|

|

市場調査レポート

商品コード

1433653

ポリプロピレン(PP)コンパウンドの市場規模、シェア、動向分析レポート:製品別、用途別、最終用途別、地域別、セグメント別予測、2024年~2030年Polypropylene Compounds Market Size, Share & Trends Analysis Report By Product (Mineral Filled, Compounded TPO, Compounded TPV, Glass Fiber Reinforced, Talc Filled), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| ポリプロピレン(PP)コンパウンドの市場規模、シェア、動向分析レポート:製品別、用途別、最終用途別、地域別、セグメント別予測、2024年~2030年 |

|

出版日: 2024年01月31日

発行: Grand View Research

ページ情報: 英文 130 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

ポリプロピレン(PP)コンパウンド市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、世界のポリプロピレン(PP)コンパウンド市場規模は、2024年から2030年にかけてCAGR 7.8%で成長し、2030年には392億1,000万米ドルに達すると推定されます。

ポリプロピレン(PP)コンパウンド市場の成長に寄与している主な要因は、自動車産業における軽量で高性能なプラスチックへの需要の高まりです。

燃費を向上させるために政府から出された厳しい環境規制により、軽量な自動車部品を製造する傾向にシフトしています。プラスチックであるポリプロピレンは軽量であるため、自動車の効率に好影響を与えます。自動車部品へのプラスチックの採用が増加し、特にアジアと中南米では電気乗用車と大型車の生産が同時に増加しているため、予測期間中にPPコンパウンドの成長が促進されると予想されます。

ガラス繊維強化セグメントは、2024年から2030年にかけて市場をリードすると予想されます。ガラス繊維強化ポリプロピレンは、引張強度が高く、耐熱性が強化され、剛性が大幅に向上しています。この製品は、前述の特性を必要とする構造部品に一般的に使用され、主に家具、家電製品、自動車用途の一部となっています。

電気・電子用途分野は、2024~2030年にCAGR 7.8%で成長すると予想されています。ポリプロピレン(PP)コンパウンドは、軽量化、熱・電気絶縁、小型化などの利点により、電気・電子産業で使用されています。その需要は、高密度データストレージのような高度な機能の使用の増加により、過去数年にわたって推進されています。さらに、PPコンパウンドの使用により、より高性能で手頃な価格の便利な電子機器の開発が可能になりました。

欧州はPPコンパウンドの第3位市場に浮上し、2023年の市場シェアは約21.0%でした。欧州は著名な自動車メーカーの1つであり、予測期間中もこの分野での優位が続くと予想されます。軽量電気自動車やハイブリッド車に対する需要の高まりに加え、AUDI AG、BMW AG、Mercedes-Benz AG、Automobili Lamborghini S.p.A.、Porsche Austria GmbH &Co.などの大手自動車メーカーがこの地域に進出しているため、自動車産業の拠点となっています。

ポリプロピレン(PP)コンパウンド市場レポートハイライト

- 製品別では、ガラス繊維強化分野は2024年から2030年にかけてCAGR 8.0%以上の成長が見込まれます。この製品は、高い引張強度、耐熱性、剛性の向上により、あらゆる産業で応用されています。

- 最終用途に基づくと、建築・建設分野は2024年から2030年までCAGR 7.0%以上の成長が見込まれます。建築・建設分野でのポリプロピレン系コンパウンドの使用は、エネルギー効率、耐候性、グリーンルーフィングオプションなどの利点により、近年増加しています。

- 中国、インド、ベトナム、タイ、ブラジル、アルゼンチンなどのアジア太平洋および中南米の新興経済圏では、携帯電話、ノートパソコン、タブレット、ファブレットなどの電子機器に対する需要が増加しており、電気・電子用途セグメントにおけるポリプロピレン系コンパウンドの消費を促進すると予想されます。

- 2023年10月、LyondellBasell Industries Holdings B.V.は、自動車用途向けの半透明ポリプロピレン(PP)コンパウンドの新シリーズ、HostacomとHifaxの発売を発表しました。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 ポリプロピレン(PP)コンパウンドの市場変数、動向および範囲

- 市場系統の見通し

- 親市場の見通し

- 関連市場の見通し

- 業界のバリューチェーン分析

- 流通チャネル分析

- 原材料の動向

- 技術概要

- 規制の枠組み

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 業界の課題

- 業界の機会

- 業界分析ツール

- ポーターのファイブフォース分析

- マクロ環境分析

第4章 ポリプロピレン(PP)コンパウンド市場:製品の推定・動向分析

- 製品の変動分析と市場シェア、2023年と2030年

- 製品別、2018年から2030年まで

- ミネラル入りPPコンパウンド

- 配合TPO

- 配合TPV

- ガラス繊維強化

- タルク入り

- その他

第5章 ポリプロピレン(PP)コンパウンド市場:用途の推定・動向分析

- 用途の変動分析と市場シェア、2023年と2030年

- 用途別、2018年から2030年まで

- 繊維

- フィルム・シート

- ラフィア

- その他

第6章 ポリプロピレン(PP)コンパウンド市場:最終用途の推定・動向分析

- 最終用途の変動分析と市場シェア、2023年と2030年

- 最終用途別、2018年から2030年まで

- 自動車

- 建築と建設

- 電気・電子

- 繊維

- その他

第7章 ポリプロピレン(PP)コンパウンド市場:地域の推定・動向分析

- 地域の変動分析と市場シェア、2023年と2030年

- 北米

- 市場の推定・予測、2018年から2030年

- 米国

- カナダ

- メキシコ

- 欧州

- 市場の推定・予測、2018年から2030年

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- ノルウェー

- アジア太平洋地域

- 市場の推定・予測、2018年から2030年

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- インドネシア

- マレーシア

- タイ

- 中南米

- 市場の推定・予測、2018年から2030年

- ブラジル

- アルゼンチン

- 中東とアフリカ

- 市場の推定・予測、2018年から2030年

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第8章 ポリプロピレン(PP)コンパウンド市場-競合情勢

- 主要市場参入企業による最近の動向と影響分析

- 企業の分類

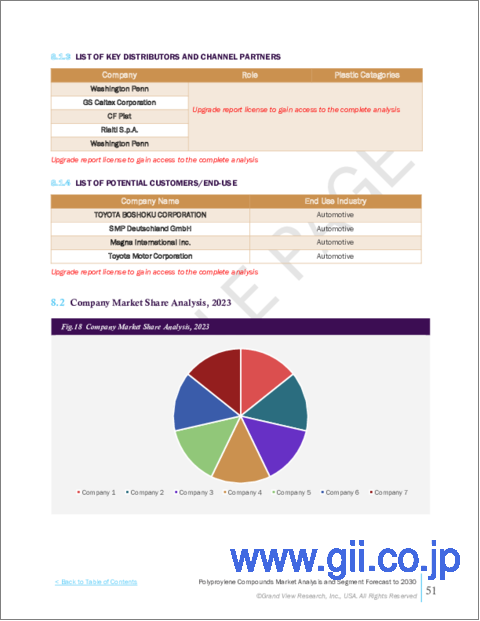

- 企業の市場シェア/地位分析、2023年

- 企業ヒートマップ分析

- 戦略マッピング

- 拡大

- 合併と買収

- パートナーシップとコラボレーション

- 新製品の発売

- 研究開発

- 企業プロファイル

- Mitsui Chemical, Inc.

- IRPC Public Company Limited

- Exxon Mobil Corporation

- Avient Corporation

- Japan Polypropylene Corporation

- SABIC

- Trinseo SA

- Sumitomo Chemical Co., Ltd.

- Washington Penn

- Borealis AG

- LyondellBasell Industries Holdings BV

- DAEHACOM Co., Ltd.

- GS Caltex Corporation

List of Tables

- Table 1 List of abbreviations

- Table 2 Polypropylene compounds market 2018 - 2030 (Kilotons) (USD Million)

- Table 3 Global market estimates and forecasts by region, 2018 - 2030 (Kilotons)

- Table 4 Global market estimates and forecasts by region, 2018 - 2030 (USD Million)

- Table 5 Global market estimates and forecasts by product, 2018 - 2030 (Kilotons)

- Table 6 Global market estimates and forecasts by product, 2018 - 2030 (USD Million)

- Table 7 Global market estimates and forecasts by application, 2018 - 2030 (Kilotons)

- Table 8 Global market estimates and forecasts by application, 2018 - 2030 (USD Million)

- Table 9 Global market estimates and forecasts by end-use, 2018 - 2030 (Kilotons)

- Table 10 Global market estimates and forecasts by end-use, 2018 - 2030 (USD Million)

- Table 11 Global market estimates and forecasts by region, 2018 - 2030 (Kilotons)

- Table 12 Global market estimates and forecasts by region, 2018 - 2030 (USD Million)

- Table 13 North America paint protection film market by product, 2018 - 2030 (Kilotons)

- Table 14 North America paint protection film market by application, 2018 - 2030 (USD Million)

- Table 15 North America paint protection film market by end-use, 2018 - 2030 (USD Million)

- Table 16 U.S. Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 17 U.S. Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 18 U.S. Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 19 Canada Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 20 Canada Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 21 Canada Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 22 Mexico Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 23 Mexico Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 24 Mexico Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 25 Europe Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 26 Europe Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 27 Europe Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 28 Germany Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 29 Germany Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 30 Germany Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 31 U.K. Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 32 U.K. Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 33 U.K. Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 34 France Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 35 France Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 36 France Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 37 Italy Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 38 Italy Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 39 Italy Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 40 Spain Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 41 Spain Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 42 Spain Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 43 Netherlands Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 44 Netherlands Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 45 Netherlands Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 46 Norway Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 47 Norway Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 48 Norway Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 49 Asia Pacific Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 50 Asia Pacific Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 51 Asia Pacific Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 52 China Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 53 China Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 54 China Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 55 Japan Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 56 Japan Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 57 Japan Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 58 India Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 59 India Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 60 India Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 61 Australia Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 62 Australia Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 63 Australia Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 64 South Korea Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 65 South Korea Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 66 South Korea Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 67 Malaysia Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 68 Malaysia Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 69 Malaysia Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 70 Indonesia Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 71 Indonesia Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 72 Indonesia Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 73 Thailand Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 74 Thailand Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 75 Thailand Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 76 Central & South America Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 77 Central & South America Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 78 Central & South America Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 79 Brazil Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 80 Brazil Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 81 Brazil Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 82 Argentina Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 83 Argentina Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 84 Argentina Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 85 Middle East & Africa Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 86 Middle East & Africa Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 87 Middle East & Africa Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 88 Saudi Arabia Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 89 Saudi Arabia Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 90 Saudi Arabia Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 91 UAE Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 92 UAE Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 93 UAE Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

- Table 94 South Africa Polypropylene Compounds Market by product, 2018 - 2030 (Kilotons)

- Table 95 South Africa Polypropylene Compounds Market by application, 2018 - 2030 (USD Million)

- Table 96 South Africa Polypropylene Compounds Market by end-use, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Market research process

- Fig. 2 Data triangulation techniques

- Fig. 3 Primary research pattern

- Fig. 4 Market research approaches

- Fig. 5 QFD modeling for market share assessment

- Fig. 6 Information Procurement

- Fig. 7 Market Formulation and Validation

- Fig. 8 Data Validating & Publishing

- Fig. 9 Market Segmentation & Scope

- Fig. 10 Polypropylene Compounds Market Snapshot

- Fig. 11 Segment Snapshot (1/2)

- Fig. 12 Segment Snapshot (1/2)

- Fig. 13 Competitive Landscape Snapshot

- Fig. 14 Parent market outlook

- Fig. 15 Polypropylene Compounds Market Value, 2023 (USD Million)

- Fig. 16 Polypropylene Compounds Market - Value Chain Analysis

- Fig. 17 Polypropylene Compounds Market - Price Trend Analysis 2018 - 2030 (USD/Sq. Meter)

- Fig. 18 Polypropylene Compounds Market - Market Dynamics

- Fig. 19 Polypropylene Compounds Market - PORTER's Analysis

- Fig. 20 Polypropylene Compounds Market - PESTEL Analysis

- Fig. 21 Polypropylene Compounds Market Estimates & Forecasts, By Product: Key Takeaways

- Fig. 22 Polypropylene Compounds Market Share, By Product, 2022 & 2030

- Fig. 23 Mineral filled PP compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 24 Compounded TPO Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 25 Others Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 26 Polypropylene Compounds Market Estimates & Forecasts, By Application: Key Takeaways

- Fig. 27 Polypropylene Compounds Market Share, By Application, 2023 & 2030

- Fig. 28 Polypropylene Compounds Market Estimates & Forecasts, in Fiber, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 29 Polypropylene Compounds Market Estimates & Forecasts, in Film & Sheet, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 30 Polypropylene Compounds Market Estimates & Forecasts, in Raffia, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 31 Polypropylene Compounds Market Estimates & Forecasts, in other applications, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 32 Polypropylene Compounds Market Revenue, By Region, 2023 & 2030 (USD Million)

- Fig. 33 North America Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 34 U.S. Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 35 Canada Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 36 Mexico Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 37 Europe Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 38 Germany Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 39 UK Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 40 France Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 41 Italy Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 42 Spain Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 43 Netherlands Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 44 Norway Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 45 Asia Pacific Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 46 China Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 47 India Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 48 Japan Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 49 South Korea Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 50 Australia Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 51 Indonesia Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 52 Malaysia Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 53 Thailand Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 54 Central & South America Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 55 Brazil Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 56 Argentina Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 57 Middle East & Africa Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 58 Saudi Arabia Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 59 UAE Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 60 South Africa Polypropylene Compounds Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Fig. 61 Key Company Categorization

- Fig. 62 Company Market Positioning

- Fig. 63 Key Company Market Share Analysis, 2023

- Fig. 64 Strategy Mapping

Polypropylene Compounds Market Growth & Trends:

The global polypropylene compounds market size is estimated to reach USD 39.21 billion by 2030, growing at a CAGR of 7.8% from 2024 to 2030, according to a new report by Grand View Research, Inc. The major factor contributing to the growth of the polypropylene (PP) compounds market is the rising demand for lightweight and high-performing plastics in the automotive industry.

There has been a shift in the trend toward manufacturing lightweight vehicle components owing to the stringent environmental regulations issued by the government to promote fuel economy. Polypropylene, being plastic, is lightweight and therefore positively influences the efficiency of the vehicle. Increasing incorporation of plastics in automotive components and the simultaneous rise in the production of electric passenger cars and heavy-duty vehicles, particularly in Asia and Central & South America, are expected to propel the growth of PP compounds over the forecast period.

The glass fiber reinforced segment is expected to lead the market from 2024 to 2030. Glass-reinforced polypropylene offers higher tensile strength, enhanced heat resistance and significantly improved stiffness. This product is commonly used in structural components that require the aforementioned properties and are predominantly a part of furniture, appliances, and automotive applications.

The electrical & electronics application segment is expected to grow at a CAGR of 7.8% from 2024-2030. Polypropylene compounds are used in electrical and electronics industry owing to their benefits such as weight reduction, thermal & electrical insulation, and miniaturization. Their demand has propelled over the past years due to increased use of advanced features such as high-density data storage. Moreover, the use of PP compounds has enabled the development of higher performing, affordable and convenient electronic equipment that are recyclable owing to its halogen-free nature.

Europe emerged as the third-largest market for PP compounds and accounted for a market share of around 21.0% in 2023. Europe is one of the prominent manufacturers of automobiles and is expected to continue its dominance in this sector over the forecast period. The rising demand for lightweight electric and hybrid vehicles, along with the presence of major automotive manufacturers, including AUDI AG, BMW AG, Mercedes-Benz AG, Automobili Lamborghini S.p.A., and Porsche Austria GmbH & Co. in this region, makes it a hub for the automotive industry.

Propylene Compounds Market Report Highlights:

- Based on product, the glass fiber reinforced segment is expected to grow at a CAGR of over 8.0% from 2024 to 2030. The product find application across industries due to their higher tensile strength, heat resistance, and improved stiffness

- Based on end-use, the building & construction segment is expected to grow at a CAGR of over 7.0% from 2024 to 2030. The use of polypropylene-based compounds in the building and construction segment has increased in recent years, owing to their benefits such as energy efficiency, weather resistance, and green roofing options

- Increasing demand for electronic gadgets such as mobiles, laptops, tablets, and phablets in emerging economies of the Asia Pacific and Central & South America, such as China, India, Vietnam, Thailand, Brazil, and Argentina, is expected to drive polypropylene compounds consumption in the electrical & electronics application segment

- In October 2023, LyondellBasell Industries Holdings B.V. announced the launch of its new range of translucent polypropylene compounds, namely Hostacom and Hifax, for automotive applications

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources & Third-Party Perspectives

- 1.3.4. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Market Snapshot

- 2.2. Segment Snapshot

- 2.3. Competitive Landscape Snapshot

Chapter 3. Polypropylene Compounds Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Parent Market Outlook

- 3.1.2. Related Market Outlook

- 3.2. Industry Value Chain Analysis

- 3.2.1. Distribution Channel Analysis

- 3.2.2. Raw Material Trends

- 3.2.3. Technological Overview

- 3.3. Regulatory Framework

- 3.4. Market Dynamics

- 3.4.1. Market Driver Analysis

- 3.4.2. Market Restraint Analysis

- 3.4.3. Industry Challenges

- 3.4.4. Industry Opportunities

- 3.5. Industry Analysis Tools

- 3.5.1. Porter's Five Forces Analysis

- 3.5.2. Macro-environmental Analysis

Chapter 4. Polypropylene Compounds Market: Product Estimates & Trend Analysis

- 4.1. Product Movement Analysis & Market Share, 2023 & 2030

- 4.2. Polypropylene Compounds Market Estimates & Forecast, By Product, 2018 to 2030 (Kilotons) (USD Million)

- 4.3. Mineral filled PP compounds

- 4.3.1. Mineral filled PP compounds Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 4.4. Compounded TPO

- 4.4.1. Compounded TPO Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 4.5. Compounded TPV

- 4.5.1. Compounded TPV Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 4.6. Glass Fiber Reinforced

- 4.6.1. Glass Fiber Reinforced Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 4.7. Talc Filled

- 4.7.1. Talc Filled Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 4.8. Others

- 4.8.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 5. Polypropylene Compounds Market: Application Estimates & Trend Analysis

- 5.1. Application Movement Analysis & Market Share, 2023 & 2030

- 5.2. Polypropylene Compounds Market Estimates & Forecast, By Application, 2018 to 2030 (Kilotons) (USD Million)

- 5.3. Fiber

- 5.3.1. Fiber Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.4. Film & Sheet

- 5.4.1. Film & Sheet Applications Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.5. Raffia

- 5.5.1. Raffia Applications Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.6. Others

- 5.6.1. Others Applications Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 6. Polypropylene Compounds Market: End-use Estimates & Trend Analysis

- 6.1. End-use Movement Analysis & Market Share, 2023 & 2030

- 6.2. Polypropylene Compounds Market Estimates & Forecast, By End-use, 2018 to 2030 (Kilotons) (USD Million)

- 6.3. Automotive

- 6.3.1. Automotive Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.4. Building & Construction

- 6.4.1. Building & Construction Applications Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.5. Electrical & Electronics

- 6.5.1. Electrical & Electronics Applications Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.6. Textile

- 6.6.1. Textile Applications Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.7. Others

- 6.7.1. Others Applications Market Revenue Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 7. Polypropylene Compounds Market: Regional Estimates & Trend Analysis

- 7.1. Regional Movement Analysis & Market Share, 2023 & 2030

- 7.2. North America

- 7.2.1. North America Polypropylene Compounds Market Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.2.2. U.S.

- 7.2.2.1. Key country dynamics

- 7.2.2.2. U.S. Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.2.3. Canada

- 7.2.3.1. Key country dynamics

- 7.2.3.2. Canada Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.2.4. Mexico

- 7.2.4.1. Key country dynamics

- 7.2.4.2. Mexico Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.3. Europe

- 7.3.1. Europe Polypropylene Compounds Market Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.3.2. Germany

- 7.3.2.1. Key country dynamics

- 7.3.2.2. Germany Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.3.3. UK

- 7.3.3.1. Key country dynamics

- 7.3.3.2. UK Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.3.4. France

- 7.3.4.1. Key country dynamics

- 7.3.4.2. France Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.3.5. Italy

- 7.3.5.1. Key country dynamics

- 7.3.5.2. Italy Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.3.6. Spain

- 7.3.6.1. Key country dynamics

- 7.3.6.2. Spain Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.3.7. Netherlands

- 7.3.7.1. Key country dynamics

- 7.3.7.2. Netherlands Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.3.8. Norway

- 7.3.8.1. Key country dynamics

- 7.3.8.2. Norway Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.4. Asia Pacific

- 7.4.1. Asia Pacific Polypropylene Compounds Market Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.4.2. China

- 7.4.2.1. Key country dynamics

- 7.4.2.2. China Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.4.3. Japan

- 7.4.3.1. Key country dynamics

- 7.4.3.2. Japan Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.4.4. India

- 7.4.4.1. Key country dynamics

- 7.4.4.2. India Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.4.5. Australia

- 7.4.5.1. Key country dynamics

- 7.4.5.2. Australia Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.4.6. South Korea

- 7.4.6.1. Key country dynamics

- 7.4.6.2. South Korea Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.4.7. Indonesia

- 7.4.7.1. Key country dynamics

- 7.4.7.2. Indonesia Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.4.8. Malaysia

- 7.4.8.1. Key country dynamics

- 7.4.8.2. Malaysia Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.4.9. Thailand

- 7.4.9.1. Key country dynamics

- 7.4.9.2. Thailand Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.5. Central & South America

- 7.5.1. Central & South America Polypropylene Compounds Market Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.5.2. Brazil

- 7.5.2.1. Key country dynamics

- 7.5.2.2. Brazil Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.5.3. Argentina

- 7.5.3.1. Key country dynamics

- 7.5.3.2. Argentina Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.6. Middle East & Africa

- 7.6.1. Middles East & Africa Polypropylene Compounds Market Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.6.2. Saudi Arabia

- 7.6.2.1. Key country dynamics

- 7.6.2.2. Saudi Arabia Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.6.3. UAE

- 7.6.3.1. Key country dynamics

- 7.6.3.2. UAE Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

- 7.6.4. South Africa

- 7.6.4.1. Key country dynamics

- 7.6.4.2. South Africa Polypropylene Compounds Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

Chapter 8. Polypropylene Compounds Market - Competitive Landscape

- 8.1. Recent Developments & Impact Analysis, By Key Market Participants

- 8.2. Company Categorization

- 8.3. Company Market Share/Position Analysis, 2023

- 8.4. Company Heat Map Analysis

- 8.5. Strategy Mapping

- 8.5.1. Expansion

- 8.5.2. Mergers & Acquisition

- 8.5.3. Partnerships & Collaborations

- 8.5.4. New Product Launches

- 8.5.5. Research And Development

- 8.6. Company Profiles

- 8.6.1. Mitsui Chemical, Inc.

- 8.6.1.1. Participant's overview

- 8.6.1.2. Financial performance

- 8.6.1.3. Product benchmarking

- 8.6.1.4. Recent developments

- 8.6.2. IRPC Public Company Limited

- 8.6.2.1. Participant's overview

- 8.6.2.2. Financial performance

- 8.6.2.3. Product benchmarking

- 8.6.2.4. Recent developments

- 8.6.3. Exxon Mobil Corporation

- 8.6.3.1. Participant's overview

- 8.6.3.2. Financial performance

- 8.6.3.3. Product benchmarking

- 8.6.3.4. Recent developments

- 8.6.4. Avient Corporation

- 8.6.4.1. Participant's overview

- 8.6.4.2. Financial performance

- 8.6.4.3. Product benchmarking

- 8.6.4.4. Recent developments

- 8.6.5. Japan Polypropylene Corporation

- 8.6.5.1. Participant's overview

- 8.6.5.2. Financial performance

- 8.6.5.3. Product benchmarking

- 8.6.5.4. Recent developments

- 8.6.6. SABIC

- 8.6.6.1. Participant's overview

- 8.6.6.2. Financial performance

- 8.6.6.3. Product benchmarking

- 8.6.6.4. Recent developments

- 8.6.7. Trinseo S.A.

- 8.6.7.1. Participant's overview

- 8.6.7.2. Financial performance

- 8.6.7.3. Product benchmarking

- 8.6.7.4. Recent developments

- 8.6.8. Sumitomo Chemical Co., Ltd.

- 8.6.8.1. Participant's overview

- 8.6.8.2. Financial performance

- 8.6.8.3. Product benchmarking

- 8.6.8.4. Recent developments

- 8.6.9. Washington Penn

- 8.6.9.1. Participant's overview

- 8.6.9.2. Financial performance

- 8.6.9.3. Product benchmarking

- 8.6.9.4. Recent developments

- 8.6.10. Borealis AG

- 8.6.10.1. Participant's overview

- 8.6.10.2. Financial performance

- 8.6.10.3. Product benchmarking

- 8.6.10.4. Recent developments

- 8.6.11. LyondellBasell Industries Holdings B.V.

- 8.6.11.1. Participant's overview

- 8.6.11.2. Financial performance

- 8.6.11.3. Product benchmarking

- 8.6.11.4. Recent developments

- 8.6.12. DAEHACOM Co., Ltd.

- 8.6.12.1. Participant's overview

- 8.6.12.2. Financial performance

- 8.6.12.3. Product benchmarking

- 8.6.12.4. Recent developments

- 8.6.13. GS Caltex Corporation

- 8.6.13.1. Participant's overview

- 8.6.13.2. Financial performance

- 8.6.13.3. Product benchmarking

- 8.6.13.4. Recent developments

- 8.6.1. Mitsui Chemical, Inc.