|

|

市場調査レポート

商品コード

1611700

医薬品包装機器の市場規模、シェア、動向分析レポート:機械別、地域別、セグメント予測、2025年~2030年Pharmaceutical Packaging Equipment Market Size, Share & Trends Analysis Report By Machine (Filling, Labelling, Form Fill & Seal, Cartoning, Wrapping, Palletizing, Cleaning), By Region (North America, Europe, APAC), And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 医薬品包装機器の市場規模、シェア、動向分析レポート:機械別、地域別、セグメント予測、2025年~2030年 |

|

出版日: 2024年11月14日

発行: Grand View Research

ページ情報: 英文 130 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

医薬品包装機器市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、世界の医薬品包装機器市場規模は2030年までに100億4,740万米ドルに達すると予測されています。

同市場は2025年から2030年にかけてCAGR 7.6%で成長すると予測されています。製薬業界の急成長とドラッグデリバリーデバイスの需要拡大が、今後数年間の市場需要を促進すると予測されています。

欧州製薬団体連合会(European Federation of Pharmaceutical Industries &Associations)によると、世界の医薬品市場は2020年に1兆4,700億米ドルと評価され、2028年には2兆2,300億米ドルに達すると予想され、著しい成長率で推進しています。製薬業界の急成長は、市場の需要拡大の極めて重要な原動力となっています。ヘルスケアニーズの増加、慢性疾患の増加、医学研究の進歩に後押しされ、医薬品セクターが世界的に拡大するにつれ、効率的で洗練された包装ソリューションに対する需要も並行して急増しています。

さらに、医薬品包装機器は、医薬品の安全性、完全性、コンプライアンスを確保し、保健当局が課す厳しい規制を満たす上で重要な役割を果たしています。ブリスター包装、ボトル充填、ラベリング機械などの革新的な包装ソリューションのニーズは、多様な医薬品製剤に対応するために高まっています。製薬業界と包装業界のこのような共生関係は、医薬品の効能を守ると同時に、世界中のヘルスケア製品のシームレスな流通と配送を促進する包装機器の重要性を強調しています。

発展途上国におけるドラッグデリバリーデバイスとブリスター包装の需要の増加は、製薬業界の重要な原動力として台頭する見通しです。先進的なドラッグデリバリーシステムは、効率性の向上、便利な投与経路、ターゲティングの改善、毒性代謝物の減少、薬物活性の延長、誤差の減少など、従来の方法に比べて顕著な利点を提供します。このような利点と、標的薬物デリバリーの継続的な進歩は、周囲の健康な細胞への影響を最小限に抑えながら、局所的な疾患治療を促進します。その結果、これらの要因は世界のドラッグデリバリー機器市場の成長に大きく貢献し、その結果、医薬品包装市場を当面押し上げると予想されます。

医薬品包装機器市場レポートハイライト

- バイアル、ボトル、シリンジなどのさまざまな容器に医薬品製剤を正確かつ効率的に分注し、生産プロセスを合理化するため、充填機が2024年に35.6%のシェアを獲得し、機械タイプセグメントを支配しました。

- 充填機は、投与量の正確性を確保し、無菌性を維持し、厳しい規制基準に準拠し、医薬品の完全性と安全性を保証します。

- 包装機セグメントは、予測期間中に最も速いCAGRで成長すると予想されます。

- 研究開発型の製薬会社、特に欧州と北米では、新しいドラッグデリバリーシステムの開発と導入に継続的に投資しています。その結果、大手製薬企業間の継続的な合併や収益性の高い提携につながっています。

- 針を使わないデバイスのような経皮技術だけでも、実行可能な送達システムのない既存分子の送達メカニズムの創出を目指す製薬パートナーに新たな道を開いています。これは予測期間中にドラッグデリバリーデバイス市場を押し上げる可能性があり、今後数年間の医薬品包装市場に燃料を供給します。

- アジア太平洋地域は、特にアジア太平洋地域の新興経済諸国における医薬品セクターの拡大により、市場を独占しています。

- 2023年8月、MULTIVAC Groupはインドに約980万米ドルを投資した新しい生産施設を開設しました。販売と生産のための10,000平方メートルに及ぶ最新鋭の複合ビルは、2024年初頭に操業を開始する予定です。当初は約60人の従業員を雇用する予定です。インド、スリランカ、バングラデシュにおける顧客サービスの向上が主な目的です。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 医薬品包装機器市場の変数、動向、範囲

- 市場系統の見通し

- 集中と成長の見通しマッピング

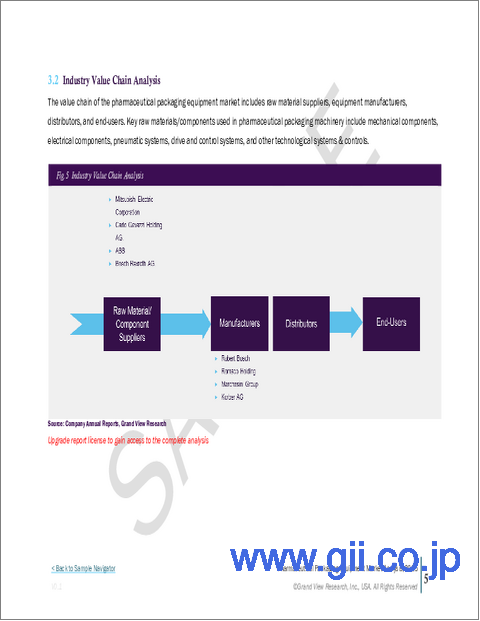

- 業界バリューチェーン分析

- 原材料・部品の見通し

- 製造業の見通し

- 流通見通し

- テクノロジーの概要

- 規制の枠組み

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 市場機会分析

- 市場課題分析

- 医薬品包装機器市場分析ツール

- ポーターの分析

- PESTEL分析

- 経済メガ動向分析

第4章 医薬品包装機器市場:機械の推定・動向分析

- セグメントダッシュボード

- 医薬品包装機器市場:機械変動分析、百万米ドル、2024年および2030年

- 充填

- ラベリング

- フォーム充填とシール

- カートン

- ラッピング

- パレタイジング

- クリーニング

- その他

第5章 医薬品包装機器市場:地域推定・動向分析

- 医薬品包装機器市場シェア、地域別、2024年および2030年、百万米ドル

- 北米

- 機械別、2018年-2030年

- 米国

- カナダ

- メキシコ

- 欧州

- 機械別、2018年-2030年

- ドイツ

- 英国

- ロシア

- スペイン

- イタリア

- アジア太平洋

- 機械別、2018年-2030年

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- 中南米

- 機械別、2018年-2030年

- ブラジル

- 中東・アフリカ

- 機械別、2018年-2030年

- サウジアラビア

- アラブ首長国連邦

第6章 競合情勢

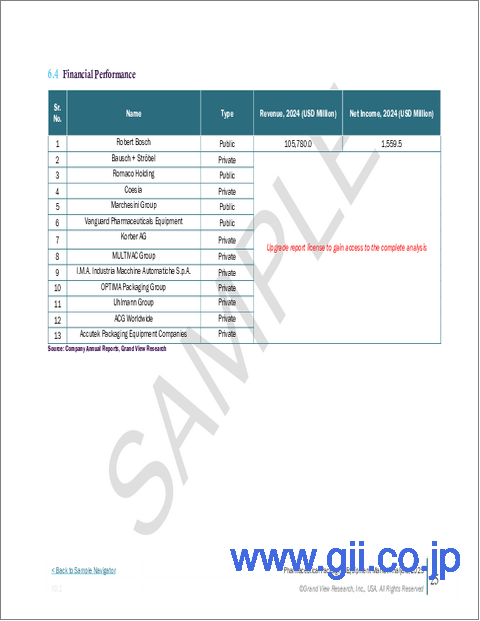

- 主要市場参入企業による最近の動向と影響分析

- 企業分類

- 企業の市場ポジショニング

- 企業の市場シェア分析

- 企業ヒートマップ分析

- 戦略マッピング

- 企業プロファイル

- Robert Bosch

- Romaco Holding

- Marchesini Group

- Korber AG

- IMA Industria Macchine Automatiche SpA

- Uhlmann Group

- Accutek Packaging Equipment Companies

- Bausch+Strobel

- Coesia

- Vanguard Pharmaceuticals Equipment

- MULTIVAC Group

- OPTIMA Packaging Group

- ACG Worldwide

- BREVETTI CEA SPA

List of Tables

- Table 1 R&D expenditure across various countries in Europe, 2023 (USD Million)

- Table 2 Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- Table 3 U.S. Macroeconomic Outlook

- Table 4 Canada Macroeconomic Outlook

- Table 5 Mexico Macroeconomic Outlook

- Table 6 Germany Macroeconomic Outlook

- Table 7 Russia Macroeconomic Outlook

- Table 8 UK Macroeconomic Outlook

- Table 9 Italy Macroeconomic Outlook

- Table 10 Spain Macroeconomic Outlook

- Table 11 China Macroeconomic Outlook

- Table 12 Japan Macroeconomic Outlook

- Table 13 India Macroeconomic Outlook

- Table 14 South Korea Macroeconomic Outlook

- Table 15 Australia Macroeconomic Outlook

- Table 16 Brazil Macroeconomic Outlook

- Table 17 Saudi Arabia Macroeconomic Outlook

- Table 18 UAE Macroeconomic Outlook

- Table 19 Recent Developments & Impact Analysis, By Key Market Participants

- Table 20 Key Companies: Mergers & Acquisitions

- Table 21 Key Companies: Collaborations/Partnerships

- Table 22 Key Companies: Expansion

- Table 23 Key Companies: Product Launches

List of Figures

- Fig. 1 Market Segmentation & Scope

- Fig. 2 Information Procurement

- Fig. 3 Data Analysis Models

- Fig. 4 Market Formulation And Validation

- Fig. 5 Data Validating & Publishing

- Fig. 6 Market Snapshot

- Fig. 7 Machine Segment Snapshot

- Fig. 8 Competitive Landscape Snapshot

- Fig. 9 Pharmaceutical Packaging Equipment Market Value, 2023 (USD Billion)

- Fig. 10 Concentration And Growth Prospect Mapping

- Fig. 11 Pharmaceutical Packaging Equipment Market - Value Chain Analysis

- Fig. 12 Industrial Revolutions

- Fig. 13 Pharmaceutical Packaging Equipment Market: Market Dynamics

- Fig. 14 Europe Pharmaceutical Production, 2000 - 2023 (USD Million)

- Fig. 15 Geographical Breakdown (By Main Markets) Of Sales Of New Medicines Launched, 2017 - 2022 (%)

- Fig. 16 Personalized Medicines accounted as a percentage of FDA approvals, 2018 - 2022 (%)

- Fig. 17 Europe R&D Expenditure, 2000 - 2023 (USD Million)

- Fig. 18 Pharmaceutical Packaging Equipment Market: PORTER's Analysis

- Fig. 19 Pharmaceutical Packaging Equipment Market: PESTEL Analysis

- Fig. 20 Pharmaceutical Packaging Equipment Market, By Machine: Key Takeaways

- Fig. 21 Pharmaceutical Packaging Equipment Market: Machine Movement Analysis & Market Share, 2023 & 2030

- Fig. 22 Pharmaceutical Packaging Equipment Market Estimates & Forecasts, By Filling, 2018 - 2030 (USD Million)

- Fig. 23 Pharmaceutical Packaging Equipment Market Estimates & Forecasts, By Labelling, 2018 - 2030 (USD Million)

- Fig. 24 Pharmaceutical Packaging Equipment Market Estimates & Forecasts, By Form Fill & Seal, 2018 - 2030 (USD Million)

- Fig. 25 Pharmaceutical Packaging Equipment Market Estimates & Forecasts, By Cartoning, 2018 - 2030 (USD Million)

- Fig. 26 Pharmaceutical Packaging Equipment Market Estimates & Forecasts, By Wrapping, 2018 - 2030 (USD Million)

- Fig. 27 Pharmaceutical Packaging Equipment Market Estimates & Forecasts, By Palletizing, 2018 - 2030 (USD Million)

- Fig. 28 Pharmaceutical Packaging Equipment Market Estimates & Forecasts, By Cleaning, 2018 - 2030 (USD Million)

- Fig. 29 Pharmaceutical Packaging Equipment Market Estimates & Forecasts, By Other Machinery, 2018 - 2030 (USD Million)

- Fig. 30 Pharmaceutical Packaging Equipment Market Revenue, By Region, 2023 & 2030, (USD Million)

- Fig. 31 Region Marketplace: Key Takeaways

- Fig. 32 Region Marketplace: Key Takeaways

- Fig. 33 North America Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 34 U.S. Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 35 Industrial Production: Manufacturing: Pharmaceutical and Medicine, Index 2017=100, Monthly, Not Seasonally Adjusted, 2022 - 2024

- Fig. 36 Canada Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 37 Canada's Health Expenditure, 2018 - 2022 (USD Billion)

- Fig. 38 Mexico Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 39 Mexico Pharmaceutical Production, 2020 - 2023 (USD Billion)

- Fig. 40 Europe Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 41 Germany Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 42 Russia Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 43 UK Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 44 Italy Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 45 Spain Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 46 Asia Pacific Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 47 China Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 48 Japan Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 49 India Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 50 South Korea Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 51 Australia Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 52 Central & South America Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 53 Brazil Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 54 Middle East & Africa Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 55 Saudi Arabia Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 56 UAE Pharmaceutical Packaging Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Fig. 57 Key Company Categorization

- Fig. 58 Company Market Share Analysis, 2023

- Fig. 59 Company Market Positioning

Pharmaceutical Packaging Equipment Market Growth & Trends:

The global pharmaceutical packaging equipment market size is anticipated to reach USD 10,047.4 million by 2030, according to a new report by Grand View Research, Inc. The market is projected to grow at a CAGR of 7.6% from 2025 to 2030. The rapid growth in the pharmaceutical industry and the growing demand for drug delivery devices are expected to propel the demand for market in the coming years.

According to the European Federation of Pharmaceutical Industries & Associations, the global pharmaceutical market was valued at USD 1.47 trillion in 2020 and is expected to reach USD 2.23 trillion by 2028, propelling at a significant growth rate. The burgeoning growth of the pharmaceutical industry has become a pivotal driver for the escalating demand in the market. As the pharmaceutical sector expands globally, propelled by increasing healthcare needs, rising chronic diseases, and advancements in medical research, there is a parallel surge in the demand for efficient and sophisticated packaging solutions.

Furthermore, pharmaceutical packaging equipment plays a crucial role in ensuring the safety, integrity, and compliance of pharmaceutical products, meeting the stringent regulations imposed by health authorities. The need for innovative packaging solutions, including blister packaging, bottle filling, and labeling machinery, is intensifying to cater to diverse pharmaceutical formulations. This symbiotic relationship between the pharmaceutical and packaging industries underscores the significance of packaging equipment in safeguarding the efficacy of medicines while facilitating the seamless distribution and delivery of healthcare products worldwide.

The increasing demand for drug delivery devices and blister packaging in developing nations is poised to emerge as a significant driver for the pharmaceutical industry. Advanced drug delivery systems offer notable advantages over traditional methods, including enhanced efficiency, convenient administration routes, improved targeting, reduced toxic metabolites, prolonged drug activity, and reduced margin for error. These advantages and continuous advancements in targeted drug delivery facilitate localized disease treatment with minimal impact on surrounding healthy cells. As a result, these factors are anticipated to contribute significantly to the growth of the global drug delivery devices market, consequently boosting the pharmaceutical packaging market in the foreseeable future.

Pharmaceutical Packaging Equipment Market Report Highlights:

- The filling segment dominated the machine type segment with a 35.6% share in 2024 due to streamlining the production process by precisely and efficiently dispensing pharmaceutical formulations into various containers such as vials, bottles, and syringes

- Filling machines ensure accuracy in dosage, maintain sterility, and comply with stringent regulatory standards, guaranteeing the integrity and safety of pharmaceutical products

- The wrapping machine segment is expected to grow at the fastest CAGR over the forecast period

- Research-based pharmaceutical companies, especially in Europe and North America, continually invest in development and introduction of new drug delivery systems. It has led to continuous mergers and profitable partnerships between major pharmaceutical companies

- Transdermal technologies such as needle-free devices alone have opened new avenues for pharmaceutical partners seeking to create delivery mechanisms for existing molecules with no viable delivery systems. It may boost the drug delivery devices market over the forecast period, fueling the pharmaceutical packaging market in the coming years

- Asia Pacific dominated the market owing to the expansion of the pharmaceutical sector in the region, especially in the developing economies of Asia Pacific

- In August 2023, MULTIVAC Group inaugurated a new production facility in India, representing a substantial investment of approximately USD 9.8 million. The state-of-the-art building complex, encompassing 10,000 square meters for sales and production, is slated to commence operations in early 2024. Initially, the site will employ around 60 individuals. The primary objective is to enhance customer service in India, Sri Lanka, and Bangladesh by leveraging regional proximity and reducing delivery times

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation and Scope

- 1.2. Market Definitions

- 1.3. Research Methodology

- 1.3.1. Information Procurement

- 1.3.2. Information or Data Analysis

- 1.3.3. Market Formulation & Data Visualization

- 1.3.4. Data Validation & Publishing

- 1.4. Research Scope and Assumptions

- 1.4.1. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.3. Competitive Insights

Chapter 3. Pharmaceutical Packaging Equipment Market Variables, Trends, & Scope

- 3.1. Market Lineage Outlook

- 3.2. Concentration & Growth Prospect Mapping

- 3.3. Industry Value Chain Analysis

- 3.3.1. Raw Material/Component Outlook

- 3.3.2. Manufacture Outlook

- 3.3.3. Distribution Outlook

- 3.4. Technology Overview

- 3.5. Regulatory Framework

- 3.6. Market Dynamics

- 3.6.1. Market Drivers Analysis

- 3.6.2. Market Restraints Analysis

- 3.6.3. Market Opportunity Analysis

- 3.6.4. Market Challenge Analysis

- 3.7. Pharmaceutical Packaging Equipment Market Analysis Tools

- 3.7.1. Porter's Analysis

- 3.7.1.1. Bargaining power of the suppliers

- 3.7.1.2. Bargaining power of the buyers

- 3.7.1.3. Threats of substitution

- 3.7.1.4. Threats from new entrants

- 3.7.1.5. Competitive rivalry

- 3.7.2. PESTEL Analysis

- 3.7.2.1. Political landscape

- 3.7.2.2. Economic and Social landscape

- 3.7.2.3. Technological landscape

- 3.7.2.4. Environmental landscape

- 3.7.2.5. Legal landscape

- 3.7.1. Porter's Analysis

- 3.8. Economic Mega Trend Analysis

Chapter 4. Pharmaceutical Packaging Equipment Market: Machine Estimates & Trend Analysis

- 4.1. Segment Dashboard

- 4.2. Pharmaceutical Packaging Equipment Market: Machine Movement Analysis, USD Million, 2024 & 2030

- 4.3. Filling

- 4.3.1. Filling Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.4. Labelling

- 4.4.1. Labelling Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.5. Form Fill & Seal

- 4.5.1. Form Fill & Seal Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.6. Cartoning

- 4.6.1. Cartoning Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.7. Wrapping

- 4.7.1. Wrapping Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.8. Palletizing

- 4.8.1. Palletizing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.9. Cleaning

- 4.9.1. Cleaning Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.10. Others

- 4.10.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Pharmaceutical Packaging Equipment Market: Region Estimates & Trend Analysis

- 5.1. Pharmaceutical Packaging Equipment Market Share, By Region, 2024 & 2030, USD Million

- 5.2. North America

- 5.2.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.2.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.2.3. U.S.

- 5.2.3.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.2.3.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.2.4. Canada

- 5.2.4.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.2.4.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.2.5. Mexico

- 5.2.5.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.2.5.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.3. Europe

- 5.3.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.3.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.3.3. Germany

- 5.3.3.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.3.3.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.3.4. UK

- 5.3.4.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.3.4.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.3.5. Russia

- 5.3.5.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.3.5.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.3.6. Spain

- 5.3.6.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.3.6.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.3.7. Italy

- 5.3.7.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.3.7.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.4. Asia Pacific

- 5.4.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.4.3. China

- 5.4.3.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4.3.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.4.4. India

- 5.4.4.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4.4.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.4.5. Japan

- 5.4.5.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4.5.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.4.6. South Korea

- 5.4.6.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4.6.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.4.7. Australia

- 5.4.7.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4.7.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.5. Central & South America

- 5.5.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.5.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.5.3. Brazil

- 5.5.3.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.5.3.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.6. Middle East & Africa

- 5.6.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.6.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.6.3. Saudi Arabia

- 5.6.3.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.6.3.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

- 5.6.4. UAE

- 5.6.4.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.6.4.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2018 - 2030 (USD Million)

Chapter 6. Competitive Landscape

- 6.1. Recent Developments & Impact Analysis by Key Market Participants

- 6.2. Company Categorization

- 6.3. Company Market Positioning

- 6.4. Company Market Share Analysis

- 6.5. Company Heat Map Analysis

- 6.6. Strategy Mapping

- 6.7. Company Profiles

- 6.7.1. Robert Bosch

- 6.7.1.1. Participant's Overview

- 6.7.1.2. Financial Performance

- 6.7.1.3. Product Benchmarking

- 6.7.1.4. Recent Developments

- 6.7.2. Romaco Holding

- 6.7.2.1. Participant's Overview

- 6.7.2.2. Financial Performance

- 6.7.2.3. Product Benchmarking

- 6.7.2.4. Recent Developments

- 6.7.3. Marchesini Group

- 6.7.3.1. Participant's Overview

- 6.7.3.2. Financial Performance

- 6.7.3.3. Product Benchmarking

- 6.7.3.4. Recent Developments

- 6.7.4. Korber AG

- 6.7.4.1. Participant's Overview

- 6.7.4.2. Financial Performance

- 6.7.4.3. Product Benchmarking

- 6.7.4.4. Recent Developments

- 6.7.5. I.M.A. Industria Macchine Automatiche S.p.A.

- 6.7.5.1. Participant's Overview

- 6.7.5.2. Financial Performance

- 6.7.5.3. Product Benchmarking

- 6.7.5.4. Recent Developments

- 6.7.6. Uhlmann Group

- 6.7.6.1. Participant's Overview

- 6.7.6.2. Financial Performance

- 6.7.6.3. Product Benchmarking

- 6.7.6.4. Recent Developments

- 6.7.7. Accutek Packaging Equipment Companies

- 6.7.7.1. Participant's Overview

- 6.7.7.2. Financial Performance

- 6.7.7.3. Product Benchmarking

- 6.7.7.4. Recent Developments

- 6.7.8. Bausch + Strobel

- 6.7.8.1. Participant's Overview

- 6.7.8.2. Financial Performance

- 6.7.8.3. Product Benchmarking

- 6.7.8.4. Recent Developments

- 6.7.9. Coesia

- 6.7.9.1. Participant's Overview

- 6.7.9.2. Financial Performance

- 6.7.9.3. Product Benchmarking

- 6.7.9.4. Recent Developments

- 6.7.10. Vanguard Pharmaceuticals Equipment

- 6.7.10.1. Participant's Overview

- 6.7.10.2. Financial Performance

- 6.7.10.3. Product Benchmarking

- 6.7.10.4. Recent Developments

- 6.7.11. MULTIVAC Group

- 6.7.11.1. Participant's Overview

- 6.7.11.2. Financial Performance

- 6.7.11.3. Product Benchmarking

- 6.7.11.4. Recent Developments

- 6.7.12. OPTIMA Packaging Group

- 6.7.12.1. Participant's Overview

- 6.7.12.2. Financial Performance

- 6.7.12.3. Product Benchmarking

- 6.7.12.4. Recent Developments

- 6.7.13. ACG Worldwide

- 6.7.13.1. Participant's Overview

- 6.7.13.2. Financial Performance

- 6.7.13.3. Product Benchmarking

- 6.7.13.4. Recent Developments

- 6.7.14. BREVETTI CEA S.P.A

- 6.7.14.1. Participant's Overview

- 6.7.14.2. Financial Performance

- 6.7.14.3. Product Benchmarking

- 6.7.14.4. Recent Developments

- 6.7.1. Robert Bosch