|

|

市場調査レポート

商品コード

1147520

捜索救助用ヘリコプターの市場規模、シェア、動向分析レポート:エンドユーザー別(商用・民間、軍用)、タイプ別(軽、重)、コンポーネント別(エンジン、救助装置)、地域別、セグメント予測、2022年~2030年Search And Rescue Helicopter Market Size, Share & Trends Analysis Report By End-use (Commercial & Civil, Military), By Type (Light, Heavy), By Component (Engine, Rescue Equipment), By Region, And Segment Forecasts, 2022 - 2030 |

||||||

|

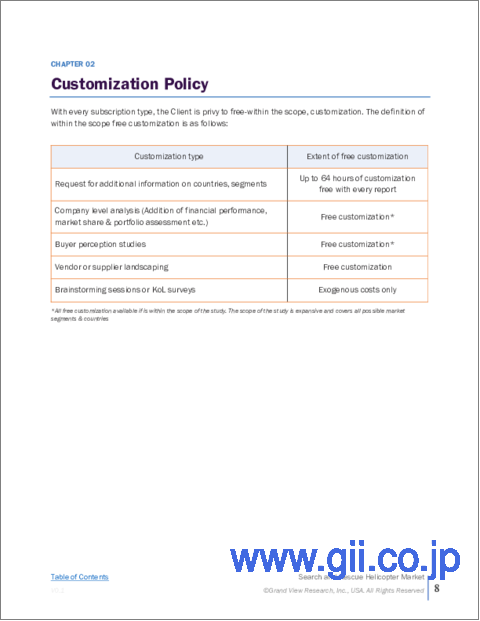

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 捜索救助用ヘリコプターの市場規模、シェア、動向分析レポート:エンドユーザー別(商用・民間、軍用)、タイプ別(軽、重)、コンポーネント別(エンジン、救助装置)、地域別、セグメント予測、2022年~2030年 |

|

出版日: 2022年10月14日

発行: Grand View Research

ページ情報: 英文 300 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

捜索救助用ヘリコプターの市場成長と動向

Grand View Research, Inc.の最新レポートによると、世界の捜索救助用ヘリコプターの市場規模は、2022年から2030年までの推定CAGRが4.1%で、2030年には28億4000万米ドルに達すると予想されています。世界中で捜索・救助活動が増加し、ヘリコプターの納入が増加していることが、この業界の成長を促進しています。例えば、2022年3月、中国交通運輸省は、レオナルドS.p.Aと6機のAW189捜索&救助ヘリコプターの契約を締結しました。同社は2023年までに同機の納入を完了させることを目指しています。民間企業や軍による避難任務、監視任務、救助活動などの増加により、捜索救助用ヘリコプターの需要が高まっています。

石油精製所などの民間企業は、自社で捜索救助用ヘリコプターを運用しているため、製品需要を生み出しています。例えば、2022年9月、石油精製会社であるEquinorは、Bristow Group Inc.に4年間にわたるSARサービスの提供契約を発注しました。この契約により、ブリストウ・グループは、SAR対応の先進的なS-92ヘリコプター3機でSARサービスを提供することになります。アジア太平洋地域は、捜索・救助ヘリコプターの商業&民間および軍事用途の増加により、2022年から2030年にかけて最も速いCAGRで成長すると予想されます。例えば、2022年6月、インド沿岸警備隊は、海岸線に沿ったSARと監視目的のためにヒンドスタン航空株式会社のMK IIIの飛行隊を発注しました。

さらに、この地域の国々は、自国へのFDIを奨励するために有利な政策を策定しています。例えば、中国はメーカーに有利なFDI政策により、Airbus S.A.S.やSikorskyなど多くの著名企業が中国に製造・組立施設を設置することができました。例えば、2019年4月、Airbus Helicoptersは中国の青島にH135最終組立ラインを開設しました。エアバスの工場は、中国で初の外国メーカーが運営するヘリコプター最終組立ライン(FAL)であり、欧州以外に位置する初のH135 FALであり、地域の市場成長を促進すると予想されます。

捜索救助用ヘリコプター市場レポートハイライト

救助機器部品は、予測期間中に最も速いCAGRを記録すると予測されます。

これは、捜索救助活動の増加によるもので、安全で成功した活動のために効率的で堅牢な救助機器が必要とされます。

沖合での捜索・救助活動の増加や古い船団の入れ替えにより、北米地域が2021年に最大の収益シェアを占めました。

航空救急車、避難任務、救助・救援任務など、複数の製品用途があることから、商業・民生最終用途セグメントが2021年の世界業界をリードしています。

目次

第1章 調査手法と範囲

- 情報調達

- 購入したデータベース

- GVRの内部データベース

- 二次情報と第三者の視点

- 1次調査

- 情報分析

- データ分析モデル

- 市場形成とデータ可視化

- データの検証と公開

第2章 エグゼクティブサマリー

- 市場の見通し

- セグメント別見通し

第3章 市場変数、動向、範囲

- 市場セグメンテーションと範囲

- 市場の定義

- 市場規模と成長見通し

- 業界バリューチェーン分析

- 市場力学

- 市場促進要因分析

- 民間人および治安目的の捜索救助活動の増加

- 捜索救助活動のための高度な技術の統合

- ヘリコプター需要の増加

- 市場抑制・課題分析

- 運用と保守のコストが高い

- 厳格な規制義務

- 市場促進要因分析

- 浸透と成長の見通しのマッピング

- 主要企業分析、2021年

- ポーターのファイブフォース分析

- PEST分析

- ヘリコプターの配達(2017-2030)

第4章 コンポーネントとシステムの推定・動向分析

- 市場規模の推計・予測、およびトレンド分析、2018年から2030年(100万米ドル)

- コンポーネントとシステムの変動分析と市場シェア、2022年と2030年

- エアロストラクチャー

- エンジン

- アビオニクス

- レスキュー装備

- 電気系統

- その他

第5章 タイプ推定・動向分析

- 市場規模の推計・予測、およびトレンド分析、2018年から2030年(100万米ドル)

- タイプの変動分析と市場シェア、2022年と2030年

- 小型

- 中型

- 大型

第6章 最終用途の推定・動向分析

- 市場規模の推計・予測、およびトレンド分析、2018年から2030年(100万米ドル)

- 最終用途の変動分析と市場シェア、2022年と2030年

- 商用・民間

- 軍隊

第7章 地域推定・動向分析

- 地域別の捜索救助ヘリコプター市場、2021年および2030年

- 地域別変動分析と市場シェア、2021年と2030年

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- アジア太平洋地域

- 中国

- インド

- 日本

- ラテンアメリカ

- ブラジル

- メキシコ

- 中東およびアフリカ(MEA)

第8章 競合情勢

- Airbus SAS

- 会社概要

- 財務実績

- 製品のベンチマーク

- 最近の開発

- Bell Textron INC.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 最近の開発

- Enstrom Helicopter Corp.

- 会社概要

- 製品のベンチマーク

- 最近の開発

- Hindustan Aeronautics Limited(HAL)

- 会社概要

- 財務実績

- 製品のベンチマーク

- 最近の開発

- Korea Aerospace Industries, Ltd.

- 会社概要

- 製品のベンチマーク

- Leonardo SPA

- 会社概要

- 財務実績

- 製品のベンチマーク

- 最近の開発

- Lockheed Martin Corporation

- 会社概要

- 財務実績

- 製品のベンチマーク

- 最近の開発

- MD Helicopters, Inc.

- 会社概要

- 製品のベンチマーク

- 最近の開発

- Robinson Helicopter Company

- 会社概要

- 製品のベンチマーク

- 最近の開発

- Russian Helicopters JSC

- 会社概要

- 製品のベンチマーク

- 最近の開発

List of Tables

- Table 1 Search and rescue helicopter market size estimates & forecasts, 2018 - 2030 (USD Million)

- Table 2 Search and rescue helicopter market, by region, 2018 - 2030 (USD Million)

- Table 3 Search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 4 Search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 5 Search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- Table 6 Key market driver impact

- Table 7 Key market restraint/challenges impact

- Table 8 Helicopter deliveries, 2017 - 2030

- Table 9 Search and rescue helicopter market for aero structures by region, 2018 - 2030 (USD Million)

- Table 10 Search and rescue helicopter market for engine, by region, 2018 - 2030 (USD Million)

- Table 11 Search and rescue helicopter market for avionics, by region, 2018 - 2030 (USD Million)

- Table 12 Search and rescue helicopter market for rescue equipment s', by region, 2018 - 2030 (USD Million)

- Table 13 Search and rescue helicopter market for electrical system, by region, 2018 - 2030 (USD Million)

- Table 14 Search and rescue helicopter market for others, by region, 2018 - 2030 (USD Million)

- Table 15 Search and rescue helicopter market for light, by region, 2018 - 2030 (USD Million)

- Table 16 Search and rescue helicopter market for medium, by region, 2018 - 2030 (USD Million)

- Table 17 Search and rescue helicopter market for heavy, by region, 2018 - 2030 (USD Million)

- Table 18 Search and rescue helicopter commercial & civil, by region, 2018 - 2030 (USD Million)

- Table 19 Search and rescue helicopter military, by region, 2018 - 2030 (USD Million)

- Table 20 North America search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 21 North America search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 22 North America search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- Table 23 U.S. search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 24 U.S. search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 25 U.S. search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- Table 26 Canada search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 27 Canada search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 28 Canada search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- Table 29 Europe search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 30 Europe search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 31 Europe search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- Table 32 Germany search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 33 Germany search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 34 Germany search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- Table 35 U.K. search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 36 U.K. search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 37 U.K. search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- Table 38 Asia Pacific search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 39 Asia Pacific search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 40 Asia Pacific search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- Table 41 China search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 42 China search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 43 China search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- Table 44 India search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 45 India search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 46 India search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- Table 47 Japan search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 48 Japan search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 49 Japan search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- Table 50 Latin America search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 51 Latin America search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 52 Latin America search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- Table 53 Brazil search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 54 Brazil search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 55 Brazil search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- Table 56 Mexico search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 57 Mexico search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 58 Mexico search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- Table 59 Middle East & Africa search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- Table 60 Middle East & Africa search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- Table 61 Middle East & Africa search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Information procurement

- Fig. 2 Primary research pattern

- Fig. 3 Primary research process

- Fig. 4 Market formulation and data visualization

- Fig. 5 Industry snapshot

- Fig. 6 Market segmentation & scope

- Fig. 7 Market Size and Growth Prospects

- Fig. 8 Value chain analysis

- Fig. 9 Market dynamics

- Fig. 10 Penetration & growth prospects mapping

- Fig. 11 Industry analysis-porter's

- Fig. 12 PEST analysis

- Fig. 13 Search and rescue helicopter market, by component & system, key takeaways, 2018 - 2030 Revenue (USD Million)

- Fig. 14 Component & system movement analysis & market share, 2021 & 2030 Revenue (USD Million)

- Fig. 15 Search and rescue helicopter market for aero structures, 2018 - 2030 (USD Million)

- Fig. 16 Search and rescue helicopter market for engine, 2018 - 2030 (USD Million)

- Fig. 17 Search and rescue helicopter market for avionics, 2018 - 2030 (USD Million)

- Fig. 18 Search and rescue helicopter market for rescue equipment s', 2018 - 2030 (USD Million)

- Fig. 19 Search and rescue helicopter market for electrical system, 2018 - 2030 (USD Million)

- Fig. 20 Search and rescue helicopter market for others, 2018 - 2030 (USD Million)

- Fig. 21 Search and rescue helicopters market, by type, key takeaways, 2018 - 2030 Revenue (USD Million)

- Fig. 22 Type movement analysis & market share, 2021 & 2030 Revenue (USD Million)

- Fig. 23 Search and rescue helicopter market for light, 2018 - 2030 (USD Million)

- Fig. 24 Search and rescue helicopter market for medium, 2018 - 2030 (USD Million)

- Fig. 25 Search and rescue helicopter market for heavy, 2018 - 2030 (USD Million)

- Fig. 26 Search and rescue helicopter market, by end-use, key takeaways, 2018 - 2030 Revenue (USD Million)

- Fig. 27 End Use movement analysis & market share, 2021 & 2030 Revenue (USD Million)

- Fig. 28 Search and rescue helicopter market for commercial & civil, 2018 - 2030 (USD Million)

- Fig. 29 Search and rescue helicopter market for military, 2018 - 2030 (USD Million)

- Fig. 30 Search and rescue helicopter market by region, 2021 & 2030 Revenue (USD Million)

- Fig. 31 Regional movement analysis & market share, 2021 & 2030 Revenue (USD Million)

- Fig. 32 North America search and rescue helicopter market- Key takeaways, 2021 & 2030 Revenue (USD Million)

- Fig. 33 Europe search and rescue helicopter market- Key takeaways, 2021 & 2030 Revenue (USD Million)

- Fig. 34 Asia Pacific search and rescue helicopter market- Key takeaways, 2021 & 2030 Revenue (USD Million)

- Fig. 35 Latin America search and rescue helicopter market- Key takeaways, 2021 & 2030 Revenue (USD Million)

- Fig. 36 MEA search and rescue helicopter market- Key takeaways, 2021 & 2030 Revenue (USD Million)

Search And Rescue Helicopter Market Growth & Trends:

The global search and rescue helicopter market size is anticipated to reach USD 2.84 billion by 2030, with an estimated CAGR of 4.1% from 2022 to 2030, according to the latest report by Grand View Research, Inc. A rise in search & rescue operations around the world and increasing deliveries of helicopters are driving the growth of the industry. For instance, in March 2022, China's Ministry of Transport signed a contract with Leonardo S.p.A for six AW189 search & rescue helicopters. The company aims to complete the deliveries of the same by 2023. The rising evacuation missions, surveillance tasks, rescue operations, and other operations, conducted by commercial & civil entities and militaries have augmented the demand for search & rescue helicopters.

Commercial entities, such as oil refineries, create product demand as they operate their own search & rescue helicopter fleets. For instance, in September 2022, Equinor, a petroleum refining company, awarded Bristow Group Inc. the contract to provide SAR services over four years. As per the contract, Bristow Group will provide SAR services with three SAR-ready advanced S-92 helicopters. The Asia Pacific region is expected to grow at the fastest CAGR from 2022 to 2030 due to the rising commercial & civil and military applications for search & rescue helicopters. For instance, in June 2022, the Indian Coast Guard ordered a squadron of Hindustan Aeronautics Ltd.'s MK III for SAR and surveillance purposes along the coastlines.

Moreover, countries in the region are formulating favorable policies to encourage FDI in their country. For instance, China's favorable FDI policies for manufacturers enabled many prominent companies, including Airbus S.A.S. and Sikorsky, to establish manufacturing and assembly facilities in China. For instance, in April 2019, Airbus Helicopters opened its H135 final assembly line in Qingdao, China. The Airbus factory is the first foreign manufacturer-operated helicopter Final Assembly Line (FAL) in China and the first H135 FAL situated outside Europe, which is anticipated to fuel the regional market growth.

Search And Rescue Helicopter Market Report Highlights:

- The rescue equipment component segment is predicted to register the fastest CAGR during the forecast period

- This is due to the increase in search & rescue operations, which require efficient and robust rescue equipment for safe and successful operations

- The North America region accounted for the largest revenue share in 2021 owing to an increase in search & rescue operations offshore and the replacement of old fleets

- The commercial & civil end-use segment led the global industry in 2021 on account of multiple product applications in this segment, such as air ambulances, evacuation missions, aid & rescue missions, and more

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Information Procurement

- 1.1.1 Purchased database

- 1.1.2 GVR's internal database

- 1.1.3 Secondary sources & third-party perspective

- 1.1.4 Primary research

- 1.2 Information Analysis

- 1.2.1 Data analysis models

- 1.3 Market Formulation and Data Visualization

- 1.4 Data Validation and Publishing

Chapter 2 Executive Summary

- 2.1 Market Outlook

- 2.2 Segmental Outlook

Chapter 3 Market Variables, Trends & Scope

- 3.1 Market Segmentation & Scope

- 3.2 Market Definitions

- 3.3 Market size and growth prospects

- 3.4 Industry Value Chain Analysis

- 3.5 Market Dynamics

- 3.5.1 Market driver analysis

- 3.5.1.1 Rise in search and rescue operations for civilians and security purposes

- 3.5.1.2 Integration of advanced technology for search and rescue operations

- 3.5.1.3 Increasing demand for helicopters

- 3.5.2 Market restraint/challenges analysis

- 3.5.2.1 High cost of operation and maintenance

- 3.5.2.2 Stringent regulatory obligations

- 3.5.1 Market driver analysis

- 3.6 Penetration and Growth Prospect Mapping

- 3.7 Key Company Analysis, 2021

- 3.8 Porter's Five Forces Analysis

- 3.9 PEST Analysis

- 3.10 Helicopter Deliveries (2017 - 2030)

Chapter 4 Component & System Estimates and Trend Analysis

- 4.1 Market Size Estimates & Forecasts and Trend Analysis, 2018 - 2030 (USD Million)

- 4.2 Component & System Movement Analysis & Market Share, 2022 & 2030

- 4.3 Aero Structures

- 4.3.1 Market size estimates and forecasts, 2018 - 2030 (USD Million)

- 4.4 Engine

- 4.4.1 Market size estimates and forecasts, 2018 - 2030 (USD Million)

- 4.5 Avionics

- 4.5.1 Market size estimates and forecasts, 2018 - 2030 (USD Million)

- 4.6 Rescue Equipment's

- 4.6.1 Market size estimates and forecasts, 2018 - 2030 (USD Million)

- 4.7 Electrical System

- 4.7.1 Market size estimates and forecasts, 2018 - 2030 (USD Million)

- 4.8 Others

- 4.8.1 Market size estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 5 Type Estimates and Trend Analysis

- 5.1 Market Size Estimates & Forecasts and Trend Analysis, 2018 - 2030 (USD Million)

- 5.2 Type Movement Analysis & Market Share, 2022 & 2030

- 5.3 Light

- 5.3.1 Market size estimates and forecasts, 2018 - 2030 (USD Million)

- 5.4 Medium

- 5.4.1 Market size estimates and forecasts, 2018 - 2030 (USD Million)

- 5.5 Heavy

- 5.5.1 Market size estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 6 End-use Estimates and Trend Analysis

- 6.1 Market Size Estimates & Forecasts and Trend Analysis, 2018 - 2030 (USD Million)

- 6.2 End-use Movement Analysis & Market Share, 2022 & 2030

- 6.3 Commercial & Civil

- 6.3.1 Market size estimates and forecasts, 2018 - 2030 (USD Million)

- 6.4 Military

- 6.4.1 Market size estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 7 Regional Estimates & Trend Analysis

- 7.1 Search and Rescue Helicopter Market By Region, 2021 & 2030

- 7.2 Regional Movement Analysis & Market Share, 2021 & 2030

- 7.3 North America

- 7.3.1 North America search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- 7.3.2 North America search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- 7.3.3 North America search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- 7.3.4 U.S.

- 7.3.4.1 U.S. search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- 7.3.4.2 U.S. search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- 7.3.4.3 U.S. search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- 7.3.5 Canada

- 7.3.5.1 Canada search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- 7.3.5.2 Canada search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- 7.3.5.3 Canada search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- 7.4 Europe

- 7.4.1 Europe search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- 7.4.2 Europe search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- 7.4.3 Europe search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- 7.4.4 Germany

- 7.4.4.1 Germany search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- 7.4.4.2 Germany search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- 7.4.4.3 Germany search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- 7.4.5 U.K.

- 7.4.5.1 U.K. search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- 7.4.5.2 U.K. search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- 7.4.5.3 U.K. search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- 7.5 Asia Pacific

- 7.5.1 Asia Pacific search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- 7.5.2 Asia Pacific search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- 7.5.3 Asia Pacific search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- 7.5.4 China

- 7.5.4.1 China search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- 7.5.4.2 China search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- 7.5.4.3 China search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- 7.5.5 India

- 7.5.5.1 India search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- 7.5.5.2 India search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- 7.5.5.3 India search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- 7.5.6 Japan

- 7.5.6.1 Japan search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- 7.5.6.2 Japan search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- 7.5.6.3 Japan search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- 7.6 Latin America

- 7.6.1 Latin America search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- 7.6.2 Latin America search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- 7.6.3 Latin America search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- 7.6.4 Brazil

- 7.6.4.1 Brazil search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- 7.6.4.2 Brazil search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- 7.6.4.3 Brazil search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- 7.6.5 Mexico

- 7.6.5.1 Mexico search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- 7.6.5.2 Mexico search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- 7.6.5.3 Mexico search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

- 7.7 Middle East & Africa (MEA)

- 7.7.1 Middle East & Africa search and rescue helicopter market, by component & system, 2018 - 2030 (USD Million)

- 7.7.2 Middle East & Africa search and rescue helicopter market, by type, 2018 - 2030 (USD Million)

- 7.7.3 Middle East & Africa search and rescue helicopter market, by end-use, 2018 - 2030 (USD Million)

Chapter 8 Competitive Landscape

- 8.1 Airbus SAS

- 8.1.1 Company overview

- 8.1.2 Financial performance

- 8.1.3 Product benchmarking

- 8.1.4 Recent developments

- 8.2 Bell Textron INC.

- 8.2.1 Company overview

- 8.2.2 Financial performance

- 8.2.3 Product benchmarking

- 8.2.4 Recent developments

- 8.3 Enstrom Helicopter Corp.

- 8.3.1 Company overview

- 8.3.2 Product benchmarking

- 8.3.3 Recent developments

- 8.4 Hindustan Aeronautics Limited (HAL)

- 8.4.1 Company overview

- 8.4.2 Financial performance

- 8.4.3 Product benchmarking

- 8.4.4 Recent developments

- 8.5 Korea Aerospace Industries, Ltd.

- 8.5.1 Company overview

- 8.5.2 Product benchmarking

- 8.6 Leonardo S.P.A

- 8.6.1 Company overview

- 8.6.2 Financial performance

- 8.6.3 Product benchmarking

- 8.6.4 Recent developments

- 8.7 Lockheed Martin Corporation

- 8.7.1 Company overview

- 8.7.2 Financial performance

- 8.7.3 Product benchmarking

- 8.7.4 Recent developments

- 8.8 MD Helicopters, Inc.

- 8.8.1 Company overview

- 8.8.2 Product benchmarking

- 8.8.3 Recent developments

- 8.9 Robinson Helicopter Company

- 8.9.1 Company overview

- 8.9.2 Product benchmarking

- 8.9.3 Recent developments

- 8.10 Russian Helicopters JSC

- 8.10.1 Company overview

- 8.10.2 Product benchmarking

- 8.10.3 Recent developments