|

|

市場調査レポート

商品コード

1633820

ミリ波センサ&モジュールの市場規模、シェア、動向分析レポート:周波数帯別、用途別、地域別、セグメント予測、2025~2030年Millimeter Wave Sensors & Modules Market Size, Share & Trends Analysis Report By Frequency Band (V-band, E-band, Other Frequency Bands), By Application, By Region, and Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| ミリ波センサ&モジュールの市場規模、シェア、動向分析レポート:周波数帯別、用途別、地域別、セグメント予測、2025~2030年 |

|

出版日: 2024年12月04日

発行: Grand View Research

ページ情報: 英文 100 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

ミリ波センサ&モジュールの市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、世界のミリ波センサ&モジュールの市場規模は、2025年から2030年にかけてCAGR 30.6%で拡大し、2030年には5億2,940万米ドルに達すると推定されています。

MMW(ミリ波)センサとモジュールは、霧、煙、雷雨などの極端な天候や視界の悪い状況で有益です。これらのデバイスは、赤外線ベースやマイクロ波ベースのセンサ技術よりも比較的優れた性能を発揮します。

ミリ波センサ&モジュールは、軍事・防衛、通信、自動車、セキュリティ、ヘルスケアなど、さまざまな分野のアプリケーションで幅広く使用されています。これらすべての産業・商業部門から寄せられる需要の増加は、さらに市場をかなりのペースで急成長させると予想されます。ワイヤレス・モバイル・ネットワーク機器の利用は、ここ数年で急激に増加しています。インターネット主導のアプリケーションやソリューションの増加により、モバイル接続エコシステム内のさまざまな機器間で大量のデータ転送を行う必要性が高まっています。このため、ミリ波モジュールやセンサーが広く使用される高速データ転送デバイスの開発が期待されています。

これらのデバイスの主な応用分野には、通信、軍事・防衛、セキュリティ・サービス、医療・ヘルスケアなどがあります。通信業界における最近の動向と継続的な研究開発は、5G技術の進化につながる可能性が高いです。

ミリ波センサ&モジュールは、より高い帯域幅の必要性から、第5世代技術の開発において重要な役割を果たすと予想されます。5G技術は今後数年で出現すると予測されており、市場はその大幅な採用を目にする可能性が高いです。最終的には、MMWセンサーとモジュールの需要が高まり、特に通信業界全体で市場全体の成長が促進されると予想されます。

官民による研究開発活動と相まって、政府の資金援助やイニシアチブの増加が市場を牽引しています。Eバンド周波数は、通信分野で広範な用途があり、この分野での用途が拡大していることから、予測期間中に最大の収益を生み出すと予想されています。このため、市場全体は予測期間中に大きな成長を遂げると見られています。

ミリ波センサ&モジュールの市場レポートハイライト

- MW技術の早期採用により、2024年の市場シェアは北米が最大です。

- 周波数帯域別では、e-バンドセグメントが、テレコム・アプリケーションでの広範な採用により、2024年の収益シェア63.4%で市場を独占しました。

- アジア太平洋のミリ波センサ&モジュールの市場は、都市化の進展と、顧客基盤拡大のために優れた品質のインターネットやその他の関連サービスを提供するための通信サービスプロバイダ間の競争企業間の敵対関係により、2024年に29.6%の収益シェアで世界市場を独占しました。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 ミリ波センサ&モジュールの市場の変数、動向、範囲

- 市場系統の見通し

- 市場力学

- 市場ドライバー分析

- 市場抑制要因分析

- 業界の課題

- 業界分析ツール

- PORTERの分析

- PESTEL分析

第4章 ミリ波センサ&モジュールの市場:周波数帯の推定・動向分析

- ミリ波センサ&モジュールの市場、周波数帯域別:主なポイント

- 周波数帯の変動分析と市場シェア、2024年と2030年

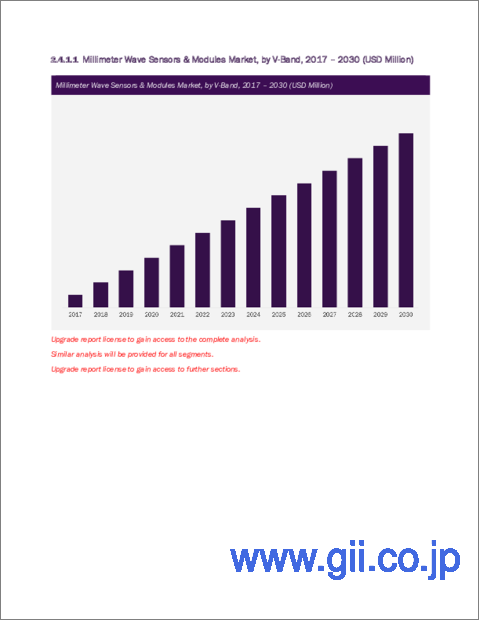

- 周波数帯別、2018年-2030年

- Vバンド

- Eバンド

- その他の周波数帯域

第5章 ミリ波センサ&モジュールの市場:用途の推定・動向分析

- ミリ波センサ&モジュールの市場、用途別:主なポイント

- 用途の変動分析と市場シェア、2024年と2030年

- 用途別、2018年-2030年

- 通信

- 軍事・防衛

- 自動車・輸送

- ヘルスケア

- エレクトロニクスおよび半導体

- セキュリティ

第6章 ミリ波センサ&モジュールの市場:地域の推定・動向分析

- ミリ波センサ&モジュールの市場:地域の展望

- 地域のマーケットプレイス:主なポイント

- 地域別、2018年-2030年

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- ラテンアメリカ

- ブラジル

- 中東およびアフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

第7章 競合情勢

- 企業分類

- 企業の市場ポジショニング

- 企業ヒートマップ分析

- 企業プロファイル/上場企業

- AVIAT NETWORKS

- Ceragon

- E-band Communications LLC

- Eravant

- QuinStar Technology, Inc.

- Farran

- Keysight Technologies

- Mistral Solutions Pvt. Ltd.

- Smiths Interconnect

- NEC Corporation

List of Tables

- Table 1 Global millimeter wave sensors & modules market: Key market driver analysis

- Table 2 Global millimeter wave sensors & modules market: Key market restraint analysis

- Table 3 Global millimeter wave sensors & modules market estimates and forecast, by frequency band (USD Thousand)

- Table 4 Global millimeter wave sensors & modules market estimates and forecast, by application (USD Thousand)

- Table 5 Global millimeter wave sensors & modules market estimates and forecast, by region (USD Thousand)

- Table 6 North America millimeter wave sensors & modules market estimates and forecast, by country, 2018 - 2030 (USD Thousand)

- Table 7 North America millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 8 North America millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 9 U.S. millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 10 U.S. millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 11 U.S. millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 12 Canada millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 13 Canada millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 14 Canada millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 15 Mexico millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 16 Mexico millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 17 Mexico millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 18 Europe millimeter wave sensors & modules market estimates and forecast, by country, 2018 - 2030 (USD Thousand)

- Table 19 Europe millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 20 Europe millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 21 UK millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 22 UK millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 23 UK millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 24 Germany millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 25 Germany millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 26 Germany millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 27 France millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 28 France millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 29 France millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 30 Asia Pacific millimeter wave sensors & modules market estimates and forecast, by country, 2018 - 2030 (USD Thousand)

- Table 31 Asia Pacific millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 32 Asia Pacific millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 33 China millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 34 China millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 35 China millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 36 India millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 37 India millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 38 India millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 39 Japan millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 40 Japan millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 41 Japan millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 42 Australia millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 43 Australia millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 44 Australia millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 45 South Korea millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 46 South Korea millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 47 South Korea millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 48 Latin America millimeter wave sensors & modules market estimates and forecast, by country, 2018 - 2030 (USD Thousand)

- Table 49 Latin America millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 50 Latin America millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 51 Brazil millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 52 Brazil millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 53 Brazil millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 54 Middle East and Africa millimeter wave sensors & modules market estimates and forecast, by country, 2018 - 2030 (USD Thousand)

- Table 55 Middle East and Africa millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 56 Middle East and Africa millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 57 UAE millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 58 UAE millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 59 UAE millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 60 KSA millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 61 KSA millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 62 KSA millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 63 South Africa millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Table 64 South Africa millimeter wave sensors & modules market estimates and forecast, by frequency band, 2018 - 2030 (USD Thousand)

- Table 65 South Africa millimeter wave sensors & modules market estimates and forecast, by application, 2018 - 2030 (USD Thousand)

- Table 66 Recent developments and impact analysis, by key market participants

- Table 67 Company heat map analysis, 2024

- Table 68 Companies implementing key strategies

List of Figures

- Fig. 1 Millimeter wave sensors & modules market segmentation

- Fig. 2 Market research process

- Fig. 3 Information procurement

- Fig. 4 Primary research pattern

- Fig. 5 Market research approaches

- Fig. 6 Value chain-based sizing and forecasting

- Fig. 7 Parent market analysis

- Fig. 8 Market formulation and validation

- Fig. 9 Millimeter wave sensors & modules market snapshot

- Fig. 10 Millimeter wave sensors & modules market segment snapshot

- Fig. 11 Millimeter wave sensors & modules market competitive landscape snapshot

- Fig. 12 Market research process

- Fig. 13 Market driver relevance analysis (Current and future impact)

- Fig. 14 Market restraint relevance analysis (Current and future impact)

- Fig. 15 Millimeter wave sensors & modules market: Frequency band outlook key takeaways (USD Thousand)

- Fig. 16 Millimeter wave sensors & modules market: Frequency band movement analysis (USD Thousand), 2024 & 2030

- Fig. 17 Millimeter wave sensors & modules market estimates and forecast, by frequency band (USD Thousand)

- Fig. 18 V-band market estimates & forecasts, 2018 - 2030 (USD Thousand)

- Fig. 19 E-band market estimates & forecasts, 2018 - 2030 (USD Thousand)

- Fig. 20 Other frequency bands market estimates & forecasts, 2018 - 2030 (USD Thousand)

- Fig. 21 Millimeter wave sensors & modules market: Application outlook key takeaways (USD Thousand)

- Fig. 22 Millimeter wave sensors & modules market: Application movement analysis (USD Thousand), 2024 & 2030

- Fig. 23 Telecommunications market estimates & forecasts, 2018 - 2030 (USD Thousand)

- Fig. 24 Military & defense market estimates & forecasts, 2018 - 2030 (USD Thousand)

- Fig. 25 Automotive & transport market estimates & forecasts, 2018 - 2030 (USD Thousand)

- Fig. 26 Healthcare market estimates & forecasts, 2018 - 2030 (USD Thousand)

- Fig. 27 Electronics & semiconductor market estimates & forecasts, 2018 - 2030 (USD Thousand)

- Fig. 28 Security market estimates & forecasts, 2018 - 2030 (USD Thousand)

- Fig. 29 Regional marketplace: Key takeaways

- Fig. 30 North America millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 31 U.S. millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 32 Canada millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 33 Mexico millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 34 Europe millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 35 Germany millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 36 UK millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 37 France millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 38 Asia Pacific millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 39 China millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 40 India millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 41 Japan millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 42 Australia millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 43 South Korea millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 44 Latin America millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 45 Brazil millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 46 Middle East and Africa millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 47 UAE millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 48 KSA millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 49 South Africa millimeter wave sensors & modules market estimates and forecast, 2018 - 2030 (USD Thousand)

- Fig. 50 Strategy framework

- Fig. 51 Company categorization

Millimeter Wave Sensors & Modules Market Growth & Trends:

The global millimeter wave sensors & modules market size is estimated to reach USD 529.4 million by 2030, expanding at a CAGR of 30.6% from 2025 to 2030, according to a new report by Grand View Research, Inc. The MMW (millimeter wave) sensors and modules are beneficial in extreme weather and low visibility conditions, such as fog, smoke, thunderstorm. These devices perform relatively better than infrared-based or microwave-based sensor technologies.

The MM wave sensors and modules are extensively used in applications across various sectors, such as military and defense, telecommunication, automotive, security, and healthcare. Increasing demand arriving from all these industrial and commercial sectors is further expected to catapult the market at a considerable pace. The usage of wireless and mobile networking equipment has risen drastically in the last few years. Increasing number of internet-driven applications and solutions is resulting in an augmented need for large amount of data transfer among various devices in the mobile connectivity ecosystem. This is expected to develop high-speed data transfer devices, wherein millimeter-wave modules and sensors are extensively used.

Major application areas of these devices include telecommunication, military and defense, security services, and medical and healthcare. Recent developments and continuous research and progress in the telecom industry are likely to lead to the evolution of the 5G technology.

Millimeter wave sensors and modules are anticipated to play a vital role in the development of fifth-generation technology owing to the need for higher bandwidth. The 5G technology is predicted to emerge in the coming years and the market is likely to witness its significant adoption. Eventually, demand for MMW sensors and modules is expected to boost, thus propelling the overall market growth, particularly across the telecom industry.

Increased government funding and initiatives, coupled with R&D activities carried out by the public and private sectors, are driving the market. E-band frequencies have extensive applications in the telecommunication sector and the segment is anticipated to generate the largest revenue over the forecast period on account of its growing applications in the sector. Therefore, the overall market is poised to witness significant growth over the forecast period.

Millimeter Wave Sensors & Modules Market Report Highlights:

- North America accounted for the largest market share in 2024 owing to the early adoption of the MMW technology

- Based on frequency band, The e-band segment dominated the market with a revenue share of 63.4% in 2024 owing to its extensive adoption in telecom applications

- The Asia Pacific millimeter wave sensors & modules market dominated the global market with a revenue share of 29.6% in 2024 owing to growing urbanization and competitive rivalry amongst the telecom service providers for offering superior quality internet and other related services to expand customer base.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation and Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources and Third-Party Perspectives

- 1.3.4. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation and Data Visualization

- 1.6. Data Validation and Publishing

Chapter 2. Executive Summary

- 2.1. Market Snapshot

- 2.2. Segment Snapshot

- 2.3. Competitive Landscape Snapshot

Chapter 3. Millimeter Wave Sensors & Modules Market Variables, Trends and Scope

- 3.1. Market Lineage Outlook

- 3.2. Market Dynamics

- 3.2.1. Market Driver Analysis

- 3.2.2. Market Restraint Analysis

- 3.2.3. Industry Challenge

- 3.3. Industry Analysis Tools

- 3.3.1. PORTER's Analysis

- 3.3.1.1. Bargaining power of the suppliers

- 3.3.1.2. Bargaining power of the buyers

- 3.3.1.3. Threats of substitution

- 3.3.1.4. Threats from new entrants

- 3.3.1.5. Competitive rivalry

- 3.3.2. PESTEL Analysis

- 3.3.2.1. Political landscape

- 3.3.2.2. Economic and social landscape

- 3.3.2.3. Technological landscape

- 3.3.1. PORTER's Analysis

Chapter 4. Millimeter Wave Sensors & Modules Market: Frequency Band Estimates and Trend Analysis

- 4.1. Millimeter Wave Sensors & Modules Market, By Frequency Band: Key Takeaways

- 4.2. Frequency Band Movement Analysis and Market Share, 2024 and 2030

- 4.3. Market Estimates and Forecasts, By Frequency Band, 2018 - 2030 (USD Thousand)

- 4.3.1. V-Band

- 4.3.1.1. Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 4.3.2. E-Band

- 4.3.2.1. Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 4.3.3. Other Frequency Bands

- 4.3.3.1. Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 4.3.1. V-Band

Chapter 5. Millimeter Wave Sensors & Modules Market: Application Estimates and Trend Analysis

- 5.1. Millimeter Wave Sensors & Modules Market, By Application: Key Takeaways

- 5.2. Application Movement Analysis and Market Share, 2024 and 2030

- 5.3. Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Thousand)

- 5.3.1. Telecommunications

- 5.3.1.1. Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 5.3.2. Military & Defense

- 5.3.2.1. Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 5.3.3. Automotive & Transport

- 5.3.3.1. Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 5.3.4. Healthcare

- 5.3.4.1. Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 5.3.5. Electronics & Semiconductor

- 5.3.5.1. Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 5.3.6. Security

- 5.3.6.1. Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 5.3.1. Telecommunications

Chapter 6. Millimeter Wave Sensors & Modules Market: Regional Estimates and Trend Analysis

- 6.1. Millimeter Wave Sensors & Modules Market: Regional Outlook

- 6.2. Regional Marketplaces: Key Takeaways

- 6.3. Market Estimates and Forecasts, By Region, 2018 - 2030 (USD Thousand)

- 6.4. North America

- 6.4.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.4.2. U.S.

- 6.4.2.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.4.3. Canada

- 6.4.3.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.4.4. Mexico

- 6.4.4.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.5. Europe

- 6.5.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.5.2. UK

- 6.5.2.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.5.3. Germany

- 6.5.3.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.5.4. France

- 6.5.4.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.6. Asia Pacific

- 6.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.6.2. China

- 6.6.2.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.6.3. Japan

- 6.6.3.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.6.4. India

- 6.6.4.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.6.5. Australia

- 6.6.5.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.6.6. South Korea

- 6.6.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.7. Latin America

- 6.7.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.7.2. Brazil

- 6.7.2.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.8. Middle East and Africa

- 6.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.8.2. UAE

- 6.8.2.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.8.3. KSA

- 6.8.3.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

- 6.8.4. South Africa

- 6.8.4.1. Market Estimates and Forecasts, 2018 - 2030 (USD Thousand)

Chapter 7. Competitive Landscape

- 7.1. Company Categorization

- 7.2. Company Market Positioning

- 7.3. Company Heat Map Analysis

- 7.4. Company Profiles/Listing

- 7.4.1. AVIAT NETWORKS

- 7.4.1.1. Company Overview

- 7.4.1.2. Financial Performance

- 7.4.1.3. Product Portfolio

- 7.4.1.4. Recent Developments/ Strategic Initiatives

- 7.4.2. Ceragon

- 7.4.2.1. Company Overview

- 7.4.2.2. Financial Performance

- 7.4.2.3. Product Portfolio

- 7.4.2.4. Recent Developments/ Strategic Initiatives

- 7.4.3. E-band Communications LLC

- 7.4.3.1. Company Overview

- 7.4.3.2. Financial Performance

- 7.4.3.3. Product Portfolio

- 7.4.3.4. Recent Developments/ Strategic Initiatives

- 7.4.4. Eravant

- 7.4.4.1. Company Overview

- 7.4.4.2. Financial Performance

- 7.4.4.3. Product Portfolio

- 7.4.4.4. Recent Developments/ Strategic Initiatives

- 7.4.5. QuinStar Technology, Inc.

- 7.4.5.1. Company Overview

- 7.4.5.2. Financial Performance

- 7.4.5.3. Product Portfolio

- 7.4.5.4. Recent Developments/ Strategic Initiatives

- 7.4.6. Farran

- 7.4.6.1. Company Overview

- 7.4.6.2. Financial Performance

- 7.4.6.3. Product Portfolio

- 7.4.6.4. Recent Developments/ Strategic Initiatives

- 7.4.7. Keysight Technologies

- 7.4.7.1. Company Overview

- 7.4.7.2. Financial Performance

- 7.4.7.3. Product Portfolio

- 7.4.7.4. Recent Developments/ Strategic Initiatives

- 7.4.8. Mistral Solutions Pvt. Ltd.

- 7.4.8.1. Company Overview

- 7.4.8.2. Financial Performance

- 7.4.8.3. Product Portfolio

- 7.4.8.4. Recent Developments/ Strategic Initiatives

- 7.4.9. Smiths Interconnect

- 7.4.9.1. Company Overview

- 7.4.9.2. Financial Performance

- 7.4.9.3. Product Portfolio

- 7.4.9.4. Recent Developments/ Strategic Initiatives

- 7.4.10. NEC Corporation

- 7.4.10.1. Company Overview

- 7.4.10.2. Financial Performance

- 7.4.10.3. Product Portfolio

- 7.4.10.4. Recent Developments/ Strategic Initiatives

- 7.4.1. AVIAT NETWORKS