|

|

市場調査レポート

商品コード

1122129

自動視野計の市場規模、シェア、動向分析レポート:タイプ別(静的、運動)、用途別(緑内障、加齢黄斑変性)、最終用途別、地域別、セグメント別予測、2022年~2030年Automated Visual Field Analyzer Market Size, Share & Trends Analysis Report By Type (Static, Kinetic), By Application (Glaucoma, Age-related Macular Degeneration), By End-use, By Region, And Segment Forecasts, 2022 - 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 自動視野計の市場規模、シェア、動向分析レポート:タイプ別(静的、運動)、用途別(緑内障、加齢黄斑変性)、最終用途別、地域別、セグメント別予測、2022年~2030年 |

|

出版日: 2022年08月04日

発行: Grand View Research

ページ情報: 英文 120 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

自動視野計の市場成長・動向

Grand View Research, Inc.の最新レポートによると、世界の自動視野計の市場規模は2030年までに3億11万米ドルに達し、2022年から2030年までCAGR6.52%で拡大する見込みであることが報告されています。この市場は、緑内障、白内障、糖尿病網膜症などの眼疾患の有病率の増加、老人人口の増加、診断用の技術的に進んだ自動視野計の導入などの要因により、予測期間中に有利な成長を示すと予想されます。さらに、新製品の発売頻度の増加や、緑内障や白内障などの眼科疾患の発生率の上昇も、市場の主要な促進要因となっています。

COVID-19が目の健康に与える世界の影響、人口の高齢化、環境の変化、ライフスタイルの変化により、視覚障害者や失明者の数は大幅に増加すると予想されています。世界的には、近視や遠視に悩む人が少なくとも22億人いると言われています。しかし、COVID-19の影響により、眼科検診を含む病院での選択的治療の延期や感染症のリスクなどにより、眼科医院を訪れる人が減少し、自動視野計の市場にはマイナスの影響を及ぼしています。また、眼科医の不足、価格圧力、競争の激化、過剰なコストなどの要因も、市場を制約しています。

多くの官民組織は、一般市民、検眼士、眼科医の間で目の健康と視力ケアに関する意識を高め、眼科疾患の診断と治療のために、啓発・広告キャンペーンやワークショップの実施などの措置を取っています。さらに、いくつかのサプライヤーは、コース、チュートリアル、ワークショップを通じて、眼科医や技術者に視野計の実地トレーニングを提供しています。このような活動は、眼科疾患や眼科ペリメーターなどの身近な診断機器に関する知識の向上を支援し、市場を牽引することになります。

自動視野計市場レポートハイライト

静止型セグメントは、自動視野検査のための大規模なデータポイントの取得に広く使用されていることから、2021年に最大の収益シェアを占めた

緑内障アプリケーションは、視神経損傷や失明、視野欠損を引き起こす緑内障の高い有病率により、予測期間中に市場を独占すると予想される

発展途上国における病院数の増加やヘルスケアサービスプロバイダー間の競争激化により、病院の最終用途セグメントが2021年に最大の売上シェアを占めた

予測期間中、北米が市場をリードすると予想されます。これは、同地域に多くの業界プレーヤーが存在すること、および眼科疾患の有病率が増加していることに起因している

目次

第1章 調査手法と範囲

- 市場セグメンテーションと範囲

- タイプ

- 応用

- 最終用途

- 地域範囲

- 推定・予測のタイムライン

- 調査手法

- 情報調達

- 購入したデータベース

- GVRの内部データベース

- 二次情報

- 1次調査

- 1次調査内容

- 北米の一次面接データ

- 欧州での一次面接のデータ

- APACの一次インタビューのデータ

- ラテンアメリカの一次面接のデータ

- MEAでの一次インタビューのデータ

- 情報またはデータ分析

- データ分析モデル

- 市場の策定と検証

- モデルの詳細

- コモディティフロー分析(モデル1)

- アプローチ1:コモディティフローアプローチ

- 出来高価格分析(モデル2)

- アプローチ2:出来高価格分析

- コモディティフロー分析(モデル1)

- 二次情報一覧

- 略語一覧

- 目的

第2章 エグゼクティブサマリー

- 市場の見通し

第3章 自動視野計の市場変数、動向および範囲

- 浸透と成長の見通しのマッピング

- 市場力学

- 市場促進要因分析

- 緑内障や白内障などの眼疾患の有病率の増加

- ヘルスケア施設を強化するための政府のイニシアチブの高まり

- 技術の進歩

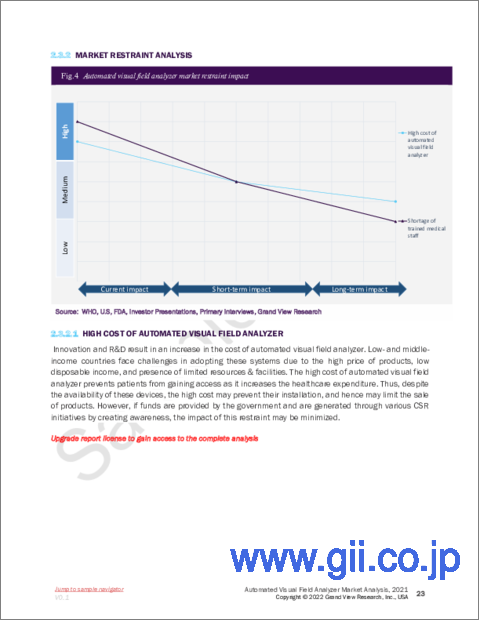

- 市場制約分析

- 自動視野分析装置の高コスト

- 訓練を受けた医療スタッフの不足

- 市場促進要因分析

- ウェアラブルインジェクター:市場分析ツール

- PESTEL別SWOT分析

- 業界分析- ポーターズ

- COVID-19の影響

- COVID-19影響分析

- 主要な市場プレーヤーへの影響

- 主要取引と戦略的提携分析

- 市場参入戦略

第4章 自動視野計市場:セグメント分析、タイプ別、2017年から2030年(100万米ドル)

- 定義と範囲

- タイプ市場シェア分析

- セグメントダッシュボード

- タイプ別の自動視野計市場

- 市場規模と予測、トレンド分析、2017年から2030年までの以下の製品

- 静的

- キネティック

第5章 自動視野計市場:セグメント分析、アプリケーション別、2017年から2030年(100万米ドル)

- 定義と範囲

- アプリケーション市場シェア分析

- セグメントダッシュボード

- アプリケーション別の自動視野計市場

- 市場規模と予測、トレンド分析、2017年から2030年までの以下の製品

- 緑内障

- 加齢黄斑変性症(AMD)

- 暗点

- その他

第6章 自動視野計市場:セグメント分析、最終用途別、2017年から2030年(100万米ドル)

- 定義と範囲

- 最終用途の市場シェア分析

- セグメントダッシュボード

- 最終用途別の自動視野計市場

- 市場規模と予測、トレンド分析、2017年から2030年までの以下の製品

- 病院

- 眼科

- その他

第7章自動視野計市場:地域市場分析、2017年から2030年(100万米ドル)

- 地域市場ダッシュボード

- 定義と範囲

- 地域市場シェア分析

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- アジア太平洋地域

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- ラテンアメリカ

- メキシコ

- ブラジル

- アルゼンチン

- コロンビア

- 中東とアフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

第8章 自動視野計市場-競合分析

- Kind of Competition

- Concentration of Market Players

- Company Market Share Analysis

- 企業ビジョンに基づくカテゴライズ

- 企業プロファイル

- Carl Zeiss

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Haag-Streit AG

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Elektron Eye Technology

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Heidelberg Engineering

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Kowa Company, Ltd

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Optopol

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- OCULUS

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Metrovision

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- MEDA Co., Ltd.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Topcon

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Carl Zeiss

List of Tables

- Table 1 List of Abbreviations

- Table 2 North America automated visual field analyzer market, by region, 2017 - 2030 (USD Million)

- Table 3 North America automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 4 North America automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 5 North America automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 6 U.S. automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 7 U.S. automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 8 U.S. automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 9 Canada automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 10 Canada automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 11 Canada automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 12 Europe automated visual field analyzer market, by region, 2017 - 2030 (USD Million)

- Table 13 Europe automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 14 Europe automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 15 Europe automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 16 Germany automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 17 Germany automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 18 Germany automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 19 U.K. automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 20 U.K. automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 21 U.K.automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 22 France automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 23 France automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 24 France automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 25 Italy automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 26 Italy automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 27 Italy automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 28 Spain automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 29 Spain automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 30 Spain automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 31 APAC automated visual field analyzer market, by region, 2017 - 2030 (USD Million)

- Table 32 APAC automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 33 APAC automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 34 APAC automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 35 China automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 36 China automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 37 China automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 38 Japan automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 39 Japan automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 40 Japan automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 41 India automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 42 India automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 43 India automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 44 Australiaautomated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 45 Australiaautomated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 46 Australiaautomated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 47 South Korea automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 48 South Korea automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 49 South Korea automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 50 Latin America automated visual field analyzer market, by region, 2017 - 2030 (USD Million)

- Table 51 Latin America automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 52 Latin America automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 53 Latin America automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 54 Brazil automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 55 Brazil automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 56 Brazil automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 57 Mexico automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 58 Mexico automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 59 Mexico automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 60 Argentina automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 61 Argentina automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 62 Argentina automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 63 Colombia automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 64 Colombia automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 65 Colombia automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 66 Middle East and Africa automated visual field analyzer market, by region, 2017 - 2030 (USD Million)

- Table 67 Middle East and Africa automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 68 Middle East and Africa automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 69 Middle East and Africa automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 70 South Africa automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 71 South Africa automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 72 South Africa automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 73 Saudi Arabia automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 74 Saudi Arabia automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 75 Saudi Arabia automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

- Table 76 UAE automated visual field analyzer market, by type, 2017 - 2030 (USD Million)

- Table 77 UAE automated visual field analyzer market, by application, 2017 - 2030 (USD Million)

- Table 78 UAE automated visual field analyzer market, by end-use, 2017 - 2030 (USD Million)

List of Figures

- Fig. 1 Market research process

- Fig. 2 Data triangulation techniques

- Fig. 3 Primary research pattern

- Fig. 4 Primary interviews in North America

- Fig. 5 Primary interviews in Europe

- Fig. 6 Primary interviews in APAC

- Fig. 7 Primary interviews in Latin America

- Fig. 8 Primary interviews in MEA

- Fig. 9 Market research approaches

- Fig. 10 Value-chain-based sizing & forecasting

- Fig. 11 QFD modeling for market share assessment

- Fig. 12 Market formulation & validation

- Fig. 13 Automated visual field analyzer market: market outlook

- Fig. 14 Automated visual field analyzer market competitive insights

- Fig. 15 Parent market outlook

- Fig. 16 Related/ancillary market outlook

- Fig. 17 Penetration and growth prospect mapping

- Fig. 18 Industry value chain analysis

- Fig. 19 Automated visual field analyzer market driver impact

- Fig. 20 Automated visual field analyzer market restraint impact

- Fig. 21 Automated visual field analyzer market strategic initiatives analysis

- Fig. 22 Automated visual field analyzer market: type movement analysis

- Fig. 23 Automated visual field analyzer market: type outlook and key takeaways

- Fig. 24 Static market estimates and forecast, 2017 - 2030

- Fig. 25 Kinetic market estimates and forecast, 2017 - 2030

- Fig. 26 Automated visual field analyzer market: application movement analysis

- Fig. 27 Automated visual field analyzer market: application outlook and key takeaways

- Fig. 28 Glaucoma market estimates and forecast, 2017 - 2030

- Fig. 29 Age-related macular degeneration (AMD) market estimates and forecast, 2017 - 2030

- Fig. 30 Scotoma market estimates and forecast, 2017 - 2030

- Fig. 31 Others market estimates and forecast, 2017 - 2030

- Fig. 32 Automated visual field analyzer market: end-use movement analysis

- Fig. 33 Automated visual field analyzer market: end-use outlook and key takeaways

- Fig. 34 Hospitals market estimates and forecast, 2017 - 2030

- Fig. 35 Eye Clinics market estimates and forecast, 2017 - 2030

- Fig. 36 Others market estimates and forecast, 2017 - 2030

- Fig. 37 Global automated visual field analyzer market: regional movement analysis

- Fig. 38 Global automated visual field analyzer market: regional outlook and key takeaways

- Fig. 39 Global market shares and leading players

- Fig. 40 North America market share and leading players

- Fig. 41 Europe market share and leading players

- Fig. 42 Asia Pacific market share and leading players

- Fig. 43 Latin America market share and leading players

- Fig. 44 Middle East & Africa market share and leading players

- Fig. 45 North America: SWOT

- Fig. 46 Europe SWOT

- Fig. 47 Asia Pacific SWOT

- Fig. 48 Latin America SWOT

- Fig. 49 MEA SWOT

- Fig. 50 North America, by country

- Fig. 51 North America

- Fig. 52 North America market estimates and forecast, 2017 - 2030

- Fig. 53 U.S.

- Fig. 54 U.S. market estimates and forecast, 2017 - 2030

- Fig. 55 Canada

- Fig. 56 Canada market estimates and forecast, 2017 - 2030

- Fig. 57 Europe

- Fig. 58 Europe. market estimates and forecast, 2017 - 2030

- Fig. 59 U.K.

- Fig. 60 U.K. market estimates and forecast, 2017 - 2030

- Fig. 61 Germany

- Fig. 62 Germany market estimates and forecast, 2017 - 2030

- Fig. 63 France

- Fig. 64 France market estimates and forecast, 2017 - 2030

- Fig. 65 Italy

- Fig. 66 Italy market estimates and forecast, 2017 - 2030

- Fig. 67 Spain

- Fig. 68 Spain market estimates and forecast, 2017 - 2030

- Fig. 69 Asia Pacific

- Fig. 70 Asia Pacific market estimates and forecast, 2017 - 2030

- Fig. 71 China

- Fig. 72 China market estimates and forecast, 2017 - 2030

- Fig. 73 Japan

- Fig. 74 Japan market estimates and forecast, 2017 - 2030

- Fig. 75 India

- Fig. 76 India market estimates and forecast, 2017 - 2030

- Fig. 77 Australia

- Fig. 78 Australia market estimates and forecast, 2017 - 2030

- Fig. 79 South Korea

- Fig. 80 South Korea market estimates and forecast, 2017 - 2030

- Fig. 81 Latin America

- Fig. 82 Latin America market estimates and forecast, 2017 - 2030

- Fig. 83 Brazil

- Fig. 84 Brazil market estimates and forecast, 2017 - 2030

- Fig. 85 Mexico

- Fig. 86 Mexico market estimates and forecast, 2017 - 2030

- Fig. 87 Argentina

- Fig. 88 Argentina market estimates and forecast, 2017 - 2030

- Fig. 89 Colombia

- Fig. 90 Colombia market estimates and forecast, 2017 - 2030

- Fig. 91 Middle East and Africa

- Fig. 92 Middle East and Africa. market estimates and forecast, 2017 - 2030

- Fig. 93 Saudi Arabia

- Fig. 94 Saudi Arabia market estimates and forecast, 2017 - 2030

- Fig. 95 South Africa

- Fig. 96 South Africa market estimates and forecast, 2017 - 2030

- Fig. 97 UAE

- Fig. 98 UAE market estimates and forecast, 2017 - 2030

- Fig. 99 Participant categorization- automated visual field analyzer market

- Fig. 100 Market share of key market players- automated visual field analyzer market

Automated Visual Field Analyzer Market Growth & Trends:

The global automated visual field analyzer market size is expected to reach USD 300.11 million by 2030, according to a new report by Grand View Research, Inc., expanding at a CAGR of 6.52% from 2022 to 2030. The market is expected to witness lucrative growth during the forecast period owing to factors such as an increase in the prevalence of ocular disorders, such as glaucoma, cataract, and diabetes retinopathy, a growing geriatric population, and the introduction of a technologically advanced automated visual field analyzer for the diagnosis. Additionally, the growing frequency of new product launches and the rise in the incidence of ocular diseases such as glaucoma and cataract are key drivers of the market.

The number of people with visual impairment and blindness is anticipated to rise significantly as a result of COVID-19's global effects on eye health, population aging, environmental changes, and lifestyle shifts. Globally, there are at least 2.2 billion people who struggle with near or far vision. However, COVID-19 has had a negative effect on the market for automated visual field analyzers due to factors such as the postponement of elective hospital treatments, including eye exams, and the risk of infection, which has caused a decrease in the number of people visiting eye clinics. The market is also being constrained by factors like a lack of ophthalmologists, price pressure, rising competition, and excessive costs.

Many public and private organizations are taking steps to raise awareness regarding eye health and vision care among the general public, optometrists, and ophthalmologists for the diagnosis and treatment of ophthalmic diseases, such as conducting awareness and advertising campaigns and workshops. Additionally, several suppliers provide ophthalmologists and technician's hands-on training in visual field analyzers through courses, tutorials, and workshops. Such activities assist to raise knowledge about ocular illnesses and accessible diagnostic equipment, such as ophthalmic perimeters, which will drive the market.

Automated Visual Field Analyzer Market Report Highlights:

- The static type segment held the largest revenue share in 2021 owing to its extensive use in capturing large data points for automated visual field testing

- The glaucoma application segment is expected to dominate the market in the forecast period owing to the high prevalence of glaucoma that leads to optic nerve damage and causes blindness or vision loss

- The hospital end-use segment held the largest revenue share in 2021 owing to the increasing number of hospitals in developing countries and growing competition among healthcare service providers

- North America is expected to lead the market over the forecast period. This can be attributed to the presence of many industry players in the region and an increase in the prevalence of ophthalmic diseases

Table of Contents

Chapter 1. Methodology and Scope

- 1.1 Market Segmentation & Scope

- 1.1.1 Type

- 1.1.2 Application

- 1.1.3 End-Use

- 1.1.4 Regional Scope

- 1.1.5 Estimates and Forecast Timeline

- 1.2 Research Methodology

- 1.3 Information Procurement

- 1.3.1 Purchased Database

- 1.3.2 GVR's Internal Database

- 1.3.3 Secondary Sources

- 1.3.4 Primary Research

- 1.3.5 Details of Primary Research

- 1.3.5.1 Data for primary interviews in North America

- 1.3.5.3 Data for Primary Interviews in Europe

- 1.3.5.4 Data for Primary Interviews in APAC

- 1.3.5.6 Data for Primary Interviews in Latin America

- 1.3.5.8 Data for Primary Interviews in MEA

- 1.4 Information or Data Analysis

- 1.4.1 Data Analysis Models

- 1.5 Market Formulation & Validation

- 1.6 Model Details

- 1.6.1 Commodity Flow Analysis (Model 1)

- 1.6.1.1 Approach 1: Commodity Flow Approach

- 1.6.2 Volume Price Analysis (Model 2)

- 1.6.2.1 Approach 2: Volume Price Analysis

- 1.6.1 Commodity Flow Analysis (Model 1)

- 1.7 List of Secondary Sources

- 1.8 List of Abbreviations

- 1.9 Objectives

- 1.9.1 Objective 1

- 1.9.2 Objective 2

- 1.9.3 Objective 3

- 1.9.4 Objective 4

Chapter 2 Executive Summary

- 2.1 Market Outlook

Chapter 3 Automated Visual Field Analyzer Market Variables, Trends & Scope

- 3.1 Penetration & Growth Prospect Mapping

- 3.2 Market Dynamics

- 3.2.1 Market Drivers Analysis

- 3.2.1.1 Increasingprevalence of ocular diseases such as glaucoma and cataract

- 3.2.1.2 Rising government initiatives to enhance healthcare facilities

- 3.2.1.3 Advancement of technology

- 3.2.2 Market Restraint Analysis

- 3.2.2.1 High cost of automated visual field analyzer

- 3.2.2.2 Shortage of trained medical staff

- 3.2.1 Market Drivers Analysis

- 3.3 Wearable Injectors: Market Analysis Tools

- 3.3.1 SWOT Analysis by PESTEL

- 3.3.2 Industry Analysis - Porter's

- 3.4 Impact of COVID-19

- 3.4.1 COVID-19 Impact analysis

- 3.4.2 Impact on Key Market Players

- 3.5 Major Deals and Strategic Alliance Analysis

- 3.6 Market Entry Strategies

Chapter 4 Automated Visual Field Analyzer Market: Segment Analysis, By Type, 2017 - 2030 (USD Million)

- 4.1 Definitions and Scope

- 4.2 Type Market Share Analysis

- 4.3 Segment Dashboard

- 4.4 Automated Visual Field Analyzer Market by Type

- 4.5 Market Size & Forecasts and Trend Analyses, 2017 to 2030 for the following

- 4.5.1 Static

- 4.5.1.1 StaticMarket Estimates and Forecast, 2017 - 2030 (USD Million)

- 4.5.2 Kinetic

- 4.5.2.1 Kinetic Market Estimates and Forecast, 2017 - 2030 (USD Million)

- 4.5.1 Static

Chapter 5 Automated Visual Field Analyzer Market: Segment Analysis, By Application, 2017 - 2030 (USD Million)

- 5.1 Definitions and Scope

- 5.2 ApplicationMarket Share Analysis

- 5.3 Segment Dashboard

- 5.4 Automated Visual Field Analyzer Market by Application

- 5.5 Market Size & Forecasts and Trend Analyses, 2017 to 2030 for the following

- 5.5.1 Glaucoma

- 5.5.1.1 Glaucoma Market Estimates and Forecast, 2017 - 2030 (USD Million)

- 5.5.2 Age-related Macular Degeneration (AMD)

- 5.5.2.1 Age-related Macular Degeneration (AMD)Market Estimates and Forecast, 2017 - 2030 (USD Million)

- 5.5.3 Scotoma

- 5.5.3.1 Scotoma Market Estimates and Forecast, 2017 - 2030 (USD Million)

- 5.5.4 Others

- 5.5.4.1 Others Market Estimates and Forecast, 2017 - 2030 (USD Million)

- 5.5.1 Glaucoma

Chapter 6 Automated Visual Field Analyzer Market: Segment Analysis, By End-Use, 2017 - 2030 (USD Million)

- 6.1 Definitions and Scope

- 6.2 End-Use Market Share Analysis

- 6.3 Segment Dashboard

- 6.4 Automated Visual Field Analyzer Market by End-Use

- 6.5 Market Size & Forecasts and Trend Analyses, 2017 to 2030 for the following

- 6.5.1 Hospitals

- 6.5.1.1 Hospitals Market Estimates and Forecast, 2017 - 2030 (USD Million)

- 6.5.2 Eye Clinics

- 6.5.2.1 Eye Clinics Market Estimates and Forecast, 2017 - 2030 (USD Million)

- 6.5.3 Others

- 6.5.3.1 Others Market Estimates and Forecast, 2017 - 2030 (USD Million)

- 6.5.1 Hospitals

Chapter 7 Automated Visual Field Analyzer Market: Regional Market Analysis, 2017 - 2030 (USD Million)

- 7.1 Regional Market Dashboard

- 7.2 Definitions and Scope

- 7.3 Regional Market Share Analysis

- 7.4 North America

- 7.4.1 North America market estimates and forecast, 2017 - 2030

- 7.4.2 U.S.

- 7.4.2.1 U.S. market estimates and forecast, 2017 - 2030

- 7.4.3 Canada

- 7.4.3.1 Canada market estimates and forecast, 2017 - 2030

- 7.5 Europe

- 7.5.1 Europe market estimates and forecast, 2017 - 2030

- 7.5.2 U.K.

- 7.5.2.1 U.K. market estimates and forecast, 2017 - 2030

- 7.5.3 Germany

- 7.5.3.1 Germany market estimates and forecast, 2017 - 2030

- 7.5.4 France

- 7.5.4.1 France market estimates and forecast, 2017 - 2030

- 7.5.5 Italy

- 7.5.5.1 Italy market estimates and forecast, 2017 - 2030

- 7.5.6 Spain

- 7.5.6.1 Spain market estimates and forecast, 2017 - 2030

- 7.6 Asia Pacific

- 7.6.1 Asia Pacific market estimates and forecast, 2017 - 2030

- 7.6.2 Japan

- 7.6.2.1 Japan market estimates and forecast, 2017 - 2030

- 7.6.3 China

- 7.6.3.1 China market estimates and forecast, 2017 - 2030

- 7.6.4 India

- 7.6.4.1 India market estimates and forecast, 2017 - 2030

- 7.6.5 Australia

- 7.6.5.1 Australia market estimates and forecast, 2017 - 2030

- 7.6.6 South Korea

- 7.6.6.1 South Korea market estimates and forecast, 2017 - 2030

- 7.7 Latin America

- 7.7.1 Latin America market estimates and forecast, 2017 - 2030

- 7.7.2 Mexico

- 7.7.2.1 Mexico market estimates and forecast, 2017 - 2030

- 7.7.3 Brazil

- 7.7.3.1 Brazil market estimates and forecast, 2017 - 2030

- 7.7.4 Argentina

- 7.7.4.1 Argentina market estimates and forecast, 2017 - 2030

- 7.7.5 Colombia

- 7.7.5.1 Colombia market estimates and forecast, 2017 - 2030

- 7.8 Middle East and Africa

- 7.8.1 Middle East and Africa market estimates and forecast, 2017 - 2030

- 7.8.2 South Africa

- 7.8.2.1 South Africa market estimates and forecast, 2017 - 2030

- 7.8.3 Saudi Arabia

- 7.8.3.1 Saudi Arabia market estimates and forecast, 2017 - 2030

- 7.8.4 UAE

- 7.8.4.1 UAE market estimates and forecast, 2017 - 2030

Chapter 8 Automated Visual Field Analyzer Market - Competitive Analysis

- 8.1 Kind of Competition

- 8.2 Concentration of Market Players

- 8.3 Company Market Share Analysis

- 8.4 Categorization based on the Company's Vision

- 8.5 Company Profiles

- 8.5.1 Carl Zeiss

- 8.5.1.1 Company overview

- 8.5.1.2 Financial performance

- 8.5.1.3 Product benchmarking

- 8.5.1.4 Strategic initiatives

- 8.5.2 Haag-Streit AG

- 8.5.2.1 Company overview

- 8.5.2.2 Financial performance

- 8.5.2.3 Product benchmarking

- 8.5.2.4 Strategic initiatives

- 8.5.3 Elektron Eye Technology

- 8.5.3.1 Company overview

- 8.5.3.2 Financial performance

- 8.5.3.3 Product benchmarking

- 8.5.3.4 Strategic initiatives

- 8.5.4 Heidelberg Engineering

- 8.5.4.1 Company overview

- 8.5.4.2 Financial performance

- 8.5.4.3 Product benchmarking

- 8.5.4.4 Strategic initiatives

- 8.5.5 Kowa Company, Ltd

- 8.5.5.1 Company overview

- 8.5.5.3 Financial performance

- 8.5.5.3 Product benchmarking

- 8.5.5.4 Strategic initiatives

- 8.5.6 Optopol

- 8.5.6.1 Company overview

- 8.5.6.2 Financial performance

- 8.5.6.3 Product benchmarking

- 8.5.6.4 Strategic initiatives

- 8.5.7 OCULUS

- 8.5.7.1 Company overview

- 8.5.7.2 Financial performance

- 8.5.7.3 Product benchmarking

- 8.5.7.4 Strategic initiatives

- 8.5.8 Metrovision

- 8.5.8.1 Company overview

- 8.5.8.2 Financial performance

- 8.5.8.3 Product benchmarking

- 8.5.8.4 Strategic initiatives

- 8.5.9 MEDA Co., Ltd.

- 8.5.9.1 Company overview

- 8.5.9.2 Financial performance

- 8.5.9.3 Product benchmarking

- 8.5.9.4 Strategic initiatives

- 8.5.9 Topcon

- 8.5.9.1 Company overview

- 8.5.9.2 Financial performance

- 8.5.9.3 Product benchmarking

- 8.5.9.4 Strategic initiatives

- 8.5.1 Carl Zeiss