|

|

市場調査レポート

商品コード

1493325

米国の体外受精市場規模、シェア、動向分析レポート:機器別、施術タイプ別、最終用途別、セグメント別予測、2024年~2030年U.S. In Vitro Fertilization Market Size, Share & Trends Analysis Report By Instrument (Disposable Devices, Capital Equipment) By Procedure Type (Fresh Donor, Frozen Donor) By End-use, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 米国の体外受精市場規模、シェア、動向分析レポート:機器別、施術タイプ別、最終用途別、セグメント別予測、2024年~2030年 |

|

出版日: 2024年05月24日

発行: Grand View Research

ページ情報: 英文 70 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

米国の体外受精市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、米国の体外受精市場規模は2024年から2030年にかけてCAGR 4.4%で拡大し、2030年には72億4,000万米ドルに達すると予測されています。

夫婦間の不妊症の有病率の上昇、体外受精の技術や手法の絶え間ない進歩、家族に対する社会の規範や態度の変化が、米国における体外受精サービスの需要増加に大きく寄与しています。

体外受精を含む生殖補助医療を取り巻く規制状況も市場力学に影響を与えています。体外受精の実施、クリニックの認定基準、倫理的配慮を規定する規制は、米国における体外受精サービスのアクセシビリティと質に影響を与えます。規制の変更は、治療費、クリニックの運営、患者の安全性などの要因に影響を与えることで、市場の成長を促進することも阻害することもあります。

不妊の問題や利用可能な治療法に関する一般市民の意識の高まりは、米国の体外受精市場の成長を促進する上で重要な役割を果たしています。教育キャンペーン、メディア報道、アドボカシー活動は、不妊症の非人間性を高め、体外受精のような不妊治療に対する理解を促進するのに役立っています。認知度が高まったことで、体外受精による不妊治療について十分な情報を得た上で決断できるようになった。

米国の体外受精市場レポート・ハイライト

- 機器別では、培養培地分野が2023年に約40%のシェアを占め、市場を独占しています。

- ディスポーザブル機器分野は予測期間中に最も速いCAGRで成長する見込みです。

- 施術タイプに基づくと、新鮮な非ドナー分野が2023年に45%以上の最大市場シェアを占めました。新鮮なサイクルは、妊娠を成功させるために必要な治療サイクルが少なくて済む可能性があるため、費用対効果が高いと認識されることが多いです。

- 冷凍ドナーは、その利便性と柔軟性により、予測期間中に最も速いCAGRを記録すると予想されています。

- 不妊治療クリニック市場は、2023年に約80%のシェアを占め、予測期間中に最も速いCAGRで成長すると予想されます。

- ART治療に対する需要の高まりにより、不妊治療クリニックやARTセンターの数が大幅に増加しています。

- 2023年10月、Merck &Co.は、不妊治療のための金融サービスを従業員に提供することを目的としたFertility benefit programの開始を発表しました。サービスの範囲は、体外受精治療、不妊検査、ホルモン治療などです。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 米国の体外受精市場の変数、動向、範囲

- 市場系統の見通し

- 親市場の見通し

- 関連/付随市場の見通し

- 市場力学

- 市場牽引要因分析

- 市場抑制要因分析

- 米国の体外受精市場分析ツール

- 業界分析- ポーターのファイブフォース分析

- PESTEL分析

第4章 米国の体外受精市場:機器の推定・動向分析

- 機器市場シェア、2023年および2030年

- セグメントダッシュボード

- 米国の体外受精市場、機器別展望

- 2018年から2030年までの市場規模と予測および動向分析

- ディスポーザブル培地

- 培養培地

- 主要機器

第5章 米国の体外受精市場: 施術タイプの推定・動向分析

- 施術タイプの市場シェア、2023年と2030年

- セグメントダッシュボード

- 米国の体外受精市場:手順タイプ別展望

- 2018年から2030年までの市場規模と予測および動向分析

- 新鮮ドナー

- 冷凍ドナー

- 新鮮非ドナー

- 冷凍非ドナー

第6章 米国の体外受精市場:最終用途の推定・動向分析

- 最終用途市場シェア、2023年および2030年

- セグメントダッシュボード

- 最終用途別米国の体外受精市場展望

- 2018年から2030年までの市場規模と予測および動向分析

- 施設クリニック

- 病院・その他の環境

第7章 競合情勢

- 主要市場参入企業による最近の動向と影響分析

- 企業/競合の分類

- ベンダー情勢

- 企業プロファイル

- Bayer AG

- Cook Medical LLC

- EMD Serono, Inc.

- Ferring BV

- FUJIFILM Irvine Scientific(FUJIFILM Holdings Corporation)

- Genea Biomedx

- EMD Serono, Inc.(Merck KGaA)

- Merck &Co., Inc.

- The Cooper Companies, Inc.

- Thermo Fisher Scientific, Inc.

- Vitrolife

- Nova IVF

- RMA Network(Reproductive Medicine Associates)

- US Fertility

List of Tables

- Table 1 List of abbreviations

- Table 2 U.S. in vitro fertilization market, by instrument, 2018 - 2030 (USD Million)

- Table 3 U.S. in vitro fertilization market, by procedure type, 2018 - 2030 (USD Million)

- Table 4 U.S. in vitro fertilization market, by end - use, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Market research process

- Fig. 2 Data triangulation techniques

- Fig. 3 Primary research pattern

- Fig. 4 Market research approaches

- Fig. 5 Value-chain-based sizing & forecasting

- Fig. 6 QFD modeling for market share assessment

- Fig. 7 Market formulation & validation

- Fig. 8 U.S. in vitro fertilization market: market outlook

- Fig. 9 U.S. in vitro fertilization competitive insights

- Fig. 10 Parent market outlook

- Fig. 11 Related/ancillary market outlook

- Fig. 12 Penetration and growth prospect mapping

- Fig. 13 U.S. in vitro fertilization market driver impact

- Fig. 14 U.S. in vitro fertilization market restraint impact

- Fig. 15 U.S. in vitro fertilization market: Instrument movement analysis

- Fig. 16 U.S. in vitro fertilization market: Instrument outlook and key takeaways

- Fig. 17 Radiofrequency ablation market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 18 Disposable devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 19 Culture Media market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 20 Cryopreservation media market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 21 Embryo culture media market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 22 Ovum processing media market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 23 Sperm processing media market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 24 Capital equipment market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 25 Sperm analyzer systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 26 Imaging systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 27 Ovum aspiration pumps market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 28 Micromanipulator market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 29 Incubators market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 30 Gas analyzers market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 31 Laser systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 32 Cryosystems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 33 Sperm separation devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 34 IVF cabinets market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 35 Anti - vibration tables market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 36 Witness systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 37 Others market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 38 U.S. in vitro fertilization market: Procedure type movement Analysis

- Fig. 39 U.S. in vitro fertilization market: Procedure type outlook and key takeaways

- Fig. 40 Surgical ablation market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 41 Fresh donor market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 42 Frozen donor market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 43 Fresh non - donor market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 44 Frozen non - donor market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 45 U.S. in vitro fertilization market: End - use outlook and key takeaways

- Fig. 46 Fertility clinics market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 47 Hospitals and other settings market estimates and forecasts, 2018 - 2030 (USD Million)

U.S. In Vitro Fertilization Market Growth & Trends:

The U.S. in vitro fertilization market size is anticipated to reach USD 7.24 billion by 2030, expanding at a CAGR of 4.4% from 2024 to 2030, according to a new report by Grand View Research, Inc. The rising prevalence of infertility among couples, the continuous advancements in IVF technology and techniques, and the shift in societal norms and attitudes toward family have significantly contributed to the increasing demand for IVF services in the U.S.

The regulatory landscape surrounding assisted reproductive technologies, including IVF, also influences market dynamics. Regulations governing IVF practices, clinic accreditation standards, and ethical considerations impact the accessibility and quality of IVF services in the U.S. Changes in regulations can either facilitate or hinder market growth by affecting factors such as treatment costs, clinic operations, and patient safety.

Increased public awareness about infertility issues and available treatment options has played a crucial role in driving the growth of the U.S. IVF market. Educational campaigns, media coverage, and advocacy efforts have helped destigmatize infertility and promote understanding about fertility treatments like IVF. Greater awareness empowers individuals to make informed decisions about seeking fertility assistance through IVF.

U.S. In Vitro Fertilization Market Report Highlights:

- Based on instruments, the culture media segment dominated the market with around 40% share in 2023 owing to as availability of funding and an increase in research activities

- The disposable devices segment is expected to grow at the fastest CAGR over the forecast period

- Based on procedure type, the fresh non-donor segment held the largest market share of over 45% in 2023. Fresh cycles are often perceived as more cost-effective due to potentially requiring fewer treatment cycles to achieve a successful pregnancy

- Frozen donors are expected to register the fastest CAGR during the forecast period owing to the convenience and flexibility offered by them

- The fertility clinics segment dominated the market with around 80% share in 2023 and is expected to grow at the fastest CAGR over the forecast period

- The increasing demand for ART treatments has led to a significant rise in the number of fertility clinics and ART centers

- In October 2023, Merck & Co. announced the launch of Fertility benefit program with the aim to provide financial services to employees for fertility treatments. The range of services includes IVF treatments, fertility tests, and hormonal treatments

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Segment Definitions

- 1.2.1. Instrument

- 1.2.2. Procedure type

- 1.2.3. End-use

- 1.2.4. Estimates and forecasts timeline

- 1.3. Research Methodology

- 1.4. Information Procurement

- 1.4.1. Purchased database

- 1.4.2. GVR's internal database

- 1.4.3. Secondary sources

- 1.4.4. Primary research

- 1.5. Information or Data Analysis

- 1.5.1. Data analysis models

- 1.6. Market Formulation & Validation

- 1.7. Model Details

- 1.7.1. Commodity flow analysis (Model 1)

- 1.7.2. Volume price analysis (Model 2)

- 1.8. List of Secondary Sources

- 1.9. List of Primary Sources

- 1.10. Objectives

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.2.1. Instrument outlook

- 2.2.2. Procedure type

- 2.2.3. End-use

- 2.3. Competitive Insights

Chapter 3. U.S. In Vitro Fertilization Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Parent market outlook

- 3.1.2. Related/ancillary market outlook

- 3.2. Market Dynamics

- 3.2.1. Market driver analysis

- 3.2.2. Market restraint analysis

- 3.3. U.S. In Vitro Fertilization Market Analysis Tools

- 3.3.1. Industry Analysis - Porter's

- 3.3.1.1. Supplier power

- 3.3.1.2. Buyer power

- 3.3.1.3. Substitution threat

- 3.3.1.4. Threat of new entrant

- 3.3.1.5. Competitive rivalry

- 3.3.2. PESTEL Analysis

- 3.3.2.1. Political landscape

- 3.3.2.2. Technological landscape

- 3.3.2.3. Economic landscape

- 3.3.1. Industry Analysis - Porter's

Chapter 4. U.S. In Vitro Fertilization Market: Instrument Estimates & Trend Analysis

- 4.1. Instrument Market Share, 2023 & 2030

- 4.2. Segment Dashboard

- 4.3. U.S. In Vitro Fertilization Market by Instrument Outlook

- 4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the Following

- 4.4.1. Disposable media

- 4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.2. Culture media

- 4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.2.2. Cryopreservation Media

- 4.4.2.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.2.3. Embryo culture media

- 4.4.2.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.2.4. Ovum Processing Media

- 4.4.2.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.2.5. Sperm Processing Media

- 4.4.2.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3. Capital Equipment

- 4.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3.2. Sperm Analyzer Systems

- 4.4.3.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3.3. Imaging Systems

- 4.4.3.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3.4. Ovum Aspiration Pumps

- 4.4.3.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3.5. Micromanipulator Systems

- 4.4.3.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3.6. Incubators

- 4.4.3.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3.7. Gas Analyzers

- 4.4.3.7.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3.8. Laser Systems

- 4.4.3.8.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3.9. Cryosystems

- 4.4.3.9.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3.10. Sperm Separation Devices

- 4.4.3.10.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3.11. IVF Cabinets

- 4.4.3.11.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3.12. Anti-vibration Tables

- 4.4.3.12.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3.13. Witness Systems

- 4.4.3.13.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3.14. Other

- 4.4.3.14.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.1. Disposable media

Chapter 5. U.S. In Vitro Fertilization Market: Procedure Type Estimates & Trend Analysis

- 5.1. Procedure Type Market Share, 2023 & 2030

- 5.2. Segment Dashboard

- 5.3. U.S. In Vitro Fertilization Market by Procedure Type Outlook

- 5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the Following

- 5.4.1. Fresh Donor

- 5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 5.4.2. Frozen Donor

- 5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 5.4.3. Fresh Non-donor

- 5.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 5.4.4. Frozen Non-donor

- 5.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 5.4.1. Fresh Donor

Chapter 6. U.S. In Vitro Fertilization Market: End-use Estimates & Trend Analysis

- 6.1. End-use Market Share, 2023 & 2030

- 6.2. Segment Dashboard

- 6.3. U.S. In Vitro Fertilization Market by End-use Outlook

- 6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the Following

- 6.4.1. Fertility Clinics

- 6.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 6.4.2. Hospitals & Others Setting

- 6.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 6.4.1. Fertility Clinics

Chapter 7. Competitive Landscape

- 7.1. Recent Developments & Impact Analysis, By Key Market Participants

- 7.2. Company/Competition Categorization

- 7.3. Vendor Landscape

- 7.3.1. List of key distributors and channel partners

- 7.3.2. Key customers

- 7.3.3. Key company heat map analysis, 2023

- 7.4. Company Profiles

- 7.4.1. Bayer AG

- 7.4.1.1. Company overview

- 7.4.1.2. Financial performance

- 7.4.1.3. Product benchmarking

- 7.4.1.4. Strategic initiatives

- 7.4.2. Cook Medical LLC

- 7.4.2.1. Company overview

- 7.4.2.2. Financial performance

- 7.4.2.3. Product benchmarking

- 7.4.2.4. Strategic initiatives

- 7.4.3. EMD Serono, Inc.

- 7.4.3.1. Company overview

- 7.4.3.2. Financial performance

- 7.4.3.3. Product benchmarking

- 7.4.3.4. Strategic initiatives

- 7.4.4. Ferring B.V.

- 7.4.4.1. Company overview

- 7.4.4.2. Financial performance

- 7.4.4.3. Product benchmarking

- 7.4.4.4. Strategic initiatives

- 7.4.5. FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation)

- 7.4.5.1. Company overview

- 7.4.5.2. Financial performance

- 7.4.5.3. Product benchmarking

- 7.4.5.4. Strategic initiatives

- 7.4.6. Genea Biomedx

- 7.4.6.1. Company overview

- 7.4.6.2. Financial performance

- 7.4.6.3. Product benchmarking

- 7.4.6.4. Strategic initiatives

- 7.4.7. EMD Serono, Inc. (Merck KGaA)

- 7.4.7.1. Company overview

- 7.4.7.2. Financial performance

- 7.4.7.3. Product benchmarking

- 7.4.7.4. Strategic initiatives

- 7.4.8. Merck & Co., Inc.

- 7.4.8.1. Company overview

- 7.4.8.2. Financial performance

- 7.4.8.3. Product benchmarking

- 7.4.8.4. Strategic initiatives

- 7.4.9. The Cooper Companies, Inc.

- 7.4.9.1. Company overview

- 7.4.9.2. Financial performance

- 7.4.9.3. Product benchmarking

- 7.4.9.4. Strategic initiatives

- 7.4.10. Thermo Fisher Scientific, Inc.

- 7.4.10.1. Company overview

- 7.4.10.2. Financial performance

- 7.4.10.3. Product benchmarking

- 7.4.10.4. Strategic initiatives

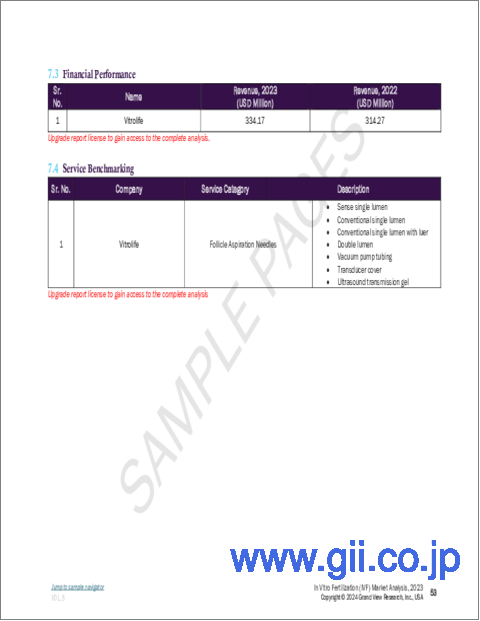

- 7.4.11. Vitrolife

- 7.4.11.1. Company overview

- 7.4.11.2. Financial performance

- 7.4.11.3. Product benchmarking

- 7.4.11.4. Strategic initiatives

- 7.4.12. Nova IVF

- 7.4.12.1. Company overview

- 7.4.12.2. Financial performance

- 7.4.12.3. Product benchmarking

- 7.4.12.4. Strategic initiativesc

- 7.4.13. RMA Network (Reproductive Medicine Associates)

- 7.4.13.1. Company overview

- 7.4.13.2. Financial performance

- 7.4.13.3. Product benchmarking

- 7.4.13.4. Strategic initiatives

- 7.4.14. U.S. Fertility

- 7.4.14.1. Company overview

- 7.4.14.2. Financial performance

- 7.4.14.3. Product benchmarking

- 7.4.14.4. Strategic initiatives

- 7.4.1. Bayer AG