|

|

市場調査レポート

商品コード

1446529

鋼管市場の市場規模、シェア、動向分析レポート:技術別、用途別、地域別、セグメント別予測、2024年~2030年Steel Pipes & Tubes Market Size, Share & Trends Analysis Report By Technology (Seamless, ERW, SAW), By Application (Oil & Gas, Power Plant), By Region, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 鋼管市場の市場規模、シェア、動向分析レポート:技術別、用途別、地域別、セグメント別予測、2024年~2030年 |

|

出版日: 2024年02月20日

発行: Grand View Research

ページ情報: 英文 100 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

鋼管市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、世界の鋼管市場規模は2030年までに1,926億米ドルに達し、2024年から2030年までのCAGRは6.1%で拡大する見込みです。

水道システムを改善するための世界各国の政府による投資の増加は、予測期間中に鋼管需要を促進すると予想されています。

2022年3月、米国環境保護庁(EPA)は、国内の一部地域で飲料水の汚染に対する懸念が高まっていることを考慮し、清潔な水のインフラ整備に使用する500億米ドルの基金を公開すると発表しました。こうした投資は、予測期間中、水処理用途の市場成長を促進すると予想されます。

石油・ガス産業では、鋼管はコンクリート杭、コンベアベルトのローラーベアリング、肉厚など幅広い用途に使用されています。この用途分野は、海洋探査・生産への投資の増加が製品需要をさらに後押ししているため、予測期間中も優位性を維持すると予想されます。

例えば、2022年6月、オランダとドイツは共同で北海に新しいガス田を掘削すると発表しました。この油田からの最初のガスは2024年末までに発生すると予想されています。これは、予測期間中の市場成長にプラスの影響を与えると予想されます。

地域別では、アジア太平洋地域が予測期間を通じて収益ベースでCAGR 7.2%と最も速い成長を記録すると予想されます。化学・石油化学と電力産業への投資の増加が市場成長を促進すると予想されます。例えば、中国のDushanzi Petrochemical Corpは2023年9月、新疆ウイグル自治区で30億米ドル規模の石油化学コンプレックスの建設を開始しました。この新プラントの操業開始は2026年と予想されています。

生産能力の拡大は、競合他社と歩調を合わせるために市場プレーヤーが採用している主要な戦略的イニシアチブのひとつです。例えば、Rama Steel Tube Ltd.は2023年2月、インドのKhopoliにある工場で能力拡張を完了しました。これは、特殊グレードの構造用鋼と高厚チューブのための3万MTの拡張です。

鋼管市場レポートハイライト:

- 技術別では、電縫鋼管が予測期間中に6.3%の成長率を記録すると予想されます。この成長は、コスト効率の高い製造プロセスによるものです。

- 用途別では、化学・石油化学が2024年から2030年にかけてCAGR 6.1%で成長すると予測されています。スチールパイプ&チューブは、高い耐酸化性や耐腐食性などの特性により、石油化学処理プラントでの精製プロセスで使用されています。

- 地域別では、北米が2023年の世界市場で第2位の収益シェアを占めています。成長が見込まれる背景には、海洋石油・ガス生産への投資の増加があります。

- 石油・ガスを供給するためのパイプライン網建設への投資の増加は、今後数年間の鋼管需要を促進すると予想されます。例えば、Pipeline &Gas Journalによると、2024年1月現在、4万1,999マイルのパイプラインが建設中であり、8万5,557マイルが計画中です。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 市場変数、動向、および範囲

- 市場の見通し

- 業界のバリューチェーン分析

- 原材料の動向

- 販売チャネル分析

- 規制の枠組み

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 業界の課題

- 市場機会

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

- PESTLE分析

- 政治的

- 経済的

- 社会的情勢

- テクノロジー

- 環境

- 法律上

第4章 鋼管市場:技術推定・動向分析

- 鋼管市場:技術変動分析、2023年および2030年

- シームレス

- 電縫溶接

- サブマージアーク溶接

第5章 鋼管市場:用途推定・動向分析

- 鋼管市場:用途変動分析、2023年および2030年

- 石油ガス

- 化学および石油化学

- 自動車と輸送

- 機械工学

- 発電所

- 工事

- その他

第6章 鋼管市場:地域推定・動向分析

- 地域のスナップショット

- 鋼管市場:地域変動分析、2023年および2030年

- 北米

- 市場推計・予測、2018~2030年

- テクノロジー別、2018~2030年

- 用途別、2018年~2030年

- 米国

- カナダ

- メキシコ

- 欧州

- 市場推計・予測、2018~2030年

- テクノロジー別、2018~2030年

- 用途別、2018年~2030年

- ドイツ

- ロシア

- フランス

- イタリア

- アジア太平洋地域

- 市場推計・予測、2018~2030年

- テクノロジー別、2018~2030年

- 用途別、2018年~2030年

- 中国

- インド

- 日本

- インドネシア

- フィリピン

- 中南米

- 市場推計・予測、2018~2030年

- テクノロジー別、2018~2030年

- 用途別、2018年~2030年

- ブラジル

- 中東とアフリカ

- 市場推計・予測、2018~2030年

- テクノロジー別、2018~2030年

- 用途別、2018年~2030年

- サウジアラビア

第7章 競合情勢

- 主要市場参入企業による最近の動向と影響分析

- Kraljic Matrix

- 企業の分類

- 企業の市場ランキング

- ヒートマップ

- 戦略マッピング

- ベンダー情勢

- List of raw material suppliers, distributors, and other prominent manufacturers

- List of prospective end-users

- 企業プロファイル

- ArcelorMittal

- United States Steel

- Nippon Steel Corporation

- Tata Steel

- Jindal Steel &Power Ltd

- Rama Steel Tubes Limited

- Steel Authority of India Limited(SAIL)

- Hyundai Steel

- VALLOUREC

- EVRAZ plc

- ThyssenKrupp AG

- JFE STEEL Corporation

List of Tables

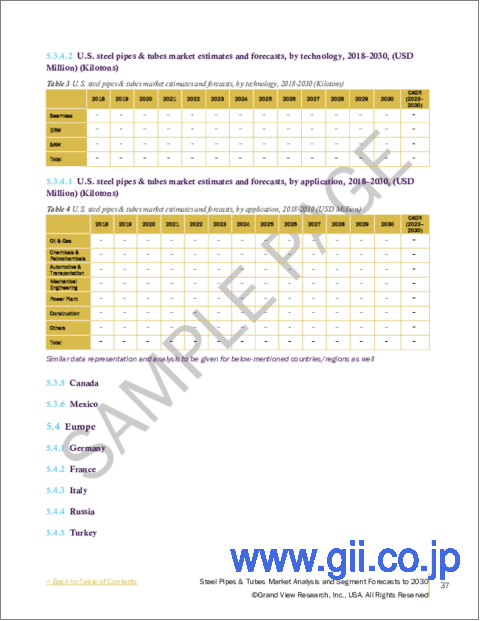

- Table 1 Steel pipes & tubes market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- Table 2 Steel pipes & tubes market estimates & forecasts, by seamless, 2018 - 2030 (USD Million) (Kilotons)

- Table 3 Steel pipes & tubes market estimates & forecasts, by ERW, 2018 - 2030 (USD Million) (Kilotons)

- Table 4 Steel pipes & tubes market estimates & forecasts, by SAW, 2018 - 2030 (USD Million) (Kilotons)

- Table 5 Steel pipes & tubes market estimates & forecasts, by oil & gas, 2018 - 2030 (USD Million) (Kilotons)

- Table 6 Steel pipes & tubes market estimates & forecasts, by chemical & petrochemical, 2018 - 2030 (USD Million) (Kilotons)

- Table 7 Steel pipes & tubes market estimates & forecasts, by construction, 2018 - 2030 (USD Million) (Kilotons)

- Table 8 Steel pipes & tubes market estimates & forecasts, by automotive & transportation, 2018 - 2030 (USD Million) (Kilotons)

- Table 9 Steel pipes & tubes market estimates & forecasts, by mechanical engineering, 2018 - 2030 (USD Million) (Kilotons)

- Table 10 Steel pipes & tubes market estimates & forecasts, by power plant, 2018 - 2030 (USD Million) (Kilotons)

- Table 11 Steel pipes & tubes market estimates & forecasts, by others, 2018 - 2030 (USD Million) (Kilotons)

- Table 12 North America steel pipes & tubes market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- Table 13 North America steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

- Table 14 North America steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (Kilotons)

- Table 15 North America steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- Table 16 North America steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- Table 17 U.S. steel pipes & tubes market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- Table 18 U.S. steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

- Table 19 U.S. steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (Kilotons)

- Table 20 U.S. steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- Table 21 U.S. steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- Table 22 Europe steel pipes & tubes market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- Table 23 Europe steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

- Table 24 Europe steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (Kilotons)

- Table 25 Europe steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- Table 26 Europe steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- Table 27 Germany steel pipes & tubes market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- Table 28 Germany steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

- Table 29 Germany steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (Kilotons)

- Table 30 Germany steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- Table 31 Germany steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- Table 32 Russia steel pipes & tubes market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- Table 33 Russia steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

- Table 34 Russia steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (Kilotons)

- Table 35 Russia steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- Table 36 Russia steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- Table 37 Turkey steel pipes & tubes market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- Table 38 Turkey steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

- Table 39 Turkey steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (Kilotons)

- Table 40 Turkey steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- Table 41 Turkey steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- Table 42 Asia Pacific steel pipes & tubes market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- Table 43 Asia Pacific steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

- Table 44 Asia Pacific steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (Kilotons)

- Table 45 Asia Pacific steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- Table 46 Asia Pacific steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- Table 47 China steel pipes & tubes market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- Table 48 China steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

- Table 49 China steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (Kilotons)

- Table 50 China steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- Table 51 China steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- Table 52 India steel pipes & tubes market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- Table 53 India steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

- Table 54 India steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (Kilotons)

- Table 55 India steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- Table 56 India steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- Table 57 Central & South America steel pipes & tubes market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- Table 58 Central & South America steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

- Table 59 Central & South America steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (Kilotons)

- Table 60 Central & South America steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- Table 61 Central & South America steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- Table 62 Brazil steel pipes & tubes market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- Table 63 Brazil steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

- Table 64 Brazil steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (Kilotons)

- Table 65 Brazil steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- Table 66 Brazil steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- Table 67 Middle East & Africa steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

- Table 68 Middle East & Africa steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (Kilotons)

- Table 69 Middle East & Africa steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- Table 70 Middle East & Africa steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- Table 71 Iran steel pipes & tubes market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- Table 72 Iran steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

- Table 73 Iran steel pipes & tubes market estimates & forecasts, by technology, 2018 - 2030 (Kilotons)

- Table 74 Iran steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- Table 75 Iran steel pipes & tubes market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

List of Figures

- Fig. 1 Market segmentation

- Fig. 2 Information procurement

- Fig. 3 Data analysis models

- Fig. 4 Market formulation and validation

- Fig. 5 Market snapshot

- Fig. 6 Segmental outlook - Technology & Application

- Fig. 7 Steel pipes & tubes market outlook, 2018 - 2030 (USD Million) (Kilotons)

- Fig. 8 Value chain analysis

- Fig. 9 Market dynamics

- Fig. 10 Porter's Analysis

- Fig. 11 PESTEL Analysis

- Fig. 12 Steel pipes & tubes market, by technology: Key takeaways

- Fig. 13 Steel pipes & tubes market, by technology: Market share, 2023 & 2030

- Fig. 14 Steel pipes & tubes market, by application: Key takeaways

- Fig. 15 Steel pipes & tubes market, by application: Market share, 2023 & 2030

- Fig. 16 Steel pipes & tubes market: Regional analysis, 2022

- Fig. 17 Steel pipes & tubes market, by region: Key takeaways

Steel Pipes & Tubes Market Growth & Trends:

The global steel pipes & tubes market size is expected to reach USD 192.60 billion by 2030, according to a new report by Grand View Research, Inc., expanding at a CAGR of 6.1% from 2024 to 2030. Increasing investment by governments across the world to improve the water system is expected to propel the demand for steel pipes & tubes over the forecast period.

In March 2022, in view of the increasing concern over drinking water contamination in certain parts of the country, the U.S. EPA announced that it would release a USD 50 billion fund to be used for the development of clean water infrastructures. Such investments are expected to fuel the market growth in water treatment applications over the forecast period.

In the oil & gas industry, steel pipes & tubes are used for a wide range of applications, such as concrete pilings, conveyor belt roller bearings, or wall thickness. This application segment is expected to maintain its dominance across the forecast period, as increasing investment in offshore exploration & production is further aiding the product demand.

For instance, in June 2022, the Netherlands and Germany jointly announced that they would drill a new gas field in the North Sea. The first gas from the field is anticipated to be generated by the end of 2024. This is expected to positively impact the market growth over the forecast period.

Based on region, Asia Pacific is expected to register the fastest growth of CAGR 7.2% in terms of revenue across the forecast period. Rising investment in chemicals & petrochemicals and the power industry is expected to drive the market growth. For instance, in September 2023, China-based Dushanzi Petrochemical Corp commenced construction of a ~USD 3 billion petrochemical complex in Xinjiang. The operations at this new plant are anticipated to begin in 2026.

Capacity expansion is one of the key strategic initiatives that is adopted by market players to keep pace with competitors. For instance, Rama Steel Tube Ltd. completed a capacity expansion in February 2023 at its plant in Khopoli, India. It is a 30,000 MT expansion for special-grade structural steel and high-thickness tubes.

Steel Pipes & Tubes Market Report Highlights:

- Based on technology, ERW is anticipated to register a growth rate of 6.3% across the forecast period. The growth is attributed to its cost-efficient manufacturing process

- Based on application, the chemicals & petrochemicals is anticipated to grow at a CAGR of 6.1% from 2024 to 2030. Steel pipes & tubes find use in petrochemical processing plants for refining processes owing to their characteristics such as high oxidation and corrosion resistance

- Based on region, North America held the second-largest revenue share in 2023 of the global market. The growth is anticipated to be driven by increasing investment in offshore oil & gas production

- Increasing investment in the construction of pipeline networks to supply oil and gas is expected to propel the demand for steel pipes in the coming years. For instance, as of January 2024, ~41,999 miles of pipeline are under construction, and 80,557 miles are in planning stage, as per the Pipeline & Gas Journal

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Information Analysis

- 1.3.2. Data Analysis Models

- 1.3.3. Market Formulation & Data Visualization

- 1.3.4. Data Validation & Publishing

- 1.4. Research Scope and Assumptions

- 1.4.1. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segmental Outlook

- 2.3. Competitive Insights

Chapter 3. Market Variables, Trends, and Scope

- 3.1. Market Outlook

- 3.2. Industry Value Chain Analysis

- 3.2.1. Raw Material Trends

- 3.2.2. Sales Channel Analysis

- 3.3. Regulatory Framework

- 3.4. Market Dynamics

- 3.4.1. Market Driver Analysis

- 3.4.2. Market Restraint Analysis

- 3.4.3. Industry Challenges

- 3.4.4. Market Opportunities

- 3.5. Porter's Five Forces Analysis

- 3.5.1. Bargaining Power of Suppliers

- 3.5.2. Bargaining Power of Buyers

- 3.5.3. Threat of Substitution

- 3.5.4. Threat of New Entrants

- 3.5.5. Competitive Rivalry

- 3.6. PESTLE Analysis

- 3.6.1. Political

- 3.6.2. Economic

- 3.6.3. Social Landscape

- 3.6.4. Technology

- 3.6.5. Environmental

- 3.6.6. Legal

Chapter 4. Steel Pipes & Tubes Market: Technology Estimates & Trend Analysis

- 4.1. Steel Pipes & Tubes Market: Technology Movement Analysis, 2023 & 2030

- 4.2. Seamless

- 4.2.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 4.3. Electric Resistance Welded

- 4.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 4.4. Submerged Arc Welded

- 4.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 5. Steel Pipes & Tubes Market: Application Estimates & Trend Analysis

- 5.1. Steel Pipes & Tubes Market: Application Movement Analysis, 2023 & 2030

- 5.2. Oil & Gas

- 5.2.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.3. Chemical & Petrochemical

- 5.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.4. Automotive & Transportation

- 5.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.5. Mechanical Engineering

- 5.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.6. Power Plant

- 5.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.7. Construction

- 5.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.8. Others

- 5.8.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 6. Steel Pipes & Tubes Market: Regional Estimates & Trend Analysis

- 6.1. Regional Snapshot

- 6.2. Steel Pipes & Tubes Market: Regional Movement Analysis, 2023 & 2030

- 6.3. North America

- 6.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.4. U.S.

- 6.3.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.4.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.5. Canada

- 6.3.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.5.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.6. Mexico

- 6.3.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.6.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.4. Europe

- 6.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.4. Germany

- 6.4.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.4.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.5. Russia

- 6.4.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.5.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.6. France

- 6.4.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.6.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.7. Italy

- 6.4.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.7.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.7.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.5. Asia Pacific

- 6.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.4. China

- 6.5.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.4.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.5. India

- 6.5.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.5.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.6. Japan

- 6.5.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.6.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.7. Indonesia

- 6.5.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.7.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.7.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.8. Philippines

- 6.5.8.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.8.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.8.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.6. Central & South America

- 6.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.6.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.6.4. Brazil

- 6.6.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.6.4.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.6.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.7. Middle East & Africa

- 6.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.7.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.7.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 6.7.4. Saudi Arabia

- 6.7.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.7.4.2. Market estimates and forecasts, by technology, 2018 - 2030 (Kilotons) (USD Million)

- 6.7.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Chapter 7. Competitive Landscape

- 7.1. Recent Developments & Impact Analysis, By Key Market Participants

- 7.2. Kraljic Matrix

- 7.3. Company Categorization

- 7.4. Company Market Ranking

- 7.5. Heat Map

- 7.6. Strategy Mapping

- 7.7. Vendor Landscape

- 7.7.1. List of raw material suppliers, distributors, and other prominent manufacturers

- 7.7.2. List of prospective end-users

- 7.8. Company Profiles

- 7.8.1. ArcelorMittal

- 7.8.1.1. Company overview

- 7.8.1.2. Financial performance

- 7.8.1.3. Product benchmarking

- 7.8.2. United States Steel

- 7.8.2.1. Company overview

- 7.8.2.2. Financial performance

- 7.8.2.3. Product benchmarking

- 7.8.3. Nippon Steel Corporation

- 7.8.3.1. Company overview

- 7.8.3.2. Financial performance

- 7.8.3.3. Product benchmarking

- 7.8.4. Tata Steel

- 7.8.4.1. Company overview

- 7.8.4.2. Financial performance

- 7.8.4.3. Product benchmarking

- 7.8.5. Jindal Steel & Power Ltd

- 7.8.5.1. Company overview

- 7.8.5.2. Financial performance

- 7.8.5.3. Product benchmarking

- 7.8.6. Rama Steel Tubes Limited

- 7.8.6.1. Company overview

- 7.8.6.2. Financial performance

- 7.8.6.3. Product benchmarking

- 7.8.7. Steel Authority of India Limited (SAIL)

- 7.8.7.1. Company overview

- 7.8.7.2. Financial performance

- 7.8.7.3. Product benchmarking

- 7.8.8. Hyundai Steel

- 7.8.8.1. Company overview

- 7.8.8.2. Financial performance

- 7.8.8.3. Product benchmarking

- 7.8.9. VALLOUREC

- 7.8.9.1. Company overview

- 7.8.9.2. Financial performance

- 7.8.9.3. Product benchmarking

- 7.8.10. EVRAZ plc

- 7.8.10.1. Company overview

- 7.8.10.2. Financial performance

- 7.8.10.3. Product benchmarking

- 7.8.11. ThyssenKrupp AG

- 7.8.11.1. Company overview

- 7.8.11.2. Financial performance

- 7.8.11.3. Product benchmarking

- 7.8.12. JFE STEEL Corporation

- 7.8.12.1. Company overview

- 7.8.12.2. Financial performance

- 7.8.12.3. Product benchmarking

- 7.8.1. ArcelorMittal