|

|

市場調査レポート

商品コード

1609598

建築用遮音材の市場規模、シェア、動向分析レポート:製品別、用途別、地域別、セグメント予測、2025年~2030年Building Acoustic Insulation Market Size, Share & Trends Analysis Report By Product (Glass Wool, Rock Wool, Foamed Plastic), By Application (Residential, Non-residential), By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 建築用遮音材の市場規模、シェア、動向分析レポート:製品別、用途別、地域別、セグメント予測、2025年~2030年 |

|

出版日: 2024年11月06日

発行: Grand View Research

ページ情報: 英文 107 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

建築用遮音材市場の成長と動向:

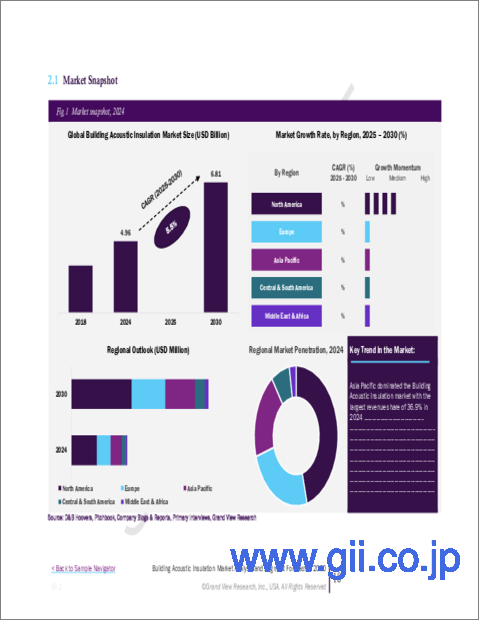

Grand View Research, Inc.の最新レポートによると、世界の建築用遮音材の市場規模は、2025年から2030年にかけてCAGR5.5%で拡大し、2030年までには68億1,360万米ドルに達すると推定されています。

この成長の背景には、住宅および非住宅の建設活動の増加とインフラ開発への投資の増加があります。さらに、エネルギー効率の高い物件の建設に関する住民の意識の高まり、既存の建物の改修要件の急増、快適な室内空間に対する需要の増加、物件に要求される音響レベルを維持するための各国の規制の進化が、市場の成長をさらに促進すると予想されます。

建築用遮音材は、主にファサード、屋根、天井、内壁、床などの建物外壁を利用した防音に重点が置かれています。これらの用途は、建設業界における遮音材の成功の重要な要因の一つです。このように、建設業界の成長は、遮音材市場の需要拡大の主な促進要因の一つとなっています。

発泡プラスチック建築用遮音材は、反響音や背景音を吸収して除去するため、騒音公害を和らげる目的で住宅に設置されます。また、音を吸収するだけでなく、室内の音や話し声の質を高める効果もあります。しかし、発泡プラスチックはポリウレタンを主成分としており、燃やすと大量の煙が出ます。そのため、ロックウールやグラスウールに比べて建築物での使用は危険です。

市場の差別化要因は、特徴的な特性を持つ建築用遮音材の生産と流通に携わるプレーヤーです。住宅用遮音材は、内部の区画、床、間仕切り、ひび割れなどに使用されます。これらの断熱材のメーカーは、換気ダクト、排水システム、梁、煙突、住宅構造の柱用にカスタマイズされた断熱パネルを製造しています。

建築用遮音材メーカーは、製造工程に新技術を採用し、低音域の音を吸収できるようにしています。その結果、運用コストと時間が削減され、他のメーカーよりも競争優位に立つことができます。市場プレーヤーは、M&A、他社との契約、製品開拓などの戦略を駆使して市場での地位を維持しています。さらに、プレーヤーは地域と製品ポートフォリオの基盤を拡大するためにM&Aに焦点を当てています。

建築用遮音材市場レポートハイライト

- 発泡プラスチック建築用遮音材材が市場をリードし、2024年の売上高は439億米ドルでした。これは、騒音公害を軽減し、反響音や背景音を遮断するのではなく、音を吸収することで除去するため、住宅や非住宅建設などの産業からの需要が高まっているためです。さらに、吸音性に優れた軽量断熱材や耐震性といった特性も、製品需要を押し上げると予想されています。

- 市場の急騰は2020年のCOVID-19パンデミックの際に観察され、世界中の建設および製造活動が中断されました。その結果、同市場における建築用遮音材の需要が阻害されました。しかし、市場はCOVID-19の大流行の影響からの回復を遂げています。さらに、工業化と都市化の進展は、予測期間中に建築用遮音材の需要を増加させると予測されます。

- 非住宅建設セグメントは2024年に最大のシェアを占め、ゼネコン、設計施工会社、プロジェクトマネージャによって開発されたオフィス、ホテルやモーテル、レストラン、モール、倉庫、ジム、レクリエーション施設の増加により、2024年から2030年までの予測期間中にCAGR5.5%で成長すると予測されています。加えて、非住宅施設における建物の遮音は、従業員のパフォーマンスと生産性の向上に役立ち、効果的なコミュニケーションを可能にし、プライバシーを確保します。

- 有力企業は、世界市場での地位を維持するため、能力増強、事業拡大、提携、M&A、アプリケーション開拓など、さまざまな事業戦略に注力しています。さらに、研究開発への投資は、プレーヤーに新たな機会を提供すると期待されています。例えば、2021年にJohns Manvilleは建築用断熱材製品ラインに新製品を追加しました。この製品、JM Corbond High Yield Open-Cell Spray Polyurethane Acoustic Foamは、卓越したスプレー塗布能力と高性能を備えています。

- 米国の建設業界は、特に大都市圏において、人口増加、都市化、住宅需要の増加により、右肩上がりの成長を遂げています。また、一般住宅、集合住宅、アパートなどの住宅防音に対する意識の高まりが、同地域の市場成長に寄与しています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 建築用遮音材市場の変数、動向、範囲

- 親市場の見通し

- 建築用遮音材市場 - バリューチェーン分析

- 製造業の動向

- 販売チャネル分析

- テクノロジーの概要

- 規制の枠組み

- アナリストの視点

- 建築用遮音材市場 - 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 市場機会分析

- 業界の課題

- 業界分析 - ポーターのファイブフォース分析

- SWOTによるPESTEL分析

- 市場混乱分析

第4章 建築用遮音材市場:製品推定・動向分析

- 重要なポイント

- 製品変動分析と市場シェア分析、2024年・2030年

- 製品別、2018年~2030年

- グラスウール

- ロックウール

- 発泡プラスチック

- その他

第5章 建築用遮音材市場:用途推定・動向分析

- 重要なポイント

- 用途変動分析と市場シェア分析、2024年・2030年

- 用途別、2018年~2030年

- 住宅

- 非住宅

第6章 建築用遮音材市場:国推定・動向分析

- 重要なポイント

- 地域変動分析と市場シェア分析、2024年・2030年

- 地域別、2018年~2030年

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- ベルギー

- ポーランド

- アジア太平洋

- 中国

- インド

- 日本

- 中南米

- ブラジル

- 中東・アフリカ

第7章 競合情勢

- 主要プレーヤー、最近の動向、業界への影響

- 主要企業 / 競合の分類

- 企業の市況分析

- 企業ヒートマップ分析

- 戦略マッピング

- 企業リスト

- Saint Gobain SA

- Owens Corning

- Rockwool A/S

- Armacell

- Kingspan Group

- Knauf Insulation

- BASF

- Johns Manville

- Fletcher Insulation

- Cellecta Inc.

List of Tables

- Table 1 Building Acoustic Insulation market estimates and forecasts, by product 2018 - 2030 (USD Million)

- Table 2 Glass Wool Building Acoustic Insulation Market, 2018 - 2030 (USD Million)

- Table 3 Rock WoolBuilding Acoustic Insulation Market, 2018 - 2030, (USD Million)

- Table 4 Foamed Plastic Building Acoustic Insulation Market, 2018 - 2030 (USD Million)

- Table 5 Other Building Acoustic Insulation Market, 2018 - 2030 (USD Million)

- Table 6 Building Acoustic Insulation market estimates and forecasts, by application 2018 - 2030 (USD Million)

- Table 7 Residential Building Acoustic Insulation market, 2018 - 2030, USD Million)

- Table 8 Non-residential Building Acoustic Insulation market, 2018 - 2030, USD Million)

- Table 9 North America Building Acoustic Insulation market estimates and forecasts, 2018 - 2030 (USD Million)

- Table 10 North America Building Acoustic Insulation market estimates and forecasts, by product, 2018 - 2030 (USD Million)

- Table 11 North America Building Acoustic Insulation market estimates and forecasts, by application, 2018 - 2030 (USD Million)

- Table 14 U.S. Building Acoustic Insulation market estimates and forecasts, 2018 - 2030 (USD Million)

- Table 15 U.S. Building Acoustic Insulation market estimates and forecasts, by product, 2018 - 2030 (USD Million)

- Table 16 U.S. Building Acoustic Insulation market estimates and forecasts, by application, 2018 - 2030 (USD Million)

- Table 19 Europe Building Acoustic Insulation market estimates and forecasts, 2018 - 2030 (USD Million)

- Table 20 Europe Building Acoustic Insulation market estimates and forecasts, by product, 2018 - 2030 (USD Million)

- Table 21 Europe Building Acoustic Insulation market estimates and forecasts, by application, 2018 - 2030 (USD Million)

- Table 24 Germany Building Acoustic Insulation market estimates and forecasts, 2018 - 2030 (USD Million)

- Table 25 Germany Building Acoustic Insulation market estimates and forecasts, by product, 2018 - 2030 (USD Million)

- Table 26 Germany Building Acoustic Insulation market estimates and forecasts, by application, 2018 - 2030 (USD Million)

- Table 29 UK Building Acoustic Insulation market estimates and forecasts, 2018 - 2030 (USD Million)

- Table 30 UK Building Acoustic Insulation market estimates and forecasts, by product, 2018 - 2030 (USD Million)

- Table 31 UK Building Acoustic Insulation market estimates and forecasts, by application, 2018 - 2030 (USD Million)

- Table 34 Asia Pacific Building Acoustic Insulation market estimates and forecasts, 2018 - 2030 (USD Million)

- Table 35 Asia Pacific Building Acoustic Insulation market estimates and forecasts, by product, 2018 - 2030 (USD Million)

- Table 36 Asia Pacific Building Acoustic Insulation market estimates and forecasts, by application, 2018 - 2030 (USD Million)

- Table 39 China Building Acoustic Insulation market estimates and forecasts, 2018 - 2030 (USD Million)

- Table 40 China Building Acoustic Insulation market estimates and forecasts, by product, 2018 - 2030 (USD Million)

- Table 41 China Building Acoustic Insulation market estimates and forecasts, by application, 2018 - 2030 (USD Million)

- Table 44 Japan Building Acoustic Insulation market estimates and forecasts, 2018 - 2030 (USD Million)

- Table 45 Japan Building Acoustic Insulation market estimates and forecasts, by product, 2018 - 2030 (USD Million)

- Table 46 Japan Building Acoustic Insulation market estimates and forecasts, by application, 2018 - 2030 (USD Million)

- Table 48 Central & South America Building Acoustic Insulation market estimates and forecasts, 2018 - 2030 (USD Million)

- Table 49 Central & South America Building Acoustic Insulation market estimates and forecasts, by product, 2018 - 2030 (USD Million)

- Table 50 Central & South America Building Acoustic Insulation market estimates and forecasts, by application, 2018 - 2030 (USD Million)

- Table 53 Brazil Building Acoustic Insulation market estimates and forecasts, 2018 - 2030 (USD Million)

- Table 54 Brazil Building Acoustic Insulation market estimates and forecasts, by product, 2018 - 2030 (USD Million)

- Table 55 Brazil Building Acoustic Insulation market estimates and forecasts, by application, 2018 - 2030 (USD Million)

- Table 58 Middle East & Africa Building Acoustic Insulation market estimates and forecasts, 2018 - 2030 (USD Million)

- Table 59 Middle East & Africa Building Acoustic Insulation market estimates and forecasts, by product, 2018 - 2030 (USD Million)

- Table 60 Middle East & Africa Building Acoustic Insulation market estimates and forecasts, by application, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Information Procurement

- Fig. 2 Primary Research Pattern

- Fig. 3 Primary Research Process

- Fig. 4 Market research approaches - Bottom-Up Approach

- Fig. 5 Market research approaches - Top-Down Approach

- Fig. 6 Market research approaches - Combined Approach

- Fig. 7 Segmental Insights

- Fig. 8 Segmental Insights

- Fig. 9 Segmental Insights

- Fig. 10 Competitive Outlook

- Fig. 11 Building Acoustic Insulation Market: Value Chain Analysis

- Fig. 12 Building Acoustic Insulation Market: Porter's Five Forces Analysis

- Fig. 13 Building Acoustic Insulation Market: PESTEL Analysis

- Fig. 14 Building Acoustic Insulation Market: Product Movement Analysis, 2022 - 2030

- Fig. 15 Glass Wool Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 16 Rock Wool Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 17 Foamed Plastic Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 18 Other Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 19 Building Acoustic Insulation Market: Application Movement Analysis, 2022-2030

- Fig. 15 Residential Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 16 Non-Residemtial Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 33 Building Acoustic Insulation market: Regional movement analysis, 2022-2030

- Fig. 34 North America Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 35 U.S. Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 36 Europe. Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 37 Germany Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 38 UK Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 39 Asia Pacific Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 40 China Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 41 Japan Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 42 Central & South America Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 43 Brazil Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 44 Middle East & Africa Building Acoustic Insulation market estimates and forecasts (USD Million)

- Fig. 45 Competition categorization and strategic framework

Building Acoustic Insulation Market Growth & Trends:

The global building acoustic insulation market size is estimated to reach USD 6,813.6 million by 2030, expanding at a CAGR of 5.5% from 2025 to 2030, according to a new report by Grand View Research, Inc. This growth is attributed to the rising residential and non-residential construction activities and growing investments in infrastructural developments. In addition, the rising awareness of residents regarding the construction of energy-efficient properties, surging requirements of renovating existing buildings, increasing demand for comfortable interior spaces, and evolving regulations of different countries to maintain the required acoustic levels in properties are further expected to propel the market growth.

Building acoustic insulation focuses on sound reduction mainly with the help of building envelopes such as facades, roofs, ceilings, internal walls, and floors. These applications are one of the crucial factors for the success of acoustic insulation in the construction industry. Thus, the growing construction industry is one of the major drivers for the growing demand for the acoustic insulation market.

Foamed plastic building acoustic insulation is installed in house properties for dampening noise pollution as they remove echoes and background sounds by absorbing them. They not only absorb sound but also enhance the quality of sound and speech in a room. However, foamed plastics are mainly composed of polyurethane, which releases smoke in large volumes when burned. This makes them unsafe for usage in buildings in comparison with rock wool and glass wool.

Market differentiators are the players engaged in the production and distribution of building acoustic insulation with distinctive characteristics. Acoustic insulation is used in residential properties for internal compartments, floors, partitions, and cracks. Manufacturers of these insulations produce customized insulation panels for ventilation ducts, drainage systems, beams, chimneys, and pillars of residential structures.

Building acoustic insulation manufacturers are opting for new technology in the manufacturing process, which allows them to absorb sound at the low end of the sound spectrum. This results in low operational costs and time and provides them with a competitive edge over other manufacturers. The market players use strategies including mergers & acquisitions, agreements with other companies, and product development to maintain their market position. In addition, players focus on mergers & acquisitions to expand their regional and product portfolio base.

Building Acoustic Insulation Market Report Highlights:

- Foamed plastic building acoustic insulation led the market and accounted for a revenue of USD 43.9 billion in 2024. This is attributed to rising demand from industries like residential and non-residential construction as they reduce noise pollution and remove echoes & background sounds not by blocking the sound but by absorbing it. Furthermore, characteristics such as lightweight insulation material with superior sound absorption and quakeproof are expected to boost the product demand

- The steep in the market was observed during the COVID-19 pandemic in 2020, which disrupted the construction and manufacturing activities around the world. This, in turn, hampered the demand for building acoustic insulation in the market. However, the market has witnessed a recovery from the impact of the COVID-19 outbreak. Moreover, growing industrialization and urbanization are estimated to increase the demand for building acoustic insulation during the forecast period

- The non-residential construction segment accounted for the largest share in 2024 and is expected to grow at a CAGR of 5.5% during the forecast period from 2024 to 2030, owing to increasing offices, hotels and motels, restaurants, malls, warehouses, gyms, and recreational properties developed by general contractors, design-build companies, and project managers. In addition, building acoustic insulation in non-residential properties helps improve the performance and productivity of employees, enables effective communication, and ensures their privacy

- Prominent players are focusing on a variety of business strategies, such as capacity building, business expansion, collaborations, mergers & acquisitions, and application development, to maintain their position in the global market. Furthermore, investment in research & development is expected to provide new opportunities for the players. For instance, in 2021, Johns Manville added a new product to its building insulation product line. The product, JM Corbond High Yield Open-Cell Spray Polyurethane Acoustic Foam has the ability to offer exceptional spray application and high performance.

- The U.S. construction industry, particularly in metropolitan areas, is experiencing a steady rise due to population growth, urbanization, and increased housing demand. The growing awareness regarding the advantages of soundproofing residential buildings such as family homes, multi-family residential buildings, and apartments are contributed to the market growth in the region

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources

- 1.3.4. Third-Party Perspectives

- 1.3.5. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segmental Outlook

- 2.3. Competitive Insights

Chapter 3. Building Acoustic Insulation Market Variables, Trends & Scope

- 3.1. Parent Market Outlook

- 3.2. Building Acoustic Insulation Market - Value Chain Analysis

- 3.2.1. Manufacturing Trends

- 3.2.2. Sales Channel Analysis

- 3.3. Technology Overview

- 3.4. Regulatory Framework

- 3.4.1. Analyst Perspective

- 3.5. Building Acoustic Insulation Market - Market Dynamics

- 3.5.1. Market Driver Analysis

- 3.5.2. Market Restraint Analysis

- 3.5.3. Market Opportunity Analysis

- 3.5.4. Industry Challenges

- 3.5.5. Industry Analysis - Porter's

- 3.5.5.1. Threat from New Entrant

- 3.5.5.2. Bargaining Power of Buyers

- 3.5.5.3. Competitive Rivalry

- 3.5.5.4. Threat of Substitutes

- 3.5.5.5. Bargaining Power of Suppliers

- 3.5.5.6. Substitute Material Analysis

- 3.5.6. PESTEL Analysis by SWOT

- 3.5.6.1. Political Landscape

- 3.5.6.2. Environmental Landscape

- 3.5.6.3. Social Landscape

- 3.5.6.4. Technology Landscape

- 3.5.6.5. Economic Landscape

- 3.5.6.6. Legal Landscape

- 3.5.7. Market Disruption Analysis

Chapter 4. Building Acoustic Insulation Market: Product Estimates & Trend Analysis

- 4.1. Key Takeaways

- 4.2. Product Movement Analysis and Market Share Analysis, 2024 & 2030

- 4.3. Building Acoustic Insulation Market Estimates & Forecasts, By Product 2018 - 2030 (USD Million)

- 4.3.1. Glass Wool

- 4.3.2. Rock Wool

- 4.3.3. Foamed Plastic

- 4.3.4. Others

Chapter 5. Building Acoustic Insulation Market: Application Estimates & Trend Analysis

- 5.1. Key Takeaways

- 5.2. Application Movement Analysis and Market Share Analysis, 2024 & 2030

- 5.3. Building Acoustic Insulation Market Estimates & Forecasts, By Application 2018 - 2030 (USD Million)

- 5.3.1. Residential

- 5.3.2. Non-residential

Chapter 6. Building Acoustic Insulation Market: Country Estimates & Trend Analysis

- 6.1. Key Takeaways

- 6.2. Regional Movement Analysis and Market Share Analysis, 2024 & 2030

- 6.3. Building Acoustic Insulation Market Estimates & Forecasts, By Region 2018 - 2030 (USD Million)

- 6.4. North America

- 6.4.1. North America Building Acoustic Insulation Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- 6.4.2. U.S.

- 6.4.2.1. U.S. Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.4.3. Canada

- 6.4.3.1. Canada Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.4.4. Mexico

- 6.4.4.1. Mexico Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.5. Europe

- 6.5.1. Europe Building Acoustic Insulation Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- 6.5.2. UK

- 6.5.2.1. UK Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.5.3. Germany

- 6.5.3.1. Germany Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.5.4. France

- 6.5.4.1. France Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.5.5. Italy

- 6.5.5.1. Italy Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.5.6. Belgium

- 6.5.6.1. Belgium Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.5.7. Poland

- 6.5.7.1. Poland Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.6. Asia Pacific

- 6.6.1. Asia Pacific Building Acoustic Insulation Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- 6.6.2. China

- 6.6.2.1. China Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.6.3. India

- 6.6.3.1. India Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.6.4. Japan

- 6.6.4.1. Japan Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.7. Central & South America

- 6.7.1. Central & South America Building Acoustic Insulation Market Estimates & Forecasts, 2018 - 2030 (Billion Liner Ft.) (USD Million)

- 6.7.2. Brazil

- 6.7.2.1. Brazil Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.8. Middle East & Africa

- 6.8.1. Middle East & Africa Building Acoustic Insulation Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- 6.8.1.1. Saudi Arabia Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.8.1.2. UAE Building Acoustic Insulation Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 6.8.1. Middle East & Africa Building Acoustic Insulation Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Competitive Landscape

- 7.1. Key Players, their Recent Developments, and their Impact on Industry

- 7.2. Key Company/Competition Categorization

- 7.3. Company Market Position Analysis

- 7.4. Company Heat Map Analysis

- 7.5. Strategy Mapping

- 7.6. Company Listing

- 7.6.1. Saint Gobain S.A.

- 7.6.1.1. Company Overview

- 7.6.1.2. Financial Performance

- 7.6.1.3. Product Benchmarking

- 7.6.1.4. Strategic Initiatives

- 7.6.2. Owens Corning

- 7.6.2.1. Company Overview

- 7.6.2.2. Financial Performance

- 7.6.2.3. Product Benchmarking

- 7.6.2.4. Strategic Initiatives

- 7.6.3. Rockwool A/S

- 7.6.3.1. Company Overview

- 7.6.3.2. Financial Performance

- 7.6.3.3. Product Benchmarking

- 7.6.3.4. Strategic Initiatives

- 7.6.4. Armacell

- 7.6.4.1. Company Overview

- 7.6.4.2. Financial Performance

- 7.6.4.3. Product Benchmarking

- 7.6.4.4. Strategic Initiatives

- 7.6.5. Kingspan Group

- 7.6.5.1. Company Overview

- 7.6.5.2. Financial Performance

- 7.6.5.3. Product Benchmarking

- 7.6.5.4. Strategic Initiatives

- 7.6.6. Knauf Insulation

- 7.6.6.1. Company Overview

- 7.6.6.2. Financial Performance

- 7.6.6.3. Product Benchmarking

- 7.6.6.4. Strategic Initiatives

- 7.6.7. BASF

- 7.6.7.1. Company Overview

- 7.6.7.2. Financial Performance

- 7.6.7.3. Product Benchmarking

- 7.6.7.4. Strategic Initiatives

- 7.6.8. Johns Manville

- 7.6.8.1. Company Overview

- 7.6.8.2. Financial Performance

- 7.6.8.3. Product Benchmarking

- 7.6.8.4. Strategic Initiatives

- 7.6.9. Fletcher Insulation

- 7.6.9.1. Company Overview

- 7.6.9.2. Financial Performance

- 7.6.9.3. Product Benchmarking

- 7.6.9.4. Strategic Initiatives

- 7.6.10. Cellecta Inc.

- 7.6.10.1. Company Overview

- 7.6.10.2. Financial Performance

- 7.6.10.3. Product Benchmarking

- 7.6.10.4. Strategic Initiatives

- 7.6.1. Saint Gobain S.A.