|

|

市場調査レポート

商品コード

1233164

産業用冷却システムの市場規模、シェア、動向分析レポート:コンポーネント別(圧縮機、凝縮器、蒸発器、制御装置、その他)、容量別、用途別、地域別、セグメント予測、2023~2030年Industrial Refrigeration Systems Market Size, Share & Trends Analysis Report By Component (Compressors, Condensers, Evaporators, Controls, Others), By Capacity, By Application, By Region, And Segment Forecasts, 2023 - 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 産業用冷却システムの市場規模、シェア、動向分析レポート:コンポーネント別(圧縮機、凝縮器、蒸発器、制御装置、その他)、容量別、用途別、地域別、セグメント予測、2023~2030年 |

|

出版日: 2023年02月10日

発行: Grand View Research

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

産業用冷却システム市場の成長と動向

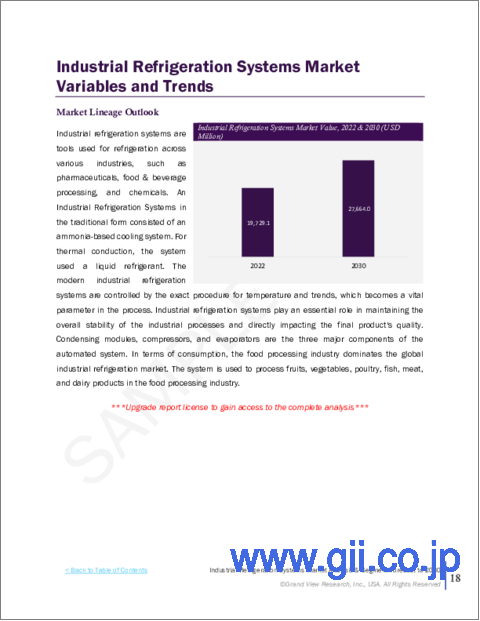

Grand View Research, Inc.が発行した新しいレポートによると、世界の産業用冷却システムの市場規模は、2023年から2030年にかけて4.4%のCAGRを記録し、2030年には276億6000万米ドルに達すると予測されています。

産業用冷蔵の需要は、腐りやすい食用品の効率的な保管を必要とする、動きの速い消費財や小売食品のために増加しています。各国政府は、コールドチェーンのインフラを支援・強化し、環境に優しい冷凍システムにシフトするためのイニシアチブを取っています。

地球温暖化と気候変動は、危機を抑制するために必要な措置を講じるよう各国に警鐘を鳴らしています。その結果、産業用冷却システム製造会社は、冷媒の地球温暖化やオゾン層破壊の可能性について懸念を表明しています。その結果、各社は費用対効果の向上、毒性の低い冷媒、エネルギー消費の低減、有害物質の低減を実現する技術に注力しています。

例えば、産業用冷却システムの著名なメーカーであるDanFoss社は、空調・冷凍システムの設計と最適化を支援するCool selector 2を発表しました。システム設計者、エンジニア、コンサルタントは、このソフトウェアを使用して、エネルギーとHVACRシステムの最適な活用を図ることができます。CO2のGWP(地球温暖化係数)が1であることから、CO2冷凍システムを使用するメリットは世界的に認められていますが、今回のアップデートにより、超臨界高圧側システムへの適用という観点からコンポーネントを計算することが可能になりました。

技術の進歩に伴い、産業用冷却システムは、そのプロセスにおいて向上が見られるようになりました。イノベーションにより、監視、温度設定、必要な時に必要なだけ通知するスマートでインテリジェントなデバイスが製造されるようになりました。人工知能(AI)をシステムに組み込むことで、生産性を向上させ、組織の運用コストを下げることで、市場のブレークスルーとなりました。

予測期間中、アジア太平洋地域の成長が最も速くなると予測されています。この拡大は、日本、インド、中国などの国々におけるコールドチェーンストレージインフラの急速な成長見込みに起因しています。例えば、インドは世界第2位の果物・野菜生産国です。このような巨大な野菜や果物の冷蔵保存や取り扱いは、困難な作業であるため、市場の成長に拍車をかけています。

産業用冷却システム市場レポートハイライト

- コンプレッサーは、商業用および産業用の冷凍、ヒートポンプ、空調アプリケーションで使用されるため、冷凍システムで最も成長しているコンポーネントです。

- 可処分所得の増加や人口の増加により、飲食品用途が最大の市場シェアを占めています。また、冷凍食品や加工食品の需要も拡大しています。

- 500~1000kWの容量セグメントでは、賞味期限の延長や製品の無駄を省くことができるため、産業用冷却システム市場をリードしています。

- アジア太平洋地域は、果物や野菜の生産者が多く、コールドチェーン保存の必要性が高いことから、市場の成長率が最も高い地域となっています。

目次

第1章 調査手法と範囲

- 市場セグメンテーションと範囲

- 市場の定義

- 情報調達

- 購入したデータベース

- GVRの内部データベース

- 二次情報一覧

- 1次調査

- 情報分析

- 市場形成とデータ可視化

- データの検証と公開

第2章 エグゼクティブサマリー

- 市場の見通し

- セグメント別見通し

第3章 産業用冷却システム市場の変数、動向、範囲

- 市場イントロダクション

- 市場規模と成長見通し

- 産業用冷却システム市場:バリューチェーン分析

- 産業用冷却システム市場力学

- 市場促進要因分析

- 加工食品の世界の消費量の増加

- 自然冷媒ベースの機器に対する需要の高まり

- コールドチェーンインフラストラクチャの開発を支援する政府のイニシアチブ

- 技術の進歩

- 市場抑制・課題分析

- エネルギー消費と高い設置および運用コスト

- 熟練労働者の不足と高い安全性への懸念

- 市場機会

- 機器監視のためのIoT対応冷凍ソリューションの使用

- 市場促進要因分析

第4章 産業用冷却システム市場:コンポーネントセグメント分析

- 産業用冷却システム市場:コンポーネントセグメント別、見通しと市場シェア 2022年および2030年

- コンポーネントの変動分析と市場シェア、2022年と2030年

- コンプレッサー

- コンデンサー

- 蒸発器

- コントロール

- その他

第5章 産業用冷却システム市場:コンプレッサータイプのセグメント分析

- 産業用冷却システム市場:コンプレッサータイプ別セグメントの見通しと市場シェア 2022年および2030年

- コンプレッサータイプの変動分析と市場シェア、2022年と2030年

- ロータリースクリューコンプレッサー

- 遠心圧縮機

- レシプロコンプレッサー

- その他

第6章 産業用冷却システム市場:レシプロコンプレッサータイプのセグメント分析

- 産業用冷却システム市場:レシプロコンプレッサータイプセグメント別の見通しと市場シェア2022年および2030年

- レシプロコンプレッサータイプの変動分析と市場シェア、2022年と2030年

- ダイヤフラム

- その他

第7章 産業用冷却システム市場:容量セグメント分析

- 産業用冷却システム市場:容量セグメント別の見通しと市場シェア 2022年および2030年

- 容量変動分析と市場シェア、2022年と2030年

- 100kW未満

- 100~500kW

- 500kW~1000kW

- 1000kW~5000kW

- 5000kW以上

第8章 産業用冷却システム市場:アプリケーションセグメント分析

- 産業用冷却システム市場:アプリケーションセグメント別の見通しと市場シェア 2022年および2030年

- アプリケーションの変動分析と市場シェア、2022年と2030年

- 冷蔵倉庫

- 飲食品

- 化学石油化学・医薬品

- 冷蔵輸送

第9章 産業用冷却システム市場:地域セグメント分析

- 産業用冷却システム市場:地域別セグメントの見通しと市場シェア 2022年および2030年

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- アジア太平洋地域

- 中国

- インド

- 日本

- ラテンアメリカ

- ブラジル

- メキシコ

- 中東とアフリカ

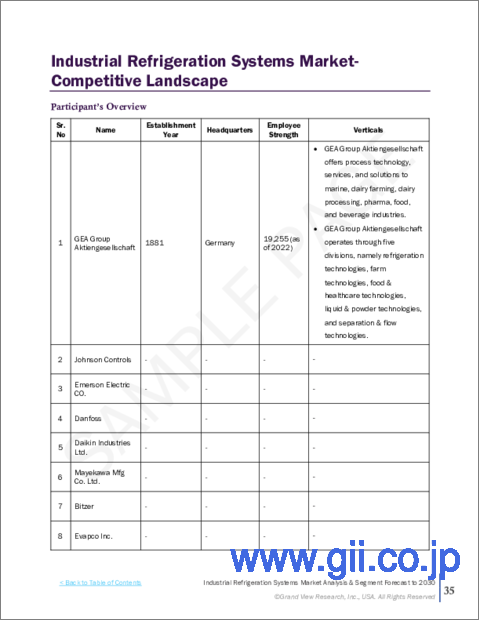

第10章 競合情勢

- 企業プロファイル

- JOHNSON CONTROLS

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- EMERSON ELECTRIC CO.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- DANFOSS

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- DAIKIN INDUSTRIES, LTD.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- GEA GROUP AKTIENGESELLSCHAFT

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- MAYEKAWA MFG. CO., LTD.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- BITZER KUHLMASCHINENBAU GMBH

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- EVAPCO, INC.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- GUNTNER GMBH &CO. KG

- 会社概要

- 製品のベンチマーク

- LU-VE SPA

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- JOHNSON CONTROLS

List of Tables

- Table 1 Global Industrial Refrigeration Systems Market, 2018 - 2030 (USD Million)

- Table 2 Global Industrial Refrigeration Systems Market, by region, 2018 - 2030 (USD Million)

- Table 3 Global Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 4 Global Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 5 Global Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 6 Global Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 7 Global Industrial Refrigeration Systems Market, by application 2018 - 2030 (USD Million)

- Table 8 Key market driver analysis

- Table 9 Refrigerants used in the food industry, 2022

- Table 10 Key market restraint/challenges impact

- Table 11 Compressors market, by region, 2018 - 2030 (USD Million)

- Table 12 Condensers market, by region, 2018 - 2030 (USD Million)

- Table 13 Evaporators market, by region, 2018 - 2030 (USD Million)

- Table 14 Controls market, by region, 2018 - 2030 (USD Million)

- Table 15 Others market, by region, 2018 - 2030 (USD Million)

- Table 16 Rotary screw compressors market, by region, 2018 - 2030 (USD Million)

- Table 17 Centrifugal compressors market, by region, 2018 - 2030 (USD Million)

- Table 18 Reciprocating compressors market, by region, 2018 - 2030 (USD Million)

- Table 19 Others market, by region, 2018 - 2030 (USD Million)

- Table 20 Diaphragm market, by region, 2018 - 2030 (USD Million)

- Table 21 Others market, by region, 2018 - 2030 (USD Million)

- Table 22 Less than 100 kW market, by region, 2018 - 2030 (USD Million)

- Table 23 100-500 kW market, by region, 2018 - 2030 (USD Million)

- Table 24 500kW-1000kW market, by region, 2018 - 2030 (USD Million)

- Table 25 1000kW-5000kW market, by region, 2018 - 2030 (USD Million)

- Table 26 More than 5000 kW market, by region, 2018 - 2030 (USD Million)

- Table 27 Refrigerated warehouse market, by region, 2018 - 2030(USD Million)

- Table 28 Food & beverage market, by region, 2018 - 2030 (USD Million)

- Table 29 Chemical Petrochemical & Pharmaceuticals market, by region, 2018 - 2030 (USD Million)

- Table 30 Refrigerated transportation market, by region, 2018 - 2030 (USD Million)

- Table 31 North America Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 32 North America Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 33 North America Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 34 North America Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 35 North America Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- Table 36 U.S. Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 37 U.S. Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 38 U.S. Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 39 U.S. Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 40 U.S. Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- Table 41 Canada Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 42 Canada Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 43 Canada Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 44 Canada Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 45 Canada Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- Table 46 Europe Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 47 Europe Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 48 Europe Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 49 Europe Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 50 Europe Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- Table 51 Germany Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 52 Germany Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 53 Germany Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 54 Germany Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 55 Germany Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- Table 56 U.K. Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 57 U.K. Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 58 U.K. Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 59 U.K. Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 60 U.K. Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- Table 61 France Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 62 France Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 63 France Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million

- Table 64 France Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 65 France Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- Table 66 Asia Pacific Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 67 Asia Pacific Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 68 Asia Pacific Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 69 Asia Pacific Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 70 Asia Pacific Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- Table 71 China Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 72 China Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 73 China Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 74 China Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 75 China Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- Table 76 India Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 77 India Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 78 India Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 79 India Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 80 India Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- Table 81 Japan Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 82 Japan Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 83 Japan Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 84 Japan Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 85 Japan Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- Table 86 Latin America Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 87 Latin America Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 88 Latin America Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 89 Latin America Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 90 Latin America Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- Table 91 Brazil Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 92 Brazil Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 93 Brazil Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 94 Brazil Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 95 Brazil Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- Table 96 Mexico Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 97 Mexico Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 98 Mexico Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 99 Mexico Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 100 Mexico Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- Table 101 MEA Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- Table 102 MEA Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- Table 103 MEA Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- Table 104 MEA Industrial Refrigeration Systems Market, by capacity, 2018 - 2030 (USD Million)

- Table 105 MEA Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Industrial Refrigeration Systems Market segmentation

- Fig. 2 Market research process

- Fig. 3 Primary research process

- Fig. 4 Information Analysis

- Fig. 5 Data validation and publishing

- Fig. 6 Industrial Refrigeration Systems Market Snapshot

- Fig. 7 Market Size and Growth Prospects, 2018 - 2030 (USD Million)

- Fig. 8 Industrial Refrigeration Systems Market: Value chain analysis

- Fig. 9 Global frozen food market estimates and forecast by product, 2018 - 2030 (USD Million)

- Fig. 10 Industrial Refrigeration Systems Market: By component segment outlook & market share, 2022 and 2030

- Fig. 11 Industrial Refrigeration Systems Market: By compressor type segment outlook & market share, 2022 and 2030

- Fig. 12 Industrial Refrigeration Systems Market: By reciprocating compressor type segment outlook & market share, 2022 and 2030

- Fig. 13 Industrial Refrigeration Systems Market: By capacity segment outlook & market share, 2022 and 2030

- Fig. 14 Industrial Refrigeration Systems Market: By application segment outlook & market share, 2022 and 2030

- Fig. 15 Industrial Refrigeration Systems Market: By region segment outlook & market share, 2022 and 2030

- Fig. 16 North America Industrial Refrigeration Systems Market: Key takeaways

- Fig. 17 Europe Industrial Refrigeration Systems Market: Key takeaways

- Fig. 18 Asia Pacific Industrial Refrigeration Systems Market: Key takeaways

- Fig. 19 Latin America Industrial Refrigeration Systems Market: Key takeaways

- Fig. 20 Middle East & Africa Industrial Refrigeration Systems Market: Key takeaways

Industrial Refrigeration Systems Market Growth & Trends:

The global industrial refrigeration systems market size is anticipated to reach USD 27.66 billion by 2030, registering a CAGR of 4.4% from 2023 to 2030, according to a new report published by Grand View Research, Inc. The demand for industrial refrigeration is increasing due to the fast-moving consumer goods and retail food which needs efficient storage for perishable edible items. Governments are taking initiatives to support and strengthen the cold chain infrastructure and shifting towards eco-friendly refrigeration systems.

Global warming and climate change have alarmed nations to take the necessary step to curb the crisis. As a result, industrial refrigeration system manufacturing companies have expressed concerns regarding the potential of global warming and ozone depletion of their refrigerants. As a result, companies are focusing on technologies to offer improved cost-effectiveness, lesser toxic refrigerants, lower energy consumption, and less toxic materials.

For instance, DanFoss, a prominent manufacturer of industrial refrigeration systems, introduced Cool selector 2 to help them design and optimize their air conditioning and refrigeration systems. System designers, engineers, and consultants can use the software to make optimum use of energy and HVACR systems. The benefits of using CO2 refrigeration systems are recognized worldwide as CO2 has a GWP (Global Warming Potential) of 1. The new update allows you to calculate components from the standpoint of an application for transcritical high-pressure side systems.

With the advancements in technology, industrial refrigeration systems have shown enhancement in their processes. Innovations have led to the manufacturing of smart and intelligent devices that monitor, set temperature, and notify the person as and when needed. The incorporation of Artificial Intelligence (AI) in the systems became a breakthrough in the market by enhancing productivity and lowering the operational cost for the organizations.

The industry growth in Asia Pacific is anticipated to observe the fastest growth during the forecast period. This expansion is attributed to the rapid growth prospects of cold-chain storage infrastructure in the countries such as Japan, India, and China. For instance, India is the second-largest fruit and vegetable producer, worldwide. The cold storage and handling the refrigeration of this huge vegetable and fruit produce is a challenging job thus fueling the market growth.

Industrial Refrigeration Systems Market Report Highlights:

- The compressor segment is the largest growing component in the refrigeration system as they are used in commercial as well as industrial refrigeration, heat pumps, and air conditioning applications

- Food and beverage applications accounted for the largest market share due to the growing disposable income and the rising population. It has augmented the demand for frozen and processed food products

- The 500-1000kW capacity segment led the industrial refrigeration systems market as they helped extend the shelf life and reduce product wastage

- Asia Pacific is the highest-growing region in the market due to the maximum number of fruits and vegetable producers and also a requirement for cold-chain storage

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market Segmentation & Scope

- 1.2 Market Definition

- 1.3 Information Procurement

- 1.3.1 Purchased Database

- 1.3.2 GVR's Internal Database

- 1.3.3 List of Secondary Sources

- 1.3.4 Primary Research

- 1.4 Information Analysis

- 1.5 Market Formulation & Data Visualization

- 1.6 Data Validation & Publishing

Chapter 2 Executive Summary

- 2.1 Market Outlook

- 2.2 Segmental Outlook

- 2.2.1 Global Industrial Refrigeration Systems Market, 2018 - 2030 (USD Million)

- 2.2.2 Global Industrial Refrigeration Systems Market, BY Region, 2018 - 2030 (USD Million)

- 2.2.3 Global Industrial Refrigeration Systems Market, BY Component, 2018 - 2030 (USD Million)

- 2.2.3.1 Global Industrial Refrigeration Systems Market, by compressor type, 2018 - 2030 (USD Million)

- 2.2.3.2 Global Industrial Refrigeration Systems Market, by reciprocating compressor type, 2018 - 2030 (USD Million)

- 2.2.4 Global Industrial Refrigeration Systems Market, BY Capacity, 2018 - 2030 (USD Million)

- 2.2.5 Global Industrial Refrigeration Systems Market, BY Application, 2018 - 2030 (USD Million)

Chapter 3 Industrial Refrigeration Systems Market Variables, Trends & Scope

- 3.1 Market Introduction

- 3.2 Market Size and Growth Prospects

- 3.3 Industrial Refrigeration Systems Market: Value Chain Analysis

- 3.4 Industrial Refrigeration Systems Market Dynamics

- 3.4.1 Market Driver Analysis

- 3.4.1.1 Rising global consumption of processed food

- 3.4.1.2 Rising demand for natural refrigerant-based equipment

- 3.4.1.3 Government initiatives supporting the development of cold chain infrastructure

- 3.4.1.4 Advancements in technology

- 3.4.2 Market Restraint/Challenge Analysis

- 3.4.2.1 Energy consumption and high installation & operating costs

- 3.4.2.2 Lack of skilled labor and high safety concerns

- 3.4.3 Market Opportunity

- 3.4.3.1 Use of IoT-enabled refrigeration solutions for equipment monitoring

- 3.4.1 Market Driver Analysis

Chapter 4 Industrial Refrigeration Systems Market: Component Segment Analysis

- 4.1 Industrial Refrigeration Systems Market: By Component Segment, Outlook & Market Share 2022 and 2030

- 4.2 Component Movement Analysis & Market Share, 2022 & 2030

- 4.3 Compressors

- 4.3.1 Compressors Market, BY Region, 2018 - 2030 (USD Million)

- 4.4 Condensers

- 4.4.1 Condensers Market, BY Region, 2018 - 2030 (USD Million)

- 4.5 Evaporators

- 4.5.1 Evaporators Market, BY Region, 2018 - 2030 (USD Million)

- 4.6 Controls

- 4.6.1 Controls Market, BY Region, 2018 - 2030 (USD Million)

- 4.7 Others

- 4.7.1 Others Market, BY Region, 2018 - 2030 (USD Million)

Chapter 5 Industrial Refrigeration Systems Market: Compressor Type Segment Analysis

- 5.1 Industrial Refrigeration Systems Market: By Compressor Type Segment Outlook & Market Share 2022 and 2030

- 5.2 Compressor Type Movement Analysis & Market Share, 2022 & 2030

- 5.3 Rotary Screw Compressors

- 5.3.1 Rotary Screw Compressors Market, BY Region, 2018 - 2030 (USD Million)

- 5.4 Centrifugal Compressors

- 5.4.1 Centrifugal Compressors Market, BY Region, 2018 - 2030 (USD Million)

- 5.5 Reciprocating Compressors

- 5.5.1 Reciprocating Compressors Market, BY Region, 2018 - 2030 (USD Million)

- 5.6 Others

- 5.6.1 Others Market, BY Region, 2018 - 2030 (USD Million)

Chapter 6. Industrial Refrigeration Systems Market: Reciprocating Compressor Type Segment Analysis

- 6.1 Industrial Refrigeration Systems Market: By Reciprocating Compressor Type Segment Outlook & Market Share 2022 and 2030

- 6.2 Reciprocating Compressor Type Movement Analysis & Market Share, 2022 & 2030

- 6.3 Diaphragm

- 6.3.1 Diaphragm Market, BY Region, 2018 - 2030 (USD Million)

- 6.4 Others

- 6.4.1 Others Market, BY Region, 2018 - 2030 (USD Million)

Chapter 7. Industrial Refrigeration Systems Market: Capacity Segment Analysis

- 7.1 Industrial Refrigeration Systems Market: By Capacity Segment Outlook & Market Share 2022 and 2030

- 7.2 Capacity Movement Analysis & Market Share, 2022 & 2030

- 7.3 Less than 100 kW

- 7.3.1 Less Than 100 kW Market, BY Region, 2018 - 2030 (USD Million)

- 7.4 100-500 kW

- 7.4.1 100 - 500 Kw Market, BY Region, 2018 - 2030 (USD Million)

- 7.5 500kW - 1000 kW

- 7.5.1 500KW - 1000 Kw Market, BY Region, 2018 - 2030 (USD Million)

- 7.6 1000kW - 5000kW

- 7.6.1 1000KW - 5000KW Market, BY Region, 2018 - 2030 (USD Million)

- 7.7 More than 5000 kW

- 7.7.1 More Than 5000 Kw Market, BY Region, 2018 - 2030 (USD Million)

Chapter 8 Industrial Refrigeration Systems Market: Application Segment Analysis

- 8.1 Industrial Refrigeration Systems Market: By Application Segment Outlook & Market Share 2022 and 2030

- 8.2 Application Movement Analysis & Market Share, 2022 & 2030

- 8.3 Refrigerated Warehouse

- 8.3.1 Refrigerated Warehouse Market, BY Region, 2018 - 2030 (USD Million)

- 8.4 Food & Beverage

- 8.4.1 Food & Beverage Market, BY Region, 2018 - 2030 (USD Million)

- 8.5 Chemical Petrochemical & Pharmaceuticals

- 8.5.1 Chemical Petrochemical & Pharmaceuticals Market, BY Region, 2018 - 2030 (USD Million)

- 8.6 Refrigerated Transportation

- 8.6.1 Refrigerated Transportation Market, BY Region, 2018 - 2030 (USD Million)

Chapter 9 Industrial Refrigeration Systems Market: Regional Segment Analysis

- 9.1 Industrial Refrigeration Systems Market: By Region Segment Outlook & Market Share 2022 and 2030

- 9.2 North America

- 9.2.1 North America Industrial Refrigeration Systems Market, BY Component, 2018 - 2030 (USD Million)

- 9.2.1.1 North American Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.2.1.1.1 North American Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.2.2 North America Industrial Refrigeration Systems Market, BY Capacity, 2018 - 2030 (USD Million)

- 9.2.3 North America Industrial Refrigeration Systems Market, BY Application, 2018 - 2030 (USD Million)

- 9.2.4 U.S.

- 9.2.4.1 U.S. Industrial Refrigeration Systems Market, By Component, 2018 - 2030 (USD Million)

- 9.2.4.1.1 U.S. Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.2.4.1.1.1 U.S. Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.2.4.2 U.S. Industrial Refrigeration Systems Market, By Capacity, 2018 - 2030 (USD Million)

- 9.2.4.3 U.S. Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- 9.2.5 Canada

- 9.2.5.1 Canada Industrial Refrigeration Systems Market, By Component, 2018 - 2030 (USD Million)

- 9.2.5.1.1 Canada Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.2.5.1.1.1 Canada Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.2.5.2 Canada Industrial Refrigeration Systems Market, By Capacity, 2018 - 2030 (USD Million)

- 9.2.5.3 Canada Industrial Refrigeration Systems Market, By Application, 2018 - 2030 (USD Million)

- 9.2.1 North America Industrial Refrigeration Systems Market, BY Component, 2018 - 2030 (USD Million)

- 9.3 Europe

- 9.3.1 Europe Industrial Refrigeration Systems Market, BY Component, 2018 - 2030 (USD Million)

- 9.3.1.1 Europe Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.3.1.1.1 Europe Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.3.2 Europe Industrial Refrigeration Systems Market, BY Capacity, 2018 - 2030 (USD Million)

- 9.3.3 Europe Industrial Refrigeration Systems Market, BY Application, 2018 - 2030 (USD Million)

- 9.3.4 Germany

- 9.3.4.1 Germany Industrial Refrigeration Systems Market, By Component, 2018 - 2030 (USD Million)

- 9.3.4.1.1 Germany Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.3.4.1.1.1 Germany Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.3.4.2 Germany Industrial Refrigeration Systems Market, By Capacity, 2018 - 2030 (USD Million)

- 9.3.4.3 Germany Industrial Refrigeration Systems Market, By Application, 2018 - 2030 (USD Million)

- 9.3.5 U.K.

- 9.3.5.1 U.K. Industrial Refrigeration Systems Market, By Component, 2018 - 2030 (USD Million)

- 9.3.5.1.1 U.K. Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.3.5.1.1.1 U.K. Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.3.5.2 U.K. Industrial Refrigeration Systems Market, By Capacity, 2018 - 2030 (USD Million)

- 9.3.5.3 U.K. Industrial Refrigeration Systems Market, By Application, 2018 - 2030 (USD Million)

- 9.3.6 France

- 9.3.6.1 France Industrial Refrigeration Systems Market, By Component, 2018 - 2030 (USD Million)

- 9.3.6.1.1 France Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.3.6.1.1.1 France Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.3.6.2 France Industrial Refrigeration Systems Market, By Capacity, 2018 - 2030 (USD Million)

- 9.3.6.3 France Industrial Refrigeration Systems Market, By Application, 2018 - 2030 (USD Million)

- 9.3.1 Europe Industrial Refrigeration Systems Market, BY Component, 2018 - 2030 (USD Million)

- 9.4 Asia Pacific

- 9.4.1 Asia Pacific Industrial Refrigeration Systems Market, BY Component, 2018 - 2030 (USD Million)

- 9.4.1.1 Asia Pacific Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.4.1.1.1 Asia Pacific Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.4.2 Asia Pacific Industrial Refrigeration Systems Market, BY Capacity, 2018 - 2030 (USD Million)

- 9.4.3 Asia Pacific Industrial Refrigeration Systems Market, BY Application, 2018 - 2030 (USD Million)

- 9.4.4 China

- 9.4.4.1 China Industrial Refrigeration Systems Market, By Component, 2018 - 2030 (USD Million)

- 9.4.4.1.1 China Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.4.4.1.1.1 China Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.4.4.2 China Industrial Refrigeration Systems Market, By Capacity, 2018 - 2030 (USD Million)

- 9.4.4.3 China Industrial Refrigeration Systems Market, By Application, 2018 - 2030 (USD Million)

- 9.4.5 India

- 9.4.5.1 India Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- 9.4.5.1.1 India Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.4.5.1.1.1 India Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.4.5.2 India Industrial Refrigeration Systems Market, By Capacity, 2018 - 2030 (USD Million)

- 9.4.5.3 India Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- 9.4.6 Japan

- 9.4.6.1 Japan Industrial Refrigeration Systems Market, By Component, 2018 - 2030 (USD Million)

- 9.4.6.1.1 Japan Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.4.6.1.1.1 Japan Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.4.6.2 Japan Industrial Refrigeration Systems Market, By Capacity, 2018 - 2030 (USD Million)

- 9.4.6.3 Japan Industrial Refrigeration Systems Market, By Application, 2018 - 2030 (USD Million)

- 9.4.1 Asia Pacific Industrial Refrigeration Systems Market, BY Component, 2018 - 2030 (USD Million)

- 9.5 Latin America

- 9.5.1 Latin America Industrial Refrigeration Systems Market, BY Component, 2018 - 2030 (USD Million)

- 9.5.1.1 Latin America Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.5.1.1.1 Latin America Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.5.2 Latin America Industrial Refrigeration Systems Market, BY Capacity, 2018 - 2030 (USD Million)

- 9.5.3 Latin America Industrial Refrigeration Systems Market, BY Application, 2018 - 2030 (USD Million)

- 9.5.4 Brazil

- 9.5.4.1 Brazil Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- 9.5.4.1.1 Brazil Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.5.4.1.1.1 Brazil Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.5.4.2 Brazil Industrial Refrigeration Systems Market, By Capacity, 2018 - 2030 (USD Million)

- 9.5.4.3 Brazil Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- 9.5.5 Mexico

- 9.5.5.1 Mexico Industrial Refrigeration Systems Market, by component, 2018 - 2030 (USD Million)

- 9.5.5.1.1 Mexico Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.5.5.1.1.1 Mexico Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.5.5.2 Mexico Industrial Refrigeration Systems Market, By Capacity, 2018 - 2030 (USD Million)

- 9.5.5.3 Mexico Industrial Refrigeration Systems Market, by application, 2018 - 2030 (USD Million)

- 9.5.1 Latin America Industrial Refrigeration Systems Market, BY Component, 2018 - 2030 (USD Million)

- 9.6 Middle East & Africa

- 9.6.1 MEA Industrial Refrigeration Systems Market, BY Component, 2018 - 2030 (USD Million)

- 9.6.1.1 MEA Industrial Refrigeration Systems Market, By Compressor Type, 2018 - 2030 (USD Million)

- 9.6.1.1.1 MEA Industrial Refrigeration Systems Market, By Reciprocating Compressor Type, 2018 - 2030 (USD Million)

- 9.6.2 MEA Industrial Refrigeration Systems Market, BY Capacity, 2018 - 2030 (USD Million)

- 9.6.3 MEA Industrial Refrigeration Systems Market, BY Application, 2018 - 2030 (USD Million)

- 9.6.1 MEA Industrial Refrigeration Systems Market, BY Component, 2018 - 2030 (USD Million)

Chapter 10 Competitive Landscape

- 10.1 Company Profiles

- 10.1.1 JOHNSON CONTROLS

- 10.1.1.1 Company overview

- 10.1.1.2 Financial Performance

- 10.1.1.3 Product Benchmarking

- 10.1.1.4 Strategic Initiatives

- 10.1.2 EMERSON ELECTRIC CO.

- 10.1.2.1 Company overview

- 10.1.2.2 Financial Performance

- 10.1.2.3 Product Benchmarking

- 10.1.2.4 Strategic Initiatives

- 10.1.3 DANFOSS

- 10.1.3.1 Company Overview

- 10.1.3.2 Financial Performance

- 10.1.3.3 Product Benchmarking

- 10.1.3.4 Strategic Initiatives

- 10.1.4 DAIKIN INDUSTRIES, LTD.

- 10.1.4.1 Company Overview

- 10.1.4.2 Financial Performance

- 10.1.4.3 Product Benchmarking

- 10.1.4.4 Strategic Initiatives

- 10.1.5 GEA GROUP AKTIENGESELLSCHAFT

- 10.1.5.1 Company Overview

- 10.1.5.2 Financial Performance

- 10.1.5.3 Product Benchmarking

- 10.1.5.4 Strategic Initiatives

- 10.1.6 MAYEKAWA MFG. CO., LTD.

- 10.1.6.1 Company Overview

- 10.1.6.2 Financial Performance

- 10.1.6.3 Product Benchmarking

- 10.1.6.4 Strategic Initiatives

- 10.1.7 BITZER KUHLMASCHINENBAU GMBH

- 10.1.7.1 Company Overview

- 10.1.7.2 Financial Performance

- 10.1.7.3 Product Benchmarking

- 10.1.7.4 Strategic Initiatives

- 10.1.8 EVAPCO, INC.

- 10.1.8.1 Company Overview

- 10.1.8.2 Financial Performance

- 10.1.8.3 Product Benchmarking

- 10.1.8.4 Strategic Initiatives

- 10.1.9 GUNTNER GMBH & CO. KG

- 10.1.9.1 Company Overview

- 10.1.9.2 Product Benchmarking

- 10.1.10 LU-VE S.P.A.

- 10.1.10.1 Company overview

- 10.1.10.2 Financial Performance

- 10.1.10.3 Product Benchmarking

- 10.1.10.4 Strategic Initiatives

- 10.1.1 JOHNSON CONTROLS