|

|

市場調査レポート

商品コード

1224666

分析機器市場の規模、シェア、動向分析レポート:技術別(PCR、分光)、用途別(法医学分析、ライフサイエンス研究開発)、製品別(機器、サービス)、セグメント別予測、2023年~2030年Analytical Instrumentation Market Size, Share & Trends Analysis Report By Technology (PCR, Spectroscopy), By Application (Forensic Analysis, Life Sciences R&D), By Product (Instruments, Services), And Segment Forecasts, 2023 - 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 分析機器市場の規模、シェア、動向分析レポート:技術別(PCR、分光)、用途別(法医学分析、ライフサイエンス研究開発)、製品別(機器、サービス)、セグメント別予測、2023年~2030年 |

|

出版日: 2023年01月30日

発行: Grand View Research

ページ情報: 英文 180 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

分析機器市場の成長と動向

Grand View Research, Inc.の最新レポートによると、世界の分析機器市場規模は、2023年から2030年にかけてCAGR 3.53%を記録し、2030年までに700億9000万米ドルに達すると予測されています。分析ラボ機器は、サンプルの定量・定性分析を主目的とする幅広い機器を含みます。製薬業界やバイオテクノロジー業界における研究開発活動の増加や、精密医療への応用を目的とした分析機器の採用が増加していることが、業界を牽引する主な要因となっています。各国の政府は、新薬開発を支援し、各地域のヘルスケアを向上させるために、医薬品の研究開発に継続的に投資しています。

例えば、2020年10月、UAE政府は、堅牢な研究開発能力を有するインドのヘルスケア製造企業を支援するために、財政的なインセンティブを提供することを発表しました。この発表は、「UAE-インドヘルスケア会議2020」で行われたもので、医薬品、ヘルスケア、医療機器、代替医療に関する両国のパートナーシップとコラボレーションを促進することを目的としています。このような取り組みにより、研究開発活動が活発化し、ひいては市場の成長を支えることになるでしょう。COVID-19の大流行により、2020年には分光器やクロマトグラフィー関連機器、熱分析器などの分析機器の売上が減少しました。

これは、ロックダウンの厳格化、サプライチェーンの混乱、期間中の臨床試験活動の減少が原因です。しかし、パンデミックにより、2021年にはポリメラーゼ連鎖反応(PCR)、マイクロアレイ、シーケンス技術に関連する機器の需要が大幅に増加しました。この期間、増加するCOVID-19の症例に対処するため、いくつかの新しいPCR製品が発売されました。例えば、2022年3月、Rocheは、検査量の増加とCOVID-19検査の業務効率の向上を目的として、新しいcobas 5800システムを英国で発売しました。さらに、技術の進歩も分析時間の短縮につながり、分析機器の医療用途を増やしています。

例えば、2021年6月、Trivitronヘルスケアは、HbA1cを3分未満で検出することを目的としたHPLC分析機器「NANO H5 &NANO H110」を発売しました。これらのHPLCベースのHbA1c分析器は、ヘモグロビンの変種、サラセミア、糖尿病のモニタリングにも役立ちます。さらに、主要企業は、マイクロプラスチック分析のための新しい分析機器を発表しています。例えば、2022年10月、アジレント・テクノロジー株式会社は、環境サンプル中のマイクロプラスチック分析用に最適化されたClarity 1.5ソフトウェア付き強化型8700 LDIRケミカル・イメージング・システムを発表しました。分析機器の進歩には、スペクトル取得、分析速度、変換、ライブラリマッチングの強化が含まれます。

これらの技術的進歩は、分析機器の採用を増やし、市場成長を促進する上で大きな助けとなります。一方、分析機器のコストが高いことが、予測される期間中の産業成長を抑制する可能性があります。質量分析計、LC/MSシステムは、技術、要件、分析に応じて、約40,000ドルから200,000ドルの費用がかかります。このような高額なコストは、中小規模の研究所では手が届かない可能性があり、市場の成長を阻害する要因となっています。しかし、こうしたコスト要因を克服するため、さまざまな企業や団体が、分析機器を手頃な価格で提供する取り組みを行っています。例えば、Thermo Fisher Scientific社は、質量分析計を手頃な価格で購入できるよう支援する「Mass Spectrometer Price Affordability Programs」を提供しています。

分析機器市場のレポートハイライト

質量分析計、クロマトグラフ、シーケンシングシステムなど、さまざまなタイプの分析機器を提供する企業が複数存在するため、機器セグメントが2022年に最大シェアを占めました。

PCR技術分野は、迅速な増幅、少量のサンプルで済む、1つのサンプルから複数の分析物を検出できるといったPCR技術の利点により、2022年に最大のシェアを占めました。

モノクローナル抗体、ワクチン、治療用タンパク質などの新規生物製剤を開発・製造するために、さまざまな生命科学産業が研究開発活動を活発化させていることから、2022年には生命科学研究開発アプリケーション分野が市場を独占しました。

北米は、医療制度と製薬産業が確立されており、臨床および研究目的の分析機器に対する大きな需要があるため、2022年に最大の売上シェアを占めました。

目次

第1章 調査手法と範囲

- 調査手法

- 調査の仮定

- 情報調達

- 購入したデータベース

- GVRの内部データベース

- 二次情報

- 1次調査

- 情報またはデータ分析

- データ分析モデル

- 市場の策定と検証

第2章 エグゼクティブサマリー

- 市場のスナップショット

- セグメントのスナップショット

- 競合情勢のスナップショット

第3章 市場変数、動向、および範囲

- 親市場分析

- 市場力学

- 市場促進要因分析

- 分析機器の技術的進歩

- 製薬業界および政府調査機関による研究開発費の増加

- 高精度医療アプリケーション向けの分析機器の採用の増加

- 市場抑制要因分析

- 機器の高コスト

- 市場促進要因分析

- 普及と成長見通しのマッピング

- 分析機器市場- ポーターのファイブフォース分析

- 分析機器市場-SWOT分析

- COVID-19影響分析

第4章 製品ビジネス分析

- 分析機器市場-製品変動分析

- 機器

- サービス

- ソフトウェア

第5章 テクノロジービジネス分析

- 分析機器市場-技術変動分析

- ポリメラーゼ連鎖反応

- 分光法

- 顕微鏡検査

- クロマトグラフィー

- フローサイトメトリー

- シーケンシング

- マイクロアレイ

- その他

第6章 アプリケーションビジネス分析

- 分析機器市場- アプリケーションの変動分析

- ライフサイエンスの研究開発

- 臨床および診断分析

- 飲食品の分析

- フォレンジック分析

- 環境試験

- その他

第7章 :地域ビジネス分析

- 分析機器市場:地域変動分析

- 北米

- SWOT分析

- 米国

- 主要な国のダイナミクス

- 競合シナリオ

- カナダ

- 主要な国のダイナミクス

- 競合シナリオ

- 欧州

- SWOT分析

- 英国

- 主要な国のダイナミクス

- 競合シナリオ

- ドイツ

- 主要な国のダイナミクス

- 競合シナリオ

- フランス

- 主要な国のダイナミクス

- 競合シナリオ

- イタリア

- 主要な国のダイナミクス

- 競合シナリオ

- スペイン

- 主要な国のダイナミクス

- 競合シナリオ

- デンマーク

- 主要な国のダイナミクス

- 競合シナリオ

- スウェーデン

- 主要な国のダイナミクス

- 競合シナリオ

- ノルウェー

- 主要な国のダイナミクス

- 競合シナリオ

- アジア太平洋地域

- SWOT分析

- アジア太平洋地域の真空採血管、2018年から2030年(100万米ドル)

- 日本

- 主要な国のダイナミクス

- 競合シナリオ

- 日本の分析機器市場、2018~2030年(USD Million)

- 中国

- 主要な国のダイナミクス

- 競合シナリオ

- 中国の分析機器市場、2018年から2030年(100万米ドル)

- インド

- 主要な国のダイナミクス

- 競合シナリオ

- インドの分析機器市場、2018年から2030年(100万米ドル)

- オーストラリア

- 主要な国のダイナミクス

- 競合シナリオ

- オーストラリアの分析機器市場、2018年から2030年(100万米ドル)

- タイ

- 主要な国のダイナミクス

- 競合シナリオ

- タイの分析機器市場、2018年から2030年(100万米ドル)

- 韓国

- 主要な国のダイナミクス

- 競合シナリオ

- 韓国の分析機器市場、2018~2030年(100万米ドル)

- SWOT分析

- ラテンアメリカ

- SWOT分析

- ラテンアメリカの分析機器市場、2018~2030年(100万米ドル)

- ブラジル

- 主要な国のダイナミクス

- 競合シナリオ

- ブラジルの分析機器市場、2018~2030年(100万米ドル)

- メキシコ

- 主要な国のダイナミクス

- 競合シナリオ

- メキシコの分析機器市場、2018~2030年(100万米ドル)

- アルゼンチン

- 主要な国のダイナミクス

- 競合シナリオ

- アルゼンチンの分析機器市場、2018~2030年(100万米ドル)

- SWOT分析

- 中東およびアフリカ(Mea)

- SWOT分析

- 南アフリカ

- 主要な国のダイナミクス

- 競合シナリオ

- サウジアラビア

- 主要な国のダイナミクス

- 競合シナリオ

- アラブ首長国連邦

- 主要な国のダイナミクス

- 競合シナリオ

- クウェート

- 主要な国のダイナミクス

- 競合シナリオ

第8章 競合情勢

- 参入企業の概要

- Thermo Fisher Scientific Inc.

- Waters Corporation

- Shimadzu Corporation

- Danaher

- Agilent Technologies, Inc.

- Bruker Corporation

- Perkinelmer, Inc.

- Mettler Toledo

- Zeiss Group

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Eppendorf Se

- F. Hoffmann-La Roche Ag

- Sartorius Ag

- Avantor, Inc.

- 財務実績

- 参入企業の分類

- 市場のリーダー

- 分析機器の市場シェア分析、2022年

- 戦略マッピング

- 拡張

- 取得

- コラボレーション

- 製品・サービスのローンチ

- パートナーシップ

- その他

- 市場のリーダー

List of Tables

- Table 1 List of secondary sources

- Table 2 List of abbreviations

- Table 3 Global analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 4 Global analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 5 Global analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 6 Global analytical instrumentation market, by region, 2018 - 2030 (USD Million)

- Table 7 North America analytical instrumentation market, by country, 2018 - 2030 (USD Million)

- Table 8 North America analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 9 North America analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 10 North America analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 11 U.S. analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 12 U.S. analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 13 U.S. analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 14 Canada analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 15 Canada analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 16 Canada analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 17 Europe analytical instrumentation market, by country, 2018 - 2030 (USD Million)

- Table 18 Europe analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 19 Europe analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 20 Europe analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 21 U.K. analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 22 U.K. analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 23 U.K. analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 24 Germany analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 25 Germany analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 26 Germany analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 27 France analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 28 France analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 29 France analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 30 Italy analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 31 Italy analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 32 Italy analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 33 Spain analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 34 Spain analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 35 Spain analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 36 Denmark analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 37 Denmark analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 38 Denmark analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 39 Sweden analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 40 Sweden analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 41 Sweden analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 42 Norway analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 43 Norway analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 44 Norway analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 45 Asia Pacific analytical instrumentation market, by country, 2018 - 2030 (USD Million)

- Table 46 Asia Pacific analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 47 Asia Pacific analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 48 Asia Pacific analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 49 Japan analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 50 Japan analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 51 Japan analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 52 China analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 53 China analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 54 China analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 55 India analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 56 India analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 57 India analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 58 Australia analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 59 Australia analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 60 Australia analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 61 Thailand analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 62 Thailand analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 63 Thailand analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 64 South Korea analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 65 South Korea analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 66 South Korea analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 67 Latin America analytical instrumentation market, by country, 2018 - 2030 (USD Million)

- Table 68 Latin America analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 69 Latin America analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 70 Latin America analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 71 Brazil analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 72 Brazil analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 73 Brazil analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 74 Mexico analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 75 Mexico analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 76 Mexico analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 77 Argentina analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 78 Argentina analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 79 Argentina analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 80 Middle East & Africa analytical instrumentation market, by country, 2018 - 2030 (USD Million)

- Table 81 Middle East & Africa analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 82 Middle East & Africa analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 83 Middle East & Africa analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 84 South Africa analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 85 South Africa analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 86 South Africa analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 87 Saudi Arabia analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 88 Saudi Arabia analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 89 Saudi Arabia analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 90 UAE analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 91 UAE analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 92 UAE analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 93 Kuwait analytical instrumentation market, by product, 2018 - 2030 (USD Million)

- Table 94 Kuwait analytical instrumentation market, by technology, 2018 - 2030 (USD Million)

- Table 95 Kuwait analytical instrumentation market, by application, 2018 - 2030 (USD Million)

- Table 96 Participant's overview

- Table 97 Financial performance

- Table 98 Key companies undergoing expansions

- Table 99 Key companies undergoing acquisitions

- Table 100 Key companies undergoing collaborations

- Table 101 Key companies launching new products/services

- Table 102 Key companies undergoing partnerships

- Table 103 Key companies undertaking other strategies

List of Figures

- Fig. 1 Market research process

- Fig. 2 Data triangulation techniques

- Fig. 3 Primary research pattern

- Fig. 4 Market research approaches

- Fig. 5 Value-chain-based sizing & forecasting

- Fig. 6 QFD modeling for market share assessment

- Fig. 7 Market formulation & validation

- Fig. 8 Market summary, 2022 (USD Million)

- Fig. 9 Market segmentation & scope

- Fig. 10 Market driver impact

- Fig. 11 Market restraint impact

- Fig. 12 Penetration & growth prospect mapping

- Fig. 13 Porter's analysis

- Fig. 14 SWOT analysis

- Fig. 15 Analytical instrumentation market: Product outlook and key takeaways

- Fig. 16 Analytical instrumentation market: Product movement analysis

- Fig. 17 Global instruments market, 2018 - 2030 (USD Million)

- Fig. 18 Global software market, 2018 - 2030 (USD Million)

- Fig. 19 Global services market, 2018 - 2030 (USD Million)

- Fig. 20 Analytical instrumentation market: Technology outlook and key takeaways

- Fig. 21 Analytical instrumentation market: Technology movement analysis

- Fig. 22 Global polymerase chain reaction market, 2018 - 2030 (USD Million)

- Fig. 23 Global spectroscopy market, 2018 - 2030 (USD Million)

- Fig. 24 Global microscopy market, 2018 - 2030 (USD Million)

- Fig. 25 Global chromatography market, 2018 - 2030 (USD Million)

- Fig. 26 Global flow cytometry market, 2018 - 2030 (USD Million)

- Fig. 27 Global sequencing market, 2018 - 2030 (USD Million)

- Fig. 28 Global microarray market, 2018 - 2030 (USD Million)

- Fig. 29 Global other type market, 2018 - 2030 (USD Million)

- Fig. 30 Analytical instrumentation market: Application outlook and key takeaways

- Fig. 31 Analytical instrumentation market: Application movement analysis

- Fig. 32 Global life sciences research & development market, 2018 - 2030 (USD Million)

- Fig. 33 Global clinical & diagnostic analysis market, 2018 - 2030 (USD Million)

- Fig. 34 Global food & beverage analysis market, 2018 - 2030 (USD Million)

- Fig. 35 Global forensic analysis market, 2018 - 2030 (USD Million)

- Fig. 36 Global environmental testing market, 2018 - 2030 (USD Million)

- Fig. 37 Analytical instrumentation market: Regional outlook and key takeaways

- Fig. 38 North America: SWOT Analysis

- Fig. 39 North America analytical instrumentation market, 2018 - 2030 (USD Million)

- Fig. 40 U.S. key country dynamics

- Fig. 41 U.S. analytical instrumentation market, 2018 - 2030 (USD Million)

- Fig. 42 Canada key country dynamics

- Fig. 43 Canada analytical instrumentation market, 2018 - 2030 (USD Million)

- Fig. 44 Europe: SWOT Analysis

- Fig. 45 Europe analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 46 U.K. key country dynamics

- Fig. 47 U.K. analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 48 Germany key country dynamics

- Fig. 49 Germany analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 50 France key country dynamics

- Fig. 51 France analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 52 Italy key country dynamics

- Fig. 53 Italy analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 54 Spain key country dynamics

- Fig. 55 Spain analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 56 Denmark key country dynamics

- Fig. 57 Denmark analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 58 Sweden key country dynamics

- Fig. 59 Sweden analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 60 Norway key country dynamics

- Fig. 61 Norway analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 62 Asia-Pacific: SWOT Analysis

- Fig. 63 Asia-Pacific analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 64 Japan key country dynamics

- Fig. 65 Japan analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 66 China key country dynamics

- Fig. 67 China analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 68 India key country dynamics

- Fig. 69 India analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 70 Australia key country dynamics

- Fig. 71 Australia analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 72 Thailand key country dynamics

- Fig. 73 Thailand analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 74 South Korea key country dynamics

- Fig. 75 South Korea analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 76 Latin America: SWOT Analysis

- Fig. 77 Latin America analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 78 Brazil key country dynamics

- Fig. 79 Brazil analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 80 Mexico key country dynamics

- Fig. 81 Mexico analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 82 Argentina key country dynamics

- Fig. 83 Argentina analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 84 MEA: SWOT Analysis

- Fig. 85 MEA analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 86 South Africa key country dynamics

- Fig. 87 South Africa analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 88 Saudi Arabia key country dynamics

- Fig. 89 Saudi Arabia analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 90 UAE key country dynamics

- Fig. 91 UAE analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 92 Kuwait key country dynamics

- Fig. 93 Kuwait analytical instrumentation market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 94 Market participant categorization

- Fig. 95 Analytical instrumentation market share analysis, 2022

- Fig. 96 Strategy framework

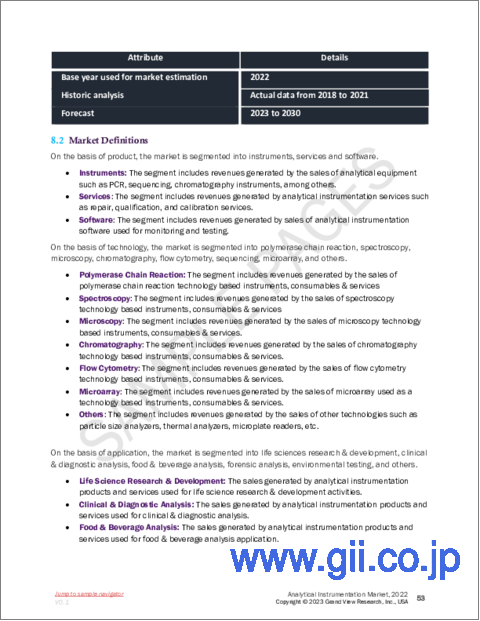

Analytical Instrumentation Market Growth & Trends:

The global analytical instrumentation market size is projected to reach USD 70.09 billion by 2030, registering a CAGR of 3.53% from 2023 to 2030, according to a new report by Grand View Research, Inc. Analytical laboratory instrumentation includes a broad range of instruments with the main purpose of quantitative and qualitative analysis of samples. Increasing research and development activities in the pharmaceutical and biotechnology industries and increasing adoption of analytical instrumentation for applications in precision medicine are key factors driving the industry. Governments from various countries are continuously investing in pharmaceutical R&D to support new drug development and improve healthcare in their regions.

For instance, in October 2020, the UAE government announced the provision of financial incentives to support Indian healthcare manufacturing companies with robust R&D capabilities. The announcement was made at the UAE-India Healthcare Conference 2020 and was intended to promote partnerships and collaborations between the two countries for pharmaceutical, healthcare, medical devices, and alternative medicine. Such initiatives will boost R&D activities, which, in turn, will support market growth. The COVID-19 pandemic led to a decrease in the sales of analytical instruments, such as spectroscopy and chromatography-related instrumentation, thermal analyzers, and others in 2020.

This was due to the imposition of lockdown strictures, disruption of supply chains, and a decrease in clinical trial activities during the period. However, due to the pandemic, instrumentation related to a polymerase chain reaction (PCR), microarray, and sequencing technologies saw a significant rise in demand in 2021. Several new PCR products were launched to tackle the increasing COVID-19 cases during this period. For instance, in March 2022, Roche launched its new cobas 5800 system in the U.K. to increase testing volumes and enhance the operational efficiency of COVID-19 testing. Moreover, technological advancements are also leading to a reduction in analysis time and are increasing the medical applications of analytical instrumentation.

For instance, in June 2021, Trivitron Healthcare launched its NANO H5 & NANO H110 HPLC analyzers intended for the detection of HbA1c in less than 3 minutes. These HPLC-based HbA1c analyzers can also aid in monitoring hemoglobin variants, thalassemia, and diabetes. Furthermore, key players are launching novel analytical instrumentation for microplastic analysis. For instance, in October 2022, Agilent Technologies, Inc. launched its enhanced 8700 LDIR Chemical Imaging System with Clarity 1.5 software optimized for the analysis of microplastics in environmental samples. The advances in analytical instruments include enhanced spectral acquisition, speed of analysis, transformation, and library matching.

These technological advancements can significantly aid in increasing the adoption of analytical instrumentation and fuel market growth. On the other hand, the high cost of analytical instrumentation may restrain the industry growth during the projected timeframe. Spectrometry has a high initial setup cost; the mass spectrometers, LC/MS systems, cost around USD 40,000 to USD 200,000, depending on the technology, requirement, and analysis. Such high costs may not be affordable for small- and medium-sized laboratories, which hampers the market growth. However, to overcome the cost-associated factors, various companies and organizations are undertaking initiatives to provide analytical instruments at affordable prices. For instance, Thermo Fisher Scientific offers Mass Spectrometer Price Affordability Programs in which the company helps buy mass spectrometry instruments at affordable prices.

Analytical Instrumentation Market Report Highlights:

- The instruments segment held the largest share in 2022 owing to the presence of several companies offering different types of analytical instrumentation, such as mass spectrometers, chromatographs, and sequencing systems

- The PCR technology segment accounted for the largest share in 2022due to the benefits offered by PCR technology, such as rapid amplification, the requirement of a small amount of sample, and utility for the detection of multiple analytes in a single sample

- The life sciences research & development application segment dominated the market in 2022 owing to the rising R&D activities by various life sciences industries to develop and manufacture novel biologics, such as monoclonal antibodies, vaccines, and therapeutic proteins

- North America held the largest revenue share in 2022due to the presence of a well-established healthcare system and pharmaceutical industry in the region, which has created a significant demand for analytical instrumentation for clinical and research purposes

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Research Methodology

- 1.2 Research Assumptions

- 1.2.1 Estimates And Forecast Timeline

- 1.3 Information Procurement

- 1.3.1 Purchased Database

- 1.3.2 GVR's Internal Database

- 1.3.3 Secondary Sources

- 1.3.4 Primary Research

- 1.4 Information Or Data Analysis

- 1.4.1 Data Analysis Models

- 1.5 Market Formulation & Validation

Chapter 2 Executive Summary

- 2.1 Market Snapshot

- 2.2 Segment Snapshot

- 2.3 Competitive Landscape Snapshot

Chapter 3 Market Variables, Trends, & Scope

- 3.1 Parent Market Analysis

- 3.2 Market Dynamics

- 3.2.1 Market Driver Analysis

- 3.2.1.1 Technological Advancements In Analytical Instruments

- 3.2.1.2 Increasing R&D Spending By Pharmaceutical Industry & Government Research Organizations

- 3.2.1.3 Increasing Adoption Of Analytical Instrumentation For Precision Medicine Applications

- 3.2.2 Market Restraint Analysis

- 3.2.2.1 High cost of instruments

- 3.2.1 Market Driver Analysis

- 3.3 Penetration &Growth Prospect Mapping

- 3.4 Analytical Instrumentation Market - Porter's Five Forces Analysis

- 3.5 Analytical Instrumentation Market - SWOT Analysis

- 3.6 COVID-19 Impact Analysis

Chapter 4 Product Business Analysis

- 4.1 Analytical Instrumentation Market-Product Movement Analysis

- 4.2 Instruments

- 4.2.1 Global Instruments Market, 2018 - 2030 (USD Million)

- 4.3 Services

- 4.3.1 Global Services Market, 2018 - 2030 (USD Million)

- 4.4 Software

- 4.4.1 Global Software Market, 2018 - 2030 (USD Million)

Chapter 5 Technology Business Analysis

- 5.1 Analytical Instrumentation Market-Technology Movement Analysis

- 5.2 Polymerase Chain Reaction

- 5.2.1 Global Polymerase Chain Reaction Market, 2018 - 2030 (USD Million)

- 5.3 Spectroscopy

- 5.3.1 Global Spectroscopy Market, 2018 - 2030 (USD Million)

- 5.4 Microscopy

- 5.4.1 Global Microscopy Market, 2018 - 2030 (USD Million)

- 5.5 Chromatography

- 5.5.1 Global Chromatography Market, 2018 - 2030 (USD Million)

- 5.6 Flow Cytometry

- 5.6.1 Global Flow Cytometry Market, 2018 - 2030 (USD Million)

- 5.7 Sequencing

- 5.7.1 Global Sequencing Market, 2018 - 2030 (USD Million)

- 5.8 Microarray

- 5.8.1 Global Microarray Market, 2018 - 2030 (USD Million)

- 5.9 Others

- 5.9.1 Global Others Market, 2018 - 2030 (USD Million)

Chapter 6 Application Business Analysis

- 6.1 Analytical Instrumentation Market-Application Movement Analysis

- 6.2 Life Sciences Research & Development

- 6.2.1 Global Life Sciences Research & Development Market, 2018 - 2030 (USD Million)

- 6.3 Clinical & Diagnostic Analysis

- 6.3.1 Global Clinical & Diagnostic Analysis Market, 2018 - 2030 (USD Million)

- 6.4 Food & Beverage Analysis

- 6.4.1 Global Food & Beverage Analysis Market, 2018 - 2030 (USD Million)

- 6.5 Forensic Analysis

- 6.5.1 Global Forensic Analysis Market, 2018 - 2030 (USD Million)

- 6.6 Environmental Testing

- 6.6.1 Global Environmental Testing Market, 2018 - 2030 (USD Million)

- 6.7 Others

- 6.7.1 Global Others Market, 2018 - 2030 (USD Million)

Chapter 07 Regional Business Analysis

- 7.1 Analytical Instrumentation Market: Regional Movement Analysis

- 7.2 North America

- 7.2.1 Swot Analysis

- 7.2.1.1 North America Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.2.2 U.S.

- 7.2.2.1 Key Country Dynamics

- 7.2.2.2 Competitive Scenario

- 7.2.2.3 U.S. Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.2.3 Canada

- 7.2.3.1 Key Country Dynamics

- 7.2.3.2 Competitive Scenario

- 7.2.3.3 Canada Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.2.1 Swot Analysis

- 7.3 Europe

- 7.3.1 Swot Analysis

- 7.3.1.1 Europe Analytical Instrumentation Market Estimates And Forecast, 2018 - 2030 (USD Million)

- 7.3.2 U.K.

- 7.3.2.1 Key Country Dynamics

- 7.3.2.2 Competitive Scenario

- 7.3.2.3 U.K. Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.3.3 Germany

- 7.3.3.1 Key Country Dynamics

- 7.3.3.2 Competitive Scenario

- 7.3.3.3 Germany Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.3.4 France

- 7.3.4.1 Key Country Dynamics

- 7.3.4.2 Competitive Scenario

- 7.3.4.3 France Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.3.5 Italy

- 7.3.5.1 Key Country Dynamics

- 7.3.5.2 Competitive Scenario

- 7.3.5.3 Italy Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.3.6 Spain

- 7.3.6.1 Key Country Dynamics

- 7.3.6.2 Competitive Scenario

- 7.3.6.3 Spain Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.3.7 Denmark

- 7.3.7.1 Key Country Dynamics

- 7.3.7.2 Competitive Scenario

- 7.3.7.3 Denmark Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.3.8 Sweden

- 7.3.8.1 Key Country Dynamics

- 7.3.8.2 Competitive Scenario

- 7.3.8.3 Sweden Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.3.9 Norway

- 7.3.9.1 Key Country Dynamics

- 7.3.9.2 Competitive Scenario

- 7.3.9.3 Norway Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.3.1 Swot Analysis

- 7.4 Asia Pacific

- 7.4.1 Swot Analysis

- 7.4.1.1 Asia Pacific Vacuum Blood Collection Tube, 2018 - 2030 (USD Million)

- 7.4.2 Japan

- 7.4.2.1 Key Country Dynamics

- 7.4.2.2 Competitive Scenario

- 7.4.2.3 Japan Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.4.3 China

- 7.4.3.1 Key Country Dynamics

- 7.4.3.2 Competitive Scenario

- 7.4.3.3 China Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.4.4 India

- 7.4.4.1 Key Country Dynamics

- 7.4.4.2 Competitive Scenario

- 7.4.4.3 India Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.4.5 Australia

- 7.4.5.1 Key Country Dynamics

- 7.4.5.2 Competitive Scenario

- 7.4.5.3 Australia Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.4.6 Thailand

- 7.4.6.1 Key Country Dynamics

- 7.4.6.2 Competitive Scenario

- 7.4.6.3 Thailand Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.4.7 South Korea

- 7.4.7.1 Key Country Dynamics

- 7.4.7.2 Competitive Scenario

- 7.4.7.3 South Korea Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.4.1 Swot Analysis

- 7.5 Latin America

- 7.5.1 Swot Analysis

- 7.5.1.1 Latin America Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.5.2 Brazil

- 7.5.2.1 Key Country Dynamics

- 7.5.2.2 Competitive Scenario

- 7.5.2.3 Brazil Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.5.3 Mexico

- 7.5.3.1 Key Country Dynamics

- 7.5.3.2 Competitive Scenario

- 7.5.3.3 Mexico Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.5.4 Argentina

- 7.5.4.1 Key Country Dynamics

- 7.5.4.2 Competitive Scenario

- 7.5.4.3 Argentina Analytical Instrumentation Market, 2018 - 2030 (USD Million)

- 7.5.1 Swot Analysis

- 7.6 Middle East & Africa (Mea)

- 7.6.1 Swot Analysis

- 7.6.1.1 Mea Analytical Instrumentation Market Estimates And Forecast, 2018 - 2030 (USD Million)

- 7.6.2 South Africa

- 7.6.2.1 Key Country Dynamics

- 7.6.2.2 Competitive Scenario

- 7.6.2.3 South Africa Analytical Instrumentation Market Estimates And Forecast, 2018 - 2030 (USD Million)

- 7.6.3 Saudi Arabia

- 7.6.3.1 Key Country Dynamics

- 7.6.3.2 Competitive Scenario

- 7.6.3.3 Saudi Arabia Analytical Instrumentation Market Estimates And Forecast, 2018 - 2030 (USD Million)

- 7.6.4 Uae

- 7.6.4.1 Key Country Dynamics

- 7.6.4.2 Competitive Scenario

- 7.6.4.3 Uae Analytical Instrumentation Market Estimates And Forecast, 2018 - 2030 (USD Million)

- 7.6.5 Kuwait

- 7.6.5.1 Key Country Dynamics

- 7.6.5.2 Competitive Scenario

- 7.6.5.3 Kuwait Analytical Instrumentation Market Estimates And Forecast, 2018 - 2030 (USD Million)

- 7.6.1 Swot Analysis

Chapter 8 Competitive Landscape

- 8.1 Participant's Overview

- 8.1.1 Thermo Fisher Scientific Inc.

- 8.1.2 Waters Corporation

- 8.1.3 Shimadzu Corporation

- 8.1.4 Danaher

- 8.1.5 Agilent Technologies, Inc.

- 8.1.6 Bruker Corporation

- 8.1.7 Perkinelmer, Inc.

- 8.1.8 Mettler Toledo

- 8.1.9 Zeiss Group

- 8.1.10 Bio-Rad Laboratories, Inc.

- 8.1.11 Illumina, Inc.

- 8.1.12 Eppendorf Se

- 8.1.13 F. Hoffmann-La Roche Ag

- 8.1.14 Sartorius Ag

- 8.1.15 Avantor, Inc.

- 8.2 Financial Performance

- 8.3 Participant Categorization

- 8.3.1 Market Leaders

- 8.3.1.1 Analytical Instrumentation Market Share Analysis, 2022

- 8.3.2 Strategy Mapping

- 8.3.2.1 Expansion

- 8.3.2.2 Acquisition

- 8.3.2.3 Collaborations

- 8.3.2.4 Product/service launch

- 8.3.2.5 Partnerships

- 8.3.2.6 Others

- 8.3.1 Market Leaders