|

|

市場調査レポート

商品コード

1404695

高吸水性ポリマーの市場規模、シェア、動向分析レポート:用途別、タイプ別、地域別、セグメント予測、2024年~2030年Super Absorbent Polymer Market Size, Share & Trends Analysis Report By Application (Personal Hygiene, Agriculture, Medical, Industrial), By Type (Sodium Polyacrylate, Polyacrylate/Polyacrylamide), By Region, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 高吸水性ポリマーの市場規模、シェア、動向分析レポート:用途別、タイプ別、地域別、セグメント予測、2024年~2030年 |

|

出版日: 2023年11月20日

発行: Grand View Research

ページ情報: 英文 87 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

高吸水性ポリマー市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、高吸水性ポリマーの世界市場規模は2030年までに151億8,000万米ドルに達し、CAGRは6.5%を記録すると予測されています。

ベビー用紙おむつ、大人用失禁製品、農業、女性用衛生用品など、様々な用途分野からの需要の高まりが、予測期間中の市場全体の成長を牽引すると見られています。

高吸水性ポリマー(SAP)はベビー用おむつの主要成分です。SAPは、中程度の高圧下で液体を保持・吸収するために使用されます。中南米やアジア太平洋を含む新興地域は、可処分所得の増加、人口の増加、合成ベビー用紙オムツの利点に関する認知度の向上など、さまざまな要因のためにベビー用紙オムツの活発な需要を目の当たりにすると予想され、これらは地域および世界のSAPs市場を牽引する重要な役割を果たすと予測されています。

医療インフラの絶え間ない発展、技術開発、医療治療へのアクセスの拡大といった要因の結果、平均寿命の統計は急激に伸びています。平均寿命の延びは、大人用失禁製品市場をさらに助け、ひいてはSAPs市場の成長を後押しすると推測されます。

高吸水性ポリマーは、その吸水性と保水性により、特に水の乏しい地域での農業用途に理想的であるため、農業産業で主要な用途を見出しています。これらの高吸水性ポリマーは、水の利用効率と作物の収量を向上させる。土壌特性の多様化、耕作可能な土地の少なさ、農家の恵まれない環境といった問題は、有利な最新技術や農法を採用できない原因となっています。

さまざまなメーカーが高吸水性ポリマーの認証を取得しています。例えば、2021年7月、日本触媒は2050年までにカーボンニュートラルを達成することを目標に、国際持続可能性炭素認証(ISCC)から高吸水性ポリマーのバイオマス認証を取得しました。

高吸水性ポリマー市場レポートハイライト

- 売上高では、アジア太平洋地域が2023年に39.0%以上の売上高シェアで市場を独占アジア太平洋地域の様々な用途分野、特に中国とインドにおける需要の増加が、市場成長を加速させる可能性が高いです。

- 個人衛生分野は、2023年の市場シェアが65.0%を超え、収益面で市場を独占しています。高吸水性ポリマーは、ベビー用紙おむつ、女性用衛生用品、大人用失禁用品などの衛生用品や、個人用使い捨て衛生用品を含むその他の用途で主に利用されています。

- 農業分野は、米国、中国、インドなどの国々で、高吸水性ポリマーの新規農業用途に関して、農業機関や政府機関が大規模な調査を継続していることから、今後数年間で大きく成長すると予想されます。

- SAPの大半はポリアクリル酸ナトリウム製で、粒状または繊維状で入手できます。ポリアクリル酸ナトリウムは液体吸収能力が高いため、衛生用途に利用されています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 高吸水性ポリマー市場の変数、動向、および範囲

- 市場系統の見通し

- 世界のプラスチック市場の見通し

- 普及と成長の見通しのマッピング

- バリューチェーン分析

- 原材料分析

- 高吸水性ポリマー- 価格動向分析、2018~2030年

- 技術動向

- 規制の枠組み

- 欧州委員会

- 国際標準化機構(ISO)

- 高吸水性ポリマー市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 市場機会分析

- 高吸水性ポリマー市場- ポーターの分析

- 高吸水性ポリマー市場-PESTEL分析

- COVID-19による高吸水性ポリマー市場への影響

- ロシアとウクライナの影響が高吸水性ポリマー市場に与える影響

第4章 高吸水性ポリマー市場:タイプの推定・動向分析

- ポリアクリル酸ナトリウム

- ポリアクリレート/ポリアクリルアミド

- その他

第5章 高吸水性ポリマー市場:用途の推定・動向分析

- 用途の変動分析と市場シェア

- 個人の衛生

- 成人用失禁用品

- 女性用衛生用品

- 赤ちゃん用おむつ

- 農業

- 医療

- 産業

- その他

第6章 高吸水性ポリマー市場:地域の推定・動向分析

- 地域変動分析と市場シェア

- 北米

- 北米高吸水性ポリマー市場推計・予測、2018年から2030年

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州の高吸水性ポリマー市場推計・予測、2018年から2030年

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- アジア太平洋

- アジア太平洋の高吸水性ポリマー市場推計・予測、2018年から2030年

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- 東南アジア

- 中南米

- 中南米の高吸水性ポリマー市場推計・予測、2018年から2030年

- ブラジル

- アルゼンチン

- 中東とアフリカ

- 中東およびアフリカの高吸水性ポリマー市場推計・予測、2018年から2030年

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第7章 競合情勢

- 主要市場参入企業による最近の動向とその影響分析

- 主要企業/競合分野の分類

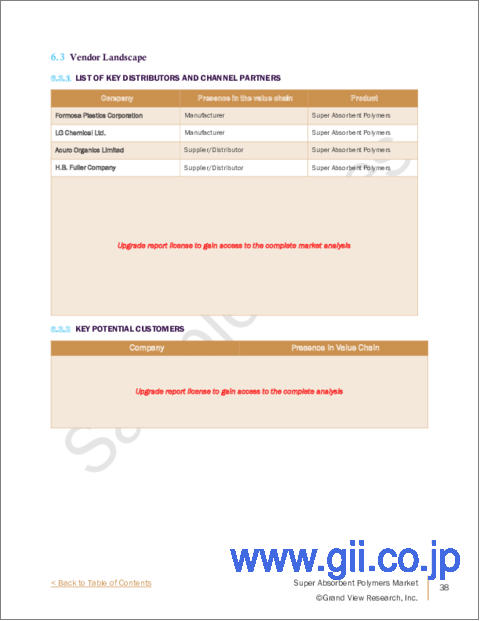

- ベンダー情勢

- 主要な販売代理店とチャネルパートナーのリスト

- 主要な潜在顧客/エンドユーザーのリスト

- 上場企業と非公開会社

- 競合ダッシュボード分析

第8章 企業プロファイル

- BASF SE

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- LG Chem

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- Formosa Plastics Corporation

- 会社概要

- 財務実績

- 製品のベンチマーク

- SANYO CHEMICAL INDUSTRIES, LTD.

- 会社概要

- 財務実績

- 製品のベンチマーク

- SONGWON

- 会社概要

- 財務実績

- 製品のベンチマーク

- Evonik Industries AG

- 会社概要

- 財務実績

- 製品のベンチマーク

- Kao Corporation

- 会社概要

- 財務実績

- 製品のベンチマーク

- NIPPON SHOKUBAI CO., LTD.

- 会社概要

- 財務実績

- 製品のベンチマーク

- Sumitomo Seika Chemicals Co. Ltd.

- 会社概要

- 財務実績

- 製品のベンチマーク

- Yixing Danson Technology

- 会社概要

- 財務実績

- 製品のベンチマーク

List of Tables

- Table 1 List of Abbreviations

- Table 2 Super Absorbent Polymer Market estimates and forecasts, by sodium polyacrylate, 2018 - 2030 (Kilotons) (USD Million)

- Table 3 Super Absorbent Polymer Market estimates and forecasts, by polyacrylate/polyacrylamide, 2018 - 2030 (Kilotons) (USD Million)

- Table 4 Super Absorbent Polymer estimates and forecasts, by others, 2018 - 2030 (Kilotons) (USD Million)

- Table 5 Super Absorbent Polymer Market estimates and forecasts, by Personal Hygiene, 2018 - 2030 (Kilotons) (USD Million)

- Table 6 Super Absorbent Polymer Market estimates and forecasts, by Adult Incontinence Products, 2018 - 2030 (Kilotons) (USD Million)

- Table 7 Super Absorbent Polymer Market estimates and forecasts, by Female Hygiene Products, 2018 - 2030 (Kilotons) (USD Million)

- Table 8 Super Absorbent Polymer Market estimates and forecasts, by Baby Diapers, 2018 - 2030 (Kilotons) (USD Million)

- Table 9 Super Absorbent Polymer Market estimates and forecasts, by Agriculture, 2018 - 2030 (Kilotons) (USD Million)

- Table 10 Super Absorbent Polymer Market estimates and forecasts, by Medical, 2018 - 2030 (Kilotons) (USD Million)

- Table 11 Super Absorbent Polymer Market estimates and forecasts, by Industrial, 2018 - 2030 (Kilotons) (USD Million)

- Table 12 Super Absorbent Polymer Market estimates and forecasts, by Others, 2018 - 2030 (Kilotons) (USD Million)

- Table 13 North America Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 14 U.S. Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 15 Canada Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 16 Mexico Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 17 Europe Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 18 Germany Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 19 UK Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 20 France Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 21 Italy Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 22 Spain Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 23 Asia-Pacific Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 24 China Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 25 India Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 26 Japan Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 27 South Korea Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 28 Australia Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 29 Southeast Asia Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 30 Central & South America Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 31 Brazil Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 32 Argentina Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 33 Middle East & Africa Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 34 Saudi Arabia Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 35 UAE Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- Table 36 South Africa Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

List of Figures

- Fig. 1 Information procurement

- Fig. 2 Primary research pattern

- Fig. 3 Primary Research Process

- Fig. 4 Market research approaches - Bottom-Up Approach

- Fig. 5 Market research approaches - Top-Down Approach

- Fig. 6 Market research approaches - Combined Approach

- Fig. 7 Super Absorbent Polymer Market- Market Snapshot

- Fig. 8 Super Absorbent Polymer Market- Segment Snapshot (1/2)

- Fig. 9 Super Absorbent Polymer Market- Segment Snapshot (2/2)

- Fig. 10 Super Absorbent Polymer Market- Competitive Landscape Snapshot

- Fig. 11 Key market opportunity penetration & growth prospect mapping

- Fig. 12 Super absorbent polymer value chain analysis

- Fig. 13 Super absorbent polymer price trend analysis (USD per kilotons)

- Fig. 14 Global population base over the age of 65 years, 2000, 2022, & 2023 (%)

- Fig. 15 Super absorbent polymer market - Porter's analysis

- Fig. 16 Super absorbent polymer market - PESTEL analysis

- Fig. 17 Super Absorbent Polymer Market: type movement analysis, 2023 & 2030

- Fig. 18 Super Absorbent Polymer Market: Application movement analysis, 2023 & 2030

- Fig. 19 Super Absorbent Polymer Market: Regional movement analysis, 2023 & 2030

- Fig. 20 Super Absorbent Polymer Market: Competitive Dashboard Analysis

Super Absorbent Polymer Market Growth & Trends:

The global super absorbent polymer market size is expected to reach USD 15.18 billion by 2030, registering a CAGR of 6.5% according to a new report by Grand View Research, Inc. Growing demand from various application sectors such as baby diapers, adult incontinence products, agriculture, and female hygiene products is expected to drive the overall market growth over the forecast period.

Super absorbent polymers (SAPs) is a key component of baby diapers. SAPs are used to retain and absorb fluids under moderately high pressure. Emerging regions including Central & South America and Asia Pacific are expected to witness a brisk demand for baby diapers owing to different factors including rising disposable income, growing population, and increasing awareness regarding the benefits of synthetic baby diapers, which are projected to play a key role in driving the regional and global SAPs market.

Life expectancy statistics have sharply increased as a result of factors like constantly developing medical infrastructure, technology developments, and expanding accessibility to medical treatments. Growing life expectancy is presumed to further assist the adult incontinence product market and, in turn, boost the growth of the SAPs market.

Super absorbent polymers find key applications in agriculture industry owing to their water absorbing and water retention properties, making them ideal for agricultural applications, particularly in water-scarce regions. These super absorbent polymers enhances water use efficiency as well as the crop yield. Problems such as diversified soil characteristics, paucity of large cultivable land, and underprivileged conditions of farmers result in an inability to adopt advantageous and latest technologies and agricultural methods.

Different manufacturers are obtaining certifications for super absorbent polymers. For instance, in July 2021, Nippon Shokubai obtained biomass certification for super absorbent polymers from International Sustainability and Carbon Certification (ISCC) with the goal of achieving carbon neutrality by 2050.

Super Absorbent Polymer Market Report Highlights:

- In terms of revenue, Asia Pacific dominated the market with a revenue share of more than 39.0% in 2023 Increasing demand from various application segments in Asia Pacific region particularly in China and India are likely to drive market growth at a faster pace

- The personal hygiene segment dominated the market in terms of revenue with a market share of more than 65.0% in 2023. Super absorbent polymers are majorly utilized in hygiene products including baby diapers, female hygiene products, adult incontinence products and other applications including personal disposable hygiene products

- The agriculture segment is expected to grow significantly over the coming years on account of ongoing extensive research conducted by agricultural and government agencies in countries such as the U.S., China, and India regarding the novel agricultural applications of super absorbent polymers

- The majority SAPs are made of sodium polyacrylate and are available in granular form or as fibers. Sodium polyacrylate is utilized in hygiene applications owing to its enhanced liquid absorption capability

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Research Methodology

- 1.2 Research scope and assumptions

- 1.3 Information Procurement

- 1.3.1 Purchased Database

- 1.3.2 GVR's Internal Database

- 1.3.3 Secondary Sources

- 1.3.4 Third-Party Perspective

- 1.3.5 Primary Research

- 1.4 Information Analysis

- 1.4.1 Data Analysis Models

- 1.5 Market Formulation and Data Visualization

- 1.6 Data Validation and Publishing

- 1.7 List of Abbreviations

Chapter 2 Executive Summary

- 2.1 Market Snapshot

- 2.2 Segment Snapshot

- 2.3 Competitive Landscape Snapshot

Chapter 3 Super Absorbent Polymer Market Variables, Trends, and Scope

- 3.1 Market Lineage Outlook

- 3.1.1 Global Plastics Market Outlook

- 3.2 Penetration and growth prospect mapping

- 3.3 Value chain analysis

- 3.3.1 Raw material analysis

- 3.4 Super absorbent polymers - Pricing trend analysis, 2018 - 2030 (USD per Kilotons)

- 3.5 Technology Trends

- 3.6 Regulatory framework

- 3.6.1 EUropean Commision

- 3.6.2 International Organization for Standardization (ISO)

- 3.7 Super absorbent polymer market dynamics

- 3.7.1 Market Driver Analysis

- 3.7.1.1 Growing demand for adult incontinence products

- 3.7.1.2 Strong demand from the agriculture industry

- 3.7.2 Market restraint analysis

- 3.7.2.1 Negative health effects upon exposure to SAP

- 3.7.3 Market Opportunity Analysis

- 3.7.4 Super absorbent polymer market - Porter's analysis

- 3.7.5 Super absorbent polymer market - PESTEL analysis

- 3.7.1 Market Driver Analysis

- 3.8 Impact of COVID-19 on Super Absorbent Polymer Market

- 3.9 Impact of Russia & Ukraine Implication on Super Absorbent Polymer Market

Chapter 4 Super Absorbent Polymer Market: Type Estimates & Trend Analysis

- 4.1 Type Movement Analysis & Market Share, 2021 - 2030

- 4.2 Sodium Polyacrylate

- 4.2.1 Super Absorbent Polymer Market Estimates and Forecasts, By Sodium Polyacrylate, 2018 - 2030 (Kilotons) (USD Million)

- 4.3 Polyacrylate/Polyacrylamide

- 4.3.1 Super Absorbent Polymer Market Estimates and Forecasts, By Polyacrylate/Polyacrylamide, 2018 - 2030 (Kilotons) (USD Million)

- 4.4 Others

- 4.4.1 Super Absorbent Polymer Estimates and Forecasts, By others, 2018 - 2030 (Kilotons) (USD Million)

Chapter 5 Super Absorbent Polymer Market: Application Estimates & Trend Analysis

- 5.1 Application Movement Analysis & Market Share

- 5.2 Personal Hygiene

- 5.2.1 Super Absorbent Polymer Market Estimates and Forecasts, By Personal Hygiene, 2018 - 2030 (Kilotons) (USD Million)

- 5.2.2 Adult Incontinence Products

- 5.2.2.1 Super Absorbent Polymer Market Estimates and Forecasts, By Adult Incontinence Products, 2018 - 2030 (Kilotons) (USD Million)

- 5.2.3 Female Hygiene Products

- 5.2.3.1 Super Absorbent Polymer Market Estimates and Forecasts, By Female Hygiene Products, 2018 - 2030 (Kilotons) (USD Million)

- 5.2.4 Baby Diapers

- 5.2.4.1 Super Absorbent Polymer Market Estimates and Forecasts, By Baby Diapers, 2018 - 2030 (Kilotons) (USD Million)

- 5.3 Agriculture

- 5.3.1 Super Absorbent Polymer Market Estimates and Forecasts, By Agriculture, 2018 - 2030 (Kilotons) (USD Million)

- 5.4 Medical

- 5.4.1 Super Absorbent Polymer Market Estimates and Forecasts, By Medical, 2018 - 2030 (Kilotons) (USD Million)

- 5.5 Industrial

- 5.5.1 Super Absorbent Polymer Market Estimates and Forecasts, By Industrial, 2018 - 2030 (Kilotons) (USD Million)

- 5.6 Others

- 5.6.1 Super Absorbent Polymer Market Estimates and Forecasts, By Others, 2018 - 2030 (Kilotons) (USD Million)

Chapter 6 Super Absorbent Polymer Market: Regional Estimates & Trend Analysis

- 6.1 Regional Movement Analysis & Market Share

- 6.2 North America

- 6.2.1 North America Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.2.2 U.S.

- 6.2.2.1 U.S. Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.2.3 Canada

- 6.2.3.1 Canada Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.2.4 Mexico

- 6.2.4.1 Mexico Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.3 Europe

- 6.3.1 Europe Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.2 Germany

- 6.3.2.1 Germany Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.3 UK

- 6.3.3.1 UK Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.4 France

- 6.3.4.1 France Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.5 Italy

- 6.3.5.1 Italy Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.3.6 Spain

- 6.3.6.1 Spain Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.4 Asia-Pacific

- 6.4.1 Asia-Pacific Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.2 China

- 6.4.2.1 China Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.3 India

- 6.4.3.1 India Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.4 Japan

- 6.4.4.1 Japan Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.5 South Korea

- 6.4.5.1 South Korea Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.6 Australia

- 6.4.6.1 Australia Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.4.7 Southeast Asia

- 6.4.7.1 Southeast Asia Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.5 Central & South America

- 6.5.1 Central & South America Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.2 Brazil

- 6.5.2.1 Brazil Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.5.3 Argentina

- 6.5.3.1 Argentina Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.6 Middle East & Africa

- 6.6.1 Middle East & Africa Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.6.2 Saudi Arabia

- 6.6.2.1 Saudi Arabia Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.6.3 UAE

- 6.6.3.1 UAE Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 6.6.4 South Africa

- 6.6.4.1 South Africa Super Absorbent Polymer Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 7 Competitive Landscape

- 7.1 Recent Developments & Their Impact Analysis, by Key Market Participants

- 7.1.1 Key Companies/Competition Categorization

- 7.2 Vendor Landscape

- 7.2.1 List of Key Distributors & Channel Partners

- 7.2.2 List of Key Potential Customers/End-users

- 7.3 Public & Private Companies

- 7.3.1 Competitive Dashboard Analysis

Chapter 8 Company Profiles

- 8.1 BASF SE

- 8.1.1 Company Overview

- 8.1.2 Financial Performance

- 8.1.3 Product Benchmarking

- 8.1.4 Strategic Initiatives

- 8.2 LG Chem

- 8.2.1 Company Overview

- 8.2.2 Financial performance

- 8.2.3 Product Benchmarking

- 8.2.4 Strategic Initiatives

- 8.3 Formosa Plastics Corporation

- 8.3.1 Company overview

- 8.3.2 Financial performance

- 8.3.3 Product benchmarking

- 8.4 SANYO CHEMICAL INDUSTRIES, LTD.

- 8.4.1 Company overview

- 8.4.2 Financial performance

- 8.4.3 Product benchmarking

- 8.5 SONGWON

- 8.5.1 Company Overview

- 8.5.2 Financial performance

- 8.5.3 Product benchmarking

- 8.6 Evonik Industries AG

- 8.6.1 Company Overview

- 8.6.2 Financial performance

- 8.6.3 Product benchmarking

- 8.7 Kao Corporation

- 8.7.1 Company Overview

- 8.7.2 Financial Performance

- 8.7.3 Product benchmarking

- 8.8 NIPPON SHOKUBAI CO., LTD.

- 8.8.1 Company Overview

- 8.8.2 Financial Performance

- 8.8.3 Product Benchmarking

- 8.9 Sumitomo Seika Chemicals Co. Ltd.

- 8.9.1 Company Overview

- 8.9.2 Financial performance

- 8.9.3 Product benchmarking

- 8.10 Yixing Danson Technology

- 8.10.1 Company Overview

- 8.10.2 Financial performance

- 8.10.3 Product benchmarking