|

|

市場調査レポート

商品コード

1588340

発症前遺伝子検査およびコンシューマーゲノミクスの市場規模、シェア、動向分析レポート:検査別、用途別、セッティング別、地域別、セグメント予測、2025年~2030年Predictive Genetic Testing And Consumer Genomics Market Size, Share & Trends Analysis Report By Test, By Application, By Setting (DTC, Professional), By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 発症前遺伝子検査およびコンシューマーゲノミクスの市場規模、シェア、動向分析レポート:検査別、用途別、セッティング別、地域別、セグメント予測、2025年~2030年 |

|

出版日: 2024年10月09日

発行: Grand View Research

ページ情報: 英文 120 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

発症前遺伝子検査およびコンシューマーゲノミクス市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、世界の発症前遺伝子検査およびコンシューマーゲノミクス市場規模は、2025年から2030年にかけて12.3%のCAGRを記録し、2030年までに95億1,000万米ドルに達すると予測されています。

市場開拓に影響を与える要因としては、症状が出る前に遺伝子感受性を予測する遺伝子検査の利用に対する意識の高まりが挙げられます。さらに、医師の志向の高まりによるこれらの製品の販売増加が市場を牽引しています。

次世代シーケンシング技術における新しいプラットフォームのイントロダクションは、遺伝学的予測キットや消費者ゲノミクスキットの精度を高めるのに役立っています。市場参入企業は、最小限の技術支援を必要とし、最適な顧客満足を提供する製品を発売するために、新しいプロトコルの導入に取り組んでいます。

製薬企業は、患者の表現型および遺伝子型情報に基づいて新規治療薬を発売するために、ゲノムベンダーといくつかの契約モデルに取り組んでいます。例えば、2018年7月、GlaxoSmithKline plcは新薬開発のために23andMeの顧客データを購入し、患者中心のヘルスケアを推進しています。

発症前遺伝子検査およびコンシューマーゲノミクス市場レポートハイライト

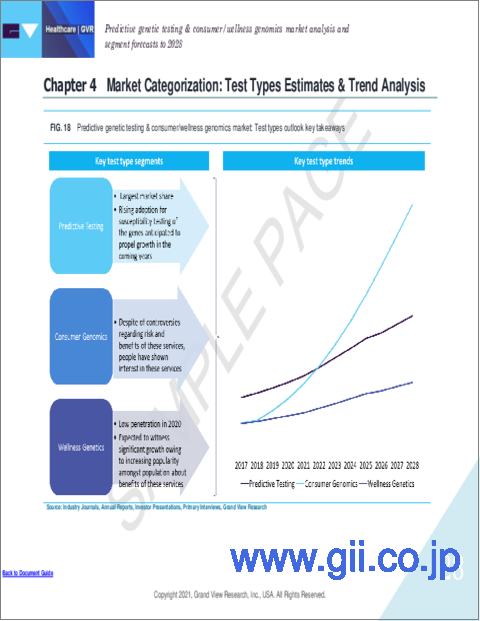

- 2024年の市場収益では、予測検査分野が大きなシェアを占めています。この検査は、世界人口の間で遺伝性疾患の罹患率が上昇し、遺伝カウンセリングサービスへの注目が高まっていることから、今後数年間で安定した需要が見込まれます。

- 乳がん・卵巣がん分野は2024年に最大の収益シェアを占め、予測期間中も主導的地位を維持すると予想されます。

- これらの検査は消費者にとって経済的なコストで利用可能であるため、DTCセグメントは2024年に市場で圧倒的な収益シェアを占めました。

- 北米は2024年に市場をリードし、45.9%の世界収益シェアを占めました。コンシューマーゲノミクスおよび発症前遺伝子検査サービスの強化に取り組む主要企業が幅広く存在することが、この地域の市場成長を促進すると予想されます。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 発症前遺伝子検査およびコンシューマーゲノミクス市場の変数、動向、範囲

- 市場系統の見通し

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- ビジネス環境分析

- 業界分析- ポーターのファイブフォース分析

- PESTEL分析

第4章 発症前遺伝子検査およびコンシューマーゲノミクス市場: 検査のビジネス分析

- 検査市場シェア、2024年と2030年

- 検査セグメントダッシュボード

- 市場規模と予測および動向分析、検査別、2018~2030年

- 予測検査

- コンシューマーゲノミクス

- ウェルネスゲノミクス

第5章 発症前遺伝子検査およびコンシューマーゲノミクス市場:用途の推定・動向分析

- 用途市場シェア、2024年および2030年

- 用途セグメントダッシュボード

- 市場規模と予測および動向分析、用途別、2018~2030年

- 乳がんと卵巣がん

- 心血管検査

- 糖尿病スクリーニングとモニタリング

- 大腸がん

- パーキンソン病/アルツハイマー病

- 泌尿器科検診/前立腺がん検診

- 整形外科および筋骨格

- その他のがんスクリーニング

- その他の疾患

第6章 発症前遺伝子検査およびコンシューマーゲノミクス市場:セッティング推定・動向分析

- セッティング市場シェア、2024年と2030年

- セッティングセグメントダッシュボード

- 市場規模と予測および動向分析、セッティング別、2018~2030年

- DTC

- プロフェッショナル

第7章 発症前遺伝子検査およびコンシューマーゲノミクス市場:地域推定・動向分析

- 地域別市場シェア分析、2024年および2030年

- 地域市場ダッシュボード

- 市場規模と予測および動向分析、2018年から2030年:

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- アジア太平洋

- 中国

- 日本

- インド

- シンガポール

- オーストラリア

- ラテンアメリカ

- ブラジル

- 中東およびアフリカ

- 南アフリカ

第8章 競合情勢

- 参入企業概要

- 企業の市況分析

- 企業分類

- 戦略マッピング

- 企業プロファイル

- 23andMe, Inc.

- Myriad Genetics, Inc.

- F. Hoffmann-La Roche Ltd

- Abbott

- Agilent Technologies, Inc.

- Thermo Fisher Scientific Inc.

- BGI

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- ARUP Laboratories

List of Tables

- Table 1 List of secondary sources

- Table 2 List of abbreviations

- Table 3 Global predictive genetic testing and consumer genomics market, by region, 2018 - 2030 (USD Million)

- Table 4 Global predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 5 Global predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 6 Global predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 7 North America predictive genetic testing and consumer genomics market, by country, 2018 - 2030 (USD Million)

- Table 8 North America predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 9 North America predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 10 North America predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 11 U.S. predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 12 U.S. predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 13 U.S. predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 14 Canada predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 15 Canada predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 16 Canada predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 17 Europe predictive genetic testing and consumer genomics market, by country, 2018 - 2030 (USD Million)

- Table 18 Europe predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 19 Europe predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 20 Europe predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 21 UK predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 22 UK predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 23 UK predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 24 Germany predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 25 Germany predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 26 Germany predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 27 Asia Pacific predictive genetic testing and consumer genomics market, by country, 2018 - 2030 (USD Million)

- Table 28 Asia Pacific predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 29 Asia Pacific predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 30 Asia Pacific predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 31 Japan predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 32 Japan predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 33 Japan predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 34 China predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 35 China predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 36 China predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 37 India predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 38 India predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 39 India predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 40 Australia predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 41 Australia predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 42 Australia predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 43 Singapore predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 44 Singapore predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 45 Singapore predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 46 Latin America predictive genetic testing and consumer genomics market, by country, 2018 - 2030 (USD Million)

- Table 47 Latin America predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 48 Latin America predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 49 Latin America predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 50 Brazil predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 51 Brazil predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 52 Brazil predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 53 Middle East & Africa Predictive genetic testing and consumer genomics market, by country, 2018 - 2030 (USD Million)

- Table 54 Middle East & Africa predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 55 Middle East & Africa predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 56 Middle East & Africa predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

- Table 57 South Africa predictive genetic testing and consumer genomics market, by test, 2018 - 2030 (USD Million)

- Table 58 South Africa predictive genetic testing and consumer genomics market, by application, 2018 - 2030 (USD Million)

- Table 59 South Africa predictive genetic testing and consumer genomics market, by setting, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Predictive genetic testing and consumer genomics market segmentation

- Fig. 2 Market research process

- Fig. 3 Data triangulation techniques

- Fig. 4 Primary research pattern

- Fig. 5 Market research approaches

- Fig. 6 Value-chain-based sizing & forecasting

- Fig. 7 Market formulation & validation

- Fig. 8 Market snapshot

- Fig. 9 Product and application outlook (USD Million)

- Fig. 10 Test, application, and setting outlook

- Fig. 11 Competitive landscape

- Fig. 12 Predictive genetic testing and consumer genomics market dynamics

- Fig. 13 Predictive genetic testing and consumer genomics market: Porter's five forces analysis

- Fig. 14 Predictive genetic testing and consumer genomics market: PESTLE analysis

- Fig. 15 Predictive genetic testing and consumer genomics market: Test segment dashboard

- Fig. 16 Predictive genetic testing and consumer genomics market: Test market share analysis, 2024 & 2030

- Fig. 17 Predictive testing market, 2018 - 2030 (USD Million)

- Fig. 18 Genetic susceptibility test market, 2018 - 2030 (USD Million)

- Fig. 19 Predictive diagnostics market, 2018 - 2030 (USD Million)

- Fig. 20 Population screening market, 2018 - 2030 (USD Million)

- Fig. 21 Consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 22 Wellness genomics market, 2018 - 2030 (USD Million)

- Fig. 23 Nutria genetics market, 2018 - 2030 (USD Million)

- Fig. 24 Skin & metabolism genetics market, 2018 - 2030 (USD Million)

- Fig. 25 Others market, 2018 - 2030 (USD Million)

- Fig. 26 Predictive genetic testing and consumer genomics market: Application segment dashboard

- Fig. 27 Predictive genetic testing and consumer genomics market: Application market share analysis, 2024 & 2030

- Fig. 28 Breast & ovarian cancer market, 2018 - 2030 (USD Million)

- Fig. 29 Cardiovascular screening market, 2018 - 2030 (USD Million)

- Fig. 30 Diabetic screening & monitoring market, 2018 - 2030 (USD Million)

- Fig. 31 Colon cancer market, 2018 - 2030 (USD Million)

- Fig. 32 Parkinsonism / Alzheimer's disease market, 2018 - 2030 (USD Million)

- Fig. 33 Urologic screening/ prostate cancer screening market, 2018 - 2030 (USD Million)

- Fig. 34 Orthopedic & musculoskeletal market, 2018 - 2030 (USD Million)

- Fig. 35 Other cancer screening market, 2018 - 2030 (USD Million)

- Fig. 36 Other diseases market, 2018 - 2030 (USD Million)

- Fig. 37 Predictive genetic testing and consumer genomics market: Setting segment dashboard

- Fig. 38 Predictive genetic testing and consumer genomics market: Setting market share analysis, 2024 & 2030

- Fig. 39 DTC market, 2018 - 2030 (USD Million)

- Fig. 40 Professional market, 2018 - 2030 (USD Million)

- Fig. 41 Predictive genetic testing and consumer genomics market revenue, by region

- Fig. 42 Regional marketplace: Key takeaways

- Fig. 43 North America Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 44 U.S. country dynamics

- Fig. 45 U.S. Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 46 Canada country dynamics

- Fig. 47 Canada Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 48 Europe Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 49 UK country dynamics

- Fig. 50 UK Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 51 Germany country dynamics

- Fig. 52 Germany Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 53 Asia Pacific Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 54 Japan country dynamics

- Fig. 55 Japan Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 56 China country dynamics

- Fig. 57 China Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 58 India country dynamics

- Fig. 59 India Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 60 Australia country dynamics

- Fig. 61 Australia Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 62 Singapore country dynamics

- Fig. 63 Singapore Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 64 Latin America Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 65 Brazil country dynamics

- Fig. 66 Brazil Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 67 MEA Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 68 South Africa country dynamics

- Fig. 69 South Africa Predictive genetic testing and consumer genomics market, 2018 - 2030 (USD Million)

- Fig. 70 Company categorization

- Fig. 71 Company market position analysis

- Fig. 72 Strategic framework

Genetic Testing And Consumer Genomics Market Growth & Trends:

The global predictive genetic testing and consumer genomics market size is expected to reach USD 9.51 billion by 2030, registering a CAGR of 12.3% from 2025 to 2030, according to a new report by Grand View Research, Inc. Factors influencing the market progression include growing awareness about utilization of genetic tests that aid in prediction of gene susceptibility to disease development prior to symptoms. Moreover, rise in sales of these products owing to growing inclination of physicians is driving the market.

Introduction of novel platforms in next-generation sequencing technology aids in enhancing the accuracy of predictive genetic and consumer genomics kits. Market participants are engaged in implementing novel protocols to launch products that require minimal technical assistance and provide optimal customer satisfaction.

Pharmaceutical firms are engaged in several agreement models with genomic vendors for the release of novel therapeutics based on patient's phenotypic and genotypic information. For instance, in July 2018, GlaxoSmithKline plc purchased 23andMe's customer data to develop a new drug, thus promoting patient-centered healthcare.

Predictive Genetic Testing And Consumer Genomics Market Report Highlights:

- The predictive testing segment accounted for a significant market revenue share in 2024. This testing is expected to witness a steady demand in the coming years on account of rising incidences of genetic disorders among the global population and increasing focus on genetic counseling services.

- The breast & ovarian cancer segment accounted for the largest revenue share in 2024 and is expected to maintain its leading position during the forecast period.

- The DTC segment accounted for a dominant revenue share in the market in 2024, as these tests are available at economical costs to consumers.

- North America led the market in 2024, accounting for a 45.9% global revenue share. The extensive presence of key players undertaking initiatives to enhance their consumer genomics & predictive genetic testing offerings is anticipated to propel regional market growth.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Segment Definitions

- 1.2.1. Test

- 1.2.2. Application

- 1.2.3. Setting

- 1.3. Estimates and Forecast Timeline

- 1.4. Research Methodology

- 1.5. Information Procurement

- 1.5.1. Purchased Database

- 1.5.2. GVR's Internal Database

- 1.5.3. Secondary Sources

- 1.5.4. Primary Research

- 1.6. Information Analysis

- 1.6.1. Data Analysis Models

- 1.7. Market Formulation & Data Visualization

- 1.8. Model Details

- 1.8.1. Commodity Flow Analysis

- 1.9. List of Secondary Sources

- 1.10. Objectives

Chapter 2. Executive Summary

- 2.1. Market Snapshot

- 2.2. Segment Snapshot

- 2.3. Competitive Landscape Snapshot

Chapter 3. Predictive Genetic Testing and Consumer Genomics Market Variables, Trends, & Scope

- 3.1. Market Lineage Outlook

- 3.2. Market Dynamics

- 3.2.1. Market Drivers Analysis

- 3.2.2. Market Restraints Analysis

- 3.3. Business Environment Analysis

- 3.3.1. Industry Analysis - Porter's Five Forces Analysis

- 3.3.1.1. Bargaining power of the suppliers

- 3.3.1.2. Bargaining power of the buyers

- 3.3.1.3. Threats of substitution

- 3.3.1.4. Threats from new entrants

- 3.3.1.5. Competitive rivalry

- 3.3.2. PESTEL Analysis

- 3.3.1. Industry Analysis - Porter's Five Forces Analysis

Chapter 4. Predictive Genetic Testing and Consumer Genomics Market: Test Business Analysis

- 4.1. Test Market Share, 2024 & 2030

- 4.2. Test Segment Dashboard

- 4.3. Market Size & Forecasts and Trend Analysis, By Test, 2018 to 2030 (USD Million)

- 4.4. Predictive Testing

- 4.4.1. Predictive Testing Market, 2018 - 2030 (USD Million)

- 4.4.2. Genetic Susceptibility Test

- 4.4.2.1. Genetic Susceptibility Test Market, 2018 - 2030 (USD Million)

- 4.4.3. Predictive Diagnostics

- 4.4.3.1. Predictive Diagnostics Market, 2018 - 2030 (USD Million)

- 4.4.4. Population Screening

- 4.4.4.1. Population Screening Market, 2018 - 2030 (USD Million)

- 4.5. Consumer Genomics

- 4.5.1. Consumer Genomics Market, 2018 - 2030 (USD Million)

- 4.6. Wellness Genomics

- 4.6.1. Wellness Genomics Market, 2018 - 2030 (USD Million)

- 4.6.2. Nutria Genetics

- 4.6.2.1. Nutria Genetics Market, 2018 - 2030 (USD Million)

- 4.6.3. Skin & Metabolism Genetics

- 4.6.3.1. Skin & Metabolism Genetics Market, 2018 - 2030 (USD Million)

- 4.6.4. Others

- 4.6.4.1. Other Tests Market, 2018 - 2030 (USD Million)

Chapter 5. Predictive Genetic Testing and Consumer Genomics Market: Application Estimates & Trend Analysis

- 5.1. Application Market Share, 2024 & 2030

- 5.2. Application Segment Dashboard

- 5.3. Market Size & Forecasts and Trend Analysis, By Application, 2018 to 2030 (USD Million)

- 5.4. Breast & Ovarian Cancer

- 5.4.1. Breast & Ovarian Cancer Market, 2018 - 2030 (USD Million)

- 5.5. Cardiovascular Screening

- 5.5.1. Cardiovascular Screening Market, 2018 - 2030 (USD Million)

- 5.6. Diabetic Screening & Monitoring

- 5.6.1. Diabetic Screening & Monitoring Market, 2018 - 2030 (USD Million)

- 5.7. Colon Cancer

- 5.7.1. Colon Cancer Market, 2018 - 2030 (USD Million)

- 5.8. Parkinsonism/Alzheimer's Disease

- 5.8.1. Parkinsonism/Alzheimer's Disease Market, 2018 - 2030 (USD Million)

- 5.9. Urologic Screening/ Prostate Cancer Screening

- 5.9.1. Urologic Screening/ Prostate Cancer Screening Market, 2018 - 2030 (USD Million)

- 5.10. Orthopedic & Musculoskeletal

- 5.10.1. Orthopedic & Musculoskeletal Market, 2018 - 2030 (USD Million)

- 5.11. Other Cancer Screening

- 5.11.1. Other Cancer Screening Market, 2018 - 2030 (USD Million)

- 5.12. Other Diseases

- 5.12.1. Other Diseases Market, 2018 - 2030 (USD Million)

Chapter 6. Predictive Genetic Testing and Consumer Genomics Market: Setting Estimates & Trend Analysis

- 6.1. Setting Market Share, 2024 & 2030

- 6.2. Setting Segment Dashboard

- 6.3. Market Size & Forecasts and Trend Analysis, By Setting, 2018 to 2030 (USD Million)

- 6.4. DTC

- 6.4.1. DTC Market, 2018 - 2030 (USD Million)

- 6.5. Professional

- 6.5.1. Professional Market, 2018 - 2030 (USD Million)

Chapter 7. Predictive Genetic Testing and Consumer Genomics Market: Regional Estimates & Trend Analysis

- 7.1. Regional Market Share Analysis, 2024 & 2030

- 7.2. Regional Market Dashboard

- 7.3. Market Size & Forecasts and Trend Analysis, 2018 to 2030:

- 7.4. North America

- 7.4.1. North America Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.4.2. U.S.

- 7.4.2.1. Key country dynamics

- 7.4.2.2. Regulatory framework

- 7.4.2.3. Competitive insights

- 7.4.2.4. U.S. Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.4.3. Canada

- 7.4.3.1. Key country dynamics

- 7.4.3.2. Regulatory framework

- 7.4.3.3. Competitive insights

- 7.4.3.4. Canada Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.5. Europe

- 7.5.1. Europe Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.5.2. UK

- 7.5.2.1. Key country dynamics

- 7.5.2.2. Regulatory framework

- 7.5.2.3. Competitive insights

- 7.5.2.4. UK Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.5.3. Germany

- 7.5.3.1. Key country dynamics

- 7.5.3.2. Regulatory framework

- 7.5.3.3. Competitive insights

- 7.5.3.4. Germany Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.6. Asia Pacific

- 7.6.1. Asia Pacific Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.6.2. China

- 7.6.2.1. Key country dynamics

- 7.6.2.2. Regulatory framework

- 7.6.2.3. Competitive insights

- 7.6.2.4. China Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.6.3. Japan

- 7.6.3.1. Key country dynamics

- 7.6.3.2. Regulatory framework

- 7.6.3.3. Competitive insights

- 7.6.3.4. Japan Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.6.4. India

- 7.6.4.1. Key country dynamics

- 7.6.4.2. Regulatory framework

- 7.6.4.3. Competitive insights

- 7.6.4.4. India Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.6.5. Singapore

- 7.6.5.1. Key country dynamics

- 7.6.5.2. Regulatory framework

- 7.6.5.3. Competitive insights

- 7.6.5.4. Singapore Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.6.6. Australia

- 7.6.6.1. Key country dynamics

- 7.6.6.2. Regulatory framework

- 7.6.6.3. Competitive insights

- 7.6.6.4. Australia Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.7. Latin America

- 7.7.1. Latin America Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.7.2. Brazil

- 7.7.2.1. Key country dynamics

- 7.7.2.2. Regulatory framework

- 7.7.2.3. Competitive insights

- 7.7.2.4. Brazil Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.8. Middle East and Africa

- 7.8.1. Middle East and Africa Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.8.2. South Africa

- 7.8.2.1. Key country dynamics

- 7.8.2.2. Regulatory framework

- 7.8.2.3. Competitive insights

- 7.8.2.4. South Africa Predictive Genetic Testing and Consumer Genomics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

- 8.1. Participant Overview

- 8.2. Company Market Position Analysis

- 8.3. Company Categorization

- 8.4. Strategy Mapping

- 8.5. Company Profiles/Listing

- 8.5.1. 23andMe, Inc.

- 8.5.1.1. Participant's Overview

- 8.5.1.2. Financial Performance

- 8.5.1.3. Product Benchmarking

- 8.5.1.4. Recent Developments/ Strategic Initiatives

- 8.5.2. Myriad Genetics, Inc.

- 8.5.2.1. Participant's Overview

- 8.5.2.2. Financial Performance

- 8.5.2.3. Product Benchmarking

- 8.5.2.4. Recent Developments/ Strategic Initiatives

- 8.5.3. F. Hoffmann-La Roche Ltd

- 8.5.3.1. Participant's Overview

- 8.5.3.2. Financial Performance

- 8.5.3.3. Product Benchmarking

- 8.5.3.4. Recent Developments/ Strategic Initiatives

- 8.5.4. Abbott

- 8.5.4.1. Participant's Overview

- 8.5.4.2. Financial Performance

- 8.5.4.3. Product Benchmarking

- 8.5.4.4. Recent Developments/ Strategic Initiatives

- 8.5.5. Agilent Technologies, Inc.

- 8.5.5.1. Participant's Overview

- 8.5.5.2. Financial Performance

- 8.5.5.3. Product Benchmarking

- 8.5.5.4. Recent Developments/ Strategic Initiatives

- 8.5.6. Thermo Fisher Scientific Inc.

- 8.5.6.1. Participant's Overview

- 8.5.6.2. Financial Performance

- 8.5.6.3. Product Benchmarking

- 8.5.6.4. Recent Developments/ Strategic Initiatives

- 8.5.7. BGI

- 8.5.7.1. Participant's Overview

- 8.5.7.2. Financial Performance

- 8.5.7.3. Product Benchmarking

- 8.5.7.4. Recent Developments/ Strategic Initiatives

- 8.5.8. Bio-Rad Laboratories, Inc.

- 8.5.8.1. Participant's Overview

- 8.5.8.2. Financial Performance

- 8.5.8.3. Product Benchmarking

- 8.5.8.4. Recent Developments/ Strategic Initiatives

- 8.5.9. Illumina, Inc.

- 8.5.9.1. Participant's Overview

- 8.5.9.2. Financial Performance

- 8.5.9.3. Product Benchmarking

- 8.5.9.4. Recent Developments/ Strategic Initiatives

- 8.5.10. ARUP Laboratories

- 8.5.10.1. Participant's Overview

- 8.5.10.2. Financial Performance

- 8.5.10.3. Product Benchmarking

- 8.5.10.4. Recent Developments/ Strategic Initiatives

- 8.5.1. 23andMe, Inc.