|

|

市場調査レポート

商品コード

1571675

内視鏡の市場規模、シェア、動向分析レポート:製品別、最終用途別、地域別、セグメント予測、2024年~2030年Endoscopes Market Size, Share And Trends Analysis Report By Product (Endoscopes (Rigid Endoscopes, Flexible Endoscopes, Disposable Endoscopes, Capsule Endoscopes)), By End-use, By Region, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 内視鏡の市場規模、シェア、動向分析レポート:製品別、最終用途別、地域別、セグメント予測、2024年~2030年 |

|

出版日: 2024年09月17日

発行: Grand View Research

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

内視鏡市場の成長と動向:

Grand View Researchの最新レポートによると、世界の内視鏡の市場規模は、2030年までには331億5,000万米ドルに達すると予測されています。

同市場は2024年から2030年にかけてCAGR4.69%で成長すると予測されています。低侵襲外科処置に関する認知度の高まりと慢性疾患の有病率の増加が市場成長を加速する主な要因です。低侵襲手術によって提供される、手術関連の出血が少ない、筋肉を切らない、回復が早いなどの利点が、従来の開腹手術よりも内視鏡手術の採用を後押ししています。加えて、内視鏡技術の進歩、様々な疾患の診断と治療への応用の急速な増加は、予測される数年間の市場成長を促進すると予想される他の主要な要因です。軟性内視鏡製品セグメントは2023年に市場を独占しました。

これは、内臓や空洞に到達する能力、より優れた安全性と効率性、人間工学に基づいた改良された機能などのユニークな特徴を考慮すると、これらのデバイスの需要が高いことに起因しています。これらの機器は、食道胃十二指腸内視鏡検査(EGD)、気管支内視鏡検査、S状結腸内視鏡検査、喉頭内視鏡検査、咽頭内視鏡検査、鼻咽頭内視鏡検査、鼻腔内視鏡検査、大腸内視鏡検査など、いくつかの内視鏡検査で最も一般的に使用されており、これが製品需要とセグメント成長を支えています。

2023年には、外来施設の最終用途セグメントが市場を独占しました。外来手術センターや診断クリニックなど、生命を脅かす疾患の早期診断や発見のための外来施設での内視鏡の採用が増加していることが、このセグメントの成長を支えています。また、不快感が少なく回復が早いキーホール内視鏡手術の採用も同分野の成長を後押ししています。さらに、北米は、より良いヘルスケアインフラ、個人の低侵襲外科手術に対する高い嗜好性、および先進技術の迅速な採用により、2023年に最大の収益シェアを占めました。機能性胃腸障害やがんの負担増は、この地域の市場成長をさらに促進すると予測されています。例えば、米国国立がん研究所が報告したデータによると、2020年には米国で新たに180万人以上のがん患者が診断されると推定されています。

M&Aや提携といったいくつかの業界再編活動により、世界市場のシェアは高いです。また、同市場のメーカーは、市場シェアと消費者基盤を強化するため、患者の要望に応じた高度な機能を備えた新しい内視鏡の発売にも注力しています。例えば、2021年1月にKarl Storz SE &Co.KGは、マルチモード蛍光イメージングと4K解像度を組み合わせた内視鏡処置用のImage 1 S Rubinaの発売を発表しました。白色光モードと蛍光モードの切り替えにより、外科医は手術のニーズに応じて設定することができます。

内視鏡市場のレポートハイライト

- 製品別では、軟性内視鏡が、内臓や空洞への到達能力、より優れた安全性と効率性、改良された人間工学的機能などの独自の特徴により、2023年に最大の収益シェアを占めました。

- 最終用途別では、外来患者施設が2023年に市場を独占し、53.3%の最大収益シェアを占めました。

- 北米は、機能性消化管障害の負担の増加、ヘルスケアインフラの改善、医療費抑制のための低侵襲手術への選好の高まりなど様々な要因により、2023年に市場を独占しました。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 内視鏡市場の変数、動向、範囲

- 市場系統の見通し

- 親市場の見通し

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 業界の課題

- 内視鏡:市場分析ツール

- 業界分析 - ポーターのファイブフォース分析

- PESTLE分析

- COVID-19パンデミックの影響

- 償還枠組み

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第4章 内視鏡市場セグメント分析、製品別、2018年~2030年(百万米ドル)

- 内視鏡市場:製品展望の重要なポイント

- 内視鏡市場:製品変動分析

- 内視鏡

- 内視鏡市場推計・予測、2018年~2030年

- 内視鏡(再利用可能・使い捨て)、製品別、2023年(%)

- 再利用可能な(硬質・軟質)内視鏡、製品別、2023年(%)

- 使い捨て内視鏡、製品別、2023年(%)

- 硬性内視鏡

- 硬性内視鏡市場推計・予測、2018年~2030年

- 硬性内視鏡・硬性消化管内視鏡市場、タイプ別(2023年)

- 腹腔鏡

- 関節鏡

- 尿管鏡

- 膀胱鏡

- 婦人科内視鏡

- 神経内視鏡

- 気管支鏡

- 子宮鏡

- 喉頭鏡

- 副鼻腔鏡

- 耳鏡

- 咽頭鏡

- 鼻咽頭鏡

- 鼻鏡

- 消化管内視鏡

- フレキシブル内視鏡

- フレキシブル内視鏡市場推計・予測、2018年~2030年

- フレキシブル内視鏡・フレキシブル消化管内視鏡市場、タイプ別(2023年)

- 腹腔鏡

- 関節鏡

- 尿管鏡

- 膀胱鏡

- 婦人科内視鏡

- 神経内視鏡

- 気管支鏡

- 子宮鏡

- 喉頭鏡

- 副鼻腔鏡

- 耳鏡

- 咽頭鏡

- 鼻咽頭鏡

- 鼻鏡

- 消化管内視鏡

- 使い捨て内視鏡

- 使い捨て内視鏡市場推計・予測、2018年~2030年

- 使い捨て内視鏡・使い捨て消化管内視鏡市場、タイプ別(2023年)

- 腹腔鏡

- 関節鏡

- 尿管鏡

- 膀胱鏡

- 婦人科内視鏡

- 神経内視鏡

- 気管支鏡

- 子宮鏡

- 喉頭鏡

- 耳鏡

- 鼻咽頭鏡

- 鼻鏡

- 消化管内視鏡

- カプセル内視鏡

- カプセル内視鏡市場推計・予測、2018年~2030年

- ロボット支援内視鏡

- ロボット支援内視鏡市場推計・予測、2018年~2030年

第5章 内視鏡市場セグメント分析、最終用途別、2018年~2030年(百万米ドル)

- 定義と範囲

- 最終用途市場シェア分析、2023年・2030年

- セグメントダッシュボード

- 世界の内視鏡市場、最終用途別、2018~2030年

- 病院

- 病院市場推計・予測、2018年から2030年

- 外来施設

- 外来施設市場推計・予測、2018年から2030年

第6章 地域別、製品別、最終用途別、2018年~2030年(百万米ドル)

- 地域別市場シェア分析、2023年・2030年

- 地域市場ダッシュボード

- 地域市場のスナップショット

- 内視鏡市場シェア(地域別、2023年・2030年):

- 北米

- 北米の内視鏡機器市場、2018年~2030年

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州の内視鏡機器市場、2018年~2030年

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ノルウェー

- スウェーデン

- デンマーク

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- タイ

- ラテンアメリカ

- ブラジル

- アルゼンチン

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- クウェート

第7章 競合情勢

- 最近の動向と影響分析:主要市場参入企業別

- 企業分類

- 企業プロファイル

- Olympus Corporation

- Boston Scientific Corporation

- PENTAX Medical(Hoya Corporation)

- FUJIFILM Holdings Corporation

- Karl Storz GmbH & Co., KG

- Stryker

- Medtronic

- Ambu A/S.

- STERIS plc.

List of Tables

- Table 1 List of Secondary Sources

- Table 2 List of Abbreviations

- Table 3 Global endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 4 Global endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 5 North America endoscopes market, by region, 2018 - 2030 (USD Million)

- Table 6 North America endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 7 North America endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 8 U.S. endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 9 U.S. endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 10 Canada endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 11 Canada endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 12 Mexico endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 13 Mexico endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 14 Europe endoscopes market, by country, 2018 - 2030 (USD Million)

- Table 15 Europe endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 16 Europe endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 17 UK endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 18 UK endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 19 Germany endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 20 Germany endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 21 France endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 22 France endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 23 Italy endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 24 Italy endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 25 Spain endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 26 Spain endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 27 Norway endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 28 Norway endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 29 Sweden endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 30 Sweden endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 31 Denmark endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 32 Denmark endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 33 Asia Pacific endoscopes market, by country, 2018 - 2030 (USD Million)

- Table 34 Asia Pacific endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 35 Asia Pacific endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 36 Japan endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 37 Japan endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 38 China endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 39 China endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 40 India endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 41 India endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 42 Australia endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 43 Australia endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 44 South Korea endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 45 South Korea endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 46 Thailand endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 47 Thailand endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 48 Latin America endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 49 Latin America endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 50 Brazil endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 51 Brazil endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 52 Argentina endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 53 Argentina endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 54 Middle East & Africa endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 55 Middle East & Africa endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 56 South Africa endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 57 South Africa endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 58 Saudi Arabia endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 59 Saudi Arabia endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 60 UAE endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 61 UAE endoscopes market, by end use, 2018 - 2030 (USD Million)

- Table 62 Kuwait endoscopes market, by product, 2018 - 2030 (USD Million)

- Table 63 Kuwait endoscopes market, by end use, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Endoscopes market segmentation

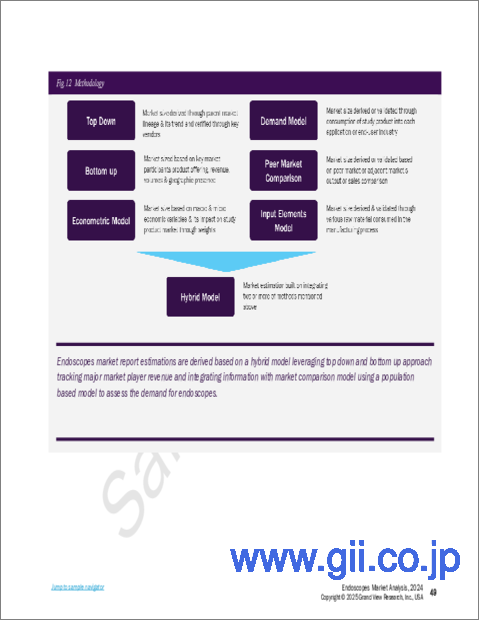

- Fig. 2 Market research process

- Fig. 3 Information procurement

- Fig. 4 Primary research pattern

- Fig. 5 Research model

- Fig. 6 Market research approaches

- Fig. 7 Value chain-based sizing & forecasting

- Fig. 8 QFD modeling for market share assessment

- Fig. 9 Market formulation & validation

- Fig. 10 Endoscopes (Reusable and Disposable) market snapshot

- Fig. 11 Endoscopes (Reusable and Disposable) competitive insights

- Fig. 12 Ancillary market outlook

- Fig. 13 Endoscopes market driver impact

- Fig. 14 Endoscopes market restraint impact

- Fig. 15 Porter's Analysis

- Fig. 16 PESTLE Analysis

- Fig. 17 Endoscopes market, product outlook key takeaways (USD Million)

- Fig. 18 Endoscopes market: Product movement analysis (USD Million)

- Fig. 19 Endoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 20 Endoscopes (reusable and disposable), by Product, 2023 (%)

- Fig. 21 Reusable (Rigid & Flexible) endoscopes, by Product, 2023 (%)

- Fig. 22 Disposable endoscopes, by product, 2023 (%)

- Fig. 23 Rigid endoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 24 Rigid endoscopes and rigid gastrointestinal endoscopes, by type (2023) (USD Million)

- Fig. 25 Laparoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 26 Arthroscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 27 Ureteroscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 28 Cystoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 29 Gynecology endoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 30 Neuroendoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 31 Bronchoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 32 Hysteroscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 33 Laryngoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 34 Sinuscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 35 Otoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 36 Pharyngoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 37 Nasopharyngoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 38 Rhinoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 39 Gastrointestinal endoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 40 Gastroscope (upper gastrointestinal endoscope) market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 41 Enteroscope market estimates and forecast 2018 - 2030 (USD Million)

- Fig. 42 Sigmoidoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 43 Duodenoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 44 Flexible endoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 45 Flexible endoscopes and flexible gastrointestinal endoscopes, by type (2023) (USD Million)

- Fig. 46 Laparoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 47 Arthroscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 48 Ureteroscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 49 Cystoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 50 Gynecology endoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 51 Neuroendoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 52 Bronchoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 53 Hysteroscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 54 Laryngoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 55 Sinuscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 56 Otoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 57 Pharyngoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 58 Nasopharyngoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 59 Rhinoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 60 Gastrointestinal endoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 61 Gastroscope (upper gastrointestinal endoscope) market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 62 Enteroscope market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 63 Sigmoidoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 64 Duodenoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 65 Colonoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 66 Disposable endoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 67 Laparoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 68 Arthroscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 69 Ureteroscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 70 Cystoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 71 Gynecology endoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 72 Neuroendoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 73 Bronchoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 74 Hysteroscopes market estimates and forecast 2018 - 2030 (USD Million)

- Fig. 75 Laryngoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 76 Otoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 77 Nasopharyngoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 78 Rhinoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 79 Gastrointestinal endoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 80 Gastroscope (upper gastrointestinal endoscope) market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 81 Enteroscope market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 82 Sigmoidoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 83 Duodenoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 84 Colonoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 85 Capsule endoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 86 Robot-assisted endoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 87 Endoscopes market, end use outlook key takeaways (USD Million)

- Fig. 88 Endoscopes market: End Use movement analysis (USD Million)

- Fig. 89 Hospitals market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 90 Outpatient facilities market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 91 Endoscopes market, regional marketplace: Key takeaways

- Fig. 92 Endoscopes market: Regional outlook, 2023 & 2030.

- Fig. 93 Endoscopes market: Regional outlook, 2023 & 2030.

- Fig. 94 North America endoscopes market, 2018 - 2030 (USD Million)

- Fig. 95 North America reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 96 North America disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 97 Key country dynamics

- Fig. 98 U.S. endoscopes market, 2018 - 2030 (USD Million)

- Fig. 99 U.S. reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 100 U.S. disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 101 Key country dynamics

- Fig. 102 Canada endoscopes market, 2018 - 2030 (USD Million)

- Fig. 103 Canada reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 104 Canada disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 105 Europe endoscopes market, 2018 - 2030 (USD Million)

- Fig. 106 Europe reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 107 Europe disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 108 Key country dynamics

- Fig. 109 UK endoscopes market, 2018 - 2030 (USD Million)

- Fig. 110 UK reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 111 UK disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 112 Key country dynamics

- Fig. 113 Germany endoscopes market, 2018 - 2030 (USD Million)

- Fig. 114 Germany reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 115 Germany disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 116 Key country dynamics

- Fig. 117 France endoscopes market, 2018 - 2030 (USD Million)

- Fig. 118 France reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 119 France disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 120 Key country dynamics

- Fig. 121 Spain endoscopes market, 2018 - 2030 (USD Million)

- Fig. 122 Spain reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 123 Spain disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 124 Key country dynamics

- Fig. 125 Italy endoscopes market, 2018 - 2030 (USD Million)

- Fig. 126 Italy reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 127 Italy disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 128 Key country dynamics

- Fig. 129 Denmark endoscopes market, 2018 - 2030 (USD Million)

- Fig. 130 Denmark reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 131 Denmark disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 132 Key country dynamics

- Fig. 133 Sweden endoscopes market, 2018 - 2030 (USD Million)

- Fig. 134 Sweden reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 135 Sweden disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 136 Key country dynamics

- Fig. 137 Norway endoscopes market, 2018 - 2030 (USD Million)

- Fig. 138 Norway reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 139 Norway disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 140 Asia Pacific endoscopes market, 2018 - 2030 (USD Million)

- Fig. 141 Asia Pacific reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 142 Asia Pacific disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 143 Key country dynamics

- Fig. 144 Japan endoscopes market, 2018 - 2030 (USD Million)

- Fig. 145 Japan reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 146 Japan disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 147 Key country dynamics

- Fig. 148 China endoscopes market, 2018 - 2030 (USD Million)

- Fig. 149 China reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 150 China disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 151 Key country dynamics

- Fig. 152 India endoscopes market, 2018 - 2030 (USD Million)

- Fig. 153 India reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 154 India disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 155 Key country dynamics

- Fig. 156 Australia endoscopes market, 2018 - 2030 (USD Million)

- Fig. 157 Australia reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 158 Australia disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 159 Key country dynamics

- Fig. 160 Thailand endoscopes market, 2018 - 2030 (USD Million)

- Fig. 161 Thailand reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 162 Thailand disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 163 Key country dynamics

- Fig. 164 South Korea endoscopes market, 2018 - 2030 (USD Million)

- Fig. 165 South Korea reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 166 South Korea disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 167 Latin America endoscopes market, 2018 - 2030 (USD Million)

- Fig. 168 Latin America reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 169 Latin America disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 170 Key country dynamics

- Fig. 171 Brazil endoscopes market, 2018 - 2030 (USD Million)

- Fig. 172 Brazil reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 173 Brazil disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 174 Key country dynamics

- Fig. 175 Mexico endoscopes market, 2018 - 2030 (USD Million)

- Fig. 176 Mexico reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 177 Mexico disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 178 Key country dynamics

- Fig. 179 Argentina endoscopes market, 2018 - 2030 (USD Million)

- Fig. 180 Argentina reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 181 Argentina disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 182 MEA endoscopes market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 183 MEA reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 184 MEA disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 185 South Africa endoscopes market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 186 South Africa reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 187 South Africa disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 188 Key country dynamics

- Fig. 189 Saudi Arabia endoscopes market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 190 Saudi Arabia reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 191 Saudi Arabia disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 192 Key country dynamics

- Fig. 193 UAE endoscopes market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 194 UAE reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 195 UAE disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 196 Key country dynamics

- Fig. 197 Kuwait endoscopes market, 2018 - 2030 (USD Million)

- Fig. 198 Kuwait reusable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 199 Kuwait disposable endoscopes market, 2018 - 2030 (USD Million)

- Fig. 200 Key company categorization

Endoscopes Market Growth & Trends:

The global endoscopes market size is anticipated to reach USD 33.15 billion by 2030, according to a new report by Grand View Research, Inc. The market is projected to grow at a CAGR of 4.69% from 2024 to 2030. Growing awareness levelsabout minimally invasive surgical procedures and the increasing prevalence of chronic disorders are the major factors accelerating the market growth. The benefits, such as less surgery-related blood loss, no muscle cutting, and quicker recovery, offered by minimally invasive surgeries boost the adoption of endoscopic procedures over traditional/open invasive surgeries. In addition, advancement in endoscopic technology and rapid increase of its application to diagnose and treat various diseases are other key factors anticipated to propel the market growth over the forecast years. The flexible endoscopes product segment dominated the market in 2023.

This is attributed to the high demand for these devices considering their unique features, such as the ability to reach viscera and cavities, better safety and efficiency, and improved ergonomic features. These devices are most commonly used in several endoscopic procedures, such as esophagogastroduodenoscopy (EGD), bronchoscopy, sigmoidoscopy, laryngoscopy, pharyngoscopy, nasopharyngoscopy, rhinoscopy, and colonoscopy procedures, which supports the product demand and segment growth.

In 2023, the outpatient facilities end-use segment dominated the market. Increasing adoption of endoscopes across outpatient facilities such as ambulatory surgery centers and diagnostic clinics for the early diagnosis and detection of several life-threatening diseases is supporting the segment growth. In addition, the introduction of keyhole endoscopic surgeries with minimal discomfort and faster recovery time also boosts the segment growth. In addition, North America held the largest revenue share in 2023 owing to its better healthcare infrastructure, high preference for minimally invasive surgical procedures among individuals, and quick adoption of advanced technologies. The increasing burden of functional gastrointestinal disorders and cancer is anticipated to further propel market growth in this region. For instance, as per the data reported by the National Cancer Institute, in 2020, over 1.8 million new cancer cases were estimated to be diagnosed in the U.S.

Several industry consolidation activities, such as mergers & acquisitions, and partnerships have resulted in a strong market share of the global market. Manufacturers in the market are also focusing on launching new endoscopes with advanced features as per patients' requirements, to enhance their market share and consumer base. For instance, in January 2021, Karl Storz SE & Co. KG announced the launch of Image 1 S Rubina, which combines multimode fluorescence imaging with 4K resolution for endoscopy procedures. The toggling between white light and fluorescence modes allows surgeons to set it per surgical needs.

Endoscopes Market Report Highlights:

- Based on product, the flexible endoscopes segment held the largest revenue share in 2023 owing to its unique features, such as the ability to reach viscera & cavities, better safety & efficiency, and improved ergonomic features

- In terms of end-use, the outpatient facilities' segment dominated the market in 2023 and accounted for the largest revenue share of 53.3% due to widespread adoption of keyhole or minimal invasive surgeries across these facilities

- North America dominated the market in 2023 owing to various factors including the increasing burden of functional gastrointestinal disorders, improved healthcare infrastructure, and the growing preference for minimally invasive surgeries to curb healthcare spending.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.1.1. Segment scope

- 1.1.2. Regional scope

- 1.1.3. Estimates and forecast timeline

- 1.2. Research Methodology

- 1.3. Information Procurement

- 1.3.1. Purchased database

- 1.3.2. GVR's internal database

- 1.3.3. Secondary sources

- 1.3.4. Primary research

- 1.3.5. Details of primary research

- 1.4. Information or Data Analysis

- 1.4.1. Data analysis models

- 1.5. Market Formulation & Validation

- 1.6. Model Details

- 1.7. Research Assumptions

- 1.8. List of Secondary Sources

- 1.9. List of Primary Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.2.1. Product outlook

- 2.2.2. End Use outlook

- 2.2.3. Regional outlook

- 2.3. Competitive Insights

Chapter 3. Endoscopes Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Parent market outlook

- 3.2. Market Dynamics

- 3.2.1. Market driver analysis

- 3.2.2. Market restraint analysis

- 3.2.3. Industry challenges

- 3.3. Endoscopes: Market Analysis Tools

- 3.3.1. Industry Analysis - Porter's

- 3.3.2. PESTLE Analysis

- 3.4. Impact of the COVID-19 Pandemic

- 3.5. Reimbursement Framework

- 3.5.1. North America

- 3.5.2. Europe

- 3.5.3. Asia Pacific

- 3.5.4. Latin America

- 3.5.5. Middle East & Africa

Chapter 4. Endoscopes Market Segment Analysis, By Product, 2018 - 2030 (USD Million)

- 4.1 Endoscopes Market: Product Outlook Key Takeaways

- 4.2 Endoscopes Market: Product Movement Analysis

- 4.3 Endoscopes

- 4.3.1 Endoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.4 Endoscopes (Reusable and Disposable), by Product, 2023 (%)

- 4.5 Reusable (Rigid & Flexible) Endoscopes, by Product, 2023 (%)

- 4.6 Disposable Endoscopes, by Product, 2023 (%)

- 4.7 Rigid Endoscopes

- 4.7.1 Rigid Endoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.2 Rigid Endoscopes and Rigid Gastrointestinal Endoscopes Market, By Type (2023) (USD Million)

- 4.7.3 Laparoscopes

- 4.7.3.1 Laparoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.4 Arthroscopes

- 4.7.4.1 Arthroscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.5 Ureteroscopes

- 4.7.5.1 Ureteroscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.6 Cystoscopes

- 4.7.6.1 Cystoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.7 Gynecology Endoscopes

- 4.7.7.1 Gynecology Endoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.8 Neuroendoscopes

- 4.7.8.1 Neuroendoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.9 Bronchoscopes

- 4.7.9.1 Bronchoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.10 Hysteroscopes

- 4.7.10.1 Hysteroscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.11 Laryngoscopes

- 4.7.11.1 Laryngoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.12 Sinuscopes

- 4.7.12.1 Sinuscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.13 Otoscopes

- 4.7.13.1 Otoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.14 Pharyngoscopes

- 4.7.14.1 Pharyngoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.15 Nasopharyngoscopes

- 4.7.15.1 Nasopharyngoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.16 Rhinoscopes

- 4.7.16.1 Rhinoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.17 Gastrointestinal Endoscopes

- 4.7.17.1 Gastrointestinal Endoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.7.17.2 Gastroscope (Upper Gastrointestinal Endoscope)

- 4.7.17.2.1. Gastroscope (Upper Gastrointestinal Endoscope) market estimates and forecast, 2018 - 2030 (USD Million)

- 4.7.17.3 Enteroscope

- 4.7.17.3.1. Enteroscope market estimates and forecast, 2018 - 2030 (USD Million)

- 4.7.17.4 Sigmoidoscopes

- 4.7.17.4.1. Sigmoidoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- 4.7.17.5 Duodenoscopes

- 4.7.17.5.1. Duodenoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- 4.8 Flexible Endoscopes

- 4.8.1 Flexible Endoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.2 Flexible Endoscopes and Flexible Gastrointestinal Endoscopes Market, By Type (2023) (USD Million)

- 4.8.3 Laparoscopes

- 4.8.3.1 Laparoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.4 Arthroscopes

- 4.8.4.1 Arthroscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.5 Ureteroscopes

- 4.8.5.1 Ureteroscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.6 Cystoscopes

- 4.8.6.1 Cystoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.7 Gynecology Endoscopes

- 4.8.7.1 Gynecology Endoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.8 Neuroendoscopes

- 4.8.8.1 Neuroendoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.9 Bronchoscopes

- 4.8.9.1 Bronchoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.10 Hysteroscopes

- 4.8.10.1 Hysteroscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.11 Laryngoscopes

- 4.8.11.1 Laryngoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.12 Sinuscopes

- 4.8.12.1 Sinuscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.13 Otoscopes

- 4.8.13.1 Otoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.14 Pharyngoscopes

- 4.8.14.1 Pharyngoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.15 Nasopharyngoscopes

- 4.8.15.1 Nasopharyngoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.16 Rhinoscopes

- 4.8.16.1 Rhinoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.17 Gastrointestinal Endoscopes

- 4.8.17.1 Gastrointestinal Endoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.8.17.2 Gastroscope (Upper GASTROINTESTINAL Endosocope)

- 4.8.17.2.1. Gastroscope (Upper GI Endosocope) market estimates and forecast, 2018 - 2030 (USD Million)

- 4.8.17.3 Enteroscope

- 4.8.17.3.1. Enteroscope market estimates and forecast, 2018 - 2030 (USD Million)

- 4.8.17.4 Sigmoidoscopes

- 4.8.17.4.1 Sigmoidoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- 4.8.17.5 Duodenoscopes

- 4.8.17.5.1 Duodenoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- 4.8.17.6 Colonoscopes

- 4.8.17.6.1. Colonoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- 4.9 Disposable Endoscopes

- 4.9.1 Disposable Endoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.9.2 Disposable Endoscopes and Disposable Gastrointestinal Endoscopes Market, By Type (2023) (USD Million)

- 4.9.3 Laparoscopes

- 4.9.3.1 Laparoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.9.4 Arthroscopes

- 4.9.4.1 Arthroscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.9.5 Ureteroscopes

- 4.9.5.1 Ureteroscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.9.6 Cystoscopes

- 4.9.6.1 Cystoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.9.7 Gynecology Endoscopes

- 4.9.7.1 Gynecology Endoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.9.8 Neuroendoscopes

- 4.9.8.1 Neuroendoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.9.9 Bronchoscopes

- 4.9.9.1 Bronchoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.9.10 Hysteroscopes

- 4.9.10.1 Hysteroscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.9.11 Laryngoscopes

- 4.9.11.1 Laryngoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.9.12 Otoscopes

- 4.9.12.1 Otoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.9.13 Nasopharyngoscopes

- 4.9.13.1 Nasopharyngoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.9.14 Rhinoscopes

- 4.9.14.1 Rhinoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.9.15 Gastrointestinal Endoscopes

- 4.9.15.1 Gastrointestinal Endoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.9.15.2 Gastroscope (Upper gastrointestinal End0scope)

- 4.9.15.2.1. Gastroscope (Upper gastrointestinal Endoscope) market estimates and forecast, 2018 - 2030 (USD Million)

- 4.9.15.3 Enteroscope

- 4.9.15.3.1. Enteroscope market estimates and forecast, 2018 - 2030 (USD Million)

- 4.9.15.4 Sigmoidoscopes

- 4.9.15.4.1. Sigmoidoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- 4.9.15.5 Duodenoscopes

- 4.9.15.5.1. Duodenoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- 4.9.15.6 Colonoscopes

- 4.9.15.6.1. Colonoscopes market estimates and forecast, 2018 - 2030 (USD Million)

- 4.10 Capsule Endoscopes

- 4.10.1 Capsule Endoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 4.11 Robot-Assisted Endoscopes

- 4.11.1 Robot-Assisted Endoscopes Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 5. Endoscopes Market Segment Analysis, By End Use, 2018 - 2030 (USD Million)

- 5.1. Definition and Scope

- 5.2. End Use Market Share Analysis, 2023 & 2030

- 5.3. Segment Dashboard

- 5.4. Global Endoscopes Market, by End Use, 2018 to 2030

- 5.5. Hospitals

- 5.5.1. Hospitals market estimates and forecasts, 2018 to 2030 (USD Million)

- 5.6. Outpatient facilities

- 5.6.1. Outpatient facilities market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 6. Region, By Product, By End Use, 2018 - 2030 (USD Million)

- 6.1. Regional Market Share Analysis, 2023 & 2030

- 6.2. Regional Market Dashboard

- 6.3. Regional Market Snapshot

- 6.4. Endoscopes Market Share by Region, 2023 & 2030:

- 6.5. North America

- 6.5.1. North America endoscopy devices market, 2018 - 2030 (USD Million)

- 6.5.2. U.S.

- 6.5.2.1. Key country dynamics

- 6.5.2.2. Regulatory framework/ reimbursement structure

- 6.5.2.3. Competitive scenario

- 6.5.2.4. U.S. endoscopy devices market, 2018 - 2030 (USD Million)

- 6.5.3. Canada

- 6.5.3.1. Key country dynamics

- 6.5.3.2. Regulatory framework/ reimbursement structure

- 6.5.3.3. Competitive scenario

- 6.5.3.4. Canada endoscopy devices market, 2018 - 2030 (USD Million)

- 6.5.4. Mexico

- 6.5.4.1. Key country dynamics

- 6.5.4.2. Regulatory framework/ reimbursement structure

- 6.5.4.3. Competitive scenario

- 6.5.4.4. Mexico endoscopy devices market, 2018 - 2030 (USD Million)

- 6.6. Europe

- 6.6.1. Europe endoscopy devices market, 2018 - 2030 (USD Million)

- 6.6.2. UK

- 6.6.2.1. Key country dynamics

- 6.6.2.2. Regulatory framework/ reimbursement structure

- 6.6.2.3. Competitive scenario

- 6.6.2.4. UK endoscopy devices market, 2018 - 2030 (USD Million)

- 6.6.3. Germany

- 6.6.3.1. Key country dynamics

- 6.6.3.2. Regulatory framework/ reimbursement structure

- 6.6.3.3. Competitive scenario

- 6.6.3.4. Germany endoscopy devices market, 2018 - 2030 (USD Million)

- 6.6.4. France

- 6.6.4.1. Key country dynamics

- 6.6.4.2. Regulatory framework/ reimbursement structure

- 6.6.4.3. Competitive scenario

- 6.6.4.4. France endoscopy devices market, 2018 - 2030 (USD Million)

- 6.6.5. Italy

- 6.6.5.1. Key country dynamics

- 6.6.5.2. Regulatory framework/ reimbursement structure

- 6.6.5.3. Competitive scenario

- 6.6.5.4. Italy endoscopy devices market, 2018 - 2030 (USD Million)

- 6.6.6. Spain

- 6.6.6.1. Key country dynamics

- 6.6.6.2. Regulatory framework/ reimbursement structure

- 6.6.6.3. Competitive scenario

- 6.6.6.4. Spain endoscopy devices market, 2018 - 2030 (USD Million)

- 6.6.7. Norway

- 6.6.7.1. Key country dynamics

- 6.6.7.2. Regulatory framework/ reimbursement structure

- 6.6.7.3. Competitive scenario

- 6.6.7.4. Norway endoscopy devices market, 2018 - 2030 (USD Million)

- 6.6.8. Sweden

- 6.6.8.1. Key country dynamics

- 6.6.8.2. Regulatory framework/ reimbursement structure

- 6.6.8.3. Competitive scenario

- 6.6.8.4. Sweden endoscopy devices market, 2018 - 2030 (USD Million)

- 6.6.9. Denmark

- 6.6.9.1. Key country dynamics

- 6.6.9.2. Regulatory framework/ reimbursement structure

- 6.6.9.3. Competitive scenario

- 6.6.9.4. Denmark endoscopy devices market, 2018 - 2030 (USD Million)

- 6.7. Asia Pacific

- 6.7.1. Japan

- 6.7.1.1. Key country dynamics

- 6.7.1.2. Regulatory framework/ reimbursement structure

- 6.7.1.3. Competitive scenario

- 6.7.1.4. Japan endoscopy devices market, 2018 - 2030 (USD Million)

- 6.7.2. China

- 6.7.2.1. Key country dynamics

- 6.7.2.2. Regulatory framework/ reimbursement structure

- 6.7.2.3. Competitive scenario

- 6.7.2.4. China endoscopy devices market, 2018 - 2030 (USD Million)

- 6.7.3. India

- 6.7.3.1. Key country dynamics

- 6.7.3.2. Regulatory framework/ reimbursement structure

- 6.7.3.3. Competitive scenario

- 6.7.3.4. India endoscopy devices market, 2018 - 2030 (USD Million)

- 6.7.4. Australia

- 6.7.4.1. Key country dynamics

- 6.7.4.2. Regulatory framework/ reimbursement structure

- 6.7.4.3. Competitive scenario

- 6.7.4.4. Australia endoscopy devices market, 2018 - 2030 (USD Million)

- 6.7.5. South Korea

- 6.7.5.1. Key country dynamics

- 6.7.5.2. Regulatory framework/ reimbursement structure

- 6.7.5.3. Competitive scenario

- 6.7.5.4. South Korea endoscopy devices market, 2018 - 2030 (USD Million)

- 6.7.6. Thailand

- 6.7.6.1. Key country dynamics

- 6.7.6.2. Regulatory framework/ reimbursement structure

- 6.7.6.3. Competitive scenario

- 6.7.6.4. Thailand endoscopy devices market, 2018 - 2030 (USD Million)

- 6.7.1. Japan

- 6.8. Latin America

- 6.8.1. Brazil

- 6.8.1.1. Key country dynamics

- 6.8.1.2. Regulatory framework/ reimbursement structure

- 6.8.1.3. Competitive scenario

- 6.8.1.4. Brazil endoscopy devices market, 2018 - 2030 (USD Million)

- 6.8.2. Argentina

- 6.8.2.1. Key country dynamics

- 6.8.2.2. Regulatory framework/ reimbursement structure

- 6.8.2.3. Competitive scenario

- 6.8.2.4. Argentina endoscopy devices market, 2018 - 2030 (USD Million)

- 6.8.1. Brazil

- 6.9. MEA

- 6.9.1. South Africa

- 6.9.1.1. Key country dynamics

- 6.9.1.2. Regulatory framework/ reimbursement structure

- 6.9.1.3. Competitive scenario

- 6.9.1.4. South Africa endoscopy devices market, 2018 - 2030 (USD Million)

- 6.9.2. Saudi Arabia

- 6.9.2.1. Key country dynamics

- 6.9.2.2. Regulatory framework/ reimbursement structure

- 6.9.2.3. Competitive scenario

- 6.9.2.4. Saudi Arabia endoscopy devices market, 2018 - 2030 (USD Million)

- 6.9.3. UAE

- 6.9.3.1. Key country dynamics

- 6.9.3.2. Regulatory framework/ reimbursement structure

- 6.9.3.3. Competitive scenario

- 6.9.3.4. UAE endoscopy devices market, 2018 - 2030 (USD Million)

- 6.9.4. Kuwait

- 6.9.4.1. Key country dynamics

- 6.9.4.2. Regulatory framework/ reimbursement structure

- 6.9.4.3. Competitive scenario

- 6.9.4.4. Kuwait endoscopy devices market, 2018 - 2030 (USD Million)

- 6.9.1. South Africa

Chapter 7. Competitive Landscape

- 7.1. Recent Developments & Impact Analysis, By Key Market Participants

- 7.2. Company Categorization

- 7.3. Company Profiles

- 7.3.1. Olympus Corporation

- 7.3.1.1. Company overview

- 7.3.1.2. Financial performance

- 7.3.1.3. Product benchmarking

- 7.3.1.4. Strategic initiatives

- 7.3.2. Boston Scientific Corporation

- 7.3.2.1. Company overview

- 7.3.2.2. Financial performance

- 7.3.2.3. Product benchmarking

- 7.3.2.4. Strategic initiatives

- 7.3.3. PENTAX Medical (Hoya Corporation)

- 7.3.3.1. Company overview

- 7.3.3.2. Financial performance

- 7.3.3.3. Product benchmarking

- 7.3.3.4. Strategic initiatives

- 7.3.4. FUJIFILM Holdings Corporation

- 7.3.4.1. Company overview

- 7.3.4.2. Financial performance

- 7.3.4.3. Product benchmarking

- 7.3.4.4. Strategic initiatives

- 7.3.5. Karl Storz GmbH & Co., KG

- 7.3.5.1. Company overview

- 7.3.5.2. Financial performance

- 7.3.5.3. Product benchmarking

- 7.3.5.4. Strategic initiatives

- 7.3.6. Stryker

- 7.3.6.1. Company overview

- 7.3.6.2. Financial performance

- 7.3.6.3. Product benchmarking

- 7.3.6.4. Strategic initiatives

- 7.3.7. Medtronic

- 7.3.7.1. Company overview

- 7.3.7.2. Financial performance

- 7.3.7.3. Product benchmarking

- 7.3.7.4. Strategic initiatives

- 7.3.8. Ambu A/S.

- 7.3.8.1. Company overview

- 7.3.8.2. Financial performance

- 7.3.8.3. Product benchmarking

- 7.3.8.4. Strategic initiatives

- 7.3.9. STERIS plc.

- 7.3.9.1. Company overview

- 7.3.9.2. Financial performance

- 7.3.9.3. Product benchmarking

- 7.3.9.4. Strategic initiatives

- 7.3.1. Olympus Corporation