|

|

市場調査レポート

商品コード

1588415

ウッドフェンス市場規模・動向分析レポート:製品別、樹種別、設置別、コーティング別、用途別、地域別セグメント動向:2025年~2030年Wood Fencing Market Size & Trends Analysis Report By Product (Picket, Vertical Boards) By Species (Cedar, Redwood), By Installation, By Coatings, By Application (Residential, Agricultural), By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| ウッドフェンス市場規模・動向分析レポート:製品別、樹種別、設置別、コーティング別、用途別、地域別セグメント動向:2025年~2030年 |

|

出版日: 2024年10月15日

発行: Grand View Research

ページ情報: 英文 95 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

ウッドフェンス市場の成長と動向

世界のウッドフェンス市場規模は、2030年には114億1,000万米ドルに達し、2025~2030年にかけてCAGR 4.6%で成長すると予測されます。

この成長は、大衆の環境意識に起因しています。木材、複合フェンス、有機リサイクル材料は、フェンスの開発に使用される環境に優しい材料のいくつかの例です。ウッドのフェンスは、その有機的な外観から住宅用途に好まれています。

世界中で住宅建設が急増していることに加え、工業用や農業用のフェンス需要が増加していることが、市場の成長を後押ししています。ウッドのフェンスは適切にメンテナンスされれば、何年も手つかずの状態を保つことができます。セキュリティ上の理由から、これらのフェンスは、住宅や農業用途の両方で使用されているため、予測期間にわたって産業の成長を推進しています。

ウッドフェンス市場には多数のバイヤーが存在し、これらのバイヤーの間ではかなりの多様化が見られます。例えば、工業セグメントの買い手の交渉力は高く、競争価格でメーカーから大量購入します。住宅部門の買い手の交渉力は、少量かつ単品購入のため中程度です。したがって、住宅建設の急増により、全体的な交渉力は中程度になると予想されます。

ピケットフェンスは、主にセキュリティ目的で庭やプールなどの住宅用途に一般的に採用されています。さらに、世界中で住宅建設活動が増加し、施設建設支出が急増していることから、今後数年間、この地域におけるウッドフェンス産業のピケットセグメントの成長に拍車がかかると予想されます。

同市場の参入企業は、大手研究機関との協力関係を活用した革新的な戦略活動に注力しています。例えば、亜鉛メッキワイヤーのBekaert社は、様々な種類のアメリカ製フェンス製品を提供しており、製品開発と技術革新のための研究開発に継続的に投資しています。Bekaertは、スロバキア工科大学(スロバキア)、ベルギー技術産業研究センター、フラウンホーファー研究所(ドイツ)と研究開発パートナーシップを結んでいます。

ウッドフェンス市場のレポートハイライト

- 製品別に、ウッドフェンス市場はピケット、レール&ポスト、バーチカルボード、その他に区分されます。ピケットフェンスは、プールや庭の池を保護する用途が高いことから、2024年には40.0%の最大売上シェアを占めました。

- シダーは、その高い耐久性により長年フェンス材料として使用されてきたため、2024年には41.6%の最高収益シェアを占めました。シダー材は化学処理を施しておらず、美的魅力に富み、色調の幅が広いため、住宅インテリアの視覚的魅力を高めています。また、シダーは見た目を維持するための手入れが不要です。

- 設置別に見ると、フェンス市場は業者・施工業者とDIYに区分されます。請負業者&施工業者セグメントは市場をリードし、2024年には56億1,000万米ドルを占めました。DIYセグメントは、2025~2030年にかけて6.1%の大幅な成長が見込まれています。

- ウッドフェンス産業は、コーティングに基づいて染色と非汚染にセグメント化されています。染色コーティングセグメントは2024年に70億3,000万米ドルの最大の売上を占め、2025~2030年にかけて最も速いCAGRで成長すると予想されています。この成長は、表面の酸化を抑え、木材の色を長期間保つことができることに起因しています。

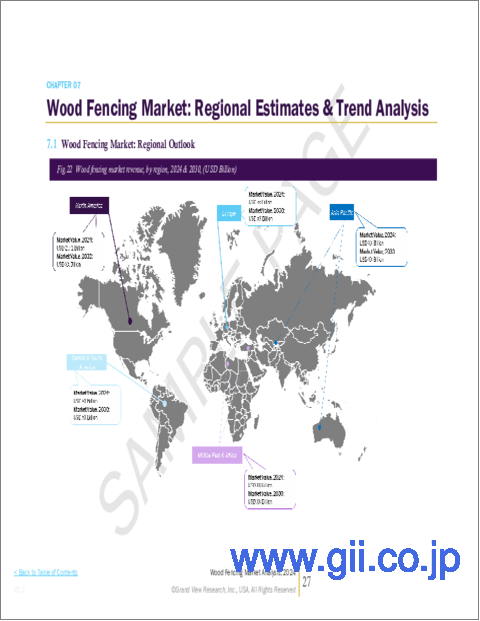

- アジア太平洋のウッドフェンス市場は世界市場を独占し、予測期間中最も速いCAGR 5.6%で成長すると予想されます。住宅建設活動の急増により、アジア太平洋が市場を独占しています。また、アジア太平洋ではリフォームプロジェクトや不動産開発が盛んであるため、予測期間中に製品需要が高まると見込まれます。

- ウッドフェンス市場は、世界参入企業と地場企業が存在するため、適度にセグメント化されています。市場参入企業、流通業者、施工業者が市場の主要参加者です。市場参入企業は、様々なタイプのウッドフェンス製品の購入と流通に従事しています。製品の多様な最終用途区分は、参入企業が製品の差別化に投資する機会を提供しています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 ウッドフェンス市場の変数、動向、範囲

- 親市場の展望

- ウッドフェンス-バリューチェーン分析

- 製造業の動向

- 流通チャネル分析

- 技術概要

- 規制の枠組み

- アナリストの視点

- ウッドフェンス-市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 市場機会分析

- 産業の課題

- 産業分析-ポーターのファイブフォース分析

- SWOTによるPESTEL分析

- 市場混乱分析

第4章 ウッドフェンス市場:製品別、推定・動向分析

- 主要ポイント

- 製品変動分析と市場シェア分析、2024年と2030年

- 製品別、2018~2030年

- ピケット

- レール&ポスト

- バーチカルボード

- その他

第5章 ウッドフェンス市場:樹種別、推定・動向分析

- 主要ポイント

- 樹種変動分析と市場シェア分析、2024年と2030年

- 樹種別、2018~2030年

- シダー

- ダグラスファー

- レッドウッド

- ホワイトウッド

- その他

第6章 ウッドフェンス市場:設置別、推定・動向分析

- 主要ポイント

- 設置変動分析と市場シェアの分析、2024年と2030年

- 設置別、2018~2030年

- 請負業者&施工業者

- DIY

第7章 ウッドフェンス市場:コーティング別、推定・動向分析

- 主要ポイント

- コーティング変動分析と市場シェア分析、2024年と2030年

- コーティング別、2018~2030年

- 着色

- 非着色

第8章 ウッドフェンス市場:用途別、推定・動向分析

- 主要ポイント

- 用途変動分析と市場シェア分析、2024年と2030年

- 用途別、2018~2030年

- 住宅用

- 農業

- その他

第9章 ウッドフェンス市場:国推定・動向分析

- 主要ポイント

- 地域変動分析と市場シェア分析、2024年と2030年

- 地域別2018~2030年

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- ベルギー

- ポーランド

- アジア太平洋

- 中国

- インド

- 日本

- 中南米

- ブラジル

- 中東・アフリカ

第10章 競合情勢

- 主要参入企業、その最近の動向、そして産業への影響

- 主要企業/競合の分類

- 企業の市況分析

- 企業ヒートマップ分析

- 戦略マッピング

- 企業リスト

- Jacksons Fencing

- Tree Way

- Wilfirs

- Travis Perkins

- Bekaert

- Seven Trust

- Sierra Pacific Industries

- Mendocino Forest Products Company, LLC(MFP)

- Redwood Empire Sawmill

- Pine River Group Home, Inc.

- LL Johnson Lumber Mfg. Co. &Johnson's Workbench

- BarretteWood

- SPEC Wood Inc.

- Cedarline Industries

List of Tables

- Table 1 Wood fencing market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

- Table 2 Wood fencing market estimates and forecasts, by species, 2018 - 2030 (USD Billion)

- Table 3 Wood fencing market estimates and forecasts, by installation channel, 2018 - 2030 (USD Billion)

- Table 4 Wood fencing market estimates and forecasts, by coatings, 2018 - 2030 (USD Billion)

- Table 5 Wood fencing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

List of Figures

- Fig. 1 Information Procurement

- Fig. 2 Primary Research Pattern

- Fig. 3 Primary Research Process

- Fig. 4 Market Research Approaches - Bottom-Up Approach

- Fig. 5 Market Research Approaches - Top-Down Approach

- Fig. 6 Market Research Approaches - Combined Approach

- Fig. 7 Regional Outlook

- Fig. 8 Segmental Outlook

- Fig. 9 Segmental Outlook

- Fig. 10 Segmental Outlook

- Fig. 11 Competitive Outlook

- Fig. 12 Wood fencing - Value chain analysis

- Fig. 13 Market driver impact analysis

- Fig. 14 Household disposable income in OECD countries, 2017-2021 (Gross per capita change in percentage)

- Fig. 15 Lumber prices, July 2019-July 2022 (USD/Thousand Board Feet)

- Fig. 16 Market restraint impact analysis

- Fig. 17 Porter's five forces analysis

- Fig. 18 Pestle by SWOT analysis

- Fig. 16 Wood fencing market, by product: key takeaways

- Fig. 17 Wood fencing market, by product: market share, 2024 & 2030

- Fig. 18 Picket wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 19 Rail & post wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 20 Vertical board wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 21 Other product wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 22 Cedar wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 23 Western red cedar wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 24 Incense cedar wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 25 Imported Japanese cedar wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 26 Other cedar wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 27 Douglas fir wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 28 Redwood wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 29 Whitewood wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 30 Other species wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 31 Wood fencing market estimates and forecasts, by contractor & installer, 2018 - 2030 (USD Billion)

- Fig. 32 Wood fencing market estimates and forecasts, by Do-It-Yourself (DIY), 2018 - 2030 (USD Billion)

- Fig. 33 Stained coating wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 34 Oil based stained coating wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 35 Other stained coating wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 36 Non-stained coating wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 37 Wood Fencing market estimates and forecasts, for residential, 2018 - 2030 (USD Billion)

- Fig. 38 Wood Fencing market estimates and forecasts, for single family residential, 2018 - 2030 (USD Billion)

- Fig. 39 Wood Fencing market estimates and forecasts, for multifamily residential 2018 - 2030 (USD Billion)

- Fig. 40 Wood Fencing market estimates and forecasts, for agricultural, 2018 - 2030 (USD Billion)

- Fig. 41 Wood fencing market estimates and forecasts, for other applications, 2018 - 2030 (USD Billion)

- Fig. 42 North America wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 43 U.S. wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 44 Canada wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 45 Mexico wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 46 Europe wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 47 UK wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 48 Germany wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 49 France wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 50 Italy wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 51 Belgium wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 52 Poland wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 53 Asia Pacific wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 54 China wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 55 India wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 56 Japan wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 57 Central & South America wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 58 Brazil wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 59 Middle East & Africa wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 60 Saudi Arabia wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 61 UAE wood fencing market estimates and forecasts, 2018 - 2030 (USD Billion)

Wood Fencing Market Growth & Trends:

The global wood fencing market size is expected to reach USD 11.41 billion in 2030 and is expected to grow at a CAGR of 4.6% from 2025 to 2030. This growth can be attributed to environmental awareness among the masses. Wood, composite fences, and organic recycled materials are a few examples of environment-friendly materials that are used for developing fences. Wooden fences are preferred in residential applications owing to their organic appearance.

The surge in residential construction activities across the globe, along with the rise in demand for fences for usage in industrial and agricultural applications, is fueling the growth of the market. If maintained properly, wooden fences remain untouched for many years. For security reasons, these fences are used in both, residential and agricultural applications thus propelling the industry growth over the forecast period.

A large number of buyers are present in the wood fencing market and there is considerable diversification among these buyers. For instance, the bargaining power of buyers from the industrial sector is high as they make bulk purchases from manufacturers at competitive prices. The bargaining power of buyers from the residential sector is medium due to their small and single purchases. Therefore, it can be concluded that the overall bargaining power is expected to be moderate due to the surging residential construction.

Picket fences are commonly employed for residential applications such as gardens and pools primarily for security purposes. Moreover, the rise in residential construction activities and the surge in institutional construction expenditures around the world are expected to fuel the growth of the picket segment of the wood fencing industry in the region in the coming years.

Players in the market are focused on innovative strategic activities with the help of collaborations with leading research institutes. For instance, Bekaert, a galvanized wire company offers American-made fencing products in different varieties and continuously invests in R&D for product development and innovation. Bekaert has research and development partnerships with the Slovak University of Technology (Slovakia), the Belgian Technology Industry Research Center, and the Fraunhofer Institute (Germany).

Wood Fencing Market Report Highlights:

- Based on product, the wood fencing market is segmented into picket, rail & post, vertical board, and others. The picket fence held the largest revenue share of 40.0% in 2024 owing to its high usage of safeguarding swimming pools or garden ponds.

- Cedar dominated with the highest revenue share of 41.6% in 2024 as it has been used as a fencing material for many years, due to its high endurance. The demand for cedar in wood fencing is high owing to its many benefits; the wood is not chemically treated; its aesthetic appeal and deep tone range enhances the visual appeal of home interiors. Cedar does not need a lot of upkeep for maintaining its look

- Based on the installation channel, the fencing market has been segmented into contractors & installers and Do-It-Yourself (DIY). The contractor & installers segment led the market and accounted for USD 5.61 billion in 2024. The DIY segment is expected to grow at a significant rate of 6.1% from 2025 to 2030

- The wood fencing industry has been segmented based on coatings into stained and non-stained. The stained coating segment held the largest revenue of USD 7.03 billion in 2024 and is expected to grow at the fastest CAGR from 2025 to 2030. This growth is attributed to its ability to reduce surface oxidation and preservation of the wood's color for longer periods

- The Asia Pacific wood fencing market dominated the global market and is expected to grow at the fastest CAGR of 5.6% over the forecast period. The surging residential construction activities allow Asia Pacific to dominate the market. Additionally, the high number of remodeling projects and real estate development in the Asia Pacific are expected to propel the product demand over the forecast period

- The wood fencing market is moderately fragmented owing to the presence of global and local players. Manufacturers, distributors, and installers are the primary participants in the market. Market players are engaged in the purchase and distribution of various types of wood fencing products. The varied end-use segmentation of products has provided opportunities for players to invest in product differentiation

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources

- 1.3.4. Third-Party Perspectives

- 1.3.5. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segmental Outlook

- 2.3. Competitive Insights

Chapter 3. Wood Fencing Market Variables, Trends & Scope

- 3.1. Parent Market Outlook

- 3.2. Wood Fencing- Value Chain Analysis

- 3.2.1. Manufacturing Trends

- 3.2.2. Sales Channel Analysis

- 3.3. Technology Overview

- 3.4. Regulatory Framework

- 3.4.1. Analyst Perspective

- 3.5. Wood Fencing - Market Dynamics

- 3.5.1. Market Driver Analysis

- 3.5.2. Market Restraint Analysis

- 3.5.3. Market Opportunity Analysis

- 3.5.4. Industry Challenges

- 3.5.5. Industry Analysis - Porter's

- 3.5.5.1. Threat from New Entrant

- 3.5.5.2. Bargaining Power of Buyers

- 3.5.5.3. Competitive Rivalry

- 3.5.5.4. Threat of Substitutes

- 3.5.5.5. Bargaining Power of Suppliers

- 3.5.5.6. Substitute Material Analysis

- 3.5.6. PESTEL Analysis by SWOT

- 3.5.6.1. Political Landscape

- 3.5.6.2. Environmental Landscape

- 3.5.6.3. Social Landscape

- 3.5.6.4. Technology Landscape

- 3.5.6.5. Economic Landscape

- 3.5.6.6. Legal Landscape

- 3.5.7. Market Disruption Analysis

Chapter 4. Wood Fencing Market: Product Estimates & Trend Analysis

- 4.1. Key Takeaways

- 4.2. Product Movement Analysis and Market Share Analysis, 2024 & 2030

- 4.3. Wood Fencing Market Estimates & Forecasts, By Product 2018 - 2030 (USD Billion)

- 4.3.1. Picket

- 4.3.2. Rail & Post

- 4.3.3. Vertical Board

- 4.3.4. Others

Chapter 5. Wood Fencing Market: Species Estimates & Trend Analysis

- 5.1. Key Takeaways

- 5.2. Species Movement Analysis and Market Share Analysis, 2024 & 2030

- 5.3. Wood Fencing Market Estimates & Forecasts, By Species, 2018 - 2030 (USD Billion)

- 5.3.1. Cedar

- 5.3.2. Douglas fir

- 5.3.3. Redwood

- 5.3.4. Whitewood

- 5.3.5. Others

Chapter 6. Wood Fencing Market: Installation Channel Estimates & Trend Analysis

- 6.1. Key Takeaways

- 6.2. Installation Channel Movement Analysis and Market Share Analysis, 2024 & 2030

- 6.3. Wood Fencing Market Estimates & Forecasts, By Installation Channel 2018 - 2030 (USD Billion)

- 6.3.1. Contractor & Installer

- 6.3.2. Do-It-Yourself

Chapter 7. Wood Fencing Market: Coatings Estimates & Trend Analysis

- 7.1. Key Takeaways

- 7.2. Coatings Movement Analysis and Market Share Analysis, 2024 & 2030

- 7.3. Wood Fencing Market Estimates & Forecasts, By Coatings, 2018 - 2030 (USD Billion)

- 7.3.1. Stained

- 7.3.1.1. Oil Based Stained

- 7.3.1.2. Others

- 7.3.2. Non-Stained

- 7.3.1. Stained

Chapter 8. Wood Fencing Market: Application Estimates & Trend Analysis

- 8.1. Key Takeaways

- 8.2. Application Movement Analysis and Market Share Analysis, 2024 & 2030

- 8.3. Wood Fencing Market Estimates & Forecasts, By Application 2018 - 2030 (USD Billion)

- 8.3.1. Residential

- 8.3.2. Agricultural

- 8.3.3. Others

Chapter 9. Wood Fencing Market: Country Estimates & Trend Analysis

- 9.1. Key Takeaways

- 9.2. Regional Movement Analysis and Market Share Analysis, 2024 & 2030

- 9.3. Wood Fencing Market Estimates & Forecasts, By Region 2018 - 2030 (USD Billion)

- 9.4. North America

- 9.4.1. North America Wood Fencing Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- 9.4.2. U.S.

- 9.4.2.1. U.S. Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.4.3. Canada

- 9.4.3.1. Canada Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.4.4. Mexico

- 9.4.4.1. Mexico Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.5. Europe

- 9.5.1. Europe Wood Fencing Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- 9.5.2. UK

- 9.5.2.1. UK Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.5.3. Germany

- 9.5.3.1. Germany Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.5.4. France

- 9.5.4.1. France Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.5.5. Italy

- 9.5.5.1. Italy Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.5.6. Belgium

- 9.5.6.1. Belgium Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.5.7. Poland

- 9.5.7.1. Poland Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.6. Asia Pacific

- 9.6.1. Asia Pacific Wood Fencing Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- 9.6.2. China

- 9.6.2.1. China Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.6.3. India

- 9.6.3.1. India Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.6.4. Japan

- 9.6.4.1. Japan Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.7. Central & South America

- 9.7.1. Central & South America Wood Fencing Market Estimates & Forecasts, 2018 - 2030 (Billion Liner Ft.) (USD Billion)

- 9.7.2. Brazil

- 9.7.2.1. Brazil Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.8. Middle East & Africa

- 9.8.1. Middle East & Africa Wood Fencing Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- 9.8.1.1. Saudi Arabia Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.8.1.2. UAE Wood Fencing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 9.8.1. Middle East & Africa Wood Fencing Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Chapter 10. Competitive Landscape

- 10.1. Key Players, their Recent Developments, and their Impact on Industry

- 10.2. Key Company/Competition Categorization

- 10.3. Company Market Position Analysis

- 10.4. Company Heat Map Analysis

- 10.5. Strategy Mapping

- 10.6. Company Listing

- 10.6.1. Jacksons Fencing

- 10.6.1.1. Company Overview

- 10.6.1.2. Financial Performance

- 10.6.1.3. Product Benchmarking

- 10.6.1.4. Strategic Initiatives

- 10.6.2. Tree Way

- 10.6.2.1. Company Overview

- 10.6.2.2. Financial Performance

- 10.6.2.3. Product Benchmarking

- 10.6.2.4. Strategic Initiatives

- 10.6.3. Wilfirs

- 10.6.3.1. Company Overview

- 10.6.3.2. Financial Performance

- 10.6.3.3. Product Benchmarking

- 10.6.3.4. Strategic Initiatives

- 10.6.4. Travis Perkins

- 10.6.4.1. Company Overview

- 10.6.4.2. Financial Performance

- 10.6.4.3. Product Benchmarking

- 10.6.4.4. Strategic Initiatives

- 10.6.5. Bekaert

- 10.6.5.1. Company Overview

- 10.6.5.2. Financial Performance

- 10.6.5.3. Product Benchmarking

- 10.6.5.4. Strategic Initiatives

- 10.6.6. Seven Trust

- 10.6.6.1. Company Overview

- 10.6.6.2. Financial Performance

- 10.6.6.3. Product Benchmarking

- 10.6.6.4. Strategic Initiatives

- 10.6.7. Sierra Pacific Industries

- 10.6.7.1. Company Overview

- 10.6.7.2. Financial Performance

- 10.6.7.3. Product Benchmarking

- 10.6.7.4. Strategic Initiatives

- 10.6.8. Mendocino Forest Products Company, LLC (MFP);

- 10.6.8.1. Company Overview

- 10.6.8.2. Financial Performance

- 10.6.8.3. Product Benchmarking

- 10.6.8.4. Strategic Initiatives

- 10.6.9. Redwood Empire Sawmill

- 10.6.9.1. Company Overview

- 10.6.9.2. Financial Performance

- 10.6.9.3. Product Benchmarking

- 10.6.9.4. Strategic Initiatives

- 10.6.10. Pine River Group Home, Inc.

- 10.6.10.1. Company Overview

- 10.6.10.2. Financial Performance

- 10.6.10.3. Product Benchmarking

- 10.6.10.4. Strategic Initiatives

- 10.6.11. L.L. Johnson Lumber Mfg. Co. & Johnson's Workbench

- 10.6.11.1. Company Overview

- 10.6.11.2. Financial Performance

- 10.6.11.3. Product Benchmarking

- 10.6.11.4. Strategic Initiatives

- 10.6.12. BarretteWood

- 10.6.12.1. Company Overview

- 10.6.12.2. Financial Performance

- 10.6.12.3. Product Benchmarking

- 10.6.12.4. Strategic Initiatives

- 10.6.13. SPEC Wood Inc.

- 10.6.13.1. Company Overview

- 10.6.13.2. Financial Performance

- 10.6.13.3. Product Benchmarking

- 10.6.13.4. Strategic Initiatives

- 10.6.14. Cedarline Industries

- 10.6.14.1. Company Overview

- 10.6.14.2. Financial Performance

- 10.6.14.3. Product Benchmarking

- 10.6.14.4. Strategic Initiatives

- 10.6.1. Jacksons Fencing