|

|

市場調査レポート

商品コード

1363517

卵子凍結および胚バンク市場規模、シェア、動向分析レポート:タイプ別、保存別、患者年齢別、地域別、セグメント予測、2023年~2030年Egg Freezing And Embryo Banking Market Size, Share & Trends Analysis Report By Type (Donor, Nondonor), By Preservation (Egg Freezing, Embryo Freezing), By Age Of Patient, By Region, And Segment Forecasts, 2023 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 卵子凍結および胚バンク市場規模、シェア、動向分析レポート:タイプ別、保存別、患者年齢別、地域別、セグメント予測、2023年~2030年 |

|

出版日: 2023年09月26日

発行: Grand View Research

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

卵子凍結および胚バンク市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、世界の卵子凍結および胚バンキング市場規模は2030年までに138億米ドルに達すると予測され、予測期間中のCAGRは16.80%です。

卵子凍結および胚バンクの市場は、医療技術の進歩と卵子凍結プロセスの改善により、より信頼性が高く実行可能な選択肢となったため、大きな成長が予測されています。不妊治療の成功率が向上するにつれ、妊孕性温存のために卵子凍結を検討する女性が増えています。

卵子凍結および胚バンクは、生殖の柔軟性、家族計画の拡張、医療適応性など様々な利点を提供します。これらの利点は、家族計画の選択肢を増やし、家族形成の決断にかかる時間的プレッシャーを軽減し、精神的幸福を高め、市場成長を促進します。2022年5月、ニューヨーク大学グロスマン医学部とニューヨーク大学ランゴン不妊治療センターが発表した研究では、38歳までに卵子を凍結し、少なくとも20個の卵子を解凍した女性の子供を持つ成功率は70%であることが、15年にわたる現実の成績で実証されました。211人の赤ちゃんが誕生しており、この調査結果は卵子凍結技術の有効性を強調し、生殖の成功を高める上での重要性を強調しています。

認知度が高まり、技術がさらに向上するにつれて、市場は今後数年で拡大すると予測されます。卵子凍結および胚バンクの需要の急増は、大手企業間の戦略的提携と相まって、市場の大きな成長を後押しし、必要とする人々のヘルスケアの選択肢を豊かにしています。

例えば、2023年4月、不妊治療と研究の世界的リーダーであるCCRM Fertility社は、バージニア州バージニアビーチを拠点とする不妊治療クリニックであるThe New Hope Center for Reproductive Medicine社の買収を発表しました。この買収により、米国東海岸におけるCCRMファティリティのプレゼンスが拡大し、革新的な不妊治療、包括的な検査、高度な研究所、社内の遺伝学や研究へのアクセスが容易になります。この開発は、不妊治療と治療の選択肢の進歩に貢献するものです。

卵子凍結および胚バンク市場レポートハイライト

- 卵子凍結および胚バンク市場レポート:卵子凍結および胚バンク市場は、卵子凍結および胚バンクのタイプに基づき、ドナーとノンドナーのセグメントに分けられます。一般的に不妊治療における卵子保存の大半を占める女性自身の卵子を用いた治療が含まれるため、2022年にはnondonorセグメントが53%以上の大きな売上シェアを占めています。

- 妊孕性温存の観点から、市場は卵子凍結と胚凍結に分類されます。胚凍結セグメントは、いくつかの要因により、2022年に71.8%の最大の売上シェアを占めました。卵子凍結は、特にキャリアの優先順位や医学的懸念への対応として、女性がより長い期間、生殖能力の可能性を維持するための柔軟性を提供します。

- 患者の年齢に基づいて、このセグメントは35歳未満、35~37歳、38~40歳、42歳以上に分類されます。35歳以上の層は卵子凍結への傾向が高いです。この年齢層は一般的に30代後半から40代前半に差し掛かった女性で、生殖能力が急速に低下し始める時期です。

- 欧州が市場を独占し、2022年には36%以上の最大収益シェアを占めました。これは主に、生殖補助医療技術の分野でこの地域の存在感と貢献が確立されていることに起因しています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 市場変数、動向、および範囲

- 市場系統の見通し

- 親市場の見通し

- 関連/付随市場の見通し

- 市場動向と展望

- 市場力学

- 市場促進要因の分析

- 市場抑制要因分析

- 事業環境分析

- PESTLE分析

- ポーターのファイブフォース分析

- COVID-19感染症の影響分析

第4章 タイプ別ビジネス分析

- 卵子凍結および胚バンク市場:タイプセグメントダッシュボード

- タイプの変動分析、2022年と2030年

- ドナー

- 非ドナー

第5章 保存別ビジネス分析

- 卵子凍結および胚バンク市場:保存セグメントのダッシュボード

- 保存変動分析、2022年と2030年

第6章 患者年齢別ビジネス分析

- 卵子凍結および胚バンク市場:患者年齢セグメントのダッシュボードの時代

- 患者年齢変動分析、2022年および2030年

- 35歳未満

- 35-37歳

- 38-40歳

- 42歳以上

第7章 地域別ビジネス分析

- 地域市場のスナップショット

- 国別の市場シェア分析、2022年

- 北米

- 欧州

- アジア太平洋地域

- ラテンアメリカ

- 中東・アフリカ

第8章 競合情勢

- 企業の分類

- 戦略マッピング

- 拡張

- 買収

- コラボレーション

- 新製品の発売

- その他

- 企業プロファイル・一覧表

- ReproTech LLC

- Cryos International

- CCRM Fertility

- RMA Network

- Carrot Fertility

- WINFertility

- Columbia University

- Shady Grove Fertility

- Kindbody

List of Tables

- Table 1. List of secondary sources

- Table 2. List of abbreviations

- Table 3. Global Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 4. Global Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 5. Global Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 6. Global Egg freezing and embryo banking market, by region, 2018 - 2030 (USD Million)

- Table 7. North America Egg freezing and embryo banking market, by country, 2018 - 2030 (USD Million)

- Table 8. North America Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 9. North America Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 10. North America Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 11. U.S. Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 12. U.S. Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 13. U.S. Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 14. Canada Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 15. Canada Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 16. Canada Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 17. Europe Egg freezing and embryo banking market, by country, 2018 - 2030 (USD Million)

- Table 18. Europe Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 19. Europe Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 20. Europe Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 21. UK Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 22. UK Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 23. UK Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 24. Germany Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 25. Germany Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 26. Germany Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 27. France Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 28. France Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 29. France Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 30. Italy Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 31. Italy Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 32. Italy Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 33. Spain Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 34. Spain Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 35. Spain Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 36. Norway Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 37. Norway Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 38. Norway Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 39. Sweden Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 40. Sweden Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 41. Sweden Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 42. Denmark Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 43. Denmark Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 44. Denmark Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 45. Asia Pacific Egg freezing and embryo banking market, by country, 2018 - 2030 (USD Million)

- Table 46. Asia Pacific Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 47. Asia Pacific Egg freezing and embryo banking market, by preservation, 2018-2030, (USD Million

- Table 48. Asia Pacific Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 49. Japan Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 50. Japan Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 51. Japan Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 52. China Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 53. China Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 54. China Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 55. India Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 56. India Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 57. India Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 58. Australia Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 59. Australia Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 60. Australia Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 61. South Korea Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 62. South Korea Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 63. South Korea Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 64. Thailand Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 65. Thailand Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 66. Thailand Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 67. Latin America Egg freezing and embryo banking market, by country, 2018 - 2030 (USD Million)

- Table 68. Latin America Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 69. Latin America Egg freezing and embryo banking market, by preservation, 2018-2030, (USD Million

- Table 70. Latin America Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 71. Brazil Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 72. Brazil Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 73. Brazil Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 74. Mexico Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 75. Mexico Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 76. Mexico Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 77. Argentina Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 78. Argentina Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 79. Argentina Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 80. Middle East & Africa Egg freezing and embryo banking market, by country, 2018 - 2030 (USD Million)

- Table 81. Middle East & Africa Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 82. Middle East & Africa Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 83. Middle East & Africa Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 84. South Africa Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 85. South Africa Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 86. South Africa Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 87. Saudi Arabia Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 88. Saudi Arabia Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 89. Saudi Arabia Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 90. UAE Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 91. UAE Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 92. UAE Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

- Table 93. Kuwait Egg freezing and embryo banking market, by type, 2018 - 2030 (USD Million)

- Table 94. Kuwait Egg freezing and embryo banking market, by preservation, 2018 - 2030 (USD Million)

- Table 95. Kuwait Egg freezing and embryo banking market, by age of patient, 2018 - 2030 (USD Million)

List of Figures

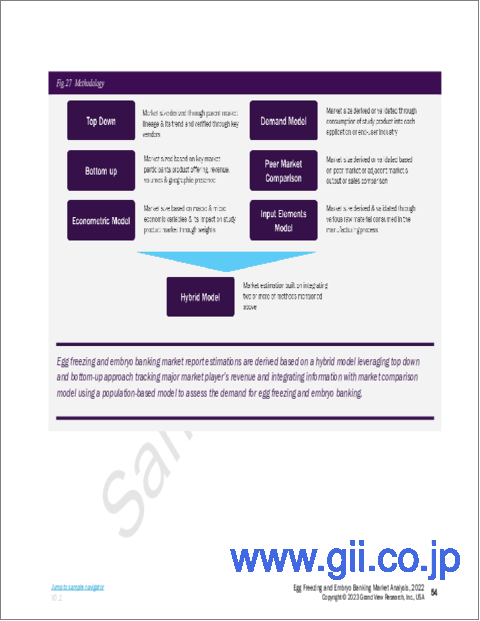

- Fig. 1 Market research process

- Fig. 2 Information procurement

- Fig. 3 Primary research pattern

- Fig. 4 Market research approaches

- Fig. 5 Value chain-based sizing & forecasting

- Fig. 6 Market formulation & validation

- Fig. 7 Egg freezing and embryo banking market segmentation

- Fig. 8 Market snapshot, 2022

- Fig. 9 Segment snapshot

- Fig. 10 Competitive landscape snapshot

- Fig. 11 Market trends & outlook

- Fig. 12 Market driver relevance analysis (current & future impact)

- Fig. 13 Market restraint relevance analysis (current & future impact)

- Fig. 14 PESTLE analysis

- Fig. 15 Porter's five forces analysis

- Fig. 16 Egg freezing and embryo banking market: Type outlook and key takeaways

- Fig. 17 Egg freezing and embryo banking market: Type movement analysis

- Fig. 18 Donor market revenue, 2018 - 2030 (USD Million)

- Fig. 19 Nondonor market revenue, 2018 - 2030 (USD Million)

- Fig. 20 Egg freezing and embryo banking market: Preservation outlook and key takeaways

- Fig. 21 Egg freezing and embryo banking market: Preservation movement analysis

- Fig. 22 Egg freezing market revenue, 2018 - 2030 (USD Million)

- Fig. 23 Embryo banking market revenue, 2018 - 2030 (USD Million)

- Fig. 24 Egg freezing and embryo banking market: Age of patient outlook and key takeaways

- Fig. 25 Egg freezing and embryo banking market: Age of patient movement analysis

- Fig. 26 Under 35 market revenue, 2018 - 2030 (USD Million)

- Fig. 27 35-37 market revenue, 2018 - 2030 (USD Million)

- Fig. 28 38-40 market revenue, 2018 - 2030 (USD Million)

- Fig. 29 Over 42 market revenue, 2018 - 2030 (USD Million)

- Fig. 30 Regional marketplace: key takeaways

- Fig. 31 Regional outlook, 2022 & 2030

- Fig. 32 Egg freezing and embryo banking market: regional movement analysis

- Fig. 33 North America Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 34 US country dynamics

- Fig. 35 US Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 36 Canada country dynamics

- Fig. 37 Canada Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 38 Europe Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 39 Germany country dynamics

- Fig. 40 Germany Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 41 UK country dynamics

- Fig. 42 UK Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 43 France country dynamics

- Fig. 44 France Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- Fig. 45 Italy country dynamics

- Fig. 46 Italy Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 47 Spain country dynamics

- Fig. 48 Spain Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- Fig. 49 Sweden country dynamics

- Fig. 50 Sweden Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- Fig. 51 Norway country dynamics

- Fig. 52 Norway Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 53 Denmark country dynamics

- Fig. 54 Denmark Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 55 Asia Pacific Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 56 Japan country dynamics

- Fig. 57 Japan Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- Fig. 58 China country dynamics

- Fig. 59 China Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 60 India country dynamics

- Fig. 61 India Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 62 Australia country dynamics

- Fig. 63 Australia Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 64 South Korea country dynamics

- Fig. 65 South Korea Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 66 Thailand country dynamics

- Fig. 67 Thailand Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 68 Latin America Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 69 Brazil country dynamics

- Fig. 70 Brazil Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 71 Mexico country dynamics

- Fig. 72 Mexico Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 73 Argentina country dynamics

- Fig. 74 Argentina Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 75 Middle East and Africa Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 76 South Africa country dynamics

- Fig. 77 South Africa Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 78 Saudi Arabia country dynamics

- Fig. 79 Saudi Arabia Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 80 UAE country dynamics

- Fig. 81 UAE Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 82 Kuwait country dynamics

- Fig. 83 Kuwait Egg freezing and embryo banking market, 2018 - 2030 (USD Million)

- Fig. 84 Company categorization

- Fig. 85 Strategy mapping

- Fig. 86 Company market position analysis

Egg Freezing And Embryo Banking Market Growth & Trends:

The global egg freezing and embryo banking market size is expected to reach USD 13.8 billion by 2030, based on a new report by Grand View Research, Inc.., exhibiting a CAGR of 16.80% during the forecast period. The market for egg freezing and embryo banking is projected to experience significant growth due to advancements in medical technology and improvements in the egg-freezing process that have made it a more reliable and viable option. As fertility treatment success improves, more women consider egg freezing for fertility preservation.

Egg freezing and embryo banking offer various benefits such as reproductive flexibility, extended family planning, and medical adaptability. These advantages enhance family planning options, reduce time pressure on family-building decisions, and boost emotional well-being, driving market growth. In May 2022, a study published by NYU Grossman School of Medicine and NYU Langone Fertility Center demonstrated a 70% success rate in having a child for women who froze eggs before 38 years of age and thawed at least 20 eggs, spanning 15 years of real-life outcomes. With 211 babies born, these findings underscore the efficacy of egg-freezing technology, highlighting its importance in enhancing reproductive success.

As awareness grows and technology improves further, the market is projected to expand in the coming years. The surging demand for egg freezing and embryo banking, combined with strategic partnerships among major players, is propelling significant growth in the market, enriching healthcare options for those in need.

For instance, in April 2023, CCRM Fertility, a global leader in fertility treatment and research, announced its acquisition of The New Hope Center for Reproductive Medicine, a fertility clinic based in Virginia Beach, Virginia. This expansion broadens CCRM Fertility's presence on the East Coast of the U.S., facilitating easier access to innovative fertility treatments, comprehensive testing, advanced laboratories, and in-house genetics and research. The development is poised to contribute to the advancement of fertility care and treatment options.

Egg Freezing And Embryo Banking Market Report Highlights:

- Based on type, the segments included are donor and nondonor. The nondonor segment held the larger revenue share of over 53% in 2022, due to its inclusion of procedures involving women's own eggs, which generally comprise the majority of fertility preservation cases

- In terms of preservation, the market is categorized into egg freezing and embryo freezing. The embryo freezing segment held the largest revenue share of 71.8% in 2022 due to several factors. Egg freezing offers women the flexibility to preserve their fertility potential for a longer period, especially as a response to career priorities or medical concerns

- Based on the age of patients, the segment is categorized as under 35, 35-37, 38-40, and over 42. The segment over 35 tends to have a higher inclination towards egg freezing. This age range typically represents women who are approaching their late 30s and early 40s, a time when fertility starts to decline more rapidly

- Europe dominated the market and accounted for the maximum revenue share of over 36% in 2022. This can be primarily attributed to the well-established presence and contribution of the region in the field of assisted reproduction technology

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.1.1. Market Definitions

- 1.2. Regional Scope

- 1.3. Estimates and Forecast Timeline

- 1.4. Research Methodology

- 1.5. Information Procurement

- 1.5.1. Purchased Database

- 1.5.2. GVR's Internal Database

- 1.5.3. Secondary Sources & Third-Party Perspectives

- 1.5.4. Primary Research

- 1.6. Information Analysis

- 1.6.1. Data Analysis Models

- 1.7. Market Formulation & Data Visualization

- 1.8. Model Details

- 1.8.1. Commodity Flow Analysis

- 1.9. List of Secondary Sources

Chapter 2. Executive Summary

- 2.1. Market Snapshot

- 2.2. Segment Snapshot

- 2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Parent Market Outlook

- 3.1.2. Related/Ancillary Market Outlook

- 3.2. Market Trends and Outlook

- 3.3. Market Dynamics

- 3.3.1. Market Driver Analysis

- 3.3.1.1. Delayed Childbearing due to Sociodemographic Factors

- 3.3.1.2. Increasing Rate of Infertilities

- 3.3.1.3. Increasing Awareness in Reproductive Health

- 3.3.2. Market Restraint Analysis

- 3.3.2.1. Ethical Concerns About the Preservation of Eggs and Sperms

- 3.3.2.2. High cost associated with banking

- 3.3.1. Market Driver Analysis

- 3.4. Business Environment Analysis

- 3.4.1. PESTLE Analysis

- 3.4.2. Porter's Five Forces Analysis

- 3.5. COVID-19 Impact Analysis

Chapter 4. Type Business Analysis

- 4.1. Egg Freezing and Embryo Banking Market: Type Segment Dashboard

- 4.2. Type Movement Analysis, 2022 & 2030

- 4.2.1. Donor

- 4.2.1.1. Donor Market, 2018 - 2030 (USD Million)

- 4.2.2. Nondonor

- 4.2.2.1. Nondonor Market, 2018 - 2030 (USD Million)

- 4.2.1. Donor

Chapter 5. Preservation Business Analysis

- 5.1. Egg Freezing and Embryo Banking Market: Preservation Segment Dashboard

- 5.2. Preservation Movement Analysis, 2022 & 2030

- 5.2.1. Egg Freezing

- 5.2.1.1. Egg Freezing Market, 2018 - 2030 (USD Million)

- 5.2.2. Embryo Freezing

- 5.2.2.1. Embryo Freezing Market, 2018 - 2030 (USD Million)

- 5.2.1. Egg Freezing

Chapter 6. Age of Patient Business Analysis

- 6.1. Egg Freezing and Embryo Banking Market: Age of Patient Segment Dashboard

- 6.2. Age of Patient Movement Analysis, 2022 & 2030

- 6.2.1. Under 35

- 6.2.2. Under 35 Market, 2018 - 2030 (USD Million)

- 6.2.3. 35-37

- 6.2.3.1. 35-37 Market, 2018 - 2030 (USD Million)

- 6.2.4. 38-40

- 6.2.5. 38-40 Market, 2018 - 2030 (USD Million)

- 6.2.6. Over 42

- 6.2.6.1. Over 42 Market, 2018 - 2030 (USD Million)

Chapter 7. Regional Business Analysis

- 7.1. Regional Market Snapshot

- 7.2. Market Share Analysis by Country, 2022

- 7.3. North America

- 7.3.1. North America Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.3.2. U.S.

- 7.3.2.1. U.S. Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.3.2.2. Key Country Dynamics

- 7.3.2.3. Regulatory & Reimbursement Framework

- 7.3.2.4. Competitive Scenario

- 7.3.3. Canada

- 7.3.3.1. Canada Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.3.3.2. Key Country Dynamics

- 7.3.3.3. Regulatory & Reimbursement Framework

- 7.3.3.4. Competitive Scenario

- 7.4. Europe

- 7.4.1. Europe Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.4.2. Germany

- 7.4.2.1. Germany Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.4.2.2. Key Country Dynamics

- 7.4.2.3. Regulatory & Reimbursement Framework

- 7.4.2.4. Competitive Scenario

- 7.4.3. UK

- 7.4.3.1. UK Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.4.3.2. Key Country Dynamics

- 7.4.3.3. Regulatory & Reimbursement Framework

- 7.4.3.4. Competitive Scenario

- 7.4.4. France

- 7.4.4.1. France Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.4.4.2. Key Country Dynamics

- 7.4.4.3. Regulatory & Reimbursement Framework

- 7.4.4.4. Competitive Scenario

- 7.4.5. Italy

- 7.4.5.1. Italy Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.4.5.2. Key Country Dynamics

- 7.4.5.3. Regulatory & Reimbursement Framework

- 7.4.5.4. Competitive Scenario

- 7.4.6. Spain

- 7.4.6.1. Spain Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.4.6.2. Key Country Dynamics

- 7.4.6.3. Regulatory & Reimbursement Framework

- 7.4.6.4. Competitive Scenario

- 7.4.7. Denmark

- 7.4.7.1. Denmark Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.4.7.2. Key Country Dynamics

- 7.4.7.3. Regulatory & Reimbursement Framework

- 7.4.7.4. Competitive Scenario

- 7.4.8. Sweden

- 7.4.8.1. Sweden Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.4.8.2. Key Country Dynamics

- 7.4.8.3. Regulatory & Reimbursement Framework

- 7.4.8.4. Competitive Scenario

- 7.4.9. Norway

- 7.4.9.1. Norway Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.4.9.2. Key Country Dynamics

- 7.4.9.3. Regulatory & Reimbursement Framework

- 7.4.9.4. Competitive Scenario

- 7.5. Asia Pacific

- 7.5.1. Asia Pacific Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.5.2. Japan

- 7.5.2.1. Japan Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.5.2.2. Key Country Dynamics

- 7.5.2.3. Regulatory & Reimbursement Framework

- 7.5.2.4. Competitive Scenario

- 7.5.3. China

- 7.5.3.1. China Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.5.3.2. Key Country Dynamics

- 7.5.3.3. Regulatory & Reimbursement Framework

- 7.5.3.4. Competitive Scenario

- 7.5.4. India

- 7.5.4.1. India Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.5.4.2. Key Country Dynamics

- 7.5.4.3. Regulatory & Reimbursement Framework

- 7.5.4.4. Competitive Scenario

- 7.5.5. South Korea

- 7.5.5.1. South Korea Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.5.5.2. Key Country Dynamics

- 7.5.5.3. Regulatory & Reimbursement Framework

- 7.5.5.4. Competitive Scenario

- 7.5.6. Australia

- 7.5.6.1. Australia Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.5.6.2. Key Country Dynamics

- 7.5.6.3. Regulatory & Reimbursement Framework

- 7.5.6.4. Competitive Scenario

- 7.5.7. Thailand

- 7.5.7.1. Thailand Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.5.7.2. Key Country Dynamics

- 7.5.7.3. Regulatory & Reimbursement Framework

- 7.5.7.4. Competitive Scenario

- 7.6. Latin America

- 7.6.1. Latin America Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.6.2. Brazil

- 7.6.2.1. Brazil Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.6.2.2. Key Country Dynamics

- 7.6.2.3. Regulatory & Reimbursement Framework

- 7.6.2.4. Competitive Scenario

- 7.6.3. Mexico

- 7.6.3.1. Mexico Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.6.3.2. Key Country Dynamics

- 7.6.3.3. Regulatory & Reimbursement Framework

- 7.6.3.4. Competitive Scenario

- 7.6.4. Argentina

- 7.6.4.1. Argentina Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.6.4.2. Key Country Dynamics

- 7.6.4.3. Regulatory & Reimbursement Framework

- 7.6.4.4. Competitive Scenario

- 7.7. MEA

- 7.7.1. MEA Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.7.2. South Africa

- 7.7.2.1. South Africa Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.7.2.2. Key Country Dynamics

- 7.7.2.3. Regulatory & Reimbursement Framework

- 7.7.2.4. Competitive Scenario

- 7.7.3. Saudi Arabia

- 7.7.3.1. Saudi Arabia Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.7.3.2. Key Country Dynamics

- 7.7.3.3. Regulatory & Reimbursement Framework

- 7.7.3.4. Competitive Scenario

- 7.7.4. UAE

- 7.7.4.1. UAE Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.7.4.2. Key Country Dynamics

- 7.7.4.3. Regulatory & Reimbursement Framework

- 7.7.4.4. Competitive Scenario

- 7.7.5. Kuwait

- 7.7.5.1. Kuwait Egg freezing and embryo banking Market, 2018 - 2030 (USD Million)

- 7.7.5.2. Key Country Dynamics

- 7.7.5.3. Regulatory & Reimbursement Framework

- 7.7.5.4. Competitive Scenario

Chapter 8. Competitive Landscape

- 8.1. Company Categorization

- 8.2. Strategy Mapping

- 8.2.1. Expansions

- 8.2.2. Acquisitions

- 8.2.3. Collaborations

- 8.2.4. New Product Launches

- 8.2.5. Others

- 8.3. Company Profiles/Listing

- 8.3.1. ReproTech LLC

- 8.3.1.1. Overview

- 8.3.1.2. Financial Performance

- 8.3.1.3. Product Benchmarking

- 8.3.1.4. Strategic Initiatives

- 8.3.2. Cryos International

- 8.3.2.1. Overview

- 8.3.2.2. Financial Performance

- 8.3.2.3. Product Benchmarking

- 8.3.2.4. Strategic Initiatives

- 8.3.3. CCRM Fertility

- 8.3.3.1. Overview

- 8.3.3.2. Financial Performance

- 8.3.3.3. Product Benchmarking

- 8.3.3.4. Strategic Initiatives

- 8.3.4. RMA Network

- 8.3.4.1. Overview

- 8.3.4.2. Financial Performance

- 8.3.4.3. Product Benchmarking

- 8.3.4.4. Strategic Initiatives

- 8.3.5. Carrot Fertility

- 8.3.5.1. Overview

- 8.3.5.2. Financial Performance

- 8.3.5.3. Product Benchmarking

- 8.3.5.4. Strategic Initiatives

- 8.3.6. WINFertility

- 8.3.6.1. Overview

- 8.3.6.2. Financial Performance

- 8.3.6.3. Product Benchmarking

- 8.3.6.4. Strategic Initiatives

- 8.3.7. Columbia University

- 8.3.7.1. Overview

- 8.3.7.2. Financial Performance

- 8.3.7.3. Product Benchmarking

- 8.3.7.4. Strategic Initiatives

- 8.3.8. Shady Grove Fertility

- 8.3.8.1. Overview

- 8.3.8.2. Financial Performance

- 8.3.8.3. Product Benchmarking

- 8.3.8.4. Strategic Initiatives

- 8.3.9. Kindbody

- 8.3.9.1. Overview

- 8.3.9.2. Financial Performance

- 8.3.9.3. Product Benchmarking

- 8.3.9.4. Strategic Initiatives

- 8.3.1. ReproTech LLC