoption of higher voltage levels, further driving the trend towards >1500V systems.

Breakup by Application:

- Utility Scale

- Residential Scale

- Small Commercial Scale

- Large Commercial Scale

- Industrial Scale

Utility scale dominate the market

Utility-scale solar projects are dominating the market as they outsize residential and commercial installations in terms of power generation capacity. Given their large scale, even a single utility-scale project can require hundreds or even thousands of inverters, thereby driving up demand in the inverter market. Furthermore, many countries are aggressively expanding their renewable energy capacity to meet climate goals by establishing utility-scale solar farms, which is further boosting the market growth. Apart from this, utility-scale projects offer economies of scale, as the per-unit cost of components, including solar PV inverters, decreases significantly with the scale of the project. This cost advantage makes utility-scale projects more financially attractive, thereby driving their prevalence. Moreover, recent advancements in technology have resulted in more efficient and reliable solar PV inverters that can handle the high power output of utility-scale projects.

Breakup by Region:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

Asia Pacific exhibits a clear dominance in the market, accounting for the largest solar PV inverter market share

The report has also provided a comprehensive analysis of all the major regional markets, which includes Asia Pacific, Europe, North America, Middle East and Africa, and Latin America. According to the report, Asia Pacific represented the largest market segment. According to the report, Asia Pacific represented the largest market.

The Asia Pacific region is dominating the solar PV inverter market due to the implementation of ambitious renewable energy targets and supportive government policies, driving large-scale installations of solar power systems. Furthermore, the region has a substantial and growing demand for electricity due to rapid industrialization, urbanization, and population growth. Solar power, facilitated by solar PV inverters, is viewed as a sustainable solution to meet this escalating energy demand. Additionally, the Asia Pacific region has a significant need for rural electrification. Countries with remote areas lacking grid infrastructure are turning towards solar power as a practical solution for electrification, thereby driving the demand for solar PV inverters. Moreover, the region's abundant sunshine provides excellent conditions for solar power generation, making solar energy a naturally preferred choice.

Competitive Landscape:

The key market players are significantly heavily in research and development (R&D) to introduce innovative products that offer higher efficiency, reliability, and better integration with energy storage systems. They are also developing smart inverters equipped with advanced features, such as predictive maintenance, remote monitoring and control, and grid support functions. Furthermore, companies are entering partnerships and collaborations with other industry players, research institutions, and technology firms to leverage shared resources and expertise. Additionally, they are pursuing mergers and acquisitions (M&A) strategies to increase their market share, expand their product portfolios, and strengthen their technological capabilities. Moreover, many leading companies are expanding their manufacturing capacities by setting up new production facilities or enhancing existing ones to meet the rising demand for solar PV inverters.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ABB Ltd

- Schneider Electric SE

- Siemens AG

- Mitsubishi Electric Corporation

- Omron Corporation

- General Electric Company

- SMA Solar Technology AG

- Delta Energy Systems Inc.

- Enphase Energy Inc.

- SolarEdge Technologies Inc.

- Huawei Technologies Co. Ltd

- Kstar New Energy Co. Ltd

- Sineng Electric Co. Ltd

- Sungrow Power Supply Co Ltd

- Tabuchi Electric Co. Ltd

- TBEA Sunoasis Co. Ltd

- Toshiba Corporation

Key Questions Answered in This Report

- 1.How big is the global solar PV inverter market?

- 2.

- What is the expected growth rate of the global solar PV inverter market during 2025-2033?

- 3.What are the key factors driving the global solar PV inverter market?

- 4.What has been the impact of COVID-19 on the global solar PV inverter market?

- 5.What is the breakup of the global solar PV inverter market based on the technology?

- 6.What is the breakup of the global solar PV inverter market based on the voltage?

- 7.What is the breakup of the global solar PV inverter market based on the application?

- 8.What are the key regions in the global solar PV inverter market?

- 9.Who are the key players/companies in the global solar PV inverter market?

Table of Contents

1 Preface

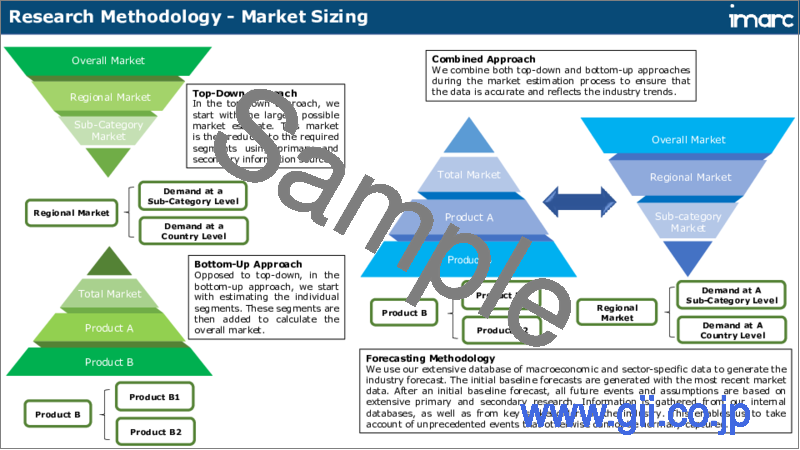

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Solar PV Inverter Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Breakup by Technology

- 5.5 Market Breakup by Voltage

- 5.6 Market Breakup by Application

- 5.7 Market Breakup by Region

- 5.8 Market Forecast

6 Market Breakup by Technology

- 6.1 Central Inverters

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 String Inverters

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Microinverters

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Others

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

7 Market Breakup by Voltage

- 7.1 < 1,000 V

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 1,000 - 1,499 V

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 > 1,500 V

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

8 Market Breakup by Application

- 8.1 Utility Scale

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Residential Scale

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Small Commercial Scale

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Large Commercial Scale

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Industrial Scale

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

9 Market Breakup by Region

- 9.1 Asia Pacific

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 Europe

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 North America

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Middle East and Africa

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

- 9.5 Latin America

- 9.5.1 Market Trends

- 9.5.2 Market Forecast

10 Global Solar PV Inverter Industry: SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Global Solar PV Inverter Industry: Value Chain Analysis

- 11.1 Overview

- 11.2 Research and Development

- 11.3 Raw Material Procurement

- 11.4 Manufacturing

- 11.5 Marketing

- 11.6 Distribution

- 11.7 End-Use

12 Global Solar PV Inverter Industry: Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Global Solar PV Inverter Industry: Price Analysis

- 13.1 Price Indicators

- 13.2 Price Structure

- 13.3 Margin Analysis

14 Solar PV Inverter Manufacturing Process

- 14.1 Product Overview

- 14.2 Raw Material Requirements

- 14.3 Manufacturing Process

- 14.4 Key Success and Risk Factors

15 Competitive Landscape

- 15.1 Market Structure

- 15.2 Key Players

- 15.3 Profiles of Key Players

- 15.3.1 ABB Ltd

- 15.3.2 Schneider Electric SE

- 15.3.3 Siemens AG

- 15.3.4 Mitsubishi Electric Corporation

- 15.3.5 Omron Corporation

- 15.3.6 General Electric Company

- 15.3.7 SMA Solar Technology AG

- 15.3.8 Delta Energy Systems Inc.

- 15.3.9 Enphase Energy Inc.

- 15.3.10 SolarEdge Technologies Inc.

- 15.3.11 Huawei Technologies Co. Ltd

- 15.3.12 Kstar New Energy Co. Ltd

- 15.3.13 Sineng Electric Co. Ltd

- 15.3.14 Sungrow Power Supply Co Ltd

- 15.3.15 Tabuchi Electric Co. Ltd

- 15.3.16 TBEA Sunoasis Co. Ltd

- 15.3.17 Toshiba Corporation