|

|

市場調査レポート

商品コード

1587401

リハビリテーションロボット市場規模、シェア、動向分析レポート:タイプ別、四肢別、最終用途別、地域別、セグメント予測、2025年~2030年Rehabilitation Robots Market Size, Share & Trends Analysis Report By Type, By Extremity, By End-use, By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| リハビリテーションロボット市場規模、シェア、動向分析レポート:タイプ別、四肢別、最終用途別、地域別、セグメント予測、2025年~2030年 |

|

出版日: 2024年10月28日

発行: Grand View Research

ページ情報: 英文 120 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

リハビリテーションロボット市場の成長と動向

Grand View Research, Inc.の最新レポートによると、世界のリハビリテーションロボット市場規模は2030年までに10億3,000万米ドルに達すると推定され、2025~2030年にかけて15.2%のCAGRで成長すると予測されています。

産業成長の主要要因は、一人当たりの医療支出の高さと、技術的に先進的機器の急速な導入です。リハビリテーションロボットは、脊髄損傷や麻痺などの症状を持つ人々の生活の質を向上させるのに有益であるため、需要が増加しています。FDAなどの規制機関による製品承認数の増加が、予測期間中の成長をさらに促進すると予想されます。脊髄損傷や筋骨格系障害の罹患率の増加が、リハビリテーションロボットの採用を促進しています。

リハビリテーションロボットの購入費やメンテナンス費用が高いこと、承認手続きが厳格であることは、今後の市場成長を妨げる要因のひとつです。さらに、COVID-19も産業の成長に大きな影響を与えています。しかし、製品の発売、提携、買収といった形で絶え間ない戦略的イニシアティブが産業の競争を激化させ、成長を支えています。また、技術の進歩が進み、主要企業による研究開発プロセスへの支出が増加していることも、市場成長を後押しする主要要因の1つとなっています。

下半身四肢は2024年に最大の収益シェアを占めました。下半身障害の有病率の増加、急速な高齢化、麻痺患者の増加が、下半身外骨格市場の採用、普及、成長を促進すると予測されています。しかし、上半身外骨格は予測期間中17.6%と最も速いCAGRが見込まれています。

病院・クリニックは2024年に47.1%の最大市場シェアを占めました。成長の主要要因は、医療支出の増加、医療施設における先端技術の急速な導入です。しかし、高齢者介護施設は予測期間中に最も速いCAGRで成長すると予想されます。この成長は、高齢者向けのより良い医療施設に対する需要の高まりと、高齢者の増加によるものです。

北米は2024年に最大のシェアを占めました。同地域における脊髄損傷の有病率の増加が市場成長を促進しています。高齢者の増加や障害者人口の増加は、リハビリテーションロボットの採用を後押しする要因の一つです。しかし、アジア太平洋は予測期間中に最も速い成長率で成長すると予想されています。

リハビリテーションロボット市場レポートハイライト

- 2024年には、外骨格セグメントがリハビリテーションロボット市場を独占し、最大の収益シェアを占めました。高齢者の増加が外骨格ロボットの使用増加に寄与すると予測されます。

- 2024年には、下半身セグメントが市場を独占し、最大の収益シェアを占めました。下半身セグメントは、急速な高齢化、下半身障害の発生率の上昇、麻痺患者の増加により、採用、普及、成長の増加が見込まれています。

- 2024年には、病院・クリニックセグメントが市場を独占し、47.1%の最大収益シェアを占めました。しかし、高齢者の増加により、市場の高齢者介護施設セグメントは予測期間中に大幅な成長が見込まれています。

- 2024年のリハビリテーションロボット市場は、北米が45.1%のシェアを占めたが、アジア太平洋などの新興国が予測期間中に最も速い成長率を示すと予測されています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 リハビリテーションロボット市場の変数、動向、範囲

- 市場系統の展望

- 親市場の展望

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- リハビリテーションロボット:市場分析ツール

- 産業分析-ポーターのファイブフォース分析

- PESTLE分析

- 技術タイムライン分析

第4章 リハビリテーションロボット市場セグメント分析、タイプ別、2018~2030年(100万米ドル)

- 定義と範囲

- タイプ市場シェア分析、2024年と2030年

- セグメントダッシュボード

- 世界のリハビリテーションロボット市場、タイプ別、2018~2030年

- セラピーロボット

- セラピーロボット市場推定・予測、2018~2030年

- 外骨格

- 外骨格市場推定・予測、2018~2030年

第5章 リハビリテーションロボット市場セグメント分析、四肢別、2018~2030年(100万米ドル)

- 定義と範囲

- 四肢市場シェア分析、2024年と2030年

- セグメントダッシュボード

- 世界のリハビリテーションロボット市場、四肢別、2018~2030年

- 上半身

- 上半身市場推定・予測、2018~2030年

- 下半身

- 下半身市場推定・予測、2018~2030年

第6章 リハビリテーションロボット市場セグメント分析、最終用途別、2018~2030年(100万米ドル)

- 定義と範囲

- 最終用途市場シェア分析、2024年と2030年

- セグメントダッシュボード

- 世界のリハビリテーションロボット市場、最終用途別、2018~2030年

- 病院・クリニック

- 病院・クリニックの市場推定・予測、2018~2030年

- 高齢者介護施設

- 高齢者介護施設市場推定・予測、2018~2030年

- 在宅ケア環境

- 在宅ケア環境市場推定・予測、2018~2030年

第7章 リハビリテーションロボット市場セグメント分析、地域別、タイプ別、四肢別、最終用途別、2018~2030年(100万米ドル)

- 地域別市場シェア分析、2024年と2030年

- 地域別市場ダッシュボード

- 地域市場のスナップショット

- リハビリテーションロボットの地域別市場シェア、2024年と2030年

- 北米

- 北米のリハビリテーションロボット市場、2018~2030年

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のリハビリテーションロボット市場、2018~2030年

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ノルウェー

- スウェーデン

- デンマーク

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- タイ

- ラテンアメリカ

- ブラジル

- アルゼンチン

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- クウェート

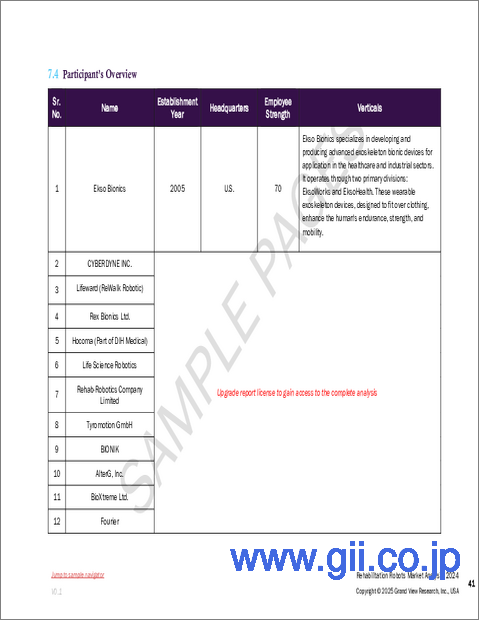

第8章 競合情勢

- 主要市場参入企業による最近の動向と影響分析

- 企業分類

- 企業プロファイル

- Tyromotion GmbH

- Life Science Robotics ApS

- Hocoma AG(DIH International Ltd.)

- Rex Bionics Ltd

- Kinova Inc.

- Rehab-Robotics Company Limited

- ReWalk Robotics Ltd

- Ekso Bionics Holdings Inc.

- Cyberdyne Inc.

- Bionik Laboratories Corporation

List of Tables

- Table 1 List of Secondary Sources

- Table 2 List of Abbreviations

- Table 3 Global rehabilitation robots market, by region, 2018 - 2030 (USD Million)

- Table 4 Global rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 5 Global rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 6 Global rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 7 North America rehabilitation robots market, by region, 2018 - 2030 (USD Million)

- Table 8 North America rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 9 North America rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 10 North America rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 11 U.S. rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 12 U.S. rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 13 U.S. rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 14 Canada rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 15 Canada rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 16 Canada rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 17 Mexico rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 18 Mexico rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 19 Mexico rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 20 Europe rehabilitation robots market, by region, 2018 - 2030 (USD Million)

- Table 21 Europe rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 22 Europe rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 23 Europe rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 24 Germany rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 25 Germany rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 26 Germany rehabilitation robots market, by end use (USD Million) 2018 - 2030

- Table 27 UK rehabilitation robots market, by type (USD Million) 2018 - 2030

- Table 28 UK rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 29 UK rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 30 France rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 31 France rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 32 France rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 33 Italy rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 34 Italy rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 35 Italy rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 36 Spain rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 37 Spain rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 38 Spain rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 39 Denmark rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 40 Denmark rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 41 Denmark rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 42 Sweden rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 43 Sweden rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 44 Sweden rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 45 Norway rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 46 Norway rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 47 Norway rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 48 Asia Pacific rehabilitation robots market, by region, 2018 - 2030 (USD Million)

- Table 49 Asia Pacific Demineralized bone matrix (DBM) market, by type, 2018 - 2030 (USD Million)

- Table 50 Asia Pacific rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 51 Asia Pacific rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 52 China rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 53 China rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 54 China rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 55 Japan rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 56 Japan rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 57 Japan rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 58 India rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 59 India rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 60 India rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 61 South Korea rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 62 South Korea rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 63 South Korea rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 64 Australia rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 65 Australia rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 66 Australia rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 67 Thailand rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 68 Thailand Demineralized bone matrix (DBM) market, by extremity, 2018 - 2030 (USD Million)

- Table 69 Thailand Demineralized bone matrix (DBM) market, by end use, 2018 - 2030 (USD Million)

- Table 70 Latin America rehabilitation robots market, by region, 2018 - 2030 (USD Million)

- Table 71 Latin America rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 72 Latin America rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 73 Latin America rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 74 Brazil rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 75 Brazil rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 76 Brazil rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 77 Argentina rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 78 Argentina rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 79 Argentina rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 80 MEA rehabilitation robots market, by region, 2018 - 2030 (USD Million)

- Table 81 MEA rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 82 MEA rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 83 MEA rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 84 South Africa rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 85 South Africa rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 86 South Africa rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 87 Saudi Arabia rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 88 Saudi Arabia rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 89 Saudi Arabia rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 90 UAE rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 91 UAE rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 92 UAE rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

- Table 93 Kuwait rehabilitation robots market, by type, 2018 - 2030 (USD Million)

- Table 94 Kuwait rehabilitation robots market, by extremity, 2018 - 2030 (USD Million)

- Table 95 Kuwait rehabilitation robots market, by end use, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Market research process

- Fig. 2 Data triangulation techniques

- Fig. 3 Primary research pattern

- Fig. 4 Market research approaches

- Fig. 5 Value-chain-based sizing & forecasting

- Fig. 6 QFD modeling for market share assessment

- Fig. 7 Market formulation & validation

- Fig. 8 Rehabilitation robots market: outlook

- Fig. 9 Rehabilitation robots competitive insights

- Fig. 10 Parent market outlook

- Fig. 11 Rehabilitation robots market driver impact

- Fig. 12 Rehabilitation robots market restraint impact

- Fig. 13 Porter's Analysis

- Fig. 14 PESTLE Analysis

- Fig. 15 Rehabilitation robots market: Type movement analysis

- Fig. 16 Rehabilitation robots market: Type outlook and key takeaways

- Fig. 17 Therapy robots market estimates and forecast, 2018 - 2030

- Fig. 18 Exoskeletons market estimates and forecast, 2018 - 2030

- Fig. 19 Rehabilitation robots market: Extremity movement analysis

- Fig. 20 Rehabilitation robots market: Extremity outlook and key takeaways

- Fig. 21 Upper body market estimates and forecast, 2018 - 2030

- Fig. 22 Lower body estimates and forecast, 2018 - 2030

- Fig. 23 Rehabilitation robots market: End use movement analysis

- Fig. 24 Rehabilitation robots market: End use outlook and key takeaways

- Fig. 25 Hospitals & clinics market estimates and forecast, 2018 - 2030

- Fig. 26 Senior care facilities estimates and forecast, 2018 - 2030

- Fig. 27 Homecare settings estimates and forecast, 2018 - 2030

- Fig. 28 Global rehabilitation robots market: Regional movement analysis

- Fig. 29 Global rehabilitation robots market: Regional outlook and key takeaways

- Fig. 30 North America rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 31 Key country dynamics

- Fig. 32 U.S. rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 33 Key country dynamics

- Fig. 34 Canada rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 35 Key country dynamics

- Fig. 36 Mexico rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 37 Europe rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 38 Key country dynamics

- Fig. 39 UK rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 40 Key country dynamics

- Fig. 41 Germany rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 42 Key country dynamics

- Fig. 43 Spain rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 44 Key country dynamics

- Fig. 45 France rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 46 Key country dynamics

- Fig. 47 Italy rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 48 Key country dynamics

- Fig. 49 Norway rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 50 Key country dynamics

- Fig. 51 Denmark rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 52 Key country dynamics

- Fig. 53 Sweden rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 54 Asia Pacific rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 55 Key country dynamics

- Fig. 56 Japan rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 57 Key country dynamics

- Fig. 58 China rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 59 Key country dynamics

- Fig. 60 India rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 61 Key country dynamics

- Fig. 62 Australia rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 63 Key country dynamics

- Fig. 64 South Korea rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 65 Key country dynamics

- Fig. 66 Thailand rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 67 Latin America rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 68 Key country dynamics

- Fig. 69 Brazil rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 70 Key country dynamics

- Fig. 71 Argentina rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 72 MEA rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 73 Key country dynamics

- Fig. 74 South Africa rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 75 Key country dynamics

- Fig. 76 Saudi Arabia rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 77 Key country dynamics

- Fig. 78 UAE rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 79 Key country dynamics

- Fig. 80 Kuwait rehabilitation robots market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 81 Key company categorization

- Fig. 82 Heat map analysis, 2023 - 2024

Rehabilitation Robots Market Growth & Trends:

The global rehabilitation robots market size is estimated to reach USD 1.03 billion by 2030, registering to grow at a CAGR of 15.2% from 2025 to 2030 according to a new report by Grand View Research, Inc. The major factors driving the industry growth are the high per capita healthcare spending and rapid adoption of technologically advanced instruments. The demand for rehabilitation robots is increasing, as these are beneficial in improving the quality of life of individuals with conditions such as spinal cord injury, paralysis, and others. The rising number of product approvals by regulatory bodies such as the FDA is expected to further propel the growth in the forecast period. Increasing incidence of spinal cord injury and musculoskeletal disorders are driving the adoption of robots for rehabilitation purposes.

The high purchasing and maintenance costs of rehabilitation robots along with stringent approval procedures are some factors that may hamper the market growth in the coming future. Furthermore, COVID 19 also significantly impacted the industry growth. However, constant strategic initiatives in the form of product launches, partnerships, and acquisitions have increased the competition in the industry, thereby supporting growth. In addition, growing technological advancements and increasing expenditure by key players in R&D processes are one of the major factors boosting the market growth.

The lower body extremity held the largest revenue share in 2024. An increase in the prevalence of lower body disabilities, a rapidly aging population, and paralyzed patients are anticipated to boost the adoption, penetration, & growth of the lower-body exoskeleton market. Although, the upper body extremity is expected to have the fastest CAGR of 17.6% over the forecast period.

Hospitals & clinics held the largest market share of 47.1% in 2024. The growth is majorly attributed due to growing healthcare expenditure, and rapid adoption of advanced technology in healthcare facilities. However, senior care facilities are expected to grow with the fastest CAGR over the forecast period. The growth can be attributed to the growing demand for better healthcare facilities for senior citizens and the rising geriatric population.

North America held the largest share in the year 2024. The increasing prevalence of spinal cord injury in the region is fueling the market growth. The rising geriatric population and growing disabled population are among the factors boosting the adoption of rehabilitation robots. However, Asia Pacific is expected to grow at the fastest growth rate during the forecast period.

Rehabilitation Robots Market Report Highlights:

- In 2024, the exoskeletons segment dominated the rehabilitation robots market and accounted for the largest revenue share. The growing elderly population is expected to contribute to an increase in the usage of exoskeletons.

- In 2024, the lower body segment dominated the market and accounted for the largest revenue share. The lower-body segment is expected to experience increased adoption, penetration, and growth due to a rapidly aging population, a rise in the incidence of lower body disabilities, and an increase in paralyzed patients.

- In 2024, the hospitals & clinics segment dominated the market and accounted for the largest revenue share of 47.1%. However, senior care facilities segment in the market is anticipated to witness significant growth over the forecast period due to the rising geriatric population.

- North America dominated the Rehabilitation Robots market with 45.1% of the total share in 2024, whereas emerging economies such as the Asia Pacific are anticipated to exhibit the fastest growth rate during the forecast period.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.1.1. Segment scope

- 1.1.2. Regional scope

- 1.1.3. Estimates and forecast timeline

- 1.2. Research Methodology

- 1.3. Information Procurement

- 1.3.1. Purchased database

- 1.3.2. GVR's internal database

- 1.3.3. Secondary sources

- 1.3.4. Primary research

- 1.3.5. Details of primary research

- 1.4. Information or Data Analysis

- 1.4.1. Data analysis models

- 1.5. Market Formulation & Validation

- 1.6. Model Details

- 1.7. Research Assumptions

- 1.8. List of Secondary Sources

- 1.9. List of Primary Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.2.1. Type outlook

- 2.2.2. Extremity outlook

- 2.2.3. End use outlook

- 2.2.4. Regional outlook

- 2.3. Competitive Insights

Chapter 3. Rehabilitation Robots Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Parent market outlook

- 3.2. Market Dynamics

- 3.2.1. Market driver analysis

- 3.2.2. Market restraint analysis

- 3.3. Rehabilitation Robots: Market Analysis Tools

- 3.3.1. Industry Analysis - Porter's

- 3.3.2. PESTLE Analysis

- 3.4. Technology Timeline Analysis

Chapter 4. Rehabilitation Robots Market Segment Analysis, By Type, 2018 - 2030 (USD Million)

- 4.1. Definition and Scope

- 4.2. Type Market Share Analysis, 2024 & 2030

- 4.3. Segment Dashboard

- 4.4. Global Rehabilitation Robots Market, by Type, 2018 to 2030

- 4.5. Therapy robots

- 4.5.1. Therapy robots market estimates and forecasts, 2018 to 2030 (USD Million)

- 4.6. Exoskeletons

- 4.6.1. Exoskeletons market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 5. Rehabilitation Robots Market Segment Analysis, By Extremity, 2018 - 2030 (USD Million)

- 5.1. Definition and Scope

- 5.2. Extremity Market Share Analysis, 2024 & 2030

- 5.3. Segment Dashboard

- 5.4. Global Rehabilitation Robots Market, by Extremity, 2018 to 2030

- 5.5. Upper body

- 5.5.1. Upper body market estimates and forecasts, 2018 to 2030 (USD Million)

- 5.6. Lower body

- 5.6.1. Lower body market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 6. Rehabilitation Robots Market Segment Analysis, By End Use, 2018 - 2030 (USD Million)

- 6.1. Definition and Scope

- 6.2. End Use Market Share Analysis, 2024 & 2030

- 6.3. Segment Dashboard

- 6.4. Global Rehabilitation Robots Market, by End Use, 2018 to 2030

- 6.5. Hospitals & clinics

- 6.5.1. Hospitals & clinics market estimates and forecasts, 2018 to 2030 (USD Million)

- 6.6. Senior care facilities

- 6.6.1. Senior care facilities market estimates and forecasts, 2018 to 2030 (USD Million)

- 6.7. Homecare settings

- 6.7.1. Homecare settings market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 7. Rehabilitation Robots Market Segment Analysis, By Region, By Type, By Extremity, By End Use, 2018 - 2030 (USD Million)

- 7.1. Regional Market Share Analysis, 2024 & 2030

- 7.2. Regional Market Dashboard

- 7.3. Regional Market Snapshot

- 7.4. Rehabilitation Robots Market Share by Region, 2024 & 2030:

- 7.5. North America

- 7.5.1. North America rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.5.2. U.S.

- 7.5.2.1. U.S. rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.5.3. Canada

- 7.5.3.1. Canada rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.5.4. Mexico

- 7.5.4.1. Mexico rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.6. Europe

- 7.6.1. Europe rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.6.2. UK

- 7.6.2.1. UK rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.6.3. Germany

- 7.6.3.1. Germany rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.6.4. France

- 7.6.4.1. France rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.6.5. Italy

- 7.6.5.1. Italy rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.6.6. Spain

- 7.6.6.1. Spain rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.6.7. Norway

- 7.6.7.1. Norway rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.6.8. Sweden

- 7.6.8.1. Sweden rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.6.9. Denmark

- 7.6.9.1. Denmark rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.7. Asia Pacific

- 7.7.1. Japan

- 7.7.1.1. Japan rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.7.2. China

- 7.7.2.1. China rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.7.3. India

- 7.7.3.1. India rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.7.4. Australia

- 7.7.4.1. Australia rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.7.5. South Korea

- 7.7.5.1. South Korea rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.7.6. Thailand

- 7.7.6.1. Thailand rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.7.1. Japan

- 7.8. Latin America

- 7.8.1. Brazil

- 7.8.1.1. Brazil rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.8.2. Argentina

- 7.8.2.1. Argentina rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.8.1. Brazil

- 7.9. MEA

- 7.9.1. South Africa

- 7.9.1.1. South Africa rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.9.2. Saudi Arabia

- 7.9.2.1. Saudi Arabia rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.9.3. UAE

- 7.9.3.1. UAE rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.9.4. Kuwait

- 7.9.4.1. Kuwait rehabilitation robots market, 2018 - 2030 (USD Million)

- 7.9.1. South Africa

Chapter 8. Competitive Landscape

- 8.1. Recent Developments & Impact Analysis, By Key Market Participants

- 8.2. Company Categorization

- 8.3. Company Profiles

- 8.3.1. Tyromotion GmbH

- 8.3.1.1. Company overview

- 8.3.1.2. Financial performance

- 8.3.1.3. Product benchmarking

- 8.3.1.4. Strategic initiatives

- 8.3.2. Life Science Robotics ApS

- 8.3.2.1. Company overview

- 8.3.2.2. Financial performance

- 8.3.2.3. Product benchmarking

- 8.3.2.4. Strategic initiatives

- 8.3.3. Hocoma AG (DIH International Ltd.)

- 8.3.3.1. Company overview

- 8.3.3.2. Financial performance

- 8.3.3.3. Product benchmarking

- 8.3.3.4. Strategic initiatives

- 8.3.4. Rex Bionics Ltd

- 8.3.4.1. Company overview

- 8.3.4.2. Financial performance

- 8.3.4.3. Product benchmarking

- 8.3.4.4. Strategic initiatives

- 8.3.5. Kinova Inc.

- 8.3.5.1. Company overview

- 8.3.5.2. Financial performance

- 8.3.5.3. Product benchmarking

- 8.3.5.4. Strategic initiatives

- 8.3.6. Rehab-Robotics Company Limited

- 8.3.6.1. Company overview

- 8.3.6.2. Financial performance

- 8.3.6.3. Product benchmarking

- 8.3.6.4. Strategic initiatives

- 8.3.7. ReWalk Robotics Ltd

- 8.3.7.1. Company overview

- 8.3.7.2. Financial performance

- 8.3.7.3. Product benchmarking

- 8.3.7.4. Strategic initiatives

- 8.3.8. Ekso Bionics Holdings Inc.

- 8.3.8.1. Company overview

- 8.3.8.2. Financial performance

- 8.3.8.3. Product benchmarking

- 8.3.8.4. Strategic initiatives

- 8.3.9. Cyberdyne Inc.

- 8.3.9.1. Company overview

- 8.3.9.2. Financial performance

- 8.3.9.3. Product benchmarking

- 8.3.9.4. Strategic initiatives

- 8.3.10. Bionik Laboratories Corporation

- 8.3.10.1. Company overview

- 8.3.10.2. Financial performance

- 8.3.10.3. Product benchmarking

- 8.3.10.4. Strategic initiatives

- 8.3.1. Tyromotion GmbH