|

|

市場調査レポート

商品コード

1268625

沈降シリカの市場規模、シェア、動向分析レポート:用途別(ゴム、農薬、オーラルケア、食品)、地域別(北米、欧州、アジア太平洋)、セグメント予測、2023年~2030年Precipitated Silica Market Size, Share & Trends Analysis Report By Application (Rubber, Agrochemicals, Oral Care, Food), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2023 - 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 沈降シリカの市場規模、シェア、動向分析レポート:用途別(ゴム、農薬、オーラルケア、食品)、地域別(北米、欧州、アジア太平洋)、セグメント予測、2023年~2030年 |

|

出版日: 2023年04月05日

発行: Grand View Research

ページ情報: 英文 114 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

沈降シリカの市場成長と動向:

Grand View Research, Inc.の新しいレポートによると、世界の沈降シリカの市場規模は、2030年までに37億2,000万米ドルに達すると予測されています。

予測期間中のCAGRは7.1%を記録すると予想されています。タイヤトレッドの耐摩耗性と接着性を高めるために、タイヤでの利用が増加していることが、成長を促進する主な要因となっています。環境に優しいという理由で、カーボンブラックを沈降シリカに置き換えることで、市場が活性化すると予想されます。

フリーフロー剤として広く使用されているため、農薬への応用は大きな成長が見込まれます。吸収能力と化学的安定性の向上により、沈降シリカの使用が増加し、農薬市場の需要を促進すると予想されます。

優れた吸収性、高純度、固結防止特性により、食品産業での使用が増加し、予測期間中に沈降シリカの需要を促進すると予想されます。沈降シリカは、食用塩や粉末食品などの食品用途に広く使用されています。野菜や果物の抽出物、保存料、栄養素を自動的に投与することで、製品の安定性を高めることができます。

農薬の分野では、農薬製造の有効成分担体として使用されています。殺菌剤、殺虫剤、除草剤など様々な農薬において、化学的有効成分の安定した高充填を可能にします。また、尿素や化学品の製造工程では、その割れにくい特性から助剤としても使用されています。

歯磨き粉業界では、洗浄剤や増粘剤として同製品の使用が増加しており、予測期間中、沈降シリカ市場の成長を促進すると期待されています。本製品は、効果的な洗浄と研磨性能を提供するためにオーラルケア用途で使用されます。主にその美白および洗浄特性から、歯磨剤に使用され、歯磨剤の要件を満たすために使用されています。

沈降シリカの市場レポートハイライト

- ゴム用途は、タイヤメーカーからの膨大な需要により、2022年の売上高で53.0%の最高市場シェアを占めました。

- 農薬用途は、液体農薬の粘弾性特性の向上などの利点により、予測期間中に6.4%のCAGRを記録すると予測されています。

- アジア太平洋は、タイヤの大量生産と建設活動の活発化により、2022年の売上高シェア42.7%で沈降シリカ市場をリードしました。

- 収益面では、中南米が同地域の景気回復を理由に収益と予測期間中にCAGR 8.4%を記録すると推定されます。

- Evonik Industries、Solvay SA.、PPG Industriesが、この市場の主要メーカーです。需要増に伴う生産能力増強や、原材料価格の変動に伴う価格修正が、トップ企業が採用する主要な戦略です。

目次

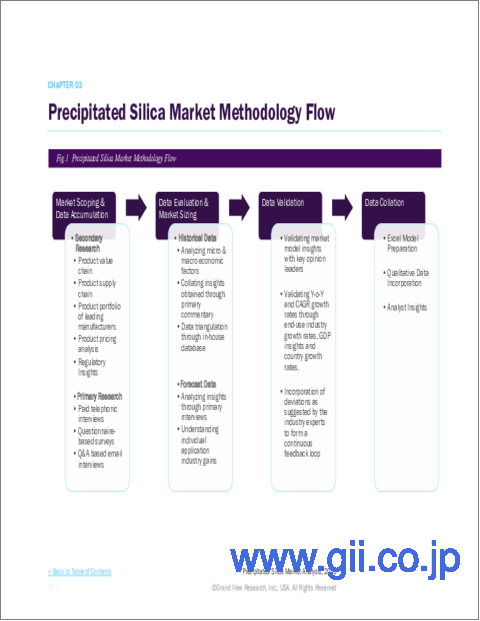

第1章 調査手法と範囲

- 市場セグメンテーションと範囲

- 市場の定義

- 情報調達

- 情報分析

- データ分析モデル

- 市場の形成とデータの視覚化

- データの検証と公開

- 調査範囲と前提条件

- データソースのリスト

第2章 エグゼクティブサマリー

- 市場の見通し

- セグメント別の見通し

- 競争力の見通し

第3章 市場変数、動向、および範囲

- 市場系統の見通し

- 世界のシリカ市場

- 業界のバリューチェーン分析

- 原材料の動向

- 製造動向と技術の概要

- 規制の枠組み

- 市場力学

- 市場促進要因の分析

- 市場抑制要因分析

- 市場機会分析

- 市場の課題

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

- PESTLE分析

- 政治的

- 経済的

- 社会的情勢

- テクノロジー

- 環境

- 法的

第4章 沈降シリカ市場:用途の推定・動向分析

- 沈降シリカ市場:用途変動分析、2022年および2030年

- ゴム

- 農薬

- オーラルケア

- 食品

- その他

第5章 沈降シリカ市場:地域推定・動向分析

- 地域分析、2022年と2030年

- 北米

- 用途別、2018年~2030年

- 米国

- カナダ

- 欧州

- 用途別、2018年~2030年

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- アジア太平洋地域

- 用途別、2018年~2030年

- 中国

- インド

- 日本

- 中南米

- 用途別、2018年~2030年

- ブラジル

- 中東とアフリカ

- 用途別、2018年~2030年

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第6章 競合情勢

- 主要市場参入企業別最近の動向と影響分析

- 企業ランキング

- ヒートマップ分析

- 市場戦略

- ベンダー情勢

- 戦略マッピング

- 企業プロファイル・一覧表

- Anten Chemical Co. Ltd.

- 会社概要

- 財務実績

- 製品のベンチマーク

- Huber Engineered Materials

- 会社概要

- 財務実績

- 製品のベンチマーク

- Evonik Industries AG

- 会社概要

- 財務実績

- 製品のベンチマーク

- PPG Industries, Inc.

- 会社概要

- 製品のベンチマーク

- IQE Group

- 会社概要

- 製品のベンチマーク

- Solvay SA

- 会社概要

- 製品のベンチマーク

- PQ Corporation

- 会社概要

- 製品のベンチマーク

- MLA Group

- 会社概要

- 製品のベンチマーク

- Tosoh Silica Corporation

- 会社概要

- 製品のベンチマーク

- Oriental Silicas Corporation

- 会社概要

- 財務実績

- 製品のベンチマーク

- WR Grace &Co.

- 会社概要

- 財務実績

- 製品のベンチマーク

- Madhu Silica Pvt. Ltd.

- 会社概要

- 財務実績

- 製品のベンチマーク

- Anten Chemical Co. Ltd.

List of Tables

- TABLE 1 Precipitated silica market estimates & forecasts, 2018-2030 (USD Million) (Kilotons)

- TABLE 2 Precipitated silica market estimates & forecasts, by rubber, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 3 Precipitated silica market estimates & forecasts, by agrochemicals, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 4 Precipitated silica market estimates & forecasts, by oral care, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 5 Precipitated silica market estimates & forecasts, by food, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 6 Precipitated silica market estimates & forecasts, by others, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 7 North America precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 8 North America precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 9 North America precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 10 U.S. precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 11 U.S. precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 12 U.S. precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 13 Canada precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 14 Canada precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 15 Canada precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 16 Europe precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 17 Europe precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 18 Europe precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 19 Germany precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 20 Germany precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 21 Germany precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 22 UK precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 23 UK precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 24 UK precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 25 France precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 26 France precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 27 Spain precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 28 Spain precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 29 Spain precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 30 Italy precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 31 Italy precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 32 Italy precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 33 Asia Pacific precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 34 Asia Pacific precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 35 Asia Pacific precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 36 China precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 37 China precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 38 China precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 39 India precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 40 India precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 41 India precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 42 Japan precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 43 Japan precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 44 Japan precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 45 Central & South America precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 46 Central & South America precipitated silica market estimates & forecasts, by product, 2018 - 2030 (USD Million)

- TABLE 47 Central & South America precipitated silica market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

- TABLE 48 Central & South America precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 49 Central & South America precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 50 Brazil precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 51 Brazil precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 52 Brazil precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 53 Middle East & Africa precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 54 Middle East & Africa precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 55 Middle East & Africa precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 56 Saudi Arabia precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 57 Saudi Arabia precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 58 Saudi Arabia precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 59 UAE precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 60 UAE precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 61 UAE precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

- TABLE 62 South Africa precipitated silica market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

- TABLE 63 South Africa precipitated silica market estimates & forecasts, by application, 2018 - 2030 (USD Million)

- TABLE 64 South Africa precipitated silica market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

List of Figures

- Fig 1. Market segmentation

- Fig 2. Information procurement

- Fig 3. Data Analysis Models

- Fig 4. Market Formulation and Validation

- Fig 5. Market snapshot

- Fig 6. Segmental outlook - Application

- Fig 7. Competitive Outlook

- Fig 8. Precipitated silica market outlook, 2018 - 2030 (USD Million) (Kilotons)

- Fig 9. Value chain analysis

- Fig 10. Market dynamics

- Fig 11. Porter's Analysis

- Fig 12. PESTEL Analysis

- Fig 13. Precipitated silica market, by application: Key takeaways

- Fig 14. Precipitated silica market, by application: Market share, 2022 & 2030

- Fig 15. Precipitated silica market: Regional analysis, 2022

- Fig 16. Precipitated silica market, by region: Key takeaways

Precipitated Silica Market Growth & Trends:

The global precipitated silica market size is anticipated to reach USD 3.72 billion by 2030, according to a new report by Grand View Research, Inc. It is expected to register a CAGR of 7.1% during the forecast period. Increasing utilization of the product in tires to enhance tire tread wear resistance and adhesion, is the major factor driving the growth. Substitution of carbon black with precipitated silica on account of its eco-friendly nature is anticipated to fuel the market.

Application of the product in agrochemicals is expected to witness a considerable growth on account of its extensive usage as free flow agent. Increasing use of precipitated silica owing to its absorption ability and improved chemical stability is expected to drive demand from the agrochemicals market.

Growing use in food industry on account of its superior absorption, high purity, and anti-caking property is expected to fuel demand for precipitated silica over the forecast period. Precipitated silica is used extensively in food applications including edible salt and powdered food products. It helps enhance product consistency through automated dosing of vegetable and fruit extracts, preservatives, and nutrients.

In agrochemicals, the product is used as an active ingredient carrier in pesticide manufacturing. It enables consistent and high loading of chemically active ingredients in various agrochemicals including fungicides, insecticides, and herbicides. In addition, the product is used as a process aid for urea and chemicals owing to its anti-cracking properties.

Increasing use of the product in toothpaste industry as a cleaning and thickening agent is expected to drive growth of the precipitated silica market over the forecast period. The product is used in oral care applications to provide effective cleaning and polishing performance. It is used in toothpaste formulations, primarily on account of its whitening and cleaning properties, to meet dentifrice requirements.

Precipitated Silica Market Report Highlights:

- Rubber application held the highest market share of 53.0% in terms of revenue in 2022 owing to huge demand from tire manufacturers

- Agrochemicals application is forecasted to register a CAGR of 6.4% over the forecast period owing to advantages like improvement in visco-elastic characteristics of liquid agrochemicals.

- Asia Pacific led the precipitated silica market with a revenue share of 42.7% in 2022 owing to massive production of tires and increasing construction activity in the region

- In terms of revenue, Central and South America is estimated to register a CAGR of 8.4% over the forecast period on account of economic recovery in the region

- Evonik Industries, Solvay SA., and PPG Industries, are the key manufacturers in the market. Capacity extension owing to rising demand and price modification on account of volatility in raw material prices are the major strategies adopted by the top players.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Information Analysis

- 1.3.2. Data Analysis Models

- 1.3.3. Market Formulation & Data Visualization

- 1.3.4. Data Validation & Publishing

- 1.4. Research Scope and Assumptions

- 1.4.1. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segmental Outlook

- 2.3. Competitive Outlook

Chapter 3. Market Variables, Trends, and Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Global Silica Market

- 3.2. Industry Value Chain Analysis

- 3.2.1. Raw Material Trends

- 3.3. Manufacturing Trends & Technology Overview

- 3.4. Regulatory Framework

- 3.5. Market Dynamics

- 3.5.1. Market Driver Analysis

- 3.5.2. Market Restraint Analysis

- 3.5.3. Market Opportunity Analysis

- 3.5.4. Market Challenges

- 3.6. Porter's Five Forces Analysis

- 3.6.1. Bargaining Power of Suppliers

- 3.6.2. Bargaining Power of Buyers

- 3.6.3. Threat of Substitution

- 3.6.4. Threat of New Entrants

- 3.6.5. Competitive Rivalry

- 3.7. PESTLE Analysis

- 3.7.1. Political

- 3.7.2. Economic

- 3.7.3. Social Landscape

- 3.7.4. Technology

- 3.7.5. Environmental

- 3.7.6. Legal

Chapter 4. Precipitated Silica Market: Application Estimates & Trend Analysis

- 4.1. Precipitated Silica Market: Application Movement Analysis, 2022 & 2030

- 4.2. Rubber

- 4.2.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 4.3. Agrochemicals

- 4.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 4.4. Oral Care

- 4.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 4.5. Food

- 4.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 4.6. Others

- 4.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 5. Precipitated Silica Market: Regional Estimates & Trend Analysis

- 5.1. Regional Analysis, 2022 & 2030

- 5.2. North America

- 5.2.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.2.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.2.3. U.S.

- 5.2.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.2.3.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.2.4. Canada

- 5.2.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.2.4.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.3. Europe

- 5.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.3.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.3.3. Germany

- 5.3.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.3.3.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.3.4. UK

- 5.3.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.3.4.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.3.5. France

- 5.3.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.3.5.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.3.6. Spain

- 5.3.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.3.6.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.3.7. Italy

- 5.3.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.3.7.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.4. Asia Pacific

- 5.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.4.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.4.3. China

- 5.4.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.4.3.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.4.4. India

- 5.4.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.4.4.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.4.5. Japan

- 5.4.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.4.5.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.5. Central & South America

- 5.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.5.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.5.3. Brazil

- 5.5.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.5.3.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.6. Middle East & Africa

- 5.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.6.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.6.3. Saudi Arabia

- 5.6.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.6.3.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.6.4. UAE

- 5.6.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.6.4.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

- 5.6.5. South Africa

- 5.6.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

- 5.6.5.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Chapter 6. Competitive Landscape

- 6.1. Recent Developments & Impact Analysis, By Key Market Participants

- 6.2. Company Ranking

- 6.3. Heat Map Analysis

- 6.4. Market Strategies

- 6.5. Vendor Landscape

- 6.5.1. List of raw material supplier, key manufacturers, and distributors

- 6.5.2. List of prospective end-users

- 6.6. Strategy Mapping

- 6.7. Company Profiles/Listing

- 6.7.1. Anten Chemical Co. Ltd.

- 6.7.1.1. Company overview

- 6.7.1.2. Financial performance

- 6.7.1.3. Product benchmarking

- 6.7.2. Huber Engineered Materials

- 6.7.2.1. Company overview

- 6.7.2.2. Financial performance

- 6.7.2.3. Product benchmarking

- 6.7.3. Evonik Industries AG

- 6.7.3.1. Company overview

- 6.7.3.2. Financial performance

- 6.7.3.3. Product benchmarking

- 6.7.4. PPG Industries, Inc.

- 6.7.4.1. Company overview

- 6.7.4.2. Product benchmarking

- 6.7.5. IQE Group

- 6.7.5.1. Company overview

- 6.7.5.2. Product benchmarking

- 6.7.6. Solvay S.A.

- 6.7.6.1. Company overview

- 6.7.6.2. Product benchmarking

- 6.7.7. PQ Corporation

- 6.7.7.1. Company overview

- 6.7.7.2. Product benchmarking

- 6.7.8. MLA Group

- 6.7.8.1. Company overview

- 6.7.8.2. Product benchmarking

- 6.7.9. Tosoh Silica Corporation

- 6.7.9.1. Company overview

- 6.7.9.2. Product benchmarking

- 6.7.10. Oriental Silicas Corporation

- 6.7.10.1. Company overview

- 6.7.10.2. Financial performance

- 6.7.10.3. Product benchmarking

- 6.7.11. W.R. Grace & Co.

- 6.7.11.1. Company overview

- 6.7.11.2. Financial performance

- 6.7.11.3. Product benchmarking

- 6.7.12. Madhu Silica Pvt. Ltd.

- 6.7.12.1. Company overview

- 6.7.12.2. Financial performance

- 6.7.12.3. Product benchmarking

- 6.7.1. Anten Chemical Co. Ltd.