|

市場調査レポート

商品コード

1186912

経口固形製剤 (OSDF):循環器市場Oral Solid Dosage Forms - Cardiology Markets |

||||||

| 経口固形製剤 (OSDF):循環器市場 |

|

出版日: 2023年01月18日

発行: Greystone Research Associates

ページ情報: 英文 82 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

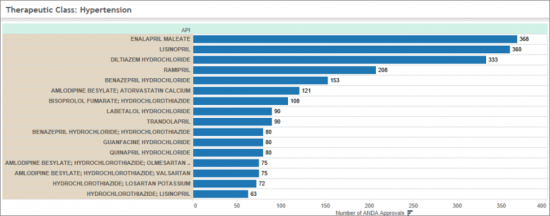

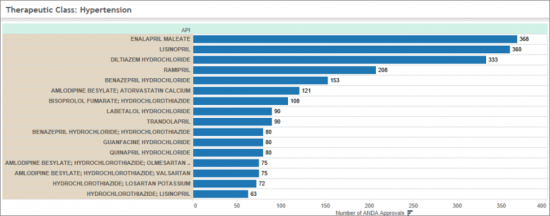

FDA認可の高血圧症治療薬API

サンプルビュー

高血圧症を適応症とするOSDF医薬品は、循環器の部門における全承認APIの90%以上を占めています。このグループには、以下のような主要な処方箋医薬品が含まれています。

|

|

サンプル画面

当レポートでは、循環器疾患を適応症とする経口固形製剤 (OSDF)の市場を調査し、サプライヤー、主要製品、薬剤クラス別の詳細データなどをまとめています。

目次

- 循環器用経口固形製剤 (OSDF)

- エグゼクティブサマリー

- 一般的なSDF:製品に関する考慮事項

- 一般的な固形剤形:循環器の適応症

- 高血圧症

- 循環器治療クラス:高血圧を除く全クラス

- 高血圧を適応とするOSDF医薬品の主要サプライヤー

- 薬剤クラス:サプライヤー別の市場プレゼンス

- 薬剤クラス:ACE阻害剤 (Abbvie・Graviti Pharmsなど)

- 薬剤クラス:Ace阻害剤 (Graviti Pharms・Zydus Pharma USAなど)

- 薬剤クラス:アドレナリン受容体遮断薬 (Able・Mylanなど)

- 薬剤クラス:アドレナリン受容体遮断薬 (Mylan・Zydus Pharmsなど)

- 薬剤クラス:アンジオテンシンII受容体 (Ajanta Pharma Ltd・Zydus Pharmsなど)

- 薬剤クラス:カルシウムチャネル遮断薬 (Accord Healthcare・Mutual Pharmなど)

- 薬剤クラス:カルシウムチャネル遮断薬 (Mylan・Zydus Pharmsなど)

- 薬剤クラス:利尿薬 (Actavis・Monarch Pharmsなど)

- 薬剤クラス:利尿薬 (Actavis・Monarch Pharmsなど)

- 薬剤クラス:血管拡張薬 (Actavis・Woodward)

- 循環器疾患を適応症とするOSDFのサプライヤー

- Accord Healthcare

- Actavis

- Alembic

- Amneal Pharms

- ANI Pharms

- Apotex

- Aurobindo

- Dr. Reddy's

- Glenmark

- Hikma

- Lupin

- Mylan

- Sandoz

- Sun Pharma

- Teva

- Torrent Pharms

- Watson Labs

- Zydus Pharms USA

- OSDF-用量マップ

Introduction

Greystone Research is pleased to announce the publication of a new life science information resource, a comprehensive overview of the markets, products and participants providing the driving force behind the OSDF segment of the drug delivery sector. The report has been designed and developed to provide pharmaceutical company decision makers, drug developers and formulators, drug device designers, and industry strategists with a detailed understanding of the expanding impact of Ora; Solid Dosage Forms on therapies, pharmaceutical strategies and healthcare treatment protocols. Provider organization business managers, healthcare administrators and investors will also benefit from this publication.

Generating Product Improvements in a Mature Market

The generic solid dosage form drug segment is a rapidly evolving and highly unpredictable environment that has been a challenge to decision makers attempting to map strategies for success in this segment. There are 600 distinct APIs for which there is at least one approved generic solid dosage form ANDA. These APIs account for over four thousand approved ANDAs. Including all approved doses, the current universe of generic solid dosage forms consists of thousands of unique tablet and capsule products. These products are marketed and supplied by more than 800 companies. Competition among the various drug and therapeutic classes is uneven, with the top ten segments accounting for a disproportionate level of activity and revenue. Understanding the underlying factors affecting business performance is key to attaining financial targets.

FDA Approved Hypertension APIs

SAMPLE VIEW

OSDF drugs indicated for Hypertension represent more than 90 % of all approved APIs in the Cardiology market segment. This group includes a number of well-known prescription medicines, including:

|

|

Other non-hypertensive drugs approved for Cardiology indications include APIs indicated for Angina, Dyslipidemia, Heart Rhythm, Myocardial Infarction, and Peripheral Blood flow.

Drug Strength and Dosing

The visualization on the below illustrates the formulation challenges for OSDF service and technology suppliers. The wide range of dosing categories and the resulting process and QA issues they represent presents opportunities as well facility and equipment issues.

SAMPLE VIEW

Table of Contents

- Oral Solid Dosage Forms for Cardiology

- Executive Summary

- Generic SDFs - Product Considerations

- Generic Solid Dosage Forms - Cardiology Indications

- Hypertension

- Cardiology Therapeutic Classes: All Classes excluding Hypertension

- Leading Suppliers of OSDF Drugs Indicated for Hypertension

- Drug Class - Market Presence by Supplier

- Drug Class - ACE Inhibitors (Abbvie o Graviti Pharms)

- Drug Class - Ace Inhibitors (Graviti Pharms to Zydus Pharma USA)

- Drug Class - Adrenoceptor Blocking Agent (Able to Mylan)

- Drug Class - Adrenoceptor Blocking Agent (Mylan to Zydus Pharms)

- Drug Class - Angiotensin II Receptor (Ajanta Pharma Ltd to Zydus Pharms)

- Drug Class - Calcium Channel Blocker (Accord Healthcare to Mutual Pharm)

- Drug Class - Calcium Channel Blocker (Mylan to Zydus Pharms)

- Drug Class - Diuretic (Actavis to Monarch Pharms)

- Drug Class - Diuretic (Actavis to Monarch Pharms)

- Drug Class - Vasodilator (Actavis to Woodward)

- Suppliers of OSDFs Indicated for Cardiology

- Accord Healthcare

- Actavis

- Alembic

- Amneal Pharms

- ANI Pharms

- Apotex

- Aurobindo

- Dr. Reddy's

- Glenmark

- Hikma

- Lupin

- Mylan

- Mylan (Continued)

- Sandoz

- Sun Pharma

- Teva

- Torrent Pharms

- Watson Labs

- Zydus Pharms USA

- OSDF - Dosage Maps