|

|

市場調査レポート

商品コード

1404749

医療用チューブの市場規模、シェア、動向分析レポート:製品タイプ別、用途別、地域別、セグメント別予測(2024年~2030年)Medical Tubing Market Size, Share & Trends Analysis Report By Product Type (Silicone, Polyolefins, Polyimide, Polycarbonates), By Application (Bulk Disposable Tubing, Catheters, Drug Delivery Systems), By Region, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 医療用チューブの市場規模、シェア、動向分析レポート:製品タイプ別、用途別、地域別、セグメント別予測(2024年~2030年) |

|

出版日: 2023年11月24日

発行: Grand View Research

ページ情報: 英文 200 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

医療用チューブ市場の成長と動向:

世界の医療用チューブの市場規模は、2030年までに195億米ドルに達し、2024年~2030年にCAGR8.5%で拡大すると予測されています。

喘息、肺がん、肺線維症などの呼吸器系疾患の世界の流行が、人工呼吸器やネブライザーなどの呼吸器系機器に不可欠な部品である医療用チューブの世界の需要を促進すると予想されています。

院内感染に対する人々の意識の高まりや感染拡大に対する懸念の高まりは、使い捨て医療機器の需要を促進すると予測されています。世界保健機関(WHO)によると、ICU感染症の発生率は中低所得国の方が高所得国よりも2~3倍高く、機器関連の感染症は中低所得国の方が米国の約13倍高くなっています。

新興国を中心とする各国政府は、慢性疾患の発生を防ぐために、大衆が適切なヘルスケアを受けられるよう、医療インフラや保険に投資しています。また、経済成長とともに国民の生活水準も向上しており、高度なヘルスケアを受けることが可能になっています。このような要因が、予測期間中の医療用チューブ製品需要の伸びを促進すると予想されます。

オーストラリア政府保健省の報告書によると、2020年~2021年までにオーストラリア人口の約47%にあたる1,160万人が、腰痛、がん、慢性閉塞性肺疾患、精神疾患、糖尿病、喘息、関節炎など10種類の慢性疾患のうち1つ以上を患うとされています。このように、生命を脅かす疾患や慢性疾患の発生は、市場成長を後押しする主要な要因のひとつになると予想されます。

医療用チューブメーカーは、先進的かつ革新的なソリューションを開発するために、提携、合併、買収を模索しています。加えて、メーカー各社は市場への浸透を高め、最終用途産業に対応するため、新製品開拓や地理的拡大などの戦略を採用しています。例えば、Nordson CorporationはNDC Technologiesを買収しました。この買収の背景には、同社の試験・検査プラットフォームを新たな最終市場や隣接技術に拡大する狙いがあります。

医療用チューブ市場のレポートハイライト

- シリコン製品タイプの需要は、2023年の世界収益シェアの25.7%を占めています。シリコンは生体組織に毒性がなく、アレルギー反応を起こしにくいため、医療用途に広く使用されています。医療機器に使用されるシリコンチューブは通常、グレードが高く、連続加硫と押出工程を経て製造されます。

- バルク使い捨てチューブの需要は、2023年の世界売上高の34.8%を占めています。バルク使い捨て器具には、手術器具、泌尿器製品、注射器、注射針などが含まれます。ある患者から別の患者への感染拡大を防止することに重点が置かれるようになり、予測期間中このセグメントを牽引すると予想されています。

- ドラッグデリバリーシステムは、2023年の世界売上高で25.2%のシェアを占めています。ドラッグデリバリーシステムのメーカーは、活性添加物や成分のイオンを放出できるよう、製品の開発にシリコンを大いに活用しています。シリコンを使用して臨床的に成功したドラッグデリバリーシステムには、Femring(Warner Chilcott;ニュージャージー州ロッカウェイ)やNorplant(Wyeth Pharmaceuticals;ニュージャージー州マディソン)などがあります。

- 北米は2023年の世界売上シェアの35.6%を占めています。技術の進歩や医療支出の増加、政府の政策などが市場の需要を押し上げると見られます。例えば、2021年、NHE(National Health Expenditure Data)によると、米国のメディケア支出は2020年比で8.4%増の9,000億米ドル、メディケイドは9.2%増の7,340億米ドルとなっています。

- 2022年5月、Freudenbergはバイオプロセス用途と医薬品向けにHelixFlex TPEチューブを発売しました。これにより、同社は製品ポートフォリオを拡大しました。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 市場変数、動向、範囲

- 市場セグメンテーションと範囲

- 浸透と成長見通しのマッピング

- 業界のバリューチェーン分析

- 技術概要

- 規制の枠組み

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 市場機会分析

- 業界の課題

- 業界分析

- ポーターの分析

- マクロ経済分析

- 経済メガトレンド

- 価格分析

第4章 医療用チューブ市場:製品タイプの推計・動向分析

- 製品タイプの分析と市場シェア(2023年・2030年)

- シリコン

- ポリオレフィン

- ポリ塩化ビニル

- ポリカーボネート

- フッ素ポリマー

- その他

第5章 医療用チューブ市場:用途の推計・動向分析

- 用途の変動分析と市場シェア(2023年・2030年)

- バルク使い捨てチューブ

- ドラッグデリバリーシステム

- カテーテル

- バイオ医薬品実験装置

- その他

第6章 医療チューブ市場:地域の推計・動向分析

- 地域市場のスナップショット

- 北米

- 市場推計・予測(2018年~2030年)

- 製品タイプ別(2018年~2030年)

- 用途別(2018年~2030年)

- 米国

- カナダ

- メキシコ

- 欧州

- 市場推計・予測(2018年~2030年)

- 製品タイプ別(2018年~2030年)

- 用途別(2018年~2030年)

- フランス

- ドイツ

- イタリア

- オランダ

- ロシア

- スペイン

- 英国

- アジア太平洋

- 市場推計・予測(2018年~2030年)

- 製品タイプ別(2018年~2030年)

- 用途別(2018年~2030年)

- 中国

- インド

- 日本

- オーストラリア

- シンガポール

- 韓国

- 中南米

- 市場推計・予測(2018年~2030年)

- 製品タイプ別(2018年~2030年)

- 用途別(2018年~2030年)

- ブラジル

- 中東・アフリカ

- 市場推計・予測(2018年~2030年)

- 製品タイプ別(2018年~2030年)

- 用途別(2018年~2030年)

- 南アフリカ

第7章 競合分析

- 主要市場参入企業による最近の動向と影響分析

- 企業分類

- 参入企業の概要

- 財務概要

- 製品ベンチマーク

- 企業の市場ポジショニング

- 企業の市場シェア分析

- 企業のヒートマップ分析

- 戦略マッピング

第8章 企業プロファイル

- ASAHI TEC CORPORATION

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- MDC Industries

- Nordson Corporation

- ZARYS International Group

- Hitachi Cable America Inc.

- NewAge Industries Inc.

- TE Connectivity

- Spectrum Plastics Group

- Bentec Medical

- Kent Elastomer Products

- Mitsubishi Chemical Europe GmbH

- Benvic Group

- Freudenberg &Co. KG

- The Hygenic Company, LLC

List of Tables

- Table 1 Silicone medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 2 Polyolefins medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 3 Polyolefins medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 4 Polyimide medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 5 Polyvinyl Chloride medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 6 Polycarbonates medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 7 Fluoropolymers medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 8 Fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 9 Others medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 10 Medical tubing market estimates and forecasts, in bulk disposable tubing, 2018 - 2030 (USD Billion)

- Table 11 Medical tubing market estimates and forecasts, in drug delivery systems, 2018 - 2030 (USD Billion)

- Table 12 Medical tubing market estimates and forecasts, in catheters, 2018 - 2030 (USD Billion)

- Table 13 Medical tubing market estimates and forecasts, in biopharmaceutical laboratory equipment, 2018 - 2030 (USD Billion)

- Table 14 Medical tubing market estimates and forecasts, in others, 2018 - 2030 (USD Billion)

- Table 15 Bulk disposable tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 16 Bulk disposable tubing market estimates and forecasts, by fluoropolymers, by type 2018 - 2030 (USD Billion)

- Table 17 Drug delivery systems market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 18 Drug delivery systems market estimates and forecasts, by fluoropolymers, by type 2018 - 2030 (USD Billion)

- Table 19 Catheters market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 20 Catheters market estimates and forecasts, by fluoropolymers, by type 2018 - 2030 (USD Billion)

- Table 21 Biopharmaceutical laboratory equipment market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 22 Biopharmaceutical laboratory equipment market estimates and forecasts, by fluoropolymers, by type 2018 - 2030 (USD Billion)

- Table 23 Others market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 24 Others market estimates and forecasts, by fluoropolymers, by type 2018 - 2030 (USD Billion)

- Table 25 North America medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 26 North America medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 27 North America medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 28 North America medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 29 North America fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 30 US medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 31 US medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 32 US medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 33 US medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 34 US fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 35 Canada medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 36 Canada medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 37 Canada medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 38 Canada medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 39 Canada fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 40 Mexico medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 41 Mexico medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 42 Mexico medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 43 Mexico medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 44 Mexico fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 45 Europe medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 46 Europe medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 47 Europe medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 48 Europe medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 49 Europe fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 50 France medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion

- Table 51 France medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 52 France medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 53 France medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 54 France fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 55 Germany medical tubing market estimates and forecasts 2018 - 2030 (USD Billion)

- Table 56 Germany medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 57 Germany medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 58 Germany medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 59 Germany fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 60 Italy medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 61 Italy medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 62 Italy medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 63 Italy medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 64 Italy fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 65 Netherlands medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 66 Netherlands medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 67 Netherlands medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 68 Netherlands medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 69 Netherlands fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 70 Russia medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 71 Russia medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 72 Russia medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 73 Russia medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 74 Russia fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 75 Spain medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 76 Spain medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 77 Spain medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 78 Spain medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 79 Spain fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 80 UK medical tubing market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

- Table 81 UK medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 82 UK medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 83 UK medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 84 UK fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 85 Asia Pacific medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 86 Asia Pacific medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 87 Asia Pacific medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 88 Asia Pacific medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 89 Asia Pacific fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 90 China medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 91 China medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 92 China medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 93 China medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 94 China fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 95 India medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 96 India medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 97 India medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 98 India medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 99 India fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 100 Japan medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 101 Japan medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 102 Japan medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 103 Japan medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 104 Japan fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 105 Australia medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 106 Australia medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 107 Australia medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 108 Australia medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 109 Australia fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 110 Singapore medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 111 Singapore medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 112 Singapore medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 113 Singapore medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 114 Singapore fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 115 South Korea medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 116 South Korea medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 117 South Korea medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 118 South Korea medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 119 South Korea fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 120 Central & South America medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 121 Central & South America medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 122 Central & South America medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 123 Central & South America medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 124 Central & South America fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 125 Brazil medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 126 Brazil medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 127 Brazil medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 128 Brazil medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 129 Brazil fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 130 Middle East & Africa medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 131 Middle East & Africa medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 132 Middle East & Africa medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 133 Middle East & Africa medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 134 Middle East & Africa fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- Table 135 South Africa medical tubing market estimates and forecasts, 2018 - 2030 (USD Billion)

- Table 136 South Africa medical tubing market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- Table 137 South Africa medical tubing market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- Table 138 South Africa medical tubing market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- Table 139 South Africa fluoropolymers medical tubing market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

List of Figures

- Fig. 1 Information Procurement

- Fig. 2 Primary Research Pattern

- Fig. 3 Primary Research Process

- Fig. 4 Market Research Approaches - Bottom Up Approach

- Fig. 5 Market Research Approaches - Top Down Approach

- Fig. 6 Market Research Approaches - Combined Approach

- Fig. 7 Market Outlook

- Fig. 8 Segmental Outlook

- Fig. 9 Competitive Insights

- Fig. 10 Market Segmentation & Scope

- Fig. 11 Penetration and Growth Prospect Mapping

- Fig. 12 Industry Value Chain Analysis

- Fig. 13 Market Driver Analysis

- Fig. 14 Market Restraint Analysis

- Fig. 15 Medical Tubing Market: Product Movement Analysis, 2023 & 2030

- Fig. 16 Medical Tubing Market: Application Movement Analysis, 2023 & 2030

- Fig. 17 Medical Tubing Market: Regional Movement Analysis, 2023 & 2030

- Fig. 18 Key Company/Competition Categorization

- Fig. 19 Competitive Dashboard Analysis

- Fig. 20 Market Position Analysis

Medical Tubing Market Growth & Trends:

The global medical tubing market size is anticipated to reach USD 19.5 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 8.5% from 2024 to 2030. The prevalence of respiratory diseases such as asthma, lung cancer, and pulmonary fibrosis worldwide is anticipated to fuel the global demand for medical tubing, as it is essential component of respiratory devices such as ventilators and nebulizers.

Growing awareness among the masses about hospital-acquired diseases and surging concerns about the spread of such infections are projected to drive demand for disposable medical devices. According to the World Health Organization (WHO), the incidences of ICU-acquired infections are 2 to 3 times higher in low- and middle-income countries than in high-income countries, while device-associated infections are approximately 13 times higher in these countries than in the U.S.

Governments, predominantly in emerging economies, are investing in their medical infrastructure and insurance to help the masses afford proper healthcare when required to prevent the occurrence of chronic diseases in them. Additionally, as these countries are growing economically, the standard of living of their population is also improving, which makes it possible for them to have access to advanced healthcare. These factors are anticipated to fuel the growth of medical tubing product demand over the forecast period.

According to a report by the Australian Government Department of Health, approximately 47% of the Australian population, or 11.6 million people, will have one or more of the 10 selected chronic conditions such as back pain, cancer, chronic obstructive pulmonary diseases, mental health conditions, diabetes, asthma, and arthritis by 2020-2021. Thus, the occurrence of life-threatening diseases and chronic diseases is anticipated to be one of the major factors boosting market growth.

Medical tubing manufacturers are seeking collaborations, mergers, and acquisitions to develop advanced and innovative solutions. In addition, manufacturers are also adopting several strategies, like new product development, and geographical expansion, to enhance their market penetration and cater to end-use industries. For instance, Nordson Corporation acquired NDC Technologies. The aim behind the acquisition is to expand the former's test and inspection platform into new end markets and adjacent technologies.

Medical Tubing Market Report Highlights:

- The demand for silicone product type segment accounted for 25.7% of the global revenue share in 2023. Silicone is widely used in medical applications as it is not toxic to living tissues and is unlikely to yield an allergenic response. Silicon tubing used in medical devices is usually of higher grade and is manufactured using a continuous vulcanization and extrusion process

- The demand for bulk disposable tubing segment accounted for a 34.8% share of the global revenue in 2023. Bulk disposable devices include surgical instruments, urological products, syringes, and needles among others. Increasing emphasis on preventing the spread of infection from one patient to another is expected to drive the segment over the forecast period

- The drug delivery systems by material segment accounted for a 25.2% share of the global revenue in 2023. Manufacturers of drug delivery systems are significantly utilizing silicone for developing their products so that they can release ions of active additives or components. Some clinically successful drug delivery systems that use silicone are Femring (Warner Chilcott; Rockaway, NJ) and Norplant (Wyeth Pharmaceuticals; Madison, NJ)

- North America accounted for 35.6% of the global revenue share in 2023. Factors such as technological advancements, and increasing healthcare spending coupled with government policies are likely to propel the market demand. For instance, in 2021, according to NHE (National Health Expenditure Data) U.S. medicare spending increased by 8.4% USD 900 billion and medicaid increased by 9.2% USD 734 billion compared to 2020

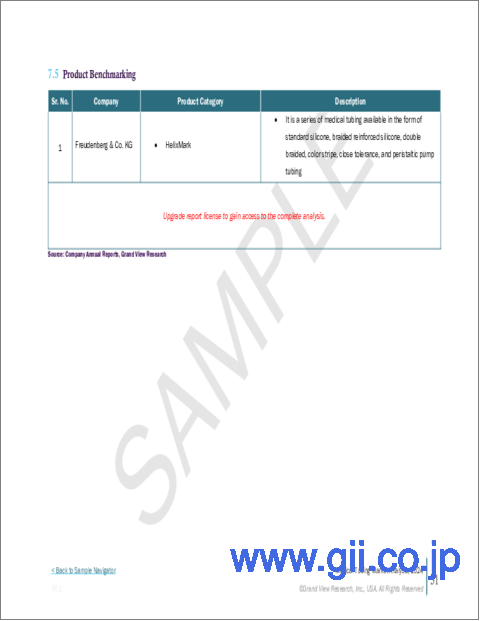

- In May 2022, Freudenberg launched HelixFlex TPE tubing for bioprocessing applications and pharmaceuticals. This helped the company to extend company's product portfolio

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Scope & Assumption

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources

- 1.3.4. Third-Party Perspectives

- 1.3.5. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segmental Outlook

- 2.3. Competitive Insights

Chapter 3. Market Variables, Trends & Scope

- 3.1. Market Segmentation & Scope

- 3.2. Penetration and Growth Prospect Mapping

- 3.3. Industry Value Chain Analysis

- 3.4. Technology Overview

- 3.5. Regulatory Framework

- 3.6. Market Dynamics

- 3.6.1. Market Driver Analysis

- 3.6.2. Market Restraint Analysis

- 3.6.3. Market Opportunity Analysis

- 3.6.4. Industry Challenges

- 3.7. Industry Analysis -

- 3.7.1. Porter's analysis

- 3.7.2. Macroeconomic Analysis

- 3.8. Economic Mega Trend

- 3.9. Pricing Analysis

Chapter 4. Medical Tubing Market: Product Type Estimates & Trend Analysis

- 4.1. Product Type Analysis & Market Share, 2023 & 2030

- 4.1.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 4.2. Silicone

- 4.2.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 4.3. Polyolefins

- 4.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 4.4. Polyvinyl chloride

- 4.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 4.5. Polycarbonates

- 4.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 4.6. Fluoropolymers

- 4.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 4.6.2. Market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 4.7. Others

- 4.7.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Medical Tubing Market: Application Estimates & Trend Analysis

- 5.1. Application Movement Analysis & Market Share, 2023 & 2030

- 5.2. Bulk Disposable Tubing

- 5.2.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 5.2.2. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 5.2.2.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 5.3. Drug Delivery Systems

- 5.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 5.3.2. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 5.3.2.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 5.4. Catheters

- 5.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 5.4.2. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 5.4.2.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 5.5. Biopharmaceutical Laboratory Equipment

- 5.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 5.5.2. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 5.5.2.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 5.6. Others

- 5.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 5.6.2. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 5.6.2.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Chapter 6. Medical Tubing Market: Regional Estimates & Trend Analysis

- 6.1. Regional Market Snapshot

- 6.2. North America

- 6.2.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.2.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.2.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.2.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.2.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.2.4. U.S.

- 6.2.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.2.4.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.2.4.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.2.4.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.2.4.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.2.5. Canada

- 6.2.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.2.5.2. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.2.5.3. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.2.5.4. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.2.5.4.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.2.5.4.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.2.6. Mexico

- 6.2.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.2.6.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.2.6.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.2.6.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.2.6.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.3. Europe

- 6.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.3.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.3.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.3.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.3.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.3.4. France

- 6.3.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.3.4.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.3.4.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.3.4.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.3.4.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.3.5. Germany

- 6.3.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.3.5.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.3.5.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.3.5.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.3.5.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.3.6. Italy

- 6.3.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.3.6.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.3.6.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.3.6.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.3.6.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.3.7. Netherlands

- 6.3.7.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.3.7.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.3.7.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.3.7.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.3.7.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.3.8. Russia

- 6.3.8.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.3.8.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.3.8.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.3.8.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.3.8.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.3.9. Spain

- 6.3.9.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.3.9.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.3.9.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.3.9.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.3.9.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.3.10. UK

- 6.3.10.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.3.10.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.3.10.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.3.10.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.3.10.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.4. Asia Pacific

- 6.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.4.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.4.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.4.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.4.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.4.4. China

- 6.4.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.4.4.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.4.4.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.4.4.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.4.4.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.4.5. India

- 6.4.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.4.5.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.4.5.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.4.5.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.4.5.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.4.6. Japan

- 6.4.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.4.6.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.4.6.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.4.6.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.4.6.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.4.7. Australia

- 6.4.7.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.4.7.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.4.7.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.4.7.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.4.7.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.4.8. Singapore

- 6.4.8.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.4.8.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.4.8.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.4.8.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.4.8.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.4.9. South Korea

- 6.4.9.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.4.9.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.4.9.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.4.9.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.4.9.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.5. Central & South America

- 6.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.5.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.5.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.5.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.5.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.5.4. Brazil

- 6.5.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.5.4.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.5.4.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.5.4.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.5.4.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.6. Middle East & Africa

- 6.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.6.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.6.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.6.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.6.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

- 6.6.4. South Africa

- 6.6.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

- 6.6.4.2. Market estimates and forecasts, by product type, 2018 - 2030 (USD Billion)

- 6.6.4.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

- 6.6.4.3.1. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

- 6.6.4.3.1.1. Fluoropolymers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Chapter 7. Competitive Analysis

- 7.1. Recent Developments & Impact Analysis, By Key Market Participants

- 7.2. Company Categorization

- 7.3. Participant's Overview

- 7.4. Financial Overview

- 7.5. Product Benchmarking

- 7.6. Company Market Positioning

- 7.7. Company Market Share Analysis

- 7.8. Company Heat Map Analysis

- 7.9. Strategy Mapping

Chapter 8. Company Profiles

- 8.1. ASAHI TEC CORPORATION

- 8.1.1. Company Overview

- 8.1.2. Financial Performance

- 8.1.3. Product Benchmarking

- 8.1.4. Strategic Initiatives

- 8.2. MDC Industries

- 8.2.1. Company Overview

- 8.2.2. Financial Performance

- 8.2.3. Product Benchmarking

- 8.2.4. Strategic Initiatives

- 8.3. Nordson Corporation

- 8.3.1. Company Overview

- 8.3.2. Financial Performance

- 8.3.3. Product Benchmarking

- 8.3.4. Strategic Initiatives

- 8.4. ZARYS International Group

- 8.4.1. Company Overview

- 8.4.2. Financial Performance

- 8.4.3. Product Benchmarking

- 8.4.4. Strategic Initiatives

- 8.5. Hitachi Cable America Inc.

- 8.5.1. Company Overview

- 8.5.2. Financial Performance

- 8.5.3. Product Benchmarking

- 8.5.4. Strategic Initiatives

- 8.6. NewAge Industries Inc.

- 8.6.1. Company Overview

- 8.6.2. Financial Performance

- 8.6.3. Product Benchmarking

- 8.6.4. Strategic Initiatives

- 8.7. TE Connectivity

- 8.7.1. Company Overview

- 8.7.2. Financial Performance

- 8.7.3. Product Benchmarking

- 8.7.4. Strategic Initiatives

- 8.8. Spectrum Plastics Group

- 8.8.1. Company Overview

- 8.8.2. Financial Performance

- 8.8.3. Product Benchmarking

- 8.8.4. Strategic Initiatives

- 8.9. Bentec Medical

- 8.9.1. Company Overview

- 8.9.2. Financial Performance

- 8.9.3. Product Benchmarking

- 8.9.4. Strategic Initiatives

- 8.10. Kent Elastomer Products

- 8.10.1. Company Overview

- 8.10.2. Financial Performance

- 8.10.3. Product Benchmarking

- 8.10.4. Strategic Initiatives

- 8.11. Mitsubishi Chemical Europe GmbH

- 8.11.1. Company Overview

- 8.11.2. Financial Performance

- 8.11.3. Product Benchmarking

- 8.11.4. Strategic Initiatives

- 8.12. Benvic Group

- 8.12.1. Company Overview

- 8.12.2. Financial Performance

- 8.12.3. Product Benchmarking

- 8.12.4. Strategic Initiatives

- 8.13. Freudenberg & Co. KG

- 8.13.1. Company Overview

- 8.13.2. Financial Performance

- 8.13.3. Product Benchmarking

- 8.13.4. Strategic Initiatives

- 8.14. The Hygenic Company, LLC

- 8.14.1. Company Overview

- 8.14.2. Financial Performance

- 8.14.3. Product Benchmarking

- 8.14.4. Strategic Initiatives